& meet dozens of singles today!

User blogs

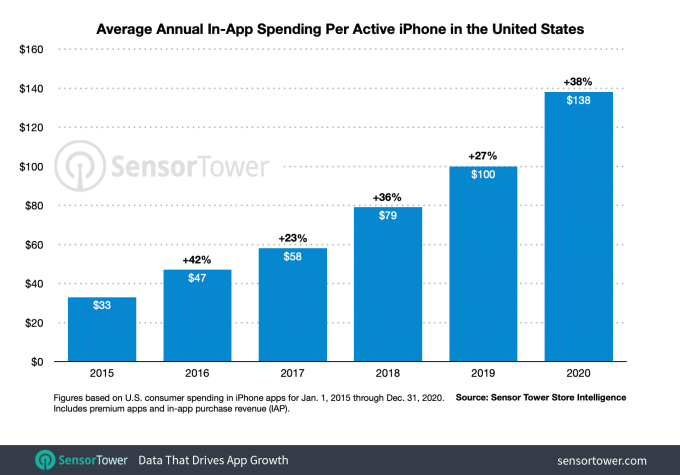

U.S. consumers spent an average of $138 on iPhone apps last year, an increase of 38% year-over-year, largely driven by the pandemic impacts, according to new data from app store intelligence firm Sensor Tower. Throughout 2020, consumers turned to iPhone apps for work, school, entertainment, shopping, and more, driving per-user spending to a new record and the greatest annual growth since 2016, when it had then popped by 42% year-over-year.

Sensor Tower tells TechCrunch it expects the trend of increased consumer spend to continue in 2021, when it projects consumer spend per active iPhone in the U.S. to reach an average of $180. This will again be tied, at least in part, to the lift caused by the pandemic — and, particularly, the lift in pandemic-fueled spending on mobile games.

Image Credits: Sensor Tower

Last year’s increased spending on iPhone apps in the U.S. mirrored global trends, which saw consumers spend a record $111 billion on both iOS and Android apps, per Sensor Tower, and $143 billion, per App Annie, whose analysis had also included some third-party Android app stores in China.

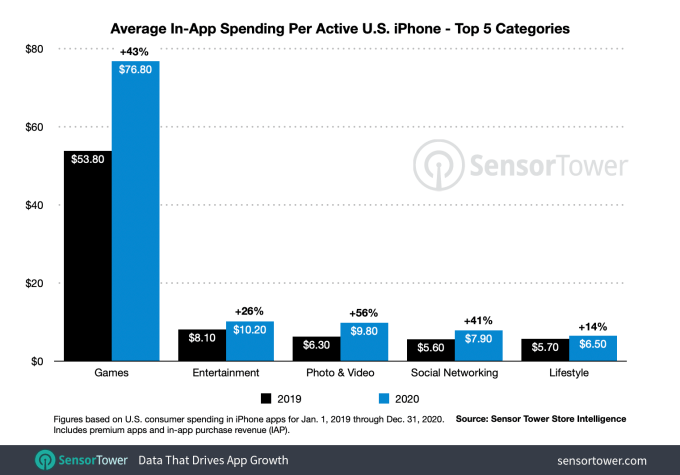

In terms of where U.S. iPhone consumer spending was focused in 2020, the largest category was, of course, gaming.

In the U.S., per-device spending on mobile games grew 43% year-over-year from $53.80 in 2019 to $76.80 in 2020. That’s more than 20 points higher than the 22% growth seend between 2018 and 2019, when in-game spending grew from $44 to $53.80.

U.S. users spent the most money on puzzle games, like Candy Crush Saga and Gardenscapes, which may have helped to take people’s minds off the pandemic and its related stresses. That category averaged $15.50 per active iPhone, followed by casino games, which averaged $13.10, and was driven by physical casinos closures. Strategy games also saw a surge in spending in 2020, growing to an average of $12.30 per iPhone user spending.

Image Credits: Sensor Tower

Another big category for in-app spending was Entertainment. With theaters and concerts shut down, consumers turned to streaming apps in larger numbers. Disney+ had launched in late 2019, just months ahead of the pandemic lockdowns and HBO Max soon followed in May 2020.

Average per-device spending in this category was second-highest, at $10.20, up 26% from the $8.10 spent in 2019. For comparison, per-device spending had only grown by 1% between 2018 and 2019.

Other categories in the top five by per-device spending included Photo & Video (up 56% to $9.80), Social Networking (up 41% to $7.90) and Lifestyle (up 14% to $6.50).

