& meet dozens of singles today!

User blogs

Medical and biotech had a strong showing at Y Combinator’s latest demo day, with nearly a dozen companies in the space catching my eye. The things a startup can accomplish in this space are astonishing these days, so don’t be surprised if a few of these companies are headline news in the next year.

Startups take on big pharma

Atom Bioworks has one of the shortest timelines and highest potential impacts; as I wrote in our second set of favorites from demo day, the company seems to be fairly close to one of the holy grails of biochemistry, a programmable DNA machine. These tools can essentially “code” a molecule so that it reliably sticks to a specific substance or cell type, which allows a variety of follow-up actions to be taken.

For instance, a DNA machine could lock onto COVID-19 viruses and then release a chemical signal indicating infection before killing the virus. The same principle applies to a cancer cell. Or a bacterium. You get the picture.

Atom’s founders have published the details of their techniques in Nature Chemistry, and says it’s working on a COVID-19 test as well as therapies for the virus and other conditions. It expects sales in the 9-figure range.

Another company along these lines is LiliumX. This company is going after “biospecific antibodies,” which are kind of like prefab DNA machines. Our own antibodies learn to target various pathogens, waste, and other items the body doesn’t want, and customized, injected antibodies can do the same for cancer cells.

LiliumX is taking the algorithmic approach to generating potential antibody stuctures that could be effective, as many AI-informed biotech companies have before it. But the company is also using a robotic testing setup to thin the herd and get in vitro results for its more promising candidates. Going beyond lead generation is a difficult step but one that makes the company that much more valuable.

Entelexo is one step further down the line, having committed to developing a promising class of therapeutics called exosomes that could help treat autoimmune diseases. These tiny vesicles (think packages for inter-cell commerce) can carry all kinds of materials, including customized mRNA that can modify another cell’s behavior.

Modifying cell behavior systematically could help mitigate conditions like multiple sclerosis, though the company did not elaborate on the exact mechanism — probably not something that can be explained in under a minute. They’re already into animal testing, which is surprising for a startup.

One step further, at least mechanically, is Nuntius Therapeutics, which is working on ways to deliver cell-specific (i.e. to skeletal muscle, kidney cells, etc) DNA, RNA, and CRISPR-based therapies. This is an issue for cutting-edge treatments: while they can be sure of taking the correct action once in contact with the target cell type, they can’t be sure that the therapeutic agent will ever reach those cells. Like ambulance drivers without an address, they can’t do their jobs if they can’t get there.

Nuntius claims to have created a reliable way to deliver genetic therapy payloads to a variety of target cells, beyond what major pharma companies like Moderna have accomplished. The company also develops and licenses its own drugs, so it’s practically a one-stop shop for genetic therapies if its techniques pan out for human use.

Beyond providing therapeutics, there is the evolving field of artificial organs. These are still highly experimental, partly due to the risk of rejection even when using biocompatible materials. Trestle Biotherapeutics is taking on a specific problem — kidney failure — with implantable lab-grown kidney tissue that can help get these patients off dialysis.

While the plan is to eventually create full kidney replacements, the truth is that for people with this condition, every week and month counts. Not only does it improve their chances of finding a donor or moving up the list, but regular dialysis is a horrible process by all accounts. Anything that reduces the need to rely on it would be welcomed by millions.

This Yale-Harvard tie-up comes from a team with quite a bit of experience in stem cell science and tissue engineering, including 3D printing human tissues — which no doubt is part of the approach.

Beyond therapy

Moving beyond actual techniques for fighting various conditions, the YC batch had quite a few dedicated to improving the process of researching and understanding those conditions and techniques.

Many industries rely on cloud-based document platforms like Google Docs for sharing and collaboration, but while copywriters and sales folks probably find the standard office suite sufficient, that’s not necessarily the case for scientists whose disciplines demand special documentation and formatting.

