& meet dozens of singles today!

User blogs

Robinhood caps a wild week for new funding, Coinbase is going public and Johnson & Johnson reveals new vaccine trial data. This is your Daily Crunch for January 29, 2021.

The big story: Robinhood raises $1B

I know the newsletter has been dominated by Robinhood and stock market news for the past few days but, well, so have the headlines.

The latest news is that after reportedly tapping its credit lines, Robinhood raised $1 billion in new funding from existing investors. It seems the company needed the money in order to meet regulatory minimums and other requirements tied to users’ trading activity.

Meanwhile, the SEC has issued a statement that doesn’t specifically mention Robinhood or GameStop by name, but it says that “extreme stock price volatility has the potential to expose investors to rapid and severe losses” that could “undermine market confidence.”

The tech giants

You can now give Facebook’s Oversight Board feedback on the decision to suspend Trump — The board says the point of the public comment process is to incorporate “diverse perspectives” from third parties who wish to share research that might inform their decisions.

Uber’s Autocab acquisition gets eyed by UK competition watchdog — Autocab makes booking and dispatch software for the taxi and private-hire vehicle industry.

Startups, funding and venture capital

Coinbase is going public via direct listing — The company has raised over $540 million in funding as a private company.

Firehawk Aerospace extends seed funding to $2.5M with $1.2M from Harlow Capital — Firehawk has developed a new kind of hybrid rocket fuel that greatly enhances rocket launch safety, cost and transportation using additive manufacturing.

SoftBank earmarks $100M for Miami-based startups — The fund will back companies that are in Miami or plan to move there.

Advice and analysis from Extra Crunch

Customer advisory boards are a gold mine for startup brand champions — Some considerations to make certain your customer advisory board is a success.

Rising African venture investment powers fintech, clean tech bets in 2020 — The Exchange looks at a report from Briter Bridges, a research group that focuses on Africa’s private capital market.

Subscription-based pricing is dead: Smart SaaS companies are shifting to usage-based models — That’s according to Open VP of Growth Kyle Povar.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Johnson & Johnson’s COVID-19 vaccine is 85% effective against severe cases, and 66% effective overall per trial data — Johnson & Johnson’s vaccine is a single shot rather than a two-course treatment.

‘Frozen’ CG snow and crash-test cadavers offer hints for 60-year-old Russian mystery deaths — New research uses simulation techniques from multiple eras to advance what is perhaps the least implausible explanation for a tragic mystery.

Reap big benefits when you attend both TC Early Stage 2021 events — TechCrunch Early Stage is a two-day virtual bootcamp that gives early founders access to leading experts.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/01/29/daily-crunch-robinhood-raises-1b/

Robinhood has detailed its latest step in the complex quagmire of market manipulation that is this week’s GameStop hedge fund Reddit army debacle. Users will for the present be limited to holding a single share of GameStop and dozens of other stocks.

Several stocks were limited to five shares, and options contracts are likewise limited on many of the most-traded stocks this week, such as AMC and Blackberry. Positions exceeding these amounts will not be automatically sold, but they will apply if the user goes under them and tries to buy again. Fractional shares are also prohibited.

Any other specifics about positions, expiring options contracts and so on can be found in the announcement and related FAQs.

Robinhood has said that it has halted and now limited trading because of “financial requirements, including SEC net capital obligations and clearinghouse deposits” — essentially, the volume and value of the trading going on was beyond its ability to legally or realistically cover. Trading of certain stocks was halted or restricted earlier this week, but the new post details exactly which stocks are affected and how.

The company had to hastily raise funds totaling over a billion dollars from its existing investors after reportedly maxing out half a billion in credit lines.

With widespread outrage at the handling of the situation and the U.S. government taking notice, it’s unlikely Robinhood’s troubles (not to mention other trading apps and platforms) are anywhere near over. With new developments appearing seemingly every few hours, it’s hard to know how this particular story will develop.

Edtech is so widespread, we already need more consumer-friendly nomenclature to describe the products, services and tools it encompasses.

I know someone who reads stories to their grandchildren on two continents via Zoom each weekend. Is that “edtech?”

Similarly, many Netflix subscribers sought out online chess instructors after watching “The Queen’s Gambit,” but I doubt if they all ran searches for “remote learning” first.

Edtech needs to reach beyond underfunded public school systems to become more sustainable, which is why more investors and founders are focusing on lifelong learning.

Besides serving traditional students with field trips and art classes, a maturing sector is now branching out to offer software tutors, cooking classes and singing lessons.

For our latest investor survey, Natasha Mascarenhas polled 13 edtech VCs to learn more about how “employer-led up-skilling and a renewed interest in self-improvement” is expanding the sector’s TAM.

