& meet dozens of singles today!

User blogs

I’m a Black man in America — that’s hard. Black founders, and uniquely Black founders in tech, are facing insurmountable odds.

As the recipients of less than 1% of venture capital raise, institutionalized systems are visibly at play. Within almost 10 years of my entrepreneurial journey, I have encountered just as many setbacks and failures as I have successes.

However, I have pressed forward despite the disparities that often plague the Black entrepreneurial community. From imbalances in fundraising to minimal capital and access, Black brilliance and its cloak of resilience continues to rise.

Now, as a CEO who has ambitiously raised nearly $13 million for my current venture, against the odds, I posit that it is not the Black founders who are missing out the most — it is the investors who are at a loss, not comprehending that they have underestimated the power of these founders’ Black brilliance.

Black founders need to own their resiliency and leverage the power that has resulted from their unique experiences.

When you think about the intersection of venture capital and technology, and specifically how it works — it is being led from an engineering perspective. Developers and coders historically go to specific schools and colleges, entering a funnel that guides them to success.

Historically, many Black students (more so Black male students), are influenced by sports as a vehicle to higher education and not necessarily the institutions recognized for technological prowess.

Their parents and community encourage athleticism because that is the only thing they know — as an institutionalized mindset reinforced over time. Unless they are guided into the accepted foundations for technology, or get into a Cal Berkeley, Stanford or Harvard, where many of the technology companies are built, they are immediately funneled outside of the “circle,” which sets the first of many ongoing obstacles for a Black tech founder.

I offer, however, that these “obstacles” are not in fact barriers but the crucial catalyst for these founders’ superpowers.

Admittedly, there were no entrepreneurs in my family. I did not have access to information about the best colleges. Despite having great grades and graduating with honors, I was completely unaware of how valuable an Ivy League education could be.

As a star basketball player, with my skills and grades, I could have played and graduated from somewhere like Yale, Brown, Columbia or even a school like Southern Methodist University where I was offered a full scholarship. But because of the lack of knowledge that I could actually do so and benefit from being inside the Ivy League “circle,” I didn’t.

I was in college from 2000 to 2004. A lot of great companies were started at elite schools during that period. It is this institutional blocking of information from myself and many other Black students that molded our overall perspective and created our glass ceilings.

Breaking through that glass ceiling, overcoming these odds to press forward relentlessly, with unyielding focus, and to hold conversations with the types of investors I have had to sit in front of, with the type of company that I have built, takes a different level of brilliance that only the Black experience can provide. For 2021 and beyond, Black founders need to not only recognize, but unlock that power as they look to fundraise and catapult their tech companies to success. It would be smart, and incredibly beneficial for investors, venture capitalists and the entire entrepreneurial ecosystem to take heed.

For Black founders, a paradigm shift is evident, but it can only manifest if implemented in these five ways.

Black founders: Forget what you think works in fundraising

Black founders and specifically Black tech founders are fed a monotonous script of how to raise money “the right way,” in light of disparaging statistics highlighting a lack of funding — so much that there is a robotic approach to the process. They try to become this cookie-cutter entrepreneur that is designed to raise money from investors, with their playbook and by their rules.

Black founders capitulate and conform to what society has dictated as appropriate fundraising, often glorifying the investor with the fate of their startup in their hands, without realizing that they hold the negotiating power. Their playbook hasn’t won us any games. As of today, own your power.

Become an irresistible force: Leverage your expertise

Set the playbook aside and lean more into your expertise and uniqueness.

Years ago, Mark Cuban delivered a keynote address at Dallas Startup Week that chronicled his road to success. One of his main points was to “Know your business, and know your business cold.” It was so simple, yet so impactful.

Early on in my career, I learned about venture capital from my experiences working for a startup. While I did not know the area in depth, I referenced what little knowledge I had as I raised for my own company years later. Although I was limited in my dealings with venture capitalists, I was confident in my background and expertise (at that time as a payroll technology sales professional) to truly stake my claim and seat at the table.

So while they may have sold a company for $7 billion or have $35 billion AUM (assets under management), I knew that they were not as well-versed in payroll or payroll technology than I was. It was this tenacious mindset that made me look at investors, rather than up to them, thereby positioning us on equal footing.

Connect in the common goal of brilliance

As a Black founder in tech, I have encountered many injustices — from networking to fundraising to the game of business as a whole. Even among those sitting at the table, there is a plethora of worldviews, political preferences, religious propensities and more that create a melting pot of divisiveness. However, recognizing that the common thread between all of the players in the game is the desire to be part of the brilliant business opportunity at hand is what will ultimately prevail.

