& meet dozens of singles today!

User blogs

Digital ordering and paying at restaurants was already gaining much ground in China before the COVID-19 pandemic hit. The tap-to-order method on a smartphone is part of the greater development in China where cash and physical documentation is increasingly being phased out. Many restaurants across large cities go as far as making digital menus mandatory, cutting staff costs.

Meanwhile, there has been pushback from the public and the authorities over aggressive digitization. An article published this week by People’s Daily, an official paper of the Chinese Communist Party, was titled: “Scan-to-order shouldn’t be the only option.”

Aside from harming consumers’ freedom of choice and removing the human interaction that diners might appreciate, mandatory smartphone use also raises concerns over data privacy. Ordering on a phone often requires access to a person’s profile on WeChat, Alipay, Meituan or other internet platforms enabling restaurants’ digital services. With that trove of data, businesses will go on to span users with ads.

“These approaches harm consumers’ data protection rights,” the People’s Daily quotes a senior personnel at the consumer rights unit of China Law Society, China’s official organization of legal academic professionals, as saying.

China has similarly targeted the ubiquity of cashless payments. In 2018, China’s central bank called rejecting cash as a form of payment “illegal” and “unfair” to those not accustomed to electronic payments, such as senior citizens.

The elderly also face a dilemma as digital health codes, which are normally generated by tracking people’s movement history using location data from SIM cards, becomes a norm amid the pandemic. Without a smartphone-enabled health pass, senior citizens could be turned away by bus drivers, subway station guards, restaurant staff and gatekeepers at other public venues.

To bridge the digital divide, the southern province of Guangdong recently began allowing citizens to check their health status by tapping their physical ID cards on designated scanners.

Cashless payment is an irreversible trend though. Between 2015 and 2020, the digital payments penetration rate amongst China’s mobile internet users went from less than 60% to over 85%, according to official data. Moreover, the government is hastening the pace to roll out digital yuan, which, unlike third-party payments methods, is issued and managed by the central bank and serves as the statutory, digital version of China’s physical currency.

Source: https://techcrunch.com/2021/02/01/china-criticize-contactless-payments/

Two years after launching its $56 million debut fund, Kindred Ventures, a San Francisco-based pre-seed and seed-stage venture fund founded by Steve Jang and Kanyi Maqubela, has closed its second fund with $100 million in capital commitments.

Jang is himself a founder who later jumped into investing. In more recent years, he cofounded Bitski, a crypto-asset wallet startup, and previously founded Schematic Labs, an early social music app that was brought into Rhapsody in 2014, and co-created the music streaming service imeem, whose assets were later acquired by MySpace.

Jang was also an early advisor to Uber, and individually invested in a number of breakout companies, including the delivery company Postmates, the synthetic biology company Zymergen, the fitness company Tonal, and the crypto exchange Coinbase.

Maqubela has similarly worn the hats of both founder and investor, spending six years as an investor with the seed- and early-stage firm Collaborative Fund before joining forces with Jang, as well as cofounding Heartbeat Health — a platform that invites patients who are at risk of heart disease and other chronic ailments to talk remotely with experts for care management.

The fund is notable, including because it doesn’t zero in on one or two sectors of tech. Why is that interesting? Well, because the venture landscape is now so crowded that institutional investors typically prefer to see seed-stage funds with a specific sector focus or an angle of some sort. It’s a way for these limited partners to better diversify their own investments and keep from backing managers who are investing in the very same deals.

Indeed, that Jang and Maqubela secured commitments from a mix of major university endowments, foundations, fund-of-funds, and strategic investors despite being generalists is something a feat.

No doubt investor interest ties to some of their earlier investments, like Coinbase — bets that underscore they are in the right entrepreneurial circles. Yet they say that another aspect of their pitch also resonated with investors, which is their “high concentration, high conviction” approach. Part of their workflow, for example, involves creating a Signal group or Slack channel as soon as they invest in a team so there can be a constant back-and-forth and to bolster the sense that Jang and Maqubela are extensions of a founding team.

Kindred says it also schedules weekly one-on-one chats with the founders it funds until their startup has designated a product launch date, after which “we move into a less rigorous, less frequent meetings,” says Jang, describing the firm’s approach very “programmatic and designed.”

But another way Kindred tries to gain an edge over competitors is by moving as close to the concept stage as possible — even helping to form startups. Jang and Maqubela point back to Heartbeat Health and Bitski, which they helped incubate and spin out. Another startup born of their “formation investing” approach is a payments company called Otto, and they say to expect more to come.

In some cases, they start the company and assemble the founding team. In other cases, they help a new founder evolve from concept to prototype to landing the right cofounder. What it asks for in exchange is an ownership stake that ranges from between 5% of a company to 20% percent, with an average ownership position of 11%, they say, and ticking upward as the firm matures.

As for deal flow, they say they source their deals through introductions from the founders in their portfolio, through their own outreach based on ideas that excite them, and from employees of past portfolio companies.

Interestingly, though the bets they make range widely in focus, different themes do emerge, including around digital health, where in addition to Heartbeat Health and Tonal they backed Color, whose at-home tests can help people understand if they are at risk of hereditary cancer, as well as whether they have been exposed to COVID-19. (It closed its newest round at a $1.5 billion valuation earlier this month.)

Kindred is focused on community, too, with bets that include the audio social network Clubhouse. And Kindred is writing checks to the occasional security company, including Anjuna Security, which aims to protects applications and data from insiders by seamlessly encrypting everything end to end.

Not last, finance is plainly an area of interest. In addition to Coinbase, for example, Kindred more recently invested in dYdX, an open trading platform for crypto assets that just last announced it had raised $10 million in Series B funding.

As for how the two — who wound up funding 25 companies altogether in their first fund — can continue to cover so much ground as they set out to invest this new, bigger vehicle, Maqubela says the question came up “more than half the time” in conversations about this next fund with its investors. But their secret sauce is no great mystery, they insist. They say they just happen to be incredibly curious people who are willing to get up to speed however possible when they meet a founder with whom they want to partner.

“It ultimately comes down to who Kanyi is and who I am,” says Jang, “and we’re both voracious about learning, it’s what drives us.”

Though both have experience and know-how about a wide number of verticals at this point, they’re “absolutely novices” at times, and they don’t let that stop them, both say.

“If we’re inspired by the founder, their intellect, their dedication to a problem, and why they’re doing what they’re doing, we’re happy to go learn as quickly as possible,” offers Jang. “We’re very dutiful students.”

Google has agreed to pay $2.59 million to more than 5,500 current employees and former job applicants as part of a settlement with the U.S. Department of Labor over allegations of systemic discrimination as it relates to compensation and hiring. Google has also agreed to reserve $250,000 a year for the next five years to address any potential pay equity adjustments that may come up. That brings Google’s total financial commitment to $3.8 million — a drop in the bucket for the company, whose parent company Alphabet has a market cap of $1.28 trillion.

The settlement comes after the DOL’s Office of Federal Contract Compliance Programs found pay disparities affecting female software engineers at Google’s offices in Mountain View, as well as in offices in Seattle and Kirkland, Washington. The OFCCP also found differences in hiring rates that “disadvantaged female and Asian applicants” for engineers roles at Google’s locations in San Francisco, Sunnyvale and Kirkland. The OFCCP’s evaluation covered Sept. 1, 2014 through Aug. 31, 2017.

As part of the settlement, Google has agreed to pay $1.35 million in back pay and interest to 2,565 female software engineers at the company ($527.50 per employee), and $1.25 million in back pay and interest to 1,757 women and 1,219 Asian applicants for software engineering roles they were not hired for ($414 per person).

Lastly, Google will reserve $1.25 million of the money to go toward pay-equity adjustments for the next five years for U.S. engineers at Google’s Mountain View, Kirkland, Seattle and New York offices.

“We believe everyone should be paid based upon the work they do, not who they are, and invest heavily to make our hiring and compensation processes fair and unbiased,” a Google spokesperson said in a statement to TechCrunch. “For the past eight years, we have run annual internal pay equity analysis to identify and address any discrepancies. We’re pleased to have resolved this matter related to allegations from the 2014-2017 audits and remain committed to diversity and equity and to supporting our people in a way that allows them to do their best work.”

“The U.S. Department of Labor acknowledges Google’s willingness to engage in settlement discussions and reach an early resolution,” Office of Federal Contract Compliance Programs Regional Director Jane Suhr said in a press release. “The technology industry continues to be one of the region’s largest and fastest growing employers. Regardless of how complex or the size of the workforce, we remain committed to enforcing equal opportunity laws to ensure non-discrimination and equity in the workforce.”

Source: https://techcrunch.com/2021/02/01/google-dol-discrimination-settlement/

In a creator-economy world, if you’re only as good as your last YouTube video, then your next YouTube video had better be bigger and louder than the last.

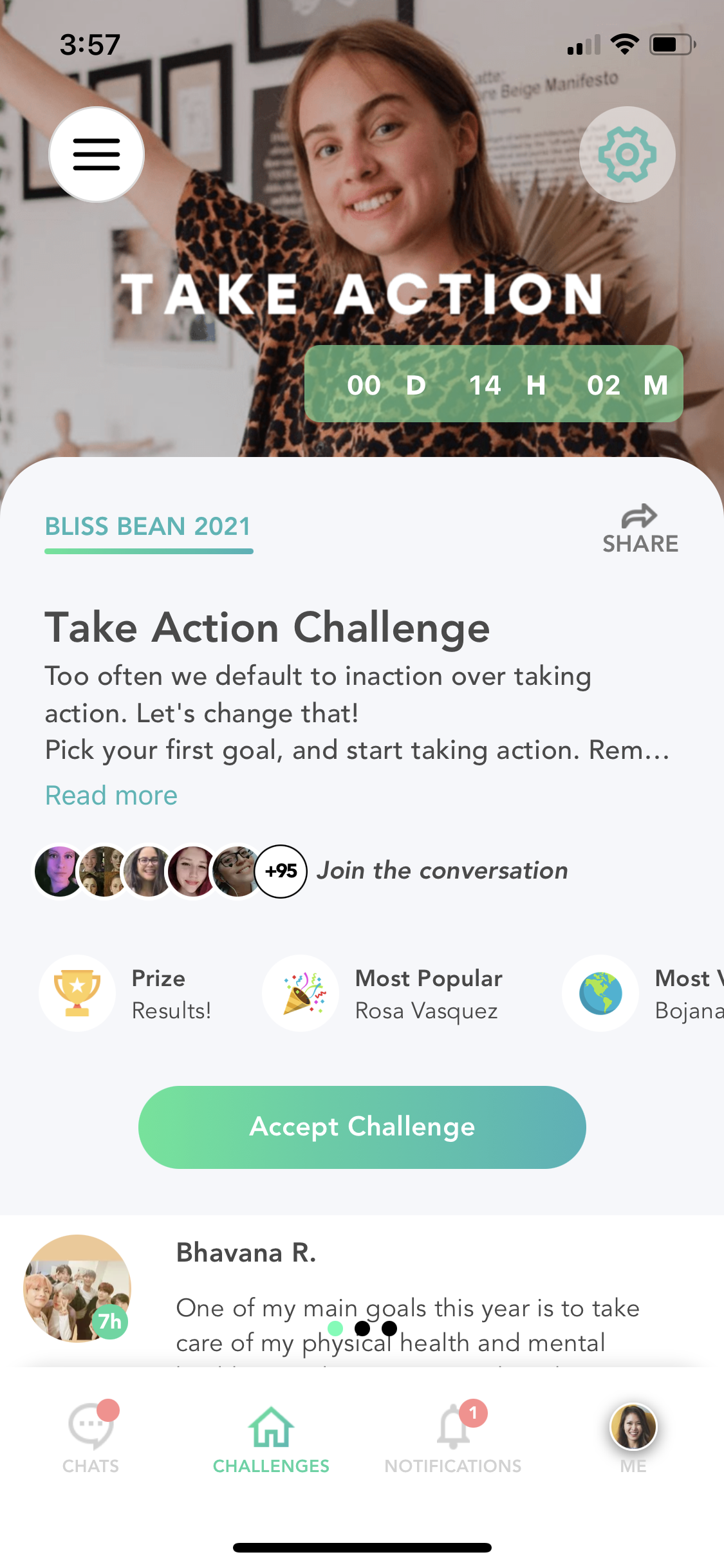

Vibely, a new startup co-founded by Asana alumni Teri Yu and Theresa Lee, wants to turn the constant, and often exhausting, beast of content creation on its head. The startup has created a premium, creator-controlled community platform that allows fans to gather and be monetized in new ways, beyond what is possible on YouTube or TikTok.

The core of Vibely, and what the co-founders hope will keep users coming back, is the ability to let any creator make a challenge for their fans to enjoy. For example, a creator whose brand evokes thoughtfulness could ask fans to sketch out their personal growth goals or take action around a new year’s resolution everyday. Or a fitness influencer could motivate fans to work out for a sprint of days.

“Most people in the creator economy are thinking about how to immediately monetize and get that instant gratification of like money here,” Yu said, which is why creators sell merchandise or hop on Cameo. “We’re focusing on long-term strategic communities.” Yu describes her startup’s shift as a mindset change, from a linear relationship between creators and fans to a multi-directional relationship between fans, superfans, new fans and creators.

Image Credits: Vibely

Vibely’s pitch is two-fold. For fans, the platform gives them a chance to chat with other fans from around the world. It also lets fans participate in community challenges and have a place to plan virtual hangouts over shared love for makeup or dance. The startup helps creators simultaneously, by giving them a one-stop shop to announce plans, do call to actions and create an ambassador program. It lets the “creator scale their time and have a multi-directional relationship with the community under or beneath them.”

Notably, Vibely is trying to be different from Patreon or OnlyFans, which is basically paywalled content for fans. Vibely doesn’t need creators to post more content, it just needs them to pop into a premium community and interact with fans in a meaningful way.

The startup is formalizing a sporadic daily occurrence: When a creator posts content, their comment sections in YouTube, Instagram and TikTok light up with fans discussing every detail you can imagine, from a suggestive hair flip to if that background poster has a hidden message. Creators often pop in to respond to a spicy thread or a random compliment, which incentivizes fans to keep swarming the content section.

The startup has spent little on customer acquisition cost and relied heavily on word of mouth. In December, Vibely launched a part-in-person, part-virtual creator house to pair top TikTok creators with their followers, generating some buzz. In 2020, Vibely had more than 600 communities with 392,000 messages sent and 37,000 challenges completed. Creators include Lavendaire, with 1.3 million YouTube subscribers and Rowena Tsai, who has 520,000 subscribers.

Yu says that there is one day where Kim Kardashian might have a community on the platform, but the main “bread and butter” of Vibely is searching for creators who represent a true interest, value or belief system. This can be a book influencer or a religious creator, for example.

“[Creators] are controlling their own destiny,” Yu said. “On Instagram or Facebook, you might create content but the algorithm decides at the end of the day whether or not your audience sees it. With Vibely, they have 100% control since this is their community.” The startup is planning to make money through membership dues and in-app mechanics like social currencies and rewards.

