& meet dozens of singles today!

User blogs

Knife Capital, a South African venture capital firm, is raising a $50 million fund for startups looking to raise Series B financing. With Knife Fund III called the African Series B Expansion Fund, the firm seeks to directly invest in the aggressive expansion of South African breakout companies. It also plans to co-invest in companies across the rest of Africa.

The first fund, known as Knife Capital Fund I or HBD Venture Capital, was a closed private equity fund managed by Eben van Heerden and Keet van Zyl. The firm offered seed capital to startups. It also generated significant exits from its portfolio — VISA acquisition of fintech startup Fundamo, and orderTalk’s acquisition by UberEats come to mind.

In 2016, the VC firm launched its current 12J offering with Knife Capital Fund II. The fund (KNF Ventures) which invests primarily in Series A stage has eight startups in its portfolio. Last year the firm told TechCrunch of its intention to extend the Fund II and open to new investors. The plan was to give startups access to networks, money and expansion opportunities.

“We want to help South African and African companies internationalize,” said co-managing partner Andrea Bohmert at the time. A testament to its cause, one of its portfolio companies, DataProphet, raised $6 million Series A to expand into the U.S. and Europe.

Bohmert tells TechCrunch that the third fund aims to address the critical Series B funding gap that has characterised the venture capital asset class in South Africa, resulting in businesses not reaching full potential or exiting too early.

“Lately, we see an increase in companies able to raise $2 million to $5 million funding rounds. And while the companies are operating within their home country, in our case South Africa, such amounts take you far due to the local cost structure,” Bohmert says. “However, once these companies start gaining international traction and need to build an infrastructure outside of their home country, they need to raise significant amounts to afford so. There are currently hardly any South African VC funds, perhaps other than Naspers Foundry, that can write checks of $5 million or more and are willing to deploy them to finance the externalization of South African companies into larger markets.”

As a result, Bohmert argues that Africa has become an incubator for international VCs who can write these checks but cannot provide the local support most of these companies still need. Likewise, there are instances where international investors actively search for local co-investors in South Africa to invest in a round, and not finding one might blow the chances of them going further with the investment. This is the gap Knife Capital intends to fill by launching this fund, Bohmert says.

“We want to be the local lead investor of choice for South African technology companies looking to internationalise, co-investing with international investors who can lead the Series B discussion and further.”

This week, Knife Capital secured $10 million out of the 50 from Mineworkers Investment Company (MIC), a South Africa-based investment firm. The commitment positions MIC as an anchor investor to the fund alongside other local and international investors.

Nchaupe Khaole, the CIO at MIC, explained that the move to change the way local institutional investors approach venture capital investment has been in MIC’s pipeline for a while. And by partnering with Knife Capital, this idea can begin to materialize.

“Our commitment brings to the table the investment, along with many of our strengths as an experienced player. One of which is our ability to influence the companies within our portfolio to partner with us and effect real, tangible change to the South African economy. We are delighted to be a key catalyst in the success of this funding round,” he said.

As per other details, Knife Capital aims for a first close by May and a final close by the end of the year. Most of its participation will be co-investing, and the idea is to that in 10 to 12 companies.

TikTok is expanding its integrations with third-party services, with the launch of a test that allows creators in the food space to link directly to recipes found on the Whisk app. This is being made possible by way of a new “recipe” button overlaid on related TikTok food videos. The feature makes a TikTok cooking video more actionable as it encourages viewers to not just watch the content, but also take the next step to save the content for later use.

The new button could also potentially drive significant traffic to Whisk — especially if a particular recipe went viral — like the “TikTok Pasta” videos have, in recent days.

The addition is being made available in partnership with Whisk and is currently in “alpha testing,” TikTok confirmed to TechCrunch. TikTok says its also worked with Whisk to help identify food content creators who could serve as the first adopters of the new functionality.

