& meet dozens of singles today!

User blogs

Three years ago, we released the first edition of the Matrix Fintech Index. We believed then, as we do now, that fintech represents one of the most exciting major innovation cycles of this decade. In 2020, all the long-term trends forcing change in this sector continued and even accelerated.

The broad movement away from credit toward debit, particularly among younger consumers, represents one such macro shift. However, the pandemic also created new, unforeseen drivers. Among them, millennials decamped from their rentals in crowded cities to accelerate their first home purchases to the benefit of proptech companies and challenger mortgage players alike.

E-commerce saw an enormous acceleration in growth rates, furthering adoption of online payments platforms. Lastly, low interest rates and looming inflation helped pave the way for the price of Bitcoin to charge toward $30,000. In short, multiple tailwinds combined to produce a blockbuster year for the category.

In this year’s refresh of the Matrix Fintech Index, we’ll divide our attention into three parts. First, a look at the public stocks’ performance. Second, liquidity. Third, we highlight one major trend in the sector: Buy Now Pay Later, or BNPL.

Public fintech stocks rose 97% in 2020

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index. While the underlying performance of these companies was strong, the pandemic further bolstered results as consumers avoided appearing in-person for both shopping and banking. Instead, they sought — and found — digital alternatives.

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index.

Our own representation of the public fintechs’ performance is the Matrix Fintech Index — a market cap-weighted index that tracks the progress of a portfolio of 25 leading public fintech companies. The Matrix fintech Index rose 97% in 2020, compared to a 14% rise in the S&P 500 and a 10% drop for the incumbent financial service companies over the same time period.

