& meet dozens of singles today!

User blogs

Myanmar’s new military government has ordered local telecom operators, internet gateways, and other internet service providers to block Twitter and Instagram in the South Asian country days after imposing a similar blackout on Facebook service to ensure “stability” in the Southeast Asian nation.

Several users from Myanmar confirmed that they were unable to access Twitter. NetBlocks, which tracks global internet usage, further reported that multiple networks in the country had started to block the American social network.

The nation’s Transport and Communications alleged in its order, dated February 5, that Twitter and Facebook-owned Instagram were being abused to spread propaganda and misinformation to the public and this posed threat to stability of the nation. The ministry offered the same explanation when it ordered to temporarily block Facebook until February 7th midnight earlier this week.

Friday’s order comes as thousands of Myanmar citizens joined Twitter this week to protest the new military government that seized power by detaining civilian leader Aung San Suu Kyi and other democratically elected leaders of her National League for Democracy, which won by landslide last year.

Twitter did not immediately respond to a request for comment.

Confirmed: Twitter is now being restricted in #Myanmar on multiple network providers; real-time network data show loss of service from ~10:00 p.m. local time with operators MPT, Mytel, Welink, 5BB and Frontiir

https://t.co/Jgc20OBk27 pic.twitter.com/jXUj6ONhmH

— NetBlocks (@netblocks) February 5, 2021

This is a developing story. More to follow…

Source: https://techcrunch.com/2021/02/05/myanmar-military-government-is-now-blocking-twitter/

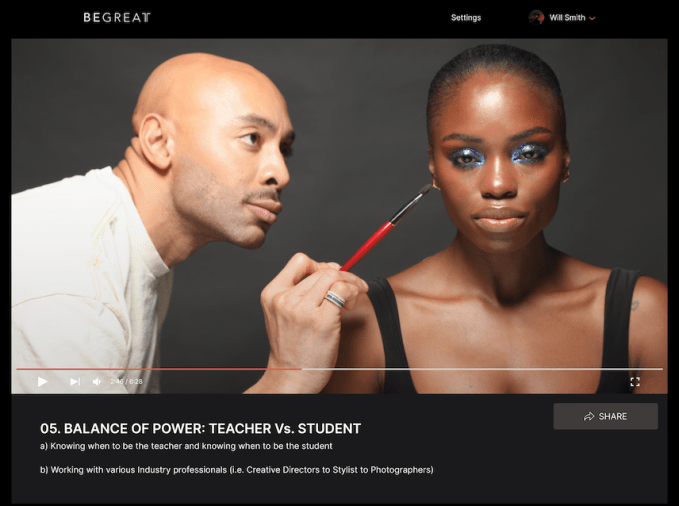

BeGreatTV, an online education platform featuring Black and brown instructors, recently closed a $450K pre-seed round from Stand Together Ventures Lab, Arlan Hamilton, Tiffany Haddish and others.

The goal with BeGreatTV is to enable anyone to learn from talented Black and brown innovators and leaders, founder and CEO Cortney Woodruff told TechCrunch.

“When you think of being a Black or brown person or individual who wants to learn from a Black or brown person, there’s nothing that really exists that gives you a glossary of every business vertical and where you see representation at every level in a well put together way,” Woodruff said. “That alone makes our market a lot larger because there are just so many verticals where no one has really invested in or shown before.”

The courses are designed to teach folks how to execute and succeed in a particular industry, enable people to better understand the business aspect of industries while also teaching “you how to deal with the socioeconomic and racial injustices that come with being the only one in the room. Whether you are a Black man or woman who wants to get into the makeup industry, there will always be a lot of biases in the world.”

When BeGreatTV launches in a couple of months (the plan is to launch in April), the platform will feature at least 10 courses — each with around 15 episodes — focused on arts, entertainment, beauty and more. At launch, courses will be available from Sir John, a celebrity makeup artist for L’Oreal and Beyoncé’s personal makeup artist, BeGreatTV co-founder Cortez Bryant, who was also Lil Wayne and Drake’s manager, as well as Law Roach, Zendaya’s stylist.

Hamilton and Haddish will also teach their own respective courses on business and entertainment, Woodruff said. So far, BeGreatTV has produced more than 40 episodes that range anywhere from three to 15 minutes each.

Image Credits: BeGreatTV

Each course will cost $64.99, and the plan is to eventually offer an all-access subscription model once BeGreatTV beefs up its offerings a bit more. For instructors, BeGreatTV shares royalties with them.

“Ultimately, the platform can include a more diverse casting of instructors that aren’t just Black and brown,” Woodruff said. But for now, he said, the idea is to “reverse the course of ‘Now this is our first Black instructor’ but ‘now this is the first white instructor'” on the platform.

BeGreatTV’s team consists of just 15 people, but includes heavy hitters like Cortez and actor Jesse Williams. Currently, BeGreatTV is working on closing its seed round and anticipates a six-figure user base by the end the year.

MasterClass is perhaps BeGreatTV’s biggest competitor. With classes taught by the likes of Gordon Ramsay, Shonda Rhimes and David Sedaris, it’s no wonder why MasterClass has become worth more than $800 million. The company’s $180 annual subscription fee accounts for all of its revenue.

“If you benchmark [BeGreatTV] to MasterClass, we are finding individuals that are not only the best at what they do in the world, but often times these individuals have broken barriers because often times they were the first to do it,” Woodruff said. “And do it without having people who look like them.”

Before he was a partner at Lightspeed Venture Partners, Gaurav Gupta had his eye on Grafana Labs, the company that supports open-source analytics platform Grafana. But Raj Dutt, Grafana’s co-founder and CEO, played hard to get.

