& meet dozens of singles today!

User blogs

AT&T just announced an agreement with private equity firm TPG that will turn DirecTV into a standalone company, albeit one that’s still majority owned by the telecom giant.

Specifically, AT&T says it will own 70% of the new company, while TPG owns 30%. This transaction values DirecTV at $16.25 billion — a dramatic decline from the $48.5 billion that AT&T paid to acquire the pay TV provider in 2015, part of a wave of telecom-media acquisitions. (Verizon owns TechCrunch thanks to its acquisition of AOL.)

Even with new offerings like AT&T TV (which will be part of the standalone company, along with the DirecTV and U-Verse services) pay TV subscriptions have been declining, with AT&T reporting a net loss of 617,000 premium video subscribers in its most recent quarter. AT&T is trying to point out the positive trends in the numbers by noting that “it hit its peak level of subscriber losses in 2019” and that “premium video net losses had improved sequentially for five straight quarters.”

Meanwhile, AT&T made an even bigger acquisition with Time Warner (now known as WarnerMedia), and its TV ambitions seem to be focused on the streaming service HBO Max.

“As the pay-TV industry continues to evolve, forming a new entity with TPG to operate the U.S. video business separately provides the flexibility and dedicated management focus needed to continue meeting the needs of a high-quality customer base and managing the business for profitability,” said AT&T CEO John Stankey in a statement. “TPG is the right partner for this transaction and creating a new entity is the right way to structure and manage the video business for optimum value creation.”

The company said the transaction should close in the second half of 2021. The combined entity is expected to pay AT&T $7.8 billion, which the telecom company will use to reduce debt. AT&T also said that when the transaction closes, DirecTV’s CEO will be Bill Morrow, currently CEO of AT&T’s U.S. video unit.

The Wall Street Journal reported last year that AT&T was exploring a deal for DirecTV.

Source: https://techcrunch.com/2021/02/25/att-is-turning-directv-into-a-standalone-company/

Anchorage has raised an $80 million Series C funding round led by GIC, also known as Singapore’s sovereign wealth fund. Andreessen Horowitz, Blockchain Capital, Lux and Indico are also participating in today’s funding round.

The thinking behind this funding round is quite simple. Some companies, such as Tesla or Square, have recently chosen to invest in cryptocurrencies. They’re converting a small portion of their cash balance into cryptocurrencies. Some investors choose to invest in companies that help you add cryptocurrencies to your cash balance — Anchorage is one of them.

The startup originally offered a custody solution. It lets you keep your cryptocurrencies safe for you so that you don’t have to take care of the wallets and their public and private keys. But more recently, Anchorage received a federal banking charter, turning it into a digital asset bank.

Getting a thumbs-up sign from regulators should definitely help when it comes to confidence. Institutional investors are looking for trusty crypto partners to dip their toes into the crypto waters.

In addition to custody, Anchorage now offers several financial products, such as staking, crypto lending, etc. In other words, it wants to become a one-stop shop for institutional investors.

Interestingly, Anchorage also wants to become a crypto-banking-as-a-service startup. The startup thinks it could become the preferred crypto partner for both challenger banks and traditional banks.

This morning DigitalOcean, a provider of cloud computing services to SMBs, filed to go public. The company intends to list on the New York Stock Exchange (NYSE) under the ticker symbol “DOCN.”

DigitalOcean’s offering comes amidst a hot streak for tech IPOs, and valuations that are stretched by historical norms. The cloud hosting company was joined by Coinbase in filing its numbers publicly today.

DigitalOcean’s offering comes amidst a hot streak for tech IPOs.

However, unlike the cryptocurrency exchange, DigitalOcean intends to raise capital through its offering. Its S-1 filing lists a $100 million placeholder number, a figure that will update when the company announces an IPO price range target.

This morning let’s explore the company’s financials briefly, and then ask ourselves what its results can tell us about the cloud market as a whole.

