& meet dozens of singles today!

User blogs

Alexa von Tobel has always felt strongly that too many people are shut out of the stock market. She felt this as a 23-year-old who didn’t have $5,000 to open a brokerage account. She felt it while building LearnVest, a financial planning startup she launched in 2009 and sold in 2015 to Northwestern Mutual for what she says was ultimately $375 million. In fact, von Tobel — who two years ago launched her own venture firm with fellow entrepreneur and former U.S. Secretary of Commerce Penny Pritzker — cares so much about the yawning gap between investors and non-investors that she has written books about how to take control of one’s money. (Perhaps unsurprisingly, she is also a certified financial planner.)

Little wonder that in late January, for a podcast that von Tobel routinely hosts for Inc., she interviewed Robinhood Vlad Tenev about the company’s quest to make investing accessible to all and how it had shaken up the brokerage landscape in the process. Neither foresaw what would happen days later, when a Reddit community of amateur investors didn’t try to occupy Wall Street so much as turn it upside down by using Robinhood, in part, to drive up the share price of companies like GameStop and AMC Theatres — then unwind those positions. As a 21-year-old college student who lost $150,000 over the course of several days told the outlet Vice, “This whole thing has numbed me to money.”

What happened? Education, in the view of von Tobel, who says it never became an integrated part of bigger picture. While the GameStop saga has “brought a lot of new learnings and new things that people have to process and consider,” paramount among these is the inadequate financial training that Americans receive.

“I want the tools to be democratized, where everyone can get equal access to the financial system,” said von Tobel in a lively chat with us late last week that you can hear here. “But I also want equal education, and that’s where we’re woefully falling behind as a society. It’s not taught in high schools, colleges, or grad schools. Very few schools even teach the basics.”

The issue only grows more important to address each year, she says. People are living longer, and they’re more responsible than ever for their financial well-being. Meanwhile, because of innovations in fintech, including at Robinhood — which became wildly popular very quickly precisely because it dispensed with many of the barriers to participating in the stock market — there is little to keep someone from making lousy decisions with outsize consequences.

So what’s to be done? For starters, she suggests that society begin to place as much emphasis on financial health as physical wellness. “If you’re close to having a major health crisis, doctors do a really good job of saying, ‘Here’s all the things that you need to do to protect yourself; here’s what needs to happen. The same needs to exist in the financial world.”

It will take a number of stakeholders, she believes. One of these is “platforms – all of them — that provide you with [financial] tools and resources, so you can understand the kind of risks you’re taking on [to the extent] that they can provide it.”

Another, she said, is regulators, including the Consumer Financial Protection Bureau. Created in 2010 to safeguard consumers in banking, mortgage, credit card and other financial transactions, the CFPB’s very constitutionality was called into question by the Trump administration, yet its guidance is sorely needed, suggests von Tobel. (“Regulation is always a step behind, and that’s a little bit of what we’re feeling” as a society right now.)

Of course, the third and biggest stakeholder of all is the U.S. educational system, says von Tobel, adding that “you need all three, working in unison” in order to have real impact.

As for any structural changes in the meantime that von Tobel thinks should happen — according to CNBC, for example, Robinhood is preparing to lobby against a trading tax that’s been floated as a way to dampen some of the frenzied activity seen in recent weeks — she declines to “pontificate too much.”

Still, she said she thinks that “getting a Citadel and everyday Americans on equal footing is where we want to end up,” and she isn’t without hope that we’ll get there.

For example, she thinks crypto is “here to stay” and that the infrastructure being created around it will be positive for innovators as well as end users. She’s also expecting “self-driving wallets” that pay bills and make investments to become the new normal, and she thinks they could minimize some of the financial distress we might continue to see otherwise.

Considering the chaos of late, the latter almost sounds too easy, but the “wallet is simply a math equation every day,” she says. “If you have so much [money] available free, where should it go? What’s the most optimal place? It’s a math equation that updates every single hour, and I do think elements of it will be self-driving based on your goals and what you want to accomplish.”

As she puts it, “I can’t wait for the day that that actually exists in a way where it automates on its own. I do believe that’s the future.”

Fintech startup Klarna is turning its mobile app into a banking app in Germany. Customers living there can now open a consumer bank account and get a Visa debit card.

For now, Klarna is launching bank accounts for a limited number of users. The company expects to roll it out more broadly in the coming months.

What you get is a full-fledged bank account with a German IBAN to receive money, set up direct deposits and debits. The debit card works with Google Pay and Apple Pay. You get two free ATM withdrawals per month.

