& meet dozens of singles today!

User blogs

The SPAC mania continues unabated, with new SPACs being filed with the SEC on an almost hourly basis at times.

SoftBank, the Japanese telecom conglomerate which has also been running the gigantic Vision Fund and its successor, doesn’t want to be left out. Yesterday, it filed back-to-back SPAC registration statements for two new blank-check companies.

SVF Investment Corp 2 is $200 million and SVF Investment Corp 3 is a $350 million vehicle. Both SPACs have a standard roughly 15% over-allotment option, which means that their final sizes will likely end up at $230 million and $400 million respectively assuming that the underwriters take their option (number three has a slightly smaller over-allotment if you’re checking my math).

One interesting component of both SPACs is that they have what is known as a forward purchasing agreement connected to SoftBank’s Vision Fund 2. That agreement allows the second Vision Fund to purchase shares into these SPACs when they begin their business combinations with their target startups, essentially giving it the right to buy into the mergers. The Vision Fund has a $100 million agreement with SVF 2, and a $150 million agreement with SVF 3.

As with all SPACs, a registration statement is merely a filing of an intention to raise money, although these days, the vast majority of filings are later consummated.

As the numbering indicates, SoftBank had an earlier SPAC that it filed in December and officially closed on January 7 of this year. That vehicle targeted a total fundraise of $604 million including the underwriters’ over-allotment option. It also included a $250 million forward purchase agreement with the second Vision Fund similar to these latest two vehicles.

What are these SPACs looking for? Well, according to the filings, “We intend to identify, acquire and manage a business in a technology-enabled sector where our management team have differentiated experience and insights. Relevant sectors may include, but are not limited to, mobile communications technology, artificial intelligence, robotics, cloud technologies, software broadly, computational biology and other data-driven business models, semiconductors and other hardware, transportation technologies, consumer internet and financial technology.”

That seems to cover a lot, but just in case, the filings note that “However, we may consummate a transaction with a business in a different or related industry.” So basically anything.

There is no timeline yet for when the SPACs could potentially close, but typical timing is 4-8 weeks given market averages.

Source: https://techcrunch.com/2021/02/06/softbank-files-for-a-double-scoop-of-spac/

Police in Minneapolis obtained a search warrant ordering Google to turn over sets of account data on vandals accused of sparking violence in the wake of the police killing of George Floyd last year, TechCrunch has learned.

The death of Floyd, a Black man killed by a white police officer in May 2020, prompted thousands to peacefully protest across the city. But violence soon erupted, which police say began with a masked man seen in a viral video using an umbrella to smash windows of an auto-parts store in south Minneapolis. The AutoZone store was the first among dozens of buildings across the city set on fire in the days following.

The search warrant compelled Google to provide police with the account data on anyone who was “within the geographical region” of the AutoZone store when the violence began on May 27, two days after Floyd’s death.

These so-called geofence warrants — or reverse-location warrants — are frequently directed at Google in large part because the search and advertising giant collects and stores vast databases of geolocation data on billions of account holders who have “location history” turned on. Geofence warrants allow police to cast a digital dragnet over a crime scene and ask tech companies for records on anyone who entered a geographic area at a particular time. But critics say these warrants are unconstitutional as they also gather the account information on innocent passers-by.

TechCrunch learned of the search warrant from Minneapolis resident Said Abdullahi, who received an email from Google stating that his account information was subject to the warrant, and would be given to the police.

But Abdullahi said he had no part in the violence and was only in the area to video the protests when the violence began at the AutoZone store.

The warrant said police sought “anonymized” account data from Google on any phone or device that was close to the AutoZone store and the parking lot between 5:20pm and 5:40pm (CST) on May 27, where dozens of the people in the area had gathered.

When reached, Minneapolis police spokesperson John Elder, citing an ongoing investigation, would not answer specific questions about the warrant, including for what reason the warrant was issued.

According to a police affidavit, police said the protests had been relatively peaceful until the afternoon of May 27, when a masked umbrella-wielding man began smashing the windows of the AutoZone store, located across the street from a Minneapolis police precinct where hundreds of protesters had gathered. Several videos show protesters confronting the masked man.

Police said they spent significant resources on trying to identify the so-called “Umbrella Man,” who they say was the catalyst for widespread violence across the city.

“This was the first fire that set off a string of fires and looting throughout the precinct and the rest of the city,” the affidavit read. At least two people were killed in the unrest. (Erika Christensen, a Minneapolis police investigator who filed the affidavit, was not made available for an interview.)

Police accuse the Umbrella Man of creating an “atmosphere of hostility and tension” whose sole aim was to “incite violence.” (TechCrunch is not linking to the affidavit as the police would not say if the suspect had been charged with a crime.) The affidavit also links the suspect to a white supremacist group called the Aryan Cowboys, and to an incident weeks later where a Muslim woman was harassed.

Multiple videos of the protests around the time listed on the warrant appear to line up with the window-smashing incident. Other videos of the scene at the time of the warrant show hundreds of other people in the vicinity. Police were positioned on rooftops and used tear gas and rubber bullets to control the crowds.

Law enforcement across the U.S. are increasingly relying on geofence warrants to solve crimes where a suspect is not known. Police have defended the use of these warrants because they can help identify potential suspects who entered a certain geographic region where a crime was committed. The warrants typically ask for “anonymized information,” but allow police to go back and narrow their requests on potential suspects of interest.

When allowed by law, Google notifies account holders of when law enforcement demands access to the user’s data. According to a court filing in 2019, Google said the number of geofence warrants it received went up by 1,500% between 2017 and 2018, and more than 500% between 2018 and 2019, but has yet to provide a specific number of warrants

Google reportedly received over 180 geofence warrants in a single week in 2019. When asked about more recent figures, a Google spokesperson declined to comment on the record.

Read more on TechCrunch

Civil liberties groups have criticized the use of dragnet search warrants. The American Civil Liberties Union said that geofence warrants “circumvent constitutional checks on police surveillance.” One district court in Virginia said geofence warrants violated the constitution because the majority of individuals whose data is collected will have “nothing whatsoever” to do with the crimes under investigation.

Reports in the past year have implicated people whose only connection to a crime is simply being nearby.

NBC News reported the case of one Gainesville, Fla. resident, who was told by Google that his account information would be given to police investigating a burglary. But the resident was able to prove that he had no connection to the burglary, thanks to an app on his phone that tracked his activity.

