& meet dozens of singles today!

User blogs

The newest unicorn in India is a startup that is helping construction and real estate companies in the world’s second most populated nation procure materials and handle logistics for their projects.

Four year-old Infra.Market said on Thursday it has raised $100 million in a Series C round led by Tiger Global. Existing investors including Foundamental Gmbg, Accel Partners, Nexus Venture Partners, Evolvence India Fund, and Sistema Asia Fund also participated in the round, which valued the Indian startup at $1 billion.

The new round, which brings Infra.Market’s total to-date raise to about $150 million, comes just two months after the Mumbai-headquartered startup concluded its Series B round. Avendus Capital advised Infra.Market on the new transaction.

Infra.Market helps small businesses such as manufacturers of paints and cements improve the quality of their production and meet various compliances. The startup adds its load cells to the manufacturing facilities of these small businesses to ensure there is no lapse in quality, and also helps them work with other businesses that can provide them with better raw material and provide guidance on pricing. It also works closely with businesses to ensure that their deliveries are made on time.

These improvements, explained co-founder Souvik Sengupta, help small manufacturers land larger clients that have higher expectations from the businesses with which they engage. He said the startup has helped small manufacturers reach customers outside of India as well. Some of its clients are in Bangladesh, Malaysia, Singapore and Dubai.

“We are bringing a service layer to these small manufacturers, enabling them to grow their business. We don’t own the asset and are creating private label brands,” he said in an interview with TechCrunch in December. Infra.Market works with more than 170 small manufacturers and counts the vast majority of major construction and real estate companies such as giants Larsen & Toubro, Tata Projects and Ashoka Buildcon as its clients. Sengupta said the startup sells to more than 400 large clients and 3,000 small retailers.

Sengupta said in December that the startup was on track to hit the ARR (annual recurring revenue) of $100 million before the pandemic hit early last year. This nearly cut the startup’s business in half for at least two early months of the pandemic. But the startup has picked up pace again, and is now on track to hit the ARR of $180 million. The startup aims to grow this figure to $300 million by March.

“We are delighted to partner with Souvik and Aaditya in the growth journey of Infra.Market which is reshaping India’s construction materials supply chain. With pioneering technology innovation and the ability to stitch together private label brands, Infra.Market is positioned for strong growth, healthy economics and profitability,” said Scott Shleifer, Partner of Tiger Global Management, in a statement.

Sengupta added today: “We are seeing rapid acceleration in demand as Infrastructure and real-estate companies are looking to shift their procurement to get consistent quality and minimize delays.”

A new fund has launched, with backing from the Singaporean government, to support tech innovation for the maritime industry. Called Motion Ventures, it is targeting $30 million SGD (about $22.8 million USD) and has completed its first close, with Wilhelmsen, one of the world’s largest maritime networks, and logistics company HHLA as anchor investors.

Motion Ventures was launched by Rainmaking, the venture building and investment firm that runs accelerator program Startupbootcamp, and will jointly invest in startups with SEEDS Capital, the investment arm of government agency Enterprise Singapore.

SEEDS Capital announced in June 2020 that it plans to invest $50 million SGD in maritime startups, with the goal of creating more resilient supply chains and fixing issues underscored by the COVID-19 pandemic.

Shaun Hon, general partner at Motion Ventures and director at Rainmaking, told TechCrunch that the fund plans to invest in around 20 early-stage startups focused on AI, machine learning and automation, with check sizes ranging between $500,000 SGD to $2 million SGD.

“We’ve got our eyes on some of the maritime value chain’s biggest challenges including decarbonization, supply chain resilience and improving safety. In most cases, the technology to address the industry’s issues already exists, but the missing link is figuring out how to apply these solutions in the corporate context,” Hon said.

“That’s what Motion Ventures aims to address,” he added. “If we can bring a consortium of industry adopters together to connect with entrepreneurs early in the process, we’re setting everyone up with the best chance to succeed.”

In addition to capital, Motion Ventures plans to partner startups with well-established maritime firms like Wilhelmsen to help them commercialize and integrate their technology into supply chains. For mentorship, Motion Ventures’ startups will also have access to Ocean Ventures Alliance, which was launched by Rainmaking in November 2020, and now includes more than 40 maritime value chain industry leaders.

