& meet dozens of singles today!

User blogs

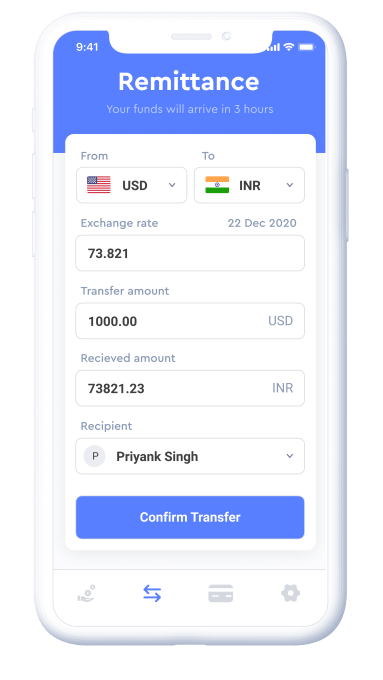

Stilt, a provider of financial services for immigrants in the United States, announced today it has raised a $100 million warehouse facility from Silicon Valley Bank for lending to its customers. This brings Stilt’s total debt facilities so far to $225 million, and will enable it to reach more than $350 million in annualized loan volume. The company also announced the public launch of its no-fee checking accounts, which have been in private beta since September.

A Y Combinator alum, Stilt was founded five years ago by Rohit Mittal and Priyank Singh. Both dealt with the challenges of accessing financial services as immigrants and wanted to created a company to serve other people without Social Security numbers or credit histories.

For applicants without traditional credit reports, Stilt’s loan application process considers their personal information, including bank transactions, education, employment and visa status, and also uses proprietary machine-learning algorithms that draws on demographic data from a wide range of financial and non-financial sources.

TechCrunch last covered Stilt when it announced a $7.5 million seed round in May 2020. During the pandemic, demand for loans increased for a wide range of reasons. Some customers sought new loans because their working hours got cut. Other borrowers’ own jobs weren’t impacted, but they needed to transfer money to family members in other countries who had lost income. Several used loans to pay for additional visa processing and many customers turned to Stilt because other financial providers shut down or reduced their loan programs over concerns about repayment.

Despite the economic challenges caused by the COVID-19 pandemic, Stilt’s loan performance has remained steady. Many of Stilt’s customers are using their loans to build a credit history in the United States and even borrowers who lost income because of the pandemic continued making payments on time (Stilt also created temporary programs, including waiving interest for a few months, to help those who were struggling financially).

Mittal said immigrants are also in general more creditworthy, because many moved to the United States to pursue educational or career opportunities. The difficulty of securing visas means “all immigrants move to the U.S. after jumping through a lot of hoops,” said Mittal. He added that “it isn’t just people coming from other countries. We also see it in DACA applicants. They tend to be the best risk-adjusted return customers. These are people who are going to school, they are working, they have seen their families work, they are helping their parents, they are doing all these things, and they understand the value of money, so they end up being a lot more financially responsible.”

Stilt’s new checking accounts, powered by Evolve Bank and Trust, are also designed for immigrants, with features like spot-rate remittance to about 50 countries. Users can also apply for credit lines and pre-approved loans through their accounts. Since opening to existing customers in September, the number of active checking accounts is growing 50% month over month, with many using it for direct deposits of their salaries.

The new debt facility from Silicon Valley Bank means Stilt will be able to provide larger loan volumes and better interest rates, said Mittal. Stilt’s average interest rate is about 12% to 14%, compared to the 30% to 100% charged by other programs, like payday loans, that people without Social Security numbers or credit reports often use.

Last year, we hit you with 44(!) episodes of Extra Crunch Live, a series that gives startups and founders direct insights from the experts who know best. We’re making Extra Crunch Live even better in 2021: we’ll take a look at funding deals through the eyes of the founders and investors who made them happen, and those same tech leaders will go through your pitch decks and give feedback and advice. Every single Wednesday at 12pm PT/3pm ET!

Today, I’m thrilled to announce the February slate for Extra Crunch Live.

Gaurav Gupta (Lightspeed Venture Partners) + Raj Dutt (Grafana Labs)

February 3, 12pm PT/3pm ET

Grafana Labs, the open-source platform for monitoring, visualization and metric analytics, has raised more than $75 million since its 2014 inception. Lightspeed’s Raj Dutt has partnered with the company throughout its journey, leading Grafana’s Series A and B. Hear from Gupta and Grafana cofounder Raj Dutt about how that Series A deal came together, and take a look at the startup’s original Series A pitch deck on the next episode of Extra Crunch Live. And don’t forget! Gupta and Dutt will be giving live feedback to Extra Crunch members who have submitted their own pitch decks.