With today’s launch, Klarna wants to build a financial super app. Klarna started as a payment method for e-commerce websites. It lets you pay for expensive goods over multiple installments. Merchants get paid when the initial transaction occurs, with Klarna transparently managing credit lines for customers.

With the company’s mobile app, you can track your past purchases and your upcoming payments. The app also lets you access a marketplace of stores, track deliveries and set up price-drop notifications.

But you couldn’t get a full overview of your finances with this data. Adding a bank account provides full visibility in everything that lands on your bank account and leaves your bank account.

It could open up some new opportunities for credit lines. For instance, if you pay in store for something really expensive with your Klarna card, you could receive a notification that suggests spreading out your expense over three months.

Klarna also plans to add savings goals and savings accounts. The startup has already launched savings accounts in Sweden. It offers flexible and fixed-term savings accounts.

Klarna has built its own core banking system, which means that it doesn’t rely on a banking-as-a-service partner to manage your bank account. It’ll compete with other digital banks in Germany, such as N26 and Vivid Money.

Source: https://techcrunch.com/2021/02/09/klarna-launches-bank-accounts-in-germany/

Most people who use AI-powered translation tools do so for commonplace, relatively unimportant tasks like understanding a single phrase or quote. Those basic services won’t do for an enterprise offering technical documents in 15 languages — but Lengoo’s custom machine translation models might just do the trick. And with a new $20M B round, they may be able to build a considerable lead.

The translation business is a big one, in the billions, and isn’t going anywhere. It’s simply too common a task to need to release a document, piece of software, or live website in multiple languages — perhaps dozens.

These days that work is done by translation agencies, which employ expert speakers to provide translation on demand at a high level of quality. The rise of machine translation as an everyday tool hasn’t affected them as much as you might think, since the occasional Portuguese user using Google’s built-in webpage translation on a Korean website is very much a niche case, and things like translating social media posts or individual sentences isn’t really something you could or would farm out to professionals.

In these familiar cases “good enough” is the rule, since the bare meaning is all anyone really wants or needs. But if you’re releasing a product in 10 different markets speaking 10 different languages, it won’t do to have the instructions, warnings, legal agreements, or technical documentation perfect in one language and merely fine in the other nine.

Lengoo started from a team working on automating that workflow between companies and translators.

“The next step to take obviously was automating the translation itself,” said CEO and founder Christopher Kränzler. “We’ll still need humans in the loop for a long time — the goal is to get the models to the level where’s they’re actually usable and the human has fewer translations to make.”

With machine learning capabilities constantly being improved, that’s not an unrealistic goal at all. Other companies have started down that road — DeepL and Lilt, for instance, which made their cases by showing major improvements over Google and Microsoft frameworks, but never claiming to remove humans from the process.

