& meet dozens of singles today!

User blogs

MetroMile began trading as a public company yesterday. Its exit from the private market was accelerated by its decision to combine with a special purpose acquisition company, or SPAC.

Such transactions have exploded in popularity in recent years, bridging the gap between a host of richly-valued private companies and endless bored capital. SPACs raise cash, go public and then merge with a private entity. The SPAC then dissolves itself into the combined entity, a process that often includes an additional slug of money (PIPE) for good measure.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

SPAC-led debuts can move faster than a traditional IPO, making them attractive to companies in a hurry. And with more visibility into how much capital might be raised than during a traditional public-offering pricing run, they can smooth worries amongst target-companies regarding how much cash they can attract by leaving the private-market fold.

MetroMile is hardly the final company we expect to debut this year via a SPAC. The list is long and may include fellow neoinsurance company Hippo. (Hippo declined to comment on the matter.)

MetroMile is hardly the final company we expect to debut this year via a SPAC. The list is long and may include fellow neoinsurance company Hippo. (Hippo declined to comment on the matter.)

But with many more SPACs coming our way, we took MetroMile’s debut as a learning moment. To that end, we got on the horn with CEO Dan Preston to chat about what the day meant for his company, and to elicit a note or two on the SPAC process for our own enjoyment.

MetroMile’s SPACtacular debut

TechCrunch asked Preston about the SPAC world and how his combination came about. He said his firm started by dipping its toe into the blank-check waters, kicking off with small set of conversations, chats that quickly gathered traction.

But don’t take that to mean that any company will elicit a similar market response. Preston said SPACs are designed for a specific class of company; namely those that want or need to share a bit more story when they go public. Younger companies, in other words, for whom a traditional S-1 filing might not be provide a sufficient summation of its potential.

Shell’s plan to roll out 500,000 electric charging station in just four years is the latest sign of an EV charging infrastructure boom that has prompted investors to pour cash into the industry and inspired a few companies to become public companies in search of the capital needed to meet demand.

Since the beginning of the year, three companies have been acquired by special purpose acquisition vehicles and are on a path to go public, while a third has raised tens of millions from some of the biggest names in private equity investing for its own path to commercial viability.

The SPAC attack began in September when an electric vehicle charging network ChargePoint struck a deal to merge with special-purpose acquisition company Switchback Energy Acquisition Corporation, with a market valuation of $2.4 billion. The company’s public listing will debut February 16 on the New York Stock Exchange.

In January, EVgo, an owner and operator of electric vehicle charging infrastructure, agreed to merge with the SPAC Climate Change Crisis Real Impact I Acquisition for a valuation of $2.6 billion— a huge win for the company’s privately held owner, the power development and investment company LS Power. LS Power and EVgo management, which today own 100% of the company will be rolling all of its equity into the transaction. Once the transaction closes in the second quarter, LS Power and EVgo will hold a 74% stake in the newly combined company.

One more deal soon followed. Volta Industries agreed to merge this month with Tortoise Acquisition II, a tie-up that would give the charging company named after battery inventor Alessandro Volta a $1.4 billion valuation. The deal sent shares of the SPAC company, trading under the ticker SNPR, rocketing up 31.9% in trading earlier this week to $17.01. The stock is currently trading around $15 per-share.

Not to be outdone, private equity firms are also getting into the game. Riverstone Holdings, one of the biggest names in private equity energy investment, placed its own bet on the charging space with an investment in FreeWire. That company raised $50 million in new round of funding earlier this year.

“The writing is on the wall and the investors have to take the time. There’s been a flight out of the traditional investment opportunities in markets,” said FreeWire chief executive, Arcady Sosinov, in an interview. “There’s been a flight out fo the oil and gas companies and out fo the traditional utilities. You have to look at other opportunities… This is going to be the largest growth opportunity of the next ten years.”

FreeWire deploys its infrastructure with BP currently, but the company’s charging technology can be rolled out to fast food companies, post offices, grocery stores, or anywhere where people go and spend somewhere between 20 minutes and an hour. With the Biden Administration’s plan to boost EV adoption in federal fleets, post offices actually represent another big opportunity for charging networks, Sosinov said.

“One of the reasons we find electrification of mobility so attractive is because it’s not if or how, it’s when,” said Robert Tichio, a partner at Riverstone in charge of the firm’s ESG efforts. “Penetration rates are incredibly low… compare that to Norway or Northern Europe. They have already achieved double digit percentages.”

A recent Super Bowl commercial from GM featuring Will Farrell showed just how far ahead Norway is when it comes to electric vehicle adoption.

