& meet dozens of singles today!

User blogs

For small and mid-sized restaurants in Nigeria and most of Africa, food procurement can be a complex process to manage. The system is such that a business can easily run out of money or have considerable savings. Most restaurants don’t have access to deal directly with farms to get better deals because they lack the staffing to chase them. Besides, they also don’t have the aggregation pull as single entities to directly get good value from the farms.

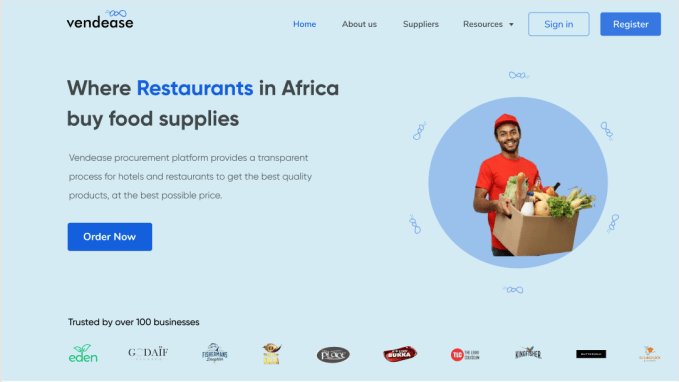

Nigerian startup Vendease solves this problem by building a marketplace that allows restaurants to buy directly from farms and food manufacturers.

The company was founded by Tunde Kara, Olumide Fayankin, Gatumi Aliyu, and Wale Oyepeju. The idea for Vendease came when founders who have been friends for more than five years noticed their favorite restaurants in cities like Lagos and Accra shutting down. Inquisitive, they asked the owners who were acquaintances why, and the problems boiled down to the unreliable and expensive nature of food procurement in the cities.

Some months later they saw a hotel manager openly complain to a vendor about the unsteady supply of produce the hotel was getting. It sparked an idea in the founders’ minds.

The established processes involved staff or a contract employee going to the market or using third-party vendors. The founders saw that these processes were often unreliable from the two unrelated events, and restaurants lost a lot of money from price inflation and bad produce.

“We thought to ourselves that if restaurant owners and hotel managers have these problems, let us actually do some research and find out if it is a problem we can solve, scale and make money while doing it,” Kara said to TechCrunch.

At the time, Kara, the CEO, and Fayankin, the COO, held the respective positions at a Pan-African media consulting company called RED Media. Aliyu, the chief product officer (CPO), also held a similar role at another Lagos and San Francisco-based, YC-backed startup, 54gene. Oyepeju, the CTO, was working on a couple of technology projects for corporates.

Before Vendease, they had founded an adtech startup for ride-hailing companies, which didn’t survive for long. So this was another shot at another entrepreneurial journey, and after two and half months of iteration, the founders decided to launch the company in January 2020. They also closed an undisclosed pre-seed round to kickstart operations.

On its website, it is described as “a procurement platform that provides a transparent process for hotels and restaurants to get the best quality products at the best possible price.” But Kara has a more fanciful description: The Amazon Prime for restaurants in Africa.

Customers can order anything ranging from bread to grains and meat to vegetables on the website. The order notification goes to the farms or food manufacturers, gets processed, and delivery is done within 24 hours.

“Why we call ourselves that is because we are deliberate about fulfilling our orders to restaurants and hotels in less than 24 hours. As most of us know, this is similar to how Amazon Prime prioritizes delivery,” he commented.

The speed and timely manner in which Vendease carries out its operations are such that it currently completes 80% of on-time and one-time deliveries across all orders.

Image Credits: Vendease

To further highlight how effective the company has been thus far, Kara claims that a good number of the 100 businesses using Vendease went from procuring only one type of produce to 80% of their catalog in two months.

As much as Vendease helps restaurants a lot, it also looks out for the vendors and farmers involved in the supply chain. Typically it takes two to three months for these set of customers to get the payments and this happens because restaurants and hotels take too long to balance their books before making payments. In effect, farmers and vendors mark up their prices to mitigate losses, making products more expensive for restaurants and hotels.

While growing up, Kara and Fayankin were on both sides of the vicious cycle. Growing up on a farm and helping his parents with livestock and crop care, Kara knows what it means to be owed for a long time.

“Those experiences help fuel what I do right now. Then, we had a problem selling our products and most times we ended up consuming them because we didn’t have enough off-takers. Even when you did, they’ll owe for six months. And this problem still exists to date.”

