& meet dozens of singles today!

User blogs

Earlybird Digital East Fund — a fund associated with Germany’s Earlybird VC, but operating separately — has launched a €200m ($242m) successor fund. The fund’s focus will remain the same as before: a Seed and Series-A fund focusing on what’s known as ‘Emerging Europe’, in other words, countries stretching from the Baltics to Central and Eastern Europe, and Turkey. The firm has also promoted Mehmet Atici, who’s been with the firm for eight years, to Partner. The new fund has made four investments so far: FintechOS, Payhawk, Picus, and Binalyze.

The back-story to DEF is a fascinating tale of what happened to Europe in the last 15 years, as tech took off and Europeans returned from Silicon Valley.

Following his exit from SelectMinds (where he was the Founder & CEO) in 2005, Cem Sertoglu moved back to Turkey. Although he says he “accidentally became the first angel investor” there, he was clearly the right man, in the right place, at the right time. He told me: “I was very lucky and ended up writing the first checks in some of the first large outcomes in Turkey.”

In 2013, Sertoglu partnered with Evren Ucok (the first angel in Peak Games and Trendyol), and Roland Manger (Earlybird). Dan Lupu, a Romanian investor who had covered the region for Intel Capital, joined them, and together they raised the ‘Earlybird Digital East Fund I’ set at $150m fund in 2014, focusing on CEE and Turkey. This was and is an area where there can be high-quality ventures to be found, but very little in the way of VC.

Thereafter, between 2014 and 2019, the fund invested in UiPath, Hazelcast, and Obilet. UiPath has become a global leader in the area known as ‘Robotic Process Automation (RPA). Hazelcast is a low latency data processing platform startup with Turkish roots. Obilet is a marketplace focused for the massive Turkish intercity bus travel market. DEF has also exited Vivense, Dolap, and EMbonds and in more recent times the fund has exited Vivense, the “Wayfair of Turkey” to Actera, the top local PE fund.

The team had spectacular early success. Peak Games, Trendyol, YemekSepeti and GittiGidiyor are the four largest Turkish tech exits to date. Digital East Fund was an investor in all of them. Peak games exited for $1.8 billion in cash to Zynga only last year.

As of Q4 2020, the fund’s metrics are:

Investment Multiple: 24.9x

Gross IRR: 104.4%

Net IRR: 84.1%

So in VC terms, they have done pretty well.

I interviewed Sertoglu to unpack the story of Earlybird Digital East Fund.

He told me DEF has achieved a 17 times investment multiple on a $150 million fund. He thinks “this might be the biggest European VC fund performance in history, and it’s not coming from Berlin, it’s not coming from London, but it’s coming from Eastern Europe. We have been told by some of our LPs that they think we’re the top 2014 vintage VC fund in the world, nobody’s seen stronger numbers than this.”

“Peak Games turned out to be a phenomenal story. When you look at how tough it’s been for Turkey, macroeconomically. The fact that a single company with 100 people essentially sold for $1.8 billion in cash, was just… it was staggering for the local market here.”

DEF’s emergence from Turkey, together with its relationship with a fund in Berlin, was not the most obvious path for the VC fund.

“One thing we realized early one was that we could invest with our own capital and syndicating to our friends, but for follow-on funding, we’d always have to go global. And that made us feel vulnerable. It made us feel we were always dependent on others’ comprehension of the opportunity that we were facing. So that’s when the first fund idea came out this was,” said Sertoglu.

“We felt that there was this unusual dislocation between opportunity and capital in Eastern Europe. Our first fund was $150 million funds – I mean, a very quaint size compared to Western markets. But we became the largest fund in the region, and decided to focus on this series A gap where we felt that there was this big opportunity, because of the way we think series A is still very much a local play.”

“Being a local player that understands the region would be an advantage, so this was proven to be true. We could essentially see pretty much everything in Eastern Europe for the last eight years. And we caught the biggest one, fortunately, which was UiPath. I think very few funds around the world can say that they see the majority if not all of the opportunities that fall into their mandate,” he said.

“We have this dual strategy of backing local champions as well as contenders for global markets as well. 20 years ago you had to be in Silicon Valley. Now, Transferwise comes out of Estonia, UiPath comes out of Romania. And that was even before the pandemic.”