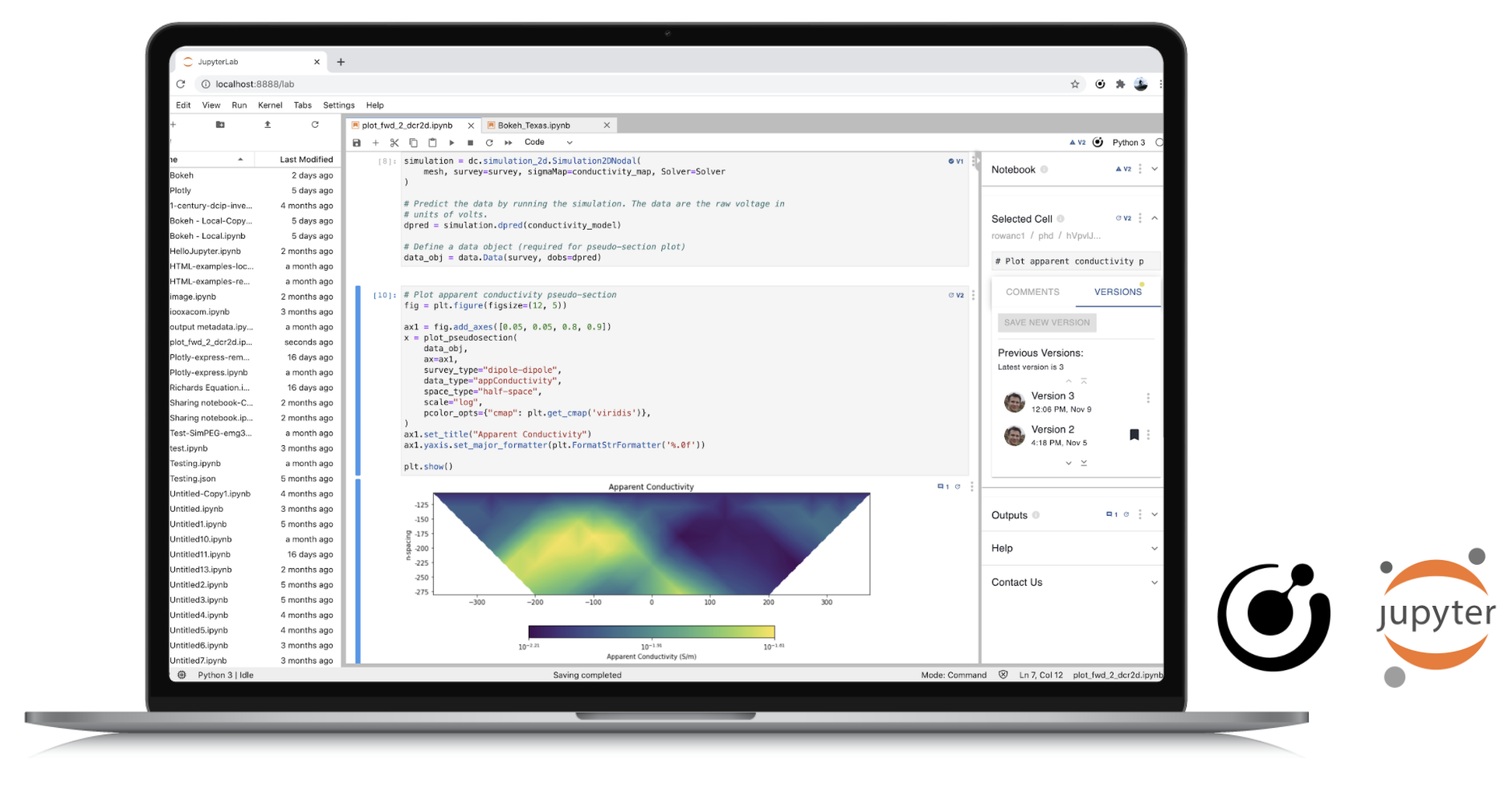

Curvenote is a shared document platform built with these folks in mind; it integrates with Jupyter, SaturnCloud, and Sagemaker, supports lots of import and export options, integrates visualization plug-ins like Plotly, and versions through Git. Now you just have to convince the head of your department it’s worth paying for.

A more specialized cloud tool can be found in Pipe|bio, which does hosted bioinformatics for developing antibody drugs like LiliumX. It’s hard to get into details here beyond that the computational and database needs of companies in biotech can be very specific and not everyone has a bioinformatics specialist on staff.

Having a tool you can just pay for instead getting a data science grad student to moonlight for your lab is almost always preferable. (Also preferable is not using special characters in your company name — just saying, it’s going to come up.)

Special tools can be found on the benchtop as well as the laptop, though, and the remaining companies are firmly in meatspace.

Forcyte is another company I highlighted in our favorite demo day companies roundups: It’s less about chemistry and molecular biology than the actual physical phenomena experienced by cells. This is a difficult thing to observe systematically, but important for many reasons.

Forcyte is another company I highlighted in our favorite demo day companies roundups: It’s less about chemistry and molecular biology than the actual physical phenomena experienced by cells. This is a difficult thing to observe systematically, but important for many reasons.

The company uses a micropatterned surface to observe individual cells and watch specifically for contraction and other shape changes. Physical constriction or relaxation of cells is at the heart of several major diseases and their treatments, so being able to see and track it will be extremely helpful for researchers.

The company has positioned itself as a way to test drugs at scale that affect these properties and claims to have already found promising compounds for lung fibrosis. Forcyte’s team is published in Nature, and received a $2.5 million SBIR award from the NIH, a pretty rare endorsement.

Kilobaser is taking aim at the growing DNA synthesizing space; companies often contract with dedicated synthesizing labs to create batches of custom DNA molecules, but at a small scale this might be better done in-house.