On the other side of the marketplace is Olumide, who grew up in a hotel and restaurant business. He runs and handles procurement activities and his experience is vital to how Vendease handles issues around unreliable and expensive supply of food produce. But now they are helping these customers reduce the waiting time to days.

Although they would’ve wanted to solve these problems earlier, their careers strayed toward media and energy. However, it has brought them back, and they’re solving additional problems they didn’t recognise in the past. They soon figured that customers couldn’t track most of their orders and be certain of what they got alongside the supply and cost issues.

Vendease has built all that to help these businesses digitize, track and automate their procurement and inventory management processes. It also helps with logistics, warehousing, quality control and financing where restaurants can buy goods and pay later.

In the next five years, the one-year-old company wants to be the operating system for food supplies in Africa. Kara talks of plans to expand to other African cities in the coming months but is tight-lipped on the names. As Demo Day approaches, the team will be looking to raise some money and follows Egypt’s Breadfast as the only restaurant-focused companies from Africa (although they have very different business models) that the accelerator has funded.

Across the street from Suzhou North, a high-speed railway station in a historic city near Shanghai, a futuristic M-shaped building easily catches the eye of anyone passing by. It houses the headquarters of the five-year-old Chinese autonomous driving startup, Momenta.

Like other major Chinese cities, Suzhou, which is famous for its serene canals and classical gardens, offers subsidized offices and policy support to attract high-tech firms. It seems to have chosen well. Momenta exceeded $1 billion in valuation in two years and became one of the most-funded driving companies in China. The startup has a dazzling list of investors, from Kai-Fu Lee’s Sinovation Ventures, the government of Suzhou, to Mercedes-Benz maker Daimler.

Momenta recently closed another massive round, which nears $500 million and lifts its total funding to over $700 million. The investment marks an important step towards the firm’s international expansion, its chief of business development Sun Huan told TechCrunch. In a few months’ time, Sun will head to Stuttgart, the German hometown of Mercedes-Benz, and open Momenta’s first European office.

The new funding, a Series C round, was led by Chinese state-backed automaker SAIC Motor, Toyota and Bosch, an indication of the traditional auto monoliths’ conviction to smart driving.

“The auto industry needs to develop more advantages when confronting Tesla’s marketing today, so they are paying more attention to autonomous driving,” Momenta’s founder and CEO Cao Xudong told TechCrunch.

Financial investors leading the round were the Singaporean sovereign fund Temasek and Alibaba founder Jack Ma’s Yunfeng Capital. Other participants included Mercedes-Benz AG, Xiaomi founder Lei Jun’s Shunwei Capital, Tencent, Cathay Capital and a few undisclosed institutions. It’s rare to see Tencent and Alibaba (or their affiliates) co-invest.

Be pragmatic

Despite the sizable financial injection, Cao said that “autonomous driving companies can no longer rely solely on fundraising to burn cash.”

Mega-fundraising has become common in the capital-intensive autonomous vehicle world. Momenta’s Chinese rivals Pony.ai has amassed over $1 billion within five years and four-year-old WeRide.ai has raised over $500 million. Like Momenta, the two firms have nabbed investments from big automakers. Pony.ai also counts Toyota as an investor, and WeRide is backed by Renault-Nissan-Mitsubishi.

Momenta declined to disclose its latest valuation. For reference, Pony.ai hit $5.3 billion in its November fundraising round.

TechCrunch went on a test ride with Momenta / TechCrunch

Momenta prides itself on what it calls a “two-legged” business model. Unlike some peers that concentrate resources on ‘Level 4,’ or real driverless passenger cars, Momenta is selling semi-automated driving software to carmakers while investing in more advanced tech that is years from mass adoption.

It also tries to cap expenses by crowdsourcing data from auto partners instead of building its own car fleets, which helps save billions of dollars, the company has reiterated. By accumulating driving data at scale, Momenta gets to finetune its algorithms through a self-correcting system. The more data it has, the better its machine becomes at driving.

“It works like a flywheel,” Cao said, using a tech industry jargon first popularized by Jeff Bezos to explain Amazon’s growth.

Driver’s habit

During a test ride TechCrunch went on, where a safety driver was present but did not intervene, a Momenta-powered Lincoln maneuvered through a neighborhood of Suzhou dotted by jaywalkers, unleashed dogs, speeding scooters and reckless truck drivers. When the sedan slowed down at a highway entrance ramp, other cars zipped past us. It felt as if we were going too slowly, but in fact all the human-steered cars were going well above the 40km/h speed limit.

