& meet dozens of singles today!

User blogs

Tokopedia, Lazada, Shopee, and other firms created an e-commerce market in Indonesia in the past decade, making it possible for consumers to shop online in the island nation. But as is true in other Asian markets, most small retailers and mom-and-pop stores in the Southeast Asian country still face a myriad of challenges in sourcing inventory and working capital, and continue to rely on an age-old supply chain network.

Nipun Mehra, a former executive of Flipkart in India, and Derry Sakti, who oversaw consumer goods giant P&G’s operations in Indonesia, began to explore opportunities to address this in 2019.

“Much like India, much of the Indonesian retail market is unorganized. In the food and vegetable category, for instance, there are lots of farmers who sell to agents, who then sell to mandis (markets). From these mandis, the inventory goes to small wholesalers, and so on. There are lots of players in the chain,” said Mehra, whose previous stints include working at Sequoia Capital India, in an interview with TechCrunch.

Mehra and Sakti co-founded Ula in January of 2020. With Ula, they are trying to organize this sourcing and supply chain for small retailers so that there is a one-stop shop for everybody.

Despite the pandemic, Ula made inroads in the Indonesian market last year and today serves more than 20,000 stores. And naturally, investors have noticed.

From left to right: Derry Sakti, Nipun Mehra (screen), Riky Tenggara, Ganesh Rengaswamy (screen), Alan Wong, and Dan Bertoli. Photo credit: Ula

On Thursday, Ula announced it has raised $20 million in a Series A financing round. The round was led by existing investor Quona Capital and B Capital Group. Other existing investors including Sequoia Capital India and Lightspeed — that financed Ula’s $10.5 million Seed round in June last year — have also participated in the Series A.

“If you look at the whole retail value chain, especially for essential goods, FMCG, staple, and fresh produce, it’s significantly fragmented,” said Ganesh Rengaswamy, Managing Partner at Quona Capital, in an interview. “Whereas the market has moved on in terms of being able to more efficiently consolidate, demand and supply. Ula is trying to redo the retail distribution ecosystem with a significant technology overlay. It’s connecting some of the largest players in the supply side to the smallest retailers and consumers.”

Additionally, Ula is providing these micro retailers, who usually operate from small shops that are extensions of their homes, with working capital so that they don’t have to wait to be paid by their customers to buy the new batch of inventory. (It’s a serious challenge that micro-retailers face in Asian markets. These shops have strong bonds with their customers, so often they sell them items without getting paid upfront. Collecting this payment often takes longer than it should.)

“Frictionless payment and offering credit to retailers so that they can more efficiently manage their cashflow are critical components of modern digital commerce,” said Rengaswamy. For Quona, which has backed several e-commerce and fintech startups in Asia, Ula checks both the boxes.

Mehra said last year was largely about expanding the Ula team and building the technology stack. The startup now plans to deploy the capital to reach more small retailers and expand within the nation.

Indonesia will remain Ula’s focus market. The opportunity in the region itself is very large. The retail spend is expected to surpass $0.5 trillion over the next 4 years, said Kabir Narang, Founding General Partner at B Capital Group, in a statement. Traditional in-store retail accounts for nearly 80% of the total retail market, according to some estimates.

Ula currently operates in the FMCG and food and vegetable spaces, but it intends to broaden its offerings to include apparel and eventually electronics.

A few more things from my notes:

- Like many other startups in Asia, Ula largely relies on feet-and-street sales people to spread the word out about its offerings and onboarding new shops. The key to growing, said Mehra, is to get a few retailers who are very happy with the services and see its value and then tell their friends about it. It’s a learning he credited to Indian business-to-business e-commerce platform Udaan co-founders Amod Malviya, Vaibhav Gupta and Sujeet Kumar, whom he worked at Flipkart back in the day. Udaan co-founders have backed Ula.

- Electronics is a category that is very popular among B2C and B2B e-commerce platforms. Mehra said he has always known that the startup could expand to electronics, so it has chosen to focus on other categories first that test the supply chain network.

