& meet dozens of singles today!

User blogs

Tesla just released its latest earnings report, and the results indicate that Elon Musk’s bets on energy storage and solar are beginning to pay off.

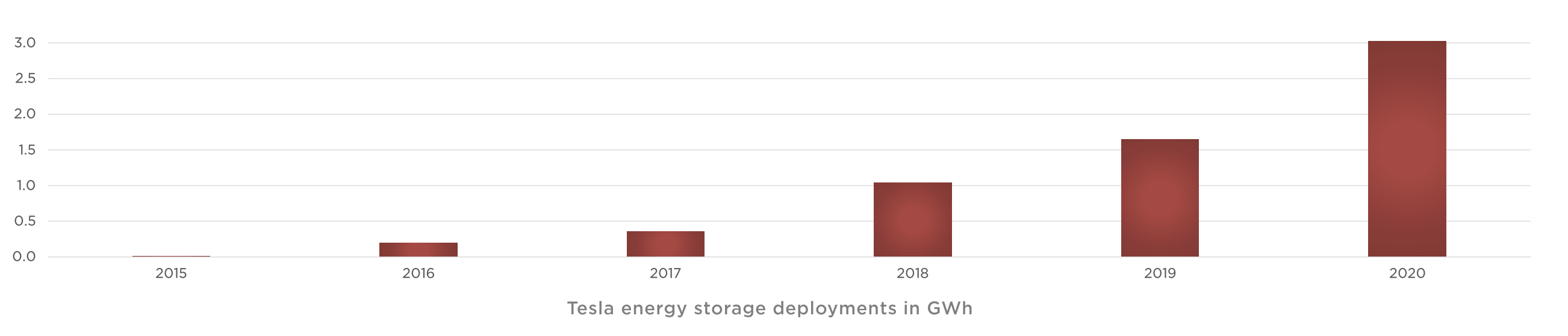

The storage business was the star of the company’s power plays in the fourth quarter, with quarterly year-on-year growth approaching 200%. As the company said in its presentation to shareholders, “[energy] deployments grew substantially from 2019 to 2020. For the first time, our total battery deployments surpassed 3 GWh in a single year, which is an 83% increase compared to the prior year.

Solar deployments also had their day in the sun. For the year, solar energy installations increased to 205 MW, an 18% increase over the prior year. “This growth is the result of meaningful improvements to our solar retrofit strategy, including product simplification, cost reduction and industry-leading pricing.

Revenue from the energy generation and storage business came in at $752 million for the fourth quarter, up from $436 million in the year-ago period, and up $579 million from the third quarter.

This is likely only the beginning of the surge that’s coming for Tesla’s power business. The company has long stated that it wants to be one of the world’s largest power or utility companies, and global capital is marshaling resources to encourage the shift to renewables.

Tesla could be a huge beneficiary from the Biden administration’s renewable plans through their goals to dramatically boost solar development and buildings. The big infrastructure spend will require big batteries to store renewable power. It will also require massive solar installations.

And even as the federal government makes money moves to renewables, private capital is coming in to boost solar installations and energy storage dramatically.

Over the last week alone, investors have pumped nearly $2 billion into companies that lend money to homeowners for solar installations and energy efficiency upgrades. One company, founded by a former SolarCity executive, announced that it had raised $800 million in capital just today.

At least some of that money will have cash registers ringing for Tesla’s energy storage and solar installation business.

Source: https://techcrunch.com/2021/01/27/teslas-power-businesses-are-beginning-to-take-off/

Reddit users have some fun with the stock market, Facebook predicts advertising challenges and ByteDance is cutting jobs in India. This is your Daily Crunch for January 27, 2021.

The big story: GameStop becomes a meme stock

GameStop’s stock continued to climb today, along with Blockbuster and AMC — all stocks shorted by institutional investors. These gains were apparently driven by users in the r/WallStreetBets subreddit.

We’ve rounded up the fairly non-committal statements from various trading apps like Robinhood about how they’re responding to this volatility.

And Lucas Matney asks how this might affect cryptocurrencies: “For investors looking to have a good time or shoot the moon, meme stocks are a more fun place to be than crypto is.”

The tech giants

Facebook predicts ‘significant’ obstacles to ad targeting and revenue in 2021 — While Facebook’s fourth quarter earnings report included solid user and revenue numbers, the company sounded a note of caution for 2021.

