& meet dozens of singles today!

User blogs

Released in 2011 “Start-up Nation: The Story of Israel’s Economic Miracle” was a book that laid claim to the idea that Israel was an unusual type of country. It had produced and was poised to produce, an enormous number of technology startups, given its relatively small size. The moniker became so ubiquitous, both at home and abroad, that “Israel Startup Nation” is now the name of the country’s professional cycling team.

But it’s been hard to argue against this position in the last ten years, as the country powered ahead, famously producing ground-breaking startups like Waze, which was eventually picked up by Google for over $1 billion in 2013. Waze’s 100 employees received about $1.2 million on average, the largest payout to employees in Israeli high tech at the time, and the exit created a pool of new entrepreneurs and angel investors ever since.

Israel’s heady mix of questioning culture, tradition of national military service, higher education, the widespread use of English, appetite for risk and team spirit makes for a fertile place for fast-moving companies to appear.

And while Israel doesn’t have a Silicon Valley, it named its high-tech cluster “Silicon Wadi” (‘wadi’ means dry desert river bed in Arabic and colloquial Hebrew).

Much of Israel’s high-tech industry has emerged from former members of the country’s elite military intelligence units such as the Unit 8200 Intelligence division. From age 13 Israel’s students are exposed to advanced computing studies, and the cultural push to go into tech is strong. Traditional professions attract low salaries compared to software professionals.

Israel’s startups industry began emerging in the late 19080s and early 1990s. A significant event came with acquisitor by AOL of the the ICQ messaging system developed by Mirabilis. The Yozma Programme (Hebrew for “initiative”) from the government, in 1993, was seminal: It offered attractive tax incentives to foreign VCs in Israel and promised to double any investment with funds from the government. This came decades ahead of most western governments.

It wasn’t long before venture capital firms started up and major tech companies like Microsoft, Google and Samsung have R&D centers and accelerators located in the country.

So how are they doing?

At the start of 2020, Israeli startups and technology companies were looking back on a good 2019. Over the last decade, startup funding for Israeli entrepreneurs had increased by 400%. In 2019 there was a 30% increase in startup funding and a 102% increase in M&A activity. The country was experiencing a 6-year upward funding trend. And in 2019 Bay Area investors put $1.4 billion into Israeli companies.

By the end of last year, the annual Israeli Tech Review 2020 showed that Israeli tech firms had raised a record $9.93 billion in 2020, up 27% year on year, in 578 transactions – but M&A deals had plunged.

Israeli startups closed out December 2020 by raising $768 million in funding. In December 2018 that figure was $230 million, in 2019 it was just under $200 million.

Late-stage companies drew in $8.33 billion, from $6.51 billion in 2019, and there were 20 deals over $100 million totaling $3.26 billion, compared to 18 totaling $2.62 billion in 2019.

Top IPOs among startups were Lemonade, an AI-based insurance firm, on the New York Stock Exchange; and life sciences firm Nanox which raised $165 million on the Nasdaq.

The winners in 2020 were cybersecurity, fintech and internet of things, with food tech cooing on strong. But while the country has become famous for its cybersecurity startups, AI now accounts for nearly half of all investments into Israeli startups. That said, every sector is experiencing growth. Investors are also now favoring companies that speak to the Covid-era, such as cybersecurity, ecommerce and remote technologies for work and healthcare.

There are currently over 30 tech companies in Israel that are valued over $1 Billion. And four startups passed the $1 billion valuation just last year: mobile game developer Moon Active; Cato Networks, a cloud-based enterprise security platform; Ride-hailing app developer Gett got $100 million ahead of its rumored IPO; and behavioral biometrics startup BioCatch.

And there was a reminder that Israel can produce truly ‘magical’ tech: Tel Aviv battery storage firm StorDot raised money from Samsung Ventures and Russian billionaire Roman Abramovich for its battery which can fully charge a motor scooter in five minutes.

Unfortunately, the coronavirus pandemic put a break on mergers and acquisitions in 2020, as the world economy closed down.

M&A was just $7.8 billion in 93 deals, compared to over $14.2 billion in 143 M&A deals in 2019. RestAR was acquired by American giant Unity; CloudEssence was acquired by a U.S. cyber company; and Kenshoo acquired Signals Analytics.