- Indonesia comprises of more than 17,000 islands, but only a handful of islands including Java and Sumatra contributes most to the GDP.

- I asked Quona’s Rengaswamy to draw parallels between e-commerce and payments markets of India and Indonesia. He said India has made more inroads with creating frictionless payments. But on the flip side, this has created potential for startups in Indonesia to solve additional challenges.

The media licensing business is a massive market, but much of the work involved is still handled manually through emails and spreadsheets. A startup called Flowhaven is working to change that. The company, which has now closed on $16 million in Series A funding, helps brands to manage their licensing partnerships, including the account management aspects, the individual product information, the financial information, and more.

The new round was led by Sapphire Sport, the part of Sapphire Ventures that specializes in sports, media and lifestyle brands. Existing investors Global Founders Capital and Icebreaker.vc also returned, bringing Flowhaven’s total raise to date to $21.5 million.

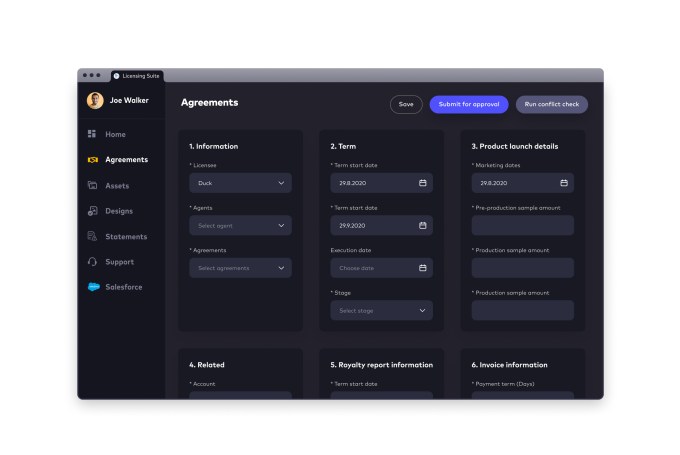

Image Credits: Flowhaven

The idea to modernize the media licensing business comes from a founder who had direct experience in the industry.

Flowhaven CEO Kalle Törmä previously worked on licensing for the Angry Birds mobile game franchise while at Rovio, starting back in 2012. While there, he created the global blueprint for managing the merchandising side of the business, which later expanded to include partnerships for the Angry Birds Star Wars and Angry Birds Transformers games.

“It was evident that the workflows were very broken — from managing the commerce, or the agreements, the product approvals, and financials. The information was very siloed. Also, there were a lot of things that fell through the cracks,” explains Törmä.

In addition, it was time consuming and difficult to pull together data that would allow management to understand how the business was doing.

The challenges Törmä faced at Rovio led him to understand what would be needed to create a solution like Flowhaven — particularly, the difficulty of managing tricky licensing workflows and timetables through manual methods.

He left Rovio in 2016 and founded Flowhaven, where he’s joined by university pal and CCO Timo Olkkola, whose background is in sales.