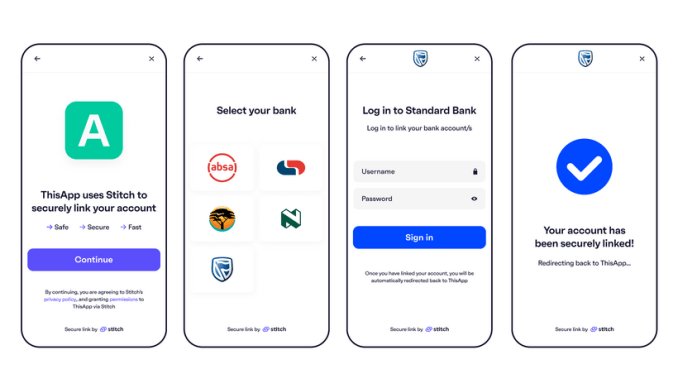

Over the years, there has been a growing trend of fintech infrastructure players around the world. In Africa, a handful of startups have launched in the past three years to provide such services. Stitch, a South African fintech startup, is one of them and today, it is coming out of stealth and announcing its seed round of $4 million. This makes it the largest round raised by any API fintech startup in Africa at the moment.

Founded by Kiaan Pillay, Natalie Cuthbert, and Priyen Pillay, Stitch wants to provide full API access to financial accounts across Africa starting from its first market, South Africa. With its API, developers can connect apps to financial accounts. This allows users to share their transaction history and balances, confirm their identities, and initiate payments.

We’ve seen a wave of API-led financial services companies proliferating around the globe. Plaid leads the way in the U.S. Sweden-based fintech Tink has also been dominant across Europe, while Truelayer and Belvo are holding the forte in the UK and Latin America.

These companies provide engineering and developer tools that reduce the technical and operational effort needed for apps to connect to their users’ financial accounts. By way of APIs, they make it possible for other companies to integrate what are otherwise complex services to build from the ground up simply by adding in a few lines of code.

Like other financial infrastructure company, Stitch services allows companies and developers to innovate around other services like personal finance, lending, insurance, payments and wealth management.

The founders draw on prior experience building API products for local markets in the past. In 2017, Kiaan Pillay worked as the head of operations for South African insurance API platform Root. He left a year to Smile Identity, a San Fransisco-based identity API company. There, he worked with fintechs across Africa and discovered they faced infrastructural issues around compliance and identity.

The Stitch team

At the same time, Pillay, Cuthbert — who was the CTO at Root — and Priyen were looking to build a Venmo for Africa, but after eight months, they soon discovered the solution was crappy. However, one feature on the platform seemed to work for the fintechs with infrastructural issues.

“We got to the point where we could build any payouts for our clients so users could link and cash out their bank accounts,” Pillay tells TechCrunch. “We decided to automate this process using screen scraping. I must admit, it didn’t look good but we took it in our stride because we thought it served its purpose and was super cool.”

This set the team up to work on Stitch — Pillay as CEO, Cuthbert as CTO and Priyen as CPO. After working on building better functionality and technology, Stitch beta launched in September 2019 and secured a pre-seed round a month later. While in stealth, Stitch says it has gotten a handful of clients, which include Intelligent Debt Management, Momentum Velocity Club, Paystack, Flexclub, and two of South Africa’s biggest insurance players. The company is also beginning to attract some attention from corporate companies around consumer-facing products.

As of now, Stitch has a data and identity API product, and this month, a payment product will be added to its offerings. Like most API fintech startups, Stitch charges developers and companies per API call. However, for some products like budgeting or personal finance management apps, it also charges a fixed fee.

With wide and deep investor backing, Stitch will use the funding to consolidate growth in South Africa. There are plans to also launch operations in West and East Africa; the company’s statement reads.

Africa’s financial infrastructure space is heating up

These markets already have players, mainly Nigerian startups, in the API fintech space. They have raised sizeable rounds with enviable backings as well. Mono, a startup that only launched six months ago, is backed by YC; For Okra, it is Pan-African VC firm TLcom Capital; OnePipe has Techstars, and US-based but Africa-focused Pngme has attracted investment from Pan African VC firms EchoVC and Lateral Capital.

