& meet dozens of singles today!

User blogs

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

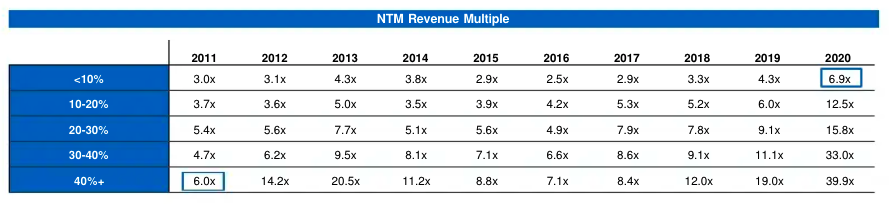

Despite some recent market volatility, the valuations that software companies have generally been able to command in recent quarters have been impressive. On Friday, we took a look into why that was the case, and where the valuations could be a bit more bubbly than others. Per a report written by few Battery Ventures investors, it stands to reason that the middle of the SaaS market could be where valuation inflation is at its peak.

Something to keep in mind if your startup’s growth rate is ticking lower. But today, instead of being an enormous bummer and making you worry, I have come with some historically notable data to show you how good modern software startups and their larger brethren have it today.

In case you are not 100% infatuated with tables, let me save you some time. In the upper right we can see that SaaS companies today that are growing at less than 10% yearly are trading for an average of 6.9x their next 12 months’ revenue.

Back in 2011, SaaS companies that were growing at 40% or more were trading at 6.0x their next 12 month’s revenue. Climate change, but for software valuations.

One more note from my chat with Battery. Its investor Brandon Gleklen riffed with The Exchange on the definition of ARR and its nuances in the modern market. As more SaaS companies swap traditional software-as-a-service pricing for its consumption-based equivalent, he declined to quibble on definitions of ARR, instead arguing that all that matters in software revenues is whether they are being retained and growing over the long term. This brings us to our next topic.

Consumption v. SaaS pricing

I’ve taken a number of earnings calls in the last few weeks with public software companies. One theme that’s come up time and again has been consumption pricing versus more traditional SaaS pricing. There is some data showing that consumption-priced software companies are trading at higher multiples than traditionally priced software companies, thanks to better-than-average retention numbers.

But there is more to the story than just that. Chatting with Fastly CEO Joshua Bixby after his company’s earnings report, we picked up an interesting and important market distinction between where consumption may be more attractive and where it may not be. Per Bixby, Fastly is seeing larger customers prefer consumption-based pricing because they can afford variability and prefer to have their bills tied more closely to revenue. Smaller customers, however, Bixby said, prefer SaaS billing because it has rock-solid predictability.

I brought the argument to Open View Partners Kyle Poyar, a venture denizen who has been writing on this topic for TechCrunch in recent weeks. He noted that in some cases the opposite can be true, that variably priced offerings can appeal to smaller companies because their developers can often test the product without making a large commitment.

So, perhaps we’re seeing the software market favoring SaaS pricing among smaller customers when they are certain of their need, and choosing consumption pricing when they want to experiment first. And larger companies, when their spend is tied to equivalent revenue changes, bias toward consumption pricing as well.

Evolution in SaaS pricing will be slow, and never complete. But folks really are thinking about it. Appian CEO Matt Calkins has a general pricing thesis that price should “hover” under value delivered. Asked about the consumption-versus-SaaS topic, he was a bit coy, but did note that he was not “entirely happy” with how pricing is executed today. He wants pricing that is a “better proxy for customer value,” though he declined to share much more.

If you aren’t thinking about this conversation and you run a startup, what’s up with that? More to come on this topic, including notes from an interview with the CEO of BigCommerce, who is betting on SaaS over the more consumption-driven Shopify.

Next Insurance, and its changing market

Next Insurance bought another company this week. This time it was AP Intego, which will bring integration into various payroll providers for the digital-first SMB insurance provider. Next Insurance should be familiar because TechCrunch has written about its growth a few times. The company doubled its premium run rate to $200 million in 2020, for example.