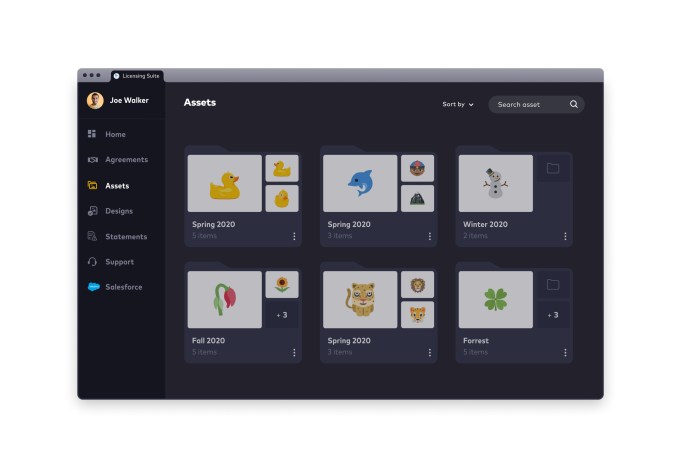

Image Credits: Flowhaven

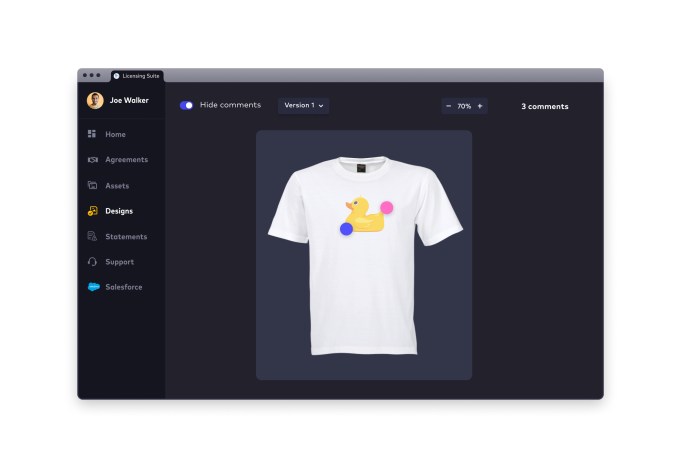

Today, the Flowhaven licensing management platform automates the brand licensing workflow process, including the planning and strategy, account and agreement management, content distribution, design approvals, royalty reporting, and more.

It also helps to keep teams on schedules that can often be tight in the media and entertainment businesses.

“There’s always a timeframe that they follow — whether it’s a film release or game release,” Törmä says. “There are lot of moving pieces in closing all the agreements and then moving the products through the approvals [so when], let’s say, a film comes out, a couple of months prior, the merchandise hits the retail shelves,” he says.

“If you don’t have the products approved and ready, then you didn’t really seize the momentum,” Törmä adds.

Image Credits: Flowhaven

Flowhaven pitches that its software isn’t just saving time, it also saves money. The company estimates that licensing professionals waste 50 hours per month at $70 per hour on work that could be automated. This equals approximately $42,000 per year wasted for a single professional.

As of its new funding, Flowhaven’s software-as-a-service platform has been adopted by close to 100 companies, ranging from smaller business to Fortune 100 companies in markets like media, entertainment, sports, fashion, and by corporate and consumer brands Though some customer names can’t be shared, Flowhaven says it’s working with Nintendo, LAIKA, Games Workshop, Acamar Films, and Crunchyroll.

Its pricing is based on how many users will be on the platform. This doesn’t include those with guest access outside the organization, who are always free of charge.

The company also reports 400% year-over-year growth and says it’s expecting that trend to continue, but declines to share its current revenue figures.

The additional funding will help Flowhaven fuel its growth, expand its product and platform, and aid in hiring, Törmä says. Today, the company’s staff is split between offices in Helsinki, London and L.A. but says it’s seeing the most growth in the latter two.

In terms of the product itself, the plan is to further develop Flowhaven’s analytics and speed up the process of exchanging information between the brand owners and their licensees.

Already in 2021, Flowhaven is growing. It began the year with a team of 30 and is now 43 people. Throughout the year, Törmä says the team will grow to nearly 100.