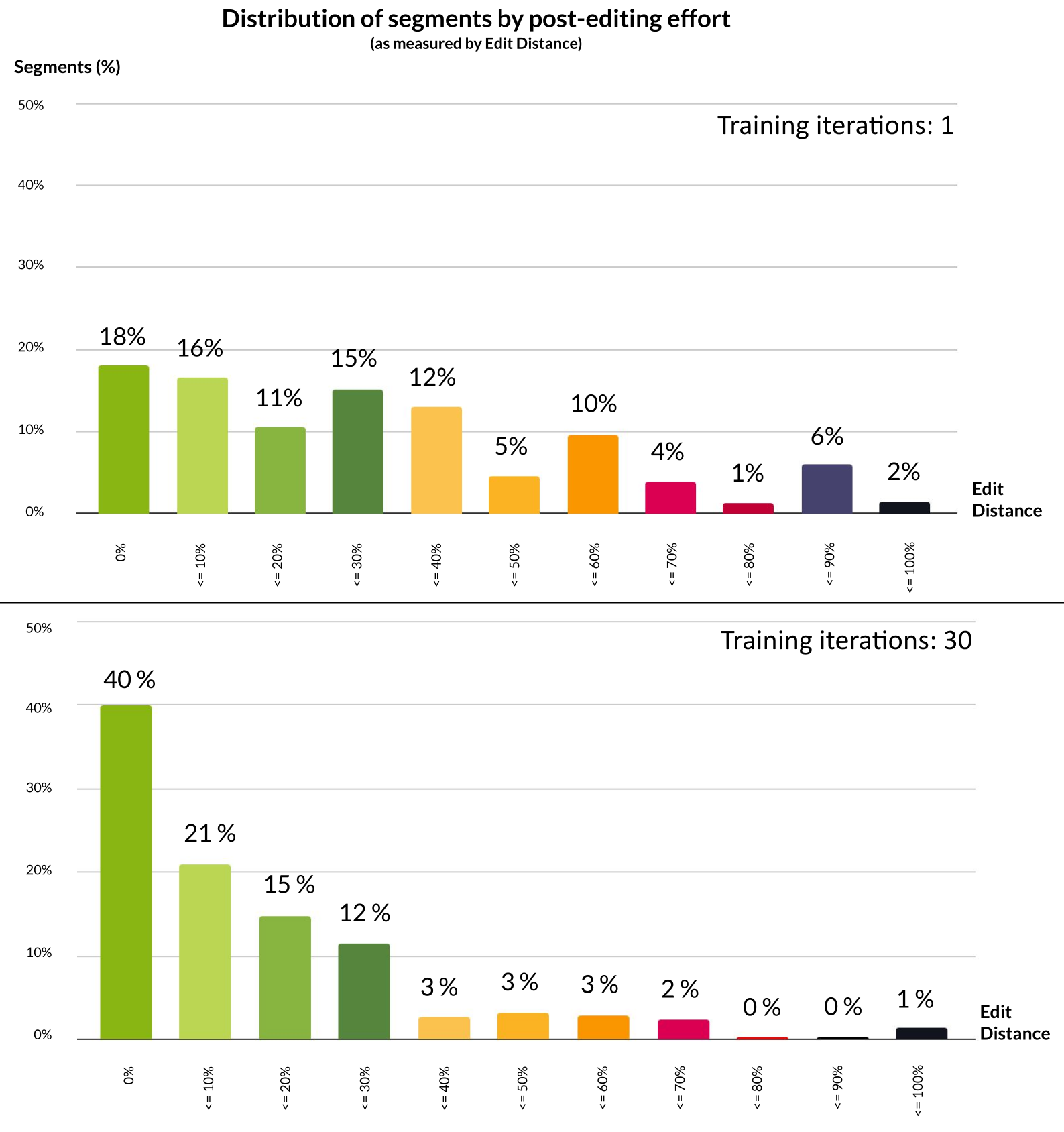

Lengoo iterates on their work by focusing on speed and specificity — that is, making a language model that integrates all the jargon, stylistic preferences, and formatting requirements of a given client. To do this they make a custom language model by training it not just with the customer’s own documents and websites, but by continually adding in feedback from the translation process itself.

“We have an automated training pipeline for the models,” said Kränzler. The more people contribute to the correction process, the faster the process gets. Eventually we get to be about three times faster than Google or DeepL.”

A new client may start with a model customized on a few thousand documents from the last couple years. But whenever the model produces text that needs to be corrected, it remembers that particular correction and integrates it with the rest of its training.

An exciting bar graph. After 30 iterations, the segments requiring no corrections have doubled, and those requiring few are much increased.

While the “quality” of a translation can be difficult to quantify objectively, in this case there’s no problem, because working as a human translator’s tool means there’s a quality check built right in. How good the translation is can be measured by “correction distance,” essentially the amount of changes the human has to make to the model’s suggested text. Fewer corrections not only means a better translation, but a faster one, meaning quality and speed both have objective metrics.

The improvements have won over customers that were leery of over-automation in the past.

“At the beginning there was resistance,” admitted Kränzler. “People turn to Google Translate for everyday translations, and they see the quality is getting better — they and DeepL have been educating the market, really. People understand now that if you do it right, machine translation works in a professional use case. A big customer may have 30, 40, 50 translators, and they each have their own style… We can make the point that we’re faster and cheaper, but also that the quality, in terms of consistency, goes up.”

Although customizing a model with a client’s data is hardly a unique approach, Lengoo seems to have built a lead over rivals and slower large companies that can’t improve their products quick enough to keep up. And they intend to solidify that lead by revamping their tech stack.

The issue is that due to relying on more or less traditional machine learning technologies, the crucial translator-AI feedback loop is limited. How quickly the model is updated depends on how much use it gets, but you’re not going to retrain a large model just to integrate a few hundred more words’ worth of content. It’s expensive computationally to retrain, so it can only be done sporadically.

But Lengoo plans to build its own, more responsive neural machine translation framework that integrates the various pipelines and processes involved. The result wouldn’t improve in real time, exactly, but would include the newest information in a much quicker and less involved way.

“Think of it as a segment by segment improvement,” said applied research lead Ahmad Taie (segments vary in size but generally are logical “chunks” of text). “You translate one segment, and by the next one, you already have the improvements made to the model.”

Making that key product feature better, faster, and easier to implement customer by customer is key to keeping clients on the hook, of course. And while there will likely be intense competition in this space, Kranzler doesn’t expect it to come from Google or any existing large companies, which tend to pursue an acquire-and-integrate approach rather than an agile development one.

