& meet dozens of singles today!

User blogs

The Swiss-based, venture capital-backed, direct air capture technology developer Climeworks is partnering with a joint venture between the government of Norway and massive European energy companies to map the pathway for a business that could provide not only the direct capture of carbon dioxide emissions from air, but the underground sequestration and storage of those emissions.

The deal could pave the way for a new business that would offer carbon capture and sequestration services to commercial enterprises around the world, if the joint venture between the Climeworks and the newly formed Northern Lights company is successful. It would mean the realization of a full-chain carbon dioxide removal service that the two companies called a necessary component of the efforts to reverse global climate change.

Northern Lights was incorporated in March as a joint venture between Equinor, Shell and Total to provide processing, transportation and underground sequestration services for captured carbon dioxide emissions. The business is one of the lynchpins in the Norwegian government’s efforts to capture and store carbon emissions safely underground under a plan called The Longship Project.

“There is growing awareness of the need to build capacity to remove CO2 from the atmosphere to achieve net zero by 2050. We are enthusiastic about this collaboration with Climeworks. Combined with safe and permanent storage, direct air capture has the potential to get the carbon cycle back in balance,” said Børre Jacobsen, the Managing Director of Northern Lights, in a statement.

The two companies are hoping to prove that Northern Lights facilities combined with Climeworks direct air capture technologies can prove to be a part of a push towards negative emissions technologies that allow companies in non-industrial sectors to become either carbon neutral or carbon negative.

There are a number of caveats to the project, which reveal both the potential promise and pitfalls of direct air capture initiatives and sequestration and monitoring projects.

The first issue is the need to set a global price for carbon dioxide emissions that would take to make the projects economically viable.

“There is one legislation worldwide that is paying for direct air capture of CO2 and that is the Low Carbon Fuel Standard in California,” said Christoph Gelbad, the co-chief executive and co-founder of Climeworks. “It’s paying up to $200 per ton… this price range is the price range that will be needed to make this full chain, really going from the atmosphere to direct air capture to underground storage and monitoring. That will be the price range needed to build up the infrastructure and finance it.”