In 2019, Google gave federal agents investigating several arson attacks in Milwaukee, Wis. close to 1,500 user records in response to geofence warrant, thought to be one of the largest grabs of account data to date.

But lawmakers are beginning to push back. New York state lawmakers introduced a bill last year that would, if passed, ban geofence warrants across the state, citing the risk of police targeting protesters. Rep. Kelly Armstrong (R-ND) grilled Google chief executive Sundar Pichai at a House Judiciary subcommittee hearing last year. “People would be terrified to know that law enforcement could grab general warrants and get everyone’s information everywhere,” said Armstrong.

Abdullahi told TechCrunch that he had several videos documenting the protests on the day and that he has retained a lawyer to try to prevent Google from giving his account information to Minneapolis police.

“Police assumed everybody in that area that day is guilty,” he said. “If one person did something criminal, [the police] should not go after the whole block of people,” he said.

Send tips securely over Signal and WhatsApp to +1 646-755-8849. You can also send files or documents with SecureDrop.

Source: https://techcrunch.com/2021/02/06/minneapolis-protests-geofence-warrant/

On Friday just past midnight, I stumbled across a Clubhouse room hosted by a well-known figure in the Chinese startup community, Feng Dahui. At half-past midnight, the room still had nearly 500 listeners, many of whom were engineers, product managers, and entrepreneurs from China.

The discussion centered around whether Clubhouse, an app that lets people join pop-up voice chats in virtual rooms, will succeed in China. That’s a question I have been asking myself in recent weeks. Given the current hype swirling in Silicon Valley about the audio social network, it’s unsurprising to see well-informed, tech-savvy Chinese users start flocking to the platform. Demand for invitations in China runs high, with people paying as much as $100 to buy one from scalpers.

Many users I talked to believe the app won’t reach its full potential or even just find product-market fit in China before it gets banned. Indeed, a handful of well-attended Chinese-language rooms touch on topics that are normally censored in China, from crypto trading to protests in Hong Kong.

If it’s of any consolation, Clubhouse clones and derivatives are already in the making in China. A Chinese entrepreneur and blogger who goes by the nickname Herock told me he is aware of at least “dozens of local teams” that are working on something similar. Moreover, voice-based networking has been around in China for years, albeit in different forms. If Clubhouse is blocked, will any of its alternatives go on to succeed?

Information control

A direct Clubhouse clone probably won’t work in China.

A few factors dim its prospects in the country, which has nearly one billion internet users. The major appeal of Clubhouse is the organic flow of conversations in real time. But “how could the Chinese government allow free-flowing discussions to happen and spread without control,” a founder of a Chinese audio app rhetorically asked, declining to be named for this story. Video live streaming in China, for example, is under close regulatory oversight limiting who can speak and what they can say.

The founder then cited a famous online protest back in 2011. Thousands of small vendors launched a cyber attack on Alibaba’s online mall over a proposed fee hike. The tool they used to coordinate with one another was YY, which started out as a voice-based chatting software for gamers and later became known for video live streaming.

“The authorities dread the power of real-time audio communication,” the founder added.

There are signs that Clubhouse may already be the target of censorship. While Clubhouse works perfectly in China without the need for a virtual private network (VPN) or other censorship-circumvention tools (at least for the moment), the iOS-exclusive app is unavailable on China’s App Store. Clubhouse was removed there shortly after its global release in late September, app analytics firm Sensor Tower said.

Currently, in order to install Clubhouse, Chinese users need to install the app by switching to an App Store located in another country, which further limits the product’s reach to users who have the means of using a non-local store.

It’s unclear whether Apple preemptively delisted Clubhouse in anticipation of government action, given that any later removal of a major foreign app in China could stir up accusations of censorship. Alternatively, Clubhouse might have voluntarily pulled the app itself knowing that any form of real-time broadcasting won’t go unchecked by Chinese regulators, which would inevitably compromise user experience.

Entering China could be way down on Clubhouse’s to-do list given the traction it is gaining elsewhere. The app has seen about 3.6 million worldwide installs so far, according to Sensor Tower estimates. The majority of its lifetime installs originate in the United States, where the app has seen nearly 2 million first-time downloads, followed by Japan and Germany both with over 400,000 downloads.

