& meet dozens of singles today!

User blogs

Vaccine misinformation has been around since well before the pandemic, but ensuring that anti-scientific conspiracies don’t get boosted online is more crucial than ever as the world races against the spread of a deadly, changing virus.

Now, Facebook says it will expand the criteria it uses to take down false vaccine claims. Under the new rules, which Facebook said it made in consultation with groups like the World Health Organization, the company will remove posts claiming that COVID-19 vaccines aren’t effective, that it’s “safer to get the disease” and the widely debunked longstanding anti-vaxxer claim that vaccines could cause autism.

Facebook says it will place a “particular focus” on enforcement against groups, Pages, groups and accounts that break the rules, noting that they may be removed from the platform outright.

In the coming weeks we'll be making it harder to find accounts in search that discourage people from getting vaccinated on Instagram. These changes won't happen overnight, but will help keep our community safe and informed, especially as more claims around the vaccine emerge.

— Adam Mosseri

(@mosseri) February 8, 2021

Facebook took steps to limit COVID-19 vaccine misinformation in December, preparing the platform for the vaccine rollout while still lagging well behind the rampant spread of anti-vaccine claims. The company began removing posts containing some misinformation about the vaccine, including “false claims that COVID-19 vaccines contain microchips” and content claiming that the vaccine is being tested on portions of the population without their consent.

Why this kind of stuff didn’t already fall under Facebook’s rules against COVID-19 misinformation is anyone’s guess. The company came out of the gate early in the pandemic with a new set of policies intended to prevent an explosion of potentially deadly COVID-related conspiracies, but time and time again the company fails to evenly and firmly enforce its own rules.

Source: https://techcrunch.com/2021/02/08/facebook-vaccine-misinformation-policy/

Income-share agreements or ISAs have been gathering force as an alternative financial model for students, particularly at non-traditional schools like coding boot camps and trade schools. We’ve done some pretty deep dives into the space over the years in terms of how these loan products incentivize students and colleges to work together for better professional outcomes. Given their novelty though, one of the largest barriers to wide adoption remains the lack of capital for these models.

That’s starting to change, and companies like Blair are leading the charge.

Blair told TechCrunch that it has raised $100 million in a new debt facility to fund what it is dubbing “Blair Capital” to fund ISAs at partner institutions. The money came from an undisclosed investor, which was described by Blair CEO Mike Mahlkow as an “institutional capital partner with more than $10 billion under management.”

My colleague Mike Butcher first profiled Blair when it was coming out of YC back in summer 2019. When Blair first got started by co-founders Mahlkow, Constantin Schreiber, and David Nordhausen, it was focused exclusively on the direct-to-consumer market for ISAs. The idea was that students would go to Blair and secure an ISA with a set amount of upfront cash to cover tuition and cost of living, and then choose a school to attend. Underwriting was based on the future income potential of the student.

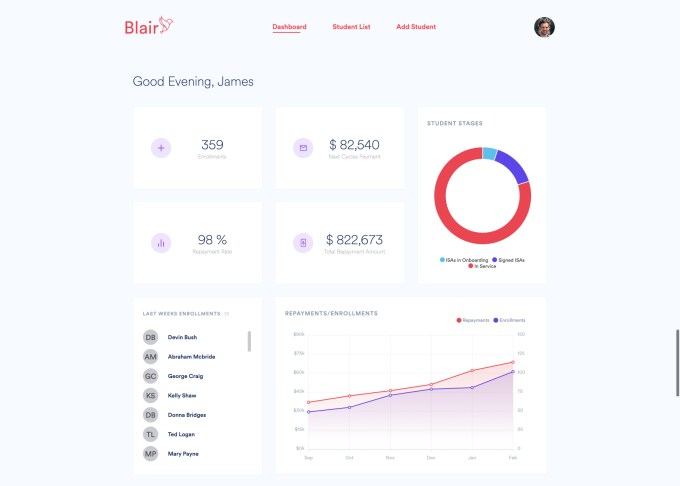

Blair’s technology platform allowed it to service ISAs for students, such as collecting their payments, tracking their requirements, and giving them updates on their remaining terms. But to really scale up the platform, Blair needed capital to actually underwrite ISAs and increase loan volumes on its platform.

So it looked to raise a debt facility — and then COVID-19 hit. “It was very, very, difficult to raise any kind of debt capital for direct-to-consumer ISAs,” Mahlkow explained in the milieu of a pandemic. But, “we got a lot of inbound demand from education institutions,” and particularly from alternative schools like coding boot camps.