Here’s who she spoke to:

- Deborah Quazzo, managing partner, GSV Ventures

- Ashley Bittner, founding partner, Firework Ventures (a future of work fund with portfolio companies LearnIn and TransfrVR)

- Jomayra Herrera, principal, Cowboy Ventures (a generalist fund with portfolio companies Hone and Guild Education)

- John Danner, managing partner, Dunce Capital (an edtech and future of work fund with portfolio companies Lambda School and Outschool)

- Mercedes Bent and Bradley Twohig, partners, Lightspeed Venture Partners (a multistage generalist fund with investments including Forage, Clever and Outschool)

- Ian Chiu, managing director, Owl Ventures (a large edtech-focused fund backing highly valued companies including Byju’s, Newsela and Masterclass)

- Jan Lynn-Matern, founder and partner, Emerge Education (a leading edtech seed fund in Europe with portfolio companies like Aula, Unibuddy and BibliU)

- Benoit Wirz, partner, Brighteye Ventures (an active edtech-focused venture capital fund in Europe that backs YouSchool, Lightneer and Aula)

- Charles Birnbaum, partner, Bessemer Venture Partners (a generalist fund with portfolio companies including Guild Education and Brightwheel)

- Daniel Pianko, co-founder and managing director, University Ventures (a higher ed and future of work fund that is backing Imbellus and Admithub)

- Rebecca Kaden, managing partner, Union Square Ventures (a generalist fund with portfolio companies including TopHat, Quizlet, Duolingo)

- Andreata Muforo, partner, TLCom Capital (a generalist fund backing uLesson)

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

In other news: Extra Crunch Live, a series of interviews with leading investors and entrepreneurs, returns next month with a full slate of guests. This year, we’re adding a new feature: Our guests will analyze pitch decks submitted by members of the audience to identify their strengths and weaknesses.

If you’d like an expert eye on your deck, please sign up for Extra Crunch and join the conversation.

Thanks very much for reading! I hope you have a fantastic weekend — we’ve all earned it.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

13 investors say lifelong learning is taking edtech mainstream

Image Credits: Bryce Durbin

Rising African venture investment powers fintech, clean tech bets in 2020

Image Credits: Nigel Sussman (opens in a new window)

After falling into yesterday’s wild news cycle, Alex Wilhelm returned to The Exchange this morning with a close look at venture capital activity across Africa in 2020.

“Comparing aggregate 2020 figures to 2019 results, it appears that last year was a somewhat robust year for African startups, albeit one with fewer large rounds,” he found.

For more context, he interviewed Dario Giuliani, the director of research firm Briter Bridges, which focuses on emerging markets in Africa, Asia and Latin America.

Talent and capital are shifting cybersecurity investors’ focus away from Silicon Valley

Image Credits: MCCAIG (opens in a new window) / Getty Images

New cybersecurity ecosystems are popping up in different parts of the world.

Some of of that growth has been fueled by an exodus from the Bay Area, but many early-stage security startups already have deep roots in East Coast cities like Boston and New York.

In the United Kingdom and Europe, government innovation programs have helped entrepreneurs close higher numbers of Series A and B rounds.

Investor interest and expertise is migrating out of Silicon Valley: This post will help you understand where it’s going.

Will Apple’s spectacular iPhone 12 sales figures boost the smartphone industry in 2021?

Image Credits: NurPhoto (opens in a new window) / Getty Images

Today’s smartphones are unfathomably feature-rich and durable, so it’s logical that sales have slowed.

A phone purchased 18 months ago is probably “good enough” for many consumers, especially in times of economic uncertainty.

Then again, of the record $111.4 billion in revenue Apple earned last quarter, $65.68 billion came from phone sales, largely driven by the release of the iPhone 12.

Even though “Apple’s success this quarter was kind of a perfect storm,” writes Hardware Editor Brian Heater, “it’s safe to project a rebound for the industry at large in 2021.”

The 5 biggest mistakes I made as a first-time startup founder

Image Credits: Randy Faris (opens in a new window) / Getty Images

Finmark co-founder and CEO Rami Essaid wrote a post for Extra Crunch that candidly describes the traps he laid for himself that made him a less-effective entrepreneur.

As someone who’s worked closely with founders at several startups, each of the points he raised resonated deeply with me.

In my experience, many founders have a hard time delegating, which can quickly create cultural and operational problems. Rami’s experience bears this out:

“I became a human GPS: People could follow my directions, but they struggled to find the way themselves. Independent thinking suffered.”