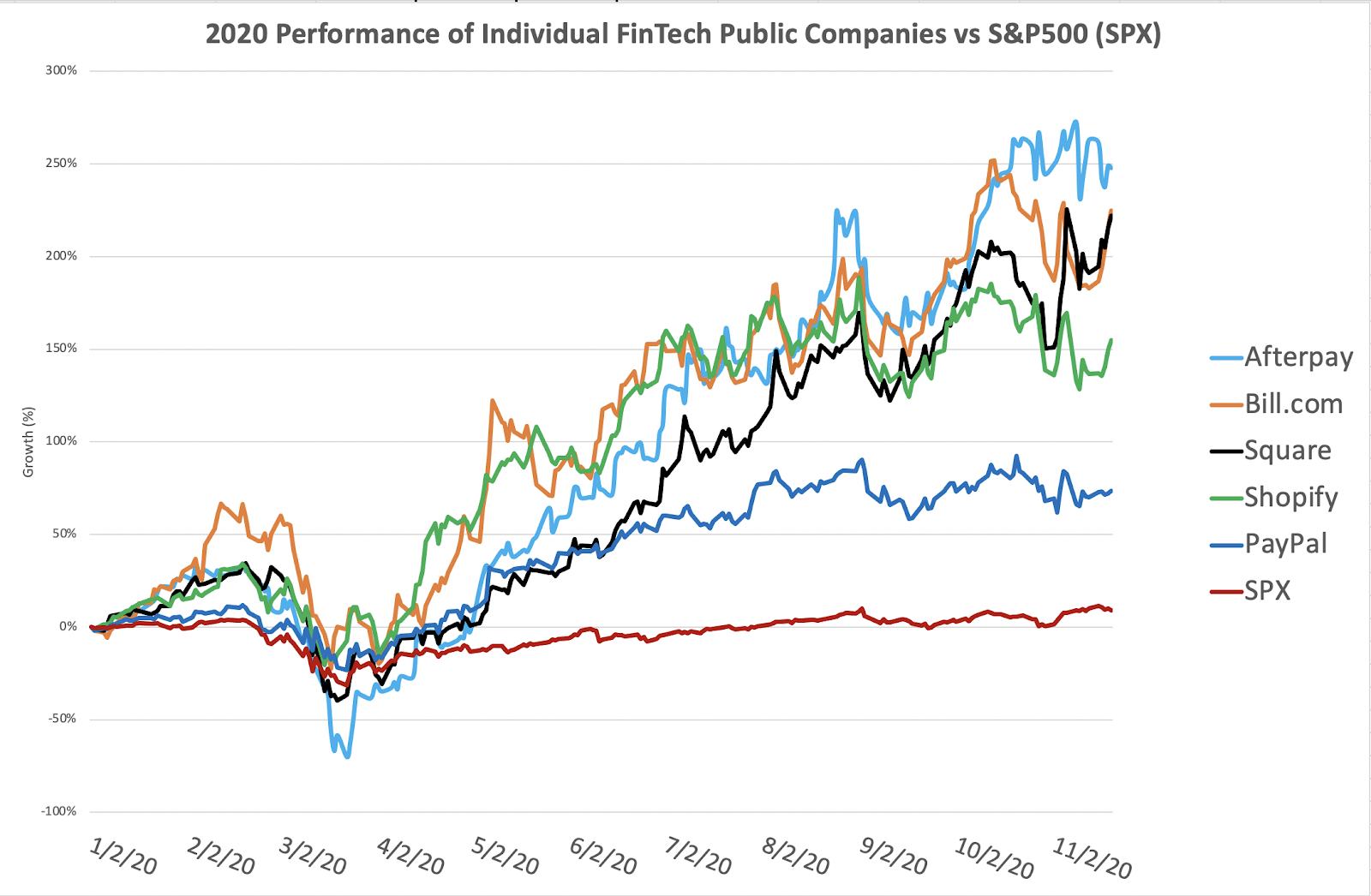

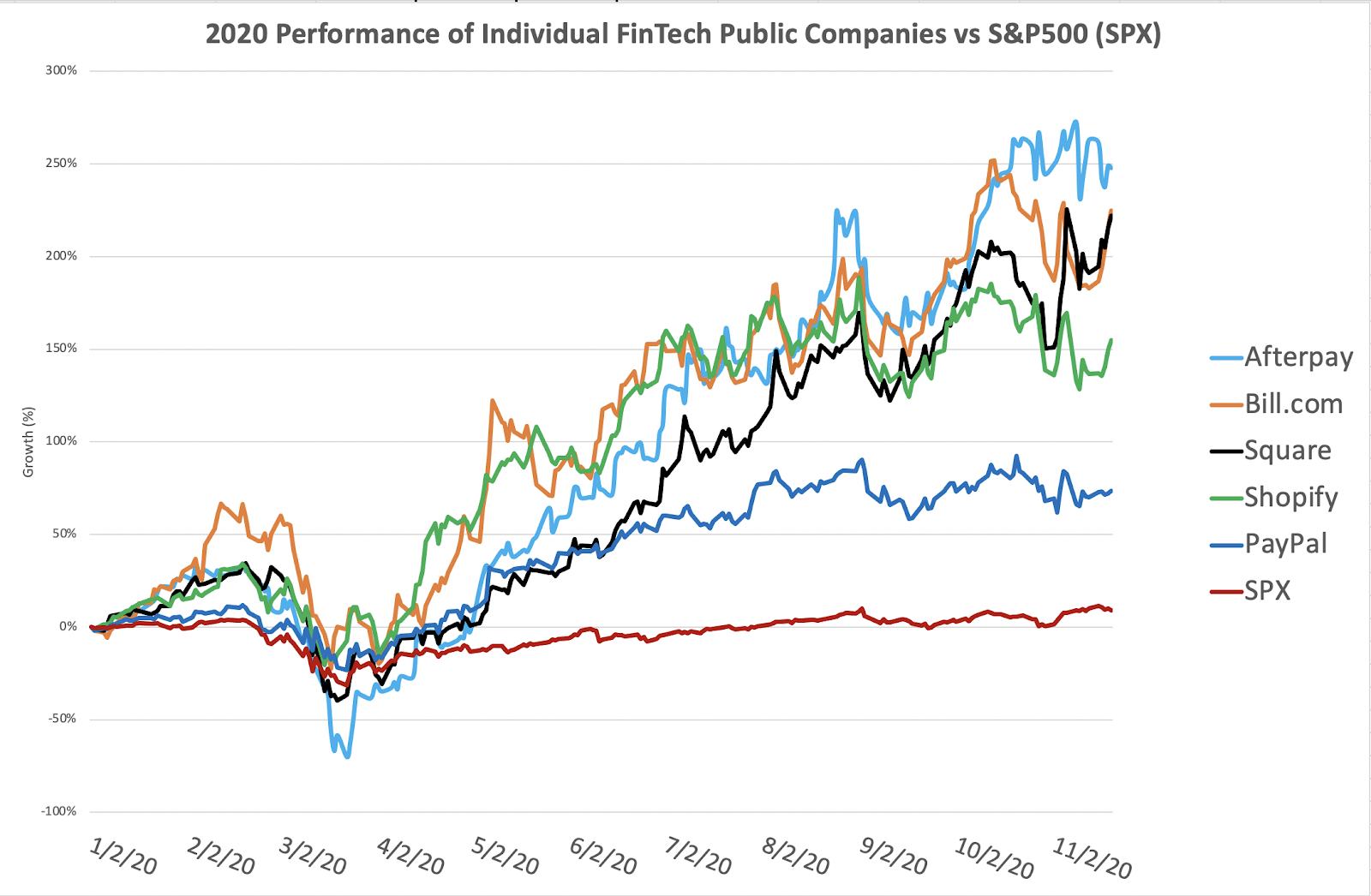

2020 performance of individual fintech companies versus S&P 500. Image Credits: PitchBook

Fintech incumbents and new entrants versus the S&P 500. Image Credits: PitchBook

E-commerce undoubtedly stood out as a major driver. As a category, retail e-commerce grew 35% YoY as of Q3, propelling PayPal and Shopify to add over $160 billion of market capitalization over the year. For its part, PayPal in the third quarter signed up 15 million net new active accounts (its highest ever).