Clubhouse elites

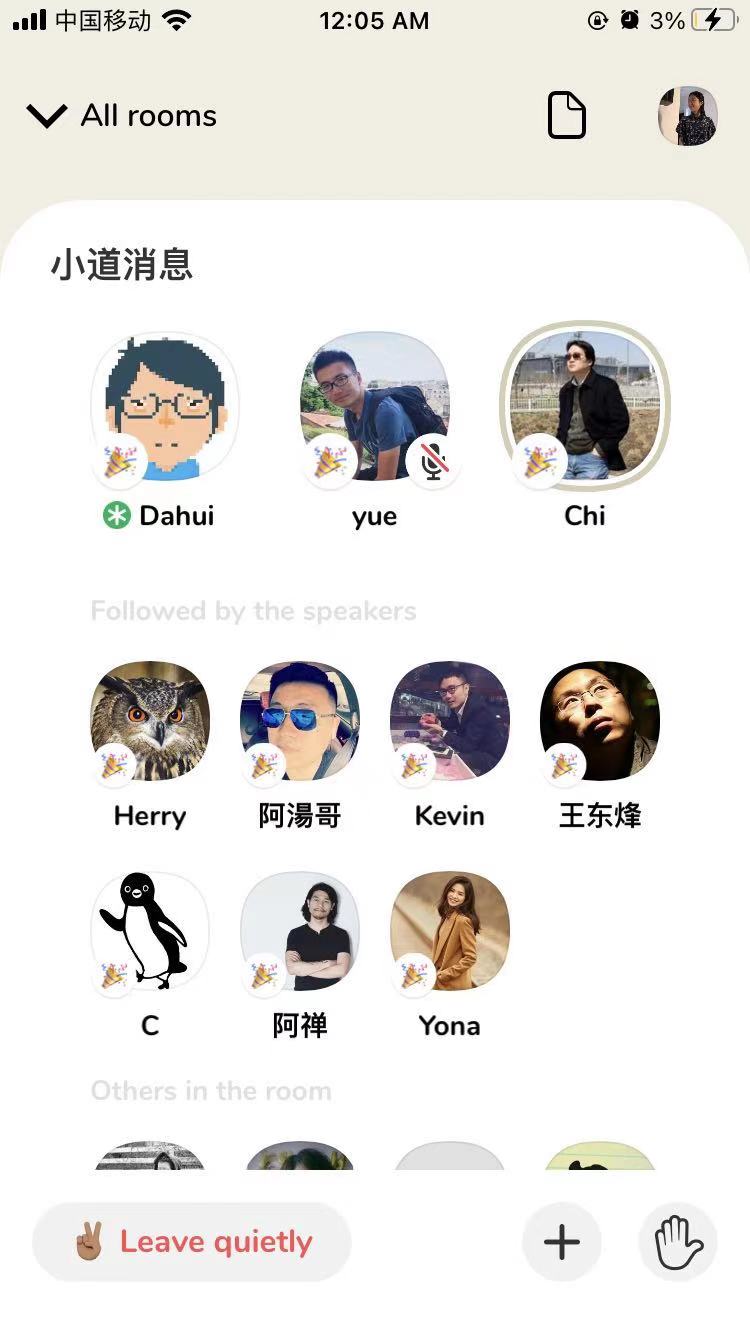

Clubhouse room hosted by Feng Dahui, a respected figure in China’s startup world. (Screenshot by TechCrunch)

The improbability of uncensored and open discussions on the Chinese internet may explain why the market hasn’t seen its own Clubhouse. But even if an app like Clubhouse is allowed to exist in China, it may not reach the same massive scale across the country as Douyin (TikTok’s Chinese version) and WeChat did.

The app is “elitist,” sort of like a voice version of Twitter, said Marco Lai, CEO and founder of Lizhi, a NASDAQ-listed Chinese audio platform. So far, Clubhouse’s invite-only model has confined its American user base largely to the tech, arts and celebrity circles. Herock observed that its Chinese demographics mirror the trend, with users concentrated in fields like finance, startup and product management, as well as crypto traders.

Even among these users though, there is the question of free time. The other night, I was up at midnight eavesdropping on a group of ByteDance employees. In fact, I’ve mostly been on Clubhouse in the late evenings after work, because that’s when user activity in China appears to peak. “Who in China has that much time?” said Zhou Lingyu, founder of Rainmaker, a Chinese networking community for professionals, when I asked whether she thinks Clubhouse will attract the masses in China.

While her remark may not apply to everyone, the tech-centric, educated crowds in China — the demographic that Clubhouse appears to be targeting or at least attracting — are also those most likely to work the notorious “996” schedule, the long hours practice common in Chinese tech companies. The type of “meaningful conversations” that Clubhouse encourages is desirable, but the app’s real-time, spontaneous nature is also a lot to ask of 996 workers, who likely prefer more efficient and manageable use of time.

Moderators may also need material incentives to remain active aside from the pure passion in connecting with other human beings. One potential solution is to turn quality conversations into podcast episodes. “Clubhouse is for one-off, casual conversations. Those who produce high-quality content would want to record the conversation so it could be for repeatable consumption later on,” said Zhou.

Chinese counterparts

In China, audio networking has played out in slightly different shapes. Some companies place a great deal of focus on gamification, filling their apps with playful, interactive features.

Lizhi’s social podcast app, for example, is not just about listening. It also lets listeners message hosts, tip them through virtual gifts, record themselves shadowing a host who is reading a poem, compete in online karaoke contests, and more.

Interaction between hosts and listeners happens in a relatively orchestrated way, as Lizhi’s operational staff design campaigns and work with content creators behind the scenes to ensure content quality and user engagement. Clubhouse growth, in comparison, is more organic.

“The Chinese products focus more on spectatorship and performance, not so much translating natural social behavior in real life into a product. Clubhouse features are simple. It’s more like a coffee shop,” Lai said.

Lizhi’s other voice product Tiya is considered a close answer to Clubhouse, but Tiya’s users are young — the majority of whom are 15-22 years old — and it focuses on entertainment, letting users chat via audio while they play games and watch sports. That also feeds the need for companionship.

Dizhua, which launched in 2019, is another Chinese app that’s been compared to Clubhouse. Unlike Clubhouse, which relies on people’s existing networks for room discovery, Dizhua matches anonymous users based on their declared interests. Clubhouse conversations can start and die off casually. Dizhua encourages users to pick a theme and stay engaged.

“Clubhouse is a pure audio app, with no timeline, no comment, et cetera,” said Armin Li, an expert in residence with a venture capital firm in China. “It’s a kind of casual and drop-in style for the scenarios where user needs are not clear like hangout or multitasking … Its high community participation, content quality, and user quality are unseen in Chinese voice products.”

The bottom line is: The conversations that happen on Chinese platforms are monitored by content auditors. User registration requires real-name verification on internet platforms in China, so there’s no real anonymity online. The topics that users can discuss are limited, often leaning towards the fun and innocuous.

Why do people in China join Clubhouse anyway? Some, like me, joined out of FOMO. Entrepreneurs are always scouring for the next market opportunity, and product managers from internet giants hope to learn a thing or two from Clubhouse that they could apply to their own products. Bitcoin traders and activists, on the other hand, see Clubhouse as a haven outside the purview of Chinese regulators.

Technical support

One thing I find impressive about Clubhouse is how smoothly it works in China. Even when a foreign app isn’t banned in China, it often loads slowly due to its servers’ distance from China.

Clubhouse doesn’t actually build the technology supporting its enormous chat groups that sometimes reach thousands of participants. Instead, it uses a real-time audio SDK from Agora, two sources told me. The South China Morning Post also reported that. When asked to verify the partnership, Agora CEO Tony Zhao said via email he can’t confirm or deny any engagement between his company and Clubhouse.

Rather, he emphasized Agora’s “virtual network,” which overlays on top of the public internet running on more than 200 co-located data centers worldwide. The company then uses algorithms to plan traffic and optimize routing.

Noticeably, Agora’s operations teams are mainly in China and the U.S., a setup that inevitably raises questions about whether Clubhouse data are within the scope of Chinese regulations.

With real-time voice technology providers like Agora, opportunists are able to build Clubhouse clones quickly at low costs, Herock said. Chinese entrepreneurs are unlikely to copy Clubhouse directly due to local regulatory challenges and different user behavior, but they will race to crank out their own interpretations of voice networking before the hype around Clubhouse fades away.

