& meet dozens of singles today!

User blogs

Doubtnut, an Indian startup that helps students learn and master concepts from math and science using short videos, has raised $31 million in a new financing round, months after it rejected an acquisition offer from India’s largest edtech firm Byju’s.

The three-year-old Gurgaon-headquartered startup said SIG and James Murdoch’s Lupa Systems led the $31 million Series B funding round. Existing investors Sequoia Capital India, Omidyar Network India and Waterbridge Ventures also participated in the round, which brings the startup’s to-date raise to about $50 million to date.

The Doubtnut app allows students to take a picture of a problem, and uses machine learning and image recognition to deliver their answers through short-videos. These videos offer students step-by-step instructions to solve a problem.

The app supports multiple languages, and has amassed over 2.5 million daily active users who spend 600 million minutes a month on the app, the startup said. More than half of the users have come online for the first time in last 12 months, the startup said.

The startup said it has developed a bank of over 65 million questions in nine languages for students from sixth grade to high-school. Unlike several other popular edtech firms, Doubtnut said its app reaches students in smaller towns and cities. “85% of the current base comes from outside of the top 15 Indian cities, and 60% users study in state boards where typical medium of instruction is the local vernacular language,” the startup said.

TechCrunch reported last year that Byju’s was in talks to acquire Doubtnut for as much as $150 million. Byju’s later lowered its deal offer, after which the two firms ended their talks.

James Murdoch last month announced he was reuniting with Uday Shankar, an executive who helped him build the Murdoch family’s Star business in India, which was later sold to Disney. Shankar will work with Murdoch to “accelerate” Lupa’s efforts in India, Murdoch said last month. Lupa has backed nearly a dozen startups so far, including Indian news aggregator and social app DailyHunt.

“Doubtnut has been built with a vision to improve learning outcomes for all students, especially those outside the major Indian cities. We specialize in developing content in vernacular languages and use technology to create affordable solutions for people in this large target segment,” said Tanushree Nagori, co-founder and CEO of Doubtnut, adding,

“We are pleased to welcome onboard SIG and Lupa; SIG brings in strong experience of investing in ed-tech companies globally and Lupa Systems brings unparalleled experience of building world-class businesses and harnessing high-impact technologies,” she added.

The startup said it will deploy the fresh capital to add support for more language and broaden the scope of subjects it covers today. Doubtnut is also planning to introduce paid courses.

TechCrunch is embarking on a major project to survey the venture capital investors of Europe, and their cities.

Our survey of VCs in the Czech Republic and Prague will capture how the country is faring, and what changes are being wrought amongst investors by the coronavirus pandemic.

We’d like to know how the Prague, and the broader Czech, startup scene is evolving, how the tech sector is being impacted by COVID-19, and, generally, how your thinking will evolve from here.

Our survey will only be about investors, and only the contributions of VC investors will be included. More than one partner is welcome to fill out the survey. (Please note, if you have filled the survey out already, there is no need to do it again).

The shortlist of questions will require only brief responses, but the more you can add, the better.

You can fill out the survey here.

Obviously, investors who contribute will be featured in the final surveys, with links to their companies and profiles.

What kinds of things do we want to know? Questions include: Which trends are you most excited by? What startup do you wish someone would create? Where are the overlooked opportunities? What are you looking for in your next investment, in general? How is your local ecosystem going? And how has COVID-19 impacted your investment strategy?

This survey is part of a broader series of surveys we’re doing to help founders find the right investors.

https://techcrunch.com/extra-crunch/investor-surveys/

For example, here is the recent survey of London.

You are not in the Czech Republic, but would like to take part? That’s fine! Any European VC investor can STILL fill out the survey, as we probably will be putting a call out to your country next anyway! And we will use the data for future surveys on vertical topics.

The survey is covering almost every country on in the Union for the Mediterranean, so just look for your country and city on the survey and please participate (if you’re a venture capital investor).

Thank you for participating. If you have questions you can email mike@techcrunch.com

(Please note: Filling out the survey is not a guarantee of inclusion in the final published piece).