It served me well not to overindex whether the venture capitalists liked me or on our differences. Locking in on the ambition of my entrepreneurial spirit and focusing on my brilliance — my Black brilliance — made them want to invest in me. Simplistically, investors want to give their money to founders who will make them money — passionately and ambitiously. Be you and find the investor that appreciates you.

Get in front of as many investors as you can

Black founders are not getting in front of enough investors. Systemically, the venture capital landscape has marginalized this community and has failed to expand their network for inclusiveness. Currently, ethnic minorities are severely underrepresented in the venture capital industry. Eighty percent of investment partners are white, with only a staggering 3% being Black or African-American.

Regardless, Black entrepreneurs must press forward and still show up. The sheer number of people that entrepreneurs must face during the fundraising process is astronomical, so one must not be swayed by the disillusionment of opportunity.

Realistically speaking, it takes a long time to raise money. Period. I have talked to thousands of potential investors to raise nearly $13 million for my current company. If you are a Black founder, it is going to take you longer to fundraise and you are going to have to get in front of more people. So I ask, “Do you have enough oxygen in the tank to withstand the obstacles, for a long enough period of time, to attract the venture capital that you need?” The wealth gap says no.

When I first started Gig Wage, the number one question I received from investors is, “How much runway do you have?” I would answer, “Until I get to where I need to get.” They would then rephrase, “How much money do you have in the bank? How long is your wife going to let you do this?” I would reply, “It does not matter how much money I have in the bank because I’m going to keep going until this happens.”

Discriminatively, there was this unspoken expectation that I lacked the financial wherewithal and stamina to withstand the fundraising process, and at times it was extremely discouraging — because to be honest, when I looked in the bank account, I realistically had about nine to 12 months of runway.

The reason Black people raise less than 1% of venture capital is because the racism weaved into the fabric of American society bleeds over into the entrepreneurial ecosystem. Despite it all, I took thousands of meetings. I was willing to endure with an ambitious conviction that I was going to win. Again, this is Black brilliance.

Own your resiliency, own your power

As a Black man, I have personally endured challenges to build resiliency — mirroring similar realities of other Black men in America. Whether it was dealing with the police or witnessing men in my family struggle with drugs, violence, poverty or the like — I often think, “Why would I be intimidated by an investor meeting or a term sheet?” The construct of America has dealt me much worse.

Black founders need to own their resiliency and leverage the power that has resulted from their unique experiences. The victory mentality that ensues thereafter is the type of mindset that venture capitalists should want to invest in, and if they do not, they are undoubtedly missing out.

The unyielding focus of “The world is stacked against me but I’m not going to quit. I’m going to pivot. I’m going to be resourceful. I’m going to figure it out — even if I’m scared,” is a person you need to invest in. It is not necessarily that they have a groundbreaking business idea, but culturally, Black people have a passion and a perspective that is unmatched, with limitless possibilities that venture capitalists are overlooking.

So for 2021 and well beyond, Black founders, and those especially in tech, need to shift their respective paradigms, own their place within the entrepreneurial space, take back their power and continue to operate at the utmost in Black brilliance. It is the investors, not the founders, that are missing out. Be bold. Be courageous. Be audacious.

As for me, the best thing that I can do right now is to continue to drive the conversation, illuminate the disparities and be as successful for Black entrepreneurs, Black professionals and the world at large as possible. I am owning my power and I’m committed to epitomizing and evangelizing Black brilliance.

Source: https://techcrunch.com/2021/02/16/investors-are-missing-out-on-black-founders/

Metropolis is a new Los Angeles-based startup that’s looking to compete with BMW-owned ParkMobile for a slice of the automated parking lot management market.

Upgrading ParkMobile’s license plate-based service with a computer vision based system that recognizes cars as they enter and leave garages has been Metropolis’ mission since founder and chief executive Alex Israel first formed the business back in 2017.

Israel, a serial entrepreneur, has spent decades thinking about parking. His last company, ParkMe, was sold to Inrix back in 2015. And it was with those earnings and experience that Israel went back to the drawing board to develop a new kind of parking payment and management service.

Now, the company is ready for its closeup, announcing not only its launch, but $41 million in financing the company raised from investors including the real estate managers Starwood and RXR Realty; Dick Costolo’s 01 Advisors; Dragoneer; former Facebook employees Sam Lessin and Kevin Colleran’s Slow Ventures; Dan Doctoroff, the head of Alphabet’s Sidewalk Labs initiative; and NBA All star and early stage investor, Baron Davis.