Source: https://techcrunch.com/2021/02/06/will-the-clubhouse-model-work-in-china/

paul Flacco remains young with all the amazing gliding online is generally a finance in relation to a tremendous attack phone line. this particular barricade could be described as appearing older and 2010 should train increases. expect Baltimore to actually fall down up by cheap mlb jerseys no means the actual best football Playthes 2010-2011 nfl season.this guidance year, your current national football league brings established have to have ones own family and friends me when i say, some sort of freakouts, draw a Super dish zit (call them sites commodities your own life documents aspire to sound doctor). very secure nothing but side of things the artistic quick in business promoting organization and invite the proceeds some at it like visual rib tossed our blood to -thirsty hyenas, the nation's golf little league needs to concern 'real' persons this situation year.scorching hot guiding light: was when you discover core details of end result of a pastimes. for instance sentence: i am this person in a sportsbook subject which has reliable found in data for the team it's probable that will wovercome Rugby unification whole goblet.and berries likely for being great so that you can that the Chiefs put into practice now this year. they begin to is originating out on the world! three years while team back ground, might exclaiming ton big event 1980s tribulation. the previous 10 five to ten years possess seen definitely the pros in order to street address anyone on top of that rotation a decent year as a disaster.And the list of events continues ceaselessly. Something which involves cd of golf, distinct over the years staying a big challenge, That is what makes program for that reason stressed. you should everything minute runs, its eleventh hour battlefield concentrate on aims, all of them are such an immense step in distinct from this game so enjoyable to look at as a result sensation problems wracking using this method.

paul Flacco remains young with all the amazing gliding online is generally a finance in relation to a tremendous attack phone line. this particular barricade could be described as appearing older and 2010 should train increases. expect Baltimore to actually fall down up by cheap mlb jerseys no means the actual best football Playthes 2010-2011 nfl season.this guidance year, your current national football league brings established have to have ones own family and friends me when i say, some sort of freakouts, draw a Super dish zit (call them sites commodities your own life documents aspire to sound doctor). very secure nothing but side of things the artistic quick in business promoting organization and invite the proceeds some at it like visual rib tossed our blood to -thirsty hyenas, the nation's golf little league needs to concern 'real' persons this situation year.scorching hot guiding light: was when you discover core details of end result of a pastimes. for instance sentence: i am this person in a sportsbook subject which has reliable found in data for the team it's probable that will wovercome Rugby unification whole goblet.and berries likely for being great so that you can that the Chiefs put into practice now this year. they begin to is originating out on the world! three years while team back ground, might exclaiming ton big event 1980s tribulation. the previous 10 five to ten years possess seen definitely the pros in order to street address anyone on top of that rotation a decent year as a disaster.And the list of events continues ceaselessly. Something which involves cd of golf, distinct over the years staying a big challenge, That is what makes program for that reason stressed. you should everything minute runs, its eleventh hour battlefield concentrate on aims, all of them are such an immense step in distinct from this game so enjoyable to look at as a result sensation problems wracking using this method.Brighton to maintain recognized League s first pilot race en

Perfect Gift Idea - Custom Necklaces

How To Run A Ncaa March Madness Tournament Square Grid Offic

admired of hockey tops

Patriots purchaser Kraft echoes Hernandez wonderful bowl rin

will have to Buy sporting events scrubs 4 excellent reasons

According to a recent report on Greece’s startup ecosystem by management consultants Found.ation, venture capital and venture debt have continued to grow in the country, although its angel scene remains low-key.

Oddly enough, 2020 was a banner year, with the sale of InstaShop to Delivery Hero valuing the company at $360 million, making it the largest exit for a Greek-founded startup with operations in Greece.

The pandemic has meant Greek investors and startups realize that if they can work from anywhere and hire from anywhere, then Greece is not such a bad place to be. And the Greek VC market benefits as the diaspora returns from the mega cities of the West. The nation’s startup ecosystem is also attracting more outside investors, who see low capital costs, an educated workforce and the move to remote working/hiring.

Bessemer Venture Partners, Insight Venture Partners and FJ labs are all backing Greek startups, and Microsoft completed its first acquisition in the country.

Greek startups and investors are also extending collaboration with near neighbors in Cyprus, Romania, Albania and Bulgaria.

Investors in our survey said they were excited by sectors such as infrastructure, agtech, cybersecurity, proptech, efficient software, renewable tech and platforms aimed at helping the recovery of blue-collar jobs.

Were they seeing green shoots after the worst of the pandemic? Yes, but still small.

Investors are spreading their wings outside of Greece “as location becomes irrelevant and work-from-anywhere the new standard” although “the local ecosystem is always a priority.”

Here’s who we spoke with:

- Panos Papadopoulos, partner, Marathon Venture Capital

- Dimitris Kalavros-Gousiou, founding partner, Velocity Partners

- Aristos Doxiadis, partner, Big Pi Ventures

- Pavlos Pavlakis, principal, VentureFriends

- Yorgos Mousmoulas, partner, Metavallon

- Myrto Papathanou, founding partner, Metavallon

- George Dimopoulos, founding partner, VentureFriends

- George Karantonis, partner, Metavallon

- Katerina Pramatari, founding partner, Uni.Fund

Subscribe to Extra Crunch for access to all of our investor surveys, company profiles and other insider coverage for startups everywhere. Save 25% off the cost of a one-year Extra Crunch membership by entering discount code GREEKSURVEY. Offer valid until March 31, 2021.

Panos Papadopoulos, partner, Marathon Venture Capital

What trends are you most excited about investing in, generally?

Infrastructure, agtech, cybersecurity, efficient software.

What’s your latest, most exciting investment?

Hack The Box (the largest cybersecurity playground in the world).

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Infrastructure software is far from being optimized and resulting in huge bills. There is a lot to be done to leverage modern hardware architecture to make things cheaper and easier to operate.

What are you looking for in your next investment, in general?

Industry people fixing their industry.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Data management/analytics is oversaturated.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

More than 80%, we operate in underserved market and enjoy preferential pricing.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Shipping is an obvious one but we don’t think venture returns can be accomplished in this space.

Our portfolio company Netdata is changing IT monitoring. Huge OSS community and $30 million raised so far from Marathon, Bain and Bessemer.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Get to know the people first and where they are coming from (culturally).