The AP Intego deal brings $185.1 million of active premium to Next Insurance, which means that the neo-insurance provider has grown sharply thus far in 2021, even without counting its organic expansion. But while the Next Insurance deal and the impending Hippo SPAC are neat notes from a hot private sector, insurtech has shed some of its public-market heat.

Stocks of public neo-insurance companies like Root, Lemonade and MetroMile have lost quite a lot of value in recent weeks. So, the exit landscape for companies like Next and Hippo — yet-private insurtech startups with lots of capital backing their rapid premium growth — is changing for the worse.

Hippo decided it will debut via a SPAC. But I doubt that Next Insurance will pursue a rapid ramp to the public markets until things smooth out. Not that it needs to go public quickly; it raised a quarter billion back in September of last year.

Various and Sundry

What else? Sisense, a $100 million ARR club member, hired a new CFO. So we expect them to go public inside the next four or five quarters.

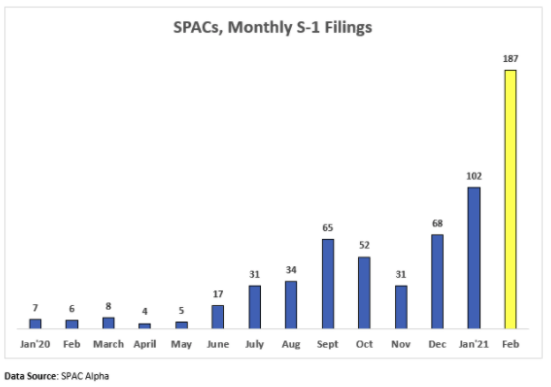

And the following chart, which is via Deena Shakir of Lux Capital, via Nasdaq, via SPAC Alpha:

Product manager might be one of the most grey roles within a startup. However, as a company progresses and the team grows, there comes a time when a founder needs to carve out dedicated roles. Of these positions, product management might be one of the most elusive — and key — roles to fill.

Ken Norton, who recently left his job as director of product at Figma to consult rising PMs, thinks it’s easier to start with defining what they aren’t: the CEO of the product.

“Product managers need to realize that there is a lot of janitorial work that gets done in product management,” he said. “It’s not fun or glamorous, and it’s certainly not being the CEO of the product. It’s just stuff that needs to get done.” I wrote up a guide on how and when to hire your first product manager that expands on some of these insights, including how focus might be the biggest trait to interview for:

- How and when to hire your first product manager

- In freemium marketing, product analytics are the difference between conversion and confusion

- Create a handbook and integrate AI to onboard remote employees

Hiring continues to be one of the hardest parts of building a startup, and those early employees can define the trajectory, culture and eventual success of it. Even during TC Sessions: Justice this past week, Precursor’s Sydney Thomas explained how startups need to make “pretty final decisions, pretty early on in what type of company you want to build.”

It’s a slight asterisk to the common narrative of how startups pivot every other day. It’s not that simple, and I’ll probably remind you of that every other week, dear Startups Weekly readers.