DigitalOcean’s financial results

TechCrunch has covered DigitalOcean with some frequency in recent years, including its early-2020 layoffs, its early-2020 $100 million debt raise and its $50 million investment from May of the same year that prior investors Access Industries and Andreessen Horowitz participated in.

From those pieces we knew that the company had reportedly reached $200 million in revenue during 2018, $250 million in 2019 and that DigitalOcean had expected to reach an annualized run rate of $300 million in 2020.

Those numbers held up well. Per its S-1 filing, DigitalOcean generated $203.1 million in 2018 revenue, $254.8 million in 2019 and $318.4 million in 2020. The company closed 2020 out with a self-calculated $357 million in annual run rate.

During its recent years of growth, DigitalOcean has managed to lose modestly increasing amounts of money, calculated using generally accepted accounting principles (GAAP), and non-GAAP profit (adjusted EBITDA) in rising quantities. Observe the rising disconnect:

Source: https://techcrunch.com/2021/02/25/digitaloceans-ipo-filing-shows-a-two-class-cloud-market/

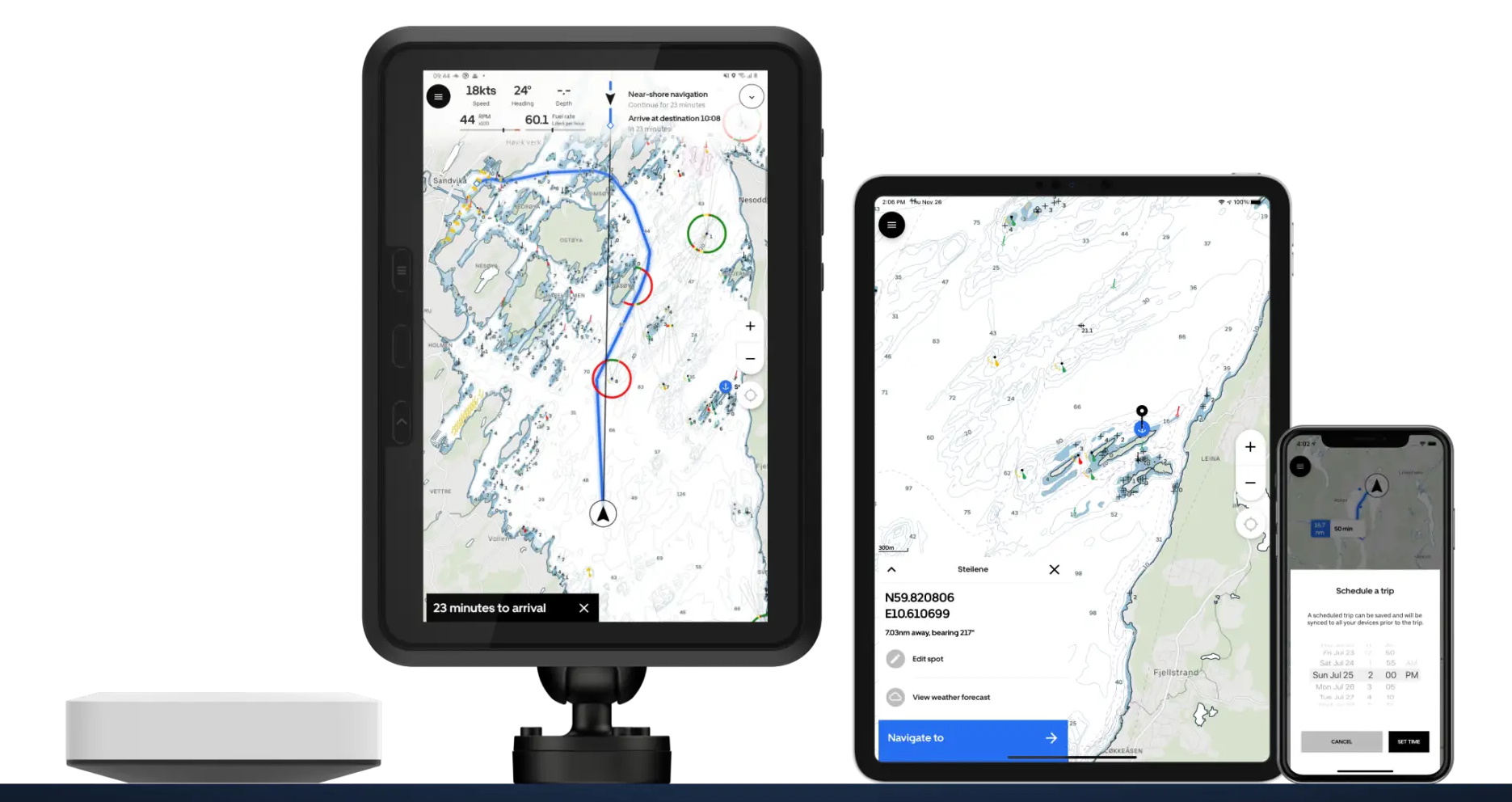

Boating is a hobby steeped in history and tradition — and so is the industry and those that support it. With worldwide connectivity, electric boats, and other technological changes dragging the sector out of old habits, Orca aims to replace the outdated interfaces by which people navigate with a hardware-software combo as slick as any other modern consumer tech.

If you’re a boater, and I know at least some of you are, you’re probably familiar with two different ways of chart-plotting, or tracking your location and route: the one attached to your boat and the one in your pocket.

The one on your boat is clunky and old-fashioned, like the GPS interface on a years-old budget sedan. The one in your pocket is better and faster — but the phone isn’t exactly seaworthy and the app drains your battery with a quickness.

Orca is a Norwegian startup from veterans of the boating and chart-plotters that leapfrogs existing products with a built-from-scratch modern interface.

“The industry hasn’t changed in the last 20 years — you have three players who own 80 percent of the business,” said co-founder and CEO Jorge Sevillano. “For them, it’s very hard to think of how software creates value. All these devices are built on a user interface that’s 10-15 years old; think about a Tomtom, lots of menus, lots of clicks. This business hasn’t had its iPhone moment, where it had to rethink its entire design. So we thought: let’s start with a blank slate and build a new experience.”

