& meet dozens of singles today!

User blogs

There’s always a fintech angle, even on Valentine’s Day.

This week, I covered Zeta, a new startup working on joint finances for modern couples. It aims to take away the money chores of a relationship, from splitting the bill at dinner to requesting rent through a payment app every month.

Aditi Shekar, the co-founder, gave me some notes about why the ongoing popularity of Venmo is validation for the company, instead of competition.

The success of Zeta hinges on the idea that people want to share their finances in an ongoing and meaningful way, and that the world of finance is ready to shift from individualism to collectivism earlier and louder. It sounds daunting, but we already know that social finance is big, as shown by apps like Venmo and Splitwise, and phenomena like the GameStop saga from just a few weeks ago.

Other startups have taken notice too, entering the world of multiplayer fintech, a term that categorizes socially focused and consumer-friendly financial services. Braid, a group-financing platform, is trying to make transactions work for various entities, from shared households to side hustles to creative projects.

Money is emotional and complex, and the opportunity within the multiplayer fintech reflects just that. The next wave of products will be able to straddle the line of comfort to successfully get adoption, and cultural shift to successfully deliver a truly collaborative cash experience.

(And in case that wasn’t enough Valentine’s Day content for you, here’s one more piece about a new dating app for gamers).

In the rest of this newsletter, we’ll talk about the new career path to CEO, our favorite startups from Techstars Demo Day and the latest SPAC you should probably know about. As always, you can find me on Twitter @nmasc_ or e-mail me at natasha.m@techcrunch.com. Want this in your inbox each week? Sign up here.

Data on startups is dreadful

Data about startups is helpful to understand directional trends and how the flow of capital works and changes over time. But as ventures as an asset class grows and the documentation around raises gets thornier, the data can sometimes be missing a big chunk of what’s actually happening on the scenes.

Here’s what to know per Danny Crichton and Alex Wilhelm: PSA: most aggregate VC trend data is garbage and Are SAFEs obscuring today’s seed volume are two pieces that explain some of the reasons why the numbers might be flawed today. The good news is that the government is also in the dark about funding data; the bad news is that without good tracking, we don’t know how progress is being made.

Etc: Shameless plug for you to tip us on Secure Drop, TechCrunch’s submission system for any news you think is important to share. You can stay anonymous.

Image via Getty Images / Sadeugra

The new CEO

Amazon founder and CEO Jeff Bezos announced weeks ago that he was shifting into an executive chairman role and AWS CEO Andy Jassy would take over as chief executive. In this analysis, our enterprise cloud reporter Ron Miller explores the question: is overseeing cloud operations the new path to CEO?

Here’s what to know, per Andrew Bartels, an analyst at Forrester Research:

“In both cases, these hyperscale business units of Microsoft and Amazon were the fastest-growing and best-performing units of the companies. [ … ] In both cases, cloud infrastructure was seen as a platform on top of which and around which other cloud offerings could be developed,” Bartels said. The companies both believe that the leaders of these two growth engines were best suited to lead the company into the future.

Etc: Ember names former Dyson head as consumer CEO as the startup looks beyond the smart mug, and Monzo, the British challenger bank nearing 5 million customers, has recruited a new US CEO.

Image Credits: Amazon / Microsoft

A triple-hitter Demo Day

TechCrunch covered favorites from Techstars’ three Demo Days, which were focused on Chicago, Boston and workforce development. Make sure to dig into the startups yourself to form your own opinions, but if you care what stood out to us, here’s what we ended up with.

Here’s what to know: The reason I love Demo Days is that it’s a fast way to understand what the next wave of startups and entrepreneurs are thinking about. In this year’s cohorts, we saw an exclusive sneaker marketplace, flexible life insurance and a part-time childcare platform that helps parents cover random gaps in their childcare schedule.

Etc: Without desks and a demo day, are accelerators worth it?

Image Credits: Paper Boat Creative (opens in a new window) / Getty Images

Public markets fly high

Archer Aviation, the electric aircraft startup targeting the urban air mobility market, is teaming up with United Airlines to become a publicly traded company via, you guessed it, a SPAC.

Here’s what to know per Kirsten Korosec, our transportation editor:

The agreement to go public and the order from United Airlines comes less than a year after Archer Aviation came out of stealth. Archer was co-founded in 2018 by Adam Goldstein and Brett Adcock, who sold their software-as-a-service company Vettery to The Adecco Group for more than $100 million. The company’s primary backer was Lore, who sold his company Jet.com to Walmart in 2016 for $3.3 billion. Lore was Walmart’s e-commerce chief until January.

Etc: Bumble priced and Nigeria’s IROKO plans to go public on the London Stock Exchange.

Use cloud foam to dollar sign

Around TC

- Announcing the TC Early Stage Pitch-Off

- Alexa von Tobel brings 15 years of financial savvy to Early Stage 2021

- Kleiner Perkins’ Bucky Moore will outline what to think about before raising a Series A at Early Stage in April

Across the week

Seen on TechCrunch

- Jack Dorsey and Jay Z invest 500 BTC to make Bitcoin ‘internet’s currency’

- Goldman Sachs and Sesame Workshop pour money into this edtech firm’s newest fund

- A Dallas-based founder looks to tackle the student loan crisis with his startup, College Cash

- How African startups raised investments in 2020

Seen on Extra Crunch

- 3 adtech and martech VCs see major opportunities in privacy and compliance

- 5 ways Robinhood’s rushed UX changes exacerbated the GameStop crisis

- Commercializing deep tech startups: A practical guide for founders and investors

- Will ride-hailing profits ever come?

- Best practices for Zoom board meetings at early-stage startups

@Equitypod: Does SoftBank have 20 more DoorDashes?

SoftBank earnings always give key insights about how a heavyweight in venture capital is performing (and the bonanza always comes with a healthy share of content and memes). This week on Equity, we couldn’t resist nerding out about it:

- SoftBank and the late-stage venture capital J Curve

- SoftBank kills half the performance incentive for its Vision Fund execs

- WeWork is apparently doing better, not that SoftBank wants you to talk about that

Of course, if SoftBank isn’t your jam, there was a whole host of other news we chatted about, from Reddit’s latest raise to DoorDash buying a salad robot. Listen here.

Until next week,

Source: https://techcrunch.com/2021/02/13/multi-player-fintech-and-the-muddled-world-of-startup-data/

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, we’re taking a look at the Bumble IPO, app store subscription revenue and talk to a developer on a crusade against the fake ratings plaguing the App Store. We’re also checking in on the missing Google privacy labels…with a spreadsheet of all 100 apps.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters.

Top Stories

Bumble IPO

Bumble, the dating app positioned as one of Tinder’s biggest rivals, began trading on public markets on Thursday. The company priced its shares at $43, above its earlier target range of $37 to $39. But once live, BMBL began trading up nearly 77% at $76 per share on Nasdaq, closing the day with a market cap of $7.7 billion and the stock at $70.55.

The app itself was founded in 2014 by early Tinder exec Whitney Wolfe Herd, who now, at 31, is the youngest woman founder to take a U.S. company public and, thanks to the IPO, the world’s youngest self-made woman billionaire, as well, said Fortune.

"I want to thank the remarkable women who paved the way for @Bumble in the public markets."

From Austin, TX, Bumble CEO & Founder @WhitWolfeHerd rings the @Nasdaq Opening Bell in celebration of #BumbleIPO. pic.twitter.com/LN4iJuBJqy

— Nasdaq (@Nasdaq) February 11, 2021

Wolfe Herd successfully leveraged her knowledge of the online dating market, then combined that with an understanding of how to position a dating app to make it more appealing to women.

