& meet dozens of singles today!

User blogs

Amazon’s Prime Wardrobe has been a key way for the e-commerce giant to expand its reach selling clothing and other apparel: giving shoppers an easy way to try on several items, return what they don’t want, and pay for what they keep has helped it cross the virtual chasm by bringing the online experience a little closer to what it’s like to shop for fashion in physical stores. Now, a startup that’s built “Prime Wardrobe as a service” to help smaller competitors offer its shoppers the same experience is announcing some funding to expand its business.

TryNow — which provides technology to online retailers that use Shopify Plus to let their customers receive and try out apparel, return what they don’t want and pay only for what they keep — has raised $12 million, funding that it will be using to continue expanding its business.

The startup, based out of San Francisco, already works with around 50 up-and-coming online retailers doing between $10 million and $100 million in revenues, with Universal Standard, Roolee, Western Rise, and Solid & Striped among its customers. Founder and CEO Benjamin Davis said in an interview that it has seen business grow six-fold in the last year as more shopping has shifted online from brick-and-mortar due to the pandemic. TryNow claims that using its service can help brands grow average order value by 63%, conversion rates by 22% and return on ad spend by 76%.

Fashion has been a primary focus for “try before you buy” services online, but the the model is not limited to it.

“Apparel is a core category for us,” said Davis, but he also said he believes that the model can be applied to improve the unit economics of selling online to other categories, like cookware. “Prime Wardrobe has solidified the power of that model for fashion, but we believe it’s much larger. We think that any purchase that is discretionary should be tried before it is bought.”

The funding, a Series A, is coming from a very notable list of backers that speaks to the opportunity in this space. Investors in the round include Shine Capital, Craft Ventures, SciFi VC (the venture firm co-founded by Max Levchin, founder and CEO of buy-now-pay-later firm Affirm), Third Kind, and Plaid co-founders Zachary Perret and William Hockey.

As-a-service, at your service

TryNow sits as part of a bigger wave of commerce and finance services that have emerged over the years to provide technology to entrepreneurs where the commerce technology they are using is not the core of the business they are building.

The thinking goes: building payments or related features is complex and not something that a company not focused on payments would build itself (much like most businesses would not build their own accounting software, or the computers that they use). And as the biggest competitors — eg, Amazon — continue to grow and build their own technology in-house to keep their competitive edge, a demand for more tech-enabled tools only grows and becomes more sophisticated with the competitive threat. These in turn get delivered as a service, since smaller competitors will lack the funds and human capital to build these themselves.

Davis said that TryNow chose to work solely with Shopify (and specifically Shopify Plus, the version of the service with more features, designed for retailers with more than $1 million in revenues) and its platform for letting retailers build and operate e-commerce storefronts, because of how it has become such an integral player in that ecosystem.

He said that there has been demand from retailers using other platforms such as Big Commerce and Adobe’s Magento — as well as the platforms themselves. And it will look to expand to these over time, but for now, “we think Shopify is the most powerful, and growing the fastest, with the biggest opportunity at checkout,” said Davis. “It’s a multibillion opportunity.”

TryNow has whittled down its core functionality in the e-commerce space to a very specific role.

It doesn’t handle checkout — that’s Shopify; nor transactions — that’s payment companies, or indeed by-now-pay-later companies (like TryNow, another kind of tech helping people defray the payment part of procurement); nor returns — it integrates with Happy Returns, Loop Returns and Returnly; nor email-based communications and marketing with customers — that’s Klaviyo.

What TryNow provides are analytics to manage the risk around any deal, and technology to integrate and manage the payments and returns experience, so that procuring doesn’t trigger a payment, returning triggers a payment for what is kept, and I suppose not returning triggers a different kind of payment (plus flagging the customer for future try-now-pay-later attempts).

Within the wider space of e-commerce, apparel has had a particularly tricky ride among those trying to bring the experience into the online world.