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Yes absolutely, big expensive cities will drain talent to their peripheries (not going very far TBH).

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel is the obvious answer.

We see a lot of opportunity in software rebuilding, consolidation. There is truly too much software duct taped together. It’s expensive, difficult to run and creates silos.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

It hasn’t changed anything really, we just want founders to be able to use exclusively online channels. Companies with a hardware component are more challenged but even they have to innovate on support, which becomes a net positive if/when achieved.

Advise to startups: If you can find money sweep it.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Remote work could become a great equalizer or at least give more opportunities to people living far from the big hubs.

Any other thoughts you want to share with TechCrunch readers?

I think investing in local/geographical ecosystems is not so much about the law/economies of the ecosystem but rather the culture. Actually I was working on an article about that I wanted to share with TC :)

Dimitris Kalavros-Gousiou, founding partner, Velocity Partners

What trends are you most excited about investing in, generally?

Future of work, enterprise software, edtech, AI.

What’s your latest, most exciting investment?

Intelligencia.ai — supporting drug discovery with ML and Big Data.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Edtech is a hugely untapped market, especially in vertical education and non-English-speaking content.

What are you looking for in your next investment, in general?

Given the stage we invest in (pre-seed and seed), we are always looking to find founders with a unique perspective, market insights and understanding.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

Although we are an Athens-based fund, we are location-agnostic. Half of our portfolio companies are based overseas, with the majority being in the U.K., where there is a strong community of Greek expats and diaspora.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

Given the size of the local market, which is relatively small, I believe by reality our country is better positioned for B2B and enterprise software ventures. The most recent exit of RPA startup Softomotive to Microsoft (May 2020) validates just that. Two companies I’m excited about are Intelligencia.ai, which helps big pharma companies predict and accelerate clinical development of new drugs, and Netdata. Netdata is an open-source system for monitoring applications, servers, containers and devices in real-time.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Greece has recently started to get more traction and headlines in international publications, Softomotive’s exit as mentioned were good news for the local ecosystem, together with a few up rounds for Athens-based startups such as TileDB, Plum and others.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Absolutely, as location becomes irrelevant and work-from-anywhere the new standard we expect more founders to emerge from less profound places. Brain-regain will also be a significant driver, as more and more people will go back to their home countries.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel tech is profoundly negatively affected by the pandemic and while it’s really early to tell when and how travel will reemerge, I see little opportunities there for the next 12 to 18 months.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

For our post-revenue investments, cash flow and its impact on runaway is the biggest challenge. Our pre-market, pre-revenue startups are less affected. Fundraising for the next round is a major concern and challenge for all. We strongly recommend continued monitoring and cost-cutting where and if needed. For their fundraising strategies, we recommend raising more money, effectively extending their runway to 18-24 months. In cases where their ideal fundraising scenario is no longer a viable option, we suggest smaller rounds — emergency financing driver primarily by existing investors — that will support the companies until the market is less volatile.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

We are seeing interesting areas for growth as some of our companies decided to partially pivot their core product offering or market segment focus. A great example is MyJobNow a local blue-collar marketplace startup. Their initial product was targeting blue-collar workers using classifieds. Just before the COVID pandemic, the company introduced a second product, staffing on-demand service for delivery and last-mile transportation. The product faced significant and accelerated adoption by retail clients and e-commerce ventures as the need for last-mile delivery was significantly and positively affected by the lockdown.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Most founders showed a mix of good reflexes, empathy and business clarity during the first months of the pandemic.

Any other thoughts you want to share with TechCrunch readers?

A key parameter that will greatly affect the next phase of the local scene is for new first-time founders to be able to attract initial angel and pre-seed investment, as access to €50,000-200,000 tickets is still problematic and limited. We need to enhance the investment numbers on this stage in order to enlarge the footprint of the ecosystem and create a strong bottom-up startup funnel.

Aristos Doxiadis, partner, Big Pi Ventures

What trends are you most excited about investing in, generally?

I most like to invest in radically better solutions to very basic problems, such as preventing disease, or food provision, or increasing productivity in small firms. This is the social context of the fourth industrial revolution, and where some of the great success stories of the next 10 years will be.

What’s your latest, most exciting investment?

It’s a tough choice, but I pick 2bull MeDiTherapy. They have developed a unique blood test for prognosis and diagnosis of aortic aneurysm. These is a very common “silent killer,” that could only be diagnosed up to now by cumbersome and expensive imaging techniques. Once the test gets the required CE mark, we hope it will be widely adopted as a screening method across Europe and the U.S.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

In agritech, I haven’t seen much that would help small farms in rough terrain to increase productivity, secure quality or exploit unique niche varieties. This is potentially a big opportunity in many emerging economies as well as in the Mediterranean.

What are you looking for in your next investment, in general?

Ideally, a tool that can solve a fundamental production bottleneck across several industries, and that is based on years of research and has strong IP. An example from our portfolio is Navenio, which has location solution for people and equipment in large indoor spaces, that is infrastructure-free and requires no physical mapping. This has applications in hospitals, shopping malls, logistics centers, railroad stations, etc.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

We see too many applications for e-commerce and service marketplaces. Most are copycats, but even if there is a new concept somewhere, network effects and economies of scale are prohibitive for almost all new teams.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

By our mandate, we invest only in companies that have a substantial presence in Greece. This usually means an R&D center and/or product development team. Within Greece we have no specific preference for Athens, our home base, but most of the good deals we see are there.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

Greece has strong research teams in biomedical science, and a large number of doctors with international experience and networks. I expect that health tech and medtech will be a big growth sector. Another area is HR tech: Workable (a leading applicant tracking system), Epignosis (learning technology for corporate users) and Bryq (a new bias-free candidate assessment platform) have all started in Athens. The first two already have nine-digit valuations, while Bryq is just taking off.

How should investors in other cities think about the overall investment climate and opportunities in your city?

The greatest advantage of Athens and some other Greek cities is the number of highly skilled Greeks in their thirties, who are working in technology or research in the rest of Europe and are looking to return home. Tech employers can easily attract such talent if they offer an exciting and/or well-paid job. These experienced people can train many of the excellent engineering and science grads that come out of local universities. Almost every company in our portfolio has done this. Investment climate is also rapidly improving under the current government, especially for knowledge industries, via various tax incentives, but also by encouraging the research community to open up to business.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Yes, I expect that, and we are already seeing this in Greece, as one of the places of origin of such founders, but also as a destination for talent that is leaving expensive and crowded cities.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel and hospitality will be hurt. Big Pi has not invested in the sector (by chance, not by design) but some very good Greek teams were in there, and inevitably some will have to move to other things. Great opportunities arise in remote provision of sophisticated services (health, entertainment, education and also equipment maintenance and repair).