CTO and co-founder Kristian Fallro started working on something like this years ago, and his company was acquired by Navico, one of the big players Sevillano refers to. But they didn’t seem to want to move forward with the ideas, and so he and the others formed Orca to pursue them. Their first complete product opened up for pre-orders this week.

“The challenge up until now has been that you need a combination of hardware and software, so the barrier to entry was very, very high,” Fallro explained. “It’s a very protected industry — and it’s too small for Apple and Google and the big boys.”

But now with a combination of the right hardware and a totally rebuilt software stack, they think they can steal a march on the dominant companies and be ready for the inevitable new generation of boaters who can’t stand to use the old tech any more. Shuttling an SD card to and from the in-boat system and your computer to update charts? Inputting destinations via directional pad? Using a separate mobile app to check weather and tides that might bear on your route? Not exactly cutting edge.

The Orca system comprises a ruggedized industrial tablet sourced from Samsung, an off the shelf marine quality mounting arm, a custom-designed interface for quick attachment and charging, and a computing base unit that connects to the boat’s own sensors like sonar and GPS over the NMEA 2000 protocol. It’s all made to be as good or better than anything you’d find on a boat today.

So far, so similar to many solutions out there. But Orca has rebuilt everything from the ground up as a modern mobile app with all the conveniences and connections you’d expect. Routing is instantaneous and accurate, on maps that are clear and readable as those on Google and Apple Maps but clearly still of the nautical variety. Weather and tide reports are integrated, as is marine traffic. It all runs on Android or iOS, so you can also use your phone, send routes or places of interest to the main unit, and vice versa.

“We can build new services that chart plotters can’t even dream of including,” said Sevillano. “With the latest tide report and wind, or if there’s a commercial ship going in your way, we can update your range and route. We do updates every week with new features and bug fixes. We can iterate and adapt to user feedback faster than anyone else.”