It’s no surprise when you think about it: shopping for apparel is an inherently physical activity, involving trying things on, browsing around big stores with wide selections, and only paying for what you actually take away with you.

That has given rise to a lot of different startups, leaning on new innovations in computer vision and other areas of artificial intelligence, better cameras on phones, new manufacturing techniques and more to try to sew up the gap between what you do online and how you would shop in the brick-and-mortar world.

(And these startups are seeing their own opportunities and demand in the market: just last week, Snap Inc acquired Fit Analytics, one of the tech companies building better tools to improve how online shoppers can estimate what size they might need to buy of an item: the social media company’s interest is to use the technology to expand how it works with its advertisers and to build out a bigger shopping experience on Snapchat and beyond.)

Before try-now-pay-later, the basic idea of selling fashion online has been to assume it’s okay to skip all the physical aspects of buying apparel before paying.

“Give me a credit card, and I’ll charge you for what you are getting, and if you don’t like it, you can get a refund? We would never operate a brick-and-mortar store that way, charging people before going into fitting rooms,” said Davis. “It’s unnatural and restricts growth.” And high-ticket items can be even harder to sell in that environment, he added.

While companies like Le Tote, Stitch Fix, and Wantable have built out fashion businesses on the premise of try first, and then pay only for what you keep, there are fewer companies out there that have distilled this idea into a standalone, B2B service. (And indeed, the try-before-you-buy service can be a tricky one to manage as a viable business, with Le Tote, now in Chapter 11, and now-defund Lumoid pointing to some of the challenges.)

“Ben and the TryNow team are taking what they’ve learned from Affirm and Stitch Fix and launching the ultimate checkout option: try now, buy later. This translates into more order volume and more profit. We all want to try before we buy: it’s only a matter of time before TryNow’s checkout solution becomes the standard,” said Brian Murray, managing director at Craft Ventures, in a statement.

Still, there are others that compete more directly. BlackCart out of Canada, which raised funding earlier this year, also provides try-now-pay-later as a service for apparel and other goods, and it integrates with other storefront platforms beyond Shopify. (It seems to take a different approach to offsetting the risk for retailers, essentially making up-front payments for goods itself and then reconciling directly with the retails around returns.) And it seems like a no brainer that Amazon might try to offer Wardrobe as a service to more retailers, as it does with so many of its other features.

Along with the funding, TryNow is also announcing a couple of new executive appointments that speak to where it sees itself competing and sitting longer term. Jessica Baier, formerly of Stitch Fix, is now VP of growth strategy; and Jonathan Kayne, a former head of product partnerships for Affirm, is now TryNow’s VP of platform.

The investors in this round are a pretty interesting set of backers that also point to possible directions for the company.

Shine is a relatively new firm co-founded by Mo Koyfman and Josh Mohrer to focus on early stage investments, with Koyfman previously backing a lot of interesting e-commerce companies at Spark; Craft is another early stage firm co-founded by David Sacks and Bill Lee; SciFi VC is Max and Nellie Levchin’s venture fund (and Max has a long and impressive track record in e-commerce, most recently as the founder and CEO of another startup in the flexible payment space, buy-now-pay-later business Affirm).

Third Kind, meanwhile, has been a prolific backer of e-commerce tech as part of its bigger investment thesis. And while Plaid’s founders are investing here as financial backers, it’s notable that they are both providing financial features as a service to third party businesses: diversification for Plaid might one day come in the form of providing tools for specific verticals, which would likely take them into the realm of more flexible payment and procurement options.

“At Shine, we are attracted to businesses with simple yet powerful insights that can ultimately lead to massively scalable new platforms,” said Koyfman in a statement. “TryNow’s understanding that a lack of tactility restricts e-commerce growth has opened the opportunity to create and scale the Try Now Buy Later category. It is rare to find such a strong team attacking such a simple but big idea. We are delighted to partner with Benjamin and the entire TryNow team as they scale their elegant platform and help e-commerce brands close the conversion gap with brick and mortar retail.”

