& meet dozens of singles today!

User blogs

Equity is celebrating its fourth birthday in a few weeks and closed 2020 with its biggest quarter to date. To celebrate and say thank you to our wonderful listeners who tune into us each and every single week, we’re growing upward and outward!

First, as many of you have noticed, we’ve expanded the Equity team. Grace Mendenhall joined the production crew this year, initially helping cover for Chris Gates while he was out on paternity leave. But now Chris is back and so we’ve doubled our producer team.

In classic startup fashion, a bigger team means we can make more swings at R&D, or in this case, add on a new show to our semiweekly cadence.

Today, the whole Equity team — Chris, Grace, Danny, Natasha and Alex — are super proud to announce that we’re expanding the podcast’s show lineup. We’re going to add a new show each week, which will rotate around a particular theme, geography or supermassive news event. It’s your midweek chance to listen to a show about one trend, whether that’s space tech or the growth of community as a competitive advantage. Sometimes it will be an exact topic you’ve cared about for so long (insert Alex and SaaS joke here) and sometimes it will be about a topic you know nothing about. We’re here to convince you to care anyway. Regardless, you can depend on the Equity trio to give you a trifecta of shows that helps you stay up to date on startup and venture capital news in a consumable way.

Starting, well, now, here’s what Equity looks like:

- Equity on Monday: Our weekly kickoff show is not changing. Except Alex has promised to learn how to speak with better diction.

- Equity on Wednesday: Our midweek show focused on a single topic or theme. Expect to hear from other TechCrunch reporters about their beats, investors on what they are seeing in the market and reporting on countries and cities where startup activity is blowing up.

- Equity, now on Friday: The main Equity episode is not changing, other than that we’re going to tighten it up a little bit and release it Friday mornings like we used to. While it was a blast to get out the door Thursday afternoon, we’re going to give Equity Wednesday a little more time to breathe. And since so many of you listen to this episode on Friday anyway, most folks won’t notice a change.

As COVID-19 fades thanks to the rollout of vaccines around the globe, we’ll eventually get back into our studio. That could mean more video down the pike. And we’ll still do the odd Equity Shot for big events that we can’t help but chat about.

Our goal was to double-down on what we think is the best part of Equity: A group of friends hammering through the news as a group, learning, joking and having fun with the world of startups and venture capital.

So, we’ll see you one more time each week. Cool? Cool. Hugs from here and chat soon. — The Equity Team

Source: https://techcrunch.com/2021/02/24/the-equity-podcast-is-getting-bigger-and-better/

Oak HC/FT general partners Annie Lamont, Andrew Adams and Tricia Kemp invested in healthcare and fintech before the two sectors were mainstream, and today, as a result of that early intuition and a handful of key exits, the trio has over a billion dollars in new fund money to show for it.

The firm announced today that it has secured $1.4 billion for its largest fund to date, an investment vehicle that will exclusively back healthcare and fintech companies. The firm previously raised $500 million, $600 million and $800 million for its other funds, respectively. Doing quick math, Oak HC/FT, which closed its first fund in 2014, has been able to triple its total assets managed in six years.

Over the history of its fund, the team has outlined six notable exits, including Anthem’s acquisition of Aspire Health, Thermo Fisher Scientific’s acquisition of Core Informatics, Diplomat’s acquisition of LDI Integrated Pharmacy Services, AXA Group’s acquisition of Maestro Health, GoDaddy’s acquisition of Poynt and Limeade’s public debut. The firm declined to share any numbers around IRR, or share information on what percent of current portfolio companies are planning to go public and which are best capitalized to do so.

Today’s fund, its fourth to date, will be invested across 20 companies, with average check sizes between $60 million and $100 million. Oak HC/FT invests in both early-stage and growth-stage companies. The fresh capitalization comes during a watershed moment for the two sectors, heavily impacted by the coronavirus pandemic from an innovation and adoption perspective.

For example, digital health funding broke records in 2020, attracting over $10 billion in the first three quarters and increase in deals by investors, compared to the previous year. Fintech, despite an uneven beginning, has been tearing through capital to meet with demand, and valuations continue to skyrocket.

