& meet dozens of singles today!

User blogs

Fleksy, an autocorrecting AI keyboard which competes with big-guns like Google’s Gboard and Microsoft’s Swiftkey, has a new way to catch users’ eyes: Art keyboards.

It’s just launched FleksyArt: A marketplace for artists to sell digital works to its users so they can customize the look of their keyboards.

Fleksy has had keyboard themes before. But the art marketplace aims to go further — opening its platform up to all sorts of artists to digitally distribute work to its “millions” of users for display on a piece of essential smartphone real-estate (it points out the keyboard is the second most used app on phones, after all).

As this is keyboard art, the illustrations and artworks appear with the letters of Fleksy’s keyboard overlaid. So the startup warns legibility is important. Clearly some designs are going to work better than others. But beyond that the creative sky is the limit.

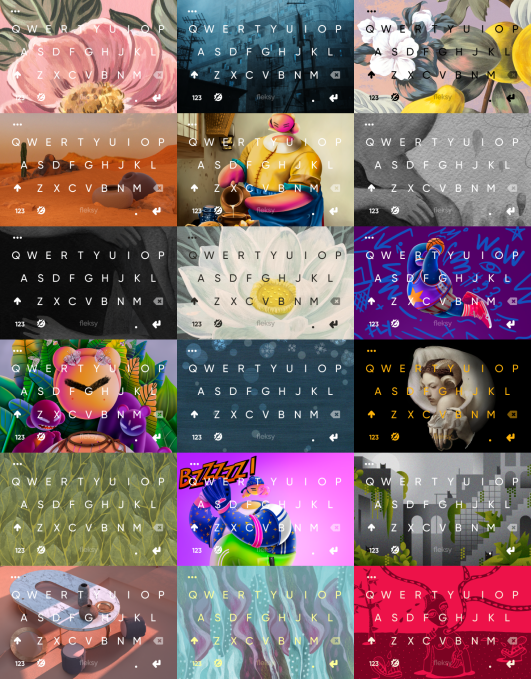

A collage of some of the different artworks available on the FleksyArt marketplace (Image credit: Fleksy)

FleksyArt is starting with several digital artists onboard, including María Picasso i Piquer, Lucila Dominguez, URKO and Maru Ceballos.

It’s inviting other artists to sign up by submitting a portfolio of work for review here.

Victoria Gerchinhoren, Fleksy’s chief design officer, explains how it works: “When we receive the portfolios, my design team approves for having the artwork in our marketplace,” she tells us, noting Fleksy has already handpicked a few artists to get the ball rolling. “I send them guidelines on how to prepare the assets and I write the last specs before publishing inside the product.”

“There defined guidelines in terms of the number of pieces (always packs of 2-4 themes) and artists can create as many packs as they want. We suggest the pieces inside each pack have a connection, they can be connected by an idea or style,” she goes on.

“We publish the packs in a dedicated section in the host app (which we redesigned with this in mind not long ago) then communicate in social media. We’ve also just launched the website section with interviews and the artist profiles and bios so they have a nice place to be showcased.”

Fleksy is setting a flat price of €2.99 for all art packs — in order that artists selling on the marketplace “have the same price and competition is fair”, as Gerchinhoren puts it.

It’s doing a 50:50 revenue split on sales — after Google’s 30% commission has been factored in. So this means that Google gets €0.89 per sale, and the artist and Fleksy then split the rest.

Fleksy has also confirmed that artists retain copyright of their works.

“We’re setting this collaboration on a revenue-share model,” it notes on its website. “You’ll receive 50% of the revenue after Google’s 30% commission. We think this is fair since you’ll provide the Artwork and Fleksy implements & distribute your Artwork. Payments are made bi-annually, upon our receipt of a legal invoice from you.”

Source: https://techcrunch.com/2021/01/26/fleksy-adds-an-art-marketplace-to-spice-up-its-keyboard-app/

Grindr, a gay, bi, trans and queer hook-up app, is on the hook for a penalty of NOK100,000,000 (aka €10M or ~$12.1M) in Europe.

Norway’s data protection agency has announced it’s notified the US-based company of its intention to issue the fine in relation to consent violations under the region’s General Data Protection Regulation (GDPR) which sets out strict conditions for processing people’s data.

The size of the fine is notable. GDPR allows for fines to scale up to 4% of global annual turnover or up to €20M, whichever is higher. In this case Grindr is on the hook for around 10% of its annual revenue, per the DPA. (Although the sanction is not yet final; Grindr has until February 15 to submit a response before the Datatilsynet issues a final decision.)