One clear sign of a maturing platform is when the company exposes the services it uses for its own tools to other developers. Zoom has been doing that for some time introducing Zoom Apps last year and the Marketplace to distribute and sell these apps. Today, the company introduced a new SDK (software development kit) to help developers embed Zoom video services inside another application.

“Our Video SDK enables developers to leverage Zoom’s industry-leading HD video, audio, and interactive features to build video-based applications and desktop experiences with native user interfaces,” Zoom’s Natalie Mullin wrote in a blog post announcing the new SDK.

If you want to include video in your app, you could try and code it yourself, or you could simply take advantage of Zoom’s expertise in this area and use the SDK to add video to the application and save a lot of time and effort.

The company envisions applications developers embedding video in social, gaming or retail applications where including video could enhance the user experience. For example, a shop owner could show different outfits to an online shopper in a live video feed, and discuss their tastes in real time.

Zoom CTO Brendan Ittelson said the SDK is actually part of a broader set of services designed to help developers take advantage of all the developer tooling that the company has been developing in recent years. As part of that push, the company is also announcing a central developer portal.

“We want to be able to have a single point where developers can go to to learn about all of the tools and resources that are available for them in the Zoom platform for their work in development, so we’re launching developer.zoom.us as that central hub for all developer resources,” Ittelson told me.

In addition, the company said that it wanted to give developers more data about how people are using the Zoom features in their applications, so they will be providing a new analytics dashboard with usage statistics.

“We are adding additional tools and actually providing developers with analytic dashboards. So folks that have developed apps for the Zoom ecosystem are able to see information about the usage of those apps across the platform,” Ittelson said.

He believes these tools combined with the new video SDK and existing set of tools will provide developers with a variety of options for building Zoom functionality into their applications, or embedding their application into Zoom as they see fit.

