& meet dozens of singles today!

User blogs

mPharma, a Ghanaian health tech startup that manages prescription drug inventory for pharmacies and their suppliers, today announced its expansion to Ethiopia.

The company was founded by Daniel Shoukimas, Gregory Rockson and James Finucane in 2013. It specializes in vendor-managed inventory, retail pharmacy operations and market intelligence serving hospitals, pharmacies and patients.

In Africa, the pharmaceutical market worth $50 billion faces challenges such as sprawling supply chains, low order volumes, and exorbitant prices. Many Africans still suffer preventable or easily treated diseases because they cannot afford to buy their medications.

With a presence in Ghana, Kenya, Nigeria, Rwanda and Zambia, as well as two unnamed countries, mPharma wants to increase access to these medications at a reduced cost while assuring and preserving quality. The company claims to serve over 100,000 patients monthly and has distributed over a million drugs to Africans from 300 partner pharmacies across the continent.

CEO Rockson says that when mPharma started eight years ago, he wanted to own a pan-African brand with operations in Ethiopia, Kenya, and Nigeria from the get-go.

By 2018, mPharma went live in the West African country. In 2019, the health tech acquired Haltons, the second-largest pharmacy chain in Kenya, subsequently entering the market and gaining 85% ownership in the company. However, it seemed like a stretch to the Ghanaian-based company to expand to the East African country as it met several pushbacks. Rockson attributes this to the harsh nature of doing business with foreign companies.

“Ethiopia is one of the most closed economies on the continent. This has made it a bit hard for other startups to launch there just because the government rarely allows foreign investments in the retail sector.”

According to Rockson, most foreign brands operate in the country through franchising, a method mPharma has employed for its expansion into Africa’s second most populous nation.

The company signed a franchise agreement with Belayab Pharmaceuticals through its subsidiary, Haltons Limited. Belayab Pharmaceuticals is a part of the Belayab Group — a conglomerate that is also an official franchisee of companies like Pizza Hut and Kia Motors in Ethiopia.

Rockson says we should expect the partnership to open two pharmacies in Addis Ababa this year. Each pharmacy will offer the company’s consumer loyalty membership program called Mutti, where they’ll get discounts and financing options to access medication.

Image Credits: mPharma

This franchising is a part of mPharma’s growth plans of enabling companies looking to enter the pharmacy retail sector. The plan is to provide access to a “pharmacy-in-a-box” solution where mPharma handles every infrastructure involved, and the pharmacy is just concerned about the consumer.

“What we’ve done is that we enable these pharmacies with our software, and we have the backend physical infrastructure and warehousing,” he said. ‘They can rely on mPharma to do all the background work from getting the products into your pharmacy and also providing the software infrastructure to be able to run delivery services while they focus on clinical care.”

mPharma is one of the well-funded healthtech startups in Africa and has raised over $50 million. Last year when it secured a Series C round of $17 million, Helena Foulkes, former president of CVS, the largest pharmacy retail chain in the U.S., was appointed to its board. She joined Daniel Vasella, ex-CEO and Chairman of Novartis as members who have decades of experience in the pharmaceutical industry.

This sort of backing, both in expertise and investment, has proven vital to how mPharma runs operations. Rockson doesn’t mince words when saying the company wants to dominate African healthcare with Ethiopia, its toughest market to enter, already secured.

“There are issues of fragmentation in pharmacy retailing, poor standards and high prices that haven’t been fixed. The African opportunity is still huge, and we are still at the beginning stages of privatisation of healthcare on the continent,” he said.

Snyk, a developer of application security technology, is now worth $4.7 billion after a new fundraising and secondary sale that totaled $300 million.

In all, investors have poured $470 million into the company after this new investment, which was led by Accel and Tiger Global, with participation from a host of existing investors including Addition, Boldstart Ventures, Canaan Partners, Coatue, GV, Salesforce Ventures, and funds managed by Blackrock.

New investors joining Accel and Tiger on the cap table included Alkeon, Atlassian Ventures, Franklin Templeton, Geodesic Capital, Sands Capital Ventures and Temasek.