On Bumble, women message first, for example, and the company often touts features and updates designed to protect women from bad actors. A lot of what Bumble does is just marketing and spin overlaid on the Tinder model. Like other dating apps, Bumble uses a similar format to connect potential matches: a swipeable “people catalog,” where users look at photos, primarily, to determine interest. Bumble, like others, also makes money by charging for extra features that give users a better shot or more efficient experience.

But all this works because users believe Bumble to be different. They believe Bumble is also capable of delivering higher-quality matches than Tinder, which has increasingly re-embraced its persona as a hook-up app.

The IPO’s success also sends a signal that investors are expecting in-person dating to rebound post-pandemic, and getting in early on the next big mass market dating app is an easy win.

Developer crusades against scammy subscription apps

Developer Kosta Eleftheriou, a Fleskly co-founder, has been on a crusade against the scammy and spammy apps overrunning the App Store, as well as Apple’s failure to do much about it.

Earlier this month, Kosta complained that copycat apps were undermining his current business, as the developer of an Apple Watch keyboard app, FlickType. Shady clones boosted by fake ratings and reviews promised the same features as his legit app, but then locked their customers into exorbitant subscriptions, earning the scammers hundreds of thousands per month.

In his eyes, the problem wasn’t just that clones existed, but that Apple’s lack of attention to fake reviews made those apps appear to be the better choice.

What Apple doesn’t want you to know about the App Store

“The apps you love, from a place you can trust” they tell you. But the reality is far from it.

A 4.5-star app? Might as well be a multi-million dollar scam.

How, you ask?

1/

— Kosta Eleftheriou (@keleftheriou) February 12, 2021

Although Apple finally removed most of his fraudulent competitors after his rants gained press attention, he’s frustrated that the system was so broken in the first place.

This week, Kosta returned with another Twitter thread detailing the multimillion-dollar scams that pretend to be the best Roku remote control app. One app, “Roku Remote Control – Roki,” for example, had a 4.5 stars across 15K+ ratings. The app was a free download, but immediately tries to lock users into a $4.99/week subscription or a lifetime payment of $19.99. However, the app offers a “buggy, ad-infested, poorly designed” experience, Kosta says.

He then used AppFigures to see only those reviews of the Roki app that also had text. When displayed like this, it was revealed that “Roki” was really just a 1.7-star app, based on consumers who took the time to write a review.

What’s worse, Kosta has also argued, that even when Apple reacts by removing a bad actor’s app, it will sometimes allow the developer to continue to run other, even more profitable scams.

Kosta says he decided to spearhead a campaign about App Store scams to “get the word out about how all these scams manage to sustain themselves through a singular common flaw in the App Store — one that has been broken for years.”

He also notes that although Apple responded to him, he believes the company is hoping for the story to blow over.

Dear Director at Apple who emailed me:

I already know that many of the apps I’ve reported have been removed.

Please acknowledge there’s a fake ratings problem plaguing the App Store, so we can begin an honest conversation.

Perhaps someone more senior will *finally* say it?

— Kosta Eleftheriou (@keleftheriou) February 11, 2021

“The way Apple tried to communicate with me also didn’t help ease my concern — they either don’t get it, or are actively trying to let the story fizzle out through some token gestures. But what they need to do first and foremost, is acknowledge the issue and protect their customers,” Kosta told TechCrunch.

One potential argument here is that because Apple financially benefits from successful subscription app scams, it’s not motivated to prioritize work that focuses on cleaning up the App Store or fake ratings and reviews. But Kosta believes Apple isn’t being intentionally malicious in an effort to grow the subscription business, it’s just that fake App Store reviews have become “a can that’s been perpetually kicked down the road.” Plus, since Apple touts the App Store as a place users can trust, it’s hard for them to admit fault on this front, he says.

Since the crusade began, Kosta has heard from others developers who have sent him examples “dozens and dozens of scams.”

“I will just keep exposing them until Apple acknowledges the problem,” he says.

Top subscription apps grew 34% to $13B in 2020

Apps saw record downloads and consumer spending in 2020, globally reaching somewhere around $111 billion to $112 billion, according to various estimates. But a growing part of that spend was subscription payments, a report from Sensor Tower indicates. Last year, global subscription app revenue from the top 100 subscription apps (excluding games), climbed 34% year-over-year to $13 billion, up from $9.7 billion in 2019.

The App Store, not surprisingly, accounted for a sizable chunk of this subscription revenue, given it has historically outpaced the Play Store on consumer spending. In 2020, the top 100 subscription apps worldwide generated $10.3 billion on the App Store, up 32% over 2019, compared with $2.7 billion on Google Play, which grew 42% from $1.9 billion in 2019. (Read more here.)

Google-Apple Privacy Label war drags on

Google said it would update its iOS apps with privacy labels weeks ago. While it did roll out some, it has yet to update top apps with Apple’s new labels, including key apps like the Google search app, Google Pay, Google Assistant, Google One, Google Meet, Google Photos, Google Calendar, Google Maps, Google News, Google Drive, Gmail and others. (Keep track of this with me here. Want to help? Email me.)

Overall, the majority of Google’s apps don’t have labels. While Google probably needed some time (and a lot of lawyers) to look this over, it’s now super late to put its labels out there. At this point, its iOS apps are out of date — which Google accidentally alerted users to earlier this week. This is awful optics for a company users already don’t trust, and a win for Apple as a result. (Which, of course, means we need to know for sure that Apple isn’t delaying Google’s submissions here…)

Still, Google had time to get this done. Its December code freeze is long over, and everyone else, for the most part, has gotten on board with the new labels. Why can’t Google?

Google's iOS apps release cycle before & after Apple asks to disclose privacy labels.

Thie pattern is probably just a coincidence. We all know "transparency forms the bedrock of [their] commitment to users"… pic.twitter.com/UgJjAhWfkm

— Thomasbcn (@Thomasbcn) February 2, 2021

Weekly News

Platforms: Apple

Apple may soon allow users to set a different default music service. The company already opened up the ability to choose a different default browser and email app, but now a new feature in the iOS 14.5 beta indicates it may allow users to set another service, like Spotify, as the default option when asking Siri to play tunes. This, however, could be an integration with HomePod and Siri voice control support in mind, rather than something as universal as switching from Mail app to Gmail.

Apple Maps to gain Waze-like features for reporting accidents, hazards and speed traps. Another new feature in the iOS 14.5 beta will allow drivers to report road issues and incidents by using Siri on their iPhone or through Apple’s CarPlay. For example, during navigation, they’ll be able to tell Siri things like “there’s a crash up head,” “there’s something on the road,” or “there’s a speed trap here.”

Apple tests a new advertising slot on the App Store. Users of Apple’s new iOS 14.5 beta have reported seeing a new sponsored ad slot that appears on the Search tab of the App Store, under the “Suggested” heading (the screen that shows before you do a search). The ad slot is also labeled “Ad” and is a slightly color to differentiate it from the search results. It’s unclear at this time if Apple is planning to launch the ad slot or is just testing it.

The App Store announces price changes for Cameroon, Zimbabwe, Germany and the Republic of Korea.

Apple alerts developers to Push Notification service server certificate update, taking place on March 29, 2021.

