& meet dozens of singles today!

User blogs

This morning Ally.io, a software startup with a focus on the OKR (objectives and key results, in case you’ve somehow avoided being exposed) goal-setting technique, announced that it has closed $50 million in new capital. The Series C round was led by Green Oaks Capital, Madrona Capital, and its Series B lead, Tiger Global.

Ally raised an $8 million Series A in August, 2019 and a $15 million Series B in October of the same year. The Series C is more than its A and B rounds put together – and doubled.

That Ally raised such a large round really wasn’t too big a surprise. OKR-software rival Gtmhub raised a $30 million Series B earlier this year, and companies in this particular software niche reported rapid-fire growth last year. TechCrunch collected growth metrics from a host of companies competing in the OKR and corporate goal-setting market, including Ally. In 2020, Gtmhub, Perdoo, WorkBoard, and Ally.io all grew in the triple digits.

In a blog post that TechCrunch saw before publication, Madrona investor and Ally backer S. Somasegar noted that “nearly $300 million” has been invested into OKR startups in the last two years. Such rapid growth from so many players in such a competitive space could signal a huge market.

Ally’s latest round makes it clear that investors expect similar growth from the cohort in 2021.

For flavor, we got new growth numbers from Ally.io. Previously the startup had shared growth of 3.3x in 2020. Its CEO Vetri Vellore told TechCrunch in an email that Ally.io’s “revenue has increased by 5x and [has] added over 600 customers” since its Series B, which came around 15 months prior. That’s quick.

It’s the sort of growth that venture investors want to own a piece of. So, even though Vellore told TechCrunch that his company has “most of [its] Series B money in the bank,” it decided to take on more capital “to accelerate further,” to which we’d add because it could.

Ally did not have to twist arms to raise more. Vellore described the round as “extremely competitive” in an email, noting that he had “started the [fundraising] process in early January.” It’s just over mid-February, so the round came together quickly: “Within two weeks of starting the process, we were able to wrap it up,” the CEO wrote, adding that the investment “was heavily oversubscribed due to strong interest from both existing investors and our new investors.”

The market for OKR software, and corporate goal-setting software in general, is proving to be large, and lucrative. Let’s see which rival player is the next to raise.

Facebook has been fined again by Italy’s competition authority — this time the penalty is €7 million (~$8.4M) — for failing to comply with an earlier order related to how it informs users about the commercial uses it makes of their data.

The AGCM began investigating certain commercial practices by Facebook back in 2018, including the information it provided to users at sign up and the lack of an opt out for advertising. Later the same year it went on to fine Facebook €10M for two violations of the country’s Consumer Code.

But the watchdog’s action did not stop there. It went on to launch further proceedings against Facebook in 2020 — saying the tech giant was still failing to inform users “with clarity and immediacy” about how it monetizes their data.

“Facebook Ireland Ltd. and Facebook Inc. have not complied with the warning to remove the incorrect practice on the use of user data and have not published the corrective declaration requested by the Authority,” the AGCM writes in a press release today (issued in Italian; which we’ve translated with Google Translate).

The authority said Facebook is still misleading users who register on its platform by not informing them — “immediately and adequately” — at the point of sign up that it will collect and monetize their personal data. Instead it found Facebook emphasizes its service’s ‘gratuitousness’.

“The information provided by Facebook was generic and incomplete and did not provide an adequate distinction between the use of data necessary for the personalization of the service (with the aim of facilitating socialization with other users) and the use of data to carry out targeted advertising campaigns,” the AGCM goes on.

It had already fined Facebook €5M over the same issue of failing to provide adequate information about its use of people’s data. But it also ordered it to correct the practice — and publish an “amendment” notice on its website and apps for users in Italy. Neither of which Facebook has done, per the regulator.

Facebook, meanwhile, has been fighting the AGCM’s order via the Italian legal system — making a petition to the Council of State.

A hearing of Facebook’s appeal against the non-compliance proceedings took place in September last year and a decision is still pending.

Reached for comment on AGCM’s action, a Facebook spokesperson told us: “We note the Italian Competition Authority’s announcement today, but we await the Council of State decision on our appeal against the Authority’s initial findings.”

“Facebook takes privacy extremely seriously and we have already made changes, including to our Terms of Service, to further clarify how Facebook uses data to provide its service and to provide tailored advertising,” it added.

