& meet dozens of singles today!

User blogs

Netflix’s original films received 35 Oscar nominations this year, once again putting the streaming service ahead of ahead of any other Hollywood studios.

“Mank” led the pack with 10 nominations, including Best Picture, Best Director (David Fincher), Best Actor in a Leading Role (Gary Oldman) and Best Actress in a Supporting Role (Amanda Seyfried). That doesn’t necessarily make it a shoo-in to be Netflix’s first Best Picture winner, however — it’s worth remembering that in 2019, the streamer’s film “Roma” received 10 nominations as well, ultimately winning three awards but not Best Picture. And last year, “The Irishman” went empty-handed despite its 10 noms.

Besides “Mank,” Netflix’s “The Trial of the Chicago 7” received six nominations, including Best Picture and Best Actor in a Supporting Role (Sacha Baron Cohen). And “Crip Camp,” a film from the Obamas’ production company Higher Ground, is nominated for Best Documentary Feature, as is “My Octopus Teacher.”

Amazon, meanwhile, received 12 nominations, with six for “Sound of Metal” (including Best Picture). “Borat Subsequent Moviefilm: Delivery of Prodigious Bribe to American Regime for Make Benefit Once Glorious Nation of Kazakhstan,” “One Night in Miami” and “Time” were nominated as well. And Apple received its first two nominations ever, for “Wolfwalkers” (Best Animated Feature) and “Greyhound” (Best Sound).

Of course, this is a streaming-centric year for movies overall. With the COVID-19 pandemic forcing theaters to close across the world, the Oscars temporarily abandoned their requirement that films screen commercially in theaters in order to qualify for wards.

And it’s probably safe to assume that most viewers (Academy members and otherwise) watched these movies via streaming. For example, Best Picture nominee and Golden Globe winner for Best Drama Film winner “Nomadland” was released by Fox Searchlight simultaneously in theaters and on Hulu.

The Academy Awards will air on April 25 at 5pm Pacific on ABC.

Sprinklr, a New York-based customer experience company, announced today it has filed a confidential S-1 ahead of a possible IPO.

“Sprinklr today announced that it has confidentially submitted a draft registration statement on Form S-1 with the Securities and Exchange Commission (the “SEC”) relating to the proposed initial public offering of its common stock,” the company said in a statement.

It also indicated that it will determine the exact number of shares and the price range at a later point after it receives approval from the SEC to go public.

The company most recently raised $200 million on a $2.7 billion valuation last year. It was its first fundraise in 4 years. At the time, founder and CEO Ragy Thomas said his company expected to end 2020 with $400 million in ARR, certainly a healthy number on which to embark as a public company.

He also said that Sprinklr’s next fundraise would be an IPO, making him true to his word. “I’ve been public about the pathway around this, and the path is that the next financial milestone will be an IPO,” he told me at the time of the $200 million round. He said that with COVID, it probably was a year or so away, but the timing appears to have sped up.

Sprinklr sees customer experience management as a natural extension of CRM, and as such a huge market potentially worth a $100 billion, according to Thomas. But he also admitted that he was up against some big competitors like Salesforce and Adobe, helping explain why he fundraised last year.

Sprinklr was founded in 2009 with a focus on social media listening, but it announced a hard push into customer experience in 2017 when it added marketing, advertising, research, customer and e-commerce to its social efforts.

The company has raised $585 million to-date, and has also been highly acquisitive buying 11 companies along the way as it added functionality to the base platform, according to Crunchbase data.

Bangalore’s fintech startup ecosystem is inching closer to delivering a new unicorn: CRED.

Two-year-old CRED is in advanced stages of talks to raise about $200 million at about $2 billion valuation, three sources familiar with the matter told TechCrunch. The new funding round, like this January’s Series C, will be largely financed by existing investors, the sources said, requesting anonymity as talks are private. The round is expected to close within a month, one of them said.

CRED, founded by Kunal Shah, has become one of the most talked-about startups in India, in part because of the pace at which its valuation has soared.

