& meet dozens of singles today!

User blogs

The Coinbase S-1 is out! And hot damn, did the company have a good fourth quarter.

TechCrunch has a first look at the company’s headline numbers. But in case you’ve been busy, the key things to understand are that Coinbase was an impressive company in 2019 with more than a half-billion in revenue and a modest net loss. In 2020, the company grew sharply to more than $1.2 billion in revenue, providing it with lots of net income.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The company’s Q4 2020 was about as big as its entire 2019 in revenue terms, albeit much more profitable because the sum was concentrated in a single quarter instead of spread out over four.

However, beyond the top-level numbers are a host of details to explore. I want to dig more deeply into Coinbase’s user numbers, its asset mix, its growing subscription incomes, its competitive landscape and who owns what in the company. At the end, we’ll riff on a chart that discusses the correlation between crypto assets and the stock market, just for fun.

Sound good? You can read along in the S-1 here if you want, and I will provide page numbers as we go.

Inside Coinbase’s direct listing

To make things simpler, we’ll frame our digging in the form of questions, starting with: How many users did Coinbase need to generate its huge 2020 revenue gains?

The answer: not as many as I expected. In 2019, Coinbase generated $533.7 million from what it describes as 1 million “Monthly Transacting Users” (page 14). That works out to $533.7 million in revenue per MTU for the year.

In 2020, Coinbase generated $1.28 billion in revenue off of 2.8 million MTUs, which works out to around $457 apiece during the year. That’s a bit lower, but not terribly so. And given that the company’s transaction margins ranged in the mid-80s percent during much of 2020, each Coinbase active trader was still quite valuable, even at a lower revenue point.

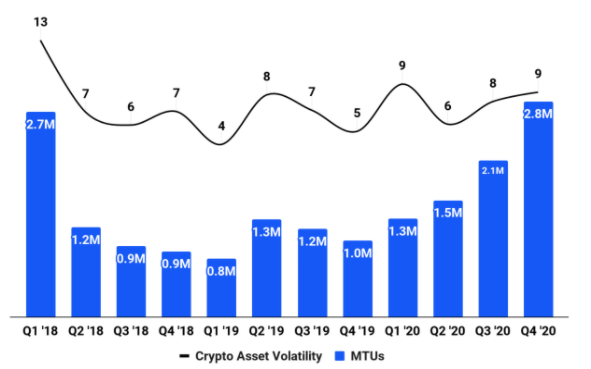

As we noted in our first look at the company’s economics, Coinbase’s metrics are highly variable. Its MTU figure is no exception. Observe the following chart from its S-1 filing (page 95):

Coinbase’s Q1 2018 was nearly as popular in MTU terms as its final quarter of 2020. And from that point in time, the company’s MTUs fell 70 percent to its Q1 2019 nadir. That’s a lot of variance.

The company itself notes in its filing that “MTUs have historically been correlated with both the price of Bitcoin and Crypto Asset Volatility,” though the company does point out that it expects such correlations to diminish over time.

The answer to our question is that it only takes a few million MTUs for Coinbase to be a huge business. But the other side of that point is that Coinbase has shown twice in two years (2018, 2019) that the number of traders on its platform can decline.

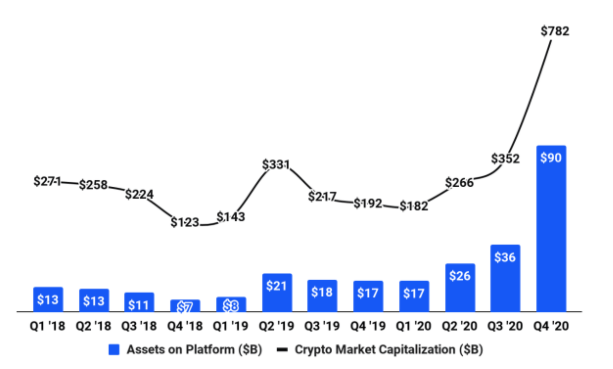

What assets do Coinbase users hold? This is a question that I am sure many of you crypto enthusiasts have. But first, what does the Coinbase user asset base look like? Like this, historically (page 96):

Holy shit, right? The chart shows two things. First, the rapid appreciation of cryptocurrencies overall, which you can spy in the upward kick of the black line. And then the blue bars show how the assets on Coinbase’s platform grew from $17 billion at the start of 2020 to $90 billion by year’s end.

Source: https://techcrunch.com/2021/02/25/five-takeaways-from-coinbases-s-1/

The executive who built the financial services boutique for Paytm, India’s most valuable startup, from the ground is ready to do something similar all over again.

Pravin Jadhav, the former chief executive of Paytm Money, revealed on Thursday his own startup, Raise Financial Services.

This time, Jadhav — under whose leadership, Paytm had amassed over 6 million Money customers — is focusing on serving a different set of the population.