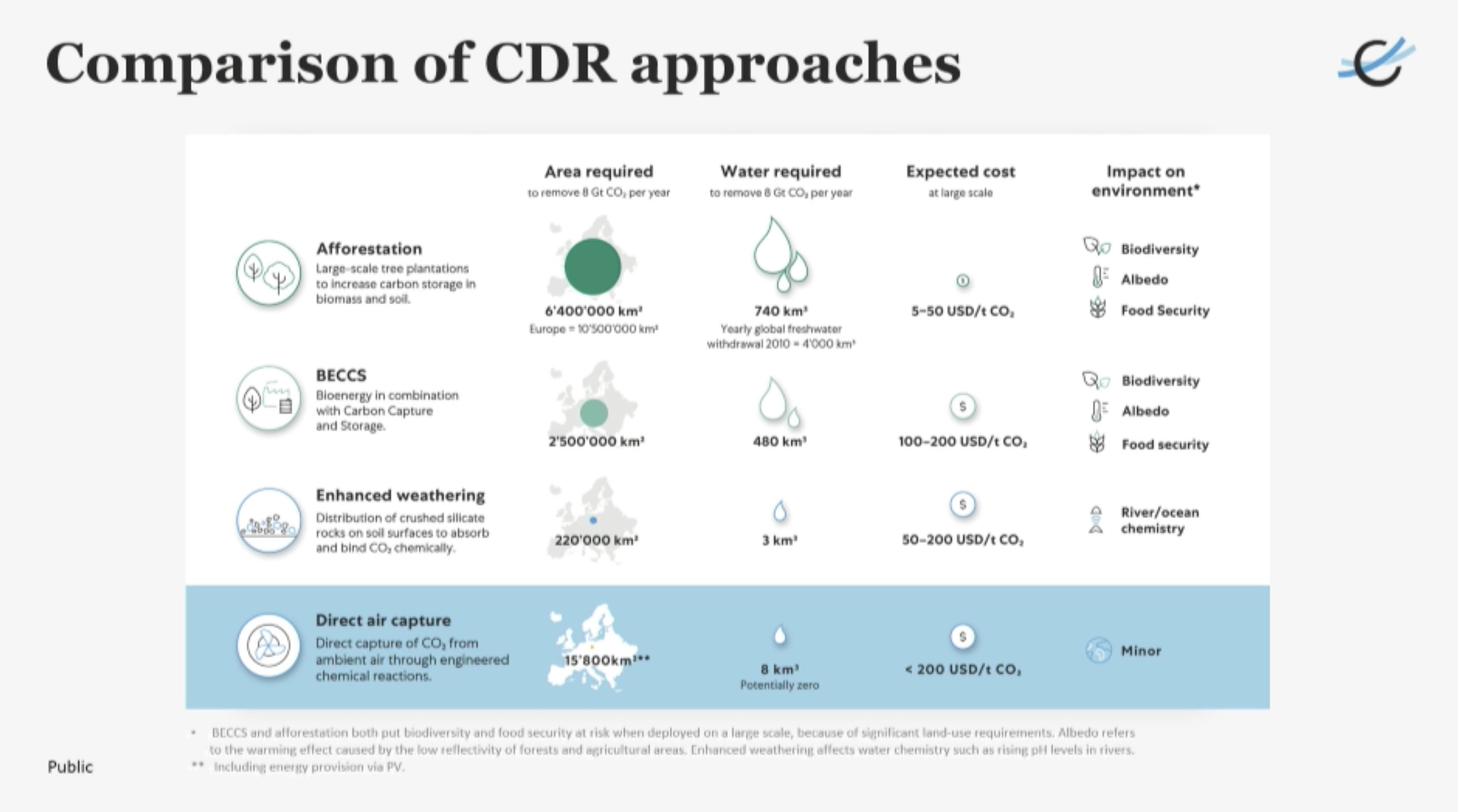

A breakdown of the costs associated with different carbon capture technologies.Image Credit: Climeworks

That price is on the highest end of any that world leaders have discusses as a potential cost for carbon emitting industries (and it’s well below the price that China has set for carbon emissions, which is important to note given the scale of China’s contribution to the production of greenhouse gases that cause global warming).

Beyond any pricing concerns associated with making these direct air carbon capture and storage solutions viable, there’s the scale at which these projects would need to be developed to make a real dent in global emissions.

Here again, Gelbad offers a clear-eyed assessment of his company’s capabilities and the size of the problem.

“The numbers given by science 10 to 20 billion tons of CO2 for removal,” Gelbad said. “Direct Air Capture will need to grow at a gigaton scale. This [potential] site will be in the megaton scale. [But] this is the range where our journey together with Northern Lights definitely could go. We see it going into the megaton ranges.”

Climeworks uses renewable energy and waste heat to power modular collectors that can be stacked into machines at any size. The only limit to the company’s ability to capture carbon dioxide is the availability of power, according to Gelbad.

The company already has a collaboration with an Icelandic company called Carbfix, where the Climeworks technology is used to capture carbon dioxide and store it in mineralized basalt. The company said in a statement that it’s looking globally for other opportunities for permanent carbon dioxide storage and that the Northern Lights solution of deep geological sequestration in an offshore saline aquifer under the North Sea represents an ideal alternative site.

To develop its technology, Climeworks has raised over $150 million from investors including the Swiss lender Zuercher Kantonalbank.

For its part, Northern Lights is already planning on capturing carbon dioxide from industrial point sources in the Oslo region, which will then be shipped to an onshore terminal on the Norwegian coast. A facility there will transport the liquefied carbon dioxide by pipeline to an offshore storage location 1.62 miles below the seabed in the North Sea.

“Northern Lights is offering carbon capture and sequestration as a service. From the idea of doing this project and from the early days of working with the ministry … my biggest surprise was the level of interest in [carbon capture and sequestration] among emitters in Europe,” said Jacobsen. “This awareness. This interest. And the need to find a solution is accelerating. We are talking about what are the possibilities and what are the solutions. Northern Lights offers a great part of the value chain.”

Some companies are already interested in becoming early customers for the project, Jacobsen said. “We have a number of MOUs and confidentiality agreements with customers and letters of support. Big interest in discussing with us. The key will be that we have to bring conversations into agreements so that we can bring this business forward.”

Each of the big three cloud vendors — Amazon, Microsoft and Google — has a marketplace where software vendors can sell their wares. It seems like an easy enough proposition to throw your software up there and be done with it, but it turns out that it’s not quite that simple, requiring a complex set of business and technical tasks.

Tackle, a startup that wants to help ease the process of getting a product onto one of these marketplaces, announced a $35 million Series B today. Andreessen Horowitz led the investment with help from existing investor Bessemer Venture Partners. The company reports it has now raised $48.5 million.

Company founder Dillon Woods says that at previous jobs, he found that it took several months with a couple of engineers dedicated to the task to get a product onto the AWS marketplace, and he noticed that it was a similar set of tasks each time.

