& meet dozens of singles today!

User blogs

Monetizable mood boards might sound like the moonshot idea that no one asked for, but when you think about it, the vision is already informally happening in various corners of the internet. A young generation of users shops with community in mind, whether that’s buying merchandise from your favorite influencers or giving into those Instagram advertisements after spending way too much time on the grid.

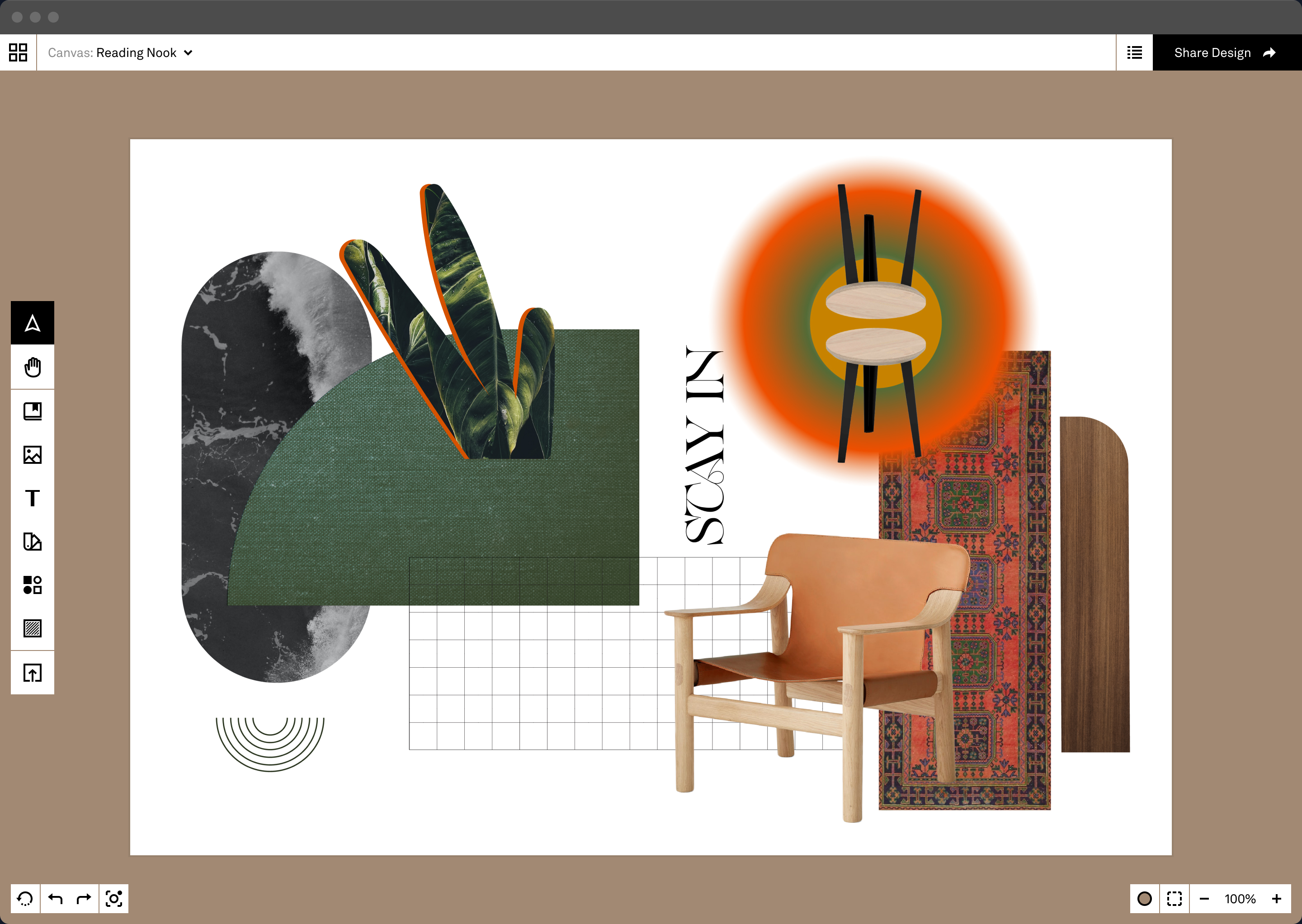

As more users think of shopping as a social, digital-first activity, The Landing, a seed-stage startup coming out of stealth, is hoping to win over those who have an affinity for designing homes and spaces. On The Landing, users can create, and shop from, room designs to help furnish their homes.