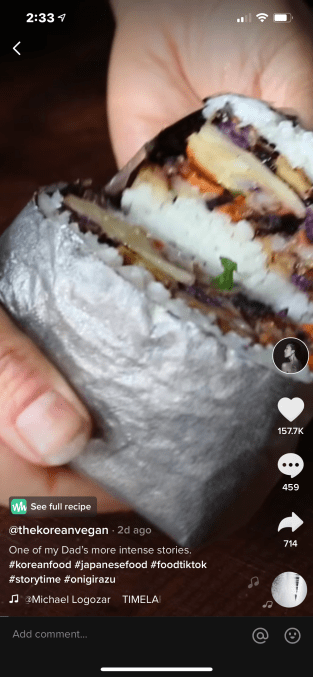

We found the feature in action on one of TikTok’s top food creators profiles, The Korean Vegan, aka Joanne L. Molinaro.

Image Credits: TikTok screenshot

The button was also first spotted by social media consultant Matt Navarra on the @feelgoodfoodie TikTok account.

New? TikTok’s got a recipe card feature via an integration with @whiskteam pic.twitter.com/5C5fOyR8YZ

— Matt Navarra (@MattNavarra) February 10, 2021

The way the feature works, from the TikTok viewer’s side, is fairly simple.

A user who’s in the test group may come across a video on the app that includes the new button that reads: “See full recipe.” The button appears just above the creator name and video description on the bottom left of the screen — the same spot where the “Green Screen” button would otherwise appear. When tapped, you’re directed to a Whisk page where you can view the recipe photos, ingredients, and choose to save the recipe to your own collection, if you’re a Whisk user.

This all takes place while still inside the TikTok app.

On the creator’s side, adding the recipe button to a video is done during the posting workflow via a new “add link” option.

The ability to add a “save recipe” feature to a TikTok video wouldn’t necessarily have to be limited to food content creators, however. Whisk allows anyone to create a recipe community on its platform, which means people can grow their followings simply by curating their favorite recipes around some sort of category or theme — like Instant Pot meals or favorite smoothie ideas or comfort baking, for example.

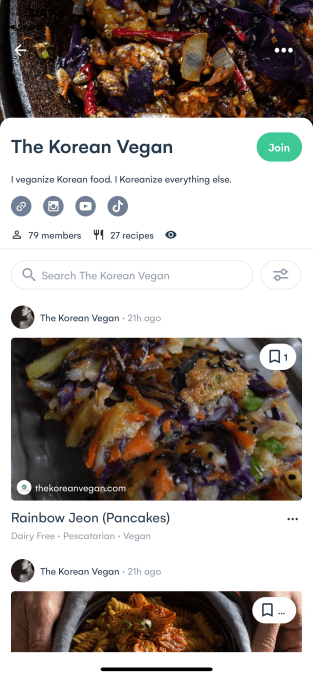

Image Credits: Whisk

Whisk has also been working more recently to expand its recipe communities to serve as a home for curators and creators alike by allowing them to point to their websites, if they have one, or link out to their social media profiles, including Instagram, YouTube, and of course, TikTok.

The idea is that fans would view the content on social media and be inspired, then visit Whisk as the next step in terms of saving the recipe, creating a shopping list, or actually trying the recipe at home. This sort of “actionable” content could present a challenge to Pinterest, which has been expanding into short-form video through Story Pins. The feature allows Pinterest creators to share video content in the tappable “story” format — including recipe and cooking videos.

Pinterest hoped to use Story Pins as a way to differentiate its short-form videos from rivals, noting during its earnings last week that Story Pins are “not as focused on entertainment,” but rather “what the Pinner could do to enrich their own lives.”

TikTok’s selection of Whisk as a new partner makes sense as the recipe app has gained a rapid following since its late 2019 launch. Today, Whisk sees over 1.5 million interactions per month on its platform. It also just won a “Best of 2020″ Google Play award.

Whisk’s TikTok button, however, is not the first integration of its kind.

Last month, learning platform Quizlet announced a similar TikTok feature aimed at creators in the education space. In its case, the buttons overlaid on top of videos would link directly to Quizlet’s study sets, like its digital flashcards. At the time, it wasn’t clear that the new Quizlet feature was a part of a larger effort to connect TikTok videos more directly with related apps and services — an addition that could lead to an expansion in TikTok content and, perhaps, influencer sponsorships, further down the road.

