& meet dozens of singles today!

User blogs

This morning, investor and SPAC raconteur Chamath Palihapitiya announced two new blank-check deals involving Latch and Sunlight Financial.

Latch, an enterprise SaaS company that makes keyless entry systems, has raised $152 million in private capital, according to Crunchbase. Sunlight Financial, which offers point of sale financing for residential solar systems, has raised north of $700 million in venture capital, private equity and debt.

We’re going to chat about the two transactions.

There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months. Why? There are nearly 300 SPACs in the market today looking for deals, and many will find one.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Think of SPACs are increasingly hungry sharks. As a shark get hungrier while the clock winds down on its deal-making window, it may get less choosy about what it eats (take public). There are enough SPACs on the hunt today that they would be noisy even if they were not time-constrained investment vehicles. But as their timers tick, expect their dealmaking to get all the more creative.

This brings us back to Chamath’s two deals. Are they more like the Bakkt SPAC, which led us to raise a few questions? Or more akin to the Talkspace SPAC, which we found pretty reasonable? Let’s find out.

Keyless locks = Peloton for real estate

Let’s start with the Latch deal.

New York-based Latch sells “LatchOS,” a hardware and software system that works in buildings where access and amenities matter. Latch’s hardware works with doors, sensors and internet connectivity.

The company has raised a number of private rounds, including a $126 million deal in August of 2019 which valued the company at $454.3 million on a post-money basis, according to PitchBook data. The company raised another $30 million in October of 2020, though its final private valuation is not known.

As Chamath tweeted this morning, Latch is merging with TS Innovation Acquisitions Corp, or $TSIA. The SPAC is associated with Tishman Speyer, a commercial real estate investor. You can see the synergies, as Latch’s products fit into the commercial real estate space.

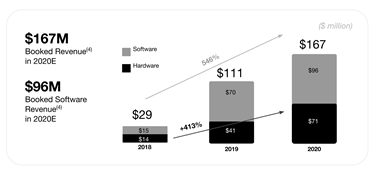

Up front, Latch is not a company that is only reporting future revenues. It has a history as an operating entity. Indeed, here’s its financial data per its investor presentation:

Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.

That could be due to strong hardware installation fees, which could later result in software revenues; the company claims an average of a six-year software deal, so hardware revenues that are attached to new software incomes could lowkey declaim long-term SaaS revenues.

Update: Adding some clarity here, the above are “booked” revenues, which I’ve made more clear, not actual revenues. Its net revenues, better known as actual revenues, were $18 million, with $14 million of that coming from hardware. So, today, the company is certainly more hardware-heavy than I first thought. Damn non-S-1 filings!

While some were quick to note that the company is far from pure-SaaS — correct — I suspect that the model that could get some traction amongst investors is that this feels a bit like Peloton for real estate. How so? Peloton has large hardware incomes up-front from new users, which convert to long-term subscription revenues. Latch may prove similar, albeit for a different customer base and market.

Per the deal’s reported terms, Latch will be worth $1.56 billion after the transaction. And the combined entity will have $510 million in cash, including $190 million from a PIPE — a method of putting private money into a public entity — from “BlackRock, D1 Capital Partners, Durable Capital Partners LP, Fidelity Management & Research Company LLC, Chamath Palihapitiya, The Spruce House Partnership, Wellington Management, ArrowMark Partners, Avenir and Lux Capital.”

Goalsetter, a platform that helps parents teach their kids financial literacy, announced the raise of a $3.9 million seed round this morning, led by Astia.

PNC Bank, Mastercard, US. Bank, Northwestern Mutual Future Ventures, Elevate Capital, Portfolia’s First Step and Rising America Fund and Pipeline Angels also participated in the round. The round also saw participation from a handful of individual investors including Robert F Smith, Kevin Durant, Chris Paul, Baron Davis, Sterling K. Brown, Ryan Bathe, CC Sabathia and Amber Sabathia.

Goalsetter launched in 2019 out of the Entrepreneurs Roundtable Accelerator. Founded by Tanya Court, who lost over $1 million in the 2001 bubble burst, the platform teaches financial literacy to children of all ages, helping them learn economic concepts, lingo and the principles of financial health.