Blair’s team. Photo via Blair.

So Blair rejiggered its platform (now dubbed Blair Servicing) away from D2C lending to being a technology servicing layer for schools offering ISAs as part of their programs. From there, it constructed Blair Capital, this new $100 million facility which can be used by its partner schools to fund their own ISA programs. That means these schools won’t have to raise their own debt capital for their ISAs if they don’t want to.

Unlike Blair’s original approach focused on consumers, underwriting for ISAs is now based on the quality of an individual school, and even more specifically an individual program. So rather than underwriting a person, Blair knows that certain programs have a given return profiles and can underwrite terms of the ISA to fit that risk.

Terms can vary widely between programs. Mahlkow explained that the company more or less has merely floors and ceilings on terms but otherwise is flexible. For instance, the company won’t do income shares above 20% (and often gets queasy even going near that number), and there are repayment caps and limits on repayment time periods as well, with most ISAs it offers being between 1-2 years or a maximum of three years.

Alternative schools with track records of student achievement can use Blair Capital right away. For newer schools without the same operating history, Blair will help guide those schools to build the early track record they need so that the company can underwrite their ISAs in the future. Either way, all schools can use Blair Servicing to handle their loans.

The school dashboard within Blair Servicing. Photo via Blair.

Blair Servicing takes a percentage fee of the money that flows back from an ISA after graduation, while Blair Capital takes an origination fee plus joins in the upside of the ISA itself. The goal is to incentive-align the loans for all parties involved.

The company, which is based in SF, remains lean at six employees. With $100 million capital to fund ISAs though, it hopes to have an outsized impact on this burgeoning industry.

Source: https://techcrunch.com/2021/02/08/blair-launches-100m-facility-to-fund-isas-for-students/

Micromobility startup Helbiz, which now operates across Europe and the USA, is merging with a special purpose acquisition company (SPAC) to become a publicly listed company, giving it a war chest to potentially roll-up smaller competitors in the space, as well as the resources to expand into “cloud” or “ghost” kitchens as part of a move into food delivery.

Helbiz intends to merge with GreenVision Acquisition Corp. (Nasdaq: GRNV), in the second quarter of 2021. The combined entity will be named Helbiz Inc. and will be listed on the Nasdaq Capital Market under the new ticker symbol, “HLBZ.”

The transaction includes $30 million PIPE anchored by institutional investors and approximately $80 million in net proceeds will be fed into Helbiz’s micro-mobility and advertising businesses, which have 2.7 million users.

Helbiz says the merged entity will have a valuation of $408 million, and by run Helbiz’s existing management under CEO Salvatore Palella.

Palella said: “Through this transaction, we’re committed to fulfilling our vision in revolutionizing transport by using micro-mobility to become a seamless last-mile solution.”

He further revealed to me that the company plans to establish ‘ghost Kitchens’ in Milan and Washington DC later this year, with the aim of introducing a 5 minute delivery time.

Helbiz has tried to differentiate itself from other players like Lime and Bird by offering e-scooters, e-bicycles, and e-mopeds all on one platform.

Key to Helbiz’s offering is an integrated geofencing platform that tends to appeal to city authorities who don’t want scooters left in random places, as well as a swappable battery that enables easier charging of the devices. Its subscription service allows users to take unlimited 30-minute trips on its e-bikes and e-scooters every month.

In Italy, the company currently operates a fleet of e-scooters and e-bicycles in Milan, Turin, Verona, Rome, Madrid, Belgrade, and in the U.S. it operates in in Washington, DC, Alexandria, Arlington and Miami.

David Fu, Chairman, and CEO of GreenVision, commented: “Helbiz has distinguished itself as the only company to offer e-scooters, e-bicycles, and e-mopeds all on one user-friendly platform… Helbiz has a proven and capital-light business model that combines hardware, software, and services with extensive customer relationships.”

Late Friday, Oscar Health filed to go public, adding another company to today’s burgeoning IPO market. The New York-based health insurance unicorn has raised well north of $1 billion during its life, making its public debut a critical event for a host of investors.

Oscar Health lists a placeholder raise value of $100 million in its IPO filing, providing only directional guidance that its public offering will raise nine figures of capital.

Both Oscar and the high-profile SPAC for Clover Medical will prove to be a test for the venture capital industry’s faith in their ability to disrupt traditional healthcare companies.