Sertoglu concluded: “So we now have fresh capital, coming on the heels of a very successful first fund, which we’re keen to deploy. We’re calling all the opportunities, seeing very ambitious, strong teams coming out of the region. And we have 200 million euros to focus on these types of opportunities in the region.”

There are over 1.7 billion underbanked people globally, the majority of which are from emerging markets. For them, accessing loans can be difficult, which is a problem fintechs try to solve. One way they do this is by promoting financial inclusion by underwriting credit via a proprietary algorithm.

One such company is FairMoney, which describes itself as “the mobile banking revolution for emerging markets.” FairMoney, founded by Laurin Hainy, Matthieu Gendreau and Nicolas Berthozat, is a licensed online lender that provides instant loans and bill payments to underserved consumers in emerging markets.

Three years after launching its mobile lending service in Nigeria, the company set up shop in India, Asia’s second-most populous country in August 2020.

Before expanding, FairMoney experienced exponential growth in Nigeria in terms of loans disbursement. Last year, it disbursed a total loan volume of $93 million, representing a 128% increase from 2019 and a staggering 3,189% growth rate from its first year of operation in 2018. As it stands, the company is projecting a $140 million loan disbursement volume by the end of 2021.

“I think we’ve been able to disburse 25-30% more than some of our competitors and I think we’re a market leader,” Hainy, the company’s CEO told TechCrunch. But compared with traditional banks, it was the seventh-largest digital financial services provider in that area.

FairMoney has come a long way since its Nigeria launch in 2017. In its first year of operation, the company had little over 100,000 users. Now, it claims to have 1.3 million unique users who have made over 6.5 million loan applications. FairMoney offers loans from ₦1,500 ($3.30) to ₦500,000 ($1,110.00) with its longest loan facility standing at 12 months. Annual percentage rates fall within 30% to 260% — the high APR, Hainy says, is due to higher default rates in Nigeria. That said, FairMoney also claims to have an NPL ratio lower than 10%.

According to the CEO, data-driven insights was behind the choice to expand to India. The Indian market is quite similar to Nigeria’s. In the Asian country, only 36% of adults have access to credit, leaving an untapped market of about 141 million people microfinance banks do not serve. But unlike Nigeria, India has better unit economics for the lending business and a more friendly regulatory environment.

“If our ambition is to build the leading mobile bank for emerging markets, we need to start with very large markets,” Hainy said. “We tested our products in 10 different markets checking out for things like what the yield economics is like, NPLs, cost of risk, customer acquisition cost, cost of infrastructure and India stood out to us.”

FairMoney Nigeria team

Following its expansion six months ago, FairMoney claims to have processed more than half a million loan applications from over 100,000 unique users. This number trickles down to $5,000 to $6,000 loan applications per day with APR standing at 12-36%. Hainy says the company has achieved this with zero ad spend or marketing.

Due to the daunting logistics behind international expansions, it’s challenging for an African-based startup to expand outside the shores of the continent. Although a rarity, there are a couple of startups to have undertaken such a task. Last year, Nigerian fintech Paga with 15 million users and a network of over 24,000 agents acquired Ethiopian software company Apposit to fast-track its expansion into Ethiopia and Mexico.

FairMoney is on a similar path, as well. And with over 100 staff spread across Nigeria, France, and Latvia, the company hopes to build an engineering and marketing team in India.

Last month, it hired the services of Rohan Khara to become its chief product officer (CPO) and facilitate the expansion. Khara was the former head of product for financial services for Indonesian super app Gojek and held senior roles at Microsoft, Quikr and MobiKwik. Hainy says with Khara’s wealth of experience building consumer products in large emerging markets — India and Indonesia — FairMoney is poised for massive growth in Nigeria and India.

“We both share the vision that financial services in emerging markets need fixing and for us, Rohan brings the expertise to see FairMoney scale from almost a million users to 10 or 20 million users.”

FairMoney French team

Born in Germany to a Nigerian father and German mother, Hainy began his entrepreneurial journey in 2015 by launching a food delivery company in Sweden. Seven months later, he founded Le Studio VC, a Paris-based startup studio and €15 million fund he ran as CEO for three years.