After long stints at Nickelodeon and ESPN, Court understands deeply how kids learn and what keeps their attention. She vowed to make sure that her children were never ignorant of what it takes to protect their wealth and create more.

The app also allows parents to give allowance through the app, and even pay out their own specified amount for every quiz question the kid gets right in the app. Plus, family and friends can give ‘goal cards’ instead of gift cards, helping kids save for the things they really want in the future.

The company recently launched a debit card for kids, as well, letting parents control the way the card is used and even lock it until their kids have passed the week’s financial literacy quiz.

Families save an average of $120 a month on the platform, and Court says that two families saved over $10,000 in the last year.

The company is also launching a massive campaign next week for Black History Month with the goal of closing the wealth gap among Black children and kids of color through financial education.

“It’s one thing to put a debit card into your teenager’s hands,” said Court. “That’s great. That teaches them how to spend money. It’s another thing to teach kids the core concepts about how to build wealth, or to know the difference between putting your money into an investment account, or putting your money into a CD versus a mutual fund versus a savings account. We teach what interest rates are, and what compound interest means. Our focus is on is financial education because it’s not enough to teach kids how to spend.”

Goalsetter raised $2.1 million in 2019 and now adds this latest round to that for a total of $6 million raised. This latest round was oversubscribed, giving Court the opportunity to be super selective about her investors.

“Every single one of these investors has a demonstrated commitment prior to people marching in the streets in April, to social justice and to investing in diversity and inclusion initiatives and people,” said Court. “Every single one of them. That was really important because we were oversubscribed and we had the luxury of being able to pick who our investors were. Every one of the investors that we invited to our table were investors who we knew invited folks who look like us in 2019 and 2018 and 2017 to their table.”

Source: https://techcrunch.com/2021/01/25/goalsetter-raises-3-9-million-to-teach-financial-literacy-to-kids/

Liz Meyerdirk made a name for herself at Uber as the Senior Director & Global Head of Business Development for the company’s Uber Eats business and she’s now turning her attention to women’s health as the new chief executive of The Pill Club.

The move comes at a perilous time for the remote delivery of women’s healthcare as the Supreme Court has taken steps to limit the provision of sexual healthcare to women in recent months.

“Women’s health care has never been more tested than right now,” Meyerdirk noted in a blog post announcing her new role. “COVID-19 has upended access to care; dozens of states have—and continue—to try and limit women’s choice; and last year, the Supreme Court voted to uphold the rollback of the ACA contraceptive mandate decision, a stunning move that could end up impacting as many as 126,000 women who previously received covered contraception through employer-based health insurance.”

A seasoned corporate executive, Meyerdirk is hoping to navigate The Pill Club through these treacherous times. “These events have shown that reliable, safe, and affordable access to women’s health and birth control is

just one more vulnerability in our health care system,” Meyerdirk wrote.

Liz Meyerdirk, chief executive of The Pill Club: Image Credit: The Pill Club

As it faces an uncertain legal environment on some fronts, the company couldn’t be in a better position financially.

The Pill Club, which is profitable and now has a $100 million run rate, is now ready for its closeup with Meyerdirk at the helm.

The company has managed to make its mark in the crowded world of online prescriptions and refill fulfillment by focusing specifically on women’s health and ensuring that those services are available to as many potential patients as possible.

“We’re now serving hundreds of thousands of women nationwide with 20% on Medicaid,” says Meyerdirk. “We prescribe in 43 states and the District of Columbia.”

For Meyerdirk, the background she had in logistics and fulfillment from her time at Uber Eats made the transition to the pill prescription and delivery service natural.

“There is a heavy logistics element to it,” said Meyerdirk.

As Meyerdirk takes the reins of the company, she said there’s a few areas that The Pill Club will expand into beyond its focus on birth control and contraception. “There are areas that our customers are asking for,” Meyerdirk said.

These areas include, initially, dermatology. Last year the company launched a delivery service for contraceptives and women’s hygiene products like pads and tampons.