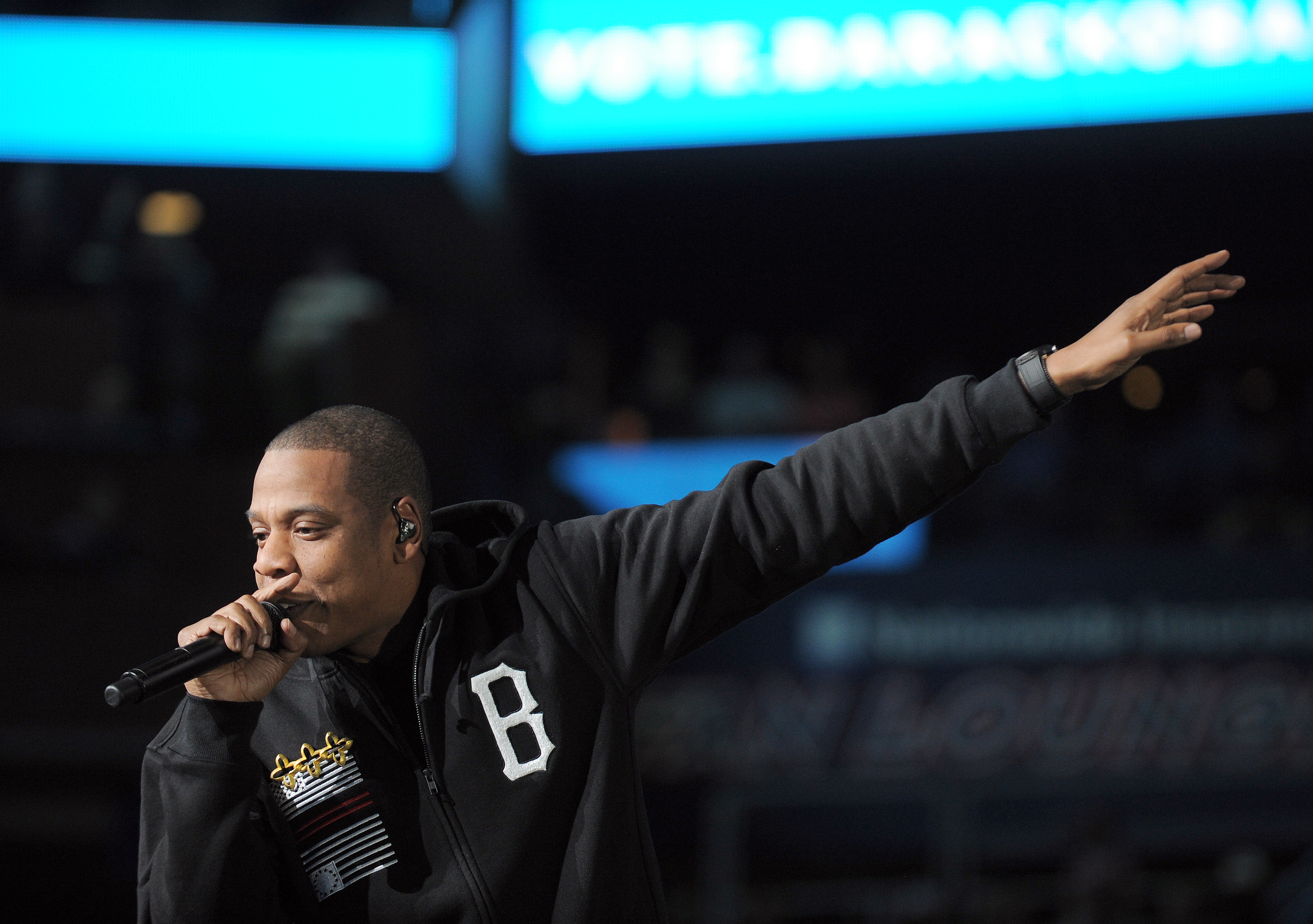

The rest of today’s newsletter will include notes on a hot up-and-coming edtech IPO, an exit that includes Jay-Z, and the latest in agricultural tech robots. Also, remember you can always find me on Twitter @nmasc_ or e-mail me at natasha.m@techcrunch.com.

The public markets get educated

It’s been yet another busy week for the public markets. I published a scoop earlier this week that Coursera is filing to go public soon, which would be one of the first debuts that will let us see how an education company’s finances changed, and accelerated, amid the pandemic’s impact on remote learning.

Here’s what to know: Like clockwork, Coursera’s S-1 dropped late Friday, giving us the first glance of the numbers behind the business. The startup tried to pain a picture of a path of profitability, with rising revenues as well as rising net losses. We get into the meat of it here.

- Unraveling ThredUp’s IPO filing: Slow growth but a shifting business model

- First impressions of AppLovin’s IPO filing

- Oscar Health prices IPO at $39 and secures a $9.5 billion valuation

Image Credits: Fotograzia / Getty Images

What’s better than one billionaire? Two

One of the biggest headlines of this past week was Square buying a majority stake of Tidal. A fintech and music collaboration might not seem that obvious, but the music economy remains one of the most under-tapped (and under-innovated) opportunities that remains out there.