There’s potential for TikTok to form other partnerships like this as well, given the app’s ability to drive trends across a number of content categories, effectively becoming the video alternative to Pinterest’s image bookmarking site.

At year-end, for example, TikTok published lists of 2020’s “top trends” in cooking, music, beauty, and style. On the style front, TikTok already ran a livestreamed video shopping pilot with Walmart that used influencers to drive purchases, demonstrating the potential in connecting video inspiration to consumer action in an even more timely fashion.

“For All Mankind: Time Capsule” is a new augmented reality app created by Apple to promote the upcoming second season of “For All Mankind,” which premieres on February 19 on Apple TV+.

Even for those of you who aren’t fans of the the show — which tells the story of an alternate history in which the Soviet Union beat the United States to the moon leading to an extended space race in the ’70s and beyond — the app is still noteworthy as another sign of Apple’s interest in AR, even beyond the reports that it’s working on AR glasses.

“Time Capsule” takes place during the decade-long gap between seasons one and two, tracing the relationship between Danny Stevens and his parents, the astronauts Gordo and Tracy Stevens. Users who download the free iOS app will be able to interact with a variety of objects — such as a mixtape and an Apple II computer — that illustrate the family relationship.

“Time Capsule” walks users through a linear experience with between 45 and 60 minutes of content, but it sounds like it’s also designed to support further exploration and additional visits. You’ll be able to check “D-mail” and play a text adventure game on the computer, and if you’ve got an Apple device with a LiDAR scanner (such as an iPhone 12 Pro, iPhone 12 Pro Max or iPad Pro) you can use a virtual slide projector to project Danny’s family photos onto your own walls.

“For All Mankind” producer Ben McGinnis said the app was created in parallel with the show’s second season, with the creative team working with Apple to figure out “which objects were best for getting the story across,” and offering feedback as the actual AR objects were developed.

Creator and executive producer Ron Moore added that he’s excited about the possibility of giving fans new ways to explore the show’s world and characters, especially since writers on the show often create far more material than what ends up on screen.

“Part of the promise of this technology is that a fan of any show, by definition, usually wants to know more about it, more about the characters,” Moore said.

In this case, “For All Mankind”‘s team had written things like love letters and newscasts that are only seen briefly on screen. They could then be used in the app, along with additional material by Stephanie Shannon, a writer on the show. The key, Moore said, is to “play fair by the audience that just wants to show up.”

“You can certainly watch ‘For All Mankind’ on-air without the AR stuff,” he added. “But if you do the AR stuff first, it enriches your experience.”

Source: https://techcrunch.com/2021/02/11/for-all-mankind-time-capsule/

Public.com, a social-focused free stock trading service, is nearing the close of a Series D just two months after raising a $65 million Series C, sources familiar with the matter told TechCrunch.

The San Francisco-based fintech aims to give people the ability to invest in companies using any amount of money, with a focus on community activity over active trading. It competes with Robinhood, M1 Finance and other American fintech companies that offer consumers a way to invest in equities with low or zero fees.

Public.com apparently got a flurry of investor interest over the past couple of weeks after Robinhood found itself in hot water and essentially raised $3.4 billion in a matter of days to help get itself out of a mess.

That new capital came at a challenging time for the unicorn, which could pursue an IPO this year. And some investors reportedly want a piece of rival Public.com’s pie.

One source told TechCrunch that many of those offering term sheets believe there could be “a mass exodus from Robinhood” and want a way to capture that value.

Public recently shook up its business model, moving from generating revenue from order flow payments, a key way that Robinhood monetizes, to collecting tips from users in exchange for executing their orders. Payment for order flow, or PFOF, has become a touchstone in the debate surrounding low-cost trading platforms, and how users may pay for their transactions if not in direct fees.

Investors betting on Public, then, would be placing a wager on not merely future user growth, but the startup’s ability to monetize effectively in the future.

