& meet dozens of singles today!

User blogs

Fiverr is adding a new way for freelancers on the marketplace to charge for their work — three- or six-month subscriptions.

Through this feature, sellers on Fiverr can offer to provide a defined set of work each month. They can also offer discounts to subscribers, although it’s not required. The buyer or seller can cancel at any time, with no fees paid on the remaining months of the subscription — but the savings only start in the second month, to prevent situations where buyers might try to use subscriptions just to get a one-time discount.

Product Manager Natasha Shine-Zirkel told me that that while Fiverr built its reputation as a marketplace to hire freelancers on a “one-time or per-project basis,” it’s increasingly become a home for ongoing work as well. So the company decided to make it easier to provide and pay for that work.

She said businesses who sign up for a subscription will get access to “high-quality sellers and build long-term relationships,” and it also “saves them hassle of filling out their requirements each time.” Sellers, meanwhile, will get more predictability in their workload and revenue.

Fiverr Subscriptions are being made available to what the company said are the “top freelancers” in eight categories, including social media marketing, SEO and voice overs.

Shine-Zirkel said Fiverr is starting out small to “learn from sellers who are really high quality and already have existing relationships.” She added that the initial categories represent a mix of work that’s normally retainer-based and other jobs that are more project-based, allowing the company to observe “how buyers and sellers use the feature” in different contexts.

At the same time, Shine-Zirkel described this as “just the beginning,” with Fiverr rolling the feature out to more freelancers in more categories over time.

In addition to launching support for subscriptions, Fiverr is introducing another feature around longer-term work called Milestones, where a bigger job is broken down into smaller pieces, with the buyer paying for each milestone as it’s completed.

Source: https://techcrunch.com/2021/02/10/fiverr-subscriptions/

If you are a founder and launched a startup last February of 2020 just before the pandemic hit, then you may have felt like you were living the ultimate business nightmare. But if your company serves to stabilize the supply-chain business, then, in fact, you may have hit the ground running at just the right time. So is the story of Miami-based startup SmartHop, an AI-powered app that helps interstate truckers make their routes more efficient and lucrative, while removing a lot of the administrative hassle for drivers.

SmartHop announced today that it raised $12 million in a Series A round, bringing the company’s total funding to date to $16.5 million. The round was led by Union Square Ventures, whose past investments include Stripe, Twitter, Coinbase, Etsy, MeetUp, SkillShare and Duolingo, among others.

SmartHop takes a complex problem with lots of moving parts and offers a simple solution. To understand the gap in the market, you need to understand the hurdles that interstate truck drivers face. And since Garcia is a former truck driver himself (he was a pet food delivery driver while in college in his native Venezuela and scaled his business to a 500-person trucking company), he has a good grasp on the pain points and intricacies of the industry.

“I lived with my parents in Caracas and I asked my parents to empty their garage and that was my first distribution center,” said Guillermo Garcia, CEO and co-founder of SmartHop, of his experience starting his first trucking company. “The trucking market moves like the stock market,” he added, explaining that it’s ever-changing and therefore impossible to predict.

According to a 2019 study by The American Trucking Associations, the trucking industry is a $791.7 billion industry, representing 80.4% of the nation’s freight bill. Additionally, 91% of trucking companies are small businesses, meaning they have six trucks or fewer. Many are owner-operators. Traditionally, to get loads, truckers had to scour apps or websites of about 15,000 different brokers. It was a total uncoordinated, inefficient, free-for-all approach that left drivers unable to predict their monthly revenues, among many other things.

This is how SmartHop helps those drivers. Let’s say Bob lives in Atlanta and he has a single truck; he’s an owner-operator. He has a load that’s going to take him all the way to Seattle, and it’s going to take him several days to get there. Financially, it doesn’t make a lot of sense for Bob to start the trip without knowing what else he can pick up along the way, or if Seattle should really be his turnaround point. Maybe there’s not a lot of freight leaving Seattle these days, but there’s a lot going out of Chicago. There’s no way for Bob to know these things.