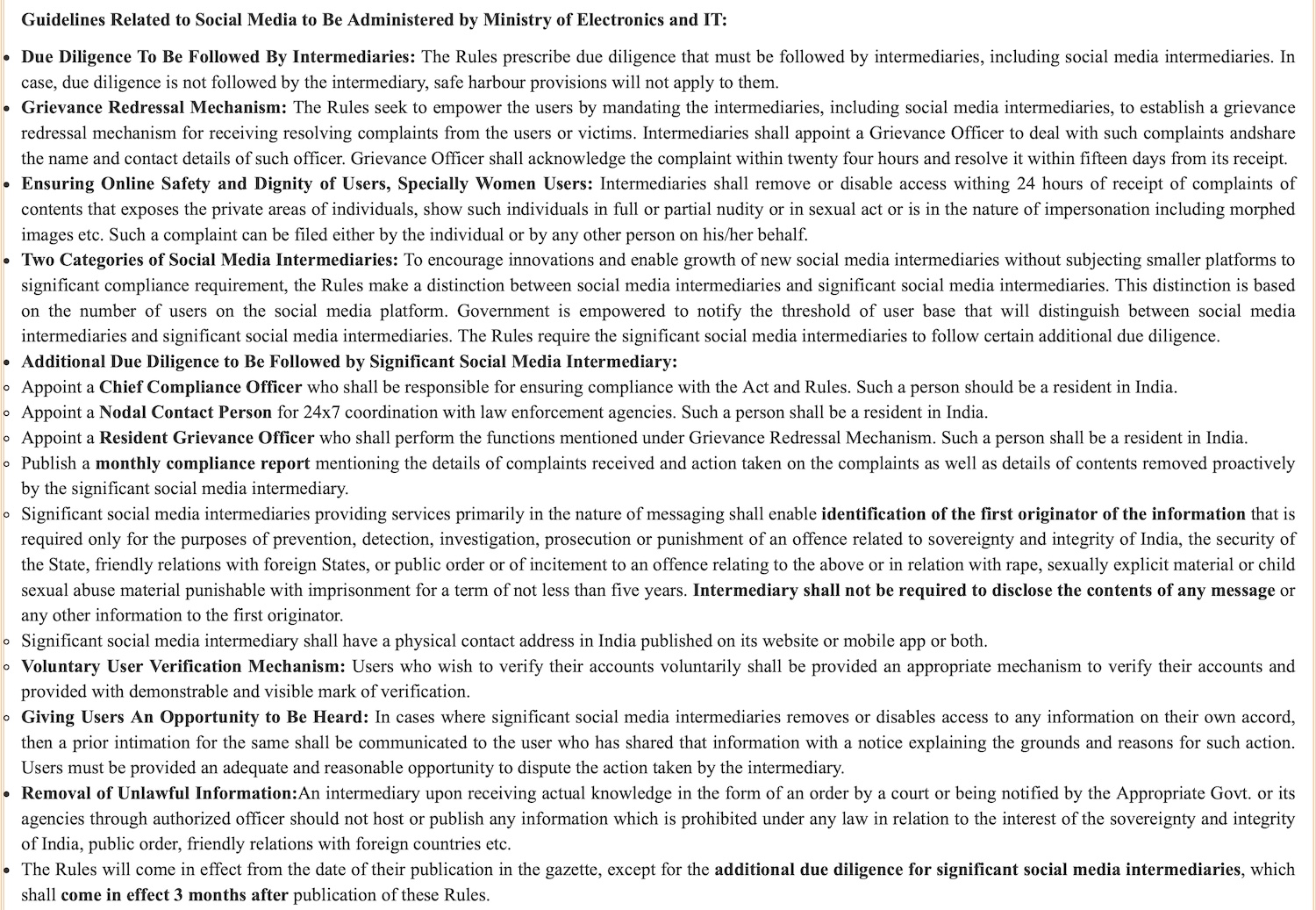

India announced sweeping changes to its guidelines for social media, on-demand video streaming services, and digital news outlets on Thursday, joining several other nations in posing new challenges for giants such as Facebook and Google that count the nation as its biggest market by users.