“What I saw [in my previous jobs] was that we were kind of redoing the same work. And I thought everybody out there was probably reinventing the same wheel. And so when I started Tackle, my goal was to create a software platform that would take that time down to one or two days. So it’s really a no code solution, and it makes it much more of a business decision, rather than this big technical integration project,” Woods told me.

While you may think it’s a pretty simple task to put an app on one of these marketplaces, Woods points out that the AWS user guide explaining the ins and outs is a 700 page pdf. He says that it’s not just the technical complexity of setting up the various API calls to get it connected, there is also the business side of selling in the marketplace, and that requires additional APIs.

“There’s not just the initial sale. There could be things later like upgrades, refunds, cancellations — maybe you need to do overage charges against that same contract. And so there are all of these downstream things that happen that all require API integration, and Tackle takes care of all of that for you,” Woods explained.

CEO John Jahnke says that the company usually starts with one product in one marketplace, which acts as a kind of proof of concept for the customer, then builds up from there. Once customers see what Tackle can do, they can expand usage.

It seems to be working with the startup reporting that it tripled annual recurring revenue (ARR), although it didn’t want to share a specific number. It also doubled headcount and the number of customers and was responsible for over $200 million in transactions across the three cloud marketplaces.

Jahnke didn’t share the exact number of customers, but he said there were currently hundreds on the platform including companies like Snowflake, GitHub, New Relic and PagerDuty.

The company currently has 67 employees spread across 25 states with plans to almost double that by the end of 2021. He says that it’s essential to put systems in place to build a diverse company now.

“How we scale through this next 100% increase in headcount is going to define the mix of the company into the future. If we can get this right right now and continue to extend on the foundation for diversity and inclusion that we started and make it a real part of our conversation at some scale, we think we’ll be set up as we go from 100 employees to 1000 employees over the long period of time to continue to grow and create opportunities for people wherever they are,” Jahnke said.

Martin Casado, general partner at lead investor a16z, says this type of selling has become essential for businesses and that’s why he wanted to invest in the company. “Cloud marketplaces have become a primary channel for selling software quickly and conveniently. Tackle is the leading player for enabling companies to sell software through the cloud,” he said.

In the wake of International Women’s Day, a group of leading VC funds are grouping together to offer remote office hours for 250-plus women founders from across Europe on May 6th this year. Women founders who want to apply can see more information here and apply for the opportunity here.

The initiative aims to dispense with the need for “warm introductions”. Each founder will have the opportunity to meet four investors during one hour of remote office hours to discuss their tech business idea, ask for advice, pitch for investment, or find a mentor.

The event is being held jointly by Playfair Capital, Tech Nation and Google for Startups. Participants include Atomico, Creandum, Dawn, Balderton, EQT, Notion, LocalGlobe, Partech and Sequoia.

A spokesman for Playfair said the previous four editions saw a total of 2,000 individual mentoring sessions with 490 founders and 105 investors taking part. To date, 18% of founders went on to raise funding after attending an event, including the founders of Organise, SideQuest, Paid, Freyda and Juno.

Playfair says the event will use “AI matching technology” between founders and investors to further optimize funding outcomes from the event.

Chris Smith, managing partner at Playfair Capital, commented: “The support from the ecosystem has been incredible and we are hugely grateful to all the investors who have thrown their weight behind this event. Starting to hear some of the success stories from previous events is incredibly exciting and early proof that by collaborating at scale and taking a long-term view we can really make an impact.”

Plan A, a Berlin-based automated SaaS B2B startup, has raised $3 million for its platform that lets companies measure, monitor, reduce and report their environmental footprint thus improving their ESG ratings. French VC Demeter led the round, with German VC Coparion and Softbank joined the round as a strategic investor. The cash will be used to enhance Plans A’s carbon emission and ESG management software for enterprise customers in Europe, and for international expansion.

Some estimates put the market for emission management solutions at between $10 billion and $26 billion in the next five years. The US Green Deal and new “EU taxonomy for sustainable activities” is putting pressure on businesses to manage their carbon emissions, leading to the ride of platforms like Plan A. Emitwise in the UK has raised $3.4M and there is also while Watershed. However, Plan A says its platform is more comprehensive than other players because of its ongoing automation and monitoring of a company’s carbon output.

Founded in 2017, Plan A has managed to garner customers including Société Générale, GANNI, AlbionVC, BMW Foundation, BCG Digital Ventures and football club Werder Bremen.