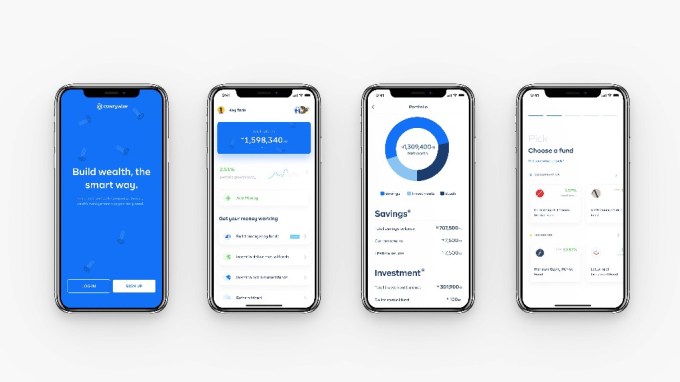

Cowrywise, a Nigerian fintech startup that offers digital wealth management and financial planning solutions, has raised $3 million in pre-Series A funding. Quona Capital led the round as Tsadik Foundation, Gumroad CEO Sahil Lavingia, and a syndicate of Nigerian angel investors locally and in the diaspora participated. The company previously raised more than $500,000 through a combination of equity financing and grants.

The idea for Cowrywise came when CEO Razaq Ahmed was an investment analyst with Meristem covering equities and making recommendations to retail and wealth management clients. He noticed that existing investment management firms in the country focused on the top 1 percent. They couldn’t scale investment products to millions of Nigerians primarily due to their restricting size.

Banks, though, have been able to make progress on this front when compared to investment firms. They expanded heavily in the mid and late 2000s to accumulate the branch networks they have today where there are about 45 million unique accounts in Nigeria.

But over the years, the quality of bank services in terms of savings and investments has drastically reduced. With interest rates hovering around 3-5% per annum, what Nigerians are now familiar with is to send and receive money via their bank accounts, and use debit cards for withdrawals leaving the market still underserved when it comes to investment products.

For this reason, Ahmed, alongside Edward Popoola as CTO, founded Cowrywise in 2017 to solve this problem. With Cowrywise, they hoped to democratise access to savings and investment products to the growing demography of underserved Nigerian millennials and the middle class.

“Wealth management had been strange to many Nigerians because the existing players were not built for the mass market. That has always been a problem we felt required a solution,” Ahmed told TechCrunch.

When they launched, the founders wanted to leverage the telecom industry’s reach to drive its investment products to millions of subscribers. But it didn’t turn out as planned, as the project became expensive to undertake and also, the telcos requested cutthroat prices and commissions.

Cowrywise founders (Edward Popoola and Razaq Ahmed)

The company switched focus, deciding to build upon existing payment infrastructure companies like Flutterwave and Paystack. The first facet of products launched to the market were savings-related products backed by fixed income instruments like treasury bills. Ahmed claims that these products yield better interests at 10%-15%, more substantial than what banks offered.

Following that was the introduction of its mutual funds’ products. Currently, the company has 19 different mutual funds and at least 20% of the total mutual funds in the country are listed on its platform. Ahmed claims this is the largest portfolio of mutual funds a single entity has in the country.

These assets cut across five investment partners, and they allow users to save and invest with as little as ₦100 ($0.25). The partners include United Capital Asset Management, Meristem Wealth Management, Afrinvest Wealth Management, ARM Investment Managers and Lotus Capital. Cowrywise indirectly charges customers for this service and splits the fee with the mutual fund partners but the CEO doesn’t disclose how much.

Also, the four-year-old company takes into account the needs of different demographics and religious background, which Ahmed asserts is as a result of an understanding with the mutual fund partners.

“Our mutual fund partners clearly recognize the value of being part of an inclusive digital platform that allows retail investors to invest regardless of faith or financial status,” he said.

The YC alum and Catalyst Fund company also offers advisory services and recommends different funds to customers based on their risk appetite and spending power.

Image Credits: Cowrywise

But building trust with users has not always been smooth for the company. It’s an issue Ahmed explains Cowrywise has had to deal with via transparency and outstanding service delivery.

For instance, one of Cowrywise’s darkest days came last September when a customer took to Twitter to complain about its lack of communication in reported stolen funds from her account. In response, Cowrywise apologised for the lapse in communication, acted on the request, and promised to do better.

“Service delivery has helped us bridge that trust gap to a huge extent, and I feel it’s reflected in the user growth and adoption we’ve experienced. Trust was a major issue we faced but right now, we’re crossing that bridge pretty well,” the CEO said.

