& meet dozens of singles today!

User blogs

It is nearly impossible for businesses in some African countries to receive money from PayPal. While the payments giant has not given reasons why this is so, speculation hints at factors like insufficient regulation and poor banking security in said countries.

That might be a thing of the past for some businesses as African payments company Flutterwave today is announcing a collaboration with PayPal to allow PayPal customers globally to pay African merchants through its ‘Pay with PayPal’ feature.

Via this partnership, African businesses can connect with the more than 377 million PayPal accounts globally and overcome the challenges presented by the highly fragmented and complex payment and banking infrastructure on the continent.

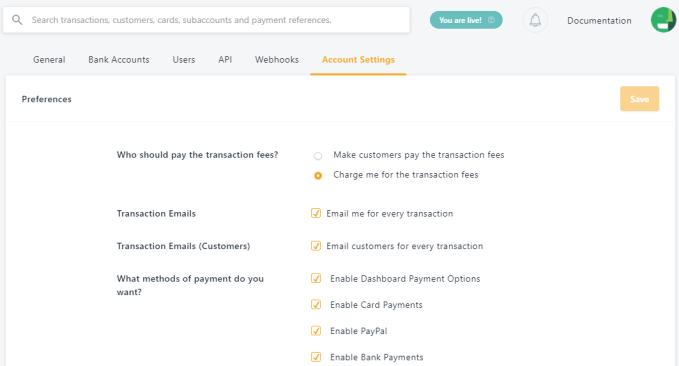

According to CEO Olugbenga ‘GB’ Agboola, this will happen via a Flutterwave integration with PayPal so merchants can add PayPal as a payment option when receiving money outside the continent. The service, which is already available for merchants with registered business accounts on Flutterwave, will be operational across 50 African countries and worldwide, the company claims. Flutterwave hopes to roll out this service to individual merchants on the platform as well.

“In a nutshell, we’re bringing more than 300 million PayPal users to African businesses so they can accept payments across the continent,” he said to TechCrunch. “Our mission at the company has always been to simplify payments for endless possibilities, and from when we started, it has always been about global payments. So despite having the largest payment infrastructure in Africa, we want to have arguably all the important payments systems in the world on our platform.”

A PayPal spokesperson confirmed the Flutterwave collaboration with TechCrunch.

Since the company’s expansion to Africa, it has maintained a one-sided relationship with most countries on the continent, allowing them only to send money. And according to its website, only 12 African countries can send and receive money on the platform, but to varying degrees. They include Algeria, Botswana, Egypt, Kenya, Lesotho, Malawi, Mauritius, Morocco, Mozambique, Senegal, Seychelles and South Africa.

Users in countries who are not afforded the luxury to do so have to rely on using the PayPal account of a friend or family, based in countries where payments can be received. Next, they request the funds via bank transfer, leading to more incurred costs or use other cross-border money platforms like WorldRemit.

This is a pain point for these businesses, particularly in Nigeria. PayPal finally arrived Africa’s most populous country in 2014 and a year later, it became the company’s second-biggest market on the continent.

But despite its fast adoption rate and large fintech appetite, merchants cannot still receive payments from other countries on the platform with various sources alluding PayPal’s decision to the country’s history with internet fraud.

Fraud or not, Nigeria’s e-commerce and that of the continent at large continues to grow at a breathtaking pace. In 2017, Africa generated $16.5 billion in revenue, and by 2022, it is expected to reach $29 billion. With numbers like this, it isn’t hard to see why PayPal wants to get in on the action, albeit not completely. Hence, the partnership with Flutterwave.

The company, via its APIs, offer payment services to individuals and businesses across the continent. Since launching in 2019, the African payments company has partnered with Visa to launch Barter; Alipay to offer digital payments between Africa and China; and Worldpay FIS for payments in Africa.

But this one with PayPal is arguably its biggest collaboration yet. Now, African businesses have more access to sell to global customers using PayPal to receive and send payments online.

In a way, Flutterwave absorbs most of the risk PayPal thinks it will incur if it makes its platform more open to merchants in these countries. But at the same time, it solidifies Flutterwave’s position in the eyes of multinationals looking to enter the African market.

Like when its partnership with Worldpay FIS coincided with its Series B funding, this announcement is also coming on the back of a raise. Last week, the payments company closed a $170 million Series C led by Avenir Growth Capital and Tiger Global, becoming a billion-dollar company in the process.

In hindsight, the mammoth raise suggests that there are a couple of projects in the company’s pipeline. Going by this partnership, we can expect the majority of them to be global plays.

Yet, these questions remain top of mind — What happens when PayPal automatically allows businesses from these neglected African countries to start receiving payments? Will both services continue to coexist if that happens? We’ve reached out to PayPal for comment.

However that plays out, this is a step forward in the right direction for Flutterwave, which has shown time and time again the length it is willing to go for its 290,000 merchants and the ongoing quest to become a global payments company.

“By working with PayPal, we can further strengthen our commitment to our customers and service users as we will be enabling them to transact and expand their business operations to reach new markets. PayPal’s global reach is unrivalled, and collaborating with them allows our customers to explore new markets where PayPal is embedded,” the CEO said.