Backed by high-profile investors including DST Global, Sequoia Capital India, Tiger Global, Ribbit Capital, and General Catalyst, CRED was valued at $806 million when it closed its Series C round in January this year and $450 million in August 2019. (TechCrunch also scooped the Series C round of CRED.)

I think @CRED_club has probably scaled faster than any Indian startup I know. In two years they have created a category so strong that everyone has an opinion on it.

— Harshil Mathur (@harshilmathur) February 27, 2021

If the new deal goes through, CRED will be the fastest startup in the world’s second largest internet market to attain a $2 billion valuation. Prior to the upcoming Series D round, CRED had raised about $228 million.

Reached by TechCrunch early last week, CRED declined to comment. Sequoia Capital India didn’t immediately respond to a request for comment.

The Indian startup operates an eponymous app that rewards customers for paying their credit card bills on time and offers deals from online brands such as Starbucks, Nykaa, and Vahdam Teas. It had over 5.9 million customers as of January — or about 20% of the credit card holder population in the country.

The startup, unlike most others in India, doesn’t focus on the usual TAM of India — hundreds of millions of users of the world’s second most populated nation — and instead caters to some of the most premium audiences.

“India has 57 million credit cards (vs 830 million debit cards) [that] largely serves the high-end market. The credit card industry is largely concentrated with the top 4 banks (HDFC, SBI, ICICI and Axis) controlling about 70% of the total market. This space is extremely profitable for these banks – as evident from the SBI Cards IPO,” analysts at Bank of America wrote in a recent report to clients.

“Very few starts-ups like CRED are focusing on this high-end base and [have] taken a platform-based approach (acquire customers now and look for monetization later). Credit card in India remains an aspirational product. The under penetration would likely ensure continued strong growth in coming years. Overtime, the form-factor may evolve (i.e. move from plastic card to virtual card), but the inherent demand for credit is expected to grow,” they added.

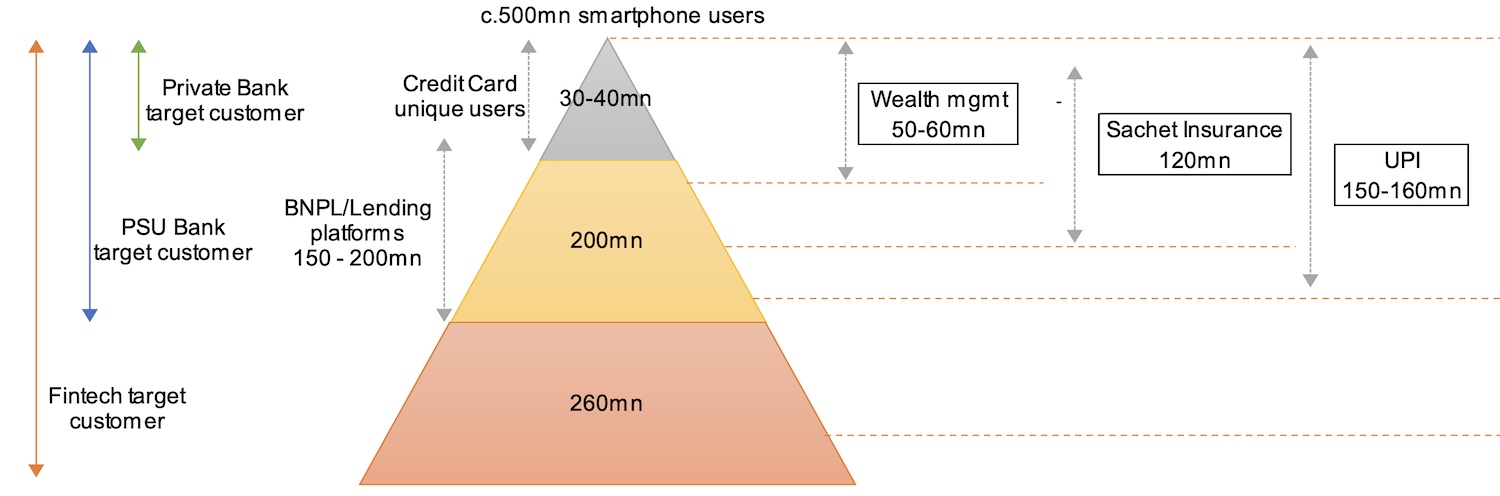

Consumer segmentation and addressable market for fintech firms in India (BofA Research)