For now, these startups don’t operate in more than two countries. For instance, Mono, Okra and OnePipe are only live in Nigeria. Pngme says it’s operating in Nigeria and Kenya, while Stitch is only in South Africa. It will be interesting to see how competition and collaboration play out when they expand outside their markets. We might not wait long as Okra is currently in beta in Kenya and South Africa, and Mono is planning an expansion into Ghana and Kenya before the end of the year.

This doesn’t bother Pillay and his team at Stitch, though. He, alongside founders of these startups who I’ve talked to in the past year, believe competition is healthy for the market, and more founders should actually build similar companies. That said, Pillay adds that what might play out is each company creating a niche functionality at which they’re best.

“Unlike the U.S. where Plaid is dominant, I think the African market needs many players because the market is large. Europe is a good example; many sizeable companies are providing similar banking API services. For us, I think what we would start to see happen is that some companies will be known to do a particular functionality well like payments, data enrichment, or merchant identification.”

Image Credits: Stitch

Stitch has an impressive lineup of investors for this seed round led by London-based VC firm, firstminute Capital and SA-based investment firm, The Raba Partnership. Other investors who took part include both funds and angels.

The funds include CRE and Village Global, Norrsken (a fund by Klarna co-founder Niklas Adalberth), Future Africa (a fund by Flutterwave co-founder Iyinoluwa Aboyeji) and 500 Fintech. The angel cohort includes Venmo co-founder Iqram Magdon Ismail, some founding members at Plaid, executives at Coinbase, Revolut, Fast, and Paystack.

On how the startup still in stealth managed to get these investors on board, Pillay says it’s down to the company’s network in the US and the belief each investor have in the product.

“Spending a lot of time in San Francisco when working with Smile has helped us to get in touch with these globally world-class founders and investors. There’s an opportunity for us to provide a new generation of financial services in markets across Africa, and we’re really fortunate to have them back us.”

For Brent Hoberman, co-founder and executive chairman of firstminute capital, the firm decided to back Stitch because it believes most online business in Africa will embed fintech capabilities in their applications — facilitating online payments, increasing lending capacity and streamlining KYC and identity checks — through Stitch.

“As a fellow South African, I’m excited to be partnering with a team of exceptionally talented local engineers with pan-African ambitions,” he added.

That said, Africa’s fintech sector is beginning to heat up after a slow January which saw agritech and cleantech sectors dominate funding rounds. This week, South African digital bank TymeBank raised a whopping $109 million to expand across the country and into Asia, extending the sort of large rounds we’ve seen in the past from a sector that attracted more than 30% of VC funding.

For Stitch, its seed round is the latest in a series of notable deals in the African API fintech space over the last two years, where other major players have raised between $500,000 to $5 million.

ViacomCBS executives held a virtual investor event today where they outlined the strategy for Paramount+, the streaming service set to launch on March 4 that’s basically a rebranded, expanded version of CBS All Access.

In addition to launching in the United States, executives said the service will be available across Latin America and Canada on March 4, with a Nordic launch a few weeks later and an Australian launch also planned for this year.

And they said that Paramount+ will cost $4.99 per month with ads in the U.S. (less than the $5.99 charged for CBS All Access), or $9.99 without ads and with additional sports, news and live TV content. There are also plans to bundle this with the company’s premium subscriptions, such as Showtime.

Yes, it’s yet another streaming service with a plus in its name. But the company’s streaming president and CEO Tom Ryan said research has shown that ViacomCBS brands — not just Paramount and CBS, but Comedy Central, MTV, Nickelodeon and more — are well-known to viewers, and they’ll all be front-and-center in the new service. Plus, it’s worth noting that ViacomCBS already produces a number of hit streaming shows on other services, such as “13 Reasons Why,” “Emily in Paris” and “Jack Ryan.”

ViacomCBS executives also argued that Paramount+ will have a unique combination of live news, live sports and (to use a phrase repeated throughout the event) “a mountain of entertainment.” And from a product perspective, the service will offer originals in 4K, HDR and Dolby Vision, with easy downloads.

On the entertainment side, the service is supposed to have more than 30,000 TV show episodes and 2,500 movies. And the library will expand with new shows like a new version of “Frasier” with Kelsey Grammer returning to the role, as well as a “Halo” TV show that will now debut on Paramount+ instead of Showtime in early 2022. The service is also rebooting a variety of Paramount properties like “Love Story,” “Fatal Attraction” and “Flashdance.”