As it continues to expand its product suite, it’s also growing its executive staff. The company not only added Meyerdirk, but also David Hsu as chief financial officer and Jeremy Downs as senior vice president of growth. Hsu joins the company from Honey, where led the $4 billion acquisition negotiations with PayPal, and Downs comes from Uber Eats, where he spent five years leading growth.

“We need sustained, long-term access to women’s health care, not just a bridge while the pandemic persists; and we need coverage for essential health services like birth control and prenatal care, regardless of whether or not you’re insured,” Meyerdirk wrote. “Reproductive care has and continues to be an essential part of our business, but there are countless opportunities to serve women in all of their life stages from puberty to menopause.”

Virgin Orbit isn’t slowing down after joining the exclusive club of small launch companies that have made it to orbit – the company just announced that it’s flying a payload on behalf of customer the Royal Netherlands Air Force (RNAF). This is the first ever satellite being put up by the Dutch Ministry of Defense, and it’s a small satellite that will act as a test platform for a number of different communications experiments.

The satellite is called ‘BRIK-II’ – not because it’s the second of its kind, but rather because it’s named after Brik, the first airplane ever owned and operated by the RNAF. This mission is one of Virgin Orbit’s first commercial operations after its successful test demonstration, and will fly sometime later this year. It’s also being planned as a rideshare mission, with other payloads expected to join – likely from the U.S. Department of Defense, which is working with Virgin Orbit’s dedicated U.S. defense industry subsidiary VOX Space on planning what they’ll be adding to the mission load out.

This upcoming mission is actually a key demonstration of a number of Virgin Orbit’s unique advantages in the launch market. For one, it’ll show how the U.S. DOD and its ally defense agencies can work together in the space domain when launching small communications satellites. Virgin Orbit is also going to use the mission as an opportunity to show off its “late-load integration” capabilities – effectively, how it can add a payload to its LauncherOne rocket just prior to launch.

For this particular flight, there’s no real reason to do a late-load integration, since there’s plenty of lead time, but part of Virgin’s appeal is being able to nimbly add satellites to its rocket just before the carrier jet that flies it to its take-off altitude leaves the runway. Demonstrating that will go a long way to help illustrate how it differentiates its services from others in the launch market including Rocket Lab and SpaceX.

Payments for consumers have made a huge shift to the online world in the last year, a time when they have moved more of their purchasing to the internet to minimize in-person transactions in the midst of a virus-based health pandemic. Today, a startup that has built a similar kind of payments infrastructure — but specifically targeting small businesses and the payments they need to make — has raised a big round of funding to double down on its own slice of the market.

Melio, which provides a platform for SMBs to pay other companies electronically using bank transfers, debit cards or credit — along with the option of cutting paper checks for recipients if that is what the recipients request — has closed $110 million in funding at a valuation that the company said was now $1.3 billion.

The company’s focus to date has been building and growing system to replace the paper invoices, snail mail, and bank transfers that might take multiple days to clear and still dominate payments for small and medium enterprises. The company was founded in Israel but has to date focused a lot of its attention on the U.S. market, where it saw growth of 2,000% last year (it doesn’t disclose the actual number of customers that it has). CEO Matan Bar said that this is where the company will continue to focus for now.

This latest round was led by Coatue and also included participation from previous backers Accel, Aleph, Bessemer Venture Partners, Corner Ventures, General Catalyst, and Latitude. It caps off a huge year for the company, which raised $130 million in 2020 (and $256 million overall), with other recent backers including others like American Express and Salesforce.

The latter two are strategic backers: AmEx is one of the options given to customers paying other businesses through Melio’s rails.

Salesforce, meanwhile, is not yet an integration partner, but Bar — who co-founded the company with Ilan Atias and Ziv Paz (respectively CTO and COO) — described its interest as similar to that of Intuit-owned accounting giant Quickbooks. Quickbooks connects with Melio so that users of one can seamlessly import activity from one platform into the other, and Bar hinted that there is an interest from the CRM giant, which provides a number of other business and productivity tools, to work together in a similar fashion.