Source: https://techcrunch.com/2021/01/25/fintechs-could-see-100-billion-of-liquidity-in-2021/

Three years ago, we released the first edition of the Matrix Fintech Index. We believed then, as we do now, that fintech represents one of the most exciting major innovation cycles of this decade. In 2020, all the long-term trends forcing change in this sector continued and even accelerated.

The broad movement away from credit toward debit, particularly among younger consumers, represents one such macro shift. However, the pandemic also created new, unforeseen drivers. Among them, millennials decamped from their rentals in crowded cities to accelerate their first home purchase, to the benefit of proptech companies and challenger mortgage players alike.

E-commerce saw an enormous acceleration in growth rates, furthering adoption of online payments platforms. Lastly, low interest rates and looming inflation helped pave the way for the price of Bitcoin to charge toward $30,000. In short, multiple tailwinds combined to produce a blockbuster year for the category.

In this year’s refresh of the Matrix Fintech Index, we’ll divide our attention into three parts. First, a look at the public stocks’ performance. Second, liquidity. Third, we highlight one major trend in the sector: Buy Now Pay Later, or BNPL.

Public fintech stocks rose 97% in 2020

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index. While the underlying performance of these companies was strong, the pandemic further bolstered results as consumers avoided appearing in-person for both shopping and banking. Instead, they sought — and found — digital alternatives.

For the fourth straight year, the publicly traded fintechs massively outperformed the incumbent financial services providers as well as every mainstream stock index.

Our own representation of the public fintechs’ performance is the Matrix Fintech Index — a market cap-weighted index that tracks the progress of a portfolio of 25 leading public fintech companies. The Matrix fintech Index rose 97% in 2020, compared to a 14% rise in the S&P 500 and a 10% drop for the incumbent financial service companies over the same time period.

2020 performance of individual fintech companies versus S&P 500. Image Credits: PitchBook

Fintech incumbents and new entrants versus the S&P 500. Image Credits: PitchBook

E-commerce undoubtedly stood out as a major driver. As a category, retail e-commerce grew 35% YoY as of Q3, propelling PayPal and Shopify to add over $160 billion of market capitalization over the year. For its part, PayPal in the third quarter signed up 15 million net new active accounts (its highest ever).

Source: https://techcrunch.com/2021/01/25/fintechs-could-see-100-billion-of-liquidity-in-2021/

A walk is, more often than not, a solitary experience. As far as the age of COVID-19 is concerned, that’s probably more bug than feature. It’s a way to escape the confines of a shutdown for a few glorious moments, to get some air and, for better or worse, reflect on the day that’s passed or the one to come.

It can, like many things these days, however, be isolating.

For me, long weekend walks have been a sort of lifesaver throughout this bizarre year. Following two months of being completely sidelined over (non-COVID) health issues, I began walking more per week than I ever have. It was a slow process at first — frankly, never leaving my one-bedroom apartment for April and May made it so it was physically painful to walk around the block when I finally felt comfortable going outside.

These days, I walk every morning, regularly crossing the bridge into Brooklyn and Manhattan. Until I started using Apple’s new Fitness+ service a few times a day, it was easily my main source of exercise. In November, however, my Apple Watch Activity bars swapped the more generic gray for the Fitness+ yellow. But even as I’ve made a point to do a couple of indoor exercises a day, I still start each day with a walk. Rain, snow, this weekend’s sub-freezing weather — skipping a day would feel like breaking a promise to myself.

My actual bars (not sure what happened in September — maybe testing a competitor’s device)

This morning Apple dropped the first five installments (episodes?) of Time to Walk. The feature is an attempt to expand the Fitness+ experience beyond the confines of its titular iOS app. A largely Watch-based experience, the feature leverages much of the wearable’s existing features (and Apple’s growing software ecosystem) to offer a more tailored and multimedia experience than you would get listening to a podcast or music alone.

As with the canny arrival of Fitness+ (December) and handwashing for watchOS (September), Apple says the timing was something of a happy coincidence. The company had been working on the feature well before COVID-19 entered the picture.