These increases were tied to apps like TikTok, YouTube, and Twitch — the latter which saw 680% year-over-year revenue growth in 2020 on U.S. iPhones, specifically. TikTok, meanwhile, saw 140% growth. In the Lifestyle category, dating apps were driving growth as consumers looked to connect with others virtually during lockdowns, while bars and clubs were closed.

Overall, what made 2020 unique was not necessarily what apps people where using, but how often they were being used and how much was being spent.

App Annie had earlier pointed out that the pandemic accelerated mobile adoption by two to three years’ time. And Sensor Tower today tells us that the industry didn’t see the same sort of “seasonality” around spending in certain types of apps, and particularly games, last year — even though, pre-pandemic, there are typically slower parts of the year for spending. That was not the case in 2020, when any time was a good time to spend on apps.

There’s a persistent fallacy swirling around that any startup growing pain or scaling problem can be solved with business development. That’s frankly not true.

Business development is rarely, if ever, the solution to succeeding in a crowded industry, differentiating an offering or delivering a truly exceptional customer experience. But standing up an effective BD operation that brings in sustainable revenue and helps validate product-market fit can be the difference between survival and failure for a startup.

Business development is rarely, if ever, the solution to succeeding in a crowded industry, differentiating an offering or delivering a truly exceptional customer experience.

I’ve had the opportunity to lead business development functions at three companies experiencing three very different stages of growth: Yelp, Stitcher and TrialPay.

At Yelp, I served as vice president of business development and corporate development for seven years. The business development team I was brought in to lead was a core business unit with accountability to the COO, CEO and board. During my tenure, I was involved in securing around 200 partnerships with companies like Apple, Amazon, Microsoft and Samsung, as well as with scores of organizations ranging from early-stage startups to corporate giants.

Yelp was on its way to becoming a go-to source of information and customer value before I arrived. But partnerships like the one I secured with Apple made Yelp into a global market leader.

At Stitcher, I took on business development as central to my role as a company founder. While it may seem like an early phase to go all-in on BD, the partnerships with music and media companies that I orchestrated in the earliest days were essential to the company’s very survival. Stitcher is an example of a company where early BD investment made sense because of the dual importance of brand name involvement in concept validation and rising above podcast market congestion.

At TrialPay, an e-commerce platform acquired by Visa in 2015, there was already an established founding team and business model to involve customers in the marketing and payment of offerings by the time I showed up. In fact, I was brought in to run business development because the company was approaching an inflection point: There was pressure internally from investors and externally from customers to expand TrialPay’s network of merchants in order to diversify commercial offerings more rapidly.

The need for business development was directly tied to consumer demand and the company’s own position between growth funding rounds.

When to go all-in on BD — and when to avoid it

There are certain market conditions that make it smart for companies to invest in BD as a growth engine and others that signal it’s best to place money, talent and time elsewhere.

You should invest in business development early when your startup’s early success depends on it. For example, at Stitcher, we wanted — and perhaps needed — early buy-in from large media companies who created the podcast content we were going to feature. We didn’t want to get in the same murky legal territory early music startups had gotten into, like Napster.

Are you ready to do whatever it takes to move the needle and drive your startup forward? Then you’re ready for TechCrunch Disrupt 2021. The leading tech conference focused on founders takes place September 21-23. There’s nothing like the thrill that comes from discovering early-stage startups and Disrupt is the world’s top launch platform.

The three days of Disrupt 2021 will be jam-packed not only with experts, panel discussions, exhibitors and the leading tech makers, shakers and investors from around the globe — it’ll be packed with value and opportunity.

Let’s talk value. Right out of the gate, you’ll receive a 3-month membership to Extra Crunch — free — when you purchase a Disrupt pass (excluding the Expo Pass). That’s a $45 value-add.

Extra Crunch, a members-only community created by TechCrunch, is specifically designed to help founders and startup teams get and stay ahead. You’ll enjoy articles on startup investment trends, fundraising, late-stage startups and more. You’ll receive weekly startup investor surveys, private tech market analysis, how-tos on fundraising and growth, topical newsletters and other exclusives delivered daily.

Membership also entitles you to Extra Crunch Live, our weekly virtual event series, discounts on TechCrunch events, discounts from software partners and more. Whew — that should keep your fingers on the pulse of everything startup.

Let’s talk even more value. Take advantage of super early-bird pricing on Founder, Innovator and Investor passes, and you can attend Disrupt 2021 for less than $100. But don’t procrastinate. Buy your pass before this time-sensitive offer disappears on May 13, 11:59 pm (PST).

Let’s talk opportunity. You’ll find it in every corner of Disrupt. Whether you’re networking on the fly in our virtual platform’s chat feature or curating your own meetings using CrunchMatch, our AI-powered networking platform, you’ll connect with people eager to collaborate, educate, learn and inspire. It’s a great way to expand your network.