Kilobaser’s benchtop machine makes the process as simple as using a copier, letting people with no technical know-how. As long as it has some argon, a reagent supply and microfluidic chip (sold by the company, naturally), it can replicate DNA you submit digitally in under two hours. This could accelerate testing in many a small lab that’s held back by its reliance on a separate facility. The company has already sold 15 machines at €15,000 each — but like razor blades, the real money is in the refills.

Reshape Biotech is perhaps the most straightforward of the bunch. Its approach to automating common lab tasks is to create custom robots for each one. That’s it! Of course, that’s easier said than done, but given the similarity of many lab layouts and equipment, a custom robotic sampler or autoclave could be adopted by thousands as (again) an alternative to hiring another part time grad student.

There were several other companies in the biotech and medical space worth looking at in the batch, but not enough space here to highlight them individually. Suffice it to say that the space is increasingly welcoming to startups as advances in tech and software are brought to bear where insuperable barriers to entry once left such possibilities remote.

Polycystic ovary syndrome, or PCOS, is a common disorder that can cause irregular periods, infertility or gestational diabetes in women. And the condition is far from rare: PCOS impacts one in 10 women, meaning there’s a big market of people out there that want better support and risk-screening to navigate the symptoms.

That’s where Veera Health comes in. The startup is an online clinic aimed at helping women in India navigate PCOS through risk-screening, mental health support and answers about effects such as acne and weight gain. If the startup does its job right, it can help bring earlier diagnosis to women around the world.

“The big issue around polycystic ovary syndrome is that there [are] a lot of different symptoms, and very often women take a long time to actually get diagnosed in the right manner,” CEO and co-founder Shashwata Narain said. “We want to provide a higher level and quality of guidance so she can have open eyes experience as she goes through her treatment process.”

Veera Health’s subscription-based program takes the medical history of a patient to better understand symptoms and any existing reports. About 60% to 70% of the patients that Veera Health has worked with so far are pre-diagnosed and are looking for a solution, so the startup then starts to pick apart potential risk factors and suggests a holistic treatment plan. The startup has a team of specialists, from clinical nutritionists to dermatologists and gynecologists, that it works with on a contractual basis to approve any plan given to a patient. The startup has employed a number of care managers, which is basically an employee in charge of handling weekly and daily communication with the patient about these plans.

The company uses published research on assessment and management of PCOS as a framework for its suggestions.

Veera Health officially launched three months ago and already has made $10,000 in revenue, growing at 300% month over month in paid customers.

Veera Health isn’t covered by insurance, so patients pay out of pocket for the services. In India, Narain says, outpatient care is “almost entirely an out-of-pocket market” and insurance is largely focused on hospitalization expenses. By using Veera Health, the co-founder estimates that by aggregating all these services into one spot, Veera Health can stop customers from spending “thousands and thousands of rupees” and playing specialist hopscotch.

In fact, one study shows that PCOS clinics have had a high retention in patients compared to other single-care providers.

The co-founder says the biggest challenge for Veera Health is educating women about how to prioritize their own health and get past the stigma of PCOS.

“It’s a challenge because you want to get as much information out there and make sure women are paying attention to their health, yet at the same time there’s a lot of stigma on [PCOS] and around women’s health to begin with.”

We know of at least one investor that thinks the conversation is ready to be had, anyway. Veera Health recently graduated from Y Combinator’s Winter 2021 cohort as one of the 39 companies based in India, the highest concentration from the accelerator yet.

Narain says that Veera Health is uniquely positioned to help women during the pandemic. Her sister and co-founder, Shobhita, was diagnosed with PCOS so experienced firsthand the confusing path to diagnosis.

“Because of the pandemic, there’s a lot more openness to online solutions,” she said. “People are at home, not able to exercise and are much more stressed out. This had a ramp up in the level of awareness on [PCOS] and the search for solutions.”

Here’s another edition of “Dear Sophie,” the advice column that answers immigration-related questions about working at technology companies.

“Your questions are vital to the spread of knowledge that allows people all over the world to rise above borders and pursue their dreams,” says Sophie Alcorn, a Silicon Valley immigration attorney. “Whether you’re in people ops, a founder or seeking a job in Silicon Valley, I would love to answer your questions in my next column.”

Extra Crunch members receive access to weekly “Dear Sophie” columns; use promo code ALCORN to purchase a one- or two-year subscription for 50% off.

Dear Sophie:

I’m a startup founder looking to expand in the U.S. I was originally looking at opening an office in Silicon Valley to be close to software engineers and investors, but then… COVID-19 :)

A lot has changed over the last year – can I still come?

— Hopeful in Hungary

Dear Hopeful:

How and where work is getting done in Silicon Valley (as well as in much of the world) shifted during the COVID-19 pandemic. That said, yes, it can still make business sense for many to join the Silicon Valley ecosystem.