Dear Sophie: How can I sponsor my mom and stepdad for green cards?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I just got my U.S. citizenship! My husband and I want to bring my mom and her husband to the U.S. to help us take care of our preschooler and toddler.

My biological dad passed away several years ago when I was an adult and my mom has since remarried.

— Appreciative in Aptos

Check out the amazing speakers joining us on Extra Crunch Live in February

Next month, Extra Crunch Live returns with a lineup of guests who are extremely well-qualified to discuss early-stage startups.

Each Wednesday at noon PPST/3 p.m. EST, join a conversation with founders and the investors who backed their companies:

February 3:

Gaurav Gupta (Lightspeed Venture Partners) + Raj Dutt (Grafana Labs)

February 10:

Aydin Senkut (Felicis Ventures) + Kevin Busque (Guideline)

February 17:

Steve Loughlin (Accel) + Jason Boehmig (Ironclad)

February 24:

Matt Harris (Bain Capital) + Isaac Oates (Justworks)

Also, we’re adding a new feature to Extra Crunch Live — our guests will offer advice and feedback on pitch decks submitted by Extra Crunch members in the audience!

10 VCs say interactivity, regulation and independent creators will reshape digital media in 2021

Image Credits: Aleksandar Nakic (opens in a new window) / Getty Images

Since the pandemic disrupted the social rhythms of work and school, many of us have compensated by changing our relationship to digital media.

For instance, I purchased a new sofa and thicker living room curtains several months ago when I realized we have no idea when movie theaters will reopen.

Last year, podcast sponsors spent almost $800 million to reach listeners, but ad revenue is estimated to surpass $1 billion this year. Clearly, I’m not the only person who used a discount code to buy a new product in 2020.

At this point, I can scarcely keep track of the multiple streaming platforms I’m subscribed to, but a new voice-activated remote control that comes with my basic cable plan makes it easier to browse my options.

Media reporter Anthony Ha spoke to10 VCs who invest in media startups to learn more about where they see digital media heading in the months ahead. For starters, how much longer can we expect traditional advertising models to persist?

And in a world with hundreds of channels, how are creators supposed to compete for our attention? What sort of discovery tools can we expect to help us navigate between a police procedural set in a Scandinavian village and a 90s sitcom reboot?

Here’s who Anthony interviewed:

- Daniel Gulati, founding partner, Forecast Fund

- Alex Gurevich, managing director, Javelin Venture Partners

- Matthew Hartman, partner, Betaworks Ventures

- Jerry Lu, senior associate, Maveron

- Jana Messerschmidt, partner, Lightspeed Venture Partners

- Michael Palank, general partner, MaC Venture Capital (with additional commentary from MaC’s Marlon Nichols)

- Pär-Jörgen Pärson, general partner, Northzone

- M.G. Siegler, general partner, GV

- Laurel Touby, managing director, Supernode Ventures

- Hans Tung, managing partner, GGV Capital

Normally, we list each investor’s responses separately, but for this survey, we grouped their responses by question. Some readers say they use our surveys to study up on an individual VC before pitching them, so let us know which format you prefer.

Does a $27 billion or $29 billion valuation make sense for Databricks?

Image Credits: Nigel Sussman (opens in a new window)

Data analytics platform Databricks is reportedly raising new capital that could value the company between $27 billion and $29 billion.

By the end of Q3 2020, Databricks had surpassed a $350 million run rate — a $150 million YoY increase, reports Alex Wilhelm.

At the time, he described the company as “an obvious IPO candidate” with “broad private-market options.”

Which begs the question: “Can we come up with a set of numbers that help make sense of Databricks at $27 billion?”

End-to-end operators are the next generation of consumer business

Image Credits: Natalia Timchenko (opens in a new window) / Getty Images

Rapid shifts in the way we buy goods and services disrupted old-school marketplaces like local newspapers and the Yellow Pages.

Today, I can use my phone to summon a plumber, a week’s worth of groceries or a ride to a doctor’s office.

End-to-end operators like Netflix, Peloton and Lemonade take a lot of time and energy to reach scale, but “the additional capital required is often outweighed by the value captured from owning the entire experience.”

Unpacking Chamath Palihapitiya’s SPAC deals for Latch and Sunlight Financial

Image Credits: Nigel Sussman (opens in a new window)

On January 25, Social Capital CEO Chamath Palihapitiya tweeted that he was making two blank-check deals.

Enterprise SaaS company Latch makes keyless entry systems; Sunlight Financial helps consumers finance residential solar power installations.

“There are nearly 300 SPACs in the market today looking for deals,” noted Alex Wilhelm, who unpacked both transactions.

“There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months.”