From a healthcare perspective, Adams told TechCrunch that it is looking at startups working on the cost of delivering care and ability to engage with complex patients. Lamont said that “virtualization of [both doctors and patients] has been incredible in the last year,” and that much of the firm’s focus is on startups that rely on providers taking risk. The investor is hinting at the big push of startups that are betting that value-based care will replace fee-for-service care. The former rewards service for money, instead of time for money, placing monetary incentive for doctors more on outcomes than number of visits it takes to get to an outcome.

I asked the team if telehealth was no longer as big of a question mark for them, since the pandemic has accelerated adoption. But Lamont argued that telehealth is still “unbelievably complicated to pull off at scale, which is less obvious to the public.” The firm is looking for startups who can bring a consumer experience to telehealth, taking the place of an in-person receptionist.

The firm is also looking at startups that blend its two expertises, healthcare and fintech, around payments and digitization of billing. Kemp said that the firm is less interested in standalone point-of-sale services for restaurants and bills, and are now looking at items that reduce friction with payments. One of its e-commerce optimization portfolio companies, Rapyd, raised $300 million at a $2.5 billion valuation in January.

Other subsectors of interest include digital consumer payments, as shown by portfolio companies Namogoo and Prove, and fraud and risk identification, as shown by portfolio companies Au10tix and Feedzai.

On the diversity front, Oak HC/FT said that within its portfolio, 26% of C-suite and executive leadership roles are held by women, and 52% of senior management roles are held by women.

The firm has invested in nearly 100 startups to date. Of the 35 investments it made in 2020, 20 of the deals were follow-on rounds.

Source: https://techcrunch.com/2021/02/24/oak-hc-ft-1-4-billion/

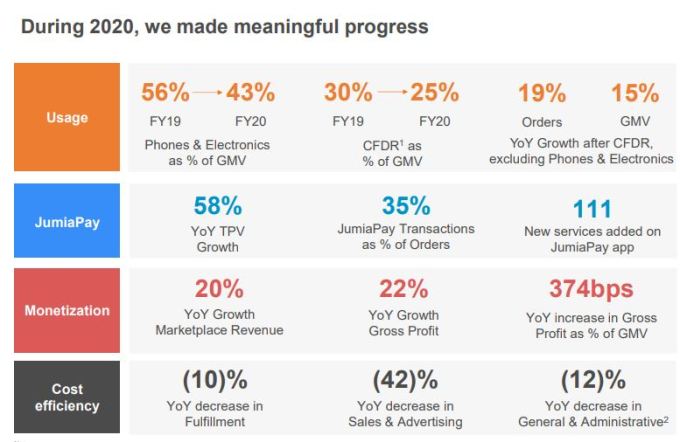

After years of losses, African e-commerce giant Jumia claimed significant progress towards profitability in its Q4 2020. Backing that claim, Jumia reported record gross profit and some improvements to its cost structure.

The company wrote in its earnings release that while “2020 has been a challenging year operationally with COVID-19 related supply and logistics disruption,” it had also proven “transformative” for its business model.

Let’s examine its financial results to see how Jumia fared during the pandemic year and see if we can see the same path to profitability discussed in its written remarks.

The results

Jumia’s core metrics were uneven in 2020. The company saw its user base grow by 12% in 2020, from 6.1 million customers in 2019 to 6.8 million customers. That means the company added 700,000 customers in 2020 compared to the 2 million customers it acquired the year before.

Other metrics were negative. The company’s gross merchandise value (GMV), the total worth of goods sold over a period of time, grew 23% from the previous quarter to €231.1 million. The company said this was a result of the Black Fridays sales in the quarter. However, when compared year-over-year, Q4 GMV was down 21% “as the effects of the business mix rebalancing initiated late 2019 continued playing out during the fourth quarter of 2020,” Jumia wrote.

Image Credits: Jumia

In terms of orders made on the platform, Jumia saw a 3% year-over-year drop from 8.3 million in Q4 2019 to 8.1 million in Q4 2020. But while the company’s metrics were mixed during Q4 and the full-year 2020 period, there were encouraging signs to be found.