SAP launches ‘RISE with SAP,’ a concierge service for digital transformation — RISE is a subscription service that combines a set of services and product offerings.

ByteDance is cutting jobs in India amid prolonged TikTok ban — The company employs more than 2,000 people in India.

Startups, funding and venture capital

SoftBank teams with home goods maker Iris Ohyama for new robotics venture — The newly formed Iris Robotics has set an extremely aggressive goal of $965 million in sales by 2025.

Literati raises $40M for its book club platform — CEO Jessica Ewing told me that she’s trying to build the first “new, innovative bookseller” since Amazon launched 25 years ago.

Renewable investment wave continues as solar lending company Loanpal raises $800M — The $800 million commitment to Loanpal arrives alongside a flurry of climate commitments from some of the world’s largest investors.

Advice and analysis from Extra Crunch

How two startups scaled to $50M ARR and beyond — The Exchange examines OwnBackup and Assembly.

Dear Sophie: How can I sponsor my mom and stepdad for green cards? — The latest “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

Check out the amazing speakers joining us on Extra Crunch Live in February — We’ll take a look at funding deals through the eyes of the founders and investors who made them happen.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Battling algorithmic bias at TC Sessions: Justice — At TC Sessions: Justice on March 3, we’re going to dive head-first into data discrimination, algorithmic bias and how to ensure a more just future.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/01/27/daily-crunch-gamestop-becomes-a-meme-stock/

Four European apps which secure user data via end-to-end encryption, ProtonMail, Threema, Tresorit and Tutanota, have issued a joint-statement warning over recent moves by EU institutions that they say are setting lawmakers on a dangerous path to backdooring encryption.

End-to-end encryption refers to a form of encryption where the service provider does not hold keys to decrypt the data, thereby enhancing user privacy — as there’s no third party in the loop with the technical capability to access data in a decrypted form.

E2e encryption also boosts security by reducing the attack surface area around people’s data.

However growth in access to e2e encrypted services has, for some half decade or more, been flagged as an issue of concern for law enforcement. This is because it makes it harder for agencies to access decrypted data. Service providers served with a warrant for e2e encrypted user data will only be able to provided it in an unreadable form.

Last month the EU Council passed a resolution on encryption that’s riven with contradiction — calling for “security through encryption and security despite encryption” — which the four e2e app makers believe is a thinly veiled call to backdoor encryption.

The European Commission has also talked about seeking “improved access” to encrypted information, writing in a wide-ranging counter-terrorism agenda also published in December that it will “work with Member States to identify possible legal, operational, and technical solutions for lawful access” [emphasis its].

Simultaneously, the Commission has said it will “promote an approach which both maintains the effectiveness of encryption in protecting privacy and security of communications, while providing an effective response to crime and terrorism”. And it has made it clear there will be no ‘one silver bullet’ as regards the e2e encryption security ‘challenge’.

But such caveats are doing nothing to alleviate the concerns of e2e encrypted app makers — who are convinced proposals from the Council of the EU, which is involved in adopting the bloc’s laws (though the Commission usually drafts legislation), sums to an push toward backdoors.

“While it’s not explicitly stated in the resolution, it’s widely understood that the proposal seeks to allow law enforcement access to encrypted platforms via backdoors,” the four app makers write, going on to warn that such a move would fatally underline the security EU institutions also claim to want to maintain.

“The resolution makes a fundamental misunderstanding: Encryption is an absolute, data is either encrypted or it isn’t, users have privacy or they don’t,” they go on. “The desire to give law enforcement more tools to fight crime is obviously understandable. But the proposals are the digital equivalent of giving law enforcement a key to every citizen’s home and might begin a slippery slope towards greater violations of personal privacy.”

They point out that any move to break e2e encryption in Europe would run counter to the global rise in interest in robustly encrypted services — pointing to the recent surge in sign-ups for apps like Signal as a result of mainstream privacy concerns attached to Facebook-owned WhatsApp.

Europe has also been ahead of the curve globally in legislating to protect privacy and security. So it would be quite the U-turn for EU lawmakers to line up to poke holes in e2e encryption. (Which, for example, EU data protection regulators are simultaneously recommending be used in order to legally secure transfers of personal data out of the bloc to third countries where it might be at risk).

To say there are ideological contradictions in the EU pushing in an anti-encryption direction is a massive understatement. Even as the contents of current communiques coming out of Brussels on this topic read as if they’re inherently conflicted — which may in fact be a recognition that squaring this circle is no simple policy proposition.