Withe big valuation and very very late stage investors on the cap table, it’s likely that this will be Snyk’s last round before a public offering. And the markets for enterprise software companies have been white hot recently, so the reception for Snyk should be positive.

Snyk’s value and sky high valuation comes from its ability to offer an application security platform that the company said is designed to provide security visibility and remediation for every component of modern applications — including their code, open source libraries, container infrastructure and infrastructure as code.

Investors seem to believe the company’s claims and so do a clutch of key new hires including Chief Marketing and Customer Experience Officer Jeff Yoshimura, a former executive at Elastic; CIO Erica Geil, who previously worked at Groupon; and Vice President, Asia Pacific Japan (APJ) Sales, Shaun McLagan, who previously worked for EMC.

After the funding, Michael Scarpelli, the Chief Financial Officer of the enterprise software darling and last year’s blockbuster public offering, Snowflake, and Ping Li, a longtime enterprise software investor and a Partner at Accel.

“We first met the Snyk team at the start of their journey, as early investors,” said Li, in a statement. “Throughout our partnership, we’ve witnessed first-hand Snyk’s unshakeable dedication to developer and security teams and their original vision become a reality. We’re looking forward to supporting the successes of Snyk in 2021 and beyond.”

Snyk’s financing comes as application vulnerabilities are becoming an increasingly popular attack vector for hackers. Roughly 43% of data breaches have been linked back to flaws in applications, according to the company.

Meanwhile, a dearth of developers focused on security means that automation has to do more heavy lifting. Snyk says it provides that through automated remediation and the integration of security features directly into developer workflows. The company also offers real-time answers to coders’ security questions.

So far, that suite of services has meant more than 27 million developers around the world are using Snyk tools and the company also provides a marketplace for security coders to pitch their own tools on the Snyk platform.

“We believe Snyk’s developer-first approach to security is a fantastic tool for developers and organizations today,” said Chris Hecht, Head of Corporate Development, Atlassian. “Snyk has already showcased some amazing integrations with our tools, and we’re now thrilled to extend our partnership with them through an Atlassian Ventures investment.”

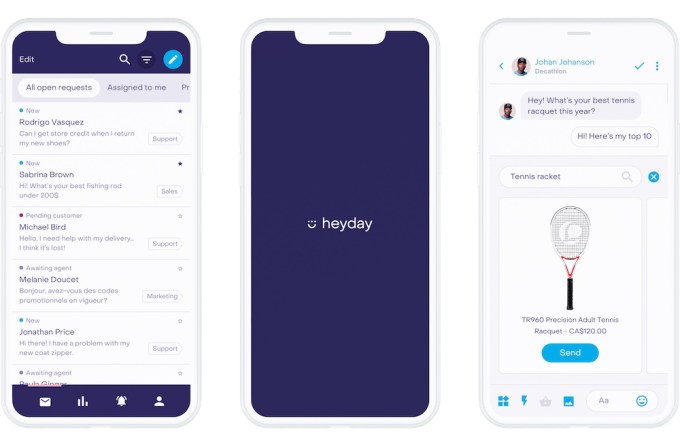

Montreal-based Heyday announced today that it has raised $6.5 million Canadian ($5.1 million in US dollars) in additional seed funding.

Co-founder and CEO Steve Desjarlais told me that the startup’s goal is to allow retailers to support more automation and more personalization in their online customer interactions, while co-founder and CMO Etienne Merineau described it as an “all-in-one unified customer messaging platform.”

So whether a customer is sending a message from Facebook Messenger, WhatsApp and Google’s Business Messages or just via email, Heyday brings all that communication together in one dashboard. It then uses artificial intelligence to determine whether it’s a customer service or sales-related interaction, and it automates basic responses when possible.

Heyday chatbots can provide order updates or even recommend products (it integrates with Salesforce, Shopify, Magento, Lightspeed and PrestaShop), then route the conversation to a human team member when necessary.

There are other platforms that combine customer service and sales, but at the same time, Merineau said it’s important to treat the two categories as distinct and trust that a good service experience will lead to sales in the feature.

