& meet dozens of singles today!

User blogs

Tickr, an app that allows UK consumers to make financial investments based on their impact on society and the environment, has secured £2.5m ($3.4m) in funding lead by Ada Ventures, a VC which focuses on ‘impact’ startups. The cash will be used for product development, expanding the user base, and eventually taking Tickr into other European countries from its current UK base.

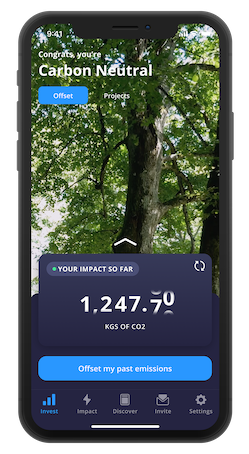

As well as investing, the platform allows customers to spend their cash via partnerships with impact-oriented compares, and offset their carbon footprint through a subscription. The core business model is £1 p/m per customer, plus 0.30% on assets above £3,000. Additional products, like carbon offsets, for example, are charged as a separate additional subscription depending on the tier selected.

The startup says it is approaching 100,000 users in the UK and is reaching a millennial audience 90% of which have ‘never invested before’ (they say) and these users are investing £250 per month on average.

Tickr App

The app is not billed as a trading app, with quick ‘in and outs’ but about building wealth whilst investing in a diversified portfolio of high impact companies. Its competitors include MoneyBox, but Tickr says it is “100% pure impact focus” by contrast. The vast majority of Europeans don’t invest in markets so this could be a good opportunity for the product.

Founders Tom McGillycuddy and Matt Latham spent 8 years working in investment management but say they became disillusioned by the jargon, high fees and indifference to causes such as the environment.

Over text interview, McGillycuddy told me: “We also realized there was zero consideration for the underlying impact of the investments people were making; it was purely about the return. Coming from Wigan and Liverpool, we were the first people in our families to be exposed to this world, and it didn’t seem right.” The pair moved into impact investing and subsequently went on to launch Tickr in 2018.

India is restoring 4G internet services in Jammu and Kashmir, a senior government official said Friday evening, 18 months after cutting internet access in the Muslim-majority state in an attempt to curb the spread of potential backlash over its decision to strip the region of its special status in August of 2019.

Rohit Kansal, principal secretary of the Jammu and Kashmir government, said 4G internet services were being restored in the entire region. India lifted ban on internet and some social media services in two districts (of 20) of the state last year but maintained speed restrictions and time limits, after Supreme Court ruled last year that an indefinite shutdown of the internet in the state was unwarranted and demonstrated “abuse of power” by the Prime Minister Narendra Modi-led government.

The internet ban in Jammu and Kashmir was by far the longest by any democracy.

In August, New Delhi told Supreme Court that it will start offering high-speed internet in one district of Jammu and one of Kashmir valley on a “trial basis.” Critics have said that ban on internet has cost citizens of Jammu and Kashmir hundreds of thousands of jobs and millions of dollars.

Raman Jit Singh Chima, a senior international counsel and Asia Pacific Policy director at Access Now, a nonprofit internet advocacy organization, said today’s move was welcoming, but “let’s be clear — the previous shutdown was excessive, mindless repeated. Glad that all Jammu and Kashmir residents will soon have internet restored, denied to them in violation of their rights under the Indian Constitution.

Omar Abdullah, former chief minister of Jammu and Kashmir, celebrated the news, adding “For the first time since Aug 2019 all of J&K will have 4G mobile data. Better late than never.”

This is a developing story. More to follow…

Dublin-based Frontline Ventures has released details of its new €70 million ($83.8M) Frontline Seed fund III which will be aimed at European B2B startups. The new fund will bring Frontline’s total funds under management to €250 million, deployed out of its offices in London, Dublin and San Francisco. Backers of the fund include the European Investment Fund (EIF), Ireland Strategic Investment Fund (ISIF) and Irish banking giant AIB, along with 10 tech angels, largely post-exit entrepreneurs, from Europe and the US.

The new fund has already begun to invest in early-stage companies, and is aiming at investing in up to 45 companies over the next four years. Investments will range from €250,000 to €2.5 million. It follows Frontline’s recent new $70m US-based growth-stage fund, Frontline X, which is geared to US startups wanting to expand to Europe and the EU region, given that Ireland is an EU member, and well placed to benefit from the ramifications of Brexit.

William McQuillan, Partner, said the fund would invest about 50 percent of the fund into new early-stage companies. The remaining funds will be delayed for later investments in existing portfolio companies.

It’s McQuillan’s view that, with Europe having 26 percent of all the global B2B software market and the US at 50 to 55 percent, Europe has plenty of growth opportunities.

The new seed fund launches at a time when US VC firms are putting down roots in Europe, such as Sequoia which opened an office in London last year, and more recently General Catalyst. In May of 2020, Frontline invested in Irish HQ’d company Evervault alongside Kleiner Perkins, Index and Sequoia.