Aydin Senkut (Felicis Ventures) + Kevin Busque (Guideline)

February 10, 12pm PT/3pm ET

In 2014, Guideline stepped into the ring with giants, launching an all-inclusive 401k platform for fast-growing businesses. Since, it’s raised nearly $140 million in funding, including a $15 million Series B round led by Felicis Ventures. Hear the behind-the-scenes story of how Guideline CEO Kevin Busque and Felicis partner Aydin Senkut came together for that deal, with a walk through the pitch deck that started it all, and get the founder/investor duo’s live feedback on your own pitch deck.

Steve Loughlin (Accel) + Jason Boehmig (Ironclad)

February 17, 12pm PT/3pm ET

Steve Loughlin views the techworld through a prismatic lens. He’s been a founder, he’s been through an acquisition, and now he invests as a partner at Accel. One such investment includes Ironclad, a contract management platform that recently raised a $100 million Series D and is valued at nearly $1 billion. Hear CEO Jason Boehmig and Loughlin talk through their original Series A deal and get live feedback on your own pitch deck from the founder/investor duo.

Matt Harris (Bain Capital) + Isaac Oates (Justworks)

February 24, 12pm PT/3pm ET

Justworks’ back-office software has garnered the attention of many investors. The company has raised $143 million from firms including FirstMark Capital, Union Square Ventures, Thrive, Redpoint, and Bain Capital. Hear from Justworks founder and CEO Isaac Oates and Bain Capital Partner Matt Harris as they describe how their partnership began and get their live feedback on your own pitch deck.

Extra Crunch Live is for EC members only. If you’re not already signed up, get on it right here. Registration info for each of these episodes is below. See you soon!

The current list of venture-backed private companies we expect to go public — and the number of companies that might say yes to a SPAC-led debut — underscore just how many large startups there are in the market.

After years of rising venture capital investment and a wave of huge rounds, many startups and unicorns could leave the private markets this year or the next.

Last year, The Exchange wrote about former startups that had scaled to around the $100 million annual recurring revenue (ARR) mark, or had revenues that were roughly equivalent if they didn’t sell software. But that wound up being a bit less interesting than we’d hoped, as companies that have reached that scale tend to be fully baked by the time we got them on the phone.

So, we’re shooting for the $50 million ARR range this year. Our goal is to see what we can ferret out from companies that are moving from the middle-late startup years and into the unicorn realm.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

What broke during the last year? Which teams have they doubled down on? How has hiring gone? We have questions. And, happily, companies have raised their hand. Today, we’re talking about OwnBackup and Assembly. Next week, it’s SimpleNexus and Kaseya. And we have Picsart on deck as a company somewhat in between our two target revenue bands.

But before we start, a final note. The following bits of journalism are more exploratory than hard-hitting. But as private companies tend to share nothing other than the occasional press release strained of personality and flavor, I’m working to bring more raw data points and observations to you even if they do not constitute the grittiest reporting you’ve ever read.

But before we start, a final note. The following bits of journalism are more exploratory than hard-hitting. But as private companies tend to share nothing other than the occasional press release strained of personality and flavor, I’m working to bring more raw data points and observations to you even if they do not constitute the grittiest reporting you’ve ever read.

Let’s get into our first two $50 million (or around there) ARR companies.

OwnBackup

OwnBackup is a company you might have heard of as it raised a $50 million round last July, an event TechCrunch covered. The company reached out regarding our $50 million ARR series by noting that its growth had accelerated since that round, so we decided to find out more.

The Exchange spoke with CEO Sam Gutman and CMO Jamie Grenney about OwnBackup’s recent growth.

According to the execs, OwnBackup is around $50 million ARR today. The company, as its name hints, provides cloud backup services to other companies. And it’s built atop the Salesforce platform, a service had a good 2020 when nCino, another company that leverages the service, went public to great effect. (That debut led to TechCrunch reporting on the trend of building atop someone else’s software to IPO scale.)

And OwnBackup has lots of room to grow inside of its current platform home. It thinks it has around 2% penetration of the Salesforce ecosystem, meaning that its current 100% yearly growth pace can continue for quite some time without a material change in strategy.

Asked if OwnBackup was worried about platform risk, Gutman and Grenney said they weren’t. Not only is Salesforce Ventures an investor, the execs noted, but the Salesforce platform is a huge SaaS ecosystem; it’s not something that could be switched off like a Google web product and consigned to the ash heap of the Internet.