Lubomila Jordanova, co-founder and CEO of Plan A, said: “Plan A’s technology has transformed companies and enabled them to turn sustainability into a competitive advantage. We have been working for multiple years on developing the best in class technology, and this investment will allow us to further tailor our carbon and ESG management platform to the needs of enterprises worldwide.”

Olivier Bordelanne, partner at Demeter: “There is a high demand for B2B monitoring services and platforms providing data-based insights on companies’ sustainability indicators or climate risk exposures. Among the many companies offering carbon footprint measurements that we have studied recently, Plan A and its team stood out by positioning themselves as the one-stop shop to help businesses calculate, monitor, and reduce their carbon footprint via mitigation and offsetting actions.”

Alexander Lüttge, Partner at Coparion, said: “Plan A offers companies an easy-to-integrate and easy-to-use SaaS solution for carbon footprint transparency, mitigation and offsetting. In our view, their solution is not only the most versatile product for automated emissions data collection in the market, it also creates transparency in emission and cost structures, as well as a significant value-add for companies through the introduction of automated business process optimization.”

Jordanova says competitors tend to calculate carbon footprints on a one-off basis, help with offsetting and then give certificates for the offsetting without supporting doing any further work. Plan A has a subscription model, where businesses pay a fee starting at 99 EUR / month to access the platform and the insights.

“We offer all of those services, but also enable the company to reduce its carbon footprint and learn how to implement sustainability on an ongoing basis,” she told me.

Plan A is in a good place to benefit from new regulatory environments. The new US administration and the EU have been significantly shifting their agenda, requiring a lot more transparency on reporting about emissions. In the Netherlands, more than 90 banks signed an agreement to create more transparency on CO2 emissions. Meanwhile, money is being divested from fossil fuels and diverted into ESG investments. But of course, companies wanting to get hold of that cash have to be able to prove their emissions. That’s where Plan A comes in.

The Nordic countries make up just 4% of Europe’s total population, but they account for a significant amount of venture capital investment.

That said, Norway’s VC community has been somewhat dormant for a while. The country makes far too much money from oil, giving it one of the world’s largest sovereign wealth funds and a large system of socialized support. Not a bad thing, but as a result, there are few “hungry” tech entrepreneurs.

High-profile players like Northzone and Creandum did well with early entries into Spotify and Klarna, among others, and now Norway is catching up with the rest of the European hubs. Among the trends our survey respondents identified were e-commerce, blockchain and crypto, healthtech, energy, mobility and climate.

Investments highlighted included Fairown, Kahoot, Spacemaker, Cognite, Pexip, PortalOne, Dignio, Speiz, Plaace, Glint Solar, variable.co and Nomono. Local investors tend to invest 50% to 90% of their fund into local startups, “but we do look at deal flow in all Nordic countries,” said one.

Use discount code HALLO to save 25% off a 1-year Extra Crunch membership.

This offer is only available to readers in Europe and expires on April 30, 2021.

On the horizon, there is hope for an increased focus on mental health and wellness from organizations, the press and the government; many also celebrated the rollout of the COVID-19 vaccine, bitcoin’s rise and a new occupant in the White House.

Green shoots of recovery are coming from portfolio revenue growth, exits and IPOs. One investors we spoke to said Norway is “becoming a major hub, with scale-ups and international capital incoming much faster these days.”

Here’s who responded to our survey:

- Sean Percival, managing partner, Spring Capital

- Espen Malmo, founding partner, Skyfall Ventures

- Kjetil Holmefjord, partner, StartupLab

- Anne Solhaug Tutar, partner, Antler

- Daniel Holth Larsen, principal, Investinor

- Magne Uppman, managing partner, SNÖ Ventures

Sean Percival, managing partner, Spring Capital

What trends are you most excited about investing in, generally?

E-commerce.

What’s your latest, most exciting investment?

Fairown.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Martech.

What are you looking for in your next investment, in general?

Not just COVID-proof but services that thrive in COVID times.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

In Norway, sustainability-focused companies. Lots of good ideas but little revenue growth proven so far.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

50% Norway, 50% Nordic/Baltic.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Norway does video tech well.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Strong B2B, weak B2C, lots of SDG focus.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

We are not so hard hit in Norway, so Oslo will likely not see much exodus. It’s still the best place to build a company in this country. Although personally I moved to a small village and don’t see myself moving back to Oslo.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

E-commerce is booming here post-COVID, where before it was rather weak.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

Our portfolio is heavy on SaaS, which has weathered things well. So for our founders, it’s mostly about keeping churn-and-burn rates low to survive.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

In some cases yes, including our e-commerce SaaS companies and my recent Bitcoin exchange investment (MiraiEx).