The all-new Startup Alley is ground zero for opportunity — exhibitors can gain valuable media exposure, attract customers, schedule product demos and track leads. Plus, the TechCrunch editorial team will choose two stand-out exhibiting startups to compete in Startup Battlefield for the $100,000 prize. And check out the new Startup Alley+ opportunity here. Exhibiting at Disrupt is an opportunity you don’t want to miss.

The world-famous Startup Battlefield pitch competition is another huge opportunity, and we’ll start accepting applications for the 2021 cohort in Q2.

Opportunity meets value at Disrupt 2021 on September 21-23. You’re ready to do whatever it takes, so jump on this chance to attend for less than $100. Buy your super early-bird pass before May 13, 11:59 pm (PST). Then sit back and enjoy that tasty, ExtraCrunch(y) membership.

Is your company interested in sponsoring or exhibiting at Disrupt 2021? Contact our sponsorship sales team by filling out this form.

Potential threats to the free flow of GIFs continue to trouble the UK’s competition watchdog.

Facebook’s $400M purchase of Giphy, announced last year, is now facing an in-depth probe by the CMA after the regulator found the acquisition raises competition concerns related to digital advertising. It now has until September 15 to investigate and report.

The watchdog took a first look at the deal last summer. It kept on looking into 2021. And then last week the CMA laid out its concerns — saying the (already completed) Facebook-Giphy acquisition could further reduce competition in the digital advertising market where the former is already a kingpin player (with over 50% share of the display advertising market).

The regulator said it had found evidence that, prior to the acquisition, Giphy had planned to expand its own digital advertising partnerships to other countries, including the UK.

“If Giphy and Facebook remain merged, Giphy could have less incentive to expand its digital advertising, leading to a loss of potential competition in this market,” it wrote a week ago.

The CMA also said it was worried a Facebook-owned Giphy could harm social media rivals were the tech giant were to squeeze the supply of animated pixels to others — or require rivals to sign up to worse terms (such as forcing them to hand over user data which it might then use to further fuel its ad targeting engines, gaining yet more market power).

On March 25 the companies were given five days by the regulator to address its concerns — by offering legally binding proposals intended to allay concerns.

An in-depth ‘phase 2’ investigation could have been avoided if concessions were offered which were acceptable to the regulator but that is evidently not the case as the CMA has announced the phase 2 referral today. And given the announcement has come just five working days after the last notification it appears no concessions were offered.

We’ve reached out to Facebook and the CMA for comment.

A Facebook spokesperson said: “We will continue to fully cooperate with the CMA’s investigation. This merger is good for competition and in the interests of everyone in the UK who uses Giphy and our services — from developers to service providers to content creators.”

While Facebook has already completed its acquisition of Giphy, the CMA’s investigation continues to put a freeze on its ability to integrate Giphy more deeply into its wider business empire.

Albeit, given Facebook’s dominant position in the digital advertising space, its business need to move fast via product innovation is a lot less pressing than years past — when it was building its market dominance free from regulatory intervention.

In recent years, the CMA has been paying close mind to the digital ad market. Back in 2019 it reported report substantial concerns over the power of the adtech duopoly, Google and Facebook. Although in its final report it said it would wait for the government to legislate, rather than make an intervention to address market power imbalances itself.

The UK is now in the process of setting up a pro-competition regulator with a dedicated focus on big tech — in response to concerns about the ‘winner takes all’ dynamics seen in digital markets. This incoming Digital Market Unit will oversee a “pro-competition” regime for Internet platforms that will see fresh compliance requirements in the coming years.

In the meanwhile, the CMA continues to scrutinize tech deals and strategic changes — including recently opening a probe of Google’s plan to depreciate support for third party cookies in Chrome after complaints from other industry players.

In January it also announced it was taking a look at Uber’s plan to acquire Autocab. However on Monday it cleared that deal, finding only “limited indirect” competition between the pair, and not finding evidence to indicate Autocab was likely to become a significant and more direct competitor to Uber in the future.

The regulator also considered whether Autocab and Uber could seek to put Autocab’s taxi company customers that compete against Uber at a disadvantage by reducing the quality of the booking and dispatch software sold to them, or by forcing them to pass data to Uber. But its phase 1 probe found other credible software suppliers and referral networks that the CMA said these taxi companies could switch to if Uber were to act in such a way — leading to it to clear the deal.