“Some drivers may want the autonomous driving car to be more aggressive, so we are also exploring a system that learns from individual style,” said Jiang Yunfei, an R&D engineer at Momenta who went on the ride. “Of course, on the condition that the car is obeying traffic rules.”

A tablet next to the dashboard showed what our car was capable of seeing and predicting on the road with a set of mass-produced sensors. “Prediction relies on data,” noted Sun. “If we build our own car fleets, it will be very costly to keep the data-driven approach.”

Momenta has joined in the ranks of companies piloting robotaxis on China’s urban roads. It aims to remove some safety drivers from its robotaxis, which it jointly operates with auto partners, in 2022 and expects all of its vehicles to go driverless in 2024. By then, the company will have significantly reduced labor costs and reach a positive operating margin per vehicle.

Automate globally

Momenta has kept a quiet public profile since its inception and rarely talked about its customers except for its partnership with Toyota on high-definition maps, which predated the investment. What Cao could say was the company has fostered “deep collaborations” with carmakers and Tier-1 suppliers across China, Germany and Japan.

By the end of 2021, multiple customers will start mass-producing mid-to-high-end cars equipped with Momenta’s software. And by 2024 or 2025, Momenta’s solutions could be powering millions of vehicles, which should provide a steady stream of driving data to the startup.

“Electrification is no longer enough to differentiate one high-end car brand from another because the motors and batteries they used are quite similar. The key differentiator now is intelligence,” said the founder.

When asked whether Momenta worries about challenges faced by Chinese firms amid geopolitical tensions and continuing U.S.-China technological decoupling, Jijay Shen, who recently joined Momenta as vice president of sales and marketing, said such situations are “uncontrollable” and “regulatory compliance” is the priority for entering any new market.

“The human race was able to achieve significant technological progress in the last ten years exactly because tech companies from different countries are building on top of each other,” said Shen, who spent over a decade at Huawei and was formerly CEO of the telecoms giant’s Ireland business.

“But because of geopolitical factors, many markets will begin to consider self-subsistence in the short term… I can’t conclude what is better, but I think the whole ecosystem and supply chain need to think what’s better — self-subsistence or interdependence.”

Let’s stipulate the storm of user media (social audio, newsletters, live streaming) is evidence of something real and lasting. When this citizen media migrates to small business and the enterprise, we see that as confirmation, validation. Most of these efforts are in the investment phase, where startups and platforms consolidate ecosystems around the various disruptions.

Clubhouse is moving to a more careful onboarding process that eschews mandatory gobbling of your contacts data and your phone number as a requirement for invitations. Twitter is surprisingly far along on integrating a suite of pilot projects — its Clubhouse clone Spaces, the Revue newsletter creation and distribution tool, and whatever happens to the Periscope live video streaming services the company has abandoned as a standalone.

As the smoke clears, what emerges is a hybrid of work from anywhere and post-pandemic digital collaboration solutions. At the top of the stack, social audio delivers some real leadership in the casual way it captures user attention. While commuting listening is proscribed for at least the next quarter, exercise and mental health breaks pick up a lot of that deficit. Some of the resulting content is appointment focused, keynote events with industry leaders and celebrities. Smaller sessions are organized around self- and group-help concerns, and the usual assortment of get-rich schemes. Much of this competes directly with cable news and podcasts, and will likely absorb the older networks into the new paradigm over time.

You can see this at play in the streaming realignment, where cable-cutting is driving us toward broadband-based consumption of so-called linear television programming. Last night, we ended up switching from Comcast’s video access to CBS’s Grammy coverage in favor of IP streaming via the CBS All Access app (now renamed Paramount +.) The Comcast CBS channel was full of glitches and pixillation; the streaming version rock solid with what seemed like better video and audio quality. On the appointment television side of the equation, old-style network shows like This Is Us and Grey’s Anatomy are finding it more difficult to compete with Netflix, Prime, and other streaming originals. And then there are the kids, who refuse to even recognize anything they can’t stream as relevant.

Moving down the stack from streaming audio (I like that better than social audio as a thing) to the newsletter services, we discover what happens when fragmentation of the media produces too much content and not enough loyalty to a manageable number of suppliers. That loyalty thing is perhaps the new eyeballs, where the stickiness of the relationship is much more desirable for its ongoing lifetime value. Newsletters at their inception were aggregators built to skim the cream of relevant media, in effect replacing the home page and adding a social layer of authority. Now the glut has moved from posts and podcasts to the newsletters themselves.