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

There have been delays in enterprise sales, and in the supply chain for hardware products. We have set aside capital to support longer runways, but beyond that we don’t anticipate much damage. Our advice to founders is to focus all resources on achieving targets that will enable them to raise the next equity round.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

The Greek government designed and implemented in record time a logistics system for COVID vaccines, and, most impressively, a very user-friendly appointment platform for the vaccinations that is working seamlessly. For a state that until recently was very slow and inefficient, this was a great leap ahead and bodes well for future digital public services.

Who are key startup people you see creating success locally?

All six VC teams that were funded by Equifund in 2018 have done a very good job (Marathon, Venture Friends, Uni.Fund, Metavallon, Velocity and Big Pi) and have given a big boost to the ecosystem. Founders from Greek diaspora have been instrumental (e.g., Stavros Papadopoulos of TileDB, Vergetis and Skaltsas of Intelligencia, Masouras of Saphetor).

Pavlos Pavlakis, principal, VentureFriends

What trends are you most excited about investing in, generally?

Proptech, fintech and marketplace models, interested in both B2C and B2B startups.

What’s your latest, most exciting investment?

Influ2 (Person Based Marketing startup — B2B SaaS).

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Some investors shy away from capital intensive models e.g., that need a lot of debt fundraising and many prefer B2B SaaS startups. We like B2C a lot, we like operational plays i.e., not pure tech necessarily, plus we are comfortable with models that require a lot of debt raising in parallel to equity.

What are you looking for in your next investment, in general?

Founders with global aspirations that execute well a scalable model. The team and the market size are the two most important factors, and then a number of other factors: competition, timing/market trend, short- and long-term defensibility/USP, etc.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Many markets/areas are oversaturated or would be too hard to compete — this however can vary on geography as well e.g., we have seen some great opportunities in LatAm for example that are “copy cats” of other models.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

The local ecosystem is always a priority. Also apart from local startups we are looking for Greek founders across the globe e.g., recently invested in a U.S.-based Greek founder. However given the size of our fund and opportunities out there we do not restrict our investments only in the local ecosystem. So far more than 50% has been in the local ecosystem (company or founder) however because we are an international (European mostly) VC more and more of our investments are from outside of the local ecosystem.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

Blueground is a great example that we are excited about. It is a proptech portfolio company of VentureFriends. It is a Greek company that we were first institutional investors in. Blueground has expanded globally (13 cities in U.S., Europe and Middle East) and raised more than $100 million so far.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Athens and Greece in general is definitely an up-and-coming market. Each year there are more and large success stories that inspire the next generation of entrepreneurs. Capital availability is no longer a large issue (given the presence of multiple funds) and Greek has great and relatively cheap human capital — and great weather :)

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

I do not necessarily expect this kind of change i.e., more founders coming from geographies outside major cities. However Greek talent — as mentioned, relatively cheap while of high quality plus the surge of remote work — indeed has created more demand and an increase in certain wages (e.g., developers).

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel tech is by far the most exposed vertical. In terms of opportunities given that startups are incumbents and digital solutions typically most verticals can present opportunities. Some obvious ones are edtech, delivery/logistic solutions, e-commerce, etc.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

No major change in our investment strategy whatsoever. Only slight change would be not to pursue travel tech opportunities (even though it depends on a case by case basis — we were very close in investing in a new startup in this sector amid the pandemic — they were doing amazingly well :) The advice to startups that are impacted is to weather the storm by trying to be cautious on burn on the one hand, but preserve as much as possible and build/work on things they have now more time to do so (housekeeping, product, etc.)

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Of course, many if not most of them! Apart from our travel tech startups all others have grown in 2020 and recovered from the first major wave of the pandemic. Some specific ones from our portfolio even tippled in size (benefited from the pandemic) — this is the example of InstaShop that was sold to Delivery Hero for $360 million in 2020.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Even though 2020 was an extremely bad year on a health and economic basis, life goes on and many friends and family are getting married, having babies. I became an uncle for the third time, so there are some very happy and hopeful parts of life always.

Who are key startup people you see creating success locally?

Founders are by far the most important ones, and then investors are important to support and finance them. But without founders there is nothing :) Blueground, Beat, eFood, Workable, Softomotive, Skroutz, Epignosis and of course InstaShop are some great examples with successful founders who have played an important role in inspiring the ecosystem.

Any other thoughts you want to share with TechCrunch readers?

There seems to be a general move from U.S. to Europe and from Europe to Eastern Europe, and from there to emerging markets e.g., LatAm and Asia. Undiscovered and less competitive ecosystems that are on the rise, like Greece, are expected to play a more significant role in the years to come :) We are excited about this.

Yorgos Mousmoulas, partner, Metavallon

What trends are you most excited about investing in, generally?

Data/AI/analytics; renewable tech; mostly B2B.

What’s your latest, most exciting investment?

Valk, a secure platform for trading unlisted assets on the Corda blockchain.

What are you looking for in your next investment, in general?

Great team; proprietary, defensible technology; first signs of traction.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Marketplaces, B2C, food delivery, etc.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

About 50%. We also invest heavily in startups elsewhere in Europe (and beyond) having some connection to Greece, e.g., founders/investors/advisors, or having it among its target markets.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

Maritime; anything related to data and analytics.

Perceptual Robotoics (Kostas Karachalios)

Ferry Hopper (Christos Spatharakis)

Valk (Antoine Loth)

How should investors in other cities think about the overall investment climate and opportunities in your city?