“After those three years, I realised that being an investor wasn’t for me yet. I felt I was too young and I wanted to build something myself,” he said.

Neobanks like Revolut in the UK and N26 in Germany were picking up across Europe. Hainy wanted to create such for Nigeria after noticing how much people lacked access to affordable financial services during a visit.

But despite studying other neobank models, Hainy and his team couldn’t replicate them in a developing market like Nigeria. Credit was still significantly underserved by Nigerian banks because of the strict methodology employed in allocating loans. Sensing an opportunity, they launched FairMoney as a neobank by leveraging a credit-first model. Like Nubank in Brazil, FairMoney started off offering loans to solve the access to credit problem. But its broader vision is not to be just a digital bank but also a commercial bank.

The company is working towards getting a microfinance bank license to operate as the former in Nigeria. However, according to the CEO, the commercial bank license will take longer maybe five to ten years.

“In the next five to ten years, I’d like to think two out of the five largest commercial banks in Nigeria will be neobanks. We want FairMoney to be one of them,” he said.

The Lagos and Paris-based company raised $11 million Series A in 2019. Between now and the time it will get a commercial bank license, Hainy says the company would’ve raised its Series B round to position itself for that task.

After India, which emerging market will FairMoney expand to next? There’s none in sight at the moment, the CEO says. The company plans to move from a credit-led value proposition to a full financial service provider, deepen its verticals, and replicate Nigeria’s growth in India for now.

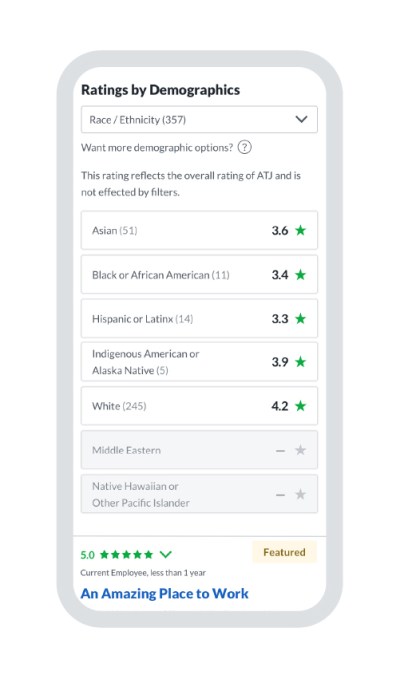

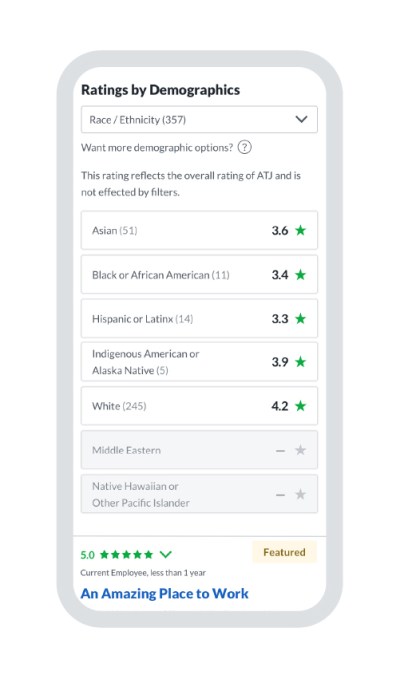

Despite efforts from companies to create equitable environments, it’s clear that employees of a certain demographics, like Black women, sometimes have very different experiences from their counterparts. Glassdoor aims to better surface those experiences through a new feature that allows folks to filter ratings by demographics.

Up until now, Glassdoor only presented an overall ranking for a specific company, so there was no way to easily determine if, for example, Black women feel the same as white men, or if Latino men feel similarly to Asian men. In addition to race, Glassdoor now allows people to filter by gender identity, parental or caregiver status, disability, sexual orientation and veteran status.

Overall, Black employees are less satisfied at work in comparison to all employees, according to new preliminary research from Glassdoor. The research is based on the more than 187,000 employees across more than 3,300 companies who have provided demographic data.