According to Alex Israel, the parking payment application is the foundation for a bigger business empire that hopes to reimagine parking spaces as hubs for a broad array of urban mobility services.

In this, the company’s goals aren’t dissimilar from the Florida-based startup, REEF, which has its own spin on what to do with the existing infrastructure and footprint created by urban parking spaces. And REEF’s $700 million round of funding from last year shows there’s a lot of money to be made — or at least spent — in a parking lot.

Unlike REEF, Metropolis will remain focused on mobility, according to Israel. “How does parking change over the next 20 years as mobility shifts?” he asked. And he’s hoping that Metropolis will provide an answer.

The company is hoping to use its latest funding to expand its footprint to over 600 locations over the course of the next year. In all, Metropolis has raised $60 million since it was formed back in 2017.

While the computer vision and machine learning technology will serve as the company’s beachhead into parking lots, services like cleaning, charging, storage and logistics could all be part and parcel of the Metropolis offering going forward, Israel said. “We become the integrator [and] we also in some cases become the direct service provider,” Israel said.

The company already has 10,000 parking spots that it’s managing for big real estate owners, and Israel expects more property managers to flood to its service.

“[Big property owners] are not thinking about the infrastructure requirements that allow for the seamless access to these facilities,” Israel said. His technology can allow buildings to capture more value through other services like dynamic pricing and yield optimization as well.

“Metropolis is finding the highest and best use whether that be scooter charging, scooter storage, fleet storage, fleet logistics, or sorting,” Israel said.

One of the new space startups with the loftiest near-term goals has raised $130 million in a Series B round that demonstrates investor confidence in the scope of its ambitions: Axiom Space, which has been tapped by NASA to add privately-developed space station modules to the ISS, announced the new funding led by C5 Capital on Tuesday.

This is the latest in a string of high-profile announcements for Axiom, which was founded in 2016 by a team including space professionals with a history of demonstrated expertise working on the International Space Station. Eventually, Axiom hopes to go from adding the first private commercial modules to the existing station, to creating their own, wholly private on-orbital platforms – for research, space tourism and more.

Axiom announced the people who will take part it it first ever private astronaut launch to the ISS, which is set to fly next January using a SpaceX Dragon spacecraft and Falcon 9 rocket. Axiom is the service provider for the mission, brokering the deal for the private spacefarers and setting up training and mission profile. That should be the first time we see a crew made up entirely of private individuals (ie., not astronauts selected, trained and employed by their respective national government) make its way to the station.

The company was also in discussions with Tom Cruise about filming at least part of an upcoming film aboard the ISS, and it’s in development with a production company on a forthcoming competition reality show that will see contestants vie for a spot on a private flight to the station.

Axiom is emerging as the leading linkage between private human spaceflight and the existing infrastructure and industry, covering both public sector partners like NASA, and the ‘rails’ of the bourgeoning industry – SpaceX and its ilk. It’s been focused on this unique opportunity longer than most in the private market, and it has all the relationships and in-house expertise to make it work.

Contestants will compete for a SpaceX trip to the International Space Station in new reality TV show

This new, significant injection of capital will help the company hire, as well as boost its ability to construct the pieces of its forthcoming private space station modules, as well as its eventual station itself. The Houston-based company aims to put its ISS modules on the station by 2024, and it has raised $150 million to date.

Knoq (formerly known as Polis) was a startup that recruited representatives to go door-to-door in their neighborhoods, talking up client products and services. So for obvious reasons, it faced challenges in 2020.

“We stopped knocking on doors in February, and this summer, we were trying to figure out what the path forward was,” founder and CEO Kendall Tucker told me.