The app makers also pick up on that. “People around the world are taking back control of their privacy, and often it’s European companies helping them do it. It seems illogical that policy makers in the EU would now push for laws that fly in the face of public opinion and undermine a growing European technology sector,” they write.

In an individual quotation from the joint-statement, Andy Yen, CEO and founder of ProtonMail, a Swiss end-to-end encrypted email service, warns against complacency in the face of the latest seeming push for a legal framework to perforate encryption.

“This is not the first time we’ve seen anti-encryption rhetoric emanating from some parts of Europe, and I doubt it will be the last. But that does not mean we should be complacent,” he said. “Put simply, the resolution is no different from the previous proposals which generated a wide backlash from privacy conscious companies, civil society members, experts and MEPs.

“The difference this time is that the Council has taken a more subtle approach and avoided explicitly using words like ‘ban’ or ‘backdoor’. But make no mistake, this is the intention. It’s important that steps are taken now to prevent these proposals going too far and keep European’s rights to privacy intact.”

Martin Blatter, CEO of end-to-end encrypted instant messaging app Threema, also argues that EU lawmakers risk kneecapping homegrown startups if they seek to push ahead with legislation to force European vendors to bypass or deliberately weaken e2e encryption.

“[It] would not only destroy the European IT startup economy, it would also fail to provide even one bit of additional security,” he warned. “Joining the ranks of the most notorious surveillance states in this world, Europe would recklessly abandon its unique competitive advantage and become a privacy wasteland.”

Also chipping in, Istvan Lam, co-founder and CEO of Tresorit, an e2e encrypted file sync & sharing service, argues that any moves to weaken encryption would seriously undermine trust in services — as well as being “irreconcilable with the EU’s current stance on data privacy”.

“We find this resolution especially alarming given the EU’s previously progressive views on data protection. The General Data Protection Regulation (GDPR), the EU’s globally recognized model for data protection legislation, explicitly advocates for strong encryption as a fundamental technology to ensure citizens’ privacy,” he said, adding: “The current and proposed approaches are at complete odds with each other, as it is impossible to guarantee the integrity of encryption while providing any kind of targeted access to the encrypted data.”

While Arne Möhle, co-founder of Tutanota, a German e2e encrypted email provider, says any push to backdoor encryption would be a disaster for security — which actually risks helping criminals.

“Every EU citizen needs encryption to keep their data safe on the web and to protect themselves from malicious attackers,” he said. “With the latest attempt to backdoor encryption, politicians want an easier way to prevent crimes such as terrorist attacks while disregarding an entire range of other crimes that encryption protects us from: End-to-end encryption protects our data and communication against eavesdroppers such as hackers, (foreign) governments, and terrorists.”

“By demanding encryption backdoors, politicians are not asking us to choose between security and privacy. They are asking us to choose no security,” he added.

A fight looks to be brewing in Europe over what exactly the Council’s contradictory edict on ensuring “security through encryption and security despite encryption” will shake out to. But it seems clear that any push toward backdoors would mobilize major regional opposition — as well as being an unattractive option for EU policymakers because it would face legal challenge under the region’s jurisprudence.

The Commission recognizes this complexity. Its counter-terrorism agenda is also notably wide-ranging. There’s certainly no suggestion that it believes e2e encryption is a sole nut that must be cracked. EU institutions are pushing across a number of fronts here, not least because a bunch of fundamental red lines limit wiggle room for non-targeted interventions.

What comes out of the Council’s resolution may therefore be a concerted push to upskill police in areas relevant to investigations (such as digital forensics and metadata analysis). And perhaps create structures for local or state level forces across the bloc to access more powerful security service technical competences for furthering targeted investigations (e.g. device hacking). Rather than an EU-level order blasted at e2e encryption vendors to mandate a universal key escrow ‘solution’ (or similar) — indiscriminately risking everyone’s security and privacy.

But it’s certainly one to watch.

IAC has acquired Confide, the encrypted mobile messaging that once made headlines for its use by White House staffers during the Trump administration. The deal, which closed on Dec. 1, 2020 but was not publicly announced, sees Confide joining Teltech, the makers of spam call-busting app Robokiller, which itself had joined IAC’s Mosaic Group by way of a 2018 acquisition.