Last year, at the time the AGCM instigated further proceedings against it, Facebook told us it had amended the language of its terms of service back in 2019 — to “further clarify” how it makes money, as it put it.

However while the tech giant appears to have removed a direct “claim of gratuity” it had previously been presenting users at the point of registration, the Italian watchdog is still not happy with how far it’s gone in its presentation to new users — saying it’s still not being “immediate and clear” enough in how it provides information on the collection and use of their data for commercial purposes.

The authority points out that this is key information for people to weigh up in deciding whether or not to join Facebook — given the economic value Facebook gains via the transfer of their personal data.

For its part, Facebook argues that it’s fair to describe a service as ‘free’ if there’s no monetary charge for use. Although it has also made changes to how it describes this value exchange to users — including dropping its former slogan that “Facebook is free and always will be” in favor of some fuzzier phrasing.

On the arguably more salient legal point that Facebook is also appealing — related to the lack of a direct opt out for Facebook users to prevent their data being used for targeted ads — Facebook denies there’s any lack of consent to see here, claiming it does not give any user information to third parties unless the person has chosen to share their information and give consent.

Rather it says this consent process happens off its own site, on a case by case basis, i.e. when people decide whether or not to install third party apps or use Facebook Login to log into a third-party websites etc — and where, it argues, they will be asked by those third parties whether they want Facebook to share their data.

(Facebook’s lead data supervisor in Europe, Ireland’s DPC, has an open investigation into Facebook on exactly this issue of so-called ‘forced consent’ — with complaints filed the moment Europe’s General Data Protection Regulation begun being applied in May 2018.)

The tech giant also flags on-site tools and settings it does offer its own users — such as ‘Why Am I Seeing This Ad’, ‘Ads Preferences’ and ‘Manage Activity’ — which it claims increase transparency and control for Facebook users.

It also points to the ‘Off Facebook Activity‘ setting it launched last year — which shows users some information about which third party services are sending their data to Facebook and lets them disconnect that information from their account. Though there’s no way for users to request the third party delete their data via Facebook. (That requires going to each third party service individually to make a request.)

Last year a German court ruled against a consumer rights challenge to Facebook’s use of the self-promotional slogan that its service is “free and always will be” — on the grounds that the company does not require users to literally hand over monetary payments in exchange for using the service. Although the court found against Facebook on a number of other issues bundled into the challenge related to how it handles user data.

In another interesting development last year, Germany’s federal court also unblocked a separate legal challenge to Facebook’s use of user data which has been brought by the country’s competition watchdog. If that landmark challenge prevails Facebook could be forced to stop combining user data across different services and from the social plug-ins and tracking pixels it embeds in third parties’ digital services.

The company is also now facing rising challenges to its unfettered use of people’s data via the private sector, with Apple set to switch on an opt-in consent mechanism for app tracking on iOS this spring. Browser makers have also been long stepping up action against consentless tracking — including Google, which is working on phasing out support for third party cookies on Chrome.