One of the bigger startups in Europe operating a trading platform for cryptocurrency has closed a big round of funding on the heels of very rapid growth and plans to open its platform to a wider stream of assets.

Bitpanda, a “neobroker” that wants to make it easier for ordinary people to invest not just in bitcoin and other digital assets, but also gold, and any established stock that takes their interest, has picked up $170 million, a Series B that catapults the company’s valuation to $1.2 billion. Bitpanda is based in Vienna, Austria and says that this equity round makes it the country’s first “unicorn” — the first startup to pass the $1 billion valuation mark.

“We are shifting to become a pan-investment platform, not just a crypto broker,” said Eric Demuth, the CEO of Bitpanda who co-founded it with Paul Klanschek and Christain Trummer. Bitpanda’s focus up to now has been primarily on building a platform to target investors in Europe, a largely untapped market, as it happens. “In the EU, we probably have less than 10% of the population owning stocks. Our growth goes hand in hand with that.”

In addition to Austria, Bitpanda is live in France, Spain, Turkey, Italy and Poland with plans to expand to more markets this year, building hubs in Madrid, Barcelona, London, Paris and Berlin. New investment options to back ETFs and “fractional” trades, which will let people invest small amounts of money in whichever stocks they would like to back, are due to be added in April, the company says.

The round is being led by Valar Ventures — the fund backed by Peter Thiel — with participation also from unnamed partners from DST Global (Yuri Milner’s fund). Both have been building name for themselves as significant backers of crypto startups. Valar is also an investor in Robinhood, and most recently, earlier this month the pair co-invested in a $350 million round for BlockFi, which provides financial services like loans to crypto traders.

While DST is a new investor in Bitpanda, Valar also led a round for Bitpanda just six months ago — a $52 million Series A. Since then, Demuth and Klanschek say that the company has seen growth skyrocket (not unlike the price of bitcoin itself).

KPIs like revenue and customer numbers “have been roughly 10x,” Klanschek said. “Very soon we will cross the €100 million revenue mark for the first few months of this year.” Annualized it will work out to around €300-400 million, he added. While the bulk of its trading is for individuals, it’s not only focused on single investors, September, the company’s trading volume for its “Pro” tier for companies, daily trading on the platform was $2 million. Now, it is over $25 million.

Bitpanda’s growth and enthusiasm taps into a much bigger trend in the world of trading. One of the byproducts of the Covid-19 pandemic has been consumers becoming more engaged in their own personal finance.

With interest rates down, professional futures less certain for some, a plethora of apps out there to do more with your money, a whole new set of investing classes thanks to cryptocurrency, and (last but not least) the juggernaut that is social media to help concepts go viral, people are dabbling in a wider range of activities, some having never done more than simply keep their money in a bank account before, and shuffling off a bit of money to their 401k’s or other pension funds.

Bitpanda made a decision last year to start to get more aggressive in its own fundraising to ride that wave.

“We are profitable, and we have been for four years, but in September we changed strategy and wanted to become ‘the’ investment platform for all of Europe,” Demuth said. “We needed more partners and more capital to get more top talent and this is why we did the Series A last year. Then over the past two months, we talked to our investors and said what do you think, it seems like there is some momentum. They said ‘we are in.” No roadshow needed, we will help you. We will call our contacts and they’ll join, too.”

There has been a huge wave of hype around crypto, although in the wider sense it’s still primarily an adopter phenomenon, far from being a mainstream investment, with most people having no idea how it works. Ironically, this is not that dissimilar to much of the stock market for most people although the difference these days is that apps like Robinhood, Square Cash and Bitpanda are making it easier to engage with crypto and other trading by lowering the barrier to entry, both in terms of actually putting money into the system, and also by making it possible to get engaged with only a small amount of money.

Whether cryptocurrency bears out in the longer term, it’s likely that the democratization will stay and become a part of the bigger process of how people manage their own money, if not by gambling all-in, then at least by creating a little diversification for themselves.

That doesn’t excuse the ridiculous hype merchants on social media that potentially exploit these new traders, nor the fact that there is still a very long way to go in regulators getting better oversight of how these new exchanges work, but it does point to an interesting future and more opportunities longer term for organizations and individuals to do more with their money and their assets (NFTs being an example on the other side, of how to build assets and value for investing in the first place).

“In today’s financial world everything is connected,” said Klanschek. “We saw huge growth on Bitpanda after the Covid stock crash in March 2020.” Crypto dropped then too, with “interest high but price very low.” Yet with saving accounts and other traditional, low-key ways for people to growth their money yielding nothing, “it eventually led to huge interest in financial markets, with crypto being established as its own financial asset, its own category.”

While there are a number of platforms emerging for people to engage of that, the pace of adoption for Bitpanda in Europe is what attracted investors here.

“Since we joined the board last September, we have continued to be impressed with the work that Eric, Paul and the team are doing. One of the positive changes caused by the pandemic was an increased interest in personal finance, and Bitpanda’s broad offer and commitment to demystifying investing for a new breed of retail investors means it is perfectly positioned to take advantage of the trend,” said James Fitzgerald, Founding Partner of Valar Ventures, in a statement. “With over 700,000 new users in just 6 months, we know that people want access to the platform, and we’re excited to bring Bitpanda to every investor in Europe.”