Platforms: Google

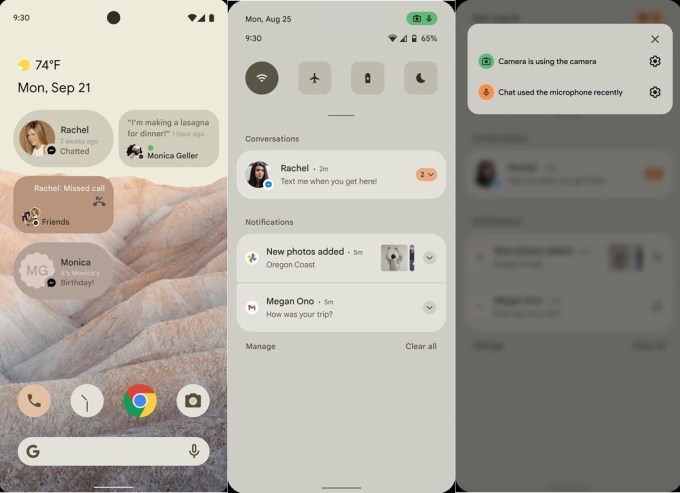

Image Credits: XDA Developers

Alleged Android 12 screenshots snagged from an early draft document by XDA Developers show Google could be borrowing some ideas from Apple’s iOS for its next update. One feature may put colored dots in the status bar to indicate when the camera or microphone are being accessing, for example. Users may also be able to toggle off their camera, microphone or location access entirely. Google may also add a “conversations” widget to show recent messages, calls and activity statuses, among other things.

Google bans data broker Predicio that was selling user data collected from a Muslim prayer app to Venntel, a government contractor that sells location data from smartphones to ICE, CBP and the FBI, following a Motherboard investigation. Google alerted developers they had a week to remove the SDK from their apps or they’d be removed from Google Play.

Google updated its instructor-led curriculum for Android Development with Kotlin, a major update for the course materials that were first released in 2018. The new materials are designed for either in-person or virtual learning, where educators combine lectures and codelabs.

Google briefly notified users that their Google iOS apps were “out of date” — an embarrassing mistake that was later corrected server-side. The bug arrived at a time when Google has yet to have updated its privacy labels for many of its largest apps, including Google, Gmail, Assistant, Maps, Photos and others.

Augmented Reality

Apple released a new iOS app, For All Mankind: Time Capsule, to promote its Apple TV+ series, “For All Mankind.” The app was built using Apple’s ARKit framework, offering a new narrative experience told in AR format featuring the show’s star. In the app, users join Danny as he examines keepsakes that connect to stories about impacting events in the lives of his parents, Gordo and Tracy Stevens, in the alternative world of the TV show.

E-commerce

TikTok is expanding its e-commerce efforts. The company told marketers it’s planning a push into livestreamed e-commerce, and will also allow creators to share affiliate links to products, giving them a way to earn commissions from their videos. The company also recently announced a partnership with global ad agency WPP that will give WPP agencies and clients early access to TikTok ad products. It will also connect top creators with WPP for brand deals.

TikTok is expanding its e-commerce efforts. The company told marketers it’s planning a push into livestreamed e-commerce, and will also allow creators to share affiliate links to products, giving them a way to earn commissions from their videos. The company also recently announced a partnership with global ad agency WPP that will give WPP agencies and clients early access to TikTok ad products. It will also connect top creators with WPP for brand deals.

The Single Day Shopping festival drove high mobile usage. Consumers spent 2.3 billion hours in Android shopping apps during week of November 8-15, 2020, reports App Annie.

Social

Image Credits: AaronP/Bauer-Griffin/GC Images

TikTok’s sale of its U.S. operations to Oracle and Walmart is shelved. The Biden administration undertook a review of Trump’s efforts to address security risks from Chinese tech firms, including the forced sale of TikTok’s U.S. operations. The Trump administration claimed TikTok was a national security threat, and ordered TikTok owner ByteDance to divest its U.S. operations if it wanted to continue to operate in the country. Several large tech companies stepped up to the plate to take on the potential windfall. But Biden’s review of the agency action puts Trump’s plan on an indefinite pause. As a result, the U.S. government will delay its appeal of of federal district court judge’s December 2020 injunction against the TikTok ban. Discussions between U.S. national security officials and ByteDance are continuing, however.

TikTok’s sale of its U.S. operations to Oracle and Walmart is shelved. The Biden administration undertook a review of Trump’s efforts to address security risks from Chinese tech firms, including the forced sale of TikTok’s U.S. operations. The Trump administration claimed TikTok was a national security threat, and ordered TikTok owner ByteDance to divest its U.S. operations if it wanted to continue to operate in the country. Several large tech companies stepped up to the plate to take on the potential windfall. But Biden’s review of the agency action puts Trump’s plan on an indefinite pause. As a result, the U.S. government will delay its appeal of of federal district court judge’s December 2020 injunction against the TikTok ban. Discussions between U.S. national security officials and ByteDance are continuing, however.

Facebook is said to be building its own Clubhouse rival. Mark Zuckerberg made a brief appearance on Clubhouse earlier this month, which now seems more like a reconnaissance mission, if The NYT’s report is true. Facebook will have to tread lightly, given its still under regulatory scrutiny for anticompetitive practices, which included cloning and acquiring its competition.

Facebook is said to be building its own Clubhouse rival. Mark Zuckerberg made a brief appearance on Clubhouse earlier this month, which now seems more like a reconnaissance mission, if The NYT’s report is true. Facebook will have to tread lightly, given its still under regulatory scrutiny for anticompetitive practices, which included cloning and acquiring its competition.

Microsoft reportedly approached Pinterest about an acquisition of the $51 billion social media platform, but those talks are no longer active.

Microsoft reportedly approached Pinterest about an acquisition of the $51 billion social media platform, but those talks are no longer active.

TikTok partnered with recipe app Whisk to add a way for users to save recipes featured in TikTok videos. The feature is currently in pilot testing with select creators.

Mark Cuban is co-founding a new podcast app, Fireside. The Shark Tank star and investor has teamed up with Falon Fatemi, who sold customer intelligence startup Node to SugarCRM last year. Fireside is basically Clubhouse, but adds the ability to export live conversations as podcasts.

TikTok expands its Universal Music Group deal just days after UMG pulled its song catalog from Triller, saying the app was withholding artist payments.

Indian firm ShareChat will integrate Snapchat’s Camera Kit technology into its Moj app to enable AR features. The move will give Snap a foothold in a key emerging market.

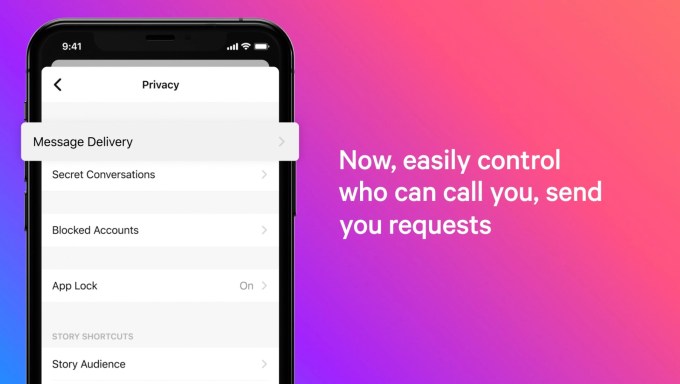

Instagram said it will impose stricter penalties against those who send abusive messages, including account bans, and develop new controls to reduce the abuse people see in their DMs. The announcement followed a recent bout of racist abuse targeted at footballers in the U.K. A joint statement from Everton, Liverpool, Manchester United and Manchester City condemned the abuse, saying “there is no room for racism, hate or any form of discrimination in our beautiful game.”

