& meet dozens of singles today!

User blogs

Last night, MetroMile and SPAC INSU Acquisition Corp. II completed their combination, putting the per-mile auto insurance startup up for regular trading today for the first time.

In the wake of last year’s debuts by neoinsurance companies Lemonade and Root, it’s not surprising to see others test the public markets. For example, Oscar Health recently announced its intention to go public via a traditional IPO.

How the new entrants will fare, however, is not clear.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

There is something of a tale of two companies in Lemonade and Root, with the pair valued at divergent multiples and sporting very different post-IPO trajectories, at least concerning their value.

While Lemonade has appreciated greatly from its IPO price ($29) to its current value ($155.33), Root’s share price dropped from its debut ($27) to today ($21.75).

While Lemonade has appreciated greatly from its IPO price ($29) to its current value ($155.33), Root’s share price dropped from its debut ($27) to today ($21.75).

This morning, as MetroMile starts its life as a public company, Oscar Health preps its own run at an IPO and other neoinsurance players like Hippo wait in the wings, let’s quickly check the difference between how Root and Lemonade have fared, and then ask what we can learn their different valuation multiples and what they might mean for the next startup insurance players hoping to gov v public while the IPO window is wide open.

Root, Lemonade

Lemonade’s path to the public markets was one that started modestly with its first IPO pricing, improved, and then, after technically going public at a down-round valuation, took off like a rocket. Root’s IPO pricing run involved what we thought of as a strong IPO range and then an above-target pricing.

But since then, Lemonade shares have rallied to several times their original price, while Root has dropped around 20%. Lemonade, for reference, sells rental insurance with an eye on going up-market in time to other forms of home-focused insurance. Root is in the auto insurance market, where MetroMile also works.

Both Lemonade and Root have yet to announce Q4 2020 results, so we’ll look at their Q3 details instead. We want to get a handle for how divergently their insurance incomes are being treated. This should give us a better understanding of how Wall Street values each, then we’ll apply those learnings to our two new companies. What we learn today will hopefully bear on other insurtech startups that want liquidity during the current cycle.

Results via the company, comparisons are Q3 2019:

- Root Q3 2020 revenue: $50.5 million (impaired from $75.8 million)

- Root Q3 2020 gross profit: $0.7 million (improved from -$36 million)

- Root Q3 2020 net loss: $85.2 million (improved from -$100.1 million)

- Premiums in force: $600.1 million

- Valuation: $5.45 billion (Google Finance)

This gives us Root revenue run rate multiple of around 27x, and a premium in force multiple of just over 9x. Now let’s observe Lemonade’s data.

Results via the company, comparisons are Q3 2019:

- Lemonade Q3 2020 revenue: $10.5 million (impaired from $17.8 million)

- Lemonade Q3 2020 gross profit: $7.3 million (improved from $4.0 million)

- Lemonade Q3 2020 net loss: $30.9 million (improved from $31.1 million)

- Premiums in force: $188.9 million

- Valuation: $9.33 billion (Google Finance)

Looking at the same two metrics, Lemonade has a run rate multiple of 222x, and a premium in force multiple of more than 49x.

Source: https://techcrunch.com/2021/02/10/how-will-investors-value-metromile-and-oscar-health/

Alexa von Tobel has a unique vantage point on the world of startups. She debuted in the tech space with the launch of LearnVest in 2009. The company raised nearly $70 million and sold to Northwestern Mutual in 2015 for an estimated $250 million, according to reports.

Since, von Tobel has founded her own venture firm called Inspired Capital. Portfolio companies include Finix, Chief, Orum, Habi and more.

But before she was an entrepreneur, or the Chief Digital Officer of a major financial services company (and then Chief Innovation Officer, overseeing the Northwestern Mutual’s venture arm), or the founding partner of a venture capital firm, she was a Certified Financial Planner.

At TechCrunch Early Stage in April, von Tobel will lead a breakout on financial planning targeted specifically at early stage startups.

Take a look:

Finance for Founders

As a founder, you not only have to master your company’s finances, you also have to tackle your own personal finances. Managing your money as a founder comes with a unique set of questions. Leveraging her expertise from LearnVest and as a Certified Financial Planner, Alexa will share financial planning best practices so founders can remove this layer of stress from the pressure of building a business.

Early Stage is back in 2021 and better than ever. The event is centered around all the startup core competencies that founders will need in their tool chest to build successful businesses, from marketing to operations to fundraising.

von Tobel joins an all-star lineup, which includes experts in the fields of sales, seed and A fundraising, recruiting, and much much more. These experts will give presentations across a variety of topics, and then answer questions live from the audience.