And in 2020, Israeli companies made 121 funding deals on the Tel Aviv Stock Exchange and global capital markets, raising a total of $6.55 billion, compared to $1.95 billion raised in capital markets in Israel and abroad in 2019, as IPOs became an attractive exit alternative.

However, early-round investments (Seed + A Rounds) slowed due to pandemic uncertainty, but picked-up again towards the end of the year. As in other countries in ‘Covid 2020’, VC tended to focus on existing portfolio companies.

Covid brought unexpected upsides: Israeli startups, usually facing longs flight to Europe or the US to raise larger rounds of funding, suddenly found that Zoom was bringing investors to them.

Israeli startups adapted extremely well in the Covid era and that doesn’t look like changing. Startup Snapshot found that 55% startups profiled had changed (or considered changing) their product due to Covid-19. Meanwhile, remote-working – which comes naturally to Israeli entrepreneurs – is ‘flattening’ the world, giving a great advantage to normally distant startup ecosystems like Israel’s.

Via Transportation raised $400 million in Q1. Next Insurance raised $250 million in Q3. Seven exit transactions with over the $500 million mark happened in Q1–Q3/2020, compared to 10 for all of 2019. These included Checkmarx for $1.1 billion and Moovit, also for a billion.

There are three main hubs for the Israeli tech scene, in order of size: Tel Aviv, Herzliya and Jerusalem.

Jerusalem’s economy and therefore startup scene suffered after the second Intifada (the Palestinian uprising that began in late September 2000 and ended around 2005). But today the city is far more stable, and is therefore attracting an increasing number of startups. And let’s not forget visual recognition company Mobileye, now worth $9.11 billion (£7 billion), came from Jerusalem.

Israel’s government is very supportive of it’s high-tech economy. When it noticed seed-stage startups were flagging, the Israel Innovation Authority (IIA) announced the launch of a new funding program to help seed-stage and early-stage startups, earmarking NIS 80 million ($25 million) for the project.

This will offer participating companies grants worth 40 percent of an investment round up to $1.1 million and 50 percent of a total investment round for startups in the country or whose founders come from under-represented communities – Arab-Israeli, ultra-Orthodox, and women – in the high-tech industry.

Investments in Israeli seed-stage startups decreased both absolutely and as a percentage of total investments in Israeli startups (to 6% from 11%). However, the decline may also be a function of large tech firms setting up incubation hubs to cut up and absorb talent.

Another notable aspect of Israel’s startups scene is its, sometimes halting, attempt to engage with its Arab Israeli population. Arab Israelis account for 20% of Israel’s population but are hugely underrepresented in the tech sector. The Hybrid Programme is designed to address this disparity.

It, and others like it, this are a reminder that Israel is geographically in the Middle East. Since the recent normalization pact between Israel and the UAE, relations with Arab states have begun to thaw. Indeed, Over 50,000 Israelis have visited the United Arab Emirates since the agreement.

In late November, Dubai-based DIFC FinTech Hive—the biggest financial innovation hub in the Middle East—signed a milestone agreement with Israel’s Fintech-Aviv. Both entities will now work together to facilitate the cross-border exchange of knowledge and business between Israel and the United Arab Emirates.

Perhaps it’s a sign that Israel is becoming more at ease with its place in the region? Certainly, both Israel’s tech scene and the Arab world’s is set to benefit from these more cordial relations.

Our Israel survey is here.

Source: https://techcrunch.com/2021/01/21/israels-startup-ecosystem-powers-ahead-amid-a-year-of-change/

Springbox AI, an AI-powered financial forecasting application designed to replace financial market investment service and aimed at the average financial markets trader, has launched on iOS and Android.

It’s been built by a team of founders who previously worked at Deutsche Bank, Credit Suisse, UBS, and BNP Paribas. It’s so far raised $2M in funding from private investors in Europe.

The app costs $49 a month, and includes a range of tools including market forecasting; live market screening of stocks, forex, and futures markets; and trading news.

Springbox AI Co-Founder Kassem Lahham said: “Most brokers focus their marketing by selling investors the dream or the myth of easy-money, resulting in 96% of self-traders losing money and quitting. Using Springbox AI traders will have access to an app that will help them succeed, focused on the data.”