Image Credits: The Landing

“There’s no contextually rich, visual shopping destination, where you could curate and discover and share and shop all in one place,” co-founder Miri Buckland said. The Landing hopes to be that destination.

Started by Buckland and Ellie Buckingham, The Landing is launching with $2.5 million in financing, in a round led by Aileen Lee at Cowboy Ventures. Lee will be taking a board seat. Other investors include Dara Treseder, the CMO of Peloton, Manish Chandra and Tracy Sun, the founders of Poshmark, Unshackled, Designer Fund, and Progression Fund.

The Landing began as a pandemic pivot. Buckland and Buckingham were always interested in solving the pain point of contextual furnishing for users, but began by physically moving people into apartments and helping them set up different furniture. Then, the pandemic hit and limited the ability to do high-touch services. Buckingham says that this was “potentially the best forcing function” to focus on what kind of business The Landing wanted to be.

“I don’t need to be the person moving into your apartment with a couch,” she said. “It was about the importance of empowering creativity and empowering individuals to create digital and physical spaces.” That’s when they dropped the moving service business, and instead used furnishing as a vector to solve the problem of contextual and social e-commerce.

It’s a smart idea that has not gone unnoticed. Houzz, a Sequoia-backed home improvement startup, connects users to products from third-party retailers as well as services from architects, designers, or contractors. There’s also Modsy, which has raised north of $70 million to date, which helps users virtually redesign their homes.

Buckingham worked for Modsy when she was at business school, where she first started noticing that she disagreed with the startups’ main thesis.

“Their motto was basically a digital rendition of an existing human service,” she said. “And I came away from the experience not super convinced that the service model was the scalable, future answer to consumerization of access to design.” She noticed that the younger generation was looking for a self-serve, customizable answer, instead.

Miri Buckland and Ellie Buckingham, the co-founders of The Landing.

The Landing is launching with creative tooling capabilities, which allow users to build and design spaces within its platform. In the coming months, the team is focused on adding a social layer atop the design tool, with features like profiles, discovery, fede, and commenting.

The Landing’s Slack channel is currently being used to discuss these features and what is most in-demand from early users.

The founders aren’t worried about a lack of demand, or only being a platform for the few times that people furnish their homes throughout their lifespan. As Buckland pointed out, people browse Zillow all the time, and have Reddit channels about dream homes, creating designs, and more. The startup is aiming to serve that population as well — the dreamers and not just the realists.

Atlanta is coming up in the tech world with several newly minted billion-dollar businesses hailing from the ATL and the city’s local venture capital community is taking notice.

Even as later stage firms like the newly minted BIP Capital rebrand and with increasingly large funds, earlier stage firms like Tech Square Ventures are staffing up and adding new partners.

The firm’s latest hire is Vasant Kamath, a general partner who joins the firm from Primus Capital, a later stage investment vehicle based out of Atlanta. Before that, he was managing investments for the private office of the Cox family.

Originally from Augusta, Ga. Kamath left the south to attend Harvard and then went out west for a stint at Stanford Business School.

In between his jaunts North and West Kamath spent time in Atlanta as an investment banker with Raymond James in the early 2000s, the beginnings of a lifelong professional career in technology. Before business school, Kamath worked at Summit Equity Partners in Boston investing in later stage technology companies.

Kamath settled in Atlanta in 2010 just as a second wave of technology companies began making their presence felt in the city.

The new Tech Square Village general partner pointed to Atlanta’s underlying tech infrastructure as one reason for the move to early stage. One pillar of that infrastructure is Georgia Tech itself. The school, whose campus abuts the Tech Square Ventures offices, is one of the top engineering universities in the country and the breadth of talent coming out of that program is impressive, Kamath said.

There’s also the companies like Airwatch, MailChimp, Calendly and others that represent the resurgence of Atlanta’s tech scene, Tech Square Ventures’ newest general partner said.

Not only are young companies reinvesting in the city, but big tech giants and telecom players like T-Mobile, Google, and Microsoft are also establishing major offices, accelerators, and incubators in Atlanta.