Instagram tells creators that it won’t promote their recycled TikToks. The company announced via its @creators account a set of best practices for Reels, noting that those featuring a watermark or logo (which TikTok smartly attaches to its content), won’t be recommended frequently on Instagram’s platform. Of course, TikTok creators are already circulating videos with tips about how to cut out the logo from TikTok videos by first exporting the video as a Live Photo, then going to their iOS Photos app, clicking on the Live Photo and choosing “Save as Video.” Problem solved.

Photos

Image Credits: Google

Google Photos for Android adds previously Pixel-only features — but only if users subscribe to Google One. The paywalled features include machine learning-powered editing tools like Portrait Blur, Portrait Light and Color Pop. There’s also a new video editor on iOS with an Android update planned. The editor now lets you crop, change perspective, add filters, apply granular edits (including brightness, contrast, saturation and warmth) and more.

Adobe adds collaboration and asynchronous editing to Photoshop, Illustrator and Fresco. The update will be supported across platforms, including desktop, iPad and iPhone.

Streaming and Entertainment

Waze adds Audible to its list of in-app audio players. The integration allows you to easily play your audiobooks while driving. Waze already supported in-app music integrations, like YouTube Music and Spotify, thanks to developer integrations with the Waze Audio Kit.

HBO Max is going international. The app will be expanded to 39 Latin American and Caribbean territories in June, replacing the existing HBO GO app.

Picture-in-picture mode returned to YouTube on iOS with the launch of the iOS 14.5 beta.

Messaging

Facebook Messenger added a new feature that makes it easier to block and mass-delete Message Requests from people you don’t know. It also said it’s working on new ways to report abuse and providing better feedback on the status of those reports.

The Biden administration pauses the Trump ban on WeChat. The administration asked a federal appeals court to place a hold on proceedings over the WeChat a day after it asked for a similar delay over the TikTok case, saying it needed time to review the previous administration’s efforts, which are now in the appeals stage.

Health & Fitness

NHS Covid-tracing app has prevented 600,000 infections in England and Wales, researchers estimated in one of the first studies of smartphone-based tracing. The app used the tracing system built by Apple and Google.

Fintech

The Robinhood backlash hasn’t stopped the downloads. Many users downrated the app after it halted meme stock trading earlier this month — a move that’s now under Congressional investigation and has prompted multiple lawsuits. But the app continues to receive downloads. The day after it halted trades was its second-largest by downloads ever, and downloads remained high in the days that followed. In January 2021, the app was installed 3.7 million times in the U.S., or 4x the installs of January 2020.

Government & Policy

Image credits: Thomas Trutschel/Photothek via Getty Images

The Chinese government blocked Clubhouse, which had been rapidly gaining attention in the country. The app itself had only briefly been made available in Apple’s China App Store last fall, but those had it installed could access its audio chat rooms without a VPN. Prior to the ban, a group discussing the 1989 pro-democracy Tiananmen protest reached 5,000 participants — the max number of participants Clubhouse supports.

A new North Dakota Senate bill proposes to ban app stores like Apple and Google from requiring developers to exclusively use their store and payment mechanisms to distribute apps, and would prevent them from retaliating, at the risk of fines. Apple’s Chief Privacy Engineer Erik Neuenschwander said the bill “threatens to destroy the iPhone as you know it,” and that Apple succeeds because it “works hard to keep the bad apps out of the App Store.”

The Coalition for App Fairness (CAF) announced that Meghan DiMuzio has now joined as its first executive director. The advocacy group fighting against app store anticompetitive behavior is made up of over 50 members, including Spotify, Tile, Basecamp, Epic Games and others.

Security & Privacy

The U.S. House of Representatives Committee on Energy and Commerce has asked Apple to improve the credibility of App Store privacy labels, so consumers aren’t harmed. The request was made after an investigation by The Washington Post revealed that many labels were false, leading to questions as to whether the labels could be trusted at all.

Apple will begin to proxy Google’s “Safe Browsing” service used by Safari through its own servers starting with iOS 14.5. Safari on iPhone and iPad includes a “Fraudulent Website Warning” feature that warns users if they’re visiting a possible phishing site. The feature leverages Google’s “Safe Browsing” database and blocklist. Before, Google may have collected user’s IP address during its interaction with Safari, when the browser would check the website URL against Google’s list. Now, Apple will proxy the feature through Apple’s own servers to limit the risk of information leaks. The change was reported by The 8-bit, MacRumors and others, after a Reddit sighting, and confirmed by Apple’s head of Engineering for WebKit.

This article is a bit confused on the details of how Safe Browsing works, but in the new iOS beta, Safari does indeed proxy the service via Apple servers to limit the risk of information leak.https://t.co/TlDZNMO8do

— othermaciej (@othermaciej) February 11, 2021

A generically named app “Barcode Scanner” on the Google Play Store had been operating as a legit app for years before turning into malware. Users of the app, which had over 10 million installs, began to experience ads that would open their browser out of nowhere. The malware was traced to the app and Google removed it from the Play Store. Unfortunately, users review-bombed a different, innocent app as a result, leaving it 1-star reviews and accusing it of being malware.

Google Chrome’s iOS app is testing a feature that would lock your Incognito tabs with either Touch ID or Face ID to add more security to the browser app.

Google Fi VPN for Android exits beta and expands to iPhone. The VPN app, designed for Google Fi users, is meant to encrypt connections when on public Wi-Fi networks or when using sites that don’t encrypt data. Users, however, question the privacy offered by VPN from Google.

Twitter said the iOS 14 privacy update will have a “modest impact” on its revenue. The companies joins others, including Facebook and Snap, in saying that Apple is impacting their business’s monetization.

Funding and M&A

Quilt, a “Clubhouse” focused self-care, raised $3.5 million seed round led by Mayfield Fund. The app has a similar format to audio social network, Clubhouse, but rooms are dedicated less to hustle culture and more to wellness, personal development, spirituality, meditation, astrology and more.

Quilt, a “Clubhouse” focused self-care, raised $3.5 million seed round led by Mayfield Fund. The app has a similar format to audio social network, Clubhouse, but rooms are dedicated less to hustle culture and more to wellness, personal development, spirituality, meditation, astrology and more.

Match Group, owner of dating apps like Match and Tinder, will buy Korean social media company Hyperconnect for $1.73 billion. The company runs two apps, Azar and Hakuna Live, both which focus on video, including video chats and live broadcasts.

Match Group, owner of dating apps like Match and Tinder, will buy Korean social media company Hyperconnect for $1.73 billion. The company runs two apps, Azar and Hakuna Live, both which focus on video, including video chats and live broadcasts.

Electronic Arts buys Glu Mobile, maker of the “Kim Kardashian: Hollywood” mobile game in a $2.4 billion deal. The all-cash deal will also bring other games, like “Diner Dash” and “MLB Tap Sports Baseball” to EA, which said it made the acquisition because mobile is the “fastest-growing platform on the planet.”

Electronic Arts buys Glu Mobile, maker of the “Kim Kardashian: Hollywood” mobile game in a $2.4 billion deal. The all-cash deal will also bring other games, like “Diner Dash” and “MLB Tap Sports Baseball” to EA, which said it made the acquisition because mobile is the “fastest-growing platform on the planet.”

French startup Powder raised $12 million for its social app for sharing clips from your favorite games, and follow others with the same interests. The app can capture video content from both desktop and mobile games.

French startup Powder raised $12 million for its social app for sharing clips from your favorite games, and follow others with the same interests. The app can capture video content from both desktop and mobile games.

Reddit’s valuation doubled to $6 billion after raising $250 million in a late-stage funding round led by Vy Capital, following the r/WallStreetBets and GameStop frenzy. The company was previously valued at $3 billion, and is also backed by Andreessen Horowitz and Tencent Holdings Ltd.