“We have notified Grindr that we intend to impose a fine of high magnitude as our findings suggest grave violations of the GDPR,” said Bjørn Erik Thon, DG of the agency, in a statement. “Grindr has 13.7 million active users, of which thousands reside in Norway. Our view is that these people have had their personal data shared unlawfully. An important objective of the GDPR is precisely to prevent take-it-or-leave-it ‘consents’. It is imperative that such practices cease.”

Grindr has been contacted for comment.

Last year a report by Norway’s Consumer Council (NCC) delved into the data sharing practices of a number of popular apps in categories such as dating and fertility. It found the majority of apps transmitted data to “unexpected third parties”, with users not clearly informed how their information was being used.

Grindr was one of the apps featured in the NCC report. And the Council went on to file a complaint against the app with the national DPA, claiming unlawful sharing of users’ personal data with third parties for marketing purposes — including GPS location; user profile data; and the fact the user in question is on Grindr.

Under the GDPR, an app user’s personal data may be legally shared if you obtain their consent to do so. However there are a set of clear standards for consent to be legal — meaning it must be informed, specific and freely given. The Datatilsynet found that Grindr had failed to meet this standard.

It said users of Grindr were forced to accept the privacy policy in its entirety — and were not asked if they wanted to consent with the sharing of their data to third parties.

Additionally, it said sexual orientation could be inferred by a user’s presence on Grindr; and under regional law such sensitive ‘special category’ data carries an even higher standard of explicit consent before it can be shared (which, again, the Datatilsynet said Grindr failed to get from users).

“Our preliminary conclusion is that Grindr needs consent to share these personal data and that Grindr’s consents were not valid. Additionally, we believe that the fact that someone is a Grindr user speaks to their sexual orientation, and therefore this constitutes special category data that merit particular protection,” it writes in a press release.

“The Norwegian Data Protection Authority considers that this is a serious case,” added Thon. “Users were not able to exercise real and effective control over the sharing of their data. Business models where users are pressured into giving consent, and where they are not properly informed about what they are consenting to, are not compliant with the law.”

The decision could have wider significance as a similar ‘forced consent’ complaint against Facebook is still open on the desk of Ireland’s data protection watchdog — despite being filed back in May 2018. For tech giants that have have set up a regional base in Ireland, and made an Irish entity legally responsible for processing EU citizens’ data, GDPR’s one-stop-shop mechanism has led to considerable delays in complaint enforcement.

Grindr, meanwhile, changed how it obtains consent in April 2020 — and the proposed sanction deals with how it was handling this prior to then, from May 2018, when the GDPR came into force.

“We have not to date assessed whether the subsequent changes comply with the GDPR,” the Datatilsynet adds.

After its report last year, the NCC also filed complaints against five of the third parties who it found to be receiving data from Grindr: MoPub (owned by Twitter), Xandr (formerly known as AppNexus), OpenX Software, AdColony, and Smaato. The DPA notes that those cases are ongoing.

Following the NCC report in January 2020, Twitter told us it had suspended Grindr’s MoPub account while it investigated the “sufficiency” of its consent mechanism. We’ve reached out to Twitter to ask whether it ever reinstated the account and will update this report with any response.

European privacy campaign group noyb, which was involved in filing the strategic complaints against Grindr and the adtech companies, hailed the DPA’s decision to uphold the complaints — dubbing the size of the fine “enormous” (given Grindr only reported profits of just over $30M in 2019, meaning it’s facing losing about a third of that at one fell swoop).

noyb also argues that Grindr’s switch to trying to claim legitimate interests to continue processing users’ data without obtaining their consent could result in further penalties for the company.

“This is in conflict with the decision of the Norwegian DPA, as it explicitly held that “any extensive disclosure … for marketing purposes should be based on the data subject’s consent“,” writes Ala Krinickytė, data protection lawyer at noyb, in a statement. “The case is clear from the factual and legal side. We do not expect any successful objection by Grindr. However, more fines may be in the pipeline for Grindr as it lately claims an unlawful ‘legitimate interest’ to share user data with third parties — even without consent. Grindr may be bound for a second round.”

Source: https://techcrunch.com/2021/01/26/grindr-on-the-hook-for-e10m-over-gdpr-consent-violations/

district managers adhere intellectual health theme

2012 Super Bowl Champion Ravens Wr Torrey Smith Won Red Robi

How To Find Your Cheap NFL Jerseys Wholesale Supplier

Five risky prophecies for those Baltimore Ravens 2013 nfl Season

perfect gear suitable for sports activities

Patriots case Kraft discussions Hernandez fantastic tank rin

Notre Dame Wins First Round Of Ncaa Football Cover Vote

Jaguars Activates Jones Drew

Atomico, the European venture capital fund that typically invests at Series A and Series B, has made a number of internal promotions, including making SaaS and enterprise-focussed investor Ben Blume a partner at the firm.