This week on Extra Crunch Live, the duo explained how they came together for Grafana’s Series A — and eventually, its Series B. They also walked us through Grafana’s original Series A pitch deck before Gupta shared the aspects that stood out to him and how he communicated those points to the broader partnership at Lightspeed.

Gupta and Dutt also offered feedback on pitch decks submitted by audience members and shared their thoughts about what makes a great founder presentation, pulling back the curtain on how VCs actually consume pitch decks.

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

Episode breakdown:

- How they met — 2:00

- Grafana’s early pitch deck — 12:00

- The enterprise ecosystem — 25:00

- The pitch deck teardown — 32:00

How they met

As soon as Gupta joined Lightspeed in June 2019, he began pursuing Dutt and Grafana Labs. He texted, called and emailed, but he got little to no response. Eventually, he made plans to go meet the team in Stockholm but, even then, Dutt wasn’t super responsive.

The pair told the story with smiles on their faces. Dutt said that not only was he disorganized and not entirely sure of his own travel plans to see his co-founder in Stockholm, Grafana wasn’t even raising. Still, Gupta persisted and eventually sent a stern email.

“At one point, I was like ‘Raj, forget it. This isn’t working’,” recalled Gupta. “And suddenly he woke up.” Gupta added that he got mad, which “usually does not work for VCs, by the way, but in this case, it kind of worked.”

When they finally met, they got along. Dutt said they were able to talk shop due to Gupta’s experience inside organizations like Splunk and Elastic. Gupta described the trip as a whirlwind, where time just flew by.

“One of the reasons that I liked Gaurav is that he was a new VC,” explained Dutt. “So to me, he seemed like one of the most non-VC VCs I’d ever met. And that was actually quite attractive.”

To this day, Gupta and Dutt don’t have weekly standing meetings. Instead, they speak several times a week, conversing organically about industry news, Grafana’s products and the company’s overall trajectory.

Grafana’s early pitch deck

Dutt shared Grafana’s pre-Series A pitch deck — which he actually sent to Gupta and Lightspeed before they met — with the Extra Crunch Live audience. But as we know now, it was the conversations that Dutt and Gupta had (eventually) that provided the spark for that deal.

When you are able to navigate a world that is designed for you, it’s easy to avoid thinking about how the world is designed for you. But it can be different if you are disabled.

At TechCrunch Sessions: Justice on March 3, we will examine the importance of ensuring accessible product design from the beginning. We’ll ask how the social and medical models of disability influence technological evolution. Integrating the expertise of disabled technologists, makers, investors, scientists, software engineers into the DNA of your company from the very beginning is vital to the pursuit of a functioning and equitable society. And could mean you don’t leave money on the table.

Join us at TechCrunch Sessions: Justice for a wide-ranging discussion as we attempt to answer these questions and further explore inclusive design with Cynthia Bennett, Mara Mills and Srin Madipalli.

Cynthia Bennett is a post-doc at Carengie Mellon University’s Human-Computer Interaction Institute, as well as a researcher at Apple. Her research focuses on human-computer interaction, accessibility and Disability Studies, and, she says on her website, spans “the critique and development of HCI theory and methods to designing emergent accessible interactions with technology.” Her research includes Biographical Prototypes: Reimagining Recognition and Disability in Design and The Promise of Empathy: Design, Disability, and Knowing the “Other.”

Mara Mills is the Associate Professor of Media, Culture, and Communication at New York University and a co-founder and co-director of the NYU Center for Disability Studies. Mills research focuses on sound studies, disability studies and history. (You can hear her discuss the intersection of artificial intelligence and disability with Meredith Whittaker, co-founder of the AI Now Institute and Minderoo Research Professor at NYU, and Sara Hendren, professor at Olin College of Engineering and author of the recently published What Can a Body Do: How We Meet the Built World, on the TechCrunch Mixtape podcast here.)

Srin Madipalli is an investor and co-founder of Accomable, an online platform that helped users find accessible vacation properties, which he sold to Airbnb. His advocacy work focuses on disability inclusion iBe sure to snag your tickets here for just $5 here.n the workplace, as well as advising tech companies on accessibility.

Make sure you can join us for this conversation and more at TC Sessions: Justice on March 3. Secure your seat now!

Robinhood has shown an impressive ability to raise enormous amounts of capital in the past few weeks to ensure it has the funds needed to allow users to trade and, presumably, provide it with enough cash until it goes public. Raising $3.4 billion so quickly is an extraordinary feat.

But how the company managed to get investors to wire money with such alacrity has been a curiosity; what about Robinhood was so compelling that giving it a multi-billion dollar injection was such an obvious decision?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We got a whiff of it when we parsed Robinhood’s Q4 2020 payment for order flow (PFOF) data, which showed the discount trading service growing nicely from its Q3 results. Robinhood’s PFOF revenue growth had slowed in sequential terms in the third quarter of 2020, but the final quarter iced near-term concerns that the unicorn’s growth days were behind it.

But then the company gave us a little more, a few charts that I think better explain why Robinhood was able to raise so much money so quickly.

But then the company gave us a little more, a few charts that I think better explain why Robinhood was able to raise so much money so quickly.

Equities and options volumes go up

The reason why Robinhood was able to raise lots more cash very quickly was because the company’s PFOF revenue driver likely went into overdrive during the mess that was the GameStop period, This is somewhat obvious, as many people were trading.

But thanks to a new chart from the company posted on its own blog, we now know that Robinhood’s PFOF incomes were likely spiking to all-time highs.

Here’s the chart the company published, which I have loosely marked with quarterly intervals. Per Robinhood, the green line is “Robinhood equities and options trading volumes over a longer time horizon, through last week:”

Source: https://techcrunch.com/2021/02/05/how-the-gamestop-stonkathon-helped-robinhood-raise-3-4b-last-week/