As for the human expert translators, the field won’t replace them but may extend their effectiveness by, eventually, as much as an order of magnitude, which may shrink the workforce there. But if international markets continue to grow and with them the need for professional translation, they might just keep pace.

The $20M round, led by Inkef Capital will allow Lengoo to make the jump to North American markets as well as additional European ones, and integrate with more enterprise stacks. Existing investors Redalpine, Creathor Ventures, Techstars (out of which program the company originated), and angels Matthias Hilpert and Michael Schmitt all joined in the round, along with new investors Polipo Ventures and Volker Pyrtek.

Alexa von Tobel has always felt strongly that too many people are shut out of the stock market. She felt this as a 23-year-old who didn’t have $5,000 to open a brokerage account. She felt it while building LearnVest, a financial planning startup she launched in 2009 and sold in 2015 to Northwestern Mutual for what she says was ultimately $375 million. In fact, von Tobel — who two years ago launched her own venture firm with fellow entrepreneur and former U.S. Secretary of Commerce Penny Pritzker — cares so much about the yawning gap between investors and non-investors that she has written books about how to take control of one’s money. (Perhaps unsurprisingly, she is also a certified financial planner.)

Little wonder that in late January, for a podcast that von Tobel routinely hosts for Inc., she interviewed Robinhood Vlad Tenev about the company’s quest to make investing accessible to all and how it had shaken up the brokerage landscape in the process. Neither foresaw what would happen days later, when a Reddit community of amateur investors didn’t try to occupy Wall Street so much as turn it upside down by using Robinhood, in part, to drive up the share price of stocks of companies like GameStop and AMC Theatres — then also get out of those shares. As a 21-year-old college student who lost $150,000 over the course of several days, told the outlet Vice, “This whole thing has numbed me to money.”

What went wrong? Education, in the view of von Tobel, who says it never became an integrated part of bigger picture. While the GameStop saga has “brought a lot of new learnings and new things that people have to process and consider,” paramount among these these is the inadequate financial training that Americans receive.

“I want the tools to be democratized, where everyone can get equal access to the financial system,” said von Tobel in a lively chat with us late last week that you can hear here. “But I also want equal education, and that’s where we’re woefully falling behind as a society” she said. “It’s not taught in high schools, colleges, or grad schools. Very few schools even teach the basics.”

The issue only grows more important to address each year, she says. People are living longer, and they’re more responsible than ever for their financial well-being. Meanwhile, because of innovations in fintech, including at Robinhood — which became wildly popular very quickly precisely because it dispensed with many of the barriers to participating in the stock market — there is little to keep someone from making lousy decisions with outsize consequences. “The financial world is very unforgiving,” she notes.

So what’s to be done? For one thing, she suggests that society begin to place as much emphasis on financial health as physical wellness. “If you’re close to having a major health crisis, doctors do a really good job of saying, ‘Here’s all the things that you need to do to protect yourself; here’s what needs to happen.” The same “needs to exist in the financial world.”

It will take a number of stakeholders, she believes. One of these is “platforms – all of them — that provide you with [financial] tools and resources, so you can understand the kind of risks you’re taking on [to the extent] that they can provide it.”

Another, she said, is regulators, including the Consumer Financial Protection Bureau, which was created in 2010 to safeguard consumers in banking, mortgage, credit card and other financial transactions. The agency’s very constitutionality was called into question by the Trump administration, but von Tobel suggests Americans could use more its help going forward. (“Regulation is always a step behind, and that’s a little bit of what we’re feeling” as a society right now.)

The third is, yes, the U.S. educational system, says von Tobel, adding, “You need all three, working in unison.”

As for any structural changes that von Tobel thinks should happen — according to CNBC, for example, Robinhood is preparing to lobby against a trading tax that’s been floated as a way to dampen some of the frenzied activity seen in recent weeks — she declines to “pontificate too much.”

Still, she said she thinks that “getting a Citadel and everyday Americans on equal footing is where we want to end up,” and she isn’t without hope that we’ll get there. Absent the changes she’d like to see — or in addition to them, at least — she’s expecting “self-driving wallets” to become the new normal, and she thinks they could minimize some of the financial distress we might continue to see otherwise.

Considering the chaos of late, it almost sounds too easy. But the “wallet is simply a math equation every day,” she says. “If you have so much [money] available free, where should it go? What’s the most optimal place? It’s a math equation that updates every single hour, and I do think elements of it will be self-driving based on your goals and what you want to accomplish.

“I can’t wait for the day that that actually exists in a way where it automates on its own,” she adds. “I do believe that is the future.”

IROKO, a Nigerian-based media company, could file to go public in the next 12 months on the London Stock Exchange (LSE) Alternative Investment Market.