The step up from principal to partner comes after 8 years spent at Atomico, which Blume first joined in 2013 as an associate. In 2017, he was promoted to principal and has built a reputation within the VC firm and beyond after leading an array of promising and successful investments.

They include Spacemaker, a startup that has developed AI-supported software for urban development and was acquired by Autodesk late last year. He also led Atomico’s investments into Onna, and Automation Hero, where he currently sits on the board. In addition, he is said to have helped manage Atomico’s early backing of U.K. chip company Graphcore, and sourced the VC’s original Series A investment in recent unicorn Hinge Health, where he currently also serves as a board member.

Prior to joining Atomico, he was a consultant at Bain & Company and a software engineer at Bank of America Merrill Lynch. He holds a first class BA in Computer Science from Queens’ College, Cambridge.

Also being promoted are associates, Hillary Ball and Luca Eisenstecken, both stepping up to principal. Eisenstecken has supported Atomico’s investments into Infarm, MessageBird and Scoutbee. And Ball has supported investments into Masterclass and Framer, among others.

Reilly Brennan loves cars. The native Michigander happily did grunt work for an automotive magazine as an undergrad at the University of Michigan before landing a gig as a trackside communications manager at General Motors, spending a few years as an editor and a general manager with an automotive publisher called NextScreen, then becoming a programming director for AOL’s automotive properties.

His next role would be on the West Coast, as executive director of an automotive research program at Stanford, where Brennan continues to be a lecturer. Little surprise that soon after, a seed-stage fund began to make sense, too, and thus was born Trucks Venture Capital, which has since made dozens of bets out of a $20 million debut effort and is wrapping up a larger fund soon.

Late last week, we talked with Brennan about two of the fastest-soaring valuations we’ve seen recently in automotive sector: that of the electric vehicle company Rivian, which raised a giant new round last week at a nearly $30 billion post-money valuation, and Cruise Automation, which also raised a giant new round last week, and also at $30 billion valuation. (Along with some other interesting bets, Trucks managed to write an early check for Cruise before it was acquired in 2016 by GM, which maintains majority ownership of the company.) We wondered if even an auto aficionado might deem things a little bubbly.

You can listen to that full conversation here. In the meantime, the excerpts below have been lightly edited for length and clarity.

TC: Who are your investors in Trucks VC? Are they individuals? Are any auto manufacturers that are trying to get a look at nascent technologies?

RB: We have some former execs from the car industry in the tech world, and a handful of family offices and definitely some large strategic companies. Unfortunately, I can’t tell you their names because I’ve signed documents that prevent me from doing that. But one of the cool things about our little Rolodex of [limited partners] is that our founders — when they want to come in and do something in transportation — it’s an easy doggie door into a lot of those entities, whether they’re people or businesses. One of the things I love about [the mix is] there’s probably no part of a vehicle, whether you’re talking about a car, truck, a bike, or a plane, that one of our investors couldn’t help out with.

TC: Do you look to be the first money into your deals?

RB: One of the interesting learnings I had in the first fund was, we were just trying to participate; we were just happy to be at the party. So we were participating in rounds that other people were leading, and our checks [from Fund I] were anywhere from $100,000 to a few thousand dollars.

The new fund is designed to take advantage of leading rounds [because] halfway through our first fund, founders would ask us to lead rounds, and frankly, the fund wasn’t big enough to do that. Our new fund is really designed so we can lead seed rounds, and that’s what we do. We’ll lead or co-lead and sit on the board. Usually, we’re owning about 10% to 12% of a company at seed.

TC: One of Truck’s early checks went to Cruise, the self-driving car company that GM acquired for an amount that has variously been reported as more than $1 billion, as well as for closer to $500 million . . .

RB: The Cruise investment, my [fellow general partners] Jeff and Kate made. I can’t tell you specifically what the acquisition price was, but it was pretty good. That being said, if you read about the valuation of Cruise now within General Motors, or that of another [self-driving] company we invested in, Nutonomy, which was acquired by [automotive supplier] Delphi [for $450 million in 2017] and is now essentially a company called Motional, they’re pretty high.

I think a lot about those early exits because they validated the space, but I also think a lot of the early investors probably wish they had more ownership. I’m not saying they shouldn’t have sold. But you look at the valuation of Cruise and Motional today — if you put those two entities together — it’s more than the valuation of General Motors, or maybe Ford Motor Company.

TC: But is Cruise’s valuation perhaps too high right now? They still have a very long lead time to making money.

RB: I would agree with you that in the public market, it feels a little bubbly when it comes to electric vehicles and some of these ideas related to technology and auto. But I do think a lot of these companies look at the opportunity to automate things greater than just robo-taxis. Last year in particular provided good insight into how the logistics and delivery part of automation is probably on the nearer term horizon than robo-taxis and therefore more valuable.