Bar came to found Melio on the heels of years of experience in peer-to-peer payments focused on the consumer market. He previously ran PayPal’s business unit focused on peer-to-peer payments, which included Venmo in the US and equivalent services (not branded Venmo) outside of it. He came to PayPal, which at the time was a part of eBay, through eBay’s acquisition of his previous startup, a social gifting platform called The Gifts Project.

As Bar describes it, PayPal “was the first time I experienced what the digitization of payments looked like as they were shifting from cash to mobile payments. Consumers were buying online instead of at brick-and-mortar stores, and even when they were getting physical items, they were paying online.” What he quickly realized, though, was that the same was not applying to the businesses themselves.

“There are still trillions being transferred via paper checks in the B2B space,” he said, with paper invoices and paper checks dominating the market. “The space is way behind other payment areas. I would be talking with SMB owners who would be using fancy Square or PayPal point of sale devices, but when they had to pay, say, a coffee bean supplier, they stuffed checks in envelopes. That’s very intriguing obviously, and it triggered our interest.”

Interestingly this isn’t a problem that hasn’t been identified before, but many of the solutions, such as Bill.com or Tipalti, are really designed for larger enterprises. “They are too overwhelming for SMBs,” he said. “Even their names say it all: Accounts Payable Automation Solutions. It’s about tens of thousands of payments, and accounting departments, not an order from a wine shop.”

That formed the basis of what the startup started to build, which has been, in essence, a very pared-down version of these other payments platforms with SMB needs in mind.

The first of these is a focus on cashflow, Bar said. Specifically, the Melio platform lets payments be made automatically but businesses themselves can delay the timing on when money actually leaves their accounts: “Buyers keep cash longer, vendors get paid faster” is how Bar describes it.

This is in part enabled by the tech that Melio has built, which builds in risk assessment, as well as fraud management, and balances payments across the whole of its platform to send money in and out without the need for the company to raise debt to back up those payments.

“We leverage data to assess risk,” said Bar. “Every dollar in this round is going towards R&D and sales and marketing. We don’t need the capital in our model.” It also works with the likes of AmEx and its own credit system in cases where people are paying on credit, but Bar also noted that currently most of the transactions that happen on its platform are not credit based. Most are bank transfers.

While others like Stripe have also built B2B payment services to pay out suppliers, Bar points out that what it has created is unique in that it is a standalone service: no need to be a part of Stripe’s wider ecosystem of services to use this if you already use another payments provider you are happy with.

Given that focus on cashflow for SMBs, what’s also interesting is the low bar to entry that Melio has built into its platform. Specifically, the service is completely free for businesses to use — that is, no fee is charged — as long as companies are making bank transfers or using debit cards. It takes a 2.9% fee when a business elects to use a credit card for a transaction (and even then Melio says that the fee is tax deductible in the US).

He noted that one of the reasons that Melio has to date targeted the US market is because of how antiquated it still is. “The average bank transfer still takes three to four business days, if you don’t want to take any risk,” he said. “We have developed models to do it same day. We take the risk that the buyer might not have the funds in that account but think about how that impacts cash flows. With Melio you still pay in three days, but money will be delivered the same day. That is how you can keep cash longer, without a payments risk.”

Targeting a market that remains very underserved at a time when so much has gone virtual in payments is why investors are also interested.

“Melio has identified both the opportunity and duty to help small businesses manage their finance remotely and improve cash flow, in normal times as well as during this crisis, as physical payments supply chains are interrupted and overwhelmed,” said Michael Gilroy, a general partner at Coatue, in a statement. “Going digital is the only way small businesses can compete against larger rivals and stay ahead of the curve.”

In terms of more product development, Bar said that the company has received “a lot of incoming interest from partners to enable B2B payments within their products on their product,” similar to what Quickbooks is doing and Salesforce is likely to do. “Payments are contextual and they want to enable a quicker way to get there. The SMB is underserved. And yes, from a unit economics it’s much better to go after Nike. But this is also to really create some financial inclusion. We want to enable services for the small shop that the big guys already have.”