“The demands onc capital in the electrification of transport will begin to approach three quarters of a trillion annually,” Tichio said. “The short answer to your question is that the needs for capital now that we have collectively, politically, socially economically come to a consensus in terms of where we’re going and we couldn’t say that 18 months ago is going to be at a tipping point.”

Shell already has electric vehicle charging infrastructure that it has deployed in some markets. Back in 2019 the company acquired the Los Angeles-based company Greenlots, an EV charging developer. And earlier this year Shell made another move into electric vehicle charging with the acquisition of Ubitricity in the UK.

“As our customers’ needs evolve, we will increasingly offer a range of alternative energy sources, supported by digital technologies, to give people choice and the flexibility, wherever they need to go and whatever they drive,” said Mark Gainsborough, Executive Vice President, New Energies for Shell, in a statement at the time of the Greenlots acquisition. “This latest investment in meeting the low-carbon energy needs of US drivers today is part of our wider efforts to make a better tomorrow. It is a step towards making EV charging more accessible and more attractive to utilities, businesses and communities.”

Maisonette, a four-year-old, New York-based company has aimed from the outset to become a one-stop curated shop for everything a family might need for their young children.

That plan appears to be working. Today, the company — which launched with preppy young children’s apparel and has steadily built out categories that include home decor, home furniture, toys, gear, and accessories — says it doubled its number of customers last year and tripled its revenue. Indeed, even as COVID could have crimped its style — sale of children’s dress-up clothes slowed for a time — its DIY and STEM toy sales shot up 1,400%.

Though the company keeps its sales numbers private, its growth is interesting, particularly given the unabated growth of Amazon, which became the nation’s leading apparel retailer somewhere around the end of 2018.

Seemingly, much of Maisonette’s traction owes to the trust it has built with customers, who see its offerings as high-end yet accessible relative to the many high-end fashion brands that are also increasingly focused on the children’s market, like Gucci and Burberry.

Specifically, the 75-person company has a merchandising team that prides itself on working with independent brands and surfacing items that are hard to find elsewhere.

Maisonette also launched its own apparel line roughly 30 months ago called Maison Me. Focused around “elevated basics” at a more reasonable price point, the line, made in China, is seeing brisk sales to families who buy items time and again as their kids outgrow or wear holes in them, says the company.

It helps that Maisonette’s founders have an eye for what’s chic. Cofounder Sylvana Ward Durrett and Luisana Mendoza Roccia met at Vogue magazine, where Durrett spent 15 years, joining the staff straight from Princeton and becoming its director of events (work that earned her a high profile in fashion circles). Roccia joined straight from Georgetown the same year, 2003, and left as the magazine’s accessories editor in 2008.

For those who might be curious, their former boss, Anna Wintour, is a champion of theirs. Yet they also have some other powerful advocates, including NEA investor Tony Florence, a kind of e-commerce whisperer who has also led previous investments on behalf of his firm in Jet, Goop, and Casper.

NEA is an investor in Maisonette, as is Thrive Capital and the growth-stage venture firm G Squared, which just today announced it led a $30 million round in the company that brings its total funding to $50 million.

Another ally is Marissa Mayer, who first met Durrett back in 2009 when Mayer was still known as Google’s first female engineer its most fashionable executive. Not only has their friendship endured — Mayer says she named one of her twin daughters Sylvana because she adored the name — but Mayer is on the board of Maisonette, where she has presumably helped refine its data strategy, including around an inherent advantage that the company enjoys: its very young customers.

“One of the things that’s really helpful when it comes to data and e-commerce is when you can capture people at a particular life stage,” Mayer explains. “It’s why people liked wedding registries. You get married, then you have children and [the retailer] can follow the children’s ages and start anticipating that customer’s needs and what they’re going to want two years from now.”

In terms of “predictable supply chain, for inventory selection, for just being able to meet that moment, having insight into those stages is really important and helpful,” she says. It can also be very lucrative for Maisonette as it continues to build out its business, notes Mayer,

Certainly, much is working in the company’s favor already. To Mayer’s point, Roccia says that more than half of Maisonette’s sales last year came from repeat customers. More, it already has an audience of more than 800,000 people who either receive emails from the company or follow its social media channels. (Maisonette also features a healthy dose of content at its site.)

Unlike some e-commerce businesses, Maisonette is asset-lite, too. Though it has opened a handful of pop-up stores previously and was contemplating a bigger move into retail (“that’s now on pause,” says Durrett), the company doesn’t have warehouses to manage. Instead, items are shipped directly to customers from the various retailers featured at its site.