“Everything from Time to Walk and our launch of Fitness+ was something we had been working on well before COVID,” the company’s senior director of Fitness Technologies Jay Blahnik tells TechCrunch. “From the very beginning, we thought of Fitness+ as a place where everyone was welcome. We wanted it to feel like a place where, whether you’re new to fitness or very fit, there was something for everyone.”

For many, a walk (or push, in the case of those who use a wheelchair for mobility) is square one when it comes to daily workouts. For my part, I was certainly far more comfortable taking quick strolls around the neighborhood. With limits on space and no real exercise equipment to speak of beyond a kettlebell and yoga mat, attempting to approximate the gym experience at home has seemed a fool’s errand.

April found me trying some YouTube yoga classes with limited efficacy. Like most attempts to exercise, it didn’t stick. Walking every day was the only thing that did. And for the first time in my life, COVID-19 found me walking without any particular destination in mind. That old cliché about it being about the journey not the destination is fine when you don’t mind constantly being late to meetings. Walking for the sake of itself, however, changes the dynamic significantly. I speak to artists, writers and musicians on a regular basis for my podcast. The common sentiment is a familiar one: You simply can’t force creativity. But for those who make a point to regularly walk and run, it’s perhaps the most surefire way to kickstart the process.

Time to Walk is Apple’s attempt to capture some of that lightning in a bottle — to follow a rotating cast of big names as they walk through locations that mean something to them. The company says it’s been making an effort to meet guests where they are and essentially coach them through the process. The ability to do so is, of course, depends on their given location — especially with all of the sorts of travel restrictions that have been in place since early last year.

Ultimately, Apple says, the decisions of where to record are made by the guests. “Some guests said, ‘this is where I want to go,’ ” says Blahnik. “And some guests were like, ‘no, I want to to do the walk I normally do.’ For us, it’s not about Shawn Mendes in the Grand Canyon, it’s about where they want to go. Sometimes that’s limited by COVID, but what we found delightful was for many people, they loved to take the walk they loved to take.”

The first four guests — Mendes, Dolly Parton, Draymond Green and Uzo Aduba — run the gamut on approaches. “We think about the stories, we think about the diverse guest,” says Blahnik. We think about all of the ways you’d like the conversations to go. But what was important to us was that the idea resonated with them. The idea of going out for a walk, having a lovely conversation and hearing stories that could give you a different perspective.”

Parton, who turned 75 earlier this month, recorded her session in a studio — in contrast to the other three names. She relates a handful of stories largely revolving around her upbringing in Sevier County (pronounced “severe”), Tennessee. There’s a story about a Christmas tree and one about opening a literacy center with the help of her father (who struggled with his own ability to read and write).

She somewhat self-effacingly relates a story about the time her hometown erected a statue of her. “So I went home, and I said, ‘Daddy, did you know they’re putting a statue of me? Do you know about the statue down at the courthouse?’ ” Parton explains. “And Daddy said, ‘Well, yeah, I heard about that.’ He said, ‘Now, to your fans out there, you might be some sort of an idol. But to them pigeons, you ain’t nothing but another outhouse.’ ”

According to Parton, her father would visit the statue at night with a bucket of soap and water to clean the pigeons’ mess off his daughter’s likeness. Her segment culminates with something approaching a behind the music-style segment, describing stories behind three of her own songs: “Coat of Many Colors,” “Circle of Love” and “9 to 5.” The latter is the real gem of the bunch, contrasting her morning routines to costars Jane Fonda and Lily Tomlin, while describing the role her acrylic nails played in the songwriting and recording process.

Image Credits: Apple

Green’s stories are more emblematic of the rest. On a walk around Malibu, the Warriors power forward discusses some inspiration stories on and off the court, from being told he would never be a star to a time he tried and failed to cheat on a test in school. The stories are purposefully personal. Aduba relates some of her own struggles to break into acting, as she walks her amusingly named dog Fenway Bark through Fort Green Park in Brooklyn.

The guests share images relating to their stories or snapshots of where they go on their walks, which are delivered to the wrist with a haptic buzz. At they end of the journey, they share three handpicked songs that can be saved to a playlist on Apple Music, similar to what the company has done for its Fitness+ workouts.

Write-ups of the Time to Walk have thus far compared it to podcasting — understandably so, given that it’s an on-demand, audio-first experience. Though the feature, which downloads directly onto the Watch when the new installment drops once a week, has its own flavor, according to Apple.

