& meet dozens of singles today!

User blogs

Dixa, the Danish customer support platform promising more personalised customer support, has acquired Melbourne-based “knowledge management” SaaS Elevio to bolster its product and technology offerings.

The deal is said to be worth around $15 million, in a combination of cash and Dixa shares. This sees Elevio’s own VC investors exit, and Elevio’s founders and employees incentivised as part of the Dixa family, according to Dixa co-founder and CEO, Mads Fosselius.

“We have looked at many partners within this space over the years and ultimately decided to partner with Elevio as they have what we believe is the best solution in the market,” he tells me. “Dixa and Elevio have worked together since 2019 on several customers and great brands through a strong and tight integration between the two platforms. Dixa has also used Elevio’s products internally and to support our own customers for self service, knowledge base and help center”.

Fosselius says that this “close partnership, strong integration, unique tech” and a growing number of mutual customers eventually led to a discussion late last year, and the two companies decided to go on a journey together to “disrupt the world of customer service”.

“The acquisition comes with many interesting opportunities but it has been driven by a product/tech focus and is highly product and platform strategic for us,” he explains. “We long ago acknowledged that they have the best knowledge product in the market. We could have built our own knowledge management system but with such a strong product already out there, built with a similar tech stack as ours and with a very aligned vision and culture fit to Dixa, we felt this was a no brainer”.

Founded in 2015 by Jacob Vous Petersen and Mads Fosselius, Dixa wants to end bad customer service with the help of technology that claims to be able to facilitate more personalised customer support. Originally dubbed a “customer friendship” platform, the Dixa cloud-based software works across multiple channels — including phone, chat, e-mail, Facebook Messenger, WhatsApp and SMS — and employs a smart routing system so the right support requests reach the right people within an organisation.

Broadly speaking, the platform competes with Zendesk, Freshdesk and Salesforce. However, there’s also overlap with Intercom in relation to live chat and messaging, and perhaps MessageBird with its attempted expansion to become an “Omnichannel Platform-as-a-Service” (OPaaS) to easily enable companies to communicate with customers on any channel of their choosing.

Meanwhile, Elevio is described as bridging the gap between customer support and knowledge management. The platform helps support agents more easily access the right answers when communicating with customers, and simultaneously enables end-users to get information and guidance to resolve common issues for themselves.

Machine learning is employed so that the correct support content is provided based on a user’s query or on-going discussion, whilst also alerting customer support teams when documents need updating. The Australian company also claims that creating user guides using Elevio doesn’t require any technical skills and says its “embeddable assistant” enables support content to be delivered in-product or injected into any area of a website “without involving developers”.

Adds the Dixa CEO : “Customer support agents still spend a lot of time helping customers with the same type of questions over and over again. Together with Elevio we are able to ensure that agents are given the opportunity to quickly replicate best practice answers, ensuring fast, standardised and correct answers for customers. Elevio is the world leader in applying machine learning to solve this problem”.

Source: https://techcrunch.com/2021/02/17/dixa-acquires-elevio/

After raising $690 million from SoftBank in December to make acquisitions, the Sweden-based cloud communications company Sinch has followed through on its strategy in that department. Today the company announced that it is acquiring Inteliquent, an interconnection provider for voice communications in the U.S. currently owned by private equity firm GTCR, for $1.14 billion in cash.

And to finance the deal, Sinch said it has raised financing totaling SEK8.2 billion — $986 million — from Handelsbanken and Danske Bank, along with other facilities it had in place.

The deal will give Sinch — a competitor to Twilio with a range of messaging, calling and marketing (engagement) APIs for those building communications into their services in mobile apps and other services — a significant foothold in the U.S. market.

Inteliquent — a profitable company with 500 employees and revenues of $533 million, gross profit of $256 million, and Ebitda of $135 million in 2020 — claims to be one of the biggest voice carriers North America, serving both other service providers and enterprises. Its network connects to all the major telcos, covering 94% of the U.S. population, with more than 300 billion minutes of voice calls and 100 million phone numbers handled annually for customers.