Springbox competes with trading apps like eToro, but eToro focuses on social trading and following a strong investor from the community. Springbox is designed for slightly more sophisticated traders, say the founders.

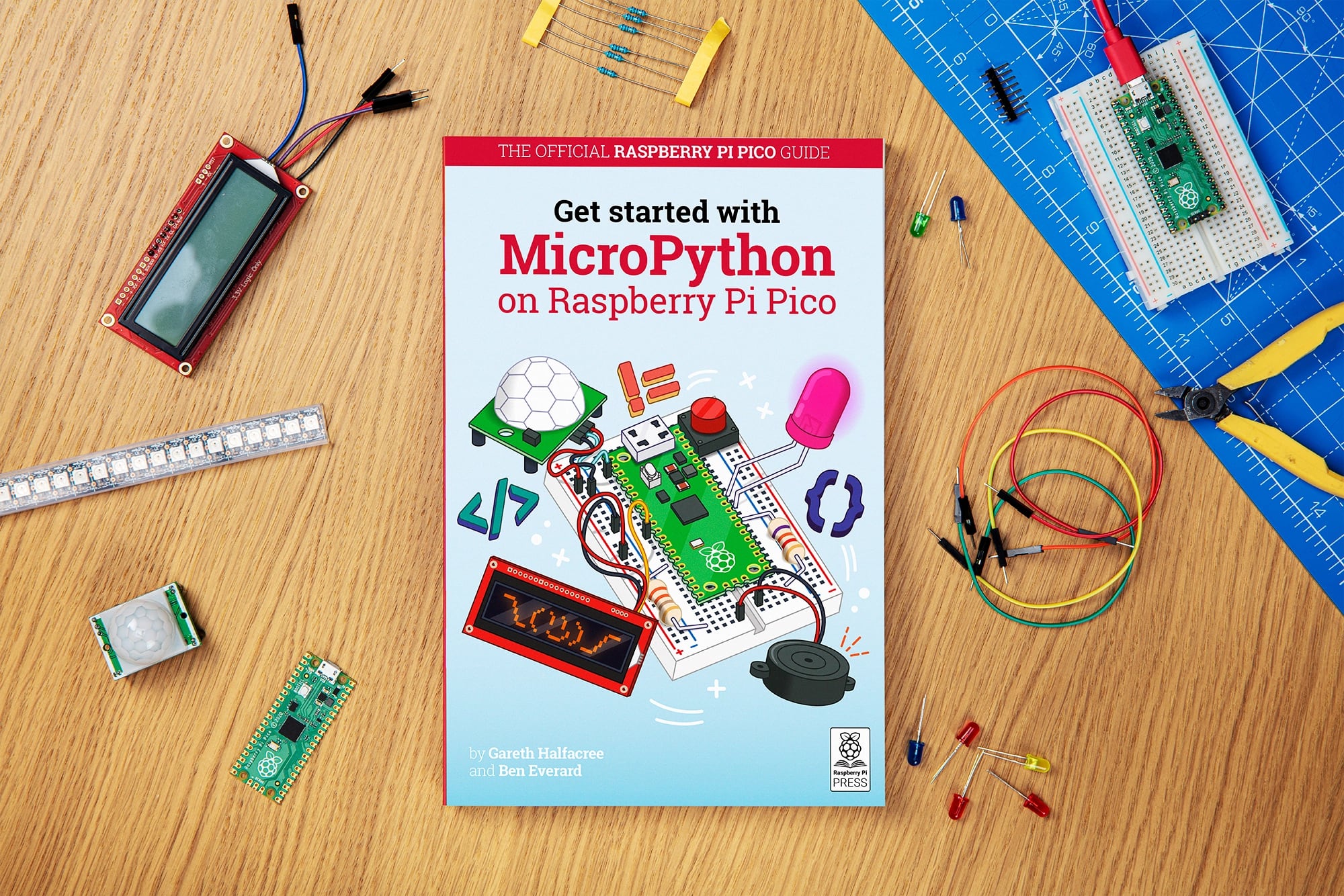

Meet the Raspberry Pi Pico, a tiny little microcontroller that lets you build hardware projects with some code running on the microcontroller. Even more interesting, the Raspberry Pi Foundation is using its own RP2040 chip, which means that the foundation is now making its own silicon.