These improvements to the most central system of the boat mean the company has ambitions for coming years beyond simply replacing the ageing gadgets at the helm.

Information collected from the boat itself is also used to update the maps in near real time — depending on what your craft is monitoring, it could be used for alerting others or authorities, for example if you encounter major waves or dangerous levels of chemicals, or detect an obstacle where none is recorded. “The Waze of the seas,” they suggested. “Our goal is to become the marine data company. The opportunities for boaters, industries related to the sea, and society are immense.”

Being flexible about the placement and features means they hope to integrate directly with boats, becoming the built-in OS for new models. That’s especially important for the up-and-coming category of electric boats, which sort of by definition buck the old traditions and tend to attract tech-savvy early adopters.

“We’re seeing people take what works on land taking it to sea. They all have the same challenge though, the biggest problem is range anxiety — and it’s even worse on the water,” said Fallro. “We’ve been talking to a lot of these manufacturers and we’re finding that building a boat is hard but building that navigation experience is even harder.”

Whether that’s entirely true probably depends on your boat-building expertise, but it’s certainly the case that figuring out an electric boat’s effective range is a devilishly difficult problem. Even after building a new boat from starting principles and advanced physical simulations to be efficient and predictable, such as Zin Boats did, the laws of physics and how watercraft work mean even the best estimate has to be completely revised every few seconds.

“Figuring out range at sea is very hard, and we think we’re one of the best out there. So we want to provide boat manufacturers a software stack with integrated navigation that helps them solve the range anxiety problem their users have,” said Fallro.

Indeed, it seems likely that prospective purchasers of such a craft would be more tempted to close the deal if they knew there was a modern and responsive OS that not only accurately tracked range but provided easy, real-time access to potential charge points and other resources. Sure, you could use your phone — and many do these days because the old chart plotters attached to their boats are so limited. But the point is that with Orca you won’t be tempted to.

The full device combo of computing core, mount, and tablet costs €1,449, with the core alone selling for €449, with a considerable discount for early bird pre-orders. (For people buying new boats, these numbers may as well be rounding errors.)

Fallro said Orca is operating with funding (of an unspecified amount) from Atomico and Nordic VC firm Skyfall Ventures, as well as angel investors including Kahoot co-founder Johan Brand. The company has its work cut out for it simply in fulfilling the orders it has collected (they are doing a brisk trade, Fallro intimated) before moving on to adding features and updating regularly as promised.

Source: https://techcrunch.com/2021/02/25/orca-wants-to-give-boating-navigation-its-iphone-moment/

Robotics took a small step into the wild world of SPACs this week, as Berkshire Grey announced its plan to go public by Q2. Setting aside some of the bigger issues with using the reverse merger route we’ve discussed plenty, BG is an ideal candidate for this next major step for a number of reasons.

First, the company’s got a track record and a ton of interest. I visited their HQ early last year, before the country shut down. Their plans were already fairly aggressive, with the wind of a recently raised $263 million Series B at their back. Retailers everywhere are already looking to automation as a way of staying competitive with the ominous monolith that is Amazon.

The mega-retailer has already acquired and deployed a ton of robots in fulfillment centers across the world. The latest number I’ve seen is 200,000. That comes from early 2020, so the number has no doubt increased since then. As Locus Robotics CEO Rick Faulk told me the other week, “There are investors that want to invest in helping everyone that’s not named ‘Amazon’ compete.” As with so many things these days, it’s Amazon versus the world.

Image Credits: Berkshire Grey

Beyond its knack for raising money by the boatload, Berkshire Grey is the company you go to when you’re looking to automate a factory from the ground, up. The company says current warehouse automation is somewhere in the neighborhood of 5%. It’s a figure I’ve seen tossed around before, and certainly points to a ton of opportunity. BG’s offering isn’t lights-out automation, but it’s a pretty full-feature solution.