Sinch is publicly traded in Sweden — where its market cap is current at $13 billion (just over 108 billion Swedish krona) — and the acquisition begs the question of whether the company plans to establish more of a financial presence in the U.S., for example with a listing there. We have asked the company what its next steps might be and will update this post as and when we learn more.

“Becoming a leader in the U.S. voice market is key to establish Sinch as the leading global cloud communications platform,” said Oscar Werner, Sinch CEO, in a statement. “Inteliquent serves the largest and most demanding voice customers in America with superior quality backed by a fully-owned network across the entire U.S.. Our joint strengths in voice and messaging provide a unique position to grow our business and power a superior customer experience for our customers.”

Inteliquen provides two main areas of service, Communications-Platform-as-Service (CPaaS) for API-based services to provide voice calling and phone numbers; and more legacy Infrastructure-as-a-Service (IaaS) products for telcos such as off-net call termination (when a call is handed off from one carrier to another) and toll-free numbers. These each account for roughly half of the total business although — unsurprisingly — the CPaaS business is growing at twice the rate of IaaS.

Its business, like many others focusing on services for people who are relying more on communications services as they are seeing each other in person less — saw a surge of use this past year, it said. (Revenues adjusted without Covid lift, it noted, would have been $499 million, so still healthy.)

As for Sinch, since spinning out from Rebtel in 2014 to take on the business of providing comunications tools to developers, it has been on an acquisition roll to bulk up its geographical reach and the services that it provides to those customers.

Deals have included, most recently, buying ACL in India for $70 million and SAP’s digital interconnect business for $250 million. The deals — combined with Twilio’s own acquisitions of companies like Sendgrid for $2 billion and last year’s Segment for $3.2 billon, speak both to the bigger trend of consolidation in the digital (API-based) communications space, as well as the huge value that is contained within it.

Inteliquent itself had been in private equity hands before this, controlled by GTCR based in Chicago, like Inteliquent itself. According to PitchBook, its most recent financing was a mezzanine loan from Oaktree Capital in 2018 for just under $19 million.

Interestingly, Inteliquent itself has been an investor in innovative communications startups, participating in a Series B for Zipwhip, a startup that is building better ways to integrate mobile messaging tools into landline services.

“We’re excited about the tremendous opportunities this combination unlocks, expanding the services we can provide to our customers. Combining our leading voice offering with Sinch’s global messaging capabilities truly positions us for leadership in the rapidly developing market for cloud communications“, comments Ed O’Hara, Inteliquent CEO, in a statement.

Source: https://techcrunch.com/2021/02/17/sinch-inteliquent/

Nate Faust has spent years in the e-commerce business — he was a vice president at Quidsi (which ran Diapers.com and Soap.com), co-founder and COO at Jet (acquired by Walmart for $3.3 billion) and then a vice president at Walmart.

Over time, he said it slowly dawned on him that it’s “crazy” that 25 years after the industry started, it’s still relying on “single-use, one-way packaging.” That’s annoying for consumers to deal with and has a real environmental impact, but Faust said, “If any single retailer were to try to tackle this problem right now on their own, they would run up into a huge cost increase to pay for this more expensive packaging and this two-way shipping.”

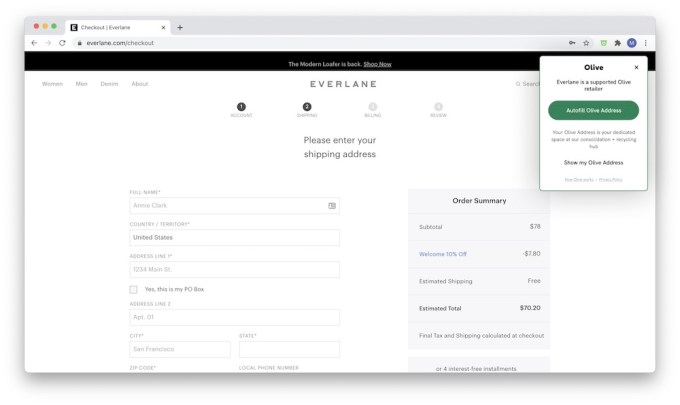

So he’s looking to change that with his new startup Olive, which consolidates a shopper’s purchases into a single weekly delivery in a reusable package.