Reddit’s valuation doubled to $6 billion after raising $250 million in a late-stage funding round led by Vy Capital, following the r/WallStreetBets and GameStop frenzy. The company was previously valued at $3 billion, and is also backed by Andreessen Horowitz and Tencent Holdings Ltd.

SplashLearn raised $18 million for its game-based edtech platform. The startup offers math and reading courses for Pre-K through 5th grade, and over 4,000 games and interactive activities.

SplashLearn raised $18 million for its game-based edtech platform. The startup offers math and reading courses for Pre-K through 5th grade, and over 4,000 games and interactive activities.

Goody raised $4 million for its mobile app that lets you send gifts to friends, family and other loved ones over a text message. The other user can then personalize the gift and share their address, if you don’t have that information.

Goody raised $4 million for its mobile app that lets you send gifts to friends, family and other loved ones over a text message. The other user can then personalize the gift and share their address, if you don’t have that information.

VerSe Innovation, the Bangalore-based parent firm of news and entertainment app Dailyhunt and short video app Josh, a TikTok rival, raised over $100 million in Series H round led by Qatar Investment Authority and Glade Brook Capital Partners. The round turns the company into a unicorn.

VerSe Innovation, the Bangalore-based parent firm of news and entertainment app Dailyhunt and short video app Josh, a TikTok rival, raised over $100 million in Series H round led by Qatar Investment Authority and Glade Brook Capital Partners. The round turns the company into a unicorn.

Tickr, an app that lets U.K. consumers make financial investments based on their impact to society and the environment, raised $3.4 million in a round led by Ada Ventures, a VC firm focused on impact startups.

Tickr, an app that lets U.K. consumers make financial investments based on their impact to society and the environment, raised $3.4 million in a round led by Ada Ventures, a VC firm focused on impact startups.

Huuuge Inc., a developer of free-to-play mobile casino games, raised $445 million in its IPO in Warsaw, becoming Poland’s largest-ever gaming industry listing.

Huuuge Inc., a developer of free-to-play mobile casino games, raised $445 million in its IPO in Warsaw, becoming Poland’s largest-ever gaming industry listing.

Uptime, an educational app that offers 5-minute bits of insight from top books and courses, raised a $16 million “seed” round led by Tesco CEO Sir Terry Leahy; entrepreneur and chairman of N Brown, David Alliance; and members of private equity firm Thomas H Lee.

Uptime, an educational app that offers 5-minute bits of insight from top books and courses, raised a $16 million “seed” round led by Tesco CEO Sir Terry Leahy; entrepreneur and chairman of N Brown, David Alliance; and members of private equity firm Thomas H Lee.

Modern Health, a mental health services provider for businesses to offer to their employees, raised $74 million, valuing its business at $1.17 billion. The Modern Health mobile app assesses each employee’s need and then provide care options.

Modern Health, a mental health services provider for businesses to offer to their employees, raised $74 million, valuing its business at $1.17 billion. The Modern Health mobile app assesses each employee’s need and then provide care options.

Scalarr raised $7.5 million to fight mobile ad fraud. The company offers products to detect ad fraud before an advertiser bids and other tools used by ad exchanges, demand-side platforms, and supply-side platforms.

Scalarr raised $7.5 million to fight mobile ad fraud. The company offers products to detect ad fraud before an advertiser bids and other tools used by ad exchanges, demand-side platforms, and supply-side platforms.

Dublin-based food ordering app Flipdish, a Deliveroo rival, raised €40 million from global investment firm Tiger Global Management. The app offers a lower commission than other delivery rivals and is even testing drone delivery with startup Manna Aero.

Dublin-based food ordering app Flipdish, a Deliveroo rival, raised €40 million from global investment firm Tiger Global Management. The app offers a lower commission than other delivery rivals and is even testing drone delivery with startup Manna Aero.

Jackpot, an NYC-based lottery ticket app, raised $50 million Series C. The app allows users to play the lottery games in nine different states, including Arkansas, Colorado, Minnesota, New Hampshire, New Jersey, New York, Ohio, Oregon, Texas and Washington, D.C.

Jackpot, an NYC-based lottery ticket app, raised $50 million Series C. The app allows users to play the lottery games in nine different states, including Arkansas, Colorado, Minnesota, New Hampshire, New Jersey, New York, Ohio, Oregon, Texas and Washington, D.C.

Downloads

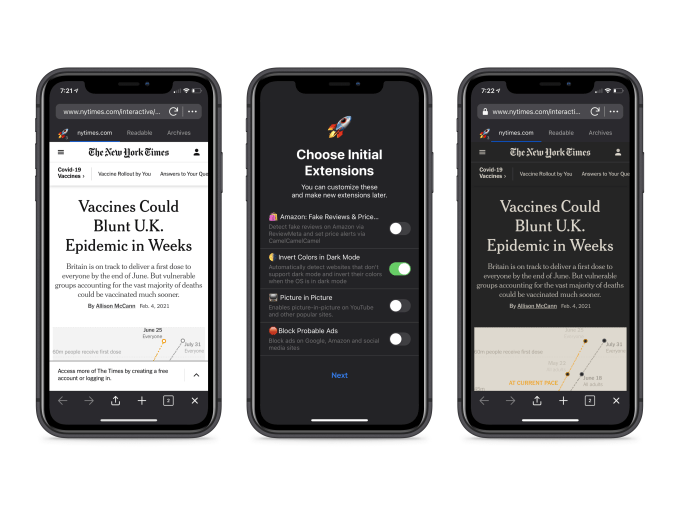

Insight’s iOS web browser supports “extensions”

Image Credits: Insight

A new startup called Insight is bringing web browser extensions to the iPhone, with the goal of delivering a better web browsing experience by blocking ads and trackers, flagging fake reviews on Amazon, offering SEO-free search experiences or even calling out media bias and misinformation, among other things. These features are made available by way of the browser’s “extensions,” which work by way of a “sub-tab” workflow where you navigate using swiping gestures. For example, when online shopping, you could view the product you’re interested in, then swipe over to see the available coupons, the trusted product reviews or to comparison shop across other sites.

The app is a free download on iOS.

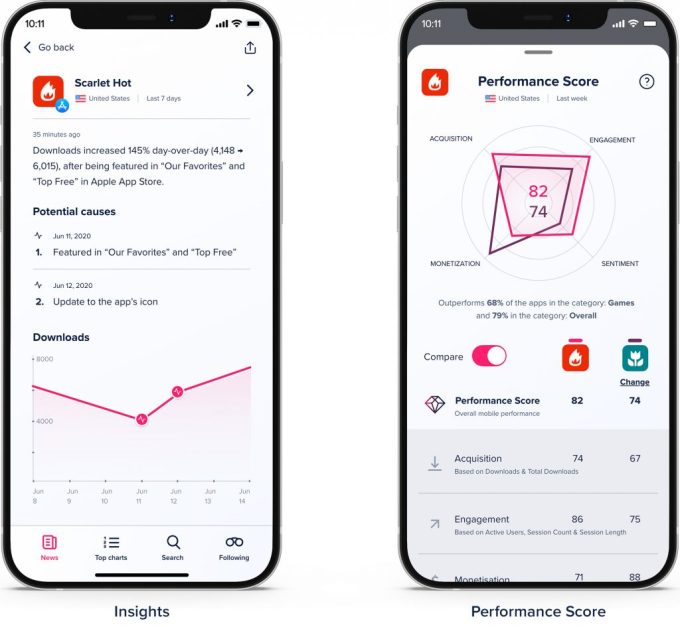

App Annie Pulse

Image Credits: App Annie

App Annie’s new app Pulse is aimed not at the more advanced analyst or marketer immersed in data, but rather at the executive who wants a “more elevated, top-down view” of the app ecosystem, TechCrunch reported. The app offers easy access to the app stores’ top charts, plus tools for tracking apps, and a news feed highlighting recent trends. Another feature, the App Annie Performance score, which aims to distill user acquisition, engagement, monetization and sentiment into a single benchmark.