About that, Cowrywise has more than 220,000 users. In its first year, it had just 2,000 users. Similarly, to highlight the journey ahead for the company, there are only half a million Nigerians actively investing in mutual funds. When compared to the total number of active bank accounts in the country of more than 40 million, it is obvious Cowrywise still has room to grow in the $3 billion market.

Cowrywise’s unique approach to wealth management is one reason why Quona Capital led the round according to partner Johan Bosini. The VC firm, known to back fintech and retail enablers like SA-based Lulalend and Yoco, and Kenya’s Sokowatch, is making its first foray into the Nigerian market with Cowrywise.

“Razaq, Edward, and the Cowrywise team are providing everyday Nigerians with easy access to powerful and flexible wealth-generating tools that have typically been reserved for people who are already wealthy,” said Bosini to TechCrunch. “In a market of 200 million people, we think this will be very impactful for individuals to have more control over their financial future.”

The company hopes to increase its customer base, and the new infusion will be critical to that. According to the company, the investment will also expand Cowrywise’s product offerings, support more fund managers in Nigeria and build out its investment management infrastructure.

Cowrywise is one of the many wealth tech startups on the continent. There are startups with comparable business models like Nigeria’s Piggyvest and others are Robinhood-esque platforms like Egypt’s Thndr and Nigeria’s Bamboo, Trove, Risevest and Chaka. Cowrywise’s investment which is the largest publicized round at this stage brings in much-needed validation for this segment of fintech startups that are starting to take off.

In the same vein, despite a slow start to a year which has seen Africa’s agritech and cleantech sectors take the lion’s share of investments, we might see fintech startups picking up the kind of pace we’ve been accustomed to that has made them dominate VC funding for the past couple of years.

WhatsApp, the popular messaging app with more than 2 billion users, has been getting a lot of heat and losing users in recent weeks after announcing (and then delaying) changes to how it shares data with its owner Facebook. And it’s not done with how it’s tweaking privacy and security. Now, it’s adding a new biometric feature to the service to bring in a new authentication layer for those using its web and desktop versions.

The company said that from today, it will let people add in a fingerprint, face, or iris scan when to use WhatsApp on desktop or web.

The feature is coming as part of a new look for the desktop versions, ahead of what the company hints will be more updates coming soon.

With the new feature, you will now have the option (not requirement) to add in a biometric login, which uses either a fingerprint, face ID, or iris ID — depending on the device — on Android or iPhone handsets, to add in a second layer of authentication.

When implemented, it will appear for users before a desktop or web version can be linked up with a mobile app account, which today relies just on using a QR code: the QR code doesn’t go away; this is a second step users will need to take, similar to how you can choose to implement two steps of authentication on a handset to use the WhatsApp mobile app today.

WhatsApp says that on iPhone, it will work with all devices operating iOS 14 and above with Touch ID or Face ID, while on Android, it will work on any device compatible with Biometric Authentication (Face Unlock, Fingerprint Unlock or Iris Unlock).

The service is another step forward in WhatsApp creating more feature parity between its flagship mobile apps, and how you interact with the service when you use it elsewhere.

While WhatsApp started as a mobile messaging app, it has over the years been building out other ways of using it, for example adding desktop support in 2015 to the iOS version.

Mobile still accounts for the majority of WhatsApp’s users, but events like global health pandemics, which are keeping more of us inside, are likely leading to a surge of users of its Web and native desktop apps, and so it makes sense for it to be adding more features there.

WhatsApp told TechCrunch that it is going to be adding in more features this year to bring the functionality of the two closer together. There are still big gaps: for example, you can’t make calls on the WhatsApp web version. (That feature may be one coming soon: as of last month, it started to get spotted in beta tests.)

To be extra clear, the biometric service, which is being turned on globally, will be opt-in. Users will need to go to their settings to turn on the feature, in the same way that today they need to go into their settings to turn on biometric authentication for their mobile apps.

What comes next for biometrics?