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Bitcoin’s rise and new open banking solutions have shown the world’s financial engines are still pushing forward. Everything is being built with less friction these days. We’re trying to highlight the movers and shakers who outsiders might not know. Iterate is a cool company builder company flying under the radar. Just had their first big investment success/cash out with a company called Porterbuddy.

Any other thoughts you want to share with TechCrunch readers?

Norway is slowing, becoming a major hub with scale-ups and international capital incoming much faster these days (recent investments from SoftBank and Founders fund, for example).

Espen Malmo, founding partner, Skyfall Ventures

What trends are you most excited about investing in, generally?

Skyfall focuses on software companies, marketplaces and hardware companies with a recurring software revenue bundle. We are really excited about the blockchain and cryptocurrency space. Our team has been involved and invested in crypto since 2012, so we’ve been excited about the industry for a long time. We have invested in two great companies in the sector, the blockchain analytics tool Nansen.ai and the cryptocurrency exchange MiraiEx. We also love embedded commerce and social commerce, which we think will boost the more independent long tail of e-commerce in the years to come. Our portfolio company Outshifter is positioned well to utilize this trend.

What’s your latest, most exciting investment?

It is always hard to pick favorites since we are excited about all our investments, but Nomono is one that really excites us. Nomono is a software and hardware solution to capture and intelligently process voice recordings and spatial audio. The solution enables podcasters to edit their recordings with the click of a button, as a sort of digital audio technician in your pocket.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

This is super hard to pinpoint and it is really challenging to label an industry as overlooked. Bioinformatics is maybe a little bit overlooked in Norway, but I don’t feel that is the case globally. Also, I think the pure B2B SaaS focus of a lot of VC funds makes it harder than necessary to get funding for hardware companies and companies with a rundle business model, even though hardware revenues bundled with recurring software revenues can create extraordinary outcomes due to high order values and strong lock-in effects.

What are you looking for in your next investment, in general?

We invest in strong technical founders solving big problems in markets ripe for change. We usually prefer that the company has a prototype or beta of their solution and some initial market traction.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

Both micromobility and telemedicine seem very crowded at this point, and we believe the current market leaders in these sectors will become the winners. I think it will be very hard to enter this space as a new startup at this moment in time.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

We have a Nordic investment mandate, but we primarily focus on Norway as we are a Norwegian pre-seed/seed fund and have our competitive insight, network and brand here in Norway. So more than 50% in Norway, but we do look at deal flow in all Nordic countries.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Norway has a great track record within the video conferencing and audio industry. After Cisco bought Tandberg, a world-leading video conferencing company, for $3.3 billion in 2010, Video Valley (the area of Lysaker right outside of Oslo) has churned out a lot of successful companies within the space. For example, Acano (acquired by Cisco for $700 million), Pexip (IPO’ed, now valued at $1.4 billion) and Huddly (IPO’ed, now valued at $0.5 billion). From our own portfolio, both Nomono and Oivi are started by serial entrepreneurs with track records from successful Video Valley companies. Also, Norway is by far the leading country globally in adoption of electric vehicles per capita, and today over 50% of all new cars bought are electrical. This means that Norway is a great playing field for startups piggybacking on the EV revolution and also the green revolution in general. The EV home charger Easee is a company to watch.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Norway is a country where you get access to a highly educated and technically skilled workforce that is proficient in English, and the valuation of the companies is well below the levels you see in the U.S., or even in Sweden. I think Norway is a country to watch, but I obviously also believe that all the Nordic countries will continue to punch well above their “weight class” in the years to come.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Yes, the acceptance of working remotely will democratize the startup ecosystem globally. We should see a relative decrease in growth in the traditional hubs of Silicon Valley/SF, Beijing, London, Berlin and so on, compared to a relative increase in companies formed and managed “in the cloud.” We already have one such company in our portfolio, Nansen.ai, which truly is distributed across the world, “in the cloud,” and has been so from day one.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

We do not invest in sectors that have been hit directly by the pandemic, so we have been lucky in that way.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

No, we have in many ways been affected positively by COVID-19 as we have major investments in companies that are working with remote work, home delivery, e-commerce, cryptocurrencies and so on. In general, technology looks like the winning category during this pandemic, and I believe that will continue.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

As answered above, a lot of our companies are actually performing better than usual amid COVID.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

The decline in infections locally and the rollout of the COVID vaccines. Also, Trump leaving the Oval Office. I don’t think I would have managed four more years with him in the spotlight, inciting hatred and nonsense on Twitter.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

Yes, Johan Brand, co-founder of Kahoot and now an angel investor.