Founded by Jason Njoku and Bastian Gotter in 2011, IROKO boasts the largest online catalog of Nollywood film content globally.

According to this report, the media company will raise between $20 million and $30 million valuing the company at $80 million to $100 million.

In October 2019, Njoku hinted that the company was going public either on the London Stock Exchange or a local exchange on the continent. However, the CEO kept mute about the whole process the following year due to how tumultuous it was for the company.

In 2020, the company had plans to increase its average revenue per user (ARPU) in Africa for its video-on-demand service, iROKOtv, from $7-8 to $20-25. Through the first four months of the year, it seemed IROKO was set to achieve that. But amid pandemic-induced lockdown fears, consumer discretionary spending reduced in Nigeria and other African markets. What followed was a 70% drop in subscription numbers, and in May, 28% of the company’s staff went on unpaid leave. But unlike the numbers iROKOtv local markets put up, its international subscribers grew 200% during the lockdown, hitting a $25-30 ARPU range.

However, more bad news came in August when the CEO announced that the company was laying off 150 people. Njoku cited the naira devaluation, regulatory onslaught by the country’s broadcast regulator, and a reduced outbound marketing team as reasons behind this decision.

With the company spending $300,000 or more every month on growth, it decided to halt any scaling efforts on the continent. IROKO instead focused on its international market, primarily the U.S and the U.K where it has been able to execute a 150% price increase from $25 per year to $60 per year. Njoku said to this decision set the company straight leaving it in a stronger cash position than it had been for years.

“The costs of pursuing Africa growth is what was really resized dramatically. We were so focused on defending Africa and basically ended up doing nothing. Zero marketing or anything to drive that,” he told TechCrunch. “We pulled back to focus on where our economics actually makes sense. Our international business organically grew double-digit in 2020 and we expect it to continue this way for the foreseeable future.”

IROKO isn’t entirely giving up on the African market, instead, think of it in stealth mode. Due to its dominance over the past eight years as one of the strongest independent SVOD companies in Africa, it is hard not to see the company in pole position to benefit from any improvements made on the continent.

That said, IROKO makes 80% of its revenue outside Africa and listing on a foreign exchange will help consolidate its efforts. For Njoku, the Nigerian Stock Exchange or other local exchanges do not have a history of listing early-stage tech companies; therefore, the London Stock Exchange makes more sense in the short term.

IROKO is also seeking a market cap of about $100 million, which is small for the primary market. This is why the media company is choosing to list on the Alternative Investment Market (AIM) of the LSE. A sub-market of the LSE, the AIM is built specifically for small-cap companies. Still, there are plans in the future for IROKO to progress to the main market as its valuation grows — something U.K sports betting company, GVC and online fashion retailer, ASOS have done in the past.

Most companies when going public, tend to raise more money than their private equity days. But it’s quite different with IROKO. The company which secured around $30 million in total with its last priced round (Series E) in January 2016, plans to raise less or a similar amount when going public in 2022. In what seems like a down round, I asked Njoku why the company isn’t planning to raise more?

“We don’t need more. To be honest, $10 million to $15 million will be for corporate development; the rest will be secondaries for shareholders. As a private company, IROKO’s valuation was never priced above $70 million so anything in our target range wouldn’t be a down round at all,” he said. “Especially if you consider in that time we exited ROK for close to the total amount of capital we raised for IROKO; we have returned $11 million to early investors and shareholders already. We still have material capital left from the ROK-Canal+ acquisition coming in every 6 months until 2023.”

When IROKO sold ROK Studios to Vivendi-owned Canal+ in July 2019, the terms of the deal remained undisclosed. But from the CEO’s statement, an estimate of the acquisition could be around $30 million. What’s particularly impressive is that the proceeds from the deal likely sustained the company through a rough patch in 2020 and might well do so after its IPO in 2022.

Joining IROKO in plans to go public within the next two years is Interswitch, a Nigerian-based payments company valued at $1 billion. But unlike Interswitch, which was founded in 2002, IROKO has been operating for just 10 years. Within that time, the only internet company to have gone public is Jumia, and it did so after seven years. IROKO is expected to achieve this feat in its 11th year of operation and Njoku, who holds an 18% stake in the company, believes it’s enough time to take the next step.

“What we can achieve in private, we can equally achieve as a public company. We will likely open up the IPO to our loyal members too so they can capture the value too, which I am super excited about. One thing about IROKO is that we have always been pioneers and we’re okay being super experimental. I plan to open-source the entire process so any other African company coming behind — if we’re successful — will benefit from our experience,” he said of the journey ahead.