Ravi Shankar Prasad, India’s IT, Law, and Justice minister, said in a press conference that social media companies will be required to acknowledge takedown requests of unlawful content within 24 hours and deliver a complete redressal in within 15 days. In sensitive cases that surround rape or other similar criminal cases, firms will be required to take down the objectionable content within 24 hours.

These firms will also be required to appoint a chief compliance officer, a nodal contact officer, who shall be reachable round the clock, and a resident grievance officer. They will also have to set up a local office in India.

Prasad said social media firms will have to disclose the originator of objectionable content. “We don’t want to know the content, but firms need to be able to tell who was the first person who began spreading misinformation and other objectionable content,” he said. WhatsApp has previously said that it can’t comply with such traceability requests without compromising end-to-end encryption security for every user.

Firms will also be required to publish a monthly compliance report to disclose the number of requests they received and what actions they took. They will also be required to offer a voluntary option to users who wish to verify their accounts.

The guidelines, which replace the law from 2011, go into effect for small firms effective immediately, but bigger services will be provided three months to comply, said Prasad.

New Delhi has put together these guidelines because citizens in India have long requested a “mechanism to address grievances,” said Prasad. India has been working on a law aimed at intermediaries since 2018. You can read the final version of the draft here, courtesy of New Delhi-based advocacy group Internet Freedom Foundation.

“India is the world’s largest open Internet society and the Government welcomes social media companies to operate in India, do business and also earn profits. However, they will have to be accountable to the Constitution and laws of India,” he said, adding that WhatsApp had amassed 530 million users, YouTube, 448 million users, Facebook’s marquee service 410 million users, Instagram 210 million users, and Twitter, 175 million users in the country.

Full guidelines for social media firms and other intermediaries. (Source: Indian government.)

For streaming platforms, the rules have outlined a three-tier structure for “observance and adherence to the code.” Until now, on-demand services such as Netflix, Disney+ Hotstar, and MX Player have operated in India with little to no censorship.

New Delhi last year said India’s broadcasting ministry, which regulates content on TV, will also be overseeing digital streaming platforms. 17 popular streaming firms including international giants had banded together to devise a self-regulation code. Prakash Javedkar, Minister of Information and Broadcasting, said in the conference that the proposed solution from the industry wasn’t adequate and there will be an oversight mechanism from the government to ensure full compliance with the code.

Streaming services will also have to attach a content ratings to their titles. “The OTT platforms, called as the publishers of online curated content in the rules, would self-classify the content into five age based categories- U (Universal), U/A 7+, U/A 13+, U/A 16+, and A (Adult). Platforms would be required to implement parental locks for content classified as U/A 13+ or higher, and reliable age verification mechanisms for content classified as “A”,” the Indian government said.

“The publisher of online curated content shall prominently display the classification rating specific to each content or programme together with a content descriptor informing the user about the nature of the content, and advising on viewer description (if applicable) at the beginning of every programme enabling the user to make an informed decision, prior to watching the programme.”

The new rules will also force digital news outlets to disclose the size of their reach and structure of their ownership.

Industry executives have expressed concerns over the new proposed regulation, saying New Delhi hasn’t consulted them for these changes. IAMAI, a powerful industry body that represents nearly all on-demand streaming services, said it was “dismayed” by the guidelines, and hoped to have a dialogue with the government.

Javedkar and Prasad were asked if there will be any consultation with the industry before these guidelines become law. The ministers said that they had already received enough inputs from the industry.

This is a developing story. Check back for more information…

Maze has closed a $15 million Series A funding round led by Emergence Capital. The company lets you run user tests at scale so that you can get feedback before rolling out a design update or test copy.

When you have a lot of users, you don’t want to roll out some changes before testing it first. Some companies run A/B tests on a small portion of users and gather feedback with custom forms and polls. But that involves some coding and complications in your roadmap. Other companies simply spend a lot of time talking one-to-one with some customers.

Maze lets you test something new based on a Figma, InVision, Adobe XD, Marvel or Sketch project. You can design something new in your favorite app and start a new test based on that project.