Perhaps most meaningful of all, the company is competing in what is a massive and growing market. In the U.S. alone, the children’s apparel market is estimated to be $34 billion. Meanwhile, the children’s market is $630 billion globally. While Maisonette is selling to U.S. customers alone right now, it plans to use some of that new funding to move into international markets, says Roccia, who has been living in Milan with her own four children during the pandemic, while Durrett began working out Maisonette’s mostly empty Brooklyn headquarters in January to create a bit of space from her three.

Indeed, on a Zoom call from their far-flung locations, they talk at length about parents needing to create new space to work from home right now, as well as to update rooms for kids attending virtual school. While no one asked for a global shutdown, home decor is a “category that has picked up due to the Covid effect,” notes Roccia.

Asked what other trends the two are tracking — for example, Maisonette features the mommy-and-me clothing pairings that have become big business in recent years — Roccia says that even with the world shut down, it remains a “huge” trend. “It started with holiday pajamas — that was kind of the catalyst to this whole movement — and now swimwear and just casual dressing has become a pretty big piece of the business, too.”

As for what Durrett has noticed, she laughs. “Llamas are big. We sell a llama music player that we had to bring back on the site several times over the holidays.” Also “rainbows and unicorns. As cliche as it sounds, we literally can’t keep them in stock.”

Unicorns, she adds, “are a thing.”

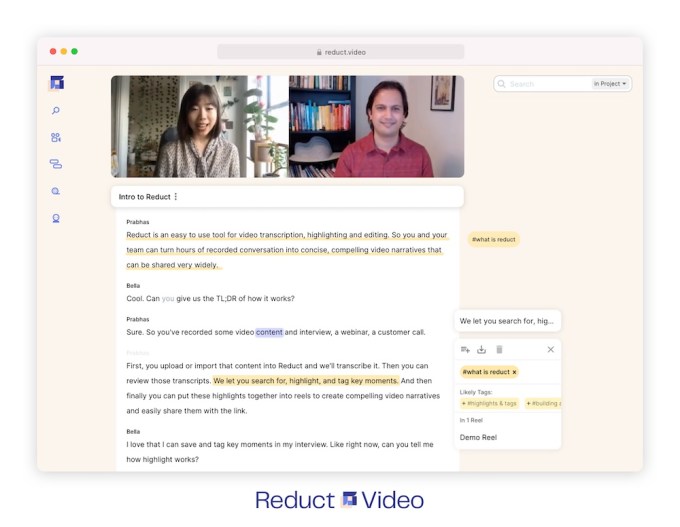

The team at Reduct.Video is hoping to dramatically increase the amount of videos created by businesses.

The startup’s technology is already used by customers including Intuit, Autodesk, Facebook, Dell, Spotify, Indeed, Superhuman and IDEO. And today, Reduct is announcing that it has raised a $4 million round led by Greylock and South Park Commons, with participation from Figma CEO Dylan Field, Hopin Chief Business Officer Armando Mann and former Twitter exec Elad Gil.

Reduct was founded by CEO Pabhas Pokharel and CTO Robert Ochshorn (both pictured above). Pokharel argued that despite the proliferation of streaming video platforms and social media apps on the consumer side, video remains “underutilized” in a business context, because it simply takes so much time to sort through video footage, much less edit it down into something watchable.

As Pokharel demonstrated for me, Reduct uses artificial intelligence, natural language processing and other technologies to simplify the process by automatically transcribing video footage (users can also pay for professional transcription), then tying that transcript to the video.

“The magic starts there: Once the transcription has been made, every single word is connected to the [corresponding] moment in the video,” he said.

Image Credits: Reduct.Video

That means editing a video is as simple as editing text. (I’ve taken advantage of a similar linkage between text and media in Otter, but Otter is focused on audio and I’ve treated it more as a transcription tool.) It also means you can search through hours of footage for every time a topic is mentioned, then organize, tag and share it.

Prabhas said that AI allows Reduct to simplify parts of the sorting and editing process, like understanding how different search terms might be related. But he doesn’t think the editing process will become fully automated — instead, he compared the product to an “Iron Man suit,” which makes a human editor more powerful.

He also suggested that this approach changes businesses’ perspective on video, and not just by making the editing process easier.

“Users on Reduct emphasize authenticity over polish, where it’s much more the content of the video that matters,” Prabhas said. He added that Reduct has been “learning from our customers” about what they can do with the product — user research teams can now easily organize and share hundreds of hours of user footage, while marketers can turn customer testimonials and webinars into short, shareable videos.

“Video has been so supply constrained, it’s crazy,” he continued. “There are all these use cases for asynchronous video that [companies] haven’t even bothered with.”

For example, he recalled one customer who said that she used to insist that team members attend a meeting even if there was only two minutes of it that they needed to hear. With Reduct, she can “give them that time back” and just share the parts they need.