TC: How much have valuations been driven up by Tesla, whose valuation now dwarfs all the major car manufacturers?

RB: One of the things the market appears to want is the simple story, and belief in Tesla is now highly aligned to [thinking that] this is just the way that transportation is going to be organized. It’s going to be a zero-emission vehicle that is highly connected and maybe attached to a consumer in a new way.

You’re seeing the same with a lot of these pure-play EV companies, whether it’s [carmaker] Fisker doing a SPAC or the way that [carmaker] Neo is received in China. There’s this purity of their message.

You can argue, successfully, that a lot of other companies have more engineering or a greater dealer network or more IP around a particular idea, but when it comes to the public market stuff, it really is about painting the picture in this one specific way that’s aligned with the future. And right now, the public markets really don’t like that composite, liberal arts approach to vehicle manufacturing; they really just want one thing that aligns very well with the future, which they believe is better electric vehicles.

TC: This seemingly applies to the Detroit carmaker Rivian. What do you think of this company that’s valued at nearly $30 billion yet hasn’t yet sold a truck or SUV? You aren’t one of its investor. Does its valuation make sense to you?

RB: From an engineering perspective, Rivian is probably one of the companies I respect most out of this new breed of manufacturers.

Tens years ago, when they started, there were a lot of new supercar entrepreneurs who were trying to start something new, but they were always small batch ideas. Like, maybe you could get 100 people to buy one. But they weren’t really well-aligned with what consumers were buying, which is increasingly utilities and trucks. So Rivian’s approach, with the segment it’s going after, is really smart, and it has fantastic engineering. So I’m actually quite bullish on Rivian.

In a year’s time, there will probably be two big events for Rivian. One, they will deliver the first batch of [electric delivery vans being built for investor] to Amazon, along with [other orders] to some of the early customers. It also wouldn’t surprise me if they’re public at some point in the next year.

They haven’t told me that; just my own personal speculation here.

TC: When you say it will go public, do you mean through a traditional IPO or maybe through a giant SPAC? Would what you guess?

I bet that Rivian will probably do a traditional IPO, that’s my guess. But they could also do a SPAC at some point. [Either way] I think the public markets are going to be really interested in Rivian. I just think there’s really good stuff there.

TC: Have you been able to test-drive its cars? Have you seen its tech up close? What makes you so confident that what Rivian is building is superior?

RB: I think the point of view they have about the segments is really interesting In the U.S., they are going after two great-growing segments in the business, which is utilities and trucks where, by the way, there’s a lot of margin, and there’s nobody specifically going after those segments.

The Rivian engineering that I speak about is really about the hires they’ve made and a lot of things they’ve done for years in advance of getting these vehicles ready. They’ve got a lot of amazing talent from big manufacturers. They made an unusual but really smart investment in a vehicle assembly facility that they purchased for relatively cheap years ago that was owned by Mitsubishi. And they put together all these components well in advance of anybody really even knowing about them, which is really smart.

Obviously, there’s still a huge amount of risk. What I’m saying is not investment advice. I just think there’s a lot of interesting stuff there that’s head and shoulders above many of the other EV companies, where there’s not a lot of substance, to be candid.

TC: My colleague Kirsten reported in December that Rivian is developing a network of charging stations along interstate highways and also at spots like hiking trails to accommodate who it imagines will be its customers. Does that make sense to you? Relatedly, how many different types of charging stations are we going to have in the world?

[Regarding the location of its stations], it’s definitely a nice ingredient in the story they’re trying to tell, though I don’t think you’ll see a Rivian charger at the entry point of every national park. They’ll probably have access to other charging networks. One of the things we’re seeing in the U.S. is you have some of these dedicated networks like Tesla has, and then you have a lot of agnostic [stations], where you can plug in and charge in a lot of other places, and Rivian will likely take advantage of that. An open question would be whether Rivian builds its own [larger] dedicated network that has a lot of coverage, and I don’t know about that yet.

The other component about Rivian that’s really fascinating is what they do for service and maintenance. I saw an open job that Rivian had a few months ago around remote diagnostics, and one of the bullet points of the job posting was that this job was really designed so that people didn’t have to go back to the dealership. [It begs the question of]: could you design experiences digitally, as with [on-demand remote doctor visits], where you could potentially talk to somebody live, you could [have Rivian] assess the vehicle, or maybe walk you through a situation where you can fix something that would prevent a lot of the trips to dealer?

If you consider the traditional dealer and OEM relationship, a lot of the ways that cars are designed is that they’re constantly having to go back to the dealer. Rivian’s point of view on that is really different, and that’s one of the other reasons it’s one to watch.