& meet dozens of singles today!

User blogs

Lime is adding electric mopeds — painted in the company’s signature green — to its micromobility platform as the startup aims to own the spectrum of inner city travel from jaunts to the corner store to longer distance trips up to five miles.

Lime said Wednesday it plans to launch as many as 600 electric mopeds on its platform this spring in Washington D.C. The company is also working with officials to pilot the mopeds in Paris. Eventually, the mopeds will be offered in a “handful of cities” over the next several months.

The mopeds, supplied by manufacturer Niu, are designed for two people and outfitted with tech like infrared-cameras in the helmet compartment that can detect if they’re in use during a trip, an effort aimed at rooting out misuse and increasing safety. Repeat offenders of Lime’s policies, which includes wearing a helmet at all times, will be kicked off the platform. Customers will also be required to take a selfie wearing the helmet at the start of a ride.

The helmets will be supplied by Moon for U.S. customers and Nikko for the European deployments.

The mopeds will have a top speed of 28 miles an hour and be able to travel up to 87 miles on a single charge. Unlike Lime scooters, in which gig economy workers can earn money by collecting, charging and bringing back to city streets, the mopeds will have swappable batteries and be maintained by full-time employees.

While it’s unclear if mopeds have always been part of Lime’s long-term plans, the company’s head of new mobility told TechCrunch that they’ve been thinking about what the future of electrified urban transportation might include.

“As we’ve grown as a company, we understood that we just needed to follow what our riders were demanding which is further distances,” said Sean Arroyo, head of new mobility at Lime. “The ability to meet any trip, at anytime, anywhere, is something that’s at the foundation for us and so our riders really are the ones that pointed us in this direction.”

Lime CEO Wayne Ting first hinted late last year that a “third mode” of transport beyond scooters and bikes was in the works for the first quarter of 2021 as well as the addition of third-party companies to its platform. Last year, Lime also started to include on its app Wheels-branded electric bikes in certain cities. Ting said, at the time, that users should expect more partnerships like these.

The expansion into mopeds is the latest sign that Lime has managed to put some of its darker Covid-19-tainted times behind it. Lime underwent a round of layoffs in April, taking on capital from Uber the next month in a down-round that brought its valuation under the $1 billion mark. Lime paused most of its operations for a month during the early COVID-19 days.

But it has since rebounded. Ting said in November that the company is both operating cash flow positive and free cash flow positive in the third quarter and was on pace to be full-year profitable, excluding certain costs (EBIT), in 2021. It also had enough cash — or access to it — to expand into mopeds.

The question is, ‘whether more modes are on the way?’

Arroyo didn’t give specifics, but it does appear more is coming.

“I think throughout this year you’re gonna see us really expand, not just with modes, but optionality,” Arroyo said. ” For us it’s really about having a platform that’s available for all these trips, and then we want to be able to provide optionality that makes sense for the riders. Shared is a huge component, but there’s a lot of different levels of what shared looks like; and throughout 2021, I think you’re gonna see us offer quite a few different options as our modes expand.”

Source: https://techcrunch.com/2021/01/27/lime-adds-shared-electric-mopeds-to-the-mix/

Gardin, a ‘deep tech’ hardware and software startup developing optical phenotyping technology and analytics to optimise food production, has raised $1.2 million in pre-seed funding.

Leading the round is LDV Capital, with participation from Seedcamp, and MMC Ventures. A number of angel investors are also investing, including Pratima Aiyagari, Gilad Engel, and Abdulaziz Alrashed.

Founded in late 2019, Gardin’s mission, in the U.K. company’s own words, is to help everyone access high quality, nutritious food that is “good for you and for our planet”.

Specifically, the startup is developing tech for farms based on its own “optical phenotyping” hardware and accompanying analytics software. The idea is to enable food producers to measure and monitor the nutritional value of food, from “seed to plate in a real world environment,” rather than a lab.

