& meet dozens of singles today!

User blogs

Datastax, the company best known for commercializing the open-source Apache Cassandra database, is moving beyond databases. As the company announced today, it has acquired Kesque, a cloud messaging service.

The Kesque team built its service on top of the Apache Pulsar messaging and streaming project. Datastax has now taken that team’s knowledge in this area and, combined with its own expertise, is launching its own Pulsar-based streaming platform by the name of Datastax Luna Streaming, which is now generally available.

This move comes right as Datastax is also now, for the first time, announcing that it is cash-flow positive and profitable, as the company’s chief product officer, Ed Anuff, told me. “We are at over $150 million in [annual recurring revenue]. We are cash-flow positive and we are profitable,” he told me. This marks the first time the company is publically announcing this data. In addition, the company also today revealed that about 20 percent of its annual contract value is now for DataStax Astra, its managed multi-cloud Cassandra service and that the number of self-service Asta subscribers has more than doubled from Q3 to Q4.

The launch of Luna Streaming now gives the 10-year-old company a new area to expand into — and one that has some obvious adjacencies with its existing product portfolio.

“We looked at how a lot of developers are building on top of Cassandra,” Anuff, who joined Datastax after leaving Google Cloud last year, said. “What they’re doing is, they’re addressing what people call ‘data-in-motion’ use cases. They have huge amounts of data that are coming in, huge amounts of data that are going out — and they’re typically looking at doing something with streaming in conjunction with that. As we’ve gone in and asked, “What’s next for Datastax?,’ streaming is going to be a big part of that.”

Given Datastax’s open-source roots, it’s no surprise the team decided to build its service on another open-source project and acquire an open-source company to help it do so. Anuff noted that while there has been a lot of hype around streaming and Apache Kafka, a cloud-native solution like Pulsar seemed like the better solution for the company. Pulsar was originally developed at Yahoo! (which, full disclosure, belongs to the same Verizon Media Group family as TechCrunch) and even before acquiring Kesque, Datastax already used Pulsar to build its Astra platform. Other Pulsar users include Yahoo, Tencent, Nutanix and Splunk.

“What we saw was that when you go and look at doing streaming in a scale-out way, that Kafka isn’t the only approach. We looked at it, and we liked the Pulsar architecture, we like what’s going on, we like the community — and remember, we’re a company that grew up in the Apache open-source community — we said, ‘okay, we think that it’s got all the right underpinnings, let’s go and get involved in that,” Anuff said. And in the process of doing so, the team came across Kesque founder Chris Bartholomew and eventually decided to acquire his company.

The new Luna Streaming offering will be what Datastax calls a “subscription to success with Apache Pulsar.’ It will include a free, production-ready distribution of Pulsar and an optional, SLA-backed subscription tier with enterprise support.

Unsurprisingly, Datastax also plans to remain active in the Pulsar community. The team is already making code contributions, but Anuff also stressed that Datastax is helping out with scalability testing. “This is one of the things that we learned in our participation in the Apache Cassandra project,” Anuff said. “A lot of what these projects need is folks coming in doing testing, helping with deployments, supporting users. Our goal is to be a great participant in the community.”

Source: https://techcrunch.com/2021/01/27/datastax-acquires-kesque-as-it-gets-into-data-streaming/

After revealing its first fund just last year, a $100 million pool of investment capital dedicated to early stage startups focusing on sustainable food development, clean energy, health innovation and new space technologies, Prime Movers Lab is back with a second fund. Prime Movers Lab Fund II is larger, with $245 million committed, but it will pursue the same investment strategy, albeit with a plan to place more bets on more companies, with an expanded investment team to help manage the funds and portfolio.

“There are a lot of VCs out there,” explained founder and general partner Dakin Sloss about the concept behind the fund. “But there aren’t many VCs that are focused exclusively on breakthrough science, or deep tech. Even though there are a couple, when you look at the proportion of capital, I think it’s something like less than 10% of capital is going to these types of companies. But if you look at what’s meaningful to the life of the average person over the next 30 years, these are all the companies that are important, whether it’s coronavirus vaccine,s or solar energy production, or feeding the planet through aquaponics. These are the things that are really meaningful to to making a better quality of life for most people.”

Sloss told me that he sees part of the issue around why the proportion of capital dedicated to solving these significant problems is that it requires a lot of deep category knowledge to invest in correctly.

“There’s not enough technical expertise in VC firms to choose winners intelligently, rather than ending up with the next Theranos or clean tech bubble,” he said. “So that’s the first thing I wanted to solve. I have a physics background, and I was able to bring together a team of partners that have really deeply technical backgrounds.”