Source: https://techcrunch.com/2021/01/27/how-2-startups-scaled-to-50m-arr-and-beyond/

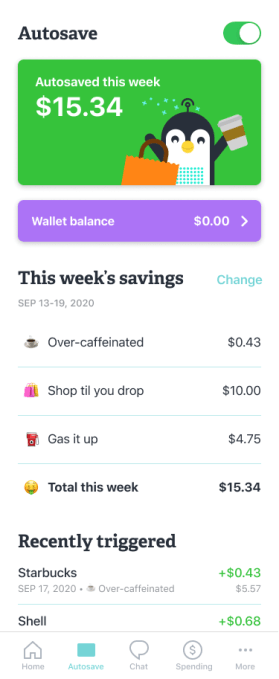

Charlie, a personal finance app that began as a chatbot, is relaunching today with a revamped experience focused on the larger goal of helping everyday Americans get out of debt. To do so, Charlie presents users with a full picture of their current debt and how long it will take them to pay it off. Users then connect their bank account to Charlie for personalized assistance in reducing their bills. It also “gamifies” saving money to make the process of setting money aside for paying down debt more fun.

According to Charlie CEO Ilian Georgiev, the idea to turn saving into more of game arose from his prior experience in the mobile gaming industry. At a company called Pocket Gems, he helped scale apps that generated millions of dollars in revenue growth from across millions of users.

Image Credits: Charlie; CEO and co-founder Ilian Georgiev

“A really well-designed mobile game gets people to obsessively manage a virtual economy,” he explains. “And what I was curious about was how do we get people to do better in the real-world economy by using the same kind of tools?”

To help on that front, Charlie’s team includes people with backgrounds in not only computer science and engineering, but also in psychology. Using similar psychological tricks as found in gaming — rules, progress bars and reward mechanisms — the app helps nudge its users towards saving.

The original version of the Charlie app, launched in 2016, worked a little differently, however. It would analyze transaction data to look for areas where the user could improve their finances. It also worked over texting and through Facebook Messenger — platforms Charlie adopted with the idea that users needed a simpler way to connect with their finances.

“But the thing that we kept hearing over and over again, both qualitatively and quantitatively, is that the biggest concern that our users had is ‘how do I get out of debt? So then we said, instead of casting this really wide net…let’s laser focus on this one particular problem,” says Georgiev.

Today, the chatbot still lives on as a feature inside the new Charlie app, but it’s not the core experience.

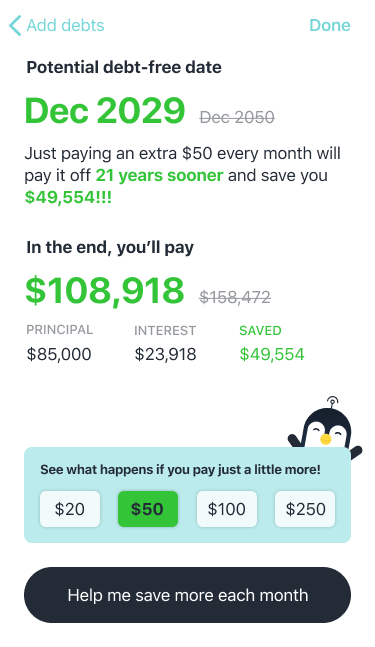

Image Credits: Charlie

Instead, users begin by providing the app with information about their debt. Georgiev stresses that many Americans often know their debt down to the penny — whether that’s how much they have left on student loans, how much left on their car, how much credit card debt they have, and so on.

The app then calculates how long it would take to pay off this debt if you only made minimum payments. This number helps shock people into action, as they’ll often discover they’re going to be in debt for another 40 or 50 years.

“For most users, that’s an epiphany because they’ve never seen these numbers before, and the math required — even if you do it in Excel — the math required to figure that out is beyond most people,” Georgiev says.

The app then encourages users to learn how they can reduce the time it would take them to get out of debt by paying more than the minimums. By clicking a button, they can visualize the what happens if you pay, for example, $20 or $50 more per month.

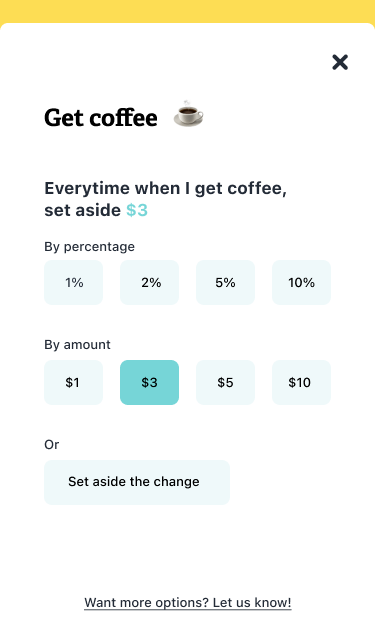

The final step is to help users find that extra cash. In part, this may come from savings the app locates on users’ behalf. But it also comes from the money-saving “game.”

Charlie helps users create autosave rules which, when applied, auto-transfer money from the user’s connected bank account to Charlie’s digital wallet (an account held at partner bank, Evolve). These can be fun rules or even sort of ridiculous ones. For example, you could create “Guilty Pleasures” rules where Charlie will put away 10% every time you eat McDonalds, or it could save $1 for you every time a contestant on “The Bachelor” says they’re “here for the right reasons.”