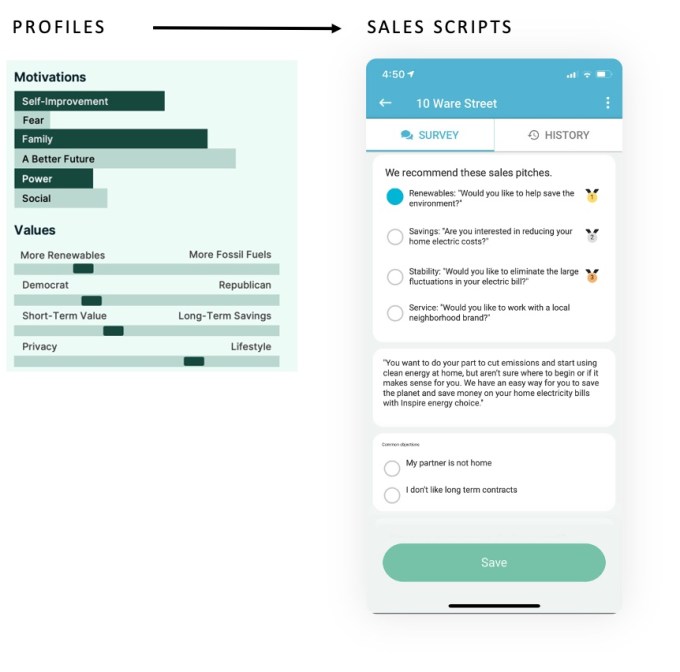

The company has already pivoted once, shifting focus from political work to commercial marketing. But Tucker said Knoq also had some attractive assets, namely its “unique, huge consumer models” designed to predict whether someone would be interested in a given product, as well as “the experience of building out these teams of neighborhood representatives.”

So after what she described as a competitive bidding prices, Knoq was acquired by Ad Practitioners, a digital media company that owns properties like Money.com and ConsumersAdvocate.org.

As part of Ad Practitioners, Tucker said the Knoq team will be able to interact with visitors to those properties and help “pair consumers with the right product,” whether that’s auto insurance or software. After all, she noted that there plenty of consumers already reaching out to Ad Practitioners via chat bots and phone calls: “These are people already asking for help … we’re really just connecting the dots.”

Image Credits: Knoq

In the acquisition announcement, Ad Practitioners CEO Greg Powel made a similar point, saying that the deal represents “a shared vision of helping people make decisions through conversations driven by data and technology while educating people about products and services that matter.”

“The Money and ConsumersAdvocate.org brands are already trusted by millions of highly-engaged users,” Powel continued. “Together, we foresee a world where consumers come to our sites for great content [and] reviews and to speak with representatives who can help them find the personal information they need.”

The Knoq leadership team has already moved to join Ad Practitioners in Puerto Rico, with the rest of the Knoq team set to move later this year.

You might think a startup would be inclined to stay put in its current location (in Knoq’s case, Boston), at least for the duration of the pandemic, but Tucker said she’s a big believer in seeing your team in person. In fact, the Knoq team had socially distanced outdoor meetups over the summer, “to brainstorm or just hang out and make sure people are okay.” Plus, she’s excited about the possibility of “hiring the amazing people on this island.”

The financial terms of the acquisition were not disclosed. Knoq had most recently raised $2.5 million from Initialized Capital and Haystack.vc, and Tucker said it was crucial that the acquisition provided a good outcome not just for her team and herself, but also her investors.

“We’re so excited for Kendall and her team on their successful exit to Ad Practitioners,” said Initialized General Partner Alda Leu Dennis in a statement. “It’s been a pleasure partnering with Knoq over the last few years. The Knoq team will bring a tech-forward approach to sales outreach and customer analytics. And, Kendall’s skills as a brilliant builder, operator and strategic thinker will be a huge asset for Ad Practitioners.”

Source: https://techcrunch.com/2021/02/16/ad-practitioners-acquies-knoq/

The hodl-crew are having quite the moment as bitcoin passed the $50,000 mark earlier today for the first time. Data pegs the peak at just over $50,500.

The price of bitcoin, the world’s best-known cryptocurrency, has historically proven a reasonable proxy for consumer interest in the cryptocurrency space, and for trading activity amongst blockchain-based assets. Bitcoin’s price has retreated since the milestone, and is now worth just over $49,000.

Bitcoin has been on a tear this year, rising from around the $30,000 mark at the start of 2021 to its recent $50,000 milestone, a gain or around 66%. Looking back a year and the gains are even more impressive, with the price of bitcoin rising from around $10,000 a year ago to its current price, a gain of 400%.

Luckily for investors and believers in other decentralized tokens, it’s not just bitcoin that is enjoying a valuation updraft. Cardano, one of the most highly-valued blockchain assets, is up around 28% in the last week according to CoinMarketCap. Its total value is nearing the $8 billion mark.

Companies built atop the burgeoning cryptocurrency space could be enjoying a boom as the price of bitcoin advances; as trading activity and consumer interest tend to rise along with the price of bitcoin, and companies like Coinbase make money from trading activity and consumer use, 2021 is starting off strongly.

Coinbase has filed to go public, and intends to pursue a direct listing in short order.

What’s driving the price of bitcoin and its sister-tokens up in the short-term? In a market melt-up its hard to point fingers with any accuracy. But broadly speaking if it feels that nearly every asset class is setting new all-time records, so why not bitcoin as well?