If you’re not familiar with microcontrollers, those devices let you control other parts or other devices. You might think that you can already do this kind of stuff with a regular Raspberry Pi. But microcontrollers are specifically designed to interact with other things.

They’re cheap, they’re small and they draw very little power. You can start developing your project with a breadboard to avoid soldering. You can pair it with a small battery and it can run for weeks or even months. Unlike computers, microcontrollers don’t run traditional operating systems. Your code runs directly on the chip.

Like other microcontrollers, the Raspberry Pi Pico has dozens of input and output pins on the sides of the device. Those pins are important as they act as the interface with other components. For instance, you can make your microcontroller interact with an LED light, get data from various sensors, show some information on a display, etc.

The Raspberry Pi Pico uses the RP2040 chip. It has a dual-core Arm processor (running at 133MHz), 264KB of RAM, 26 GPIO pins including 3 analog inputs, a micro-USB port and a temperature sensor. It doesn’t come with Wi-Fi or Bluetooth. And it costs $4.

If you want to run something on the Raspberry Pi Pico, it’s quite easy. You plug your device to your computer using the micro-USB port. You boot up the Raspberry Pi Pico while pressing the button. The device will appear on your computer as an external drive.

In addition to C, you can use MicroPython as your development language. It’s a Python-inspired language for microcontrollers. The Raspberry Pi Foundation has written a ton of documentation and a datasheet for the Pico.

Interestingly, the Raspberry Pi Foundation wants to let others benefit from its own chip design. It has reached out to Adafruit, Arduino, Pimoroni and Sparkfun so that they can build their own boards using the RP2040 chip. There will be an entire ecosystem of RP2040-powered devices.

This is an interesting move for the Raspberry Pi Foundation as it can go down this path and iterate on its own chip design with more powerful variants. It provides two main advantages — the ability to control exactly what to put on board, and price.

Image Credits: Raspberry Pi Foundation

Berlin-based early-stage fund APX today announced that its two investors, European publisher Axel Springer and sports car maker Porsche, have increased their investment in the fund to a total of €55 million.

With this, APX, which launched in 2018, is now able to deploy up to €500,000 in pre-Series A seed funding per company. That’s up from up to €100,000 when the fund launched. So far, the group has invested in more than 70 companies and plans to increase this number to close to 200 by 2022.

When APX launched, the fund didn’t disclose the total investment from Porsche and Axel Springer. Today, the team said that the new investment “more than doubles APX’s total amount for investing in new and current companies.” APX also stressed that the total volume of the fund is now “at least” €55 million, in part because the investors can always allocate additional funding for outliers.

In addition to the new funding, APX also today announced that it is doing away with its 100-day accelerator program and instead opting for a long-term commitment to its companies, including participation in future rounds.

“We will try and invest into 50 or more companies this year — and we were at 35 last year. So this is quite some growth,” APX founding managing director (and folk music aficionado) Henric Hungerhoff told me. “We think that our deal flow systems and our entire operations are settled in well enough that we can have quality founders in our portfolio. That’s our goal — and that might even increase to 70 the year after. […] We see really nice synergies or network effects within our portfolio, with founders helping other founders and learning from each other.”

Hungerhoff tells me that the team is quite confident in its ability now to identify quality deal flows. The team is using a data-driven approach. And while it leverages its own network and that of its founders, it has also set up a scout program at leading European universities to identify potential founders, for example.

As APX founding managing director, and the former CEO of Axel Springer’s Plug and Play accelerator, Jörg Rheinboldt noted, APX never asks its founders to pitch. Instead, the team has multiple conversations with them about the product they want to build, how they came up with the idea — and how it changed over time.

“And then, we do multiple things simultaneously,” Rheinboldt said. “One is, we look at team dynamics. How do the founders interact? We also stress them a little bit — in a friendly way — where someone asks very fast questions, or we focus a little bit on one person and see how the others rescue them. We want to know about the team dynamics and then we want to understand the strategy, how we can help them best?”

The idea here is to be able to invest quickly. In addition, though, with the new funding, the team isn’t just able to invest into more companies but also invest more into the individual companies.