Before SmartHop, Bob had to pick up the phone, call brokers and make deals. Most of this work was done while on the road and Bob had no foresight into his next couple of weeks of work – or life, for that matter.

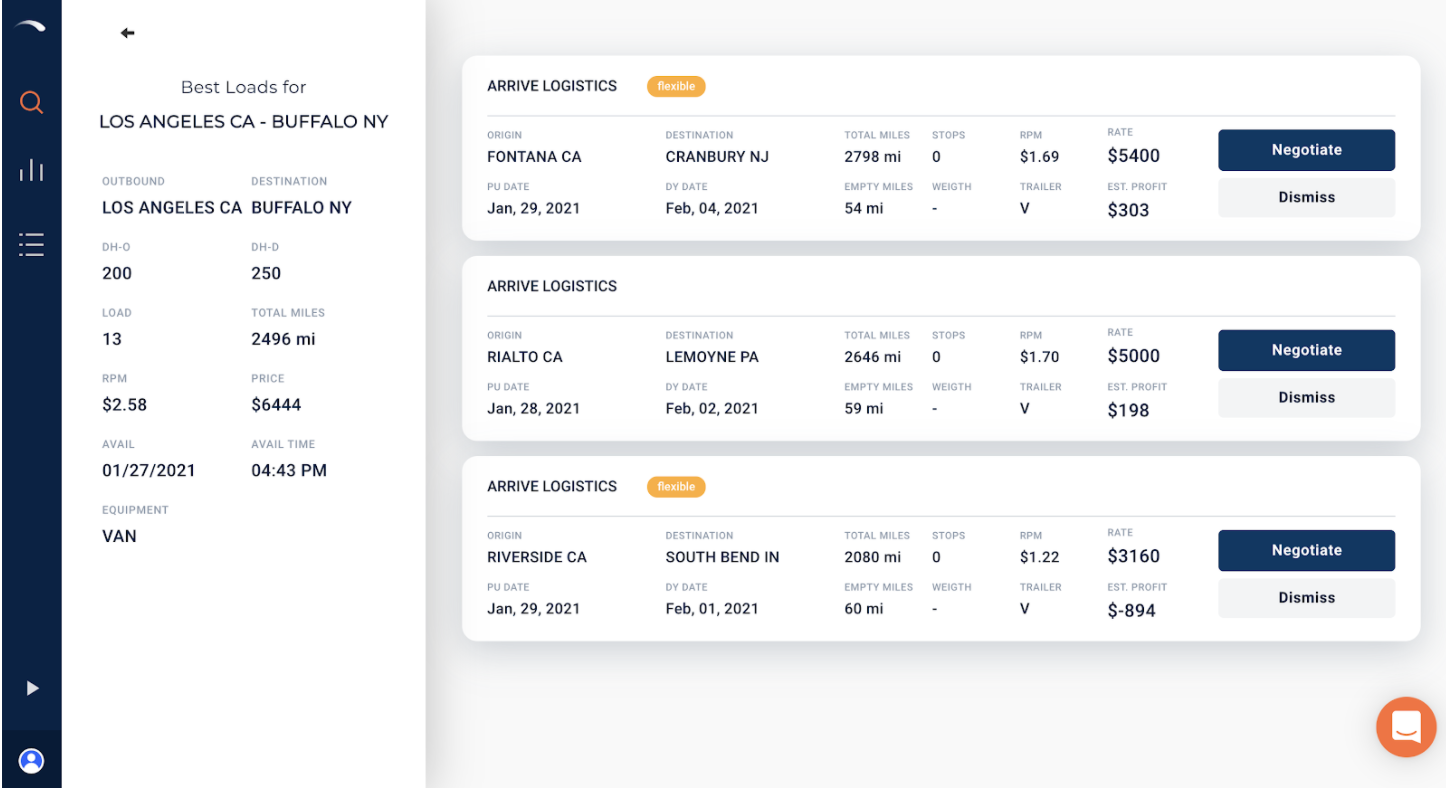

With SmartHop, Bob can enter details about his truck’s capacity, cities he doesn’t like driving through and other details, and SmartHop will recommend loads to him that optimize his profits and travel time. Think of it like when you’re driving and using Waze and it asks if you want to drive to Starbucks because it’s a couple of minutes out of the way. All you have to do is accept, and Waze does the rest. SmartHop operates similarly.