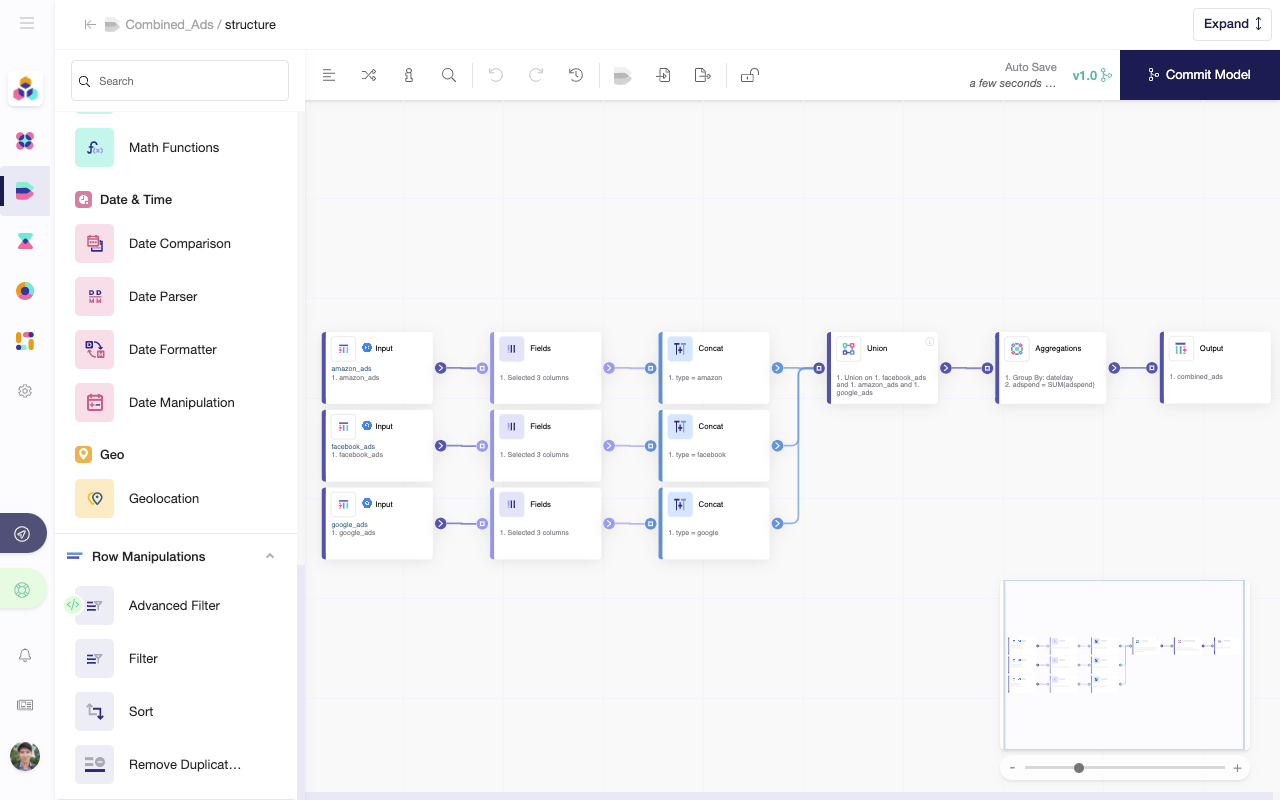

Berlin-based y42 (formerly known as Datos Intelligence), a data warehouse-centric business intelligence service that promises to give businesses access to an enterprise-level data stack that’s as simple to use as a spreadsheet, today announced that it has raised a $2.9 million seed funding round led by La Famiglia VC. Additional investors include the co-founders of Foodspring, Personio and Petlab.

The service, which was founded in 2020, integrates with over 100 data sources, covering all the standard B2B SaaS tools from Airtable to Shopify and Zendesk, as well as database services like Google’s BigQuery. Users can then transform and visualize this data, orchestrate their data pipelines and trigger automated workflows based on this data (think sending Slack notifications when revenue drops or emailing customers based on your own custom criteria).

Like similar startups, y42 extends the idea data warehouse, which was traditionally used for analytics, and helps businesses operationalize this data. At the core of the service is a lot of open source and the company, for example, contributes to GitLabs’ Meltano platform for building data pipelines.

“We’re taking the best of breed open-source software. What we really want to accomplish is to create a tool that is so easy to understand and that enables everyone to work with their data effectively,” Y42 founder and CEO Hung Dang told me. “We’re extremely UX obsessed and I would describe us as no-code/low-code BI tool — but with the power of an enterprise-level data stack and the simplicity of Google Sheets.”

Before y42, Vietnam-born Dang co-founded a major events company that operated in over 10 countries and made millions in revenue (but with very thin margins), all while finishing up his studies with a focus on business analytics. And that in turn led him to also found a second company that focused on B2B data analytics.

Even while building his events company, he noted, he was always very product- and data-driven. “I was implementing data pipelines to collect customer feedback and merge it with operational data — and it was really a big pain at that time,” he said. “I was using tools like Tableau and Alteryx, and it was really hard to glue them together — and they were quite expensive. So out of that frustration, I decided to develop an internal tool that was actually quite usable and in 2016, I decided to turn it into an actual company. ”

He then sold this company to a major publicly listed German company. An NDA prevents him from talking about the details of this transaction, but maybe you can draw some conclusions from the fact that he spent time at Eventim before founding y42.

Given his background, it’s maybe no surprise that y42’s focus is on making life easier for data engineers and, at the same time, putting the power of these platforms in the hands of business analysts. Dang noted that y42 typically provides some consulting work when it onboards new clients, but that’s mostly to give them a head start. Given the no-code/low-code nature of the product, most analysts are able to get started pretty quickly — and for more complex queries, customers can opt to drop down from the graphical interface to y42’s low-code level and write queries in the service’s SQL dialect.