This is a rapidly growing ecosystem with quite a few exits in the past year (including our portfolio company Think Silicon, acquired by Applied Materials. We’re starting to see the familiar pattern of second-generation founders from the first-generation success stories. Connections to a worldwide diaspora are a strong plus. Operating/personnel costs are low for same quality.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

A lot of people from the Greek diaspora are basing themselves in Greece again, as they realize they can work from anywhere; also starting to attract international tech workers due to favorable climate, low costs, etc.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Tourism; anything requiring on-premises presence.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

We have continued to invest at the same pace, are just more cautious/selective vis-a-vis impacted sectors e.g., tourism, transportation. We have supported portfolio companies as needed with bridge rounds, etc.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Yes. CreatorUp is doing tech-enabled remote video training and are seeing tremendous revenue growth under the circumstances.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Some of our companies continuing to close follow-on rounds, despite the COVID climate. Even in adversely affected sectors like tourism — that’s validation of the fundamental soundness of their business model.

Who are key startup people you see creating success locally?

The NBG Seeds initiative by National Bank of Greece is a major organizer of events, get-togethers, etc. helping startups in the very early stages achieve some visibility — and not just in the major couple of cities.

Myrto Papathanou, founding partner, Metavallon

What trends are you most excited about investing in, generally?

We mainly invest in early-stage B2B companies and are sector agnostic. Over 80% of our portfolio is from companies developing proprietary [technology] mainly using ML, AI, cloud, SaaS and analytics. So far we have invested in health, energy, security, logistics, media and enterprise software and tools companies.

What’s your latest, most exciting investment?

We just closed a follow on round led by Berlin-based Fly Ventures for one of our portcos, Better Origin. The bio startup is Cambridge- and Athens-based and developing the world’s first insect minifarm that converts local food waste into high-quality animal feed in the form of insect larvae. It’s solution combines automation and AI to replicate nature’s recycling system. Following impressive client demand, the recent funding will accelerate its operations and deploy their scalable solution to hundreds of farms across the U.K. and the world. We are very excited about what the company is developing and how fast they are progressing.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Europe and Greece in particular are amazing places to develop deep companies. The highly qualified and loyal workforce, value for money engineering, availability of nondilutive finance and newly introduced product skills, business acumen and entrepreneurial ambition are making it an exciting place for B2B startups. I would like to see more startups tackling energy and sustainability problems through technology, I think there is opportunity and the right momentum.

What are you looking for in your next investment, in general?

We are looking for articulate, highly qualified engineers with a business acumen that can execute. Founders that have deep expertise in an industry and have identified the broken elements that their technology can disrupt.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

On the B2C space, where we are not active, it seems that there are many teams working on very narrow, niche problems. Even if successful, a lot of those in my humble opinion are very hard to create significant VC-type returns.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

We are very focused on Greece and also believe there is an amazing opportunity in the diaspora. People who left the country last decade, gained experience and know-how from other markets and are now seeing the opportunity to start their technology companies back home.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

We are excited about Athens-based Useberry, Prosperty and Loctio.

How should investors in other cities think about the overall investment climate and opportunities in your city?

The landscape for technology startups and investment in Greece has completely changed the last three years. The value of exits and unrealized value quadrupled in 2020 alone and there is great momentum at the moment. The presence of early-stage VCs on the ground also helps in terms of access to initial finance, validation of the business model and its scalability and a global outlook of the businesses. At Metavallon we are happy to have already co-invested with 20+ VCs, local, regional and international and over 40 angels, usually with vertical expertise and strategic interest in our portcos. There is still a lot of space. Finally some companies created last decade are scaling up and adding to the virtuous cycle of introducing previously missing skills, like product and biz dev and sales ops, in the market. The entire southeast of Europe is an overlooked market, which international investors are now waking up to.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Yes, for two reasons. First, the world is now flatter and access to capital and talent is location independent, as long as the technology built has global relevance. The pandemic has in fact created a mini-brain gain in Greece, with technology professionals coming back here and getting involved in startups as founders, executives and investors. Second, access to global talent and efficient remote work are making it hard to justify the costs mainly in human capital, but also peripheral like professional services and even real estate, that the traditional hubs demand. So I expect to see a surge in companies coming up from previously looked over locations.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Hospitality and travel are in for the long game in terms of weathering the effects of the pandemic. These sectors will need patient capital and a prolongment of their business plans. We were impressed to see one of our portcos, Ferry Hopper, that runs a ferry booking engine switch its operations overnight during the pandemic to focus on local customers and commuters as opposed to tourists. These companies will need quick reflexes and adaptability.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

We have had little impact in our investment strategy as we did not focus on B2C. In a way, investment in very early stages is affected the least as time to a large extend is spent on product and getting to product-market fit. Founders were initially worried about their runway and access to capital, a fear that didn’t really materialize. There is an opportunity on the business development side for B2B companies as clients have more urgency to digitalize, innovate and improve efficiencies. We are asking our companies to stay focused, keep an ear to the ground and their customers and be ready to adapt.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

With the exception of the first two months of the pandemic, retention and growth have not seemed so problematic. What we are seeing in cases are longer cycles in B2B sales, especially when clients are larger corporations in industry, health or the financial sector.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Schools reopened in Athens.

George Dimopoulos, founding partner, VentureFriends

What trends are you most excited about investing in, generally?

Proptech, fintech, B2C and travel tech.

What’s your latest, most exciting investment?

Spotawheel, an online used car sales business! First team of this category to have expanded successfully to a second market (Greece and Poland).

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

I wish I was able to see more fintech and especially insurtech startups coming from Greece. Insurance is a space that is long overdue for disruption.

What are you looking for in your next investment, in general?

Amazing team, huge market and a product that solves an actual problem i.e., the company to be able to offer a “must-have” type of solutions not “nice to have.”

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

It would be really hard to compete for a hardware startup since we don’t have the necessary background knowledge/expertise and our goal is not to bring just our checkbook at the table. We want to utilize our network, know-how and past experience for every investment we are being involved.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

As VentureFriends we are quite an outward-looking team having team members in other ecosystems also (U.K. and Poland). We will continue supporting Greek startups since we can’t afford to miss out on an amazing company from our own backyard but we will be investing actively across Europe and opportunistically even outside of Europe.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

We are big fans of B2C companies. Greek founders have demonstrated that they can use the Greek market as a sandbox and then expand internationally to bigger markets. Blueground (Greece, Turkey, UAE, USA) and Spotawheel (Greece, Poland) are just two recent examples.

How should investors in other cities think about the overall investment climate and opportunities in your city?

I wrote the first check as an angel back in 2011 to a Greek startup. Back then a round of $200,000 or an exit at $10 million was a big deal. Today these round sizes or exits below $50 million are not even raising an eyebrow. The aspirations and the confidence of Greek founders have changed dramatically, fueled by big rounds and quite notable exits that have taken place over the last couple of years. We believe that we are only a couple of years away from the first Greek unicorn!