Chinese users of the instant messenger Signal knew that good time wouldn’t last long. The app, which is used for encrypted chats, is unavailable in mainland China as of Tuesday morning, a test by TechCrunch shows. The website of the app has been banned in China since Monday, according to censorship tracking website Greatfire.org.

More to come…

Shared micromobility startup Bird said it is investing $150 million into a European expansion plan that will including launching in more than 50 cities this year, a move that it says will double its footprint in the region.

This growth plan is already underway with Bird recently bringing its scooters to Bergen, Norway, Tarragona, Spain and Palermo, Italy.

Bird emphasized that its European expansion will be more than just a geographic one. Bird said it is adding more scooters to its fleets in existing cities, which is nearing 50. The company also made several other promises as part of its announcement, including plans to launch new mobility products and safety initiatives, “the next generation of recycling and second-life applications for vehicles,” investing in equity programs and “securing partnerships across the region.”

It isn’t clear what these new mobility products or initiatives around safety or recycling will be. A Bird spokesperson said these will be new vehicles and “transport modes” in the region. Bird didn’t provide details about what it means by securing partnerships, a phrase that could mean an extension of its franchise program called the Bird Platform or some other kind of arrangement with local governments or operators. Under the Bird Platform, which was first introduced in November 2018, the company provides independent operators with scooters to manage as they please in exchange for a percentage of the cost of each ride.

Bird did say plans will include programs like the subsidized ride passes it announced last week.

Bird has promoted company insiders Renaud Fages to head of operations and Brendan O’Driscoll to global head of product to lead the effort.

How Bird will pay for this expansion is as interesting as what it plans to do. A Bird spokesperson told TechCrunch it’s using “existing resources” to fund these various initiatives. However, the pandemic, its acquisition of Circ and its effort to launch operations in new cities while maintaining existing fleets have depleted its funds. (Last June, Bird shut down scooter sharing in several cities in the Middle East, an operation that was managed by Circ.) The company’s last public fundraising announcements were more than a year ago. The company raised $275 million in a Series D round back in September 2019. That round was later extended to $350 million.

Bird was reportedly close to accessing new funds, according to a report from The Information. The media outlet reported in January that Bird was in the midst of finalizing a deal to raise more than $100 million in convertible debt, led by existing investors Sequoia Capital and Valor Equity Partners.

Stripe gets a mind-boggling valuation, Facebook promotes COVID vaccines and Elon Musk has an interesting new title. This is your Daily Crunch for March 15, 2021.

The big story: Stripe valued at $95B

That’s right: The popular payments company has raised $600 million in new funding at a $95 billion valuation. It says it will use the money to expand in Europe while also growing its global payments and treasury network.

“Whether in fintech, mobility, retail or SaaS, the growth opportunity for the European digital economy is immense,” said president and co-founder John Collison in a statement.

Meanwhile, over in Extra Crunch, Alex Wilhelm takes a closer look at the company’s new growth numbers, like the fact that it’s now working with more than 50 companies that are each processing more than $1 billion annually.

The tech giants

Facebook to label all COVID-19 vaccine posts with pointer to official info — The company says it has also implemented some “temporary” measures aimed at limiting the spread of vaccine misinformation/combating vaccine hesitancy.

His Majesty Elon the First, Technoking of Tesla — In Musk-speak, his new title still translates into the chief executive officer of the electric car company.

Netflix gets 35 Oscar nominations, including 10 for ‘Mank’ — Of course, this is a streaming-centric year for movies overall.

Startups, funding and venture capital

Airtable is now valued at $5.77B with a fresh $270 million in Series E funding — Airtable is a relational database that many describe as a souped-up version of Excel or Google Sheets (and there’s at least one TechCrunch editor who swears by it).

WeWork unbundles its products in an attempt to make itself over, but will the strategy work? — The pandemic presented WeWork with challenges, but also, some might say, opportunity.

ElevateBio raises $525M to advance its cell and gene therapy technologies — The company’s business model focuses on both developing and commercializing its own therapies, while also working through long-term partnerships with academic research institutions.

Advice and analysis from Extra Crunch

Julia Collins and Sarah Kunst outline how to build a fundraising process — Collins is the first Black woman to co-found a venture-backed unicorn, so it should come as no surprise that investors lined up to bet on her latest venture.

Olo raises IPO range as DigitalOcean sees possible $5B debut valuation — It’s a busy day in IPO-land.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

US e-commerce on track for its first $1 trillion year by 2022, due to lasting pandemic impacts — The COVID-19 pandemic boosted U.S. online shopping by $183 billion, according to a new report by Adobe’s e-commerce division.

BMW debuts the next generation of its iDrive operating system — With its new system, BMW is expanding the center dashboard display all the way through the cockpit.

4 signs your product is not as accessible as you think — Bringing decades-long legacy code and design into the future isn’t easy.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.