CRED says it is trying to help customers improve their financial behavior. An individual needs a credit score of at least 750 to join CRED. In a recent newsletter to customers, CRED said the median credit score of its customers was 830 and at “any given point in time” more than 375,000 individuals are on the app’s waiting list, many of whom have demonstrably improved their score to join CRED.

“It’s easy to be responsible when you’re empowered. 80% CRED Protect members got visibility on extra interest charges and avoided late payment fees by tracking their dues on CRED. Ignorance is not always bliss. CRED members detected additional charges worth over ₹145 Crores [$20.1 million] on their statements. CRED members avoided over ₹43.5 Crores [$6 million] worth of late payment fees,” it wrote in the newsletter.

“With the help of regular bill payment reminders, and a seamless credit card management experience; 160,000 CRED members improved their credit scores last month. CRED members know it pays to be good as they earned cash-back worth ₹12 Crores [$1.65 million] by paying their bills on time. There’s always something to look forward to on CRED. Our members got access to over 750 new rewards and products.”

The startup makes money by cross-selling financing products — for which it has a revenue-sharing arrangement with banks and other financial institutions — and levies a similar cut from merchants who are on the platform, Shah, who is also one of the most prolific angel investors in India, told TechCrunch in an interview in January this year.

Northvolt, the Swedish battery manufacturer which raised $1 billion in financing from investors led by Goldman Sachs and Volkswagen back in 2019, has signed a massive $14 billion battery order with VW for the next 10 years.

The big buy clears up some questions about where Volkswagen will be getting the batteries for its huge push into electric vehicles, which will see the automaker reach production capacity of 1.5 million electric vehicles by 2025.

The deal will not only see Northvolt become the strategic lead supplier for battery cells for Volkswagen Group in Europe, but will also involve the German automaker increasing its equity ownership of Northvolt.

As part of the partnership agreement, Northvolt’s gigafactory in Sweden will be expanded and Northvolt agreed to sell its joint venture share in Salzgitter, Germany to Volkswagen as the car maker looks to build up its battery manufacturing efforts across Europe, the companies said.

The agreement between Northvolt and VW brings the Swedish battery maker’s total contracts to $27 billion in the two years since it raised its big $1 billion cash haul.

“Volkswagen is a key investor, customer and partner on the journey ahead and we will continue to work hard with the goal of providing them with the greenest battery on the planet as they rapidly expand their fleet of electric vehicles,” said Peter Carlsson, the co-founder and chief executive of Northvolt, in a statement.

Northvolt’s other partners and customers include ABB, BMW Group, Scania, Siemens, Vattenfall, and Vestas. Together these firms comprise some of the largest manufacturers in Europe.

Back in 2019, the company said that its cell manufacturing capacity could hit 16 Gigawatt hours and that it had sold its capacity to the tune of $13 billion through 2030. That means that the Volkswagen deal will eat up a significant portion of expanded product lines.

Founded Carlsson, a former executive at Tesla, Northvolt’s battery business was intended to leapfrog the European Union into direct competition with Asia’s largest battery manufacturers — Samsung, LG Chem, and CATL.

Back when the company first announced its $1 billion investment round, Carlsson had said that Northvolt would need to build up to150 gigawatt hours of capacity to hit targets for. 2030 electric vehicle sales.

The plant in Sweden is expected to hit at least 32 gigawatt hours of production thanks, in part to backing by the Swedish pension fund firms AMF and Folksam and IKEA-linked IMAS Foundation, in addition to the big financial partners Volkswagen and Goldman Sachs.

Northvolt has had a busy few months. Earlier in March the company announced the acquisition of the Silicon Valley-based startup company Cuberg.