And like CBS All Access before it, Paramount+ will be home to new Star Trek shows — not just the already launched “Discovery,” “Picard” and “Lower Decks,” but also the upcoming “Strange New Worlds” and the kids animated series “Prodigy.”

On the movie side, Paramount CEO Jim Gianopulos said the company is still a big believer in the theatrical model, but it will be bringing some 2021 releases — including “A Quiet Place Part 2,” the first “Paw Patrol” movie and “Mission Impossible 7” — to Paramount+ in an accelerated fashion, 30 to 45 days after they come to theaters (a much less aggressive strategy than HBO Max, which will stream all Warner Bros. movies this year simultaneously with their theatrical release). And there will be new straight-to-streaming movies as well, starting with reboots of “Paranormal Activity” and “Pet Sematary.”

Source: https://techcrunch.com/2021/02/24/paramount-will-cost-4-99-per-month-with-ads/

Singapore is quickly turning into a hub for food-tech startups, partly because of government initiatives supporting the development of meat alternatives. One of the newest entrants is Next Gen, which will launch its plant-based “chicken” brand, called TiNDLE, in Singaporean restaurants next month. The company announced today that it has raised $10 million in seed funding from investors including Temasek, K3 Ventures, EDB New Ventures (an investment arm of the Singapore Economic Development Board), NX-Food, FEBE Ventures and Blue Horizon.

Next Gen claims this is the largest seed round ever raised by a plant-based food tech company, based on data from PitchBook. This is the first time the startup has taken external investment, and the funding exceeded its original target of $7 million. Next Gen was launched last October by Timo Recker and Andre Menezes, with $2.2 million of founder capital.

Next Gen’s first product is called TiNDLE Thy, an alternative to chicken thighs. Its ingredients include water, soy, wheat, oat fiber, coconut oil and methylcellulose, a culinary binder, but the key to its chicken-like flavor is a proprietary blend of plant-based fats, like sunflower oil, and natural flavors that allows it to cook like chicken meat.

Menezes, Next Gen’s chief operating officer, told TechCrunch that the company’s goal is to be the global leader in plant-based chicken, the way Impossible and Beyond are known for their burgers.

“Consumers and chefs want texture in chicken, the taste and aroma, and that is largely related to chicken fat, which is why we started with thighs instead of breasts,” said Menezes. “We created a chicken fat made from a blend, called Lipi, to emulate the smell, aroma and browning when you cook.”

Both Recker and Menenzes have years of experience in the food industry. Recker founded German-based LikeMeat, a plant-based meat producer acquired by the LIVEKINDLY Collective last year. Menenzes’ food career started in Brazil at one of the world’s largest poultry exporters. He began working with plant-based meat after serving as general manager of Country Foods, a Singaporean importer and distributor that focuses on innovative, sustainable products.

“It was clear to me after I was inside the meat industry for so long that it was not going to be a sustainable business in the long run,” Menenzes said.

Over the past few years, more consumers have started to feel the same way, and begun looking for alternatives to animal products. UBS expects the global plant-based protein market to increase at a compounded annual growth rate of more than 30%, reaching about $50 billion by 2025, as more people, even those who aren’t vegans or vegetarians, seek healthier, humane sources of protein.

Millennial and Gen Z consumers, in particular, are willing to reduce their consumption of meat, eggs and dairy products as they become more aware of the environmental impact of industrial livestock production, said Menenzes. “They understand the sustainability angle of it, and the health aspect, like the cholesterol or nutritional values, depending on what product you are talking about.”

Low in sodium and saturated fat, TiNDLE Thy has received the Healthier Choice Symbol, which is administered by Singapore’s Health Promotion Board. Next Gen’s new funding will be used to launch TiNDLE Thy, starting in popular Singaporean restaurants like Three Buns Quayside, the Prive Group, 28 HongKong Street, Bayswater Kitchen and The Goodburger.

Over the next year or two, Next Gen plans to raise its Series A round, launch more brands and products, and expand in its target markets: the United States (where it is currently recruiting a growth director to build a distribution network), China, Brazil and Europe. After working with restaurant partners, Next Gen also plans to make its products available to home cooks.

“The reason we started with chefs is because they are very hard to crack, and if chefs are happy with the product, then we’re very sure customers will be, too,” said Menenzes.