Hundreds of millions of users in India today don’t have access to financial services. They don’t have a credit card, banks don’t lend to them, and they have never purchased an insurance cover or invested in mutual funds or stocks.

Scores of large firms and startups in India today are attempting to reach these users by building an underwriting technology that can use alternative data to determine an applicant’s credit worthiness. It’s a tough and capital intensive business, built on pillars of uncertainties, assumptions and hopes.

In an interview with TechCrunch, Jadhav said Raise Financial Services is aimed at customers living in metro, tier 1 and tier 2 cities (so very much in and around urban cities). “They want financial products, they are literate about these products, but they are not being served the way they should be,” he said.

Pravin Jadhav, left, poses with Paytm founder and CEO Vijay Shekhar Sharma. Jadhav left Paytm last year.

He said his new startup will offer products across financial services including investing, financing, insurance, wealth, and payments. “Just not doing the banking part, as I believe that is more of an infrastructure play,” he said.

“The idea is to offer great exceptional products that are not being offered by anyone. Number 2: Focus a lot on tech-driven distribution. And third is that today the quality of customer service experience is bad across the market. So we are trying to solve that,” he said. “Over time, we will try to stitch all of this together.”

Jadhav also announced he has raised a Seed financing round. He did not disclose the amount, but revealed enough high-profile names, including: Kunal Shah (Cred), Kalyan Krishnamurthi (Flipkart), Amod Malviya and Sujeet Kumar (Udaan), Sameer Nigam and Rahul Chari (PhonePe), Amrish Rau (Pine Labs, Citrus Pay), Sandeep Tandon (Freecharge), Jitendra Gupta (Jupiter), Girish Mathrubootham (Freshworks), Nischal Shetty (WazirX), Kuldeep Dhankar (Clevertap), Sreevatsa Prabhakar (Servify), and Amit Bhor (Walnut).

Jadhav himself is also investing, and venture investor Mirae Asset Venture is leading the round, with participation from Multi-Act Private Equity, Blume Ventures (via its Founder’s Fund) and US based early-stage investor Social Leverage, for which it is the first investment in India.

Ashish Dave, CEO of Mirae Asset Venture’s India business, told TechCrunch that even though he had known Jadhav, it was listening to him at various Clubhouse sessions that prompted him to reach out to Jadhav.

Jadhav said users can expect the startup’s first product to be live by the end of the year. (TechCrunch understands it’s shipping much sooner. Raise Financial Services’ offerings will have some similarities with SoFi and Goldman Sachs’ Marcus.)

Source: https://techcrunch.com/2021/02/25/pravin-jadhav-raise-financial-services-startup/

Dawn Belt has been working with top tech companies for two decades, most recently helping commercial electric vehicle company Proterra go public as a SPAC in January.

Now she’ll be joining us at TC Early Stage in April to talk about building a company in 2021, from however you incorporate to however you decide to maybe go public one day.

As a partner at Fenwick & West, a top Silicon Valley law firm, Belt works with startups of all ages, sizes and industries (two of her past IPOs include Facebook and Bill.com). She has also written legal perspectives on a wide range of other topics that startups face, including implications of the CARES Act, board diversity legal requirements and how to manage acquired startups successfully. She also co-authored the firm’s Gender Diversity Survey, an in-depth report on women’s participation at senior levels of public tech companies.

She’ll be at Early Stage to share her experiences old and new, to help you make better decisions now for your company. The talk is part of the two days of events that explore seed and Series A fundraising, recruiting and more for early-stage startups at TC Early Stage – Operations and Fundraising on April 1 & 2. Grab your ticket now before prices increase tomorrow!

Coinbase’s S-1 publicly dropped this morning with much anticipation. My colleague Alex Wilhelm has the high-level details, but there was one major wrinkle for the crypto trading darling: two of its early investors seem to be cutting down their stakes pre-IPO.

The most notable case is Union Square Ventures, the prominent venture firm where Fred Wilson co-led the Series A round into the company back in 2013, which was the first investment made under the firm’s then newly christened blockchain thesis.

Over the past two years — which is the extent of disclosures that Coinbase includes in its S-1 filing — USV has been rapidly selling off its holdings in the company across multiple transactions, mostly selling to other venture firms around the cap table. Since late 2019, the firm has sold off approximately 28% of its holdings in Coinbase.

USV currently owns about 7.3% of Coinbase’s outstanding shares, or roughly 13.9 million of a total of 191.3 million based on Coinbase’s disclosed share count. As the following table indicates, USV has conducted four separately-dated transactions to sell nearly 5.5 million shares of its holdings in secondary transactions.

Fellow early-stage fintech investor Ribbit Capital, which joined USV in the Series A, also conducted a smaller secondary transaction in November 2019, selling a bit less than 5% of its outstanding shares (559,228 of 11,995,949 shares).

What’s interesting is not just that USV in particular is selling a large part of its holdings, but also the price they were willing to sell at. According to Coinbase’s filing, USV sold 3.35 million shares at $23 per share in late 2019, and later sold about 2 million shares at $28.83 per share in mid-2020.