Image Credits: Heyday

“We believe that helping is the new selling,” he said.

Desjarlais added, “We’re really against the ticket ID system. A customer is not a ticket …

I truly believe that every single customer is a relationship with a brand that needs to be nurtured over time and that will give more value to the brand over time.”

Heyday was founded in 2017 and says that over the past two quarters, it has doubled recurring revenue. Customers include French sporting good company Decathlon, Danish fashion house Bestseller to food and consumer product brand Dannon — Merineau noted that the platform was “bilingual out of the box” and has seen strong international growth.

“Retailers who believe that [the changes brought about by] COVID-19 are temporary are in the wrong mindset,” he said. “The new mantra of future-forward brands is ‘adapt or die.’ … Brands obviously want to delvier great service, but they care about the bottom line. We help them kill two birds with one stone.”

The startup had previously raised $2 million Canadian, according to Crunchbase. This new round comes from existing investors Innovobot and Desjardins Capital. Merineau said the money will help Heyday “double down on the U.S. and scale.”

The U.S. Department of Defense is setting up a working group to focus on climate change.

The new group will be led by Joe Bryan, who was appointed as a Special Assistant to the Secretary of Defense focused on climate earlier this year.

The move is one of several steps that the Biden administration has taken to push an agenda that looks to address the dangers posed by global climate change.

Bryan, who previously served as Deputy Assistant to the Secretary of the Navy for Energy under the Obama administration, will oversee a group intended to coordinate the Department’s responses to Biden’s recent executive order and subsequent climate and energy-related directives and track implementation of climate and energy-related actions and progress, according to a statement.

The Department of Defense controls the purse strings for hundreds of billions of dollars in government spending and is a huge consumer of electricity, oil and gas, and industrial materials. Any steps it takes to improve the efficiency of its supply chain, reduce the emissions profile of its fleet of vehicles, and use renewable energy to power operations could make a huge contribution to the commercialization of renewable and sustainable technologies and a reduction in greenhouse gas emissions.

The Pentagon is already including security implications of climate change in its risk analyses, strategy development and planning guidance, according to the statement, and is including those risk analyses in its intallation planning, modeling, simulation and war gaming, and the National Defense Strategy.

“Whether it is increasing platform efficiency to improve freedom of action in contested logistics environments, or deploying new energy solutions to strengthen resilience of key capabilities at installations, our mission objectives are well aligned with our climate goals,” wrote Defense Secretary Lloyd Austin, in a statement. “The Department will leverage that alignment to modernize the force, strengthen our supply chains, identify opportunities to work closely with allies and partners, and compete with China for the energy technologies that are essential to our future success.”

Facebook has challenged the FTC’s antitrust case against it using a standard playbook that questions the agency’s arguably expansive approach to defining monopolies. But the old arguments of “we’re not a monopoly because we never raised prices” and “how can it be anticompetitive if we never allowed competition” may soon be challenged by new doctrine and the new administration.

In a document filed today which you can read at the bottom of this post, Facebook lays out its case with a tone of aggrieved pathos:

By a one-vote margin, in the fraught environment of relentless criticism of Facebook for matters entirely unrelated to antitrust concerns, the agency decided to bring a case against Facebook that ignores its own prior decisions, controlling precedent, and the limits of its statutory authority.

Yes, Facebook is the victim here, and don’t you forget it. (Incidentally, the FTC, like the FCC, is designed to split 3:2 along party lines, so the “one vote margin” is what one sees for many important measures.)

But after the requisite crying comes the reluctant explanation that the FTC doesn’t know its own business. The suit against Facebook, the company argues, should be spiked by the judge because it fails along three lines.

First, the FTC does not “allege a plausible relevant market.” After all, to have a monopoly, one must have a market over which to exert that monopoly. And the FTC, Facebook argues, has not done so, alleging only a nebulous “personal social networking” market, and “no court has ever held that such a free goods market exists for antitrust purposes,” and the FTC ignores the “relentlessly competitive” advertising market that actually makes the company money.