Here’s what to know: Square CEO Jack Dorsey used his other company, Twitter, to share more information about the $297 million deal. As part of this transaction, Tidal owner Jay-Z got a board seat with Square, triggering conversations about the future of musical NFTs. The deal also officially confirmed that Jay-Z isn’t just a businessman, he’s a business, man.

- 3Lau spoke on the Good Time Show, hosted by Sriram Krishnan and Aarthi Ramamurthy, about his NFT audio journey.

- Cappuccino lets you share short, intimate audio stories with your friends.

- Plus, stay tuned for an NFT-focused Equity show next week. If there’s anyone you think we need to interview for the episode, DM me names.

Singer Jay-Z performs before US President Barack Obama speaks at a campaign rally in Columbus, Ohio, on November 5, 2012. After a grueling 18-month battle, the final US campaign day arrived Monday for Obama and Republican rival Mitt Romney, two men on a collision course for the world’s top job. The candidates have attended hundreds of rallies, fundraisers and town halls, spent literally billions on attack ads, ground games, and get out the vote efforts, and squared off in three intense debates. AFP PHOTO/Jewel Samad (Photo credit should read JEWEL SAMAD/AFP/Getty Images)

Decentralized insect farming, anyone?

In this week’s Equity Wednesday episode, we brought on TC’s climate tech editor, Jonathan Shieber, to talk about the opportunities within agtech right now. We covered a lot within the 20-minute episode: from $100 million for mealworms, farm-to-grill robots and decentralized insect farming.

Here’s what to know: Farms have always had a compelling reason to turn to robotics to make tedious work much, much easier. We got into two different businesses and their approaches on how to serve farm robots, from SaaS leases to selling the robots one by one.

- Corporate sustainability initiatives may open doors for carbon offset startups

- Autonomous dust cropping might be a new suite of services amid agtech robotics

Image Credits: Fernando Trabanco Fotografía / Getty Images

Around TechCrunch

Thanks to all of you who tuned into TC Sessions: Justice this past week, it was so fun to hang — and make sure to give virtual kudos to my colleague, and showrunner, Megan Rose Dickey.

Next up is TechCrunch Early Stage, our yearly event that is all about tactical advice to help new and first-time founders navigate the Wild West world that is venture capital and startups. We just announced the judges of the pitch-off competition, and have already landed top-tier venture capitalists to share what you won’t find on Twitter: behind the scenes startup advice that is beyond 180 characters.

It’s the bootcamp you always wished you could attend, so get your tickets here.

Across the week

Seen on Extra Crunch

Understanding how investors value growth in 2021

Dear Sophie: Can you demystify the H-1B process and E-3 premium processing

11 words and phrases to cut from your VC pitch deck

Making sense of the $6.5B Okta-Auth0 deal

Seen on TechCrunch

SoftBank makes mountains of cash off of human laziness

Mary Meeker’s Bond has closed its second fund with $2 billion

The technology selloff is getting to be somewhat material

What China’s Big Tech CEOs propose at the annual parliament meeting

And finally…

I wanted to end by using this platform to address the rise of anti-Asian violence across our country. Conversations around how to be a more inclusive and anti-racist society need to be more loud, and more collaborative in order for change to actually happen. Intention around inclusion will impact the world we live in, the startups we create and the success of our collective. Here are some resources to donate, petition and learn.

Thanks,

gear circuit SecureDrop

pittsburgh steelers or organic green bay Packers american fo

away Season modifications in the fundamental 12 Baylor

but that is after rent

ok point out young women stifle Vermont

chick x person who reads

daydream snowboarding Playoff match - recommendations on How

daydream football Playoff matchup - based on how you ll be a

Size 6Xl Scrubs Areas That Are Mlb Jerseys Wholesale Underserved This Has

The post Some Changes At APW appeared first on A Practical Wedding: Wedding Planning, Inspiration, and Ideas.