Olive works with hundreds of different apparel brands and retailers, including Adidas, Anthropologie, Everlane, Hugo Boss, Outdoor Voices and Saks Fifth Avenue. After consumers sign up, they can install the Olive iOS app and/or Chrome browser extension, then Faust said, “You shop on the directly on the retailer and brand sites you normally would, and Olive assists you in that checkout process and automatically enters your Olive details.”

Image Credits: Olive

The products are sent to an Olive consolidation facility, where they’re held for you and combined into a weekly shipment. Because the retailers are still shipping products out like normal, all that packaging is still being used — but at least the consumer doesn’t have to dispose of it. And Faust said that eventually, Olive could work more closely with retailers to reduce or eliminate it.

Until then, he said the real environmental impact comes from “the consolidation of deliveries into fewer last mile stops” — the startup estimates that doubling the number of items in a delivery reduces the per-item carbon footprint by 30%.

The weekly shipments are delivered by regular mail carriers in most parts of the United States, and by local couriers in dense urban areas. They arrive in reusable shippers made from recyclable materials, and you can return any products by just selecting them in the Olive app, then putting them back in the shipper and flipping the label over.

In fact, Faust argued that the convenience of the return process (no labels to print out, no visits to the local FedEx or UPS store) should make Olive appealing to shoppers who aren’t drawn in by the environmental impact.

“In order to have the largest environmental impact, the selling point can’t be the environmental impact,” he said.

Olive delivery is available at no extra cost to the consumer, who just pays whatever they normally would for shipping.

Faust acknowledged that Olive runs counter to the “arm’s race” between Amazon and other e-commerce services working to deliver purchases as quickly as possible. But he said that the startup’s consumer surveys found that shoppers were willing to wait a little longer in order to get the other benefits.

Plus, Olive is starting with apparel because “there’s not that same expectation of speed” that you get in other categories, and because the items cost enough that the delivery economics still work out, even if you only order one product in a week.

Tens of thousands of students and professionals move out of India each year to pursue higher education and for work. Even after spending months in a new country, they struggle to get a credit card from local banks, and end up paying a premium to access a range of other financial services.

Banks in the U.S., or in most other countries for that matter, rely on local credit scores to determine the worthiness of potential applicants. Even if an individual had a great credit score in India, for instance, that wouldn’t hold any water for banks in a foreign land.

That was the takeaway Raghunandan G, the founder of ride-hailing firm TaxiForSure (sold to local giant Ola), returned to India with after a trip. After months of research and assembling a team, Raghunandan believes he has a solution.

On Wednesday, he announced Zolve, a neobanking platform for individuals moving from India to the U.S. (or the other way around).

The startup works with banks in the U.S. and India to provide consumers access to financial products seamlessly — without paying any premium or coughing up any security deposit.

In an interview with TechCrunch, Raghunandan said the startup underwrites the risks, which has enabled banks in foreign countries to extend their services to Zolve customers. “Consumers can open an account with us and access all banking services as if they are banking with their national bank,” he said.

As part of the announcement, Raghunandan said two-month-old Zolve has raised $15 million in a seed financing round led by Accel and Lightspeed. Blume Ventures and several high-profile angel investors, including Kunal Shah (founder of Cred), Ashish Gupta (formerly the MD of Helion), Greg Kidd (known for his investments in Twitter and Ripple), Rahul Mehta (managing partner at DST Global) and Rahul Kishore (senior managing director of Coatue Capital), also participated in the round. So did Founder Collective (which has backed Airtable and Uber), in what is its first investment in an Indian startup.