That acquisition gave Northvolt a foothold in the U.S. and established the company’s advanced technology center.

The acquisition also gives Northvolt a window into the newest battery chemistry that’s being touted as a savior for the industry — lithium metal batteries.

Cuberg spun out of Stanford University back in 2015 to commercialize what the company called its next-generation battery combining a liquid electrolyte with a lithium metal anode. The company’s customers include Boeing, BETA Technologies, Ampaire, and VoltAero and it was backed by Boeing HorizonX Ventures, Activate.org, the California Energy Commission, the Department of Energy and the TomKat Center at Stanford.

Cuberg’s cells deliver 70 percent increased range and capacity versus comparable lithium ion cells designed for electric aviation applications. The two companies hope that they can apply the technology to Northvolt’s automotive and industrial product portfolio with the ambition to industrialize cells in 2025 that exceed 1,000 Wh/L, while meeting the full spectrum of automotive customer requirements, according to a statement.

“The Cuberg team has shown exceptional ability to develop world-class technology, proven results and an outstanding customer base in a lean and efficient organization,” said Peter Carlsson, CEO and Co-Founder, Northvolt in a statement. “Combining these strengths with the capabilities and technology of Northvolt allows us to make significant improvements in both performance and safety while driving down cost even further for next-generation battery cells. This is critical for accelerating the shift to fully electric vehicles and responding to the needs of the leading automotive companies within a relevant time frame.”

For years, there was a debate as to whether WeWork was a tech company or more of a real estate play. At first, most people viewed WeWork as a real estate startup disguised as a tech startup.

And as it kept scooping up more and more property, the lines continued to blur. Then we all watched as the company’s valuation plummeted and its IPO plans went up in smoke. Today, WeWork is rumored to be going public via a SPAC at a $10 valuation, down significantly from the $47 billion it was valued at after raising $1 billion in its SoftBank-led Series H round in January 2019.

Co-founder and then-CEO Adam Neumann notoriously stepped down later that year amid allegations of a toxic combination of arrogance and poor management. WeWork has since been very publicly trying to redeem itself and turn around investor — and public — perception.

Chairman Marcelo Claure kicked off a strategic, five-year turnaround plan in earnest in February 2020. That same month, the beleaguered company named a real estate — not tech — exec as its new CEO, a move that set tongues wagging.

WeWork then also set a target of becoming free cash flow positive by a year to 2022 as part of its plan, which was aimed at both boosting valuation and winning back investor trust.

It likely saw the demise of competitor Knotel, which ended up filing for bankruptcy and selling assets to an investor, and realized it needed to learn from some of that company’s mistakes.

The question now is: Has WeWork legitimately turned a corner?

Since the implementation of its turnaround plan, the company says it has exited out of over 100 pre-open or underperforming locations. (It still has over 800 locations globally, according to its website.) WeWork has also narrowed its net loss to $517 million in Q3 2020 from $1.2 billion in the third quarter of 2019.

Meanwhile, revenue has taken a hit, presumably due to the impact of the coronavirus. Revenue slumped to $811 million the 2020 third quarter, compared with $934 million in Q3 2019.

The pandemic presented WeWork with challenges, but also — some might say — opportunity.

With so many people being forced to work from home and avoiding others during the work day, the office space in general struggled. WeWork either had to adapt, or potentially deal with a bigger blow to its valuation and bottom line.

WeWork’s dilemma is similar to those of real estate companies around the world. With so many companies shifting to remote work not just temporarily, but also permanently, landlords everywhere have had to adjust.

For example, as McKinsey recently pointed out, all landlords have been forced to be more flexible and restructure tenant leases. So in effect, anyone operating commercial real estate space has had to become more flexible, just as WeWork has.

For its part, WeWork has taken a few steps to adapt. For one, it realized its membership-only plan was not going to work anymore, and a dip in membership was evidence of that. So, it worked to open its buildings to more people through new On Demand and All Access options. The goal was to give people who were weary of working out of their own homes a place to go, say one day a week, to work. WeWork also saw an opportunity to work with companies to offer up its office space as a perk via an All Access offering, as well as with universities that wanted to give their students an alternative place to study.