SmartHop technology giving a driver three load booking options, which the platform’s tech will negotiate and book (image: SmartHop).

“Some truckers don’t like to drive through New York City because there are a lot of tolls, bridges and traffic,” said Garcia, “So it doesn’t matter the value of the load, he’s just not going to pick it up,” he added.

But if you really want to go full autopilot, SmartHop can take over and autonomously book the loads for you – all you have to do is drive and take care of the truck, Garcia said.

The more a trucker uses SmartHop, the more the company learns the driver’s preferences and makes better suggestions or bookings.

SmartHop charges a transaction fee of 3% of the gross sale. “Our incentives are very aligned, so when they make money, we make money, and when they are taking days off, we don’t charge anything,” said Garcia.

“[Union Square Ventures] is focused on businesses that utilize technology to build networks and broaden access,” said Rebecca Kaden, managing partner at Union Square Ventures. “We were particularly excited to meet Guillermo and the SmartHop team, because that’s exactly what they are doing — software empowers the owner-operator trucking company to optimize their business and compete with players far bigger in number.”

Ryder, the Miami-based logistics company, also participated in the round through its new venture arm, RyderVenture. SmartHop is its first investment. Equal Ventures and Greycroft, from SmartHop’s seed round, also invested.

“A lot of startups have a lot of good technology and no one to test it on,” said Karen Jones, Ryder executive VP, CMO and head of new product innovation. “And the software doesn’t go very far if there is no one in the real world to try it.” Prior to the RyderVenture investment, Ryder partnered with SmartHop to test the product on its own trucks, of which they have 275,000.

The company, which was part of the 2019 New York City Techstars cohort, currently has 50 full-time employees and 100 trucks using the product. Each truck, on average, grosses between $10K – $15K per month.

The latest funding round will go toward product development as well as embedded financial products. Unlike big companies, smaller trucking companies don’t have the leverage to negotiate better rates on fuel or insurance, but with SmartHop’s volume of drivers, it can change that. Additionally, they’ll be offering to factor invoices, so drivers can sell a 45-day invoice and get paid within just 24 hours by SmartHop. “Because we have so much data, we become the ultimate underwriter so I’m able to underwrite in advance, and much smarter,” said Garcia.

Source: https://techcrunch.com/2021/02/10/smarthop-raises-a-12m-series-a-to-ease-trucking-logistics/

This morning Ramp, a startup that competes in the corporate spend market, announced that it has secured a $150 million debt facility with Goldman Sachs. Ramp previously raised a $30 million Series B in late December 2020, after raising a $23 million Series A earlier in the same year.

TechCrunch spoke with Ramp co-founder and CEO Eric Glyman about its new credit access. Glyman said that until it was secured, his company had previously financed customer corporate spend off its own balance sheet. That effort would have become more difficult and inefficient as Ramp secured more customers, something that its rapid-fire fundraising implies that it has.

Its larger startup category is growing, as TechCrunch has reported. Ramp, Brex, Airbase, Divvy, Teampay and others compete for the custom of companies’ spend; the startups provide credit to businesses usually on a charge-card basis, collecting interchange revenues and, in some cases, software incomes as well.

Ramp intends on using its new credit facility to boost its product work, Glyman said, noting that its new access to revolving debt will free up capital that it can invest into software.

So far Ramp’s model appears to be working. The company told TechCrunch that it saw 47% growth from November to December, a figure that measures not revenue but transaction volume. However, as Ramp monetizes off of transaction volume, we can infer that its revenue scaled rapidly during the same period.

The tingling feeling you have on the back of your neck is correct; Ramp is now big enough to share harder numbers than mere percentage growth metrics. We do know that the company reached the $100 million spend threshold — an aggregate metric, not a rate — in the fall of 2020 after being founded around 18 months earlier. From there you can math your way to an estimate of the company’s current spend base.