Ultimately, the FTC’s efforts to structure a crabbed ‘use’ market for a free service in which it can claim a large Facebook ‘share’ are artificial and incoherent.

The implication here is not just that the FTC has failed to define the social media market (and Facebook won’t do so itself), but that such a market may not even exist because social media is free and the money is made by a different market. This is a variation on a standard big tech argument that amounts to “because we do not fall under any of the existing categories, we are effectively unregulated.” After all you cannot regulate a social media company by its advertising practices or vice versa (though they may be intertwined in some ways, they are distinct businesses in others).

Thusly Facebook attempts, like many before it, to squeeze between the cracks in the regulatory framework.

This continues with the second argument, which says that the FTC “cannot establish that Facebook has increased prices or restricted output because the agency acknowledges that Facebook’s products are offered for free and in unlimited quantities.”

The argument is literally that if the product is free to the consumer, it is by definition not possible for the provider to have a monopoly. When the FTC argues that Facebook controls 60 percent of the social media market (which of course doesn’t exist anyway), what does that even mean? 60 percent of zero dollars, or 100 percent, or 20 percent, is still zero.

The third argument is that the behaviors the FTC singles out — purchasing up-and-coming competitors for enormous sums and nipping others in the bud by restricting its own platform and data — are not only perfectly legal but that the agency has no standing to challenge them, having given its blessing before and having no specific illegal activity to point to at present.

Of course the FTC revisits mergers and acquisitions all the time, and there’s precedent for unraveling them long afterwards if, for instance, new information comes to light that was not available during the review process.

“Facebook acquired a small photo-sharing service in 2012, Instagram… after that acquisition was reviewed and cleared by the FTC in a unanimous 5-0 vote,” the company argues. Leaving aside the absurd characterization of the billion-dollar purchase as “small,” leaks and disclosures of internal conversations contemporary with the acquisition have cast it in a completely new light. Facebook, then far less secure than it is today, was spooked and worried that Instagram may eat its lunch, and it was better to buy than compete.

The FTC addresses this and indeed many of the other points Facebook raises in a FAQ it posted around the time of the original filing.

Now, some of these arguments may have seemed a little strange to you. Why should it matter if a market has money from consumers being exchanged if there is value exchanged elsewhere contingent on those users’ engagement with the service, for instance? And how can the depredations of a company in the context of a free product that invades privacy (and has faced enormous fines for doing so) be judged by its actions in an adjacent market, like advertising?

The simple truth is that antitrust law has been stuck in a rut for decades, weighed down by doctrine that states that markets are defined by the price of a product and whether a company can increase it arbitrarily. A steel manufacturer that absorbs its competitors by undercutting them and then later raises prices when it is the only option is a simple example and the type that antitrust laws were created to combat.

If that seems needlessly simplistic, well, it’s more complicated in practice and has been effective in many circumstances — but the last 30 years have shown it to be inadequate to address the more complex multi-business domains of the likes of Microsoft, Google, and Facebook (to say nothing of TechCrunch parent company Verizon, which is a whole other matter).

The ascendance of Amazon is one of the best examples of the failure of antitrust doctrine, and resulted in a breakthrough paper called “Amazon’s Antitrust Paradox” which pilloried these outdated ideas and showed how network effects led to subtler but no less effective anticompetitive practices. Establishment voices decried it as naive and overreaching, and progressive voices lauded it as the next wave of antitrust philosophy.

It seems that the latter camp may win out, as the author of this controversial paper, Lina Khan, has just been nominated for the vacant 5th Commissioner position at the FTC.

Whether or not she is confirmed (she will face fierce opposition, no doubt, as an outsider plainly opposed to the status quo), her nomination validates her view as an important one. With Khan and her allies in charge at the FTC and elsewhere, the decades-old assumptions that Facebook relies on for its pro forma rejection of the FTC lawsuit may be challenged.

That may not matter for the present lawsuit, which is unlikely to be subject to said rules given its rather retrospective character, but the gloves will be off for the next round — and make no mistake, there will be a next round.

Federal Trade Commission v Facebook Inc Dcdce-20-03590 0056.1 by TechCrunch on Scribd