Kjetil Holmefjord, partner, StartupLab

What trends are you most excited about investing in, generally?

Sector agnostic. Personally interested in climate.

What’s your latest, most exciting investment?

Latest one announced: Variable.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now? What are you looking for in your next investment, in general?

Positive impact, fast team, big returns.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

100% Norway.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Video, health, climate.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Getting better every day.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Increase but maybe not a surge.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Uncertain.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

More international competition for investment opportunities.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Yes.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

Vaccine news.

Anne Solhaug Tutar, partner, Antler

What trends are you most excited about investing in, generally?

We focus on technology companies and are industry agnostic in general, but in Oslo we have a particular focus on startups within the energy, property and mobility sector.

What’s your latest, most exciting investment?

Speiz, Plaace and Glint Solar are a few examples.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Absolutely! We love any company that removes friction and focuses on solving real problems. Very often we see that the best companies are started by founders that have directly been impacted by an inefficiency or problem themselves, and later dedicate their lives to fixing it. Those founders will go above and beyond, and work relentlessly to understand their customers’ needs. We will see a lot of new opportunities from decentralized finance and a shift to a truly global economy where borders and barriers will be surpassed with smart technology.

What are you looking for in your next investment, in general?

The most important factor for any investment we make: a very strong co-founder team. Beyond that, a thoroughly validated business idea and model, a concept that has the potential to scale, traction; rapid growth week over week and founders solving a real problem and not a made-up problem.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

We have a decade behind us of incremental innovations. In the next 10 to 20 years, we will see huge leaps and groundbreaking new technologies. Lots of current small improvement solutions will be replaced by technologies that are dramatically changing the way we live, work, collaborate and act.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

We can invest anywhere, but the Oslo branch typically invests in locally established companies. I’d say 90%.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

Our focus in Norway says a lot about the industries we think have potential for disruption and where Norway holds a particularly strong position; energy, property and mobility.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Compared to other locations, we see that startups based out of Oslo are typically cheaper than in other parts of the world. Investors that are able to identify the right founders can make great investments in Norway. At the same time, Norwegian founders would benefit from more investors with an international focus. The ecosystem of investors and accelerators is rapidly growing in Oslo, and with more and more successful local startups we have a great environment set up for breeding more great companies going forward. We’re very bullish on what will come out of Oslo over the next few years.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Generally we experience two simultaneous trends: More talent being freed up from their previous engagements and more uncertainty, with founders being more on the fence about making the leap. We haven’t made observations of this being connected to specific cities or areas yet.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

I’m not sure it’s wise to develop completely new businesses based on opportunities from COVID only; rather, COVID can, timing-wise, really spark the launch or growth for some and significantly slow down the growth pace for others.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

We invest as per normal and see that there is still a lot of capital ready to be deployed in Norway. Our companies have received a lot of soft funding from government initiatives, which is a huge and highly appreciated help to our portfolio companies. For our startups, and most others, the advice is always to keep the burn rate at manageable levels during this time of extra uncertainty, and plan the fundraising strategy accordingly. Otherwise, it’s never been more important to be lean and agile. The founders that are able to navigate well in a context with lots of uncertainty can do really well in the current climate!

Daniel Holth Larsen, principal, Investinor

What trends are you most excited about investing in, generally?

Resource efficiency, healthier lifestyles, internet of behaviors, how we work and learn.

What’s your latest, most exciting investment?

Dignio (SaaS/medtech).

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

Forestry technology; a lot of focus on agriculture, but not forestry. Massive market opportunity, well positioned for SDGs, and driven by megatrends (building with wood, etc.).

What are you looking for in your next investment, in general?

In general: Proven scalability in a massive global market opportunity, with a (both) nice and savvy founding team.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

- I think the consumer fintech space will get hard for startups in the coming years. Banks and institutions have competitive advantages through their large customer bases and access to resources and are investing heavily in the space (both through M&A, but more importantly with in-house initiatives and projects).

- Not one particular product per se, but I’m concerned about nice-to-have enterprise products that are not embedded and adapted in several departments of the customer (i.e., a marketing tool solely used by the marketing team at an organization, or a procurement tool used exclusively by procurement). I think many of these services will have a hard time in the tailwinds of COVID, and I think it is essential to get noticed by C-suites and other departments to survive in the longer run (regardless of your size and number of customers).

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

More than 50%. We are the largest and most active player in Norway by far. In 2020, we did 16 new direct investments, more than 60 follow-up investments, four IPOs, six investments in other venture funds, two complete exits.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

The Norwegian ecosystem will continue to thrive and be more and more relevant internationally in regards to software, particularly B2B software. This is driven by:

- Leading technological adaption and usage by the government, institutions and business.