“There’s a lot of momentum here in early stage and i think it’s building. It’s the right time for a firm like TSV to take advantage of all of the things,” Kamath said.

Another selling point for making the jump to early stage investing was the relationship that Kamath had established with Tech Square Ventures founder, Blake Patton. A serial entrepreneur who’s committed to building up Atlanta’s startup ecosystem, Patton has been the architect of Tech Square Ventures’ growth through two separate initiatives.

In all, the firm has $90 million in assets under management. What began with a small pilot fund, Tech Square Ventures Fund 1, (a $5 million investment vehicle) has expanded to include two larger funds raised in conjunction with major industrial corporate partners like AT&T, Chick-Fil-A, Cox Enterprises, Delta, Georgia-Pacific, Georgia Power, The Home Depot, UPS, Goldman Sachs, and Invesco, under the auspices of a program called Engage. Those funds total $54 million in AUM and the firm is halfway toward closing a much larger second flagship fund under the Tech Square Ventures name with a $75 million target.

All this activity has led to a blossoming entrepreneurial community that early stage funds like Tech Square Ventures hopes to tap.

“We see a fair number of folks from these large corporations spinning out and starting things themselves,” said Kamath. “For a decade plus, you have multiple entrepreneurs doing really well and increasing acceleration in terms of climate and exits.”

And more firms from outside of the region are beginning to take notice.

“I think that is happening,” said Kamath. “You might seen investment from outside the region. At the seed stage it’s harder you do need to have feet on the ground right when they’re starting and building their business. Once they’ve been vetted and had that early round of investment you will definitely see a lot of activity. We’re seeing more investment at the Series A and B from out of town. That’s the strategy.”

It all points to a burgeoning startup scene that’s based in a collaborative approach, which should be good not only for Tech Square Ventures, but the other early stage funds like Atlanta Ventures, Outlander Labs, BLH Ventures, Knoll Ventures and Overline, that working to support the city’s entrepreneurs, Kamath said.

Lob is a startup promising to help businesses deliver physical mail more quickly and affordably, and with more personalization.

The company estimates that its platform has been used to deliver mail to one in two U.S. households. And today, it’s announcing that it has raised $50 million in Series C funding.

CEO Leore Avidar told me he founded Lob with Harry Zhang nearly a decade ago to “allow people to send mail programmatically.” Over time, the company has become increasingly focused on enterprise clients — its 8,500-plus customers include Twitter, Expedia and Oscar Health — although Avidar said it will always offer a product for small businesses as well.

Avidar explained that in a digital age, there are two main categories of physical mail that Lob continues to support for its customers. First, there’s mail sent for “a regulatory purpose, a compliance purpose” — in other words, mail that businesses are legally required to send in printed form. Second, there’s direct mail sent as marketing, which Avidar said many companies are rediscovering.

“Marketing as a whole is always trying to find a unique channel in order to make their customer aware of whatever their call to action is,” he said. “Right now, social is really expensive, Google AdWords is super expensive, with email you can easily unsubscribe. No one’s been paying attention to direct mail, and the prices don’t scale with supply and demand.”

Lob says that it can reduce the execution time on a direct mail campaign by 95%, from 90 days to less than a day. For the actual printing and delivery, it has built out a network of partners across the country. And other companies like PostPilot and Postalaytics are building on top of the Lob platform.

The startup has now raised $80 million in total funding. The new round was led by Y Combinator Continuity Fund — Lob participated in the YC accelerator and the Continuity Fund also led the startup’s previous funding.

Avidar said the company is planning to triple the amount of physical mail delivered through the platform this year, which means the round will allow it to continue expanding the Print Delivery Network, as well as increasing headcount to more than 260 employees.

“Lob is leading the digital transformation of direct mail, a business process used by every company on Earth that has remained virtually untouched by software,” said YC Managing Partner and Lob board member Ali Rowghani in a statement. “Lob’s platform delivers exceptional value to some of the world’s largest senders of direct mail by lowering cost and improving deliverability, tracking, reporting, and ROI. Even for the most sophisticated senders of direct mail, Lob’s API-driven product is vastly superior to legacy approaches.”