WhatsApp’s recent announcements about data-sharing changes between it and Facebook have put a lot of people on edge about the company’s intentions. And that’s no surprise. It’s a particularly sensitive issue since messaging has been thought of a very personal and sometimes private space, seen as separate from what people do on more open social networking platforms.

Over the years, however, that view has been eroded through data leaks, group messaging abuse, and (yes) changes in privacy terms.

That means there will likely be a lot of people who will doubt what Facebook’s intentions are here, too.

WhatsApp is pretty clear in outlining that it’s not able to access the biometric information that you will be storing in your device, and that it is using the same standard biometric authentication APIs that other secure apps, like banking apps, use.

But the banking app parallel is notable here, and maybe one worth thinking about more. Consider how the company has been adding a lot more features and functionality into WhatsApp, including the ability to pay for goods and services, and in markets like India, tests to offer insurance and pension products.

Yes, this new biometric feature is being rolled out today to create a more secure way for people to link up apps across devices. But in the interest of that feature parity, in future, it will be interesting to see how and if biometrics might appear as those other features get rolled out beyond mobile, too.

Levity, which has been operating in stealth (until now), is the latest no-code company to throw its wares into the ring, having picked up $1.7M in pre-seed funding led by Gil Dibner’s Angular Ventures. The Berlin-based startup wants to bring AI-powered workflow automation to anyone, letting knowldge workers automate tedious, repetitive and manual parts of their job without the need to learn how to code.

Suitable for customer service, marketing, operations, HR, and more, Levity has elected to be a horizontal offering from the get-go. Typical repetitive tasks that can be automated includes reviewing and categorizing documents, images, or text. The premise is that conventional, rule-based automation software isn’t able to automate tasks like these as it requires cognitive abilities, meaning that they usually done manually. This, of course, is where machine learning come into play.

“We want to solve the problem that people spend so much time at their jobs doing boring, repetitive stuff that can be automated to free up space and time for fun and interesting work,” says Gero Keil, co-founder and CEO. “Even though this is what AI has been promising us for decades, there are very few solutions out there, and even less for non-technical people who can’t code”.

To that end, Keil says Levity’s entire mission is to help non-technical knowledge workers automate what they couldn’t automate before. Specifically, the startup targets work processes that involve making decisions on unstructured data, such as images, text, PDFs and other documents.

“For example, if a company receives hundreds or thousands of emails from partners and customers with attachments every day, someone typically has to download the attachment, look at it and then decide what to do with it,” explains Keil. “With Levity, they can train their own custom AI on all of the historic data that they have accumulated, and once it has learned from that it seamlessly integrates with their existing tools and workflows e.g. Dropbox, Gmail, Slack etc.”

More broadly, he says there are many companies struggling to “productionize AI” that would really benefit from having an end-to-end platform “that enables them to build their own AI solutions and make them part of their processes”.

Keil argues that Levity’s main competitor is people doing work manually, but concedes that there is crossover with automation machine learning tools, workflow automation offerings, and labeling tools,

“Instead of going deep into every domain of the ML value chain and making the lives of developers and data scientists at large corporations easier, we focus only the most essential bits and pieces, wrap them in simple and enjoyable UX and abstract the rest away,” he says. “That makes us the best for non-developers in small and medium-sized businesses that want to automate previously non automatable processes in the most straightforward way. The people that have the automation problem become the same people that solve the automation problem; it’s a paradigm shift just like what Wix and Squarespace did to websites”.

Adds Gil Dibner, general partner and founder at Angular Ventures, in a statement: “Levity is driving a massive shift that will affect all knowledge workers. By allowing knowledge workers to easily train AI engines, build AI-powered automations, and integrate them into their everyday workflows, Levity is radically democratizing the benefits of AI.”

Alongside Angular, Levity’s other backers include: System.One, Discovery Ventures (founders of SumUp), Martin Henk (founder of Pipedrive) and various additional unnamed angel investors.