- Low risk in career changes: talent fluctuating from leading companies to startups.

- Leading support and growth financing initiatives: Innovation Norway, funds, etc.

- Great global market access: EU networks, foreign investments, etc.

I think we especially have advantages in subsectors like proptech, energy, healthcare and education. I’m particularly excited about Kahoot, Cognite, Dignio (portfolio), Xeneta (portfolio), Gelato, Play Magnus (portfolio) and reMarkable.

How should investors in other cities think about the overall investment climate and opportunities in your city?

- Transparent way of doing business: honest, close to zero corruption;

- High grade of innovation and many opportunities;

- Happy population = happy founders and FTEs, and high productivity;

- Favorable policies and regulation (policies and legal proceedings, IPOs, etc.);

- No language barriers;

- Significant support from government, institutions and local business.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

Maybe, maybe not. I still think cities will be the most prominent location for startups as (1) Big business is not rural, and startup founders typically come from banks, consultancies, corporations, etc. and also recruit from the likes of it; and (2) Network access and information is more vast in cities, and even though people are currently staying at home, geographical proximity remains a key factor.

This might happen in the longer run as more corporations recruit more people remotely, but I don’t see this happening the next following years as a consequence of our situation today. I think it will take more time.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Oil and gas; we have not made any new investments the last three years, but still have some companies in our portfolio (mostly specific technologies for the O&G industries). Its attractiveness was obviously declining pre-COVID as well, but the crisis has only made the sustainable shift stronger. I don’t see it rebounding to its previous levels. I think startups have opportunities in business partnerships cross-industry, and we are seeing many examples of that now. I also think that software companies that are thriving in the current market have a clear upper hand in building sustainable long-term cultures in their organizations and attracting talent from those other industries affected (travel, aviation, O&G, retail, hotels and accommodation, etc.).

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

Hasn’t impacted it in a big way as most of our companies are performing well. Founders are primarily concerned with the mental health of their employees. My advice: CEOs should especially spend a lot of time on vision and goals, culture, teamwork and collectiveness.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Yes, last year was a record year for us both in terms of exits, IPOs and gross IRR in the portfolio. More than 80% of invested capital is in software, hardware and healthcare, and most of our companies are thriving. We see some, but very few, being negatively affected in a big way.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

I’m doing well personally, but I have enjoyed seeing:

- Our fantastic team members and founders getting the recognition they deserve.

- Stagnating unemployment, people getting back to work.

- Increased focus on mental health and wellbeing from organizations, the press and government.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

Some:

Kremena Tosheva (SNÖ Ventures, investor), Karen Dolva (No Isolation, founder CEO), Frida Rustøen (Idékapital, investor), Ann-Tove Kongsnes (Investinor, investor), Trond Riiber Knudsen (TRK, investor), Patrick Sandahl (Investinor, investor), Bente Sollid Storehaug (chairperson), Birger Magnus (chairperson), Erik Langaker (chairperson, investor), Anders Kvåle (Arkwright, entrepreneur, investor), Mathilde Tuv Kverneland (Arkwright X, investor), Dilan Mizrakli Landgraff (Antler, investor), Jacob Tveraabak (entrepreneur, investor), Remi Dramstad (Selmer, lawyer), Martin Schütt (Askeladden, founder/investor), Christian Sagstad (Thommessen, lawyer), Jan Grønbech (growth expert), Nils Thommessen (ex-lawyer, investor and board person), Eilert Hanoa (CEO of Kahoot, investor), Tom Even Mortensen (investor, growth expert), Birgitte Villmo (Investinor, investor), Bente Loe (Alliance Ventures, investor).

Magne Uppman, managing partner, SNÖ Ventures

What trends are you most excited about investing in, generally?

We invest across all digital tech, but some of the areas we have been looking more into lately include health tech, future of work, event and creative tech.

What’s your latest, most exciting investment?

Our latest investment was a follow-on investment in PortalOne, the world’s first hybrid games company. PortalOne converges gaming, shows and the broader entertainment industry into one platform in a really fun and engaging way. It is like nothing you have ever seen before. Spun out of Oslo, they are soon ready to launch in the U.S.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

One space that continues to evolve is the integration of social into various sectors — e.g., social fitness, social shopping, etc. And particularly, how we can recreate the connections that we make in the physical world in the digital version, leveraging the unique accessibility and reach that the digital platform offers.