“Individuals with financial identities in multiple geographies need seamless global financial solutions and we believe the team’s strong identification with the problem will enable them to deliver compelling and innovative financial experiences,” said Bejul Somaia, Lightspeed India Partners, in a statement.

Before starting Zolve, Raghunandan founded TaxiForSure, a ride-hailing firm, that he later sold to Ola for $200 million. Image Credits: Zolve

Raghunandan acknowledged that a handful of other startups are also attempting to solve this challenge, but he said other firms are not making use of a consumer’s credit history from their origin nation. “We are the only one who is looking at this problem in a completely different light. We are not trying to solve the problem at the destination country where consumers face the challenges. We are finding the solution in the home country itself, where the consumers already have a reputation and credit history,” he said.

Once a customer has access to a credit card and other financial services in the new nation, they can quickly broaden their local credit history, something that otherwise takes years, he said.

“The global citizen community is largely underserved in terms of access to financial services and we believe that there is a huge market opportunity for Zolve. Raghu has a proven track record as a founder and we are delighted to partner with him again, on his latest venture. The team’s passion and commitment are commendable and we are positive that Zolve will create tremendous value for this community,” said Anand Daniel, partner at Accel, in a statement.

Headquartered in San Francisco and Bangalore, Zolve offers a range of compelling features even for those who don’t plan to visit a foreign land. If you’re in India, for instance, you can use Zolve to buy shares of companies listed at U.S. exchanges. You can also buy bitcoin and other cryptocurrency from exchanges based in the U.S. or Europe, said Raghunandan.

The startup, which has already amassed more than 5,000 customers, has formed revenue-sharing arrangements with its banking partners. Raghunandan said since Zolve currently onboards customers in India and generates much of its revenue from banking partners in the U.S., it’s already operating on a profitable model.

A space startup connected to the International Space Station raises $130 million, Atlassian releases a new version of Trello and bitcoin briefly passes $50,000. This is your Daily Crunch for February 16, 2021.

The big story: Axiom Space raises $130M

Founded in 2016, Axiom Space is working with NASA to add privately developed space station modules to the International Space Station. It’s also the service provider for the first private astronaut launch to the ISS, scheduled for January 2022 using a SpaceX Dragon spacecraft and Falcon 9 rocket.

Eventually, the startup hopes to create its own orbital platforms. And in his story on the funding, Darrell Etherington says Axiom is emerging as “the leading linkage between private human spaceflight and the existing infrastructure and industry.”

The tech giants

Atlassian launches a whole new Trello — Trello is one of the most popular project management tools around, and in many ways it brought digital Kanban boards to the mainstream.

TikTok hit with consumer, child safety and privacy complaints in Europe — TikTok is facing a fresh round of regulatory complaints in Europe.

Reddit’s transparency report shows a big spam problem and relatively few government requests — Volume-wise, the largest problem by far is spam.

Startups, funding and venture capital

01 Advisors, the venture firm of Dick Costolo and Adam Bain, has closed fund two with $325M — Costolo and Bain previously served as Twitter’s CEO and its chief operating officer, respectively.

Shared scooter startup Revel adds electric bike subscriptions to its business — Revel will start offering monthly electric bike subscriptions in New York.

Tencent backs digital rights startup Pex in $57M round — The startup describes its Attribution Engine as the “licensing infrastructure for the Internet.”

Advice and analysis from Extra Crunch

Inside Rover and MoneyLion’s SPAC-led public debuts — Looking at the financial health of two companies that we’ve heard about for ages and never got to see inside of.

Four strategies for deep tech startups recruiting top growth marketers — How do deep tech companies connect and cultivate strong relationships with talented nontechnical growth people outside of their industry?

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Bitcoin briefly breaks the $50K barrier as Coinbase’s direct listing looms — The hodl-crew are having quite the moment.

Imagine a better future for social media at TechCrunch Sessions: Justice — We’ll discuss how much responsibility social networks have in the rise of toxic culture, deadly conspiracies and organized hate online.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Source: https://techcrunch.com/2021/02/16/daily-crunch-axiom-space-raises-130m/