As referenced, Sloss himself has a degree from Stanford in Mathematics, Physics and Philosophy. He was a serial entrepreneur before starting the fund, having founded Tachyus, OpenGov and nonprofit California Common Sense. Other Partners on the team include systems engineer Dan Slomski, who previously worked on machine vision, electro-mechanical systems and developing a new multi-phase flow fluid analyzer; Amy Kruse, who holds a PhD in neuroscience and has served as an executive in defence technology and applied neuroscience companies; and Carly Anderson, a chemical engineer who has worked in biomedicine and oil & gas, and who has a PhD in chemical and biomolecular engineering. In addition to core partners with that kind of expertise, Prime Movers Lab enlists the help of venture partners and specialist advisors like former astronaut Chris Hadfield.

Having individuals with deep field expertise on the core team, in addition to supplementing that with top-notch advisors, is definitely a competitive advantage, particularly when investing in the kinds of companies that Prime Movers Lab does early on in their development. There’s a perception that companies pursuing these kinds of hard tech problems aren’t necessarily as viable as a target for traditional venture funding, specifically because of the timelines for returns. Sloss says he believes that’s a misperception based on unfortunate past experience.

“I think there are three big myths about breakthrough science or hard tech or deep tech,” he said. “That it takes longer, that it’s more capital intensive, and that it’s higher risk. And I think the reason those myths are out there is people invested in things like Theranos, and the clean tech bubble. But I think that there were fundamental mistakes made in how they underwrote risk of doing that.”