“With deployment of Gardin’s OS, insight from our analytics will be delivered to help food producers optimise production, grow nutritious food, lower carbon footprint and reduce waste,” says founder and CEO Sumanta Talukdar. “At Gardin, we want to empower food producers to feed the world consciously, sustainably and nutritionally, as it should be”.

Talukdar says he started the company after learning that the traditional food industry currently “does not, or cannot, quantifiably measure food nutrition and quality”. This has seen Gardin partner with some of the leading crop and plant physiologists, phenotyping experts and plant scientists to identify the key biochemical mechanisms in various crops related to plant physiology.

“By designing hardware to specifically measure the signatures of these mechanisms, Gardin is able to quantify plant physiology and key compounds density with high fidelity (i.e. signal/noise ratio) at a cost similar to consumer electronics goods,” he explained. To achieve this, Gardin is employing a multispectral data fusion approach, using a suite of remote sensing and computer vision techniques to capture very specific data which is then “fused” to drive the analytics.

To that end, Gardin has been designed to assist both traditional and CEA (controlled environment agriculture), with the ambitious aim to become the new “food production gold standard”.

“Our full stack product is designed to run and optimise the entire growing environment running silently in the background like an OS i.e we are solving their problems, helping food producers grow higher quality food and reducing their operating costs and carbon footprint,” adds Talukdar.

“We have also designed our platform so we can integrate with their existing architectures. To us, asking a producer in what is already an asset heavy industry to change or add to their system to make us fit, was folly”.

In terms of traction, Talukdar says Gardin has already secured pilot trials that are ready to go live early this year with “key go-to-market clients. They include supermarket chains, food producers and vertical farms.

French startup Mooncard is partnering with Flying Blue to offer Air France miles to its customers. This is the first time you can earn miles with a payment card in France that isn’t an American Express card.

Mooncard provides corporate payment cards to streamline your expenses. Most companies in France don’t use corporate cards. But fintech startups have created corporate cards that can help you streamline expenses.

In addition to Visa cards, Mooncard lets you easily take a photo of your receipts, add details and submit expenses to your accounting team. You can set up different limits and validation processes.

Today’s news is interesting as American Express has been in a monopolistic position for decades with its partnership with Flying Blue. In France, companies had to choose American Express if they wanted miles as perks.