The app is currently iOS-only.

About a decade ago, I remember having a conversation with a friend about big data. At the time, we both agreed that it was the purview of large companies like Facebook, Yahoo and Google, and not something most companies would have to worry about.

As it turned out, we were both wrong. Within a short time, everyone would be dealing with big data. In fact, it turns out that huge amounts of data are the fuel of machine learning applications, something my friend and I didn’t foresee.

Frameworks were already emerging like Hadoop and Spark and concepts like the data warehouses were evolving. This was fine when it involved structured data like credit card info, but data warehouses weren’t designed for unstructured data you needed to build machine learning algorithms, and the concept of the data lake developed as a way to take unprocessed data and store until needed. It wasn’t sitting neatly in shelves in warehouses all labeled and organized, it was more amorphous and raw.

Over time, this idea caught the attention of the cloud vendors like Amazon, Microsoft and Google. What’s more, it caught the attention of investors as companies like Snowflake and Databricks built substantial companies on the data lake concept.

Even as that was happening startup founders began to identify other adjacent problems to attack like moving data into the data lake, cleaning it, processing it and funneling to applications and algorithms that could actually make use of that data. As this was happening, data science advanced outside of academia and became more mainstream inside businesses.

At that point there was a whole new modern ecosystem and when something like that happens, ideas develop, companies are built and investors come. We spoke to nine investors about the data lake idea and why they are so intrigued by it, the role of the cloud companies in this space, how an investor finds new companies in a maturing market and where the opportunities and challenges are in this lucrative area.

To learn about all of this, we queried the following investors:

- Caryn Marooney, general partner, Coatue Management

- Dharmesh Thakker, general partner, Battery Ventures

- Casey Aylward, principal, Costanoa Ventures

- Derek Zanutto, general partner, CapitalG

- Navin Chaddha, managing director, Mayfield

- Jon Lehr, co-founder and general partner, Work-Bench

- Peter Wagner, founding partner, Wing Ventures

- Nicole Priel, managing director, Ibex Ventures

- Ilya Sukah, partner, Matrix Partners

Where are the opportunities for startups in the data lakes space with players like Snowflake and the cloud infrastructure vendors so firmly established?

Caryn Marooney: The data market is very large, driven by the opportunity to unlock value through digital transformation. Both the data lake and data warehouse architectures will be important over the long term because they solve different needs.

For established companies (think big banks, large brands) with significant existing data infrastructure, moving all their data to a data warehouse can be expensive and time consuming. For these companies, the data lake can be a good solution because it enables optionality and federated queries across data sources.

Dharmesh Thakker: Databricks (which Battery has invested in) and Snowflake have certainly become household names in the data lake and warehouse markets, respectively. But technical requirements and business needs are constantly shifting in these markets — and it’s important for both companies to continue to invest aggressively to maintain a competitive edge. They will have to keep innovating to continue to succeed.

Regardless of how this plays out, we feel excited about the ecosystem that’s emerging around these players (and others) given the massive data sprawl that’s occurring across cloud and on-premise workloads, and around a variety of data-storage vendors. We think there is a significant opportunity for vendors to continue to emerge as “unification layers” between data sources and different types of end users (including data scientists, data engineers, business analysts and others) in the form of integration middleware (cloud ELT vendors); real-time streaming and analytics; data governance and management; data security; and data monitoring. These markets shouldn’t be underestimated.

Casey Aylward: There are a handful of big opportunities in the data lake space even with many established cloud infrastructure players in the space:

- Business intelligence/analytics/SQL may end up converging with machine learning/code like Scala or Python in certain products, but these domains have different end users and communities, programming language preferences and technical skills. Generally, architectural lock-ins are a big point of fear within core infrastructure. This is true for end users with their cloud providers, storage solutions, compute engines, etc. Solutions will be heterogeneous because of that and technology that enables this flexibility will be important.

- As data moves around today, it is being reprocessed in each platform, which at scale is inefficient and expensive. There is an opportunity to build technology that allows users to move data around without rewriting transformations, data pipelines and stored procedures.

- Finally, we’re seeing more traction around general data processing frameworks that are not MapReduce under the hood, especially in the Python data science ecosystem. This is a transition from Hadoop or even Spark, since they aren’t always best suited for unstructured, more modern algorithms.

We surveyed five investors from the Brussels, Belgium ecosystem, and overall the mood was upbeat.

Investors are backing companies in smart living, life sciences (“a really promising sector for Belgium”), B2B, “industry 4.0,” fintech, mobility, health and music tech. Food tech appears “an overcrowded space.” Another says: “COVID confirmed our strategy to invest in local companies and with a sector focus on smart living life science and tech.”

Belgium has a “dynamic ecosystem of health actors, from biotech firms, universities and startups and scaleups. We follow the #BeHealth initiative, which unites the various parts of the Belgian health sector.”

Belgium is “not a market for B2C startups” as it has a “small but complex market with different regions/cultures/languages.” They are focusing on Belgium and neighboring countries for investing.

However, finding funding for startups is still a “difficult task today” said one, as it suffers from a lack of “scale capital” for later rounds.

How should investors in other cities think about the overall investment climate and opportunities in the city? “As a well-educated environment, multicultural, multilingual,” says one. “The ecosystem is very dynamic, with great opportunities. While valuations are usually lower compared to other hubs in Europe, there is quite some money available on the market,” says another.

Brussels’ geography makes it “very well-connected to Europe and international by nature.” It is multicultural and multilingual, so as a result startups position themselves for international expansion, “whether first to France or the Netherlands or beyond. For investors that are scoping opportunities in Belgium, they should recognize that Belgian startups are well-suited for international growth.”

As a small and very dense country, Belgium “already has a distributed founder geography.”

Investors have also been advising companies “to make sure that they have enough cash to last until the end of next 2021 at least.”

We spoke to the following:

- Pauline Brunel, partner, BlackFin

- Xavier de Villepin, partner, TheClubDeal

- Frederic Convent, partner, TheClubDeal

- Alexandre Dutoit, partner, Scale Fund

- Olivier de Duve, partner, Inventures Investment Partners

Use discount code BELGIUM to save 25% off a 1-year Extra Crunch membership

This offer is only available to readers in Europe and expires on March 31, 2021

Pauline Brunel, partner, BlackFin

What trends are you most excited about investing in, generally?

Fintech, insurtech

What are you looking for in your next investment, in general?

Outstanding team, big opportunity.

Xavier de Villepin, partner, TheClubDeal

What trends are you most excited about investing in, generally?

Smart living, life sciences and tech.

What’s your latest, most exciting investment?

Univercells — Series C.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

More startups needed in the smart living sector. In general, companies with international ambitions maintaining local sticky jobs.

What are you looking for in your next investment, in general?

Daring entrepreneurs within growing markets.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

We are wary of blockchain and crypto currencies.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

More than 50%.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Life sciences, including biotech, is a really promising sector for Belgium. On the contrary, Belgium is not a market for B2C startups (small but complex market with different regions/cultures/languages).

How should investors in other cities think about the overall investment climate and opportunities in your city?