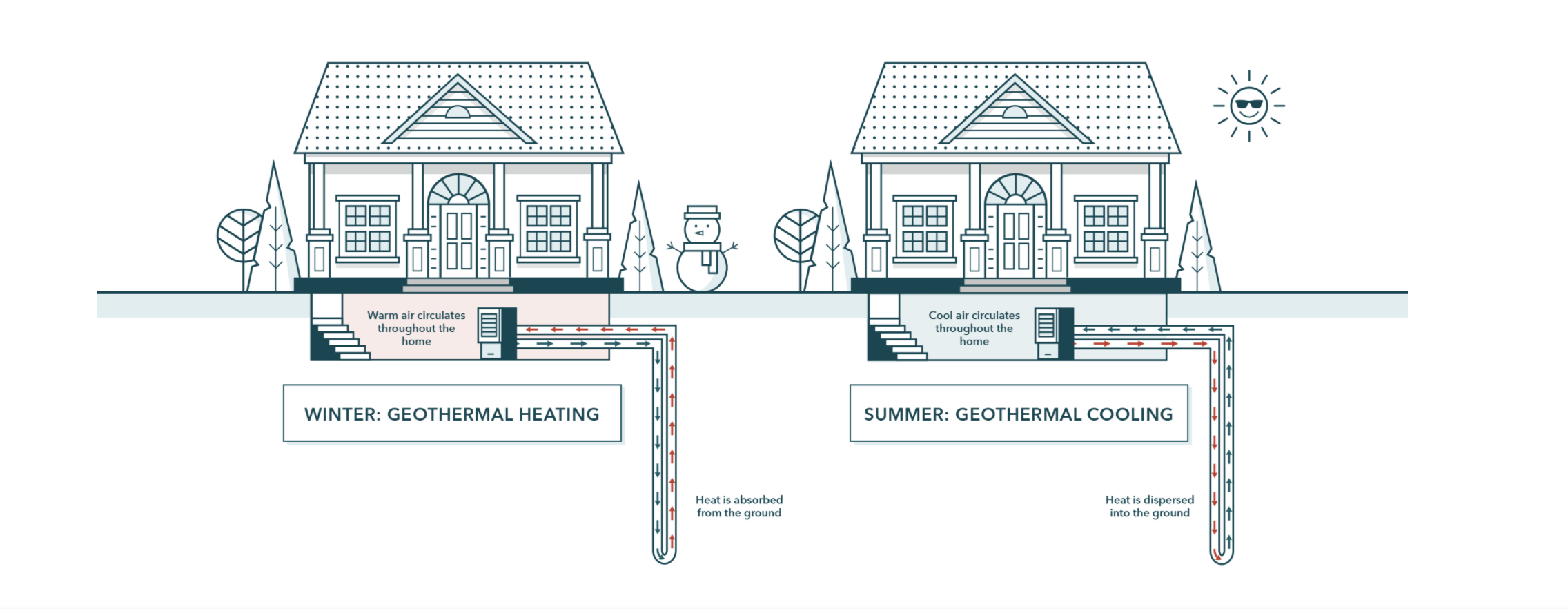

There’s a low energy solution to home heating and cooling sitting right underneath most houses, but until recently no one has been able to tap it.

That solution is geothermal energy, using the earth’s own heat to provide temperature controlled comfort to homeowners is the mission that Kathy Hannun set for herself while working at Google X (the skunkworks division within Google) and it’s been her goal when she spun out her technology as the startup Dandelion Energy.

Her company is now helmed by chief executive Michael Sachse, a former entrepreneur in residence at the venture firm NEA and a longtime executive at the energy management company, Opower, so Hannun can focus on pushing the technology she developed forward.

Helping her advance the geothermal tech is a new $30 million cash infusion from Breakthrough Energy Ventures, the fund backed by Bill Gates and a slew of other billionaires to provide financing that can commercialize the new sustainable technologies needed to help the world respond and adapt to global warming.

In Dandelion’s case that means driving down the cost of installing geothermal systems from over $50,000 to roughly $18,000 to $20,000. The company partnered with Con Edison back in 2019 to offer Westchester homeowners $5,000 off their installations, and that project accounts for some of the 500 homes that are already using Dandelion’s system.

While the number of installations is small Sachse and Hannun have ambitious goals and some other strategic financial backers that may help them meet their targets.

Chiefly, the U.S. homebuilding giant Lennar is an investor in the company’s latest round and their presence on the cap table could mean big things if Dandelion can get its systems installed in any planned new construction.

“Our goal is to be able to do 10,000 homes per year. When we think about getting to 10,000 homes per year what that requires is for us to expand geographically,” Sachse said. “Lennar, which depending on how you measure it either the second largest or the largest homebuilder — they are not just an investor but we are working with them on developing communities.”

For now Dandeliion’s technology is only used by folks in very specific situations who could loosely be described as upper middle class.

“We think of our typical customer as someone who is interested in making a sound economic choice. They’re in their 40s or 50s, with a college degree and good credit,” Sachse said. “Living in a home that is 2000 to 2500 square feet that is by definition a little bit removed from the traditional urban infrastructure. Upper middle class product in the same way that solar has found traction in homes like that.”

Currently, the company focuses on the retrofit market and is confining its operations to the Northeast where there are roughly 5.6 million homes that use fuel oil or propane where installing a Dandelion system can make economic sense given the current costs for the tech.

“The core target customer is someone who is using fuel oil or propane to heat their home. The reason to target them is because we think the payback or them is most attractive,” Sachse said. “Typically the customers who are investing in a Dandelion system and paying cash are going to see a five to seven year payback. Customers who are financing are going to see a lower energy bill from day one.”