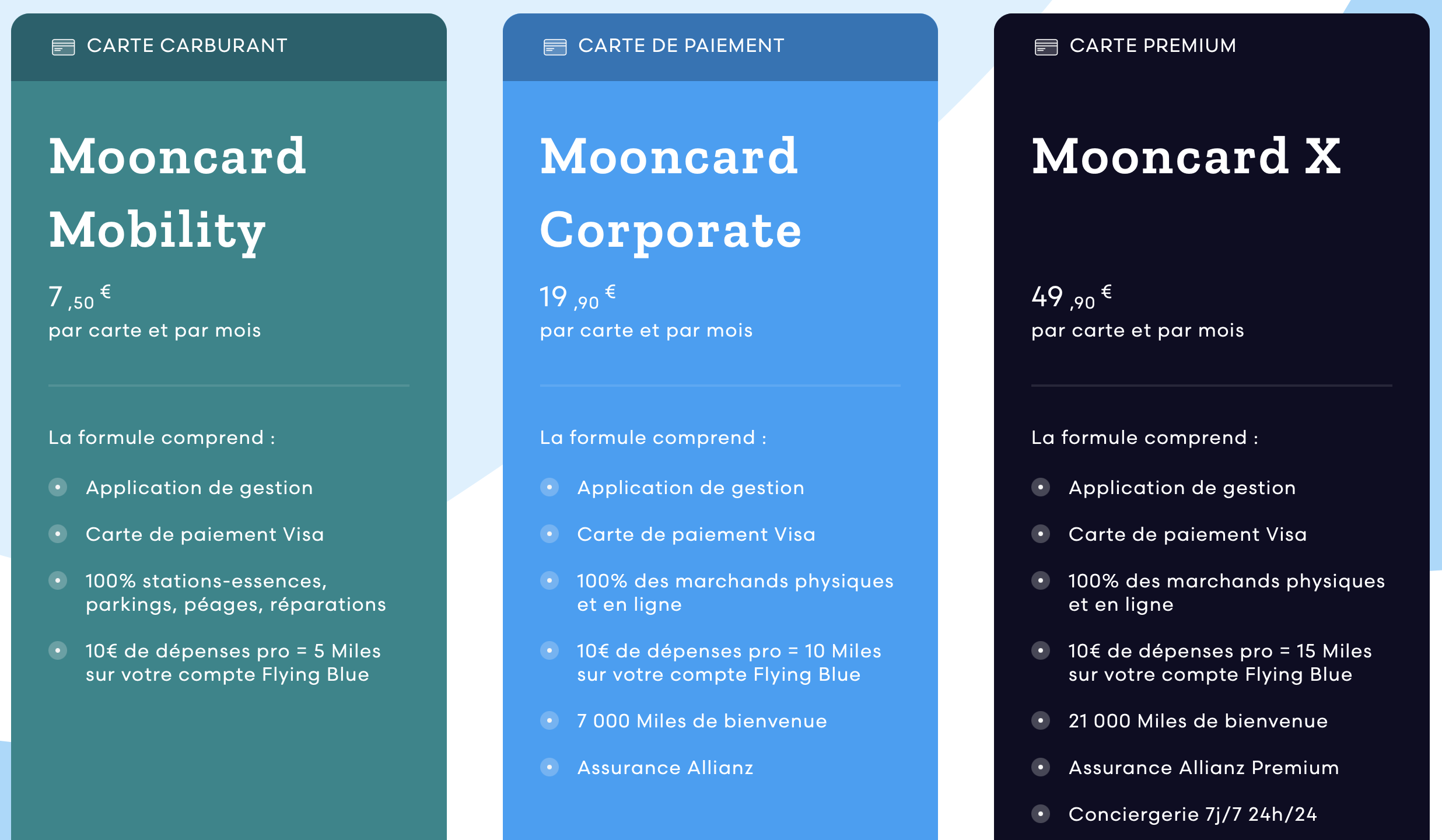

When it comes to pricing, it looks pretty similar to what American Express offers:

There’s one big difference — Mooncard relies on the Visa network. As many restaurants and shops don’t support American Express, it could be enough to lure customers away from American Express. Employees can use their miles for personal trips.

There are 3,000 companies using Mooncard as well as many public institutions.

Joanne Chen just became the second general partner in the history of the now 26-year-old, Silicon Valley venture firm, Foundation Capital.

Were she still alive, Foundation’s founder, Kathyrn Gould, would undoubtedly cheer the development.

Known for her big personality, Gould first met Chen when Chen was an an MBA student at the University of Chicago. Gould was recovering from a bout with cancer at the time, and after being introduced to Chen through one of Chen’s professors, she initially advised Chen not to go into venture. As Gould herself discovered early on, doors open more easily to men in the venture world, which is why she’d started her own firm in the first place.

Yet, like Gould, being dissuaded only motivated Chen more. Though she began her career as an engineer at Cisco, she’d always been interested in finance, jumping into a banking analyst role with Jeffries, then working as an associate with the capital advisory firm Probitas before cofounding a mobile gaming company she’d later wind down.

Grad school in Chicago — and meeting Gould — only reinforced for Chen how much she wanted to become a VC, and following stints at Formation 8 and Hyde Park Angels, she landed at Foundation in 2014. (Sadly, Gould passed away in 2015.)

Certainly, Chen has brought a fresh perspective to a firm that features 10 investors altogether, the rest men.