Thrasio, an early mover and leading player in the wave of startups emerging to consolidate and scale companies that sell their goods mainly via Amazon’s Marketplace, has raised some more funding and is making a key executive appointment to do some scaling of its own. The company, which to date has acquired and consolidated some 6,000 companies selling on Amazon, has picked up $100 million, and alongside that it’s announcing a new CFO, retail vet Bill Wafford, as it eyes up its next steps, including a public listing.

The $100 million is an extension to Thrasio’s Series C — a round that saw a $750 million injection only about 6 weeks ago, and a previous close of $260 million last July.

Josh Silberstein, who is the co-founder and co-CEO with Carlos Cashman, said Thrasio is not disclosing valuation except to note that it is 50% higher than the it was a month ago for Thrasio, which today is profitable.

For some context, when we reported on the $750 million round, we noted that the valuation was potentially between $3 billion and $4 billion. All a spokesperson would tell us at the time was that it was “less than $10 billion” although a debt round in January put the valuation at around $3 billion.

Silberstein said the latest $100 million is coming from previous backers that didn’t get the allocation they hoped for in the previous financing. The list of past backers includes Oaktree, Advent, Peak6, Western Technology Investment, and Jason Finger, the co-founder of one of the early players in food delivery startups, Seamless.

Giving insiders are little more of a share also seems to hint at the fact that the company looks to be preparing for its next steps as a business, which might include a public listing via a SPAC or a more traditional IPO route.

“We are engaged in conversations where valuation where may once again become a topic so holding off on additional commentary for now,” said Silberstein in response to the question. “We’ve reached a point that there are legal consequences to being anything other than vague.”

As part of that process, Wafford is coming on as CFO from a previous role as CFO at JC Penney and before that, CFO of Vitamin Shoppe, in a longer resume that also includes finance roles at retailers like Walgreens and Target. He is replacing Joe Falcao, a longtime employee of the company, who is taking a role as SVP, Finance and Treasurer, to scale the company’s treasury, tax, and international finance functions.

Wafford’s experience across a range of bigger brick-and-mortar retailers that work with and partner with smaller brands across a number of categories from fashion to health and household goods is notable, in that it’s an analogue of what Thrasio is essentially building in the online world, where its 6,000-plus brands run the gamut from a therapeutic sock maker, to a company that has developed a spray to remove pet odors and stains, to a high-end kitchen goods maker.

“Thrasio’s trajectory and the speed at which it has achieved growth is impressive to say the least, especially how they’ve capitalized on the market changes that have occurred over the last twelve months,” said Bill Wafford, CFO, in a statement. “I’ve been delighted to discover an energizing, team-minded culture that embraces experimentation and adaptability. I’m thrilled to take on the role to prepare the organization for its next phase of growth.”

By one estimate there are about 5 million third-party sellers on Amazon today, a number that appears to be growing exponentially, with more than 1 million sellers joining the platform in 2020 alone. Thrasio’s business model is based around the premise that most of them are not that well prepared to scale when and if the most successful of this lot see their products take off.

Silberstein and Thrasio estimate that there are probably 50,000 businesses selling on the Amazon platform with FBA (Fulfillment by Amazon) that are making $1 million or more per year in revenues.

“What happens when you get into that price range is that it gets hard to grow your business and manage it,” he said, citing SEO, marketing, and supply chain management as some of the challenges. “That means as you grow from $1 million to $10 million, the margins would decrease and it gets even harder to make returns. We simply observed that reality that all these great companies had reached a point between a lack of access to capital and simply not being able to keep doing what they do. We thought, if we acquire 10-20 of these we would have the scale to build best in breed supply chain, marketing, and so on. We would fix the problem.”

It realised quickly, though, that there was an opportunity to take that even further and make that the business itself. And so Thrasio has been building a huge analytics engine that digs into Amazon data and a lot more to determine which companies are interesting, how to help them sell better, and eventually to conceive of even bigger businesses outside of the Amazon ecosystem, covering other marketplaces, other sales channels and direct D2C sales.

It hasn’t been the only one. Possibly spurred by Thrasio’s success we’ve seen launches and major funding for a plethora of these roll-up plays. Branded launched its own roll-up business on $150 million in funding earlier this year, and others including Berlin Brands Group, SellerX, Heyday, Heroes, Perch and more — collectively raising or committing from their own balance sheets well over $1 billion in aid of their own efforts to buy up small but promising third-party merchants.

With Amazon only getting bigger by the day, and the challenge of weeding out quality from quite a lot of me-too knock-offs also growing, there is a clear role for improving discoverability and connecting consumers to the most interesting products, and helping those products succeed. At the same time, it will be worth watching how the roll-ups themselves grow and if they manage to deliver on all that they are promising to the brands they are buying, and to their investors.