They feel Brussels is one of the main tech hubs in Belgium. Though the private equity and risk-on mentality is still not here. Finding funding for startups is still a difficult task today.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

I don’t think it will have a substantial impact, as many startups were already favoring remote work and flexible working hours.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19?

Definitely travel and hospitality (part of smart living). It suffered a lot. But it’s a good time to invest. It’s an opportunity for startups to rethink their model and challenge the way they were seeing things before.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

COVID-19 confirmed our strategy was right … to focus on local competitiveness in the backbones of our economy: smart living, life sciences and tech. But within each sector, each company may be impacted differently. So a case-by-case analysis and in-depth due diligence is a necessity more than ever. Our advice to startups is to consider this environment will stay for another year and to plan the cash flows very carefully.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

The last lockdown giving much more freedom to companies to continue to operate and witness that many of them adapted their way of working to stay operational.

Frederic Convent, partner, TheClubDeal

What trends are you most excited about investing in, generally?

Smart living, life sciences, tech.

What’s your latest, most exciting investment?

Univercells Series C.

What are you looking for in your next investment, in general?

More companies active in smart living, life sciences and tech.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Blockchain and crypto.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

50%.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Fintech is doing well in Brussels. We like an Antwerp mortgage B2B fintech: Oper.

How should investors in other cities think about the overall investment climate and opportunities in your city?

As a well-educated multicultural, multilingual environment.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Most startups are already used to working remotely so the impact for the hubs is less, as they and their clients proved able to work elsewhere.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19?

Travel and hospitality will suffer a lot in this COVID crisis. Life sciences are well-positioned to address the crisis.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

COVID confirmed our strategy to invest in local companies and with a sector focus on smart living, life sciences and tech.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

In medtech, essential medical intervention some green shoots benefit from the crisis.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

The last lockdown pushed companies to adapt their business model and to focus on the new situation.

Alexandre Dutoit, partner, ScaleFund

What trends are you most excited about investing in, generally?

We aim at bridging the equity gap between seed rounds and Series A.

What’s your latest, most exciting investment?

Kaspard, a silver economy company having developed a fall-detection technology.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

We like B2B. Industry 4.0 type of deals lack a bit in our opinion.

What are you looking for in your next investment, in general?

Above all, we need a great team. Then we want to see some commercial traction, being POCs, first contracts.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Food tech appears to us as an overcrowded space. A lot of B2C entrepreneurs are doing “more of the same.”

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

We focus on Belgium and neighboring countries.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Biotech is definitely a hit in Belgium. Fintech and music tech are also growing.

How should investors in other cities think about the overall investment climate and opportunities in your city?

The ecosystem is very dynamic, with great opportunities. While valuations are usually lower compared to other hubs in Europe, there is quite some money available on the market.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

I don’t see that coming, especially as entrepreneurs like to network, share experiences and be in an emulative environment.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Very few, as great teams are able to adapt. We have in our portfolio a company closely tied to events that has been able to rethink its business model and is now even more profitable compared to before the crises. Besides, companies that foster remote work or can install service at a distance will be short-term winners.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

COVID has not impacted our strategy. Entrepreneurs are afraid of the uncertainty and lack of perspective. We encourage them to prepare themselves for the next opened window and to work on tech and processes, while reassuring them on the financing side.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Utopix, a startup linked to the event industry, has been able to rethink its business model as their sales were falling down. They have down their best month ever since then.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

I have seen hope after the summer period when companies were angry to do business again. Unfortunately, that hasn’t lasted very long. We try to remain positive and focus on important things.

Any other thoughts you want to share with TechCrunch readers?

Brussels is a growing scene for startups, very well-connected to Europe and international by nature.

Olivier de Duve, partner, Inventures Investment Partners

What trends are you most excited about investing in, generally?

At Inventures, we invest in a range of startups that have strong financial returns and a measurable social and environmental impact. Looking to 2021, we’re most excited about the mobility sector, HR tech, the blue economy (investing in technologies around water and ocean health) and the circular economy. These sectors started to grow rapidly in Europe, and we’re excited to source some great deals in the coming year.

What’s your latest, most exciting investment?

We just led a round in MySkillCamp, a Belgian HR tech company that equips SMEs and corporates with an adaptable platform for employee learning. MySkillCamp has been stunning us with their rapid growth, even during the pandemic, and it’s a testament to the fact that companies need solutions for upskilling and reskilling their workforce.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

I’ll flip this question to be investor-centric. We’d really like to see more impact venture capital firms that are active in the Series B and beyond stage in Europe. For now, the largest impact VCs are concentrated in the US — having that source of capital here in Brussels or in neighboring ecosystems will help earlier-stage European VCs continue to scale and support their portfolio companies in later rounds. Having that access to capital is key for making a sustainable ecosystem.

What are you looking for in your next investment, in general?

Our investment thesis is to find startups that are financially strong and tackle one of the 17 United Nations Sustainable Development Goals (SDGs). Broadly that has meant companies in health, mobility, renewable energy, climate and more. As we’re rounding out our second fund, our next investment has to hit our sweet spot of clear commercial traction, a stellar team and solid plans for scaling internationally.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Several markets are oversaturated like shared light vehicle scooters or telemedicine solutions. D2C medical devices is also a tough market to break into. Given the pandemic situation, startups active in the recreational sector like tourism and sport are struggling more than ever. All products or services that are not digital are less resilient and will need to shift as soon as possible.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

About half of our startups are coming from Belgium. We’ve historically invested in the U.K., France, the Netherlands and Luxembourg, however we’re open to investing across the EU.

Which industries in your city and region seem well-positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Two sectors that come to mind are mobility and health. Belgium is a hyperconnected country, and mobility startups that address user needs for a more sustainable and efficient transportation will do well here. As for health, Belgium has a dynamic ecosystem of health actors, from biotech firms, universities, and startups and scaleups. We follow the #BeHealth initiative, which unites the various parts of the Belgian health sector. One company that we wanted to highlight is Citizen Lab — they are a digital democracy platform that helps local governments organize voting, participatory budgeting and more. They’re setting the conversation around civic tech and we’re so excited to see what the founders Wietse Van Ransbeeck and Aline Muylaert have in store for 2021.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Belgium is a multicultural, multilingual country — so startups that are grown here naturally are positioning themselves for international expansion, whether first to France or the Netherlands or beyond. For investors that are scoping opportunities in Belgium, they should recognize that Belgian startups are well-suited for international growth and a role that they could play as investors is helping to introduce Belgian startups to other markets.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

As a small and very dense country, Belgium already has a distributed founder geography. In Brussels we have Co.Station, which is home to dozens of startups. However, we also see strong growth in innovation coming from Leuven, Ghent, Antwerp, Liege — and these cities are maximum two hours away by train. Our latest investment, MySkillCamp, for example, is based in Tournai, with an office in Brussels.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

We found out in our portfolio that companies are quite resilient to the crisis because they are addressing societal issues like health, climate and energy. SaaS companies or other digital services are also less exposed, which points out that digitalization is key to survive. Companies that are highly dependent on large governmental contracts could be more exposed to shifts in spending patterns due to COVID.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

COVID-19 has not impacted our investment strategy so much as our post-investment strategy. Since the pandemic started, we’ve been “all hands on deck” with helping our portfolio companies weather the storm — from organizing new fundraising to scoping out new markets and helping on strategic growth projects. We’ve been advising our companies to make sure that they have enough cash to last until the end of next 2021 at least. What we’re seeing is that contracts are taking longer to be signed, especially for our companies looking to partner with governments that are more cash strapped and limited because of the pandemic.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Definitely! On the ecosystem level, we’ve seen a lot of fundraising activity in the last six months, particularly in the health and biotech sector — one example of that is Belgium-based Univercells. For our portfolio, we’ve seen that tools that serve governments and the transition to a more digital economy has created enormous opportunities for our B2B and B2G companies to thrive during this time.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

A few moments have given us hope during 2020. Seeing the racial reckoning in the U.S. spark conversations in Europe about justice and D&I has given me a lot of hope around the role of the venture capital and startup sector in creating a more equal society. Initiatives like Diversity VC are helping us to do that. Also, the sheer number of startups with climate benefits, from cultured meat to sustainable packaging and more, has showcased the financial viability and the demand for expanding the world’s options for sustainability — another large societal challenge.