Aside from being the only woman in the group, Chen has a strong point of view, for example, on the entrepreneurial potential of students from U.C. Berkeley, where she studied as an undergraduate. While the university is not nearly so organized as Stanford when it comes to minting founders, in her view it has just as much talent and, as a result, it’s a network into which she invests a lot of time and energy as an investor.

Chen, who was born in China and great up in Montreal, also spends a lot of time thinking about AI, both as an investor and also simply a person in the world. Her father, who received his PhD from the University of Montreal, went on to work at Bell Labs as a researcher, and her mother is a computer programmer and “DevOps person” who Chen routinely talks with about software tools. But their background isn’t so simple.

Like many immigrants, her parents fled China during the Cultural Revolution. Because her grandfather helped architect a major telecom company in China, he was persecuted by the Communist Party, stripped of all his responsibilities and titles and, as an “intellectual,” says Chen, thrown in jail. Meanwhile, his son (her father) wasn’t allowed to start college until he was 21, and it was only because he was a good student that was he invited abroad to obtain his master’s degree.

Today, her family’s experience combined with China’s use of artificial intelligence — including to track its Muslim minority — is top of mind for Chen in ways it may not be for someone with a lesser grasp of the lengths to which authoritarian regimes will go, and how quickly they can act.

It’s why most of Chen’s work centers on understanding how AI, from how machines evolve from organizing activity to replacing humans (which will definitely happen, says Chen); to how to recognize and counter malicious applications of AI with AI (such as through recruiting software that screens out names and gender to eliminate human bias); and how to otherwise make sure that AI is used to improve human life, she suggests.

Of course, Chen isn’t exactly alone in her interest in AI. Nearly every startup today incorporates — or says it does — AI into its offerings, from lending companies to startups that help remote teams work more effectively. And investors, including at Foundation, have funded many of them.

Asked how she deals with competition for many of these deals, Chen says she moves as fast when there’s a decision to be made. She engages with VPs of engineering and technical founders who share ideas through Slack communities and elsewhere. She also notes that Foundation provides capital to roughly 30 operators who write angel checks and help steer the firm’s attention to interesting deals.

Mostly, suggests Chen, she focuses on whatever is not landing in her inbox — a lesson learned in part from Gould years ago.

It’s easy to believe. As Gould once told this editor of the advice she gives to other VCs: “It not the calls you take. It’s the calls you make. Everyone is calling you with dumb startup ideas, and you can stay hugely busy sorting through that crap. My advice instead is to figure out who are the 10 to 20 smartest people you know and call them. One of them is always starting a company.”

eFounders is expanding its focus by creating a second startup studio called Logic Founders. This time, Logic Founders is going to focus on fintech startups exclusively. Camille Tyan (pictured above) is going to lead the new studio.

Over the past ten years, eFounders has launched dozens of software-as-a-service companies trying to improve the way we work. Portfolio companies include Front, Aircall and Spendesk.

Camille Tyan previously co-founded PayPlug, a payments company that was acquired by Natixis (Groupe BPCE). He plans to follow the eFounders model centered around a new vertical. Logic Founders will come up with ideas for new startups. It’ll recruit two co-founders and start working on the product for the first 12 to 18 months of the company.

Ideally, the startup finds product-market fit and raises a seed round after this initial phase. The startup studio keeps a stake in the startup but it moves on so that it can focus on new projects.

If you’ve been following eFounders closely, the startup studio has already worked on several fintech companies, such as Spendesk, Upflow, Multis and Swan. New fintech projects will likely fall under the Logic Founders umbrella.

The studio says it will launch API-first financial products. It is riding the embedded finance trend — many believe financial products will be distributed by platforms that aren’t primarily focused on finance but could benefit from fintech features. You can expect companies working on payments orchestration, asset securitization, lending APIs, crypto and B2B identity.

Source: https://techcrunch.com/2021/01/26/saas-startup-studio-efounders-launches-a-fintech-startup-studio/