Dandelion’s innovations touch on three different aspects of making geothermal systems work, the drill, the heat exchanger, and the monitoring and management system for the heating and cooling system once it’s installed.

First, the company designed a drill that could give installation operations a smaller footprint. Installers need about 7 feet of space to drill down the 300 feet to 500 feet the company needs to access the 55 degree temperatures necessary to create the Dandelion heat loop.

The company then connects that loop to a novel heat exchanger located in a mechanical room of the house. That heat pump is connected to several sensors allowing the company to integrate with things like the Nest Thermostat to enable homeowners to have more control of the temperature n their homes through their smart phones.

Dandelion Energy heating and cooling system. Image Credit: Dandelion Energy

Dandelion’s system also includes a smart remote monitoring system that collects and stores data. The data is then uploaded about every 10 seconds and is monitored by Dandelion engineers, the company said. This means any potential problems will be caught immediately and a repair man can be sent to the homeowner’s house before the customer is even aware there might be an issue.

The company’s executives argue that massive adoption of their home heating and cooling systems represent a vital part of any energy transition away from fossil fuels, chiefly because electric heating systems are inefficient.

“If we had a grid that was large enough to renewable supply electricity and not worry about the efficiency of the electricity demand we’d be in an amazing spot,” Sachse said. “Realistically to electrify the grid we need to triple our capacity while becoming more efficient. I don’t see how we get there without as part of that journey finding more sustainable ways to heat our homes.”

Geothermal home heating would certainly go a long way toward stabilizing the grid, according to Hannun

“Already air conditioners that are more efficient are putting enormous strain on the grid. Drives fuel use and transition challenges. The benefits of geothermal because of that connection to the ground is really moving out the demand peak,” she said. “The technology has a lot of benefits that it confers to the grid and help it operate much better. Which is one reason why we’ve seen utilities in New York embrace this technology and really become its champion.”

Breakthrough Energy Ventures is wholeheartedly on board with Dandelion’s solution.

“Through a combination of technology, data and operations, Dandelion is making geothermal heating and cooling cost-effective for the residential market, and working to solve a critical need for homeowners and our energy ecosystem,” said Carmichael Roberts, Breakthrough Energy Ventures, in a statement. “Dandelion’s geothermal heat pumps provide an efficient electric heating and cooling system that lowers the cost of heating and cooling for homeowners, no matter their region or climate. We’re looking forward to working with Dandelion as they look to fully displace fossil fuels from the home’s heating and cooling systems.”

TigerGraph, a well-funded enterprise startup that provides a graph database and analytics platform, today announced that it has raised a $105 million Series C funding round. The round was led by Tiger Global and brings the company’s total funding to over $170 million.

“TigerGraph is leading the paradigm shift in connecting and analyzing data via scalable and native graph technology with pre-connected entities versus the traditional way of joining large tables with rows and columns,” said TigerGraph found and CEO, Yu Xu. “This funding will allow us to expand our offering and bring it to many more markets, enabling more customers to realize the benefits of graph analytics and AI.”

Current TigerGraph customers include the likes of Amgen, Citrix, Intuit, Jaguar Land Rover and UnitedHealth Group. Using a SQL-like query language (GSQL), these customers can use the company’s services to store and quickly query their graph databases. At the core of its offerings is the TigerGraphDB database and analytics platform, but the company also offers a hosted service, TigerGraph Cloud, with pay-as-you-go pricing, hosted either on AWS or Azure. With GraphStudio, the company also offers a graphical UI for creating data models and visually analyzing them.

The promise for the company’s database services is that they can scale to tens of terabytes of data with billions of edges. Its customers use the technology for a wide variety of use cases, including fraud detection, customer 360, IoT, AI, and machine learning.

Like so many other companies in this space, TigerGraph is facing some tailwind thanks to the fact that many enterprises have accelerated their digital transformation projects during the pandemic.

“Over the last 12 months with the COVID-19 pandemic, companies have embraced digital transformation at a faster pace driving an urgent need to find new insights about their customers, products, services, and suppliers,” the company explains in today’s announcement. “Graph technology connects these domains from the relational databases, offering the opportunity to shrink development cycles for data preparation, improve data quality, identify new insights such as similarity patterns to deliver the next best action recommendation.”