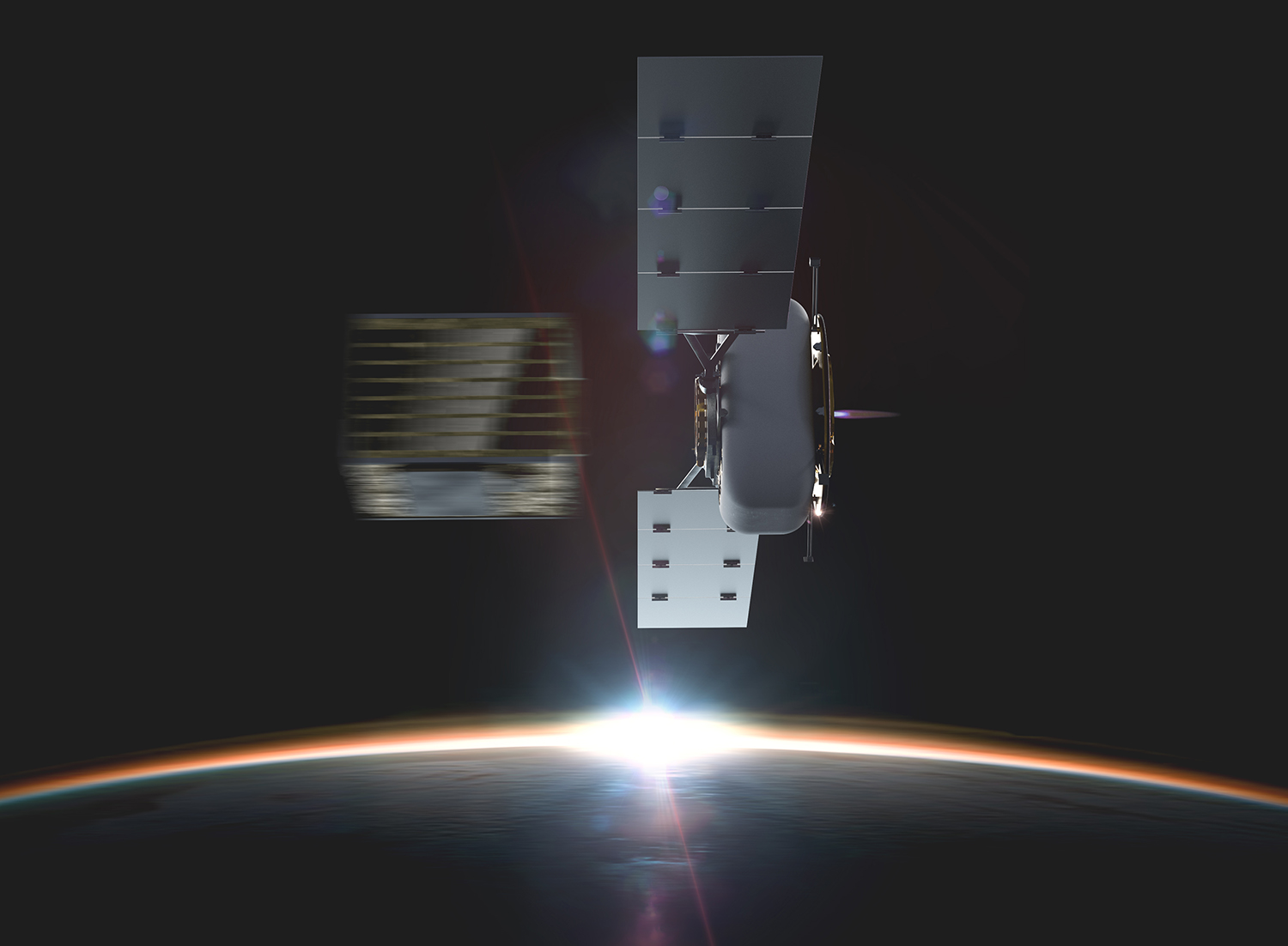

Image Credits: Momentus

To avoid making those kinds of mistakes, Sloss says that Prime Movers Lab views prospective investments from the perspective of a “spectrum of risk,” which includes risk of the science itself (does the fundamental technology involve actually work), engineering risk (given the science works, can we make it something we can sell) and finally, commercialization or scaling risk (can we then make it and sell it at scale with economics that work). Sloss says that if you use this risk matrix to assess investments, and allocated funds to address primarily the engineering risk category, concerns around timeframes to return don’t really apply.

He cites Primer Movers Lab’s Fund I portfolio, which includes space propulsion company Momentus, heading for an exit to the public markets via SPAC (the company’s Russian CEO actually just resigned in order to smooth the path for that, in fact), and notes that of the 15 companies that Fund I invested in, four are totally on a path to going public. That would put them much faster to an exit than is typical for early stage investment targets, and Sloss credits the very different approach most hard science startups take to IP development and capital.

“The inflection points in these types of companies are actually I think faster to get to market, because they’ve spent years developing the IP, staying at relatively low or attractive valuations,” he said. “Then we can kind of come in, at that inflection point, and help them get ready to commercialize and scale up exponentially, to where other investors no longer have to underwrite the difference between science and engineering risk, they can just see it’s working and producing revenue.”

Companies that fit this mold often come directly from academia, and keep the team small and focused while they’re figuring out the core scientific discovery or innovation that enables the business. A prime example of this in recent memory is Wingcopter, a German drone startup that developed and patented a technology for a tilt-wing rotor that changes the economics of electric autonomous drone flight. The startup just took its first significant startup investment after bootstrapping for four years, and the funds will indeed be used to help it accelerate engineering on a path towards high-volume production.

While Wingcopter isn’t a Prime Movers Lab portfolio company, many of its investments fit the same mold. Boom Aerospace is currently working on building and flying its subscale demonstration aircraft to pave the way for a future supersonic airliner, while Axiom Space just announced the first crew of private tourists to the International Space Station who will fly on a SpaceX Falcon 9 for $50 million a piece. As long as you can prove the fundamentals are sound, allocating money turning it into something marketable seems like a logical strategy.

For Prime Movers Lab’s Fund II, the plan is to invest in around 30 or so companies, roughly doubling the number of investments from Fund I. In addition to its partners with scientific expertise, the firm also includes Partners with skill sets including creative direction, industrial design, executive coaching and business acumen, and provides those services to its portfolio companies as value-add to help them supplement their technical innovations. Its Fund I portfolio includes Momentus and Axiom, as mentioned, as well as vertical farming startup Upward Farms, coronavirus vaccine startup Covaxx, and more.

People and businesses are relying on the internet to get things done more than ever before, an opportunity but also an infrastructure headache for service providers that need to scale quickly and reliably to meet that demand.

Today, a startup that has built a clever, software-based way for them to expand their networks without buying costly equipment is announcing a major round of funding on the back of its business booming.

DriveNets — which provides software-based routing solutions to service providers that run them as virtualized services over “white box” generic architecture — has closed $208 million in funding, a Series B that values the company at over $1 billion post-money.

The plan will be to use the funding to continue building out the business internationally and to tailor it to more use cases beyond carriers, including the wave of bigger companies that stream large amounts of media and have some control over their networks as a result.

Future deals are still under NDA, CEO Ido Susan said, but he described the opportunity as a clear one: “If you want to serve bandwidth with low latency, if you want to offer strong 5G capability or cloud gaming, you need to be close to your end customer.”

The Series B is being D1 Capital Partners. Previous backers Bessemer Venture Partners and Pitango (which co-led DriveNets’ previous, $110 million round when it emerged from stealth) also made a significant investment, and Atreides Management also participated. This latest round was made at more than double DriveNets’ valuation in 2019.