Image Credits: Charlie

As those rules apply, money is saved and a little progress bar fills. The app rewards you with rainbow confetti as you achieve, also similar to some mobile gaming experiences.

At the end of the month, the user can take that saved money to make a larger payment towards their debt. Currently, Charlie doesn’t manage the bill pay aspects itself — which is a limitation. You have to transfer the funds back to your bank. But a bill pay feature is due to arrive in a couple’ months time, we’re told.

Later this year, Charlie plans to offer debt refinancing services to users. In this case, the team believes they can give the users lower interest rates because Charlie users will have proven, through their use of the app, that they’re lower risk.

Further down the road, Charlie aims to move more into neobank territory by issuing a debit card to users that works with users’ Charlie account. To differentiate from the growing number of neobanks, Charlie will continue to focus on paying down debt and savings.

Georgiev notes that the app’s business model is not built around user data collection, however. Data that’s ingested is sanitized and encrypted, and the app has a strict privacy policy. Plus, Charlie mainly helps people save money, but those funds are actually stored with a partner bank, not in Charlie itself. And because it’s involved in the act of moving money, it has to adhere to regulations around security and fraud prevention.

Today, Charlie charges a $4.99 per month subscription, which the company aims to make up for by helping people reduce their larger debt loads more quickly. However, even that small amount could give money-sensitive users pause, despite Charlie’s perks and successes.

To date, Charlie has registered a half million users for its older chatbot experience. It hopes to now grow that figure with its new tools.

The app is available on iOS and Android.

Source: https://techcrunch.com/2021/01/27/charlie-launches-a-mobile-app-that-gamifies-getting-out-of-debt/

Finesse, a startup promising to take the guesswork and waste out of fashion, is announcing that it has raised $4.5 million in seed and pre-seed funding.

Founder and CEO Ramin Ahmari said the tremendous waste in the fashion industry has become a badly-kept secret, with Burberry recently facing a backlash over its practice of burning unwanted products, and the industry as a whole producing an estimated 13 million tons of textile waste each year.

Finesse is looking to change that, Ahmari said, in part by taking advantage of the fact that that fashion trends are moving out of the “hermetically sealed” world of catwalks and onto social media, where new products take off “on the backs and bodies and posts” of influencers like Kylie Jenner.

“This is data we have access to,” he said. Noting that he previously worked in finance, Ahmari added that the stock market is “much more unpredictable” than the fashion industry — there just hasn’t been a tech startup applying tools like natural language processing and deep learning to fashion.

“In the simplest terms, you can think of what we do as seeing when Kylie posts a picture on Instagram and people go crazy about it … and then you see that happen not just on Kylie’s post but across Instagram, TikTok, Google Trends,” he said. “We predict the establishing of a trend before it goes super viral.”

Image Credits: Finesse

Finesse then uses this data to design new products. Ahmari said that by taking advantage of a “very fast supply chain,” along with tools like CLO 3D modeling software, Finesse can go from identifying a trend to having a product available for purchase in less than 25 days.

While the startup is officially launching today, it’s already been selling products through “drops,” where customers vote for and pre-order products that will only be available in limited quantities. Ahmari said Finesse focuses on selling unique pieces rather than staples, but because it’s confident about consumer demand, it can keep things much more affordable — the products currently for sale range from $8 to $116.

And unlike most fashion companies, Ahmari said that Finesse does not need to employ a giant design department, although he suggested that team members like Vice President of Product Andrea Knopf and Head of Product Development Brittany Fleck — who work in tandem with the startup’s algorithms —are “artists in their own right.”

“Unless we have true AI — which we’re very far from — you are never going to have a machine that’s purely creative,” he said. “You have to have feedback cycles … What we are eliminating is the job where it’s just an intern doing grunt work, all of these people just going through Instagram to find new fashion trends.”

Ahmari also said that with its emphasis on sustainability and connecting with the LGBTQ community (Ahmari identifies as queer and non-binary, and all of the startup’s products are designed for any gender), Finesse is aimed squarely at Gen Z consumers who are tired of fashion dictated by “white, older, cisgender men.”

The startup’s investors include former Twitter head of engineering Alex Roetter, Collective Health CEO Ali Diab, Hoxton Ventures, MaC Venture Capital, Mango Capital and Fab Fit Fun co-founder Sam Teller.

“We believe that FINESSE is truly the future of fashion, from its trend prediction to sustainable supply-chain and manufacturing,” said MaC Managing Partner Marlon Nichols in a statement. “We hope other fashion brands can learn from FINESSE’s disruption in the space and we’re eager to see what’s next.”

Source: https://techcrunch.com/2021/01/27/finesse-launch-seed-funding/