The event is split across two days: On April 1 we’ll be hearing from experts in fundraising and operations, and on July 8 we’ll learn more from experts in fundraising and marketing. At both events, the TechCrunch pitch-off will be center stage, giving early stage companies the chance to pitch to and get feedback from seasoned investors. Early Stage is entirely virtual, so folks from anywhere in the world can pick up and ticket and show up from the comfort of their couch.

We sincerely hope you’ll join us!

DNA profiling company Ancestry has confirmed it fought two U.S. law enforcement requests to access its DNA database in the past six months, but that neither request resulted in turning over customer or DNA data.

The Utah-based company disclosed the two requests in its latest transparency report covering the latter half of 2020. The report said Ancestry “challenged both of these requests, which were withdrawn,” and that the company “provided no data” at the time of the report, published Tuesday.

Ancestry did not say which agencies or police departments requested the DNA data or for what reason the company challenged the request. Ancestry spokesperson Gina Spatafore confirmed the search warrants were to obtain DNA data but declined to comment beyond what was in the report.

The company also said in its most recent report that it “refused numerous inquiries” from U.S. law enforcement for failing to obtain the proper legal process. The report also said the company received four valid law enforcement requests, but that it did not provide any data in response.

Ancestry has more than 3.6 million subscribers and has more than 18 million customer DNA profiles in its database, making it the largest in the world.

DNA profiling companies like Ancestry are increasingly popular with customers wanting to learn more about their family heritage, their genetic markers, and to understand their cultural and ethnic backgrounds. But as these DNA databases become larger, they are also attracting attention from law enforcement who want access to help solve crimes.

On its website, Ancestry says: “We believe that the nature of our members’ DNA data is particularly sensitive, so we insist on a court order or search warrant as the minimum level of due process before we will review our ability to comply with the request. We also seek to put our members’ privacy first, so we also will try to minimize the scope or even invalidate the warrant before complying.”

It’s not the first time Ancestry has pushed back against a legal demand. Last year the company said it rejected an out-of-state search warrant, ordered by a court in Pennsylvania, to “seek access” to its DNA database on the grounds that the warrant was “improperly served.”

Ancestry has only complied with one search warrant for DNA data from a database it acquired and later made public, not realizing that police would use the database to search for leads.

It’s not uncommon for companies with large amounts of customer data to frequently receive law enforcement demands for user data — or for companies to publish periodic transparency reports that detail the number of legal demands they receive.

To its credit, Ancestry is one of only two DNA profiling sites that publishes a transparency report. 23andMe also publishes the number of data demands it receives each quarter, but to date has not released any customer data to law enforcement. FamilyDNA said over a year ago that it was “working on publishing” a transparency report.

The move by Ancestry and 23andMe came shortly after police used DNA profiling site GEDmatch to identify the DNA of a suspected serial killer, a breakthrough which later led to the arrest of the so-called Golden State Killer in 2018. GEDmatch said it was “not approached by law enforcement” prior to the search. GEDmatch soon after allowed its users to opt-in for their DNA to be included in police searches.

Last year, GEDmatch confirmed it was hit by two data breaches that made user profiles visible to other users, including law enforcement.

Source: https://techcrunch.com/2021/02/10/ancestry-police-warrant-dna-database/

Apple Maps is inching into more Waze-like territory with an update that will give drivers the ability to report road hazards, accidents, or even speed traps. The new features are live now in the iOS 14.5 beta, which is now open to public beta testers as well as developers, but won’t roll out to the general public until later this spring, Apple says.

To use the new features, drivers will be able to report road issues and incidents by using Siri on their iPhone or through Apple’s CarPlay. For example, during navigation, they’ll be able to tell Siri things like “there’s a crash up head,” “there’s something on the road,” or “there’s a speed trap here.” They’ll also be able to correct stale accident or hazard alert information by saying things like “the hazard is gone” or the “incident is no longer here.”

While using Siri makes the reporting experience safer, the updated app will also allow users to swipe up on the map to tap a report button to alert others to accidents, hazards or speed traps, as well.

The update could present a challenge to Google-owned navigation app Waze, which has long been a popular tool for staying alerted to road conditions, hazards, accidents and police presence. In Waze, users can interact by touching the screen or issuing commands through Google Assistant, but voice support for iOS users, naturally, is more limited. Today, Waze supports the use of Siri Shortcuts, which have to be manually configured and added to Siri, for example.

The new Apple Maps features could also make Apple’s app more appealing to users who feel their user data is safer within Apple’s ecosystem, thanks to the work Apple has done to position itself as the company that cares more about consumer privacy.