We also think there are significant advancements to be made within the privacy sector against a backdrop of increased data vulnerability and third-party access to information.

What are you looking for in your next investment, in general?

Brilliant and ambitious founder teams. And being in Norway, we want them to target a much larger and hopefully also global market pretty soon after launch. Norway and the Nordics are perfect testing pits, with a digitally advanced, high-trust population, but too small a market for most tech companies that want to become big.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

We believe that most areas pretty fast become crowded, and try to avoid companies that do only incremental improvements in oversaturated areas. But we don’t necessarily avoid competition if the businesses have a transformative technology and see solutions or have secrets that others have not yet seen.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

So far we’ve been focused on Norwegian companies only, but with our upcoming fund, we will be pan-Nordic. We expect that about 50% of our investments will be Norwegian, whereas the other 50% will be spread across Sweden, Denmark, Finland and Iceland.

Which industries in your city and region seem well positioned to thrive, or not, long term? What are companies you are excited about (your portfolio or not), which founders?

We see a good variety of exciting companies from Oslo and Norway. Kahoot, Spacemaker, Cognite and Pexip have been leading the way lately, with new ones like Memory, Tibber, PortalOne, reMarkable and many others coming right behind. We also believe that Norway’s strong roots with industrial companies now seem to move into tech, for example with a highly skilled workforce moving over from the oil and gas industry, as well as really exciting companies coming out of this area — Cognite being a strong example. Norway also has some unique strengths in ocean tech, renewable energy, agriculture and shipping, all fields that we believe will produce exciting startups built around tech advancements.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Oslo is a city with a strong foundation and an exciting momentum in tech. There’s too few local VCs, though, and that creates a funding gap around the Series A stage, but at the same time lots of opportunities for investors taking their time to get to know the ecosystem. They should know that the Nordics are fragmented, so it’s not enough to know Stockholm; they should also invest time in the other Nordic hubs in order to succeed with a Nordic investment strategy.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

The trend of remote work will increase. We have portfolio companies that don’t even have an office today; Confrere, for instance, which offers a video meeting and conferencing platform currently focused primarily on the healthcare sector, has all their employees working remote. But we also see a strong advantage of companies being tightly connected to a startup hub, there is so much learning, inspiration and network to be shared. Hopefully we’ll see even more minihubs being built around the country, and them connecting tightly to each other. There is a lot of potential in more and better collaboration between the different hubs, locally, nationally and internationally.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

Some of the industry segments that look weaker are business travel, retail and hospitality. Exciting opportunities exist within event, games, work tools and efficiency, health tech and sustainability. One particularly interesting challenge is to understand and anticipate which of the trends that have arisen during these times will be temporary and which will be permanent.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

Some areas have developed fast, and that impacts which areas we focus on. The biggest worries on the portfolio side have been (1) that their B2B sales will be affected and (2) that the investment climate will be more challenging. Our advice has been to secure a long runway for some companies, whereas other companies have accelerated because of the shifts caused by COVID-19 and need to run even faster.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

Yes, the first two months were hard for some of the portfolio companies, but after that things recovered and they mostly are back at the revenue growth that they planned for before the pandemic.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

At SNÖ we often draw the comparison between being a founder and the proud heritage we have in Norway with polar explorers and their great expeditions. What our founders have shown the last year, through these uncertain times, gives me good hope that this comparison is valid like never before. Entrepreneurs are the polar explorers of 2021.

Who are key startup people you see creating success locally, whether investors, founders or even other types of startup ecosystems roles like lawyers, designers, growth experts, etc. We’re trying to highlight the movers and shakers who outsiders might not know.

There are many in the Oslo scene that have contributed a lot during the last few years; Rolf Assev, Alexander Woxen, Per Einar Dybvik, Tor Bækkelund, Kjetil Holmefjord at StartupLab, Ingar Bentsen and Hans Christian Bjørne at TheFactory, Anniken Fjelberg at 657, Anders Mjåset at Mesh, Heidi Aven at SHE, Knut Wien and Maja Adriaensen at Startup Norway, Lucas H. Weldeghebriel and Per-Ivar Nikolaisen at Shifter. And many more. All great people who deserve praise.

TC Early Stage: The premiere how-to event for startup entrepreneurs and investors

From April 1-2, some of the most successful founders and VCs will explain how they build their businesses, raise money and manage their portfolios.

At TC Early Stage, we’ll cover topics like recruiting, sales, legal, PR, marketing and brand building. Each session includes ample time for audience questions and discussion.

Use discount code ECNEWSLETTER to take 20% off the cost of your TC Early Stage ticket!