D1 has been an especially prolific investor in the last year, going big on businesses that are seeing a lot of attention as a result of pandemic conditions. They include e-commerce giants Warby Parker and Instacart, fintech TransferWise, gaming engine Unity, online car sales platform Cazoo, and transportation startup Bolt.

DriveNets’ big round is based both on bigger trends in the market, as well as its own strong record.

Before this round, DriveNets had already counted AT&T among its customers, a major vote of confidence for the company and its virtual network approach, but it seems that recent circumstances and the spike in internet activity have brought more providers to consider its approach.

“The internet was growing 30%-40% annually even before Covid-19,” said Susan. “But even five years ago, incumbent carriers were coming to us saying, said no one can build virtual networks. Now, it’s not a question of whether it works or not, but when you will adopt it.”

Recent momentum for the company’s sales, he said, is very good. “Everyone is working and studying from home so you need more capacity and bandwidth in the network,” he added.

DriveNets’ core product is a more flexible and cost-effective replacement for the traditional network router that relies on virtualized architecture. Traditionally, routers have been sold as vertically-integrated hardware solutions, bringing together both software and hardware into one branded big box, with companies like Cisco and Juniper Networks dominating the space.

In their place, as Susan and co-founder Hillel Kobrinsky envisioned it, DriveNets provides a solution that is based around generic white boxes. It currently works with three providers for these boxes, Susan said.

These work in conjunction with a system it has developed called Network Cloud, which in turn runs a networking stack called the DriveNets Operating System. Service providers control their systems of white boxes and other servers through a virtualized service run over Docker containers, using open APIs to automate and configure various network services.

This allows for more flexibility in capacity among the white box servers, but they can also be easily added and removed as needed. Essentially, it’s a system that disaggregates the software from the hardware, to make expanding the hardware much easier, and controlling the software significantly more flexible to boot.

(Ironically, my conversation with Susan took place over Zoom with him in his home office, which also doubles as a DIY workshop. So with a full array of hardware equipment surrounding Susan, we talked about how software would come to dominate the world.)

It’s a disruptive concept that potentially steps on a lot of toes, but Adam Fisher, a partner with Bessemer, said that he’s confident it’s one that will continue to gain traction.

“We are extremely enthusiastic about the company,” he said. “Aside from Ido and Hillel as entrepreneurs, we really connected with their vision. Network routing is moving to software and cloud architecture. We’re talking not just about the small parts here but the hearts and lungs of the system. DriveNets is starting with the hardest parts. Once one customer becomes multiple customers, you just realise it’s the future.”

Beauty and wellness appointment booking apps have proliferated of the last few years, but it appears the race is still on as today one of the leaders, Booksy, raises $70 million in a Series C round led by Cat Rock Capital, with participation from Sprints Capital.

The round was also joined by OpenOcean, Piton Capital, VNV Global, Enern, Kai Hansen, Zach Coelius and Manta Ray Ventures, and takes the total raised by the firm to $119 million. The funding will be used for expansion plans across North America, expanding to new verticals, and acquiring complementary businesses.

The Booksy app is used by customers to book and pay for beauty appointments with local businesses. Salons, nail bars and barbershops can manage the bookings, payments, and customer base via the accompanying Booksy Biz app. The platform also allows salons to sell other products via Booksy E-Commerce, which acts as a marketplace allowing customers to discover and book other local stylists, nail technicians etc.

Booksy was founded by Polish entrepreneurs Stefan Batory (CEO) and Konrad Howard. Allowing customers to schedule their best appointment time means that 38% of customers end up booking after-hours and increasing their appointment frequency by 20%, says the company. The startup launched in 2014 but is now in the US (its largest market), UK, Poland, Spain, Brazil, and South Africa. It claims to be the number-one beauty booking app in each country, with “13 million” consumers on the app.

Batory said in a statement: “Like with many sectors negatively hit by the pandemic, it’s been a turbulent time for the beauty and wellness industry but we’re confident in its ability to come back from this, so it’s fantastic to see our latest group of investors share our optimism and vision. This latest round of funding enables us to reach even more salons and service providers across the US, and in all the regions we operate, which in turn helps them reach more customers.”

Alex Captain, founder and managing partner at Cat Rock Capital, said: “We are incredibly excited to invest in Booksy as it builds the leading global software platform for digitizing the beauty and wellness industry around the world.”

Booksy certainly seems to have cracked the international expansion game ahead of most competitors, which tend to stay more local to their countries of origin such as Treatwell, Styleseat, Vagaro and Mindbody. The opportunity for Booksy is to now use its war cast to roll-up other local players.

It has already acquired rival Lavito in 2018 and, more recently, merged with Versum in December 2020 allowing it to enter Mexico.