“We want to invest deeper per startup at a very early stage,” Hungerhoff said. “So far, […] our typical approach was a non-dilution, pro-rata follow-on strategy with most of our portfolio companies. And this is something we want to pledge in the future. Looking at the past, 100% of the times in equity rounds, we do the pro-rata follow-on or more, but now, we have developed a strategy that we will, for the fastest-moving of fastest-growing companies, we want to deploy significantly more cash in a very early phase, which means an amount of up to €500,000.”

What the team saw was that the companies in its portfolio would raise a small pre-seed round from APX and other investors, with APX typically taking a 5% stake in the startup. Most founders would then go on and raise extended pre-seed or seed rounds soon thereafter.

“We more felt like we missed out when we saw these companies raising really nice financing rounds and we did our investment,” Rheinbolt said. “We felt very good that we can do a pro-rata investment. but we looked at each other and said: we knew this, we knew that they would do this 12 weeks ago. We could have given them a check and maybe the round would have been done in eight weeks and maybe [our stake] wouldn’t be 5% but 7%.”

Given this new focus on supporting startups throughout their lifecycle, it’s no surprise that APX did away with the 100-day program as well. But the team still expects to be quite hands-on. With a growing network, though, the partners also expect that founders will be able to learn from each other, too. “We now see the value that is coming from this,” Hungerhoff said. For example, a team that we’ve invested in two months ago, they’re now thinking about the angel round. They can actually get the best advice on this — or just experienced sharing — from another team, rather than talking to Jörg who did this maybe 30 years ago — no offense.”

The team also spends a lot of time thinking about its community, which now includes founders from 20 countries. The COVID pandemic has obviously moved most of the interactions online. Before COVID, APX often hosted events in its offices, which helped create the kind of serendipity that often leads to new ideas and connections. Looking ahead, the team still believes that there is a lot of value in having face-to-face meetings, but at the same time, maybe not every company needs to move to Berlin and instead visit for a few days every now and then.

Bonus: Here is Hungerhoff’s latest album with St. Beaufort.

No-code — software that lets you accomplish tasks that previously required coding skills — is an increasingly hot space, even if the basic premise has been promised and not fully realised for many years. Related to this are companies like Airtable, which attempt to make building relational databases and interrogating them as easy as creating a spreadsheet. Now Softr, a startup out of Berlin, wants to push the no-code concept further by making it easy to build websites on top of Airtable without the need to write code.

Recently soft launched on Product Hunt, today the young company is disclosing $2.2 million in seed funding, having previously been bootstrapped by its two Armenian founders, CEO Mariam Hakobyan and CTO Artur Mkrtchyan. Leading the round is Atlantic Labs, along with Philipp Moehring (Tiny.VC) and founders from GitHub, SumUp, Zeitgold, EyeEm and Rows.

Started in 2019, Softr has built a no-code platform to enable anybody to build websites and web apps based on data housed in Airtable. The idea is to let Airtable do the database grunt work, combined with Softr’s relatively flexible but template-driven approach to website and web app creation.

Softr’s Hakobyan explains that out of the box the startup offers templates for anything from a simple marketing website to web apps for an e-commerce store, job board, marketplace and more. Those applications can include functionality like user authentication, gated content, payments, upvoting, and commenting etc.

“Softr has zero learning curve and can literally be used by anyone without a tech background, as it abstracts away all the technical aspects and focuses the user on product building and content, rather than technology,” she explains. “Softr uses Airtable as the database, as it makes it easy creating and sharing relational databases, without having to learn SQL or scripting. Airtable has gotten pretty popular in the last few years and is used not only by individuals but also Fortune 500 companies”.

Image Credits: Softr

To that end, Hakobyan says Softr’s magic is that it uses the concept of “pre-built building blocks” (listings, user accounts, payments etc) and business logic to handle most of the heavy lifting on behalf of the website creator. “When using blocks and templates.. ., 70% of the work is already done for the user,” she explains.

In addition, Softr connects to popular services like Stripe, Paypal, Mailchimp, Zapier, Integromat, Hotjar, Google Analytics, Hubspot, Drift and others.

Softr is currently used by “several thousands of makers and startups”. Examples of applications that customers have built on Softr include a language learning school with membership, a baby-sitters booking marketplace, and a community with gated content and online courses.

Armed with capital, Softr plans to expand its customer base to non-tech functions of SMBs to help them build internal tooling, such as employee directories, product inventories, real estate listings etc., and to automate manual processes.