Fintechs could see $100 billion of liquidity in 2021

Image Credits: dan tarradellas (opens in a new window) / Getty Images

On Monday, we published the Matrix Fintech Index, a three-part study that weighs liquidity, public markets and e-commerce trends to create a snapshot of an industry in perpetual flux.

For four years running, the S&P 500 and incumbent financial services companies have been outperformed by companies like Afterpay, Square and Bill.com.

In light of steady VC investment, increasing consumer adoption and a crowded IPO pipeline, “fintech represents one of the most exciting major innovation cycles of this decade.”

Drupal’s journey from dorm-room project to billion-dollar exit

Image Credits: Acquia

On January 15, 2001, then-college student Dries Buytaert released Drupal 1.0.0, an open-source content-management platform. At the time, about 7% of the world’s population was online.

After raising more than $180 million, Buytaert exited to Vista Equity Partners for $1 billion in 2019.

Enterprise reporter Ron Miller interviewed Buytaert to learn more about his 18-year journey.

“His story is compelling, but it also offers lessons for startup founders who also want to build something big,” says Ron.

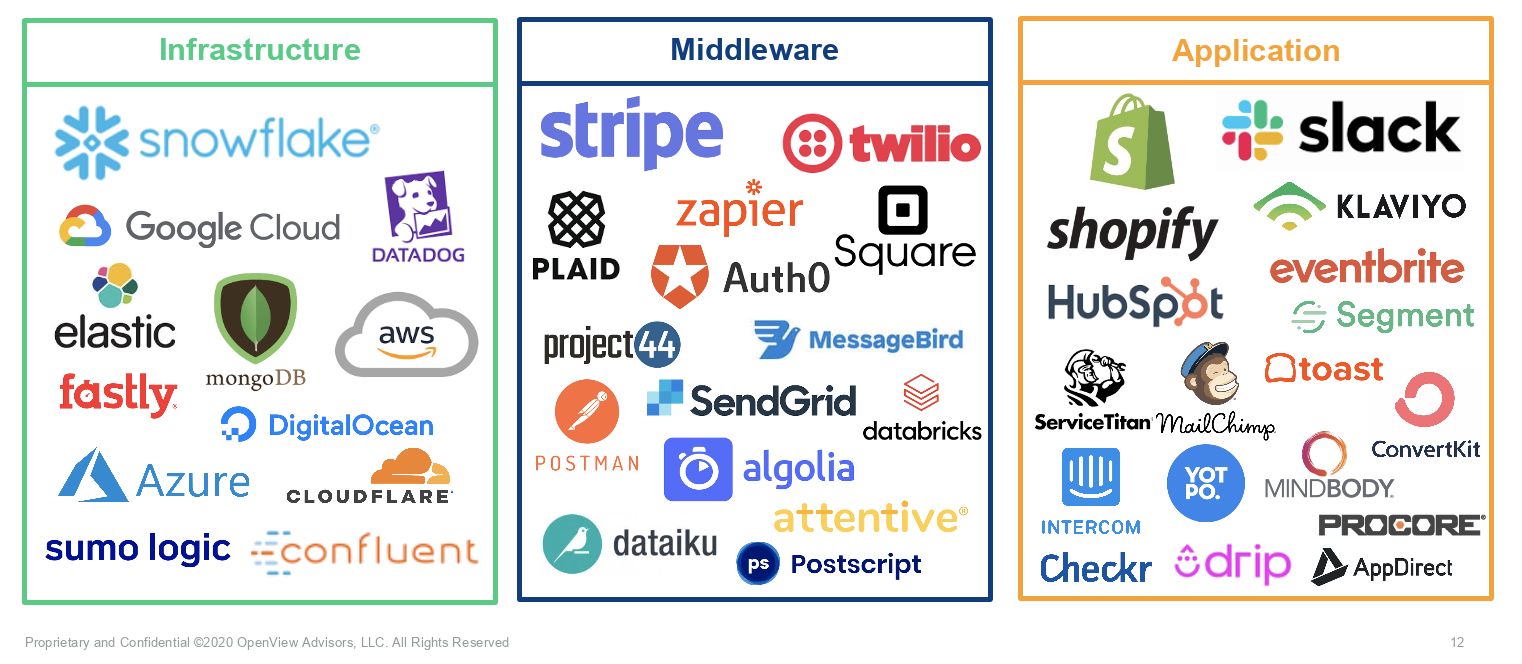

Software buying has evolved. The days of executives choosing software for their employees based on IT compatibility or KPIs are gone. Employees now tell their boss what to buy. This is why we’re seeing more and more SaaS companies — Datadog, Twilio, AWS, Snowflake and Stripe, to name a few — find success with a usage-based pricing model.