Source: https://techcrunch.com/2021/02/11/reduct-video-funding/

Human Interest, a 401(k) provider for small and medium-sized businesses (SMBs), announced Thursday that it has tacked on another $55 million to its Series C.

The news is notable for a couple of reasons. For one, the San Francisco-based company had already raised $50 million across two tranches in 2020. Secondly, the majority of its existing backers (about 40 of 55) joined one new investor — NEA spinout NewView Capital (NVC) — in pumping more capital into Human Interest.

And last but definitely not least, the latest extension — which closed in December but is only now being publicly announced — effectively doubles Human Interest’s valuation from its financing a few months prior.

CEO Jeff Schneble would not disclose the company’s current valuation, but he did say Human Interest “is now in the position of becoming a unicorn” the next time it raises, if that round “follows the same step-ups as the last couple” of financings.

With this latest extension, Human Interest has now raised a total of $136.7 million since its 2015 inception.

Human Interest’s growth has been impressive. It’s gone from adding about $100,000 a month in net new revenue in early 2019 to now adding more than $1 million a month in net new revenue, according to Schneble. The startup’s goal is to get to over $2 million a month by year’s end.

“We’ve grown about 10 times in the past 18 months or so, and we’re not going to stop here,” he told TechCrunch. “Our goal is to get to $100 million-plus ARR [annual recurring revenue] in the next three years so that we can go public in the next three to four years.”

Since its launch, Human Interest says it has helped nearly 3,000 businesses across America to offer retirement accounts to their more than 80,000 employees.

The COVID-19 pandemic was challenging, but led to an interesting shift in the company’s business. Pre-2020, about 85% of its customers were first-time 401(k) users. Last year, that number dropped to about 50%. This means that more companies moved from existing plans to Human Interest.

“Given there was a recession and a lot of uncertainty, it was a much easier pitch, considering we could offer a more affordable product,” Schneble said.

Human Interest says it works with “every kind of SMB” — from tech startups to law offices, from dentists to dog walkers, manufacturing firms and social justice nonprofits. Customers include a San Francisco Bay Area electrician company, a Denver-based pizza chain and a Seattle-based chain of gas stations and convenience stores.

Despite being just a few years old, Schneble said the company doesn’t view itself as a startup.

“We want to build a really big company that will be around for decades, and can go public,” he said. “If we were trying to sell the company, we might be doing this differently.”

Currently, Human Interest has about 300 employees, up from a little over 100 a year ago. It plans to double the size of its engineering team this year.

Looking ahead, Schneble said the company is simply out “to do more of the same.”

“We don’t need new products,” he told TechCrunch. “There’s so much runway just doing what we’re doing, and that’s taking market share from others.”

It also plans to focus on improving the technology on its platform, which it moved from a third-party provider to in-house in 2020. The move led the company to double its margins over the past six months while eliminating transaction fees for plan administrators and participants, according to Schneble.

“Often financial services products get worse as you go,” he said. “We want to be the opposite, and this year are focused on making our platform as awesome as it can be.”

Human Interest says it also launched new offerings, Complete and Concierge, last year in an effort to simplify retirement plan administration and “make retirement savings accessible to people in all lines of work.”

“The big incumbents haven’t figured out how to make plans affordable and accessible for smaller companies,” Schneble said. “We knew that to make a permanent dent in this country’s retirement crisis, we had to do something different.”

The 401(k) space is indeed a growing one. Last July San Mateo-based Guideline — which is also focused on SMBs — announced an $85 million Series D round co-led by Al Gore’s Generation Investment Management and Greyhound Capital. It was later revealed that American Express Ventures had joined the financing as an investor.

With more than $2 billion in assets under management, new investor NewView Capital (NVC) — which also backed Plaid — aims to match late-stage funding with “significant operational support.”

NewView founder and Managing Partner Ravi Viswanathan said he was impressed by how the company simplifies the process and administration for SMBs to offer 401(k)s and “is able to do so at lower fees through software and automation.”

The NewView team was also drawn to the company’s desire to make offering a 401(k) accessible for more employers. In a blog post, Ankit Sud and Christina Fa wrote:

“Traditional 401(k) providers like Vanguard and Fidelity designed and priced their plans for large businesses. The administrative burden and high fees make it unaffordable for small business owners. In fact, only 10% of small to mid-sized businesses (SMBs) offer 401(k) plans to their workforce, despite employing one-third of the working population…Human Interest brings simple, affordable 401(k) plans to the 90% of small businesses that do not offer retirement plans today. “

Source: https://techcrunch.com/2021/02/11/401k-provider-human-interest-doubles-valuation-with-55m-fundraise/