Last year, Jumia’s Q4 gross profit after fulfillment expense was €1.0 million. We reported at the time that the number’s positivity was commendable if merely another mile of the company’s path to profitability.

The company built on that result in 2020, allowing it to report a record gross profit after fulfillment expense result of €8.4 million in the final quarter of last year. From a full-year perspective, the numbers are even starker, with Jumia managing just €1.5 million in 2019 gross profit after fulfillment expense; in 2020, that number grew to €23.5 million.

That Jumia managed those improvements while seeing its 2019 revenues of €160.4 million slip 12.9% in 2020 to €139.6 million is notable.

JumiaPay and improvement in losses and expenses

There are other metrics that are encouraging for Jumia.

Its gross profit reached €27.9 million in 2020, representing a year-over-year gain of 12%. Sales and Advertising expense decreased year-over-year by 34% to €10.2 million, while General and Administrative costs, excluding share-based compensation, came to €21.8 million in the year, falling 36% year-over-year.

In 2019, Jumia incurred a massive €227.9 million in losses, a 34% increase from 2018 figures of €169.7 million. But that changed last year as Jumia reported a smaller €149.2 million in operating losses, representing a 34.5% decrease from 2019.

Turning from GAAP numbers to more kind metrics, Jumia’s Q4 2020 adjusted EBITDA loss also decreased. The company recorded an adjusted EBITDA of -€28.3 million in the final quarter of 2020, falling 47% year-over-year from 2019’s €53.4 million Q4 result. For the full 2020 period, Jumia reported €119.5 million in adjusted EBITDA losses, down 34.6% from FY19’s -€182.7 million result.

Jumia lost less money on an adjusted EBITDA basis in 2020 of any of its full-year periods we have the data for. Still, the company remains deeply unprofitable today and for the foreseeable future.

Fintech

Jumia’s fintech product, JumiaPay, has been a factor behind its improving metrics.

In Q1 2020, it processed 2.3 million transactions worth €35.5 million. That number grew to €53.6 million from 2.4 million transactions in Q2 2020. In the third quarter of last year, it recorded 2.3 million transactions with a payment volume of €48.0 million. For Q4, JumiaPay performed 2.7 million transactions worth €59.3 million.

In total, JumiaPay processed 9.6 million transactions with a total payment volume (TPV) of €196.4 million throughout 2020. TPV increased by 30% in Q4 2020 from its 2019 result and 58% in 2020 as a whole.

JumiaPay is a critical part of Jumia’s business, as 33.1% of its orders in Q4 2020 were paid for with the service, up from 29.5% in Q4 2019.

Share price and optimism around profitability

Jumia went public in April 2019. Since opening as Africa’s first tech company on the NYSE at $14.50 per share, the company’s stock has been on a rollercoaster ride.

It traded at $49 per share at one point before battling with scepticism about its business model, fraud allegations, and shorting by Andrew Left, a well-known short-seller and founder of Citron Research. What followed was the company’s share price crashing to $26 before reaching an all-time low of $2.15 on the 18th of March 2020.

Later, Left made a reversal after claiming Jumia had handled its fraud problems. He took long positions at the company and later proposed it would hit $100 per share. That change in market sentiment, coupled with the fact that Jumia changed its business model and halted operations in Cameroon, Rwanda, and Tanzania, enabled its share price to climb back, reaching an all-time high of $69.89 this February 10th.

Before today’s earnings call, Jumia was trading at $48.81. Since dropping its latest data, the company’s share price has expanded by around 10% to just over $54 per share as of the time of writing, indicating investor bullishness despite its continued operating and adjusted EBITDA losses.

Kapor Capital, the venture firm focused on funding social impact ventures and founders of color, is raising a $125 million fund, called Fund III, a source familiar with the situation told TechCrunch.

What’s notable about this fund is that it will be the first time Kapor Capital is accepting outside money from investors for a fund. Historically, the capital have come directly from Kapor Capital founders Mitch Kapor and Freada Kapor Klein.

The fund will be led by Kapor Capital partners Brian Dixon and Ulili Onovakpuri. The two will function as co-managing partners.