Any other thoughts you want to share with TechCrunch readers?

Belgium is home to a vibrant, active and fast-growing startup scene!

Tony Florence isn’t as well known to the public as other top investors like Bill Gurley or Marc Andreessen, but he’s someone who founders with SaaS and especially marketplace e-commerce companies know — or should. He’s responsible for the global tech investing activities for NEA, one of the world’s biggest venture firms in terms of assets under management (it closed its newest fund with $3.6 billion last year).

Florence has also been involved with a long list of e-commerce brands to break through, including Jet, Gilt, Goop, Casper, Letgo, and Moda Operandi.

It’s because we talked earlier this week with one of his newer e-commerce bets, Maisonette, that we wanted to ask him about brand building more than a year into a pandemic that has changed the world in both fleeting and permanent ways. We wound up talking about how customer acquisition has changed; what he thinks of the growing number of companies trying to roll up third-party sellers on Amazon; and how upstarts can maintain momentum when even younger companies become a shiny new fascination for customers.

Note: one topic that he couldn’t and wouldn’t comment on is the future of one founder who Florence has backed twice, Marc Lore, who stepped down from Walmart last month to begin building what he recently told Vox is a multi-decade project to build “a city of the future.” (More on this to come, evidently.)

Part of our chat with Florence, lightly edited for length and clarity, follows:

TC: You’ve funded a number of very different businesses that have managed to grow even as Amazon has eaten up more of the retail market. Is there any sector or vertical you wouldn’t back because of the company?

TF: You have to be thoughtful about Amazon. I wouldn’t say there’s one particular area that you either can ignore or feel like you’re completely comfortable and open to, given the scale of their platform. At the same time, there are founding principles and fundamentals that we think about as they relate to companies being able to compete and operate successfully.

TC: And these are what? You’ve backed Marc Lore, Philip Krim (of Casper), Sylvana and Luisana of Maisonette. Do they have something in common?

TF: Sometimes [founders] come at the problem organically; they’re living it [and want to solve it]. Other times, somebody like Marc sees a business opportunity and just attacks it. But there are commonalities. These are folks who are very customer centric, who are focused on good, fundamental unit economics, and who are obsessive about their people, their teams. It takes a village to build a young successful company, and all of those founders you mentioned are great at recruiting world-class people. There’s a sense of vision and mission and culture.

When you wake up and decide to do something, the majority of people you talk to just want to tell you the reasons why it can’t work, so it also takes a certain [wherewithal] to have such conviction around what you’re doing that you’re kind of all in on it, and you’re going to break through no matter what.

TC: Maisonette was going to open a brick-and-mortar store but put a pin in that plan because of COVID. Will we go back to seeing direct-to-consumer brands opening real-world locations when this is over? Has the pandemic permanently changed that calculation?

TF: Leading up to the pandemic, a lot of the young DTC companies that were direct-to-consumer brands, and even the traditional e-commerce marketplaces, were experimenting with offline. Some of it was out of necessity, frankly. Sometimes [customer acquisition costs] became so expensive that it was actually cheaper for them to go offline. In other cases, it was done because the customer wanted that closed loop experience, as with [mattress maker] Casper.

A lot of companies [opened these stores] in a contained way it worked really well. It’s very accretive financially to the overall business contribution, margin wise. It was accretive for the overall customer experience. And in many cases, it didn’t cannibalize anything. It just expanded the [total addressable market].

We’re spending a lot of time right now continuing to think through what are the permanent changes that are going to come out of the pandemic, but I would say the omnichannel model has really has started to take shape and succeed if you look at big retailers like Walmart and Target, so I think there will be an omnichannel dynamic to many of these companies that we’re talking about. Also, over the last 12 months, the cost of acquisition and the efficacy of marketing has swung back in the favor of these young companies. It’s improved to a point where we don’t really even need to think about offline.

TC: I know it had become expensive to acquire customers digitally because it was so crowded out there. Did it become less crowded?

TF: There were very few platforms that these companies could use pre pandemic that weren’t oversaturated . . . it was just very competitive, and that would bid up the cost of acquisition. In the last 12 months, you’ve seen big parts of that market go away. With airlines and financial services and a lot of the spend going way down, it’s become a lot cheaper for companies to market digitally.

TC: Still, it feels at times that it’s hard to maintain a brand’s momentum over time; there’s always some new outfit nipping at its heels. How does a brand itself fresh and relevant in 2021?

TF: There’s a hits dynamic — a fad dynamic — in the consumer space, so that’s always a challenge. You [compete by] continually reinventing and adding [to your offerings]. You see that in social categories, you see that in marketplaces [where they add] managed services and other components [like] payments, and you clearly see it in the way some of the direct-to-consumer companies continue to add new products to the mix.

You focus on the core aspects of your brand and its mission and vision and make sure that the customers really feel that. There’s a community dynamic that has really occurred the last four or five years around e-commerce companies. Glossier is a great example of a company that built a great community around a core set of product offerings, and that has really propelled that company beyond its core customer customer base.

There’s also a contextual commerce opportunity. Goop is a great example this; Gwyneth [Paltrow] brilliantly came up with [an effective way] to merge content and commerce, and that’s something a lot of companies in the commerce space have started to invest in.

TC: Content, community and not necessarily speed, so focusing on what Amazon does not. Can I ask: do you think Amazon needs to be reigned in?

TF: If you’re competing with them [in the] cloud market or a commerce market, they’re a very formidable competitor, and you got to take them very, very seriously. They’re at a scale that’s just incredibly impressive. But I do think you’re seeing a lot of innovation around the edges and companies finding areas that Amazon maybe can’t focus on or isn’t focusing on.

TC: What do you think of these Amazon Marketplace roll-ups that we’re seeing? There’s been at least a half of dozen of them that already, including Thrasio, which announced $750 million this week. All are raising money hand over first.

TF: We haven’t made an investment in the area, though we’re watching very closely. It can be a very capital intensive strategy to execute on because you’re buying brands and then bringing them onto the platform to consolidate and grow, but there’s just an enormous long tail to the e-commerce space and this is an opportunity to consolidate that.

TC: Like, an infinite opportunity? How many roll-ups can the market support?

TFL I do think that we’ll see a handful of these companies get to decent scale. The question will be whether you’ve got more of an arbitrage going on [by] buying companies and generating synergies or there’s some fundamental bigger breakthrough. If you could use AI [and] machine learning to understand how to better serve customers and think about customer acquisition a little bit better, that would be really interesting. If there are real economies of scale to the supply chains [or] baseline infrastructure, that would certainly be interesting.

It’s early on. It remains to be seen how this is gonna play out.

Pictured above, left to right: NEA’s global managing director, Scott Sandell, and Florence, who is the head of global tech investing activities at NEA and who works alongside Mohamad Makhzoumi, who oversees the firm’s healthcare practice.