The service itself runs on Google Cloud and the 25-people team manages about 50,000 jobs per day for its clients. the company’s customers include the likes of LifeMD, Petlab and Everdrop.

Until raising this round, Dang self-funded the company and had also raised some money from angel investors. But La Famiglia felt like the right fit for y42, especially due to its focus on connecting startups with more traditional enterprise companies.

“When we first saw the product demo, it struck us how on top of analytical excellence, a lot of product development has gone into the y42 platform,” said Judith Dada, General Partner at LaFamiglia VC. “More and more work with data today means that data silos within organizations multiply, resulting in chaos or incorrect data. y42 is a powerful single source of truth for data experts and non-data experts alike. As former data scientists and analysts, we wish that we had y42 capabilities back then.”

Dang tells me he could have raised more but decided that he didn’t want to dilute the team’s stake too much at this point. “It’s a small round, but this round forces us to set up the right structure. For the series, A, which we plan to be towards the end of this year, we’re talking about a dimension which is 10x,” he told me.

Waterfund, an investment and trading firm that specializes in acquiring and managing water-related infrastructure assets, today announced a deal with Israel-based crowdfunding platform OurCrowd that will see the Waterfund team commit $50 million to build a water- and agtech-focused portfolio of 15 companies. The first of these investments is in Plenty, a well-funded vertical farming startup.

In addition to these direct investments, the two companies are also working together on a new water-focused platform called Aquantos, which aims to issue so-called Blue Bonds and other financial products related to the water industry. Comparable to Green Bonds that focus on projects with environmental benefits — and which have been around for more than a decade now — Blue Bonds are still a new idea and focus on projects that could benefit the oceans.

“We are working to issue Blue Bonds that can be both climate bonds-certified and backed by sovereign or sub-sovereign borrowers,” said Waterfund CEO Scott Rickards. “This new financial tool and others are being designed to enable water projects in the Middle East to acquire leading technologies to address water scarcity in a fundamentally new way.”

Rickards argues that a lack of private capital has held back innovation in the water sector and that this new partnership — and the equity and debt financing opportunities it brings with it — will help change this.

OurCrowd, meanwhile, currently has about $1.5 billion in committed funding and has made investments in about 250 companies across its 25 funds. Among the companies the platform has invested in are the likes of Lemonade, Jump Bikes and Beyond Meat. Its portfolio also includes a number of existing agtech startups and last November, OurCrowd partnered with Sprout Agritech (a company in its portfolio) to run a new agtech accelerator in New Zealand.

“The Abraham Accords present a huge opportunity to bring new water and agricultural technology to the water scarcity challenges of the entire Middle East,” said OurCrowd founder and CEO Jon Medved. “Alongside Waterfund, it is our mission to invest in and help build game-changing technology companies. We are excited to be working together with Waterfund to drive more private capital to address the critical challenges of water.”

The COVID-19 pandemic has led to people everywhere shopping more online and Latin America is no exception.

São Paulo-based Nuvemshop has developed an e-commerce platform that aims to allow SMBs and merchants to connect more directly with their consumers. With more people in Latin America getting used to making purchases digitally, the company has experienced a major surge in business over the past year.

Demand for Nuvemshop’s offering was already heating up prior to the pandemic. But over the past 12 months, that demand has skyrocketed as more merchants have been seeking greater control over their brands.

Rather than selling their goods on existing marketplaces (such as Mercado Libre, the Brazilian equivalent of Amazon), many merchants and entrepreneurs are opting to start and grow their own online businesses, according to Nuvemshop co-founder and CEO Santiago Sosa.

“Most merchants have entered the internet by selling on marketplaces but we are hearing from newer generations of merchants and SMBs that they don’t want to be intermediated anymore,” he said. “They want to connect more directly with consumers and convey their own brand, image and voice.”

The proof is in the numbers.