The sources for this story were granted anonymity due to the sensitivity of the discussions.

Public grew quickly in 2020, expanding its user base by a multiple of 10 since the start of the year.

Co-founder Leif Abraham told TC’s Alex Wilhelm in December that the company’s growth has been consistent instead of lumpy, expanding at around 30% each month. The co-founder also stressed that most of Public’s users find its service organically, implying that the startup’s marketing costs have not been extreme, nor its growth artificially boosted.

We don’t know yet how much Public is raising in its Series D, or who all is investing. Public has not responded to multiple requests for comment. VC firm Accel — which led its Series A, B and C rounds — also declined to comment. But we’ll definitely report details as we get them.

Source: https://techcrunch.com/2021/02/11/robinhoods-pain-is-publics-gain-as-vcs-rush-to-give-it-more-money/

Demetrius Curry has spent the last couple years chasing a dream.

His startup, College Cash, allows brands to petition users to create photo and video marketing content highlighting their product or service, with the wrinkle being that content creators are paid by the brands in the form of credits that go directly towards paying down their student loan debt. This model awards the brands involved a level of social good will and tax benefits.

The Dallas area founder was inspired to tackle student loan debt crisis after talking with his daughter about the prospect of eventually paying down her own loan debt. Curry has spent the past two years building out the nascent platform, tracking down brand partners, navigating accelerator programs, enticing users and pounding the pavement to find investors that are willing to bet on his vision.

College Cash has raised $105,000 to date, and is hoping to eventually wrap the funding into a $1 million seed round.

Filling out the round has been its own challenge for Curry who has struggled at times to find opportunity, even among historic levels of capital flowing into the startup ecosystem, a distinction that has been less noticeable for black founders that still make up just a small percentage of VC allocation. In the aftermath of last summer’s protests against police brutality, a number of venture capital firms issued statements decrying institutional racism and pledging to back more underserved founders, spinning up new programs for diverse founders.

Demetrius Curry, CEO of College Cash

While Curry says he appreciates the scope of the problem and the good intentions of those making the statements, he believes that venture capital networks still have a lot to learn about what being an “underserved” founder means and that plenty of the existing efforts feel like “lip service.” He says that even as Silicon Valley continues to idolize dropouts from prestigious universities, stakeholders have less interest in recognizing the accomplishments of founders who fought their way through poverty or found opportunity in geographies where opportunities are harder to come by.

“You can’t look for something different if you’re looking in the same places,” Curry tells TechCrunch. “When you look at the topic of ‘underserved founders,’ it’s not only a skin color thing, it’s also about where they came from and what they’ve been through.”

Curry says that it can be frustrating to compete for early stage opportunities when investors aren’t willing to meaningfully adjust their parameters. Of particular frustration to Curry has been navigating the world of “warm introductions” to even get a foot in the door for programs meant for diverse founders, or applying for early stage programs geared towards the “underserved” only to be told that they weren’t far enough along to qualify.

“Think about how much we had to go through to even get in the room with you,” Curry says. “I’ve sold plasma to pay a web hosting fee, nothing is going to stop me.”

College Cash’s mission of expanding opportunities for people struggling to manage their student loan debt is personal to Curry who saw his life turn around after going back to school.

Decades ago, fresh out of the military, Curry said he had a random conversation with a stranger while eating at a Hardee’s — the discussion about what more he wanted from life ended up pushing him to to go back and get his GED and later a business degree. What followed was a career in finance that eventually led towards his recent entrepreneurial pursuits with College Cash.

The platform is firmly an early-stage venture at the moment, but Curry has big ambitions he’s building toward. His next effort is building out a College Cash tipping integration with gig economy platforms, with the aim that users of those platforms could ultimately opt to tip a worker and route that money directly towards paying down that person’s student loan debt.

Curry says the team at College Cash has been working with a “national gig economy platform” to run a pilot of the integration and has run focus groups showing that users are more likely to tip when they know that money goes towards erasing loan debt.