Source: https://techcrunch.com/2021/02/17/tigergraph-raises-105m-series-c-for-its-enterprise-graph-database/

Hardware may indeed be hard, but a startup that’s built a platform that might help buck that idea by making hardware a little easier to produce has announced some more funding to continue building out its platform.

Fictiv, which positions itself as the “AWS of hardware”, providing a platform for those wanting to design and manufacture items, to easily evaluate and order the manufacturing, and subsequent movement of those goods, has raised $35 million.

It will be using the money to continue building out its platform and the supply chain that underpins Fictiv’s business, which the startup describes as the “Digital Manufacturing Ecosystem.”

David Evans, the CEO and founder, said that the focus of the company has been and will continue to be jobs that are highly specialised, and ultimately not mass-produced items, such as prototypes or objects that are specialised and by their nature not aimed at mass markets, such as particular medical devices.

“We are focused on 1,000 to 10,000,” he said in an interview. “This is the range where most products still die.”

The round — a Series D — is coming from a mix of strategic and financial investors. Led by 40 North Ventures, it also includes Honeywell, Sumitomo Mitsui Banking Corp., Adit Ventures, and M20 (Microsoft’s strategic investment arm), as well as past backers Accel, G2VP, and Bill Gates.

The round brings the total raised by Fictiv to $92 million, and its valuation is not being disclosed

Evans said that the last couple of years since its previous round ($33 million raised in early 2019) have well and truly tested the business concept that he envisioned when first establishing the startup.

Even before the pandemic, “we had no idea what the trade wars between the U.S. and China would do.”

Quite abruptly, the supply chain got completely “crunched, with everything shut down” in China over those disputes, at which point, Fictiv shifted manufacturing to other parts of Asia such as India, and to the U.S. That ended up helping the company when the first wave of Covid-19 hit, initially in China.

Then came the global outbreak, and Fictiv found itself shifting yet again as plants shut down in the countries where it had recently opened. Then, with trade issues cooled down, Fictiv again reignited relationships and operations in China, where Covid had been contained early, to continue working there.

“I guess we were just in the right places at the right time,” he said.

The startup made its name early on with building prototypes for tech companies neighboring it in the Bay Area, startups build VR and other gadgets, with services that included injection molding, CNC machining, 3D printing and urethane casting, with customers using cloud-based software to design and order parts, which then were routed by Fictiv to the plants best suited to make them.

These days, while that business continues, Fictiv is also working with very large global multinationals on their efforts with smaller-scale manufacturing, products that are either new or unable to be tooled as efficiently in their existing factories.

Work that it does for Honeywell, for example, includes mostly hardware for its aerospace division. Medical devices and robotics are two other big areas for the company currently, it said.

But Evans and his investors are careful not to describe what they do as specifically industrial technology.

“Industrial tech is a misnomer. I think of this as digital transformation, cloud-based SaaS and AI,” said Marianne Wu, the MD of 40 North. “The baggage of industrial tech tells you everything about the opportunity.”

Fictiv’s pitch is that by taking on the supply-chain management of producing hardware for a business, it can produce hardware using its platform in a week, a process that might have previously taken 3 months to complete, which can mean lower costs and more efficiency.

“And when you speed up development, you see more products getting introduced,” he said.

There is still a lot of work to be done, however. One of the big sticking points in manufacturing has been the carbon footprint that it creates in production, and also in terms of the resulting goods that are produced.

That will likely become even more of an issue, if the Biden Administration follows through on its own commitments to reduce emissions and to lean more on companies to follow through for those ends.

Evans is all too aware of that issue and accepts that manufacturing may be one of the hardest to shift.

“Sustainability and manufacturing are not synonymous,” he admits. And while materials and manufacturing will take longer to evolve, for now, he said the focus has been on how to implement better private and public and carbon credits programs. He envisions a better market for carbon credits, he said, with Fictiv doing its part with the launch of its own tool for measuring this.

“Sustainability is ripe for disruption, and we hope to have the first carbon-neutral shipping program, giving customers better choice for more sustainability. It’s on the shoulders of companies like us to drive this.”

Source: https://techcrunch.com/2021/02/17/fictiv-nabs-35m-to-build-out-the-aws-of-hardware-manufacturing/