To differentiate and encourage paid subscriptions, creators are now being wined and dined with tools for managing these microapp sites and competing with magazines and publishers for marquee authors. Newsletter stars start appearing on streaming audio in much the same way that Washington Post and New York Times reporters populate the CNN and MSNBC roundtables. Newsletter’s role as a blend of must reads is shifting to original material and a marketing channel for influence with the streaming audio communities. Twitter’s Revue newsletter tool already lets you drag and drop tweets into the latest issue. It seems a small tweak to use the newsletter as a calendar for upcoming Spaces notifications of events. The company has announced plans for Super Followers who can produce and receive subscribed content via this path between the platform and satellite services.

Twitter hasn’t been Super Clear on how or what video services they will maintain after they sunset Periscope, but closing the loop between streaming audio and on demand video programming gives Twitter a powerful advantage over services like Clubhouse that have fewer pieces of the puzzle. On the other hand, Twitter has to demonstrate newfound ability to launch and integrate the pieces to stay competitive with competitors both visible and in stealth. They include Facebook, Amazon and its growing ad platform, and streaming “Plus” services at a time where subscribers are dropping subscriptions to add new offerings from Disney, Apple, HBO Max, Paramount, and the cheaper free ad-supported streaming TV (FAST) networks like Peacock and Hulu.

Working from anywhere is accelerating the streaming media transition. News becomes a notification-driven stream to dip in and out of as the vaccines begin to take hold. Work promotes attention and care of our values, while home brings a time of relearning how to breathe, treasuring our family and friends, and putting time into exploring things we have been fighting to keep alive: the rhythms of history, genealogy, climate change, the possibility that government can work for a change. As our anxiety moderates, we can dip into music, movies, sports, and other expressive uses of the powerful network we turned on to survive. Turn on, tune in, stay home.

Streaming audio can work for marketing, learning, sharing, and monetizing. It can also work for extending our collaboration with music, painting, storytelling, a kind of virtual comedy club, book club, and debating society. I can imagine the return of liner notes to the music experience, a kind of Prairie Home Companion writ small. The Grammys last night were awkward, strained by the exigencies of the virus. But the performances were bunched together, with the wonderful touch of the group of artists sitting on stools campfire-style after their song to listen and rock to the music of their fellow nominees. Clubhouse style.

We’re on the cusp of a powerful change in the way we live and work. Not just out of necessity but of a desire to fulfill the promise of global communication. We’ve laid the tracks of this new age of collaboration. Now we have to figure out what to do with it.

from the Gillmor Gang Newsletter

__________________

The Gillmor Gang — Frank Radice, Michael Markman, Keith Teare, Denis Pombriant, Brent Leary and Steve Gillmor. Recorded live Friday, March 12, 2021.

Produced and directed by Tina Chase Gillmor @tinagillmor

@fradice, @mickeleh, @denispombriant, @kteare, @brentleary, @stevegillmor, @gillmorgang

Subscribe to the new Gillmor Gang Newsletter and join the backchannel here on Telegram.

The Gillmor Gang on Facebook … and here’s our sister show G3 on Facebook.

There’s been quite a bit of movement in the additive manufacturing space in recent months. If I had to pinpoint a reason, I would say that — much like robotics (another space I follow fairly closely) — the category has gotten a boost in interest from the pandemic. Medical applications are understandably of interest lately, as is alternative manufacturing.

Desktop Metal, Markforged and new-comer Mantel have all made pretty big announcements in recent weeks, and now Fortify is making the round with a significant raise. The Boston-based startup announced a $20 million Series B equity round, led by Cota Capital with additional participation from Accel Partners, Neotribe Ventures and Prelude Ventures.

Fortify is attempting to stake out a claim in material deposits. Using digital light processing (DLP) tech, the company can mix and print in a variety of different materials, with a wide range of properties. The list includes some useful traits, including electromagnetic and thermal.

Like Mantel, the company looks to be targeting manufacturing tools, including injection molding.

“Fortify has been focused on proving the viability of our product and market opportunity over the past 18+ months, and exceeded our goals set at the beginning of 2020,” CEO Josh Martin said in a release. “This next round will expand our go-to-market footprint in key verticals such as injection mold tooling while enabling us to capture market share in end-use electronic devices.”

Recent months have also found the company enlisting other 3D printing vets. Paul Dresens (ex Desktop Metal) signed on as VP of Engineering, while former GrabCad (a Stratasys acquisition) market exec Rob Stevens has signed on as an advisor.