The eight-year-old company, launched to capitalize on the sweeping health insurance reforms passed under the administration of President Barack Obama offers insurance products to individuals, families and small businesses. The company claimed 529,000 “members” as of January 31, 2021. Oscar Health touts that number as indicative of its success, with its growth since January 31 2017 “representing a compound annual growth rate, or CAGR, of 59%.”

However, while Oscar has shown a strong ability to raise private funds and scale the revenues of its neoinsurance business, like many insurance-focused startups that TechCrunch has covered in recent years, it’s a deeply unprofitable enterprise.

Inside Oscar Health

To understand Oscar Health we have to dig a bit into insurance terminology, but it’ll be as painless as we can manage. So, how did the company perform in 2020? Here are its 2020 metrics, and their 2019 comps:

- Total premiums earned: $1.67 billion (+61% from $1.04 billion).

- Premiums ceded to reinsurers: $1.22 billion (+113%, from $572.3 million).

- Net premium earned: $455 million (-3% from $468.9 million).

- Total revenue: $462.8 million (-5% from $488.2 million).

- Total insurance costs: $525.9 million (-8.7% from $576.1 million).

- Total operating expenses: $865.1 million (+16% from $747.6 million).

- Operating loss: $402.3 million (+56% from $259.4 million).

Let’s walk through the numbers together. Oscar Health did a great job raising its total premium volume in 2020, or, in simpler terms, it sold way more insurance last year than it did in 2019. But it also ceded a lot more premium to reinsurance companies in 2020 than it did in 2019. So what? Ceding premiums is contra-revenue, but can serve to boost overall insurance margins.

As we can see in the net premium earned line, Oscar’s totals fell in 2020 compared to 2019 thanks to greatly expanded premium ceding. Indeed, its total revenue fell in 2020 compared to 2019 thanks to that effort. But the premium ceding seems to be working for the company, as its total insurance costs (our addition of its claims line item and “other insurance costs” category) fell from 2020 to 2019, despite selling far more insurance last year.

Sadly, all that work did not mean that the company’s total operating expenses fell. They did not, rising 16% or so in 2020 compared to 2019. And as we all know, more operating costs and fewer revenues mean that operating losses rose, and they did.

Oscar Health’s net losses track closely to its operating losses, so we spared you more data. Now to better understand the basic economics of Oscar Health’s insurance business, let’s get our hands dirty.

Ifeoma Ozoma, a former Pinterest employee who alleged racial and gender discrimination at the company, is co-leading new legislation with California State Senator Connie Levya and others to empower those who experience workplace discrimination and/or harassment. Introduced today, the Silenced No More Act (SB 331) would prevent the use of non-disclosure agreements in workplace situations involving all forms of discrimination and harassment.

“It is unacceptable for any employer to try to silence a worker because he or she was a victim of any type of harassment or discrimination—whether due to race, sexual orientation, religion, age or any other characteristic,” Levya said in a statement. “SB 331 will empower survivors to speak out—if they so wish—so they can hold perpetrators accountable and hopefully prevent abusers from continuing to torment and abuse other workers.”

This proposed bill would expand the current protections workers have through the Stand Together Against Non-Disclosures Act, also authored by Levya, that went into effect 2019. Ozoma, along with former coworker Aerica Shimizu Banks, came forward with claims of both racial and gender discrimination last year. They eventually settled with Pinterest, but the STAND Act technically only protected them for speaking out about gender discrimination. This new bill would ensure workers are also protected when speaking out about racial discrimination.

How to contact TechCrunch

Got a tip? Contact us securely using SecureDrop. Find out more here. You can also reach this author via Signal at 415-516-5243

“It was a legal gamble,” Ozoma told TechCrunch about coming forward with claims of both racial and gender discrimination, despite having signed an NDA. Pinterest could’ve decided to sue both Ozoma and Banks, Ozoma said, but that would’ve required the company to admit wrongdoing.

“Technically, we weren’t [supposed to talk about racial discrimination] and that’s what most companies bank on,” she said.

It’s a long road ahead for the bill, which needs to be passed by the legislature and ultimately signed into law by CA Governor Gavin Newsom, but it would represent a monumental shift in the tech industry, if passed.

“It would be huge and not just for tech, but for your industry as well,” she told me. “I believe that we don’t have real progress unless we approach things intersectionally and that’s the lesson from all of us.”