Onovakpuri was promoted from principal to partner back in 2018. At the time, she told me was interested in technology that makes access to healthcare more accessible, either through reimbursements to low-income people or through subsidized payments. On the people operations side, Onovakpuri said she was looking at investing in startups that help create inclusive cultures.

“What we have found is that more needs to be done in order to keep [people from diverse backgrounds] in and happy, so that’s what I’ve invested in,” Onovakpuri said.

Her first couple of investments were in mSurvey mSurvey, which started as a text message platform to identify disparities in the world, and tEQuitable, which aims to help companies be more inclusive.

Her co-manager, Dixon, became one of the first Black investors to be promoted to partner at a venture capital in 2015. At the time, Dixon told me he was focused on increasing the number of founders who identify as women and/or an underrepresented person of color in Kapor Capital’s portfolio to above 50%.

“As partner, that’s what I’m trying to continue to do,” Dixon said at the time. “We’re still looking for the best companies. We’re still looking for companies that are going to be impact companies, but also have VC-like returns, so I think that’s what unique about Kapor Capital, is that not many early-stage firms have that focus, and we think we do it pretty well.”

Today, 59% of the companies in Kapor Capital’s portfolio have a founder who identifies as a woman and/or an underrepresented person of color. Kapor Capital has been instrumental in advancing diversity and inclusion in the tech industry. Back in 2016, for example, Kapor Capital began requiring new portfolio companies to invest in diversity and inclusion as part of a Founders’ Commitment.

Kapor Capital has invested in companies like AngelList, Pigeonly, Bitwise Industries, Blavity, Bloc Power, Hustle and others.

Kapor Capital declined to comment for this story.

Source: https://techcrunch.com/2021/02/24/kapor-capital-is-raising-a-125-million-fund/

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie:

Help! Our startup needs to hire 50 engineers in artificial intelligence and related fields ASAP. Which visa and green card options are the quickest to get for top immigrant engineers?

And will Biden’s new immigration bill help us?

— Mesmerized in Menlo Park

Dear Mesmerized,

I’m getting this question quite frequently now as more and more startups with recent funding rounds are looking to quickly expand. In the latest episode of my podcast, I discuss some of the quickest visa categories for startups to consider when they need to add talent quickly.

As always, I suggest consulting with an experienced immigration lawyer who can help you quickly strategize and implement an efficient and cost-effective hiring and immigration plan. An immigration lawyer will also be up to date on any immigration policy changes and plans in the event that the Biden administration’s U.S. Citizenship Act of 2021 passes. It was introduced in the House and Senate this month.

That proposed legislation would enable more international talent to come to the U.S. for jobs and clear employment-based visa backlogs, among other things. Given the legislation’s substantial benefits offered to employers, I encourage your startup — and other companies — to let congressional representatives know you support it.

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

Given that most U.S. embassies and consulates remain at limited capacity for routine visa and green card processing due to the pandemic, it is generally quicker to hire American and international workers who are already in the U.S. Although U.S. Citizenship and Immigration Services (USCIS) is experiencing substantial delays in processing cases due to the coronavirus, as well as an increase in applications, Premium Processing is currently available for most employment-based petitions. We are still able to support many folks with U.S. visa appointment scheduling at consulates abroad using various national interest strategies.

With all of that in mind, here are the visa categories that offer the quickest way to hire international talent.

H-1B transfers

Hiring individuals by transferring their H-1B to your startup can be completed in a couple of months with premium processing. Premium processing is an optional service that for a fee guarantees USCIS will process the petition within 15 calendar days.

What’s more, H-1B transferees can start working for your startup even before USCIS has issued a receipt notice or made a decision in the case. You just need to make sure that USCIS received the petition, which is why I always recommend sending all packages to USCIS with tracking.

Premium processing can help to get a digital receipt as the paper receipts are often backlogged. I stopped suggesting this route during the Trump administration, but am feeling more comfortable providing it as an option under the Biden administration. The H-1B is the only type of visa that allows somebody to start working upon the filing of a transfer application.

Source: https://techcrunch.com/2021/02/24/dear-sophie-which-immigration-options-are-the-fastest/