“Often podcasts are hosted,” Blahnik says, by way of distinction. “In our journey to build out this experience, we certainly considered if there should be a host walking with this person. What we realized is that, for what we were trying to create, the intimacy of having the singular guest talk to you felt a lot more like you were on a walk with them. The notion that it’s not happening in a studio (in almost all cases), that they’re walking someplace that inspires them. You’ll hear that with Draymond and Shawn — with Shawn he’s huffing and puffing up that hill and it’s kind of nice because you’re in that moment together.”

Time to Walk isn’t raw, exactly. It is an Apple production, after all. The company’s certainly not tossing out found audio here. But the content does seem more off-the-cuff than many of its productions, even as it’s packaged together with a slick intro and a trio of songs at the end. But it’s a nice change of pace for those looking for something that feels a little more personal than we’re accustom to from some of the names involved.

Your own mileage will vary, depending on, among other things, your interest in the guest. Though, there’s always a chance someone you’ve never been particularly interested in — or even heard of — will offer some unique tidbit or interesting way of looking at things. That’s one of the potential upsides of having Apple doing the curating here — there’s some interesting potential for discovery. And even in the case of artists you’re familiar with, there’s good potential to discover something new.

The weekly 20 to 45-minute audio supplement won’t make the actual act of walking any less solitary — but for a little while, at least, it’s nice to feel like someone’s along for the ride.

Source: https://techcrunch.com/2021/01/25/walking-with-dolly/

Starting next month, Facebook will open up academic access to a dataset of 1.3 million political and social issue ads, including those that ran between August 3 and November 3, 2020 — Election Day in the U.S.

Facebook’s Ad Library, launched in 2019, offers a searchable database of all ads running on Facebook and Instagram. Implemented after the 2016 Russian election interference fiasco, the database allows researchers and reporters to drill down into ads by topic, company and candidate, displaying data about when an ad ran, who saw it and how much it cost.

Facebook says the decision to offer a deeper look into ads on the platform comes after feedback from the research community, which specifically requested more information about targeting. Facebook’s extremely granular ad targeting tools are of particular interest to researchers, who will soon have access to why certain people saw ads, including data on location and interest.

“We recognize that understanding the online political advertising landscape is key to protecting elections, and we know we can’t do it alone,” Facebook Product Manager Sarah Clark Schiff wrote in the announcement.

The company’s ad targeting systems have plunged the company into hot water in the past. In 2016, Facebook disabled a targeting option for “ethnic affinity” in credit, housing and employment-related ad categories following reporting on how those tools could be abused for illegal discrimination. In 2018, the company removed 5,000 additional ad targeting options due to similar potential for discriminatory advertising practices. And the extent to which the Trump campaign sailed into the White House on the strength of its micro-targeting Facebook ad operations is still a matter of debate.

Regardless of how you feel about the tools themselves, Facebook’s public-facing ad library has been invaluable tool for reporters, providing both issue-specific deep dives and an easy at-a-glance view of political spending by party, race and candidate. The new targeting data won’t live on the public Ad Library but will instead be limited to the Facebook Open Research & Transparency platform, which is only accessible by university-linked researchers.

Source: https://techcrunch.com/2021/01/25/facebooks-ad-library-targeting-political-ad-election-data/

This morning, Qualtrics, a software company that tracks customer and employee sentiment, filed a new S-1 document. The new filing raises Qualtrics’ expected IPO price range, providing the Utah-based unicorn with a higher potential valuation in its impending debut.

Qualtrics previously sold to SAP for $8 billion while on the path to going public; after a time inside the larger software company, Qualtrics announced it would spin out as its own public company. TechCrunch previously explored the company’s initial IPO filing and its first IPO pricing interval.

At the time, we described it as just that: Qualtrics’ first IPO price range. We expected the company to raise its targets. Why? At its initial $22 to $26 per-share price range, it simply felt undervalued compared to current-market analogs and benchmarks.

Let’s talk about its new price range.

Pricing

Qualtrics is a SaaS company that is growing at a moderate clip and is nearly break-even if you remove the cost of share-based compensation. And at a run rate of around $800 million in its most recent quarter, it’s a large firm.

So it’s not just another fast-growing SaaS firm that’s crested $100 million in ARR that is still running stiff deficits, it’s a different beast. That makes the effort to triangulate its valuation all the more fun.

At its new interval and with some minor share-count tweaks detailed in its new filing, Qualtrics will raise as much as $1.68 billion in its debut, a figure that is exclusive of some transactions associated with the IPO.

With its new $27 to $29 per-share IPO price range, Qualtrics is shooting a little bit higher than before. But before we get too sure that the company is being conservative, let’s get some new valuation numbers:

Source: https://techcrunch.com/2021/01/25/qualtrics-raises-ipo-pricing-ahead-of-debut/