Nuvemshop has seen the number of merchants on its platform surge to nearly 80,000 across Brazil, Argentina and Mexico compared to 20,000 at the start of 2020. These businesses range from direct-to-consumer (DTC) upstarts to larger brands such as PlayMobil, Billabong and Luigi Bosca. Virtually every KPI tripled in the company in 2020 as the world saw a massive transition to online, and Nuvemshop’s platform was home to 14 million transactions last year, according to Sosa.

“With us, businesses can find a more comprehensive ecosystem around payments, logistics, shipping and catalogue/inventory management,” he said.

Nuvemshop’s rapid growth caught the attention of Silicon Valley-based Accel. Having just raised $30 million in a Series C round in October and achieving profitability in 2020, the Nuvemshop team was not looking for more capital.

But Ethan Choi, a partner at Accel, said his firm saw in Nuvemshop the potential to be the market leader, or the “de facto” e-commerce platform, in Latin America.

“Accel has been investing in e-commerce for a very long time. It’s a very important area for us,” Choi said. “We saw what they were building and all their potential. So we pre-emptively asked them to let us invest.”

Today, Nuvemshop is announcing that it has closed on a $90 million Series D funding led by Accel. ThornTree Capital and returning backers Kaszek, Qualcomm Ventures and others also put money in the round, which brings Nuvemshop’s total funding raised since its 2011 inception to nearly $130 million. The company declined to reveal at what valuation this latest round was raised but it is notable that its Series D is triple the size of its Series C, raised just over six months prior. Sosa said only that there was a “substantial increase” in valuation since its Series C.

Nuvemshop is banking on the fact that the density of SMBs in Latin America is higher in most Latin American countries compared to the U.S. On top of that, the $85 billion e-commerce market in Latin America is growing rapidly with projections of it reaching $116.2 billion in 2023.

“In Brazil, it grew 40% last year but is still underpenetrated, representing less than 10% of retail sales. In Latin America as a whole, penetration is somewhere between 5 and 10%,” Sosa said.

Nuvemshop co-founder and CEO Santiago Sosa;

Image courtesy of Nuvemshop

Last year, the company transitioned from a closed product to a platform that is open to everyone from third parties, developers, agencies and other SaaS vendors. Through Nuvemshop’s APIs, all those third parties can connect their apps into Nuvemshop’s platform.

“Our platform becomes much more powerful, vendors are generating more revenue and merchants have more options,” Sosa told TechCrunch. “So everyone wins.” Currently, Nuvemshop has about 150 applications publishing on its ecosystem, which he projects will more than triple over the next 12 to 18 months.

As for comparisons to Shopify, Sosa said the company doesn’t necessarily make them but believes they are “fair.”

To Choi, there are many similarities.

“We saw Amazon get to really big scale in the U.S.. Merchants also found tools to build their own presence. This birthed Shopify, which today is worth $160 billion. Both companies saw their market caps quadruple during the pandemic,” he said. “Now we’re seeing the same dynamics in LatAm…Our bet here is that this company and business has all the same dynamics and the same really powerful tailwinds.”

For Accel partner Andrew Braccia, Nuvemshop has a clear first mover advantage.

“Over the past decade, direct-to-consumer has become one of the most important drivers of entrepreneurship globally,” he said. “Latin America is no exception to this trend, and we believe that Nuvemshop has the level of sophistication and ability to understand all that change and fuel the continued transformation of commerce from offline to online.”

Looking ahead, Sosa expects Nuvemshop will use its new capital to significantly invest in: continuing to open its APIs; payments processing and financial services; “everything related to logistics and logistics management” and attracting smaller merchants. It also plans to expand into other markets such as Colombia, Chile and Peru over the next 18-24 months. Nuvemshop currently operates in Mexico, Brazil and Argentina.

“While the countries share the same secular trends and product experience, they have very different market dynamics,” Sosa said. “This requires an on the ground local knowledge to make it all work. Separate markets require distinct knowledge. That makes this a more complicated opportunity, but one that enables a long-term competitive advantage.”