Teltech confirmed the Confide acquisition, but declined to share the deal terms. The confidential mobile messaging app had raised just $3.5 million in funding, according to Crunchbase data, and had been valued between $10 to $50 million, as a result. (Pitchbook put the valuation at ~$14 million around the same time.)

According to Teltech, the deal was for the Confide IP and technology, but not the team.

The company believes Confide makes for a good fit among its growing group of mobile communication apps, including Robokiller and its latest app, SwitchUp, which offers users a second phone number for additional privacy and spam blocking purposes. Other Teletech apps include phone call recorder TapeACall and blocked call unmasker TrapCall.

Confide, however, may end up being one of the better-known additions among that group, thanks to being remembered as a favored tool of choice among frustrated Washington Republicans during the Trump years.

But despite the user growth that news had driven, things slowed in the months that followed, when researchers published a report that claimed Confide wasn’t as secure as it had promised. Confide quickly fixed its vulnerabilities but then a month later was facing a class action lawsuit (later dismissed by the plaintiff) over the security issues.

Teltech says it was aware of the security concerns, but it had conversations with the prior Confide team and understands that the earlier issues had been “quickly and effectively remediated.”

While IAC won’t speak to its specific plans for Confide’s future, the app will continue to offer users a safe and secure way to communicate. What it won’t do, though, is try to directly compete with Telegram or other private apps that offer large channels or group chats that support tens of thousands of people at once.

“I think one kind of key differentiators is that Confide is definitely more for one-on-one and smaller group communication, rather than with Signal and Telegram where there’s some larger chat dynamics,” notes Giulia Porter, Teltech’s VP of Marketing. “One thing that makes us a little bit different is just that we’re more personal,” she says.

Despite having hit some bumps in the road over the years, Confide as of the time of the acquisition, still had around 100,000 monthly active users. There’s now a team of around 10 assigned to work on the app, adding needed resources to its further development, and soon, an updated logo and branding.

Confide’s existing desktop and mobile apps will also continue to be available, but later updated with new features as part of Teltech’s efforts.

Investors and IAC alike have declined to talk about deal price, but that may speak for itself.

“With the absolute explosion in privacy over the past several years, Confide, which started as a side project, has become a mission-critical platform for sensitive communication throughout the world,” said Confide co-founder and President Jon Brod, in a statement shared with TechCrunch about Confide’s exit.

“We’re thrilled that IAC shares our passion for secure communication and recognizes the unique business we have built. IAC has a proven track record of providing fast-growing companies with the support to reach their full potential and we are excited to see IAC take Confide to the next level,” he said.

Source: https://techcrunch.com/2021/01/27/iacs-teltech-acquired-encrypted-mobile-messaging-app-confide/

Squarespace announced this afternoon that it is going public. The online website creation and hosting service is a venture-backed entity, having raised Series A and B rounds in 2010 and 2014, respectively. Those deals were worth a combined $78.5 million, according to Crunchbase data.

But Squarespace is perhaps best known for its epic 2017-era $200 million secondary round that General Atlantic financed. A secondary round is a transaction in which an external party buys share from existing shareholders, instead of the company issuing new equity. Some private companies execute secondary transactions when they do not need additional capital, but are also not near a liquidity event.

The 2017 transaction fits well with the company’s now-impending 2021 IPO.

At the time TechCrunch reported that the company had revenues of around $300 million and that it was profitable.

By filing, Squarespace joins a growing list of companies pursuing the public markets in recent months. At the end of 2020 C3.ai, DoorDash and Airbnb listed. To kick off 2021, Affirm and Poshmark listed to great effect. Coinbase has filed, Robinhood is a hot IPO prospect, and now Squarespace is throwing its hat into the ring.

The Squarespace filing is private, which means that we are waiting for a future public S-1 from the company. Here’s its own words on the current state of affairs:

Squarespace, Inc. today announced that it has confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”). The registration statement is expected to become effective after the SEC completes its review process, subject to market and other conditions.

As Squarespace is a software company, a cloud company and a company with a hand in the e-commerce space, we can only presume that it will suffer from a stultifying lack of investor interest when it does file, price and list.1 After all, we’ve not seen a hot software IPO for weeks.

Hat’s off to Squarespace for freeing us from the news doldrums. We’re going back to our nap now.

1This is sarcasm.

Source: https://techcrunch.com/2021/01/27/squarespace-files-privately-to-go-public/