Source: https://techcrunch.com/2021/02/25/lob-raises-50m-for-its-direct-mail-platform/

MorphAIs is a new VC out of Berlin, aiming to leverage AI algorithms to boost its investment decisions in early-stage startups. But there’s a catch: it hasn’t raised a fund yet.

The firm was founded by Eva-Valérie Gfrerer who was previously head of Growth Marketing at FinTech startup OptioPay and her background is in Behavioural Science and Advanced Information Systems.

Gfrerer says she started MorphAIs to be a tech company, using AI to assess venture investments and then selling that as a service. But after a while, she realized the platform could be applied an in-house fund, hence the drive to now raise a fund.

MorphAIs has already received financing from some serial entrepreneurs, including: Max Laemmle, CEO & Founder Fraugster, previously Better Payment and SumUp; Marc-Alexander Christ, Co-Founder SumUp, previously Groupon (CityDeal) and JP Morgan Chase; Charles Fraenkl, CEO SmartFrog, previously CEO at Gigaset and AOL; Andreas Winiarski, Chairman & Founder awesome capital Group.

She says: “It’s been decades since there has been any meaningful innovation in the processes by which venture capital is allocated. We have built technology to re-invent those processes and push the industry towards more accurate allocation of capital and a less-biased and more inclusive start-up ecosystem.”

She points out that over 80% of early-stage VC funds don’t deliver the minimum expected return rate to their investors. This is true, but admittedly, the VC industry is almost built to throw a lot of money away, in the hope that it will pick the winner that makes up for all the losses.

She now plans to aim for a pre-seed/seed fund, backed by a team consisting of machine learning scientists, mathematicians, and behavioral scientists, and claims that MorphAIs is modeling consistent 16x return rates, after running real-time predictions based on market data.

Her co-founder is Jan Saputra Müller, CTO and Co-Founder, who co-founded and served as CTO for several machine learning companies, including askby.ai.

There’s one problem: Gfrerer’s approach is not unique. For instance, London-based Inreach Ventures has made a big play of using data to hunt down startups. And every other VC in Europe does something similar, more or less.

Will Gfrerer manage to pull off something spectacular? We shall have to wait and find out.

This morning Coinbase, an American cryptocurrency exchange, released an S-1 filing ahead of its direct listing. The company’s public debut has been hotly anticipated thanks to recent activity amongst bitcoin and other blockchain-based assets, the company’s controversial political positions, and its spiking valuation on private exchanges.

Coinbase’s financials show a company that grew rapidly from 2019 to 2020. More than that, the company also crossed the threshold into unadjusted profitability; it’s common amongst quickly-growing tech companies to lean more heavily on adjusted profit and other more flattering metrics.

In 2019 Coinbase $30.4 million against $533.7 million in revenue. In 2020 the company’s net income rose to $127.5 million against $1.28 billion in revenue.

The crypto unicorn grew just over 139% in 2020, a massive improvement on its 2019 results. The company’s scale and growth help us understand why some investors are bidding its value up to as much as $100 billion on the private markets.

Coinbase has highly variable revenues. The company posted revenues of $190.6 million in Q1 2020, a number that dipped to $186.4 million in the second quarter. Then Coinbase’s topline accelerated in Q3 2020 to $315.4 million, and $585.1 million in the final quarter of 2020.

It’s easy to see why Coinbase is moving forward with its direct listing now; the company just posted an excellent quarter.

In that outsized fourth-quarter period, Coinbase generated operating income of $226.6 million, and net income of $176.8 million. Those represent high-quality profitability improvements from preceding periods, and provide Coinbase with attractive end-of-year profit margins.

The cryptocurrency exchange generates the vast majority of its revenues from transaction revenues, as anticipated. Coinbase also has a comparatively modest “subscription and services” revenue category, which was worth around $20.7 million in Q4 2020 revenues.

Finally, Coinbase swun from operating cash flow negative in 2019 to incredibly cash-flow positive in 2020. However, the $3.0 billion in positive operating cash flow that Coinbase generated last year includes “$2.7 billion related to cash from the change in custodial funds due to customers,” diminishing the number to a more understandable scale.

This is a first look, but Coinbase is a quickly growing, profitable unicorn that looks more than ready for its direct listing. The question ahead of investors is merely how to value Coinbase’s revenue growth as it does track with broader market interest in cryptocurrencies, a historically fluid quantity.