Locus, which just raised a healthy $150M Series E, represents a different end of the spectrum. Similar to offerings from companies like Fetch, it offers a more plug-and-play approach to automation. The lowered barrier of entry means a far less costly on-ramp. It also means you don’t have to shut down your warehouses for an extended period to implement the tech. It’s a more workable solution for situations with contract-based clients or temporary seasonal needs.

The company uses a RaaS (robot-as-a-service) model to deploy its technology. That’s something you’re going to be hearing more and more of around the industry. Like the HaaS (the “h” being hardware) model, the company essentially rents out these super-pricey machines, rather than selling them outright. It’s another way to lower the barrier of entry, and it gives the robotics companies the opportunity to offer continuous service upgrades.

Image Credits: Future Acres

It’s a model Future Acres, a Southern Californian agtech startup, is exploring as it comes out of stealth. Things are still early days for the company, which spun out of Wavemaker Partners (which also developed food service robotics company Miso). Among other things, the company is looking toward a crowdfunded raise by way of SeedInvest. I’ve not seen a lot of robotics companies take that route, so it will be interesting to see how that plays out.

Like logistics, agtech is shaping up to be a pretty massive category for robotics investments. FarmWise was ahead of that curve, announcing a $14.5 million round back in 2019 (bringing its total to north of $20 million). This week the Bay Area startup added crop dusting functionality to its weed-pulling robot.

Image Credits: NASA/JPL-Caltech

NASA’s Perseverance understandably grabbed the biggest robotics headlines of the week. Landing with a parachute sporting the JPL motto, “Dare mighty things,” the rover sent back some of the best and most stunning images of Mars to date.

MSCHF’s livestream, on the other hand, was a bit more spotty. But aside from a fair number of interruptions with the feed, I suspect the company’s 40th drop went about as well as it could have hoped. Prior to announcing that it would mount a remote-control paintball gun to the back of Spot, Boston Dynamics issued a statement condemning the move:

Our mission is to create and deliver surprisingly capable robots that inspire, delight & positively impact society. We take great care to make sure our customers intend to use our robots for legal uses. We cross-check every purchase request against the U.S. Government’s denied persons and entities lists, prior to authorizing a sale.

Image Credits: MSCHF

MSCHF seemed to bask in the attention, even before its name was revealed to the public. At the very least, the stunt was a success from the standpoint of having ignited a conversation about the future of robotics. Boston Dynamics intrinsically understands that its robots sometimes freak people out — it’s a big part of the reason we get viral videos from the company, like the recent one featuring various robots dancing to The Contours.

Among other things, the company is pushing back against the dystopian optics of shows like Black Mirror. Of course, a paintball gun isn’t a weapon, per say. But for the moment, optics are also important. A rep from the company told me, “I turned down a customer that wanted to use Spot for a haunted house. Even putting it in that context of using our technology to scare people was not within our terms of use and not how we imagined the product being beneficial for people, and so we declined that initial sale.”

Video shows NYPD's new robotic dog in action in the Bronx https://t.co/4PwuA7gjDk pic.twitter.com/RkMCSoGRUV

— New York Post (@nypost) February 23, 2021

The ACLU notably raised concern last year after footage from one of our events featuring Spot being used in the field by the Massachusetts police made the rounds. This week, the NYPD deployed a Spot robot yet again — this time at the scene of a home invasion in the Bronx (not to mention a new paint job and the name “Digidog” for some reason). Your own interpretation of those particular optics will likely depend on, among other things, your feelings about cops.

Certainly police departments have utilized robotics for decades for bomb disposal. It’s true that Boston Dynamics (along with much of the robotics industry) got early funding from DARPA. Spot in its current form isn’t much as far as war machines go, but I think these are important conversations to have at this stage in robotic evolution. Certainly there are military drones in the world, and have been for more than a decade.

That’s an important ethical conversation. As is the responsibility of robotics manufacturers once their machines are out in the world. Boston Dynamics does due diligence when selling its robots, but does it continue to be responsible for them once it no longer owns them? That’s certainly not a question we’re going to answer this week.