Seventy percent of Frontline’s seed portfolio companies have raised capital from US VCs since 2012, and Frontline partners have experience with companies such as Google, Twitter, SurveyMonkey, Airtable, and Yammer.

In a statement, McQuillan said, “When we looked at the data back in 2012 – at the very start of Frontline – it was painfully clear that European entrepreneurs lacked the infrastructure and support to build a global business out of Europe. Today, Europe rightfully finds itself on top-tier US investors’ target list, but global expansion remains an important challenge to solve. As a team, we’ve pooled all of our experience and resources into helping our founders cross the Atlantic. Seed Fund III will be an extension of our work – to help founders get off the ground – and go global.”

Frontline’s more notable investments include Linked Finance, Clearbanc, and Currencyfair. The Frontline X growth fund has invested in the Series B of TripActions; People.ai’s $100 million Series C; and Clearbanc’s $50 million Series B.

Notable exits include Logentries, which was acquired by Rapid7; Orchestrate, acquired by CenturyLink; and Pointy acquired by Google in 2020.

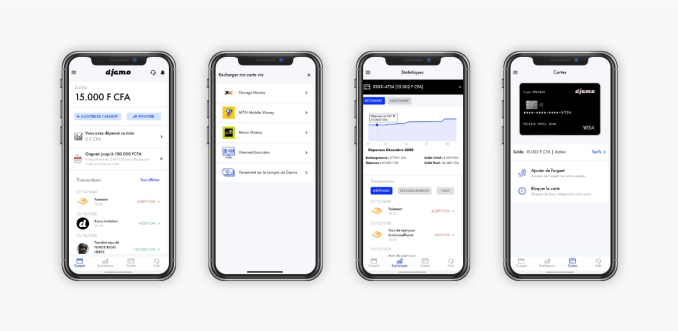

Djamo, a financial super app for consumers in Francophone Africa, is the first startup from Ivory Coast to get backing from Y Combinator.

While there has been a huge profusion of financial services that have emerged in recent years in Africa, Djamo’s mission is to try to plug one specific and a very underserved gap in Francophone Africa.

In the region, less than 25% of adults have bank accounts as the focus for banks remains the top 10-20% wealthiest customers. The rest, which is a huge segment of the market of about 120 million people, is not perceived as profitable. But as banks slacked, mobile money from the region’s telcos filled in the gap. In the last 10 years, their wallets have reached more than 60% of the population — proof of how many millions of French-speaking natives were hungry for financial services. Today, this mobile money infrastructure and reach allows startups to build upon their existing payment infrastructure to democratize access through different applications.

Djamo is one of such companies taking advantage of this opportunity to bring affordable and seamless banking to the region.

In 2019, Hassan Bourgi, a second-time founder, returned to Ivory Coast after exiting his Latin American-based startup, Busportal, to Naspers-company redBus. There he met Régis Bamba who was still working at MTN, one of Africa’s largest telcos, leading several mobile money projects.

Frustrated by the unpleasant banking experiences they and many millennials faced in the country, Bourgi and Bamba launched Djamo last year to challenge the banking industry status quo.

“Banking services are really difficult to access here, and we saw that as a huge opportunity,” Djamo CEO Bourgi said to TechCrunch. “Since day one, we wanted to design a mobile-first platform that could break into the masses and our combined experience building mass-market consumer products was very critical to launching Djamo.”

According to Bourgi, the country’s millennials are trying to create relations with technology companies and be served differently from the norm. So, Djamo is providing this audience with a better front end experience and faster customer service.

Image Credits: Djamo

Rather than offering a one-size-fits-all approach, they focused on accommodating multiple layers tailored to different user needs. Whether it’s affording Ivorians the luxury to pay for online services like Amazon, Alibaba, or Netflix, or providing VISA debit cards in a timely fashion, these tailored approaches have made Djamo grow organically via word of mouth.

And why not? Before Djamo came along, the CEO says people would need to go to their bank branches and stay in long queues to get their cards or even load them with credit. Djamo relieves that stress and even allows customers to use their cards with zero fees in a wide range of services.

“For us, it was important to offer a zero-fee card with no recurring fee to a certain limit. After that, you pay as you go in transaction fees. There is a premium plan around $4 a month where users can transact to higher limits,” said Bourgi.

Today, Djamo claims to have around 90,000 registered users and processes over 50,000 transactions monthly. However, to get to this point, the company has ridden on sheer resourcefulness around its operations.

Unlike Nigeria, where there are established payment infrastructure players like Flutterwave and Paystack, Ivory Coast doesn’t have such household names.

“We have a couple of providers, but most are unreliable. But this doesn’t matter to the end-user, you have to make it work somehow,” said Bambi, the company’s CPO and CTO.