Image Credits: Glassdoor

That same research showed Apple had the highest overall company rating among Black employees, with an average rating of 4.2 out of five. Apple’s overall company rating from that sample size is 3.9.

“Because these data are so new — having been collected within just the last four months — it’s important to resist the urge to make sweeping claims based on early data,” Glassdoor Data Scientist Amanda Stansell and Chief Economist Andrew Chamberlain said in the report. “The averages we’ve reported above are not derived from representative probability samples of company workforces — they represent data shared anonymously by Glassdoor users at this time. Readers should therefore take some caution in making conclusive, company-wide inferences about the state of race and employee satisfaction.”

Source: https://techcrunch.com/2021/02/17/glassdoor-now-lets-you-filter-company-reviews-by-demographics/

Despite efforts from companies to create equitable environments, it’s clear that employees of a certain demographics, like Black women, sometimes have very different experiences from their counterparts. Glassdoor aims to better surface those experiences through a new feature that allows folks to filter ratings by demographics.

Up until now, Glassdoor only presented an overall ranking for a specific company, so there was no way to easily determine if, for example, Black women feel the same as white men, or if Latino men feel similarly to Asian men. In addition to race, Glassdoor now allows people to filter by gender identity, parental or caregiver status, disability, sexual orientation and veteran status.

Overall, Black employees are less satisfied at work in comparison to all employees, according to new preliminary research from Glassdoor. The research is based on the more than 187,000 employees across more than 3,300 companies who have provided demographic data.

Image Credits: Glassdoor

That same research showed Apple had the highest overall company rating among Black employees, with an average rating of 4.2 out of five. Apple’s overall company rating from that sample size is 3.9.

“Because these data are so new — having been collected within just the last four months — it’s important to resist the urge to make sweeping claims based on early data,” Glassdoor Data Scientist Amanda Stansell and Chief Economist Andrew Chamberlain said in the report. “The averages we’ve reported above are not derived from representative probability samples of company workforces — they represent data shared anonymously by Glassdoor users at this time. Readers should therefore take some caution in making conclusive, company-wide inferences about the state of race and employee satisfaction.”

Source: https://techcrunch.com/2021/02/17/glassdoor-now-lets-you-filter-company-reviews-by-demographics/

If you’ve ever tried to hop on the bus in San Francisco and were bummed to find that Apple Pay wasn’t an option: good news! That’s changing. Apple has announced that support for Clipper (the payment system for BART, Muni, Caltrain, AC Transit, and a bunch of other Bay Area transit agencies) is officially on the way. You’ll soon be able to just tap your iPhone or Apple Watch to the card reader and be on your way.

Apple says that Apple Pay will work across all 24 agencies where Clipper is accepted, meaning it should play friendly with:

- AC Transit

- BART

- Caltrain

- City Coach

- County Connection

- Dumbarton Express

- FAST

- Golden Gate Ferry

- Golden Gate Transit

- Marin Transit

- Muni

- Petaluma Transit

- SamTrans

- San Francisco Bay Ferry

- Santa Rosa CityBus

- SMART

- SolTrans

- Sonoma County Transit

- Tri Delta Transit

- Union City Transit

- Vine

- VTA

- WestCAT

- Wheels

Apple does mention that it’ll work with the optional “Express Transit” feature built into Wallet, allowing you to make these relatively small transit transactions without requiring Face ID or Touch ID verification — a nice touch for when there’s 10 people waiting to get on behind you and you’d rather not have to deal with convincing your phone that you are, in fact, you.

So when will it officially roll out? Good question — and one that Apple isn’t answering yet. In an e-mail announcing the coming Clipper support, they say it’s “Coming soon,” but don’t get any more specific than that. A tweet from the @BayAreaClipper account, meanwhile, narrows it down to “this spring” and reiterates that Google Pay support is coming soon, as well.

We’re going mobile! Clipper is coming to Apple Pay and Google Pay this spring. Stay tuned for more details! #clippercard

— Bay Area Clipper (@BayAreaClipper) February 17, 2021

Source: https://techcrunch.com/2021/02/17/apple-pay-will-soon-work-on-bart-and-muni/