The usage-based model allows a customer to start at a low cost, while still preserving the ability to monetize a customer over time.

The usage-based model allows a customer to start at a low cost, minimizing friction to getting started while still preserving the ability to monetize a customer over time because the price is directly tied with the value a customer receives. Not limiting the number of users who can access the software, customers are able to find new use cases — which leads to more long-term success and higher lifetime value.

While we aren’t going 100% usage-based overnight, looking at some of the megatrends in software — automation, AI and APIs — the value of a product normally doesn’t scale with more logins. Usage-based pricing will be the key to successful monetization in the future. Here are four top tips to help companies scale to $100+ million ARR with this model.

1. Land-and-expand is real

Usage-based pricing is in all layers of the tech stack. Though it was pioneered in the infrastructure layer (think: AWS and Azure), it’s becoming increasingly popular for API-based products and application software — across infrastructure, middleware and applications.

Image Credits: Kyle Povar / OpenView

Some fear that investors will hate usage-based pricing because customers aren’t locked into a subscription. But, investors actually see it as a sign that customers are seeing value from a product and there’s no shelf-ware.

In fact, investors are increasingly rewarding usage-based companies in the market. Usage-based companies are trading at a 50% revenue multiple premium over their peers.

Investors especially love how the usage-based pricing model pairs with the land-and-expand business model. And of the IPOs over the last three years, seven of the nine that had the best net dollar retention all have a usage-based model. Snowflake in particular is off the charts with a 158% net dollar retention.

The Dyatlov Pass incident is the mother of all cold cases: nine people found dead in 1959, deep in the Ural mountains, under circumstances no one has ever been able to satisfactorily explain. But new research uses simulation techniques from multiple eras to advance what is perhaps the least implausible story of this tragic mystery.

The paper, published yesterday in Nature Communications Earth and Environment, was accompanied by a highly readable summary in National Geographic, which is very much worth your time. (Even if the headline is the dreaded “Has science solved…?”)

Essentially the mystery is this: The eight students and their ski instructor had pitched their tent on a slope that seemed safe — if not perfectly so then comparatively considering the surroundings at Kholat Syakhl, or “Dead Mountain” — but were later found spread out around the area in various stages of disrobing and destruction. The carnage seemed beyond what an avalanche would produce, and anyway there seemed to be no evidence or likelihood of one in the first place.

For more than 60 years this has been a source of speculation and conspiracy, especially since there was the appearance of a cover-up by the Soviet government at the time. Even Russia revisiting the event in 2019 didn’t seem to produce a convincing explanation.

Enter Alexander Puzrin and Johan Gaume, from Switzerland’s ETH Zürich and EPFL, respectively, two highly prestigious and advanced technical institutes. Curious about the incident for their own reasons, they began looking into how to work out once and for all what happened. An interesting personal detail:

The scientific investigation came with an added benefit from Puzrin’s wife, who is Russian. “When I told her that I was working on the Dyatlov mystery, for the first time she looked at me with real respect,” he says.

One hardly knows what to say!

At all events the researchers put together a new hypothesis based on a few ideas.

First, the slope was not as shallow as it appeared — it was near the minimum for an avalanche to occur, and the snow was characterized as having a base layer conducive to slippage of snow on top. Freezing winds could have added mass and set off a slide under the cut-out in which the group put their tent.

Second, Gaume visited the creators of the movie “Frozen,” which featured highly realistic snow simulation. He met with Disney’s snow simulation specialist and got permission to use and modify the code — but in this case, to see what an avalanche striking sleeping students would do to them. Their simulations showed that it wouldn’t take much — a block of icy snow the size of a large car — to cause the devastation witnessed by the rescue party.

Third, they used research performed by GM that broke the ribs of a hundred cadavers — for the purposes of tuning seatbelts. They proposed that because the Russian students would have been sleeping on their skis, it was fairly similar to how certain cadavers with rigid supports reacted to impacts. Thus the horrific injuries instead of the usual asphyxiation produced by being submerged in a drift that usually happens to victims of avalanches.

It’s all still speculation on top of speculation, but the important part is that by combining these various, reasonably objective measures, Puzrin and Gaume show that it’s possible that an avalanche was responsible for the Dyatlov Pass incident, however rare the combination of circumstances must have been.

They freely admit that many may not accept this explanation — “It’s too normal,” said Gaume — and will continue to pursue the conspiracies and fantasy scenarios the incident has spawned for half a century. But for others it may offer some solace: a reason to believe that these poor nine souls were just in the wrong place at the wrong time.