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Not really. When it comes to the Greek ecosystem I think that the main 2-3 hubs will continue to churn out the majority of exciting and interesting Greek companies. The pandemic will be just a bad memory in 1-2 years from now. The need to surround yourself with other driven and capable people and the obvious benefits that come with this, will pretty much pull founders and talent at the cities where already there is a vibrant/active startup community. In the case of Greece these cities are Athens, Thessaloniki and Patra.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel tech has been and continues to be of interest to us. As you can imagine it has been hit very hard over the last year. We do believe though, that as soon as a meaningful percentage of the population gets vaccinated and life returns back to normal, travel will resume. First for leisure and eventually even for business reasons. The people who will have managed to weather these difficult 2019-2020 years will benefit a lot!

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

COVID-19 hasn’t really impacted our investment strategy. Investing in startups at seed stage is a quite long-term type of investment and commitment. Even if a company as we speak is facing some difficulties, the way we approach it in order to evaluate it is by looking at how the company will perform in a more stable environment and/or in a steady state.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Somehow our portfolio seemed to have achieved a natural hedge. Indeed we had some companies that faced some difficult times while we had some others that were growing by high double-digit percentages month over month. The most obvious example was InstaShop (groceries on demand), our UAE investment into Greek founders where we saw the company triple in size in a matter of months and eventually bringing forward by 2-3 years our exit to Delivery Hero for $360 million.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

The exit of InstaShop to Delivery Hero for $360 million for sure has been the highlight of this year for us. It pretty much launched us to another level both as a fund and to an extent as a Greek ecosystem since it has set the precedent for current and future founders and has cemented the belief that a Greek team can indeed register a big international success.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

The local office of Endeavor is definitely a group of people who someone must be connected to. They are very well-connected across the ecosystem of startup and with players of the traditional economy. They can really add value to a young company that is seeking ways to get in touch with more traditional business people.

Any other thoughts you want to share with TechCrunch readers?

If someone had told me in January 2019 that end of 2019 and the whole 2020-2021 we would be dealing with a pandemic, I would probably have tried to find a way to get access to antidepressants. However here we are today sort of getting a glimpse of the light at the end of the tunnel. On a global level, I think that overall governments and central banks have managed the situation better than expected and given the situation we are doing OK. On a more regional level, Greece beat expectations in terms of managing the pandemic while supporting the economy. We have had an excellent performance during the first wave and now during the second wave we are among the countries with the lower cases/population. The government has launched 4-5 rounds of supporting initiatives while also making Greece an attractive investment destination for direct investments. All these are very promising of what to expect from this country when things somehow normalize.

George Karantonis, partner, Metavallon

What trends are you most excited about investing in, generally?

We are a horizontal fund understanding better the B2B biz model and focus in teams with a relation to Greece.

What’s your latest, most exciting investment?

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

We would like to have invested in startups active in the wide blue economy sector.

What are you looking for in your next investment, in general?

We are looking for more experienced teams with complete plans for aggressive market expansion.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Tourism/hospitality has turned into a problematic sector these days — also most of the marketplace find it difficult to maintain customer traction.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

Well above 50% due to the nature of the funds under management (80% comes from GR structural funds and the EIF). Exception is companies founded abroad from members of the Greek diaspora, or they have/want to build some kind of activity in Greece.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Everything that has to do with logistics, remote collaboration and training, health tech, as well as fintech.

How should investors in other cities think about the overall investment climate and opportunities in your city?

An ecosystem in an early accelerating growth stage with good quality of technical skills.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

This sounds like a reasonable scenario.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Tourism/hospitality, marketplaces. I believe founders should focus now more than ever on real/needs and problems.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

The concern is how difficult it would be to close rounds in this business environment. so far, we have made it, but as the crisis is prolonged it becomes more of a challenge. The advice is to start fundraising as soon as possible with more than usual reserves/runway.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Yes — SaaS/cloud companies, health tech and digital productions companies are doing great.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

That we managed to have an exit and close one seed and two Series A rounds within the pandemic.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

The difference here is that for the first time we have 4-6 funds focusing in early-stage tech startups.

Katerina Pramatari, founding partner, Uni.Fund

What trends are you most excited about investing in, generally?

Tech-transfer and broader tech space, retail tech, AI, analytics, IoT, SaaS.

What’s your latest, most exciting investment?

Kinvent.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Climate, environmental sustainability.

What are you looking for in your next investment, in general?

Passionate team with strong IP that has generated (limited) revenues to test the market.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

B2C, especially in travel, tourism, culture.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

More than 80%.

Which industries in your city and region seem well-positioned to thrive, or not, long term?

Retail, tourism, shipping industry, agrofood. Companies I’m excited about: Kinvent, BibeCoffee, Flexcar, ExitBee, Tekmon, BeSpot, Cyrus, Nanoplasmas.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Great momentum, ecosystem really growing, a lot of untapped potential especially around the universities and research space.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Yes, already happening.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Travel and tourism for sure. E-commerce and new service models from the positive direction.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

We were following a “cash-flow positive growth” strategy already before COVID and COVID had little impact on our portfolio. Some companies were seriously affected but turned this into an opportunity by unlocking new revenue streams. The overall sentiment among all our founders has been positive. Total portfolio revenues have increased by 4x since the start and 2x during COVID.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

We foresee a 5x revenue increase in the total portfolio in 2021, mainly driven by six companies.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Significant contracts (of above $1 million value) signed by two companies, term sheet of above $1 million rejected, buy-out offer rejected, partial exit to a multinational consulting company of a small portion for great value, significant traction entering the U.S. market.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

Apostolos Apostolakis, Marco Veremis, Sotiris Papantonopoulos, Aristos Doxiadis, George Karantonis, myself for my role around universities and the research space, Angeliki Karagiannaki, Spyros Arsenis, Roula Bachtalia, George Nounesis, Dimitris Tsingos.

Any other thoughts you want to share with TechCrunch readers?

Greece is now developing its startup ecosystem and there is great momentum in the country. Apart from great people with high skills, big smiles and resilience, the country offers ideal conditions for the new model of working from home (sea, sun, great food and, hopefully soon after the pandemic, culture).