Ramp is betting its software package, wrapped around corporate cards, on a focus on savings; the startup helps customers root out repeat payments and other mal expense.

It has competition. Ramp’s rivals are also layering software on top of corporate card offerings. A question that TechCrunch has raised is whether all players in the maturing corporate spend space will wind up charging for their software layer on top of their credit offerings (TeamPay, for example, reported both software revenues and transaction volume results to TechCrunch.)

Corporate spend TAM would rise if so.

To grok what’s going on in the corporate spend management space, recall the changes in the world of venture capital over the last decade or so. In olden times, venture firms had money to invest in startups. There wasn’t much by current standards, and it was concentrated in only a few hands. It was rare. So, venture capitalists were able to make you come to them, charge more equity per dollar of investment and not offer modern-level services. Today, however, in venture-land money is plentiful, so investing terms are more generous. And, on top of merely offering access to capital, your local VC probably wants to help startups hire, and more.

Corporate spend is the same. Offering credit and corporate cards is now barely table stakes; the value of the software on top of the revolving charge card is the competition.

Let’s see how fast Ramp can grow its customer base, spend and revenue, while scaling its software. And how soon one of its rivals tries to one-up its latest with news of its own. This is a fun space to watch.

NeuReality, an Israeli AI hardware startup that is working on a novel approach to improving AI inferencing platforms by doing away with the current CPU-centric model, is coming out of stealth today and announcing an $8 million seed round. The group of investors includes Cardumen Capital, crowdfunding platform OurCrowd and Varana Capital. The company also today announced that Naveen Rao, the GM of Intel’s AI Products Group and former CEO of Nervana System (which Intel acquired), is joining the company’s board of directors.

The founding team, CEO Moshe Tanach, VP of operations Tzvika Shmueli and VP for very large-scale integration Yossi Kasus, has a background in AI but also networking, with Tanach spending time at Marvell and Intel, for example, Shmueli at Mellanox and Habana Labs and Kasus at Mellanox, too.

It’s the team’s networking and storage knowledge and seeing how that industry built its hardware that now informs how NeuReality is thinking about building its own AI platform. In an interview ahead of today’s announcement, Tanach wasn’t quite ready to delve into the details of NeuReality’s architecture, but the general idea here is to build a platform that will allow hyperscale clouds and other data center owners to offload their ML models to a far more performant architecture where the CPU doesn’t become a bottleneck.

“We kind of combined a lot of techniques that we brought from the storage and networking world,” Tanach explained. Think about traffic manager and what it does for Ethernet packets. And we applied it to AI. So we created a bottom-up approach that is built around the engine that you need. Where today, they’re using neural net processors — we have the next evolution of AI computer engines.”

As Tanach noted, the result of this should be a system that — in real-world use cases that include not just synthetic benchmarks of the accelerator but also the rest of the overall architecture — offer 15 times the performance per dollar for basic deep learning offloading and far more once you offload the entire pipeline to its platform.

NeuReality is still in its early days, and while the team has working prototypes now, based on a Xilinx FPGA, it expects to be able to offer its fully custom hardware solution early next year. As its customers, NeuReality is targeting the large cloud providers, but also data center and software solutions providers like WWT to help them provide specific vertical solutions for problems like fraud detection, as well as OEMs and ODMs.

Tanach tells me that the team’s work with Xilinx created the groundwork for its custom chip — though building that (and likely on an advanced node), will cost money, so he’s already thinking about raising the next round of funding for that.

“We are already consuming huge amounts of AI in our day-to-day life and it will continue to grow exponentially over the next five years,” said Tanach. “In order to make AI accessible to every organization, we must build affordable infrastructure that will allow innovators to deploy AI-based applications that cure diseases, improve public safety and enhance education. NeuReality’s technology will support that growth while making the world smarter, cleaner and safer for everyone. The cost of the AI infrastructure and AIaaS will no longer be limiting factors.”

Source: https://techcrunch.com/2021/02/10/neureality-raises-8m-for-its-novel-ai-inferencing-platform/