According to a recent report from PitchBook, Silicon Valley will continue to be the center for VC investment and high-tech talent, even though several large tech companies relocated out of Silicon Valley and implemented full-time work-from-home policies — and many predicted that “the Bay Area tech scene as we know it would be lost, and VC would find a new home.”

Clearly, while the pandemic’s impact on the venture industry will be felt in years to come, VC will continue to be centered in Silicon Valley. In a recent episode of my podcast, I discussed work trends and how to use immigration to support company priorities as well as attract and retain talent in the United States.

The PitchBook report points out that Silicon Valley “has kept a tight hold on fundraising in the U.S., closing on commitments exceeding $151 billion over the past five years, more than the rest of the U.S. ecosystems combined. LPs have continued to funnel capital to area VCs because of the region’s track record of success, which includes 17 of the 22 U.S. companies to ever receive a private valuation of $10 billion or more.”

Image Credits: Joanna Buniak / Sophie Alcorn (opens in a new window)

So while VCs will likely return to the old ways of networking and funding post-pandemic, we’ll see a hybrid of online and in-person meetings because there are so many benefits to in-person networking and exchanging ideas.

The pandemic has clearly had an impact on the way we work, and this is especially true for salespeople. Salesforce introduced a number updates to Sales Cloud this morning including Salesforce Meetings, a smart overlay for Zoom meetings that gives information and advice to the sales team as they interact with potential customers in online meetings.

Bill Patterson, EVP and General Manager of CRM applications at Salesforce says that the company wanted to help sales teams manage these types of interactions better and take advantage of the fact they are digital.

“There’s a broad recognition, not just from Salesforce, but really from every sales organization that selling is forever changed, and I think that there’s been a broad understanding, and maybe a surprise in learning how effective we can be in the from anywhere kind of times, whether that’s in office or not in office or whatever,” Patterson explained.

Salesforce Meetings gives that overlay of information, whether it’s advice to slow down the pace of your speech or information about the person speaking. It can also compile action items and present a To Do list to participants at the end of each meeting to make sure that tasks don’t fall through the cracks.

This is made possible in part through the Einstein intelligence layer that is built across the entire Salesforce platform. In this case, it takes advantage of a new tool called Einstein Intelligent Insights, which the company is also exposing as a feature for developers to build their own solutions using this tool.

For sales people who might find the tool a bit too invasive, you can dial the confidence level of the information up or down on an individual basis, so that you can get a lot of information or a little depending on your needs.

For now, it works with Zoom and the company has been working closely with the Zoom development team to provide the API and SDK tooling it needs to pull something like this off, according to Patterson. He notes that plans are in the works to make it compatible with WebEx and Microsoft Teams in the future.

While the idea was in the works prior to the pandemic, COVID created a sense of urgency for this kind of feature, as well as other features announced today like Pipeline Inspection, which uses AI to analyze the sales pipeline. It searches for changes to deals over time with the goal of finding the ones that could benefit most from coaching or managerial support to get them over the finish line.

Brent Leary, founder and principal analyst at CRM Essentials says that this ability to capture information in online meetings is changing the way we think about CRM.

“The thing the caught my attention is how tightly integrated video meetings/collaboration is now into sales process. This is really compelling because meeting interactions that may not find their way into the CRM system are now automatically captured,” Leary told me.

Salesforce Meetings is available today, while Pipeline Inspection is expected to be available this summer.

Plaid, the fintech giant, has announced the inaugural cohort of startups in its new accelerator program, FinRise.

The equity-free and capital-free program has chosen five early-stage fintech startups out of 100 applications to join its cohort, working on issues central to the financial services industry such as simplifying payments and access to credit. The accelerator, announced two months ago, is explicitly focused on backing underrepresented founders in tech.

Last week, The Information reported that Plaid is nearing a new financing deal that would value the company at between $10 billion to $15 billion. Beyond a high valuation, Plaid sports a key characteristic that positions it well to help early-stage startups: it has gone through regulatory hurdles. Months ago, Plaid announced it would not merge with Visa in what would have been a $5.3 billion dollar acquisition. This event, as well as advice on how privat fintech startups can deal with policy issues, will be part of FinRise programming.

While participants don’t get funding, FinRise has collated a number of “capital access partners” which basically means investors who are committed to meeting with these companies and potentially writing a check. This network includes Accion, Acrew, Amex Ventures, Flourish, Harlem Capital, Kapor, Matrix, Village Capital, Visible Hands, and First Round.

Here’s a look at the five startups:

- Global Data Consortium is building a process for global digital identity verification for businesses. Co-founded by Bill Spruill and Charles Gaddy, the startup is building a data supplier network of more than 200 sources to help build a standard of processes around digital identity verification. “As we continue to scale our platