& meet dozens of singles today!

User blogs

Yesterday, China flipped the switch on a nationwide carbon trading market, in what could be one of the most significant steps taken to reduce greenhouse gas emissions in 2021 — if the markets can work effectively.

China is the world’s largest emitter of greenhouse gases and its share of the world’s emissions output continues to climb.

As the Chinese government works to curb its environmental impact, policies like a carbon trading system could spur the adoption of new technologies, increasing demand for goods and services from domestic startups and tech companies around the world.

Carbon markets, implemented in some parts of the U.S. and widely across Europe, put a price on industrial emissions and force companies to offset those emissions by investing in projects that would remove an equivalent portion of greenhouse gases from the atmosphere.

They’re a key component of the 2015 Paris Agreement, but they’re also a controversial one. That’s because if they’re not implemented properly and managed effectively they can be a “massive loophole” for emitters, as Gilles Dufrasne, policy officer at Carbon Markets Watch, told Time last year.

This is especially true of China. Corruption in China is endemic and the country has long sacrificed environmental policy and stewardship at the altar of economic growth. China’s not alone in making that calculus, but the decisions have happened at a scale orders of magnitude larger than almost any other nation (with the exception of the U.S.)

The efficacy of the policy is also effected by the hierarchies that exist within the bureaucracy of the Chinese Communist Party. As ChinaDialogue noted, the measures were issued by the Ministry of Ecology and Environment, which carry lower legal authority than if they came from the NDRC, the leading governing body for macroeconomic policy across China and the overseer of the nation’s major economic initiatives.

That said, no country as large as China, which accounts for 28% of the world’s greenhouse gas emissions, has ever implemented a national carbon emissions trading market.

BEIJING, CHINA – MARCH 20: Chinese President Xi Jinping delivers a speech during the closing session of the National People’s Congress (NPC) at the Great Hall of the People on March 20, 2018 in Beijing, China. (Photo by Lintao Zhang/Getty Images)

China first started testing regional emissions trading systems back in 2011 in Shenzhen, Shanghai, Beijing, Guangdong, Tianjin, Hubei, Chongqing and Fujian. Using a system that instituted caps on emissions based on carbon intensity (emissions per unit of GDP) rather than an absolute emissions cap, the Chinese government began rolling out these pilots across its power sector and to other industries.

After a restructuring in 2018, the plan, which was initially drafted under the auspices of the National Development and Reform Commission was kicked down to the Ministry of Ecology and the Environment. The devolution of China’s cap and trade emissions program came as the United States was withdrawing from the Paris Agreement amid an abdication of climate regulation or initiatives under the Presidency of Donald Trump.

For now, the emissions trading system covers China’s power industry and roughly 2,000 energy generation facilities. That alone represents 30% of the nation’s total emissions and over time the trading system will encompass heavy industry like cement, steel, aluminum, chemicals and oil and gas, according to ChinaDialogue.

Initially, the government is allocating emissions allowances for free and will begin auctioning allowances “at the appropriate time according to the situation.”

That kind of language, and concerns raised by state-owned enterprises and financial services firms flagging the effect carbon pricing could have on profitability and lending risk shows that the government in Beijing is still putting more weight on the economic benefits rather than environmental costs of much of its industrial growth.

That said, a survey of market participants cited by ChinaDialogue indicated that prices are expected to start at 41 yuan (US$6.3) per ton of CO2 and rise to 66 yuan per ton in 2025. The price of carbon in China is expected to hit 77 yuan by 2030.

Meanwhile, a commission on carbon prices formed in 2017 and helmed by the economists Joseph Stiglitz and Nicholas Stern indicated that carbon needed to be priced at somewhere between $40 and $80 by 2020 and somewhere in the $50 to $100 range by 2030 if the markets and prices were to have any impact on behavior.

No nation has actually hit those price targets, although the European Union has come the closest — and seen the most reduction in greenhouse gas emissions as a result.

Still, the plan from the Chinese government does include public reporting requirements for verified company-level emissions. And the existence of a market, if the government decides to put real prices in place and consequences for flouting the system, could be a huge boon for the monitoring and management equipment startups that are developing tech to track emissions.

As the analysts at ChinaDialogue note:

“The hardest part of carbon pricing is often getting it started. The moment that the Chinese government decides to increase ambition with the national ETS, it can. The mechanism is now in place, and it can be ramped up if the momentum and political will provided by President Xi’s climate ambition continues. In the coming years, this could see an absolute and decreasing cap, more sectors covered, more transparent data provision and more effective cross-government coordination. This is especially so with energy and industrial regulators who will need to see the ETS not as a threat to their turf, but as a measure with significant co-benefits for their own policy objectives.”

Source: https://techcrunch.com/2021/02/02/china-launched-its-national-carbon-trading-market-yesterday/

The growth of remote working and managing workforces that are distributed well beyond the confines of a centralized physical office — or even a single country — have put a spotlight on the human resources technology that organizations use to help manage those people. Today, one of the HR startups that’s been seeing a surge of growth is announcing a round of funding to double down on its business.

Oyster, a startup and platform that helps companies through the process of hiring, onboarding and then providing contractors and full-time employees in the area of “knowledge work” with HR services like payroll, benefits and salary management, has closed a Series A round of $20 million.

The company is already working in 100 countries, and CEO and Tony Jamous (who co-founded the company with Jack Mardack) said in an interview that the plan is to expand that list of markets, and also bring in new services, particularly to address the opportunity in emerging markets to hire more people. In terms of services, currently Oyster does not cover candidate sourcing or any of the interviewing and evaluation process: those could be areas to build or partner to provide them as part of its one-stop shop.

“There 1.5 billion knowledge workers coming into the workforce in next 10 years, mostly from emerging economies, while in developed economies there are some 90 million jobs unfilled,” Jamous said. “There are super powers you can gain from being globally distributed, but it poses a major challenge around HR and payroll.”

Emergence Capital, the B2B VC that has backed the likes of Zoom, Salesforce, Bill.com and our former sister site Crunchbase, is leading the funding. The Slack Fund (Slack’s strategic investment vehicle), and London firm Connect Ventures (which has previously backed the company at seed stage) are also participating. The investment will accelerate Oyster’s rapid growth, and support its mission of enabling people to work from anywhere.

Oyster’s valuation is not being disclosed. The startup has raised about $24 million to date.

One of the great ironies of the global health pandemic is that while our worlds have become much smaller — travel and even local activities have been drastically curtailed and many of us spend day in, day out at home — the employment opportunity and scope of how organizations are expected to operate has become significantly bigger.

Public health-enforced remote working has led to companies de-coupling workers from offices, and that has opened the door to seeking out and working with the best talent, regardless of location.

This predicament may have become more acute in the last year, but it’s been one that has been gradually coming into focus for years, helped by trends in cloud computing and globalization. Jamous said that the idea for Oyster came to him was something that he’s been thinking about for years, but became more apparent when he was still at his previous startup, Nexmo — the cloud communications provider that was acquired by Vonage for $230 million in in 2016.

At Nexmo we wanted to be a great local employer, headquartered in two countries but wanted to have people everywhere,” he said. “We spent millions building employment infrastructure to do that, becoming knowledgable about local laws in France, Korea and more countries.” He realised quickly that this was a highly inefficient way to work. “We weren’t ready for the complexity and diversity of issues that would come up.”

After he moved on from Nexmo and did some angel investing (he backs other distributed work juggernauts like Hopin, among others), he decided that he would try to tackle the workforce challenge as the focus of his next venture. That was in mid-2019, pre-pandemic. It turned out that the timing was spot on, with every organization looking in the next year at ways to address their own distributed workforce challenges.

The emerging market focus, meanwhile, also has a direct link to Jamous himself: he left his home country of Lebanon to study in France when he was 17, and has essentially lived abroad since then. But as with many people who move into developed from emerging markets, he realised that the base of technical talent in his home country was something that was worth tapping, using tech to help.

Related to its wider social mission, Oyster has a pending application to become a B-Corporation.

Jamous is not the only one that founded an HR company based on his personal experience: Turing’s founders have cited their own experience growing up in India and working with people remotely from there, while Remote’s founder hails from Europe but built Gitlab (where he had been head of product) based on a similar premise of tapping into the talent he knew existed all around the world.

And indeed, Oyster is not alone in tackling this opportunity. The list of HR startups looking to be the ADP’s of the world of distributed work include Deel, Remote, Hibob, Papaya Global, Personio, Factorial, Lattice, Turing and Rippling. And these are just some of the HR startups that have raised money in the last year; there are many, many more.

The attraction of Oyster seems to come in the simplicity of how the services are provided — you have options for contractors, and full-timers, and full, larger staff deployments in other countries. You have options to add on benefits for employees if you choose. And you have some tools to work out how hires fit into your bigger budgets, and also to guide you on remuneration in each local market. Pricing starts at $29 per person, per month for contractors, to $399 for working with full employees, to other packages for larger deployments.

“It has a few well funded competitors, but that’s usually a good signal,” said Jason Green, the Emergence partner who led on its investment. “But you want to bet on the horse that will lead the race, and that comes down to execution. Here, we are betting on a team that’s done it before, an entrepreneur experienced in building a company and selling it. Tony’s made money and knows how to build a business. But more than that, he’s mission driven and that will matter in the space, and to employees.”

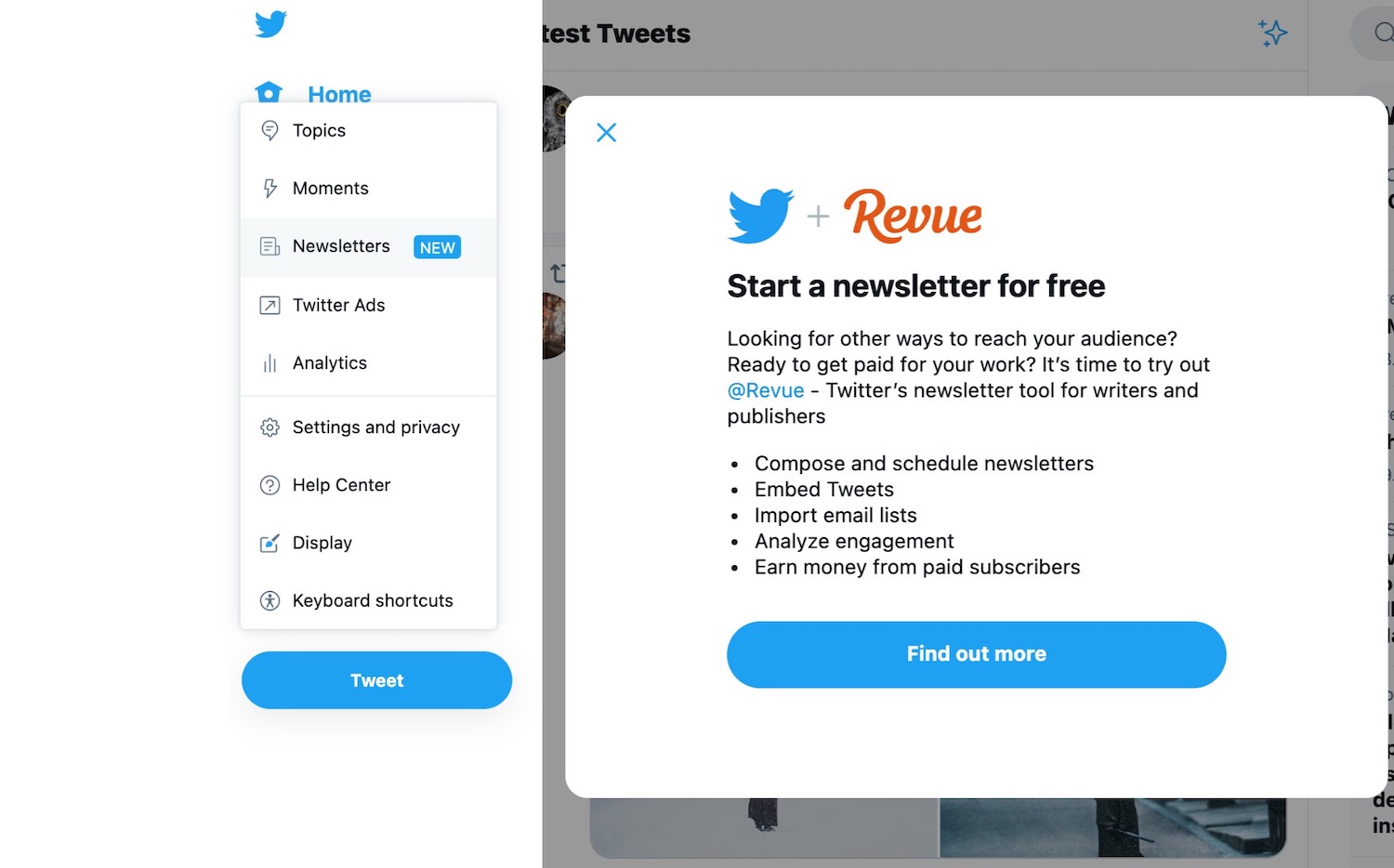

If you were itching to launch an email newsletter via Twitter, following its acquisition of the Dutch newsletter platform Revue last month, it appears you’ll have to wait a little bit longer for the official unveiling — although some Twitter users are reporting being able to sign up for the newsletter publishing tool right now.

The social media company confirmed to TechCrunch it’s reverted Revue’s Publisher offer back to private beta for the moment — saying this means it’s only accessible to existing customers at this time.

Nonetheless, it also appears to have quietly flipped the launch switch over the last 12 hours or so — at least for some users.

Earlier today, a number of TechCrunch staffers were able to go through the process of setting up a Twitter Revue newsletter — including our very own Editor-in-Chief, Matthew Panzarino.

setting up my twtrevue pic.twitter.com/VTAZPFSCTY

— Matthew Panzarino (@panzer) February 1, 2021

At the time of writing India-based reporter, Manish Singh, also has access to the interface — which prompts Twitter users to set up a free newsletter to reach their audience, flagging features such as the ability to embed tweets, import email lists, analyze engagement and earn money from subscribers.

So it looks as if Twitter has been testing a newsletter launch in a number of markets. It’s less clear whether/if it aborted a planned launch. We’ve asked the company for more details and will update this post with any response.

Unless you’ve been on a very long digital detox you’ll have noticed that newsletters have been having quite the moment of late. The rise of platforms that help writers monetize their content via an email-delivery format presents a clear risk/opportunity to Twitter, a company that relies on an army of users freely and publicly contributing short-form content.

But with Twitter launching its own in-house newsletter, tweets can potentially inflate in value — becoming the top of the funnel for Twitter users to build a community of followers who they made be able to convert to paying subscribers for longer form content, delivered in a newsletter format.

Twitter told us today that it has put new sign-ups to Revue on ice so it can focus on improving the offering in order to effectively meet the demand of new customers — and make Revue an even more powerful tool for publishers.

It added that it’s working quickly to roll out a new version that’s open to new customers, with a spokeswoman pointing to a mailing list for interested parties to sign up to get the latest updates here.

It’s not clear exactly why Twitter might have aborted a launch — or whether it was just quietly testing sign-ups in select markets, which at least three of our writers happened to be able to access. As we reported last month, it had already been working to integrate the newsletter into its platform and is clearly moving at a clip to get Revue plugged in so it can start to capitalize on the hype and momentum around paid newsletters.

Simultaneously, preventing users from finding a home for their longer form thoughts elsewhere is also likely front of mind for Twitter — as competition for attention in the social sphere heats up, such as from the likes of (rival) newsletter platform Substack (which has been building momentum since 2017); and buzzy live-voice chat app Clubhouse (which has recently captivated the clique-loving technorati).

But it seems Twitter feels its Revue newsletters aren’t quite ready for the prime time just yet.

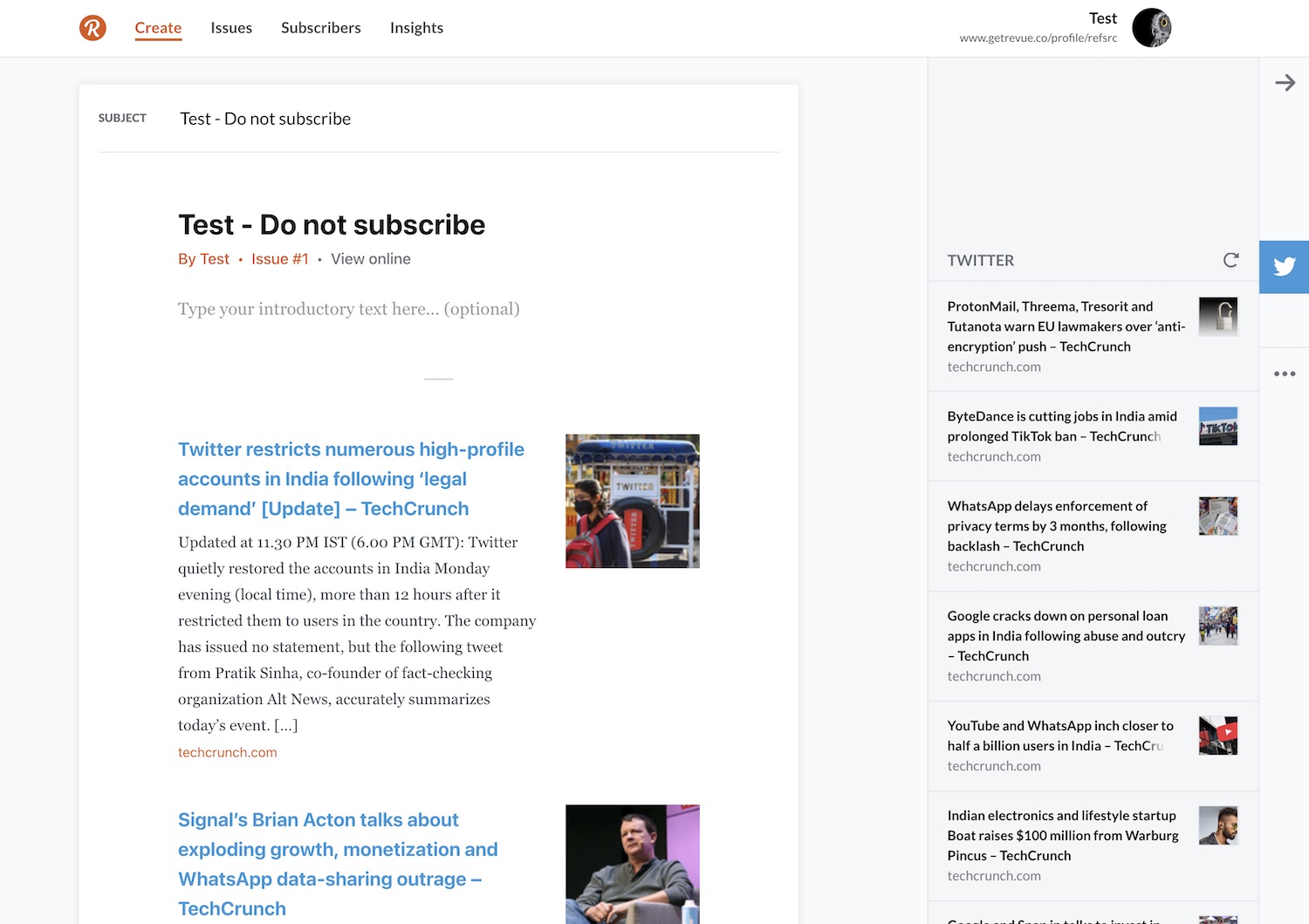

For those eager to know more about how ‘Twitter + Revue’ will work in practice, here’s the lowdown from our very own @refsrc — who does have early access.

The newsletter feature, available from the three-dot “More” menu option on Twitter’s web interface, enables a user to sign up for Revue with a few clicks using their social account. Once onboard, users can begin drafting their newsletter and drag their recent tweets to it — if they so choose.

Image credit: TechCrunch

The newsletter platform, which competes with among others Andreessen Horowitz-backed Substack, maintains integration support for a number of third-party services including Facebook, Instagram, Pocket, Product Hunt, Instapaper, and even RSS feeds. Once users have integrated these services, they can drag and drop stories from those feeds to the newsletter.

In the current avatar, users can manually add email addresses of subscribers, or import a list from Mailchimp or a CSV file. On the welcome screen, which noted reverse engineer Jane Manchun Wong first spotted last week, Twitter also advertises that its newsletter can help writers and publishers earn money from paid subscribers.

Like before, Revue lets users schedule their newsletters. All in all, there doesn’t appear to be any additional features in this entire workflow.

Image credit: TechCrunch

Source: https://techcrunch.com/2021/02/02/twitter-quietly-rolls-out-revue-newsletters-integration-on-web/

French startup Seyna is getting a new CEO. Stephen Leguillon is joining the company as chief executive while Philippe Mangematin is stepping back from day-to-day activities for personal reasons — he’ll become honorary chairman.

If you’re not familiar with the company, Seyna is an insurtech startup that has obtained an insurance license focused on property and casualty. This is a significant move as the French regulator (ACPR) hasn’t handed out a new license in this category since 1983.

The company’s go-to-market strategy is also interesting as it doesn’t sell insurance products to consumers directly. Instead, the company is building out insurance-as-a-service products. It partners with other companies that offer Seyna’s insurance products under their own brands.

Behind the scenes, Seyna offers an API to generate insurance contracts on demand — an API is a programming interface that lets two services interact with each other. You can also connect directly to Seyna’s interface to manage contracts.

Seyna has created its own core insurance system, which is an important differentiating factor compared to legacy players. The startup can generate many different variants that cover around 20 different insurance products — pet insurance, ticket cancelation, rent guarantee, etc. Clients include Garantme and Decathlon.

The company’s new CEO Stephen Leguillon previous co-founded La Belle Assiette, a company that lets you hire a chef for a dinner at home and that I covered on TechCrunch. He added a second product called GoCater, a corporate catering service — GoCater was letter spun out from La Belle Assiette and acquired by ezCater.

Seyna has raised a €14 million seed round ($17 million at today’s rate) from Global Founders Capital, Allianz France, Financière Saint James and several business angels. Insurance companies require a ton of capital to operate, that’s why the seed round seems quite big for the French market.

Prakhar Singh and ex-Paystack employee Abdul Hassan have known each other for seven years, building different tech products individually and collectively along the way.

Before joining Paystack in 2018, Hassan co-founded OyaPay, a payments startup the year before. After leaving the Stripe-owned company in 2019, he launched a data startup called Voyance where Singh, who had already exited one of his products — Transferpay.ng, an offline payments startup — was a software engineer.

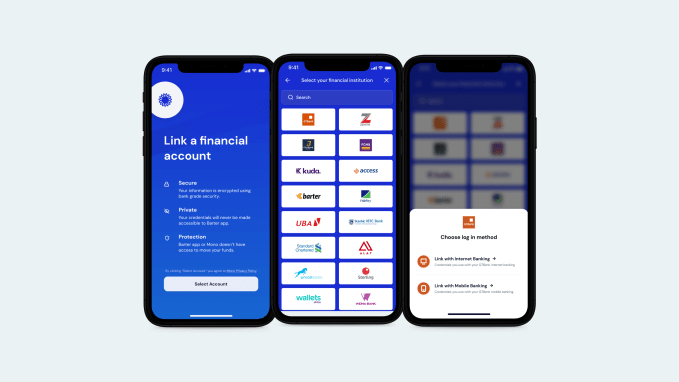

Last June, the duo started working on Mono, a project that would allow companies to access their customers’ financial accounts in Nigeria.

By streamlining various data in a single API, companies and third-party developers can retrieve vital information like account statements, real-time balance, historical transactions, income, expense and account owner identification. Of course, this isn’t without users’ consent as they are required to login with their internet or mobile login credentials before any transaction takes place.

Following a series of tests and iterations, Mono launched its beta version in August, with Hassan as CEO and Singh as CTO. A month later, the startup closed a $500,000 pre-seed investment from early-stage investors like Lateral Capital, Ventures Platform, Golden Palm Investments and Rally Cap. It was one of the notable pre-seed rounds on the continent because of the length of time it took from launch to funding, a trait other API fintech startups in the region share, albeit with significantly longer timelines.

In a region where more than half of the population is either unbanked or underbanked, these open finance players are trying to improve financial inclusion on the continent. Open finance thrives on the notion that with access to a financial ecosystem via open APIs and new routes to move money, access financial information and make borrowing decisions, the barriers and costs of entry for the unbanked and underbanked might come down.

However, for Hassan, Mono’s play overlaps open finance and open banking. Although the two terminologies portray what these African startups want to accomplish, the CEO believes that they are subject to regulation from the government and apex financial institutions. Mono is a data company playing in the fintech space, he says.

Prakhar Singh (CTO) and Abdul Hassan (CEO)

He likened Mono to how Google was in its early days when it started with a simple mission to organize the world’s information and make it accessible. Decades later, Google has metamorphosed into an internet giant playing in a plethora of sectors.

“If you ask me, I’ll say we don’t see ourselves entirely in open banking or finance,” he told TechCrunch. “Today, we’re concerned about how we can get data from different sources and aggregate into a database where businesses can get access to them with our users’ consent. Down the line, we can use this data for different use cases and solve various problems.”

Mono has already secured partnerships with more than 16 financial institutions in Nigeria and has a little over a hundred businesses like Carbon, Renmoney, Flutterwave and Indicina using its platform. They process about 5 million datasets per hour, the CEO claims.

These clients are mainly lending companies with a few others in proptech and health tech, which allow users to pay for their services in installments. But there are plans to diversify this clientele. One such way will be to improve onboarding processes on applications through its one-click signup feature.

From a user’s perspective, here’s how it works when considering two savings applications: Users submit their KYC to the first savings app. But for one reason or the other, maybe due to a better interest rate, some users switch to a second savings app.

However, there’s a little hassle in that a second KYC is needed for this process. What Mono has done with the one-click signup feature is to let users transfer their data from the first app to the second without repeating the process. And to that end, Mono has partnered with two of Nigeria’s leading savings and investment platforms to roll out the service.

“First, we’ve enabled companies with a new infrastructure that allows them to get access to customers’ financial accounts and understand their history before giving them loans or any financial service. Now, we think with the new generation of companies coming up in Africa, Mono will be the one to power their onboarding processes,” Hassan remarks on the platform’s offerings.

Image Credits: Mono

For any investor, Mono’s sticky features, coupled with explosive growth, looks too good of an opportunity to pass on. Today, the six-month-old startup announced that it has been accepted into Y Combinator’s Winter 2021 batch. It will receive $125,000 in seed funding with an opportunity to receive follow-up investment after graduating in March. The startup also joins 39 other African startups per YC data which have passed through the accelerator since 2009.

Getting into the accelerator helps Mono with one of its biggest challenges. According to Hassan, Mono has come across users who are still skeptical to input their internet banking details on the platform due to personal experiences with online fraud in the country.

“To date, we’ve been focusing on building, and I think we’ve gotten to a stage where we’re seeing some people not wanting to use their internet banking on Mono.” But with YC’s backing and a conscious offline marketing plan afterwards, the founder thinks Mono’s credibility can get a lift.

At Paystack, where Hassan was a product manager, he was privileged to experience firsthand the company’s innovation and growth before it was acquired by Stripe last year. He says he learned the ropes of product development and management, and hiring — lessons that have stuck with him to Mono, a company now with 13 staff across Nigeria and India.

The plan for Mono is to be a global company and getting into YC provides the perfect opportunity to do so. The company is also planning an imminent pan-African expansion to Ghana and Kenya, and from all indication, Mono might execute one if not the two before the end of Q1. Setting the company up for expansion and the hiring spree that comes with it will require capital, so a seed round is in the works to facilitate the whole process.