From your web browser, you can ask your user to do something in your app, provide some context and ask a quick question at the end of the test. After that, you get a link for your next testing campaign.

You can test it on hundreds or thousands of potential users and get a detailed report with a success rate, where your users drop off, answers to your questions and polls and more. Maze now also lets you test concepts without a design.

Essentially, Maze wants to empower product designers and product managers. They can be in charge of the product roadmap with actual numbers to back their claims. And everybody can collaborate on user tests as it’s a software-as-a-service product. It makes it easier to run a design-led company.

In addition to Emergence Capital, Jay Simons and existing investors Amplify Partners, Partech and Seedcamp also participated in today’s funding round. The company plans to grow the size of its team.

Over the past 12 months, Maze has grown its monthly recurring revenue by 600%. It now generates $1.5 million in annual recurring revenue and 40,000 companies are now using Maze. One million testers have completed at least one test on Maze. Customers include GE, Samsung, Vodafone, Braze and FairMoney

Source: https://techcrunch.com/2021/02/25/maze-raises-another-15-million-for-its-user-testing-platform/

TreeCard, a U.K. yet-to-launch fintech offering a spending card made out of wood and the promise to fund reforesting via the interchange fees generated, has raised $5.1 million in seed funding. The round is led by EQT Ventures, with participation from Seedcamp and Episode 1.

Angel investors also backing the startup include Matt Robinson (founder of GoCardless), Paul Forester (founder of Indeed) and Charlie Delingpole (founder of ComplyAdvantage). TreeCard says the funding will be used to hire talent, support the roll-out of its product across the U.K. and to expand into the U.S. and “key European markets”.

Aiming to become a “leading green finance brand”, TreeCard was founded in August 2020 by Thiel fellow Jamie Cox (who previously co-founded Cashew), Gary Wu and James Dugan. The team hit onto the idea of swapping loyalty points or cash back for tree planting, in a bid to create a fintech proposition with more societal impact.

Once signed up, you link the TreeCard app to your current bank accounts so you can begin routing your spending through the Mastercard-powered TreeCard. Purchases you then make — or, specifically, a portion of the card transaction fees your spending generates — is then put toward tree planting projects run by green search engine Ecosia, which is also a pre-seed investor in TreeCard.

“[At a] high level, the climate crisis is the biggest existential risk that humanity has faced in the last 200,000 years; we believe directing the flow of consumer finances is the most powerful way to affect change,” CEO Cox tells me. “We’re building a finance company that allows consumers to not just to do less damage with their spending, but to actively improve the world.

“We are building a free spending card that allows consumers to spend more responsibly. The card uses interchange to reforest as they spend and sophisticated analytics to help them identify healthy spending as well as destructive ones”.

Of course, consumer card interchange fees in the U.K./EU are very low compared to the U.S. Offering a spending card and account isn’t without overhead, so it isn’t clear how sustainable TreeCard could be on interchange revenue alone. Perhaps unsurprisingly, the U.S., where generated fees are higher, is seen as a key launch market for the startup.

“Interchange fees in the U.S. are significantly higher than in the EU so this presents a sufficient revenue opportunity for us to perform our reforestation investments and cover marketing and management costs,” explains Cox. “In the EU we’re going to be partnering with an existing retail bank who will provide all our banking infrastructure for free. This will mean that, even though our interchange fee cut is lower, it will be sufficient to cover our costs in the EU. We will announce the name of the bank shortly”.

Meanwhile, early backer Ecosia is described by the TreeCard founder as its “mother” company. “They’re our closest partner and we’ll be working very closely with them as we grow,” Cox says. “They invested the first cheque into the company and will be doing all our tree planting for us. Ecosia’s marketing team is extremely experienced and they will be helping us use their search engine as a core channel for user acquisition over the next few years”.

Comments Tom Mendoza, deal partner at EQT Ventures: “TreeCard has the potential to become a leading green finance brand, going where no brand has gone before in creating a de facto platform for impactful financial management. At EQT Ventures, we’re increasingly aware of the environment and the impact that our investments have on the world around us, so we’re really excited to support the TreeCard team, who are actively working with the financial system to create a better future for the planet”.