For example, Georgetown did a pretty unique partnership with WeWork to have one of its locations serve as “their replacement library and common space.” And, companies like Brandwatch have recently shifted from leveraging WeWork’s traditional spaces to instead offer employees access to WeWork locations around the globe via All Access passes.

WeWork has also launched new product features. At the beginning of the year, the company launched the ability to book space on the weekend and outside of business hours.

The unbundling of space

I talked with Prabhdeep Singh, WeWork’s global head of marketplace, who is overseeing the new products and also spearheading WeWork’s shift online, to learn more about the company’s new strategy.

“What we’ve essentially done is unbundle our space,” he said. “It used to be that the only way to enjoy our spaces was via a bundled subscription product and monthly memberships. But we realized with COVID, the world was shifting, and to open up our platform to a broader group of people and make it as flexible as humanly possible. So they can now book a room for a half hour or get a day pass, for example. The use cases are so wide.”

Since On Demand launched as a pilot in New York City in August 2020, demand has steadily been climbing, according to Singh. So far, reservations are up by 65% — and revenue up by 70% — over the 2020 fourth quarter. But of course, it’s still early and they were starting from a small base. Nearly two-thirds of On Demand reservations are made by repeat customers, he added.

“Over the last year and a half, we’ve been really figuring out what things we want to focus on what things we don’t,” Singh said. “As a flexible space provider, we are looking at where the world is going. And while we’re a small part of the whole commercial office space industry, we are working to use technology to enable a flexible workspace experience via a great app and the digitization of our spaces.”

For now, things seem to be looking up some. In February, WeWork says it had nearly twice as many active users compared to January. Also, people apparently like having the option to come in at off hours. Weekend bookings now account for an estimated 14.5% of total bookings.

Nearly double as many existing members purchased All Access passes in February 2020 compared to January to complement their existing private office space during COVID, the company said.

In the beginning of the COVID-19, WeWork saw a higher departure of small and medium sized businesses (SMBs) than of its enterprise members, partially due to the nature of their businesses and the need to more immediately manage cash flow, the company said. But in the third quarter of 2020, SMB desk sales were up 50% over the second quarter.

Interestingly, throughout the pandemic, WeWork has seen its enterprise segment grow at nearly double the rate of its SMBs, now making up over half of the company’s total membership base.

While it’s slowing down investing in new real estate assets in certain markets, it is still working to “right-size” its portfolio via exits.

And, when it comes to its finances, as of March 2, WeWork said its bonds were trading at the highest point since the summer of 2019, when the company failed to go public. That’s way up from a 52-week low of about 28%.

“At ~92% for a ~10% yield, the creditor sentiment is clearly positive and a testament to the overall market’s belief that WeWork’s flexible workspace product has a viable future in the future of real estate,” a spokesperson told TechCrunch.

Just last March, WeWork’s bonds were trading at 43 cents on the dollar and S&P Global had lowered WeWork’s credit rating further into junk territory and put the company on watch for further downgrades, reported Forbes.

Still, the company is not done adapting. Singh told TechCrunch that to make WeWork’s value proposition even stronger, it’s working to offer a “business in a box.” Late last year, WeWork partnered with a number of companies to offer SMBs and startups, for example, services such as payroll, healthcare and business insurance.

“A lot of people that come to WeWork are growing businesses,” Singh said. “So while we’ve stuck with our core business services, we’re working to offer more, as in a real suite of HR services that might be complex and expensive for a small business to manage on their own.”

It’s also working to be able to offer its On Demand product globally so that people can opt to work out of a WeWork space from any of its locations around the world.

“Right now, we are in the largest work from home experiment,” Singh said. “I think we’re about to shift to the largest return to work experiment ever. We are just going to be very well positioned.”

The company appears to be trying to become a more sophisticated real estate company that may not be as flashy as the one of the Adam Neumann era, but more stable and more in demand. But is it trying to do too much, too fast?

It will be interesting to see how it all goes.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20 percent off tickets right here.