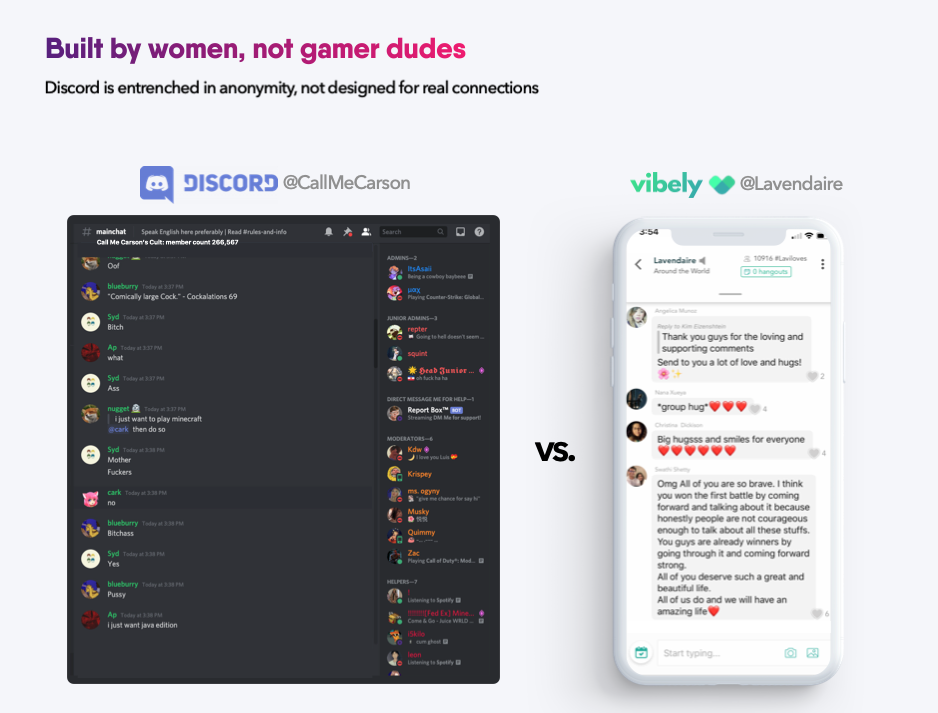

Vibely’s moonshot goal is to be a more positive, and supportive, Discord, a platform used by gamer communities across the world. So far, Yu says that less than .1% of Vibely users have been flagged by other users, although notably would not share total user numbers. There is also an ambassador program that appoints a user to oversee a community, as well as a global community manager on the team.

“The ceiling of where [Discord] can support is really only going to be gamers,” she said. “But creators want to protect their brand right now and make sure people have a positive experience,” so they are looking for another place to set up.

Image Credits: Vibely

While moderation is apparently going well so far, Vibely will most certainly encounter problems as more and more users join its platform. In the world of challenges, craze and hype led by fanatics could potentially become harmful if someone takes it too far. While Vibely aims to be a judgement-free zone for people to connect around the world, scale has a uniquely pessimistic way of forking that from time to time. Some consumer apps have responded to this truth by aggressively hiring on-staff moderators, but that too can become grueling work.

To hit the ground running, Vibely announced today that it has raised $2 million in seed financing from backers including Steve Chen, the co-founder of YouTube; Justin Rosenstein, the co-founder of Asana and co-creator of Netflix’s “Social Dilemma” documentary; Scott Heiferman, the co-founder of Meetup; Turner Novak, formerly an investor at Gelt, and more.

Google rethinks its gaming strategy, Microsoft rolls out its quantum computing platform and UiPath is now valued at $35 billion. This is your Daily Crunch for February 1, 2021.

The big story: Google shutters internal game studios

When Google announced its Stadia cloud platform, it also said it was forming Stadia Games and Entertainment, an internal studio that would create titles for the platform. Now it seems the company is abandoning this approach.

It’s a surprising move, not just because Google has yet to release a single game from the studio, but also because the company opened studios in Montreal and Los Angeles, as well as acquiring Typhoon Studios — so it seems like a real investment.

“Given our focus on building on the proven technology of Stadia as well as deepening our business partnerships, we’ve decided that we will not be investing further in bringing exclusive content from our internal development team SG&E, beyond any near-term planned games,” Google exec Phil Harrison said in a blog post.

The tech giants

Microsoft’s Azure Quantum platform is now in public preview — Azure Quantum is Microsoft’s cloud-based platform for using quantum hardware and software tools from partners like Honeywell Quantum Solutions, IonQ, 1QBit and others.

Xiaomi sues the US government over blacklisting — The filing, which was submitted on Friday, calls the decision “unlawful and unconstitutional.”

Google now gives you more information about the sites in your search results — Clicking the new hamburger-style menu icon will pop up a new info panel with additional information about the site.

Startups, funding and venture capital

Robotic process automation platform UiPath raises $750M at $35B valuation — The company’s automation platform aims to “transform the way humans work” by giving companies a way to build out and run automations across departments.

Databricks raises $1B at $28B valuation as it reaches $425M ARR — Databricks is a data-and-AI focused company that interacts with corporate information stored in the public cloud.

Weights & Biases raises $45M for its machine learning tools — Weights & Biases says it now has more than 70,000 users across more than 200 enterprises.

Advice and analysis from Extra Crunch

Robinhood’s Q4 2020 revenue shows a return to growth — Robinhood has been the world’s most discussed startup over the last week.

Best practices as a service is a key investment theme to watch in 2021 — It’s one thing to give people and businesses tools, and something else to train them to use those tools effectively.

Lightspeed’s Gaurav Gupta and Grafana Labs’ Raj Dutt will tell us why they financially tied the knot (twice!) — The new and improved Extra Crunch Live pairs founders and the investors who led their earlier rounds.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Amazon says government demands for user data spiked by 800% in 2020 — Amazon said it processed 27,664 government demands for user data in the last six months of 2020.

What investors need to know about research and inspiration in the COVID-19 era — Remote research will remain the rule even as the worst of the pandemic mercifully ends.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/02/01/daily-crunch-google-shutters-internal-game-studios/