Notable, too, is the addition of speed traps, which represents a shift in direction for Apple Maps. Historically, Apple has been opposed to including police warnings in its product. But that lack of support has contributed to Google’s ability to dominate the navigation and mapping market on mobile devices.

Apple’s decision here also follows an expansion of Waze-like features to Google Maps, blurring the distinctions between Google’s two navigation products even further. And as Google continued to roll out the ability to report accidents, traffic, speed traps and more to Google Maps users on iOS, it made it even harder for anyone who would have otherwise considered switching to Apple Maps to make the jump.

Apple, belatedly, has seemed to realize this as well.

The founders of Accord, an early stage startup focused on bringing order to B2B sales, are not your typical engineer founders. Instead, the two brothers, Ross and Ryan Rich, worked as sales reps seeing the problems unique to this kind of sale first-hand.

In November 2019, they decided to leave the comfort of their high-paying jobs at Google and Stripe to launch Accord and build what they believe is a missing platform for B2B sales, one that takes into account the needs of both the sales person and the buyer.

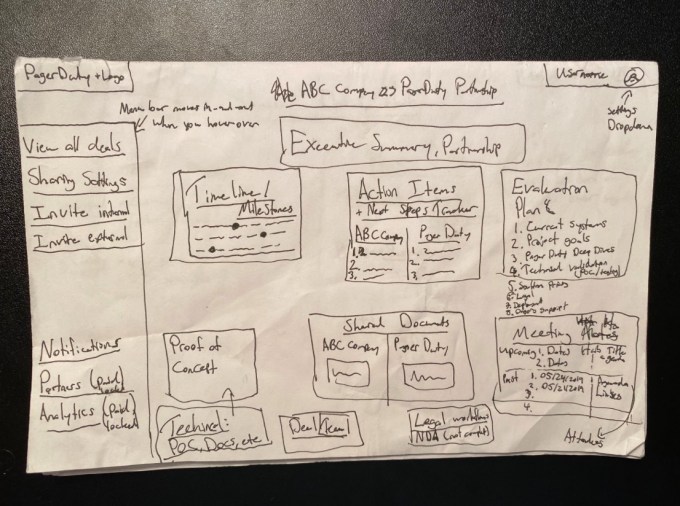

Today the company is launching with a $6 million seed round from former employer Stripe and Y Combinator. It should be noted that the founders applied to YC after leaving their jobs, and impressed the incubator with their insight and industry experience, even though they didn’t really have a product yet. In fact, they literally drew their original idea on a piece of paper.

The original prototype was just a drawing of their idea. Image Credits: Accord

Recognizing they had the sales skills, but lacked programming chops, they quickly brought in a third partner, Wayne Pan to bring their idea to life. Today, they have an actual working program with paying customers. They’ve created a kind of online hub for B2B sales people and buyers to interact.

As co-founder Ross Rich points out these kinds of sales are very different from the consumer variety, often involving as many as 14 people on average on the buyer side. With so many people involved in the decision-making process, it can become unwieldy pretty quickly.

“We provide within the application shared next steps and milestones to align on and that the buyer can track asynchronously, a resource hub to avoid sorting through those hundreds of emails and threads for a single document or presentation and stakeholder management to make sure the right people are looped in at the right time,” Rich explained.

Accord also integrates with the company CRM like Salesforce to make sure all of that juicy data is being tracked properly in the sales database. At the same time, Rich says the startup wants to this platform to be a place for human interaction. Instead of an automated email or text, this provides a place where humans can actually interact with one another, and he believes that human element is important to help reduce the complexity inherent in these kinds of deals.

With $6 million in runway and a stint at Y Combinator under their belts, the founders are ready to make more concerted go-to-market push. They are currently at 9 people, mostly engineers aside from the two sales-focused founders. He figures to be bringing in some new employees this year, but doesn’t really have a sense of how many they will bring on just yet, saying that is something that they will figure out in the coming months.

As they do that, they are already thinking about being inclusive with several women on the engineering team, recognizing if they don’t start diversity early, it will be more difficult later on. “[Hiring a diverse group early] only compounds when you get to nine or 10 people and then when you’re talking to someone and they are wondering ‘do I trust this team and is that a culture where I want to work?’ He says if you want to build a diverse and inclusive workplace, you have to start making that investment early.

It’s early days for this team, but they are building a product to help B2B sales teams work more closely and effectively with customers, and with their background and understanding of the space, they seem well positioned to succeed.

Source: https://techcrunch.com/2021/02/10/accord-launches-b2b-sales-platform-with-6m-seed/