Those prices are well-below Coinbase’s Series E price per share of $36.19, which it received in late 2019. It’s also below the price set by the secondary transactions of Coinbase CEO and co-founder Brian Armstrong and Paradigm founder and Coinbase co-founder Fred Ehrsam, who received $32.57 for their shares in late 2018.

Now, there are a couple of nuances to consider here. The secondary sale of preferred shares will typically convert to common (even if the sale is to another preferred shareholder), which means that the shares sold would hold fewer investor rights and provisions, and therefore, are intrinsically worth less to investors. This was the case with Coinbase as it disclosed in its filing, and that may explain at least some of the gap in the price.

The timing of USV’s investment is also perhaps notable. The bulk of USV’s investment in Coinbase comes from its 2012 vintage fund, which if it follows default industry practice, has a targeted 10-year shelf life. That means that the fund is designed to pay out its returns by 2022 — which was quickly coming up for the firm back in 2019 and 2020. There may have been some pressure to sell at least some of the firm’s stake early to make the firm’s LPs happier.

It’s also useful to note that USV and Ribbit mostly sold to other, existing investors like A16Z and Paradigm, which shows that other investors deeply burrowed on the cap table were quite excited to put more money to work in Coinbase, even at a fairly late stage.

Nonetheless, it’s rare for an ambitious fund like USV to sell arguably its single most important investment of all time just a year or two before what may well be one of the largest blockbuster IPOs of 2021. At a valuation of $100 billion let’s say (which is what Coinbase priced at a recent private market transaction), USV’s stake would be worth about $7.3 billion. Yet, the shares it sold over the past two years would have been worth several billion at exit, and it sold them for about $140 million in cash.

The mystery here is perhaps solved a bit. Fred Wilson, in a blog post from early 2018, talked about “taking money off the table” in earlier USV investments like Twitter, where the firm “sold about 30% of our position in those two secondary transactions for about $250mm and returned 2x the entire fund to our investors.” Then referring to crypto, he said:

If you are sitting on 20x, 50x, 100x your money on a crypto investment, it would not be a mistake to sell 10%, 20% or even 30% of your position. Selling 25% of your position on an investment that is up 50x is booking a 12.5x on the entire investment, while allowing you to keep 75% of it going. I know that many crypto holders think that selling anything is a mistake. And it might be. Or it might not be. You just don’t know.

Clearly, he took money off the table. It’s a financially-astute, risk-adjusted approach, even if it left billions of returns behind. A16Z and Paradigm are, I am sure, quite pleased to have made the purchase.

Memmo.me, a startup allowing users to pay celebrities for personalized video messages, is announcing that it has raised $10 million in Series A funding.

“We’re really excited about our mission to break down these barriers [and help talent] connect one-to-one instead of one-to-thousands,” said co-founder and CEO Gustav Lundberg Toresson.

He added that celebrities are embracing this as a new source of income. It’s particularly appealing during the pandemic, but he predicted that celebrities will still be excited about “making this much money from their living rooms” after the pandemic ends.

The concept probably reminds you of Cameo (indeed, Carole Baskin of “Tiger King” fame has presence on both platforms), but while Cameo is U.S.-based, Memmo was founded in Stockholm, and Lundberg Toresson said its strategy is both global and localized — the company is currently operating localized marketplaces for Sweden, Germany, Finland, Norway, the United Kingdom, Spain, Italy and Canada, as well as a general global market.

“We want to be the place where you can find everyone from world famous talents like a soccer or basketball star, to the local musician down the road,” he said. “It’s all about using localization to help you find who’s most relevant for you, wherever you are.”

The startup says it has been used to send more than 100,000 messages globally, and that sales grew 50% every month between July of last year and January 2021.

The round was led by Left Lane Capital, with the firm’s founder and managing parter Harley Miller joining the Memmo board. Delivery Hero co-founder Lukasz Gadowski, FJ Labs, Depop CEO Maria Raga, Zillow co-founder Spencer Rascoff, former Groupon operations director Inbal Leshem, Voi Technology co-founder Fredrik Hjelm, former Udemy CEO Dennis Yang and Wolt co-founder Elias Aalto also participated.

“We’ve been impressed with the pace at which Memmo has expanded their offering across markets, where localization is critical to unlocking marketplace liquidity,” Miller said in a statement. “The ability to monetize the gap between wealth and fame for talent & celebrities, all the while allowing them to engage deeply with fans, is a trend that was only further underscored by the pandemic.”

Although Left Lane is based in New York, Lundberg Toresson said he was particularly excited about the firm’s marketplace expertise, and that its investment does not signal an imminent U.S. launch.

Memmo has now raised a total of $12 million. The new funding will allow the startup to add new features like live videos and to build out its business offerings, where companies can hire celebrities to create promotional videos for external marketing or internal employee motivation.