Lacking better options, Djamo switches from one provider to another to keep operations running. The year-old startup has also faced scepticism issues, common with most African fintech startups when they first launch. In Djamo’s case though, the founders had to go at lengths to prove to banks and customers that the platform was safe to use for onboarding, KYC and transactions.

Hassan Bourgi (CEO) and Régis Bamba (CTO & CPO)

Onboarding customers also came with its own set of problems: the delivery of Djamo VISA cards. Bourgi says unlike more developed countries on the continent, it is a Herculean task to access efficient delivery and logistics services in Ivory Coast. So, the startup built a delivery app with in-house delivery agents for this particular purpose. “The objective for our customers is that after registering with us, they get their cards the next day in a timely fashion,” Bourgi added.

But even before pushing out its MVP, Djamo had already received monetary validation for its product. In June 2019, it raised a pre-seed investment of $350,000 from private investors — arguably the largest round at this stage in the Francophone region. The ingenuity of the solution, at least to French-speaking Africa, and the founders’ track record was crucial to Djamo closing the round, Hassan explained.

For a long time, Francophone Africa has been underrated by international investors despite signs pointing to the emergence of a budding startup scene. Part of this has to do with language barriers and the region’s GDP and income per capita where English-speaking countries, excluding South Africa, contribute to 47% of sub-Saharan Africa’s average GDP, while French-speaking countries boast of only 19%.

However, with the World Bank stating that the region will have 62.5% of Africa’s fastest-growing economies by 2021, there’s bullishness around its growth in the coming years.

With so many untapped opportunities, underrepresented regions like Francophone Africa are ripe for disruption. Investors know this and though their checks are still skewed towards Anglophone Africa, million-dollar raises from Senegalese energy startup, Oolu and Cameroonian healthtech startup, Healthlane in 2020 show their keenness on the market.

Like Djamo, both startups are YC-backed and are the other Francophone startups to have made it into the accelerator. But with this Winter 2021 batch, Djamo becomes the first fintech startup from the region. Following Healthlane’s acceptance in 2020, it is also the first time French-speaking Africa has had representatives for consecutive years.

To the founders, YC’s backing validates Djamo’s premise that financial service distribution across the Francophone Africa region is fundamentally changing towards applications.

“In Ivory Coast, people always say that the banking industry is too complex and we can’t do anything about it. But we saw it as a huge opportunity and a great industry to take on. Everywhere you see frustration, customers in pain, there is an opportunity for a business to come and do it better,” said Régis.

After participating in the three-month-long program which culminates in a Demo Day on March 23rd, Djamo will also take part in Visa’s Fintech Fast Track Program, an avenue for the company to leverage the fintech giant’s network to introduce new payment experiences.

Twinco Capital, a Madrid and Amsterdam-based startup making it easier to access supply chain finance, has raised €3 million in funding.

Leading the round is Spanish VC fund Mundi Ventures, with participation from previous backer Finch Capital and several unnamed angels. Twinco Capital also has a debt facility with the Spanish investment bank EBN Banco de Negocios, which is common for any type of lending company.

Founded in 2016 by Sandra Nolasco and Carmen Marin Romano, Twinco Capital offers a supply chain finance solution that includes purchase order funding. To do this, it integrates with large corporates on the purchase side and then funds suppliers by paying up to 60% of the purchase order value upfront and the remainder immediately upon delivery.

The entire process is digital, promising a quick decision and fast deployment of funds, and is powered by Twinco’s supply chain analytics and the data it is able to access by partnering with both sides of the supply chain.

“The financing of global supply chains is expensive and inefficient, the burden of the cost is mostly borne by the suppliers and in particular by those that are SMEs in emerging markets,” explains Twinco Capital co-founder and CEO Sandra Nolasco.

“Take any global supply chain, such as apparel, automotive, electronics etc. Exporters in countries like Bangladesh, China or Vietnam that have been supplying European companies for years, with stable commercial relationships. However, their creditworthiness is still measured only on the basis of annual financials, making access to competitive liquidity a major obstacle for growth”.

By having visibility on both sides, including upcoming orders, Twinco provides liquidity to the suppliers “from purchase order to final invoice payment”.

“We do that by analyzing supply chain data – the performance of the suppliers, the network effects between common suppliers and buyers (and many more data points I am not allowed to mention!),” says the Twinco CEO. “In short, using advanced data analytics we can better assess, price and significantly mitigate risk. The good news is that the more transactions we fund, the more suppliers and buyers we add, the more robust is our risk assessment. We believe there is a strong network effect”.

To that end, Twinco makes money by charging a “discount fee” for each purchase order it funds. “Since default rates are a fraction of that fee, we can unlock significant value,” says Nolasco.

Meanwhile, the fintech is also unlocking an asset class for investors and competes with local banks that are much more manual and don’t benefit from increased visibility via network effects. Nolasco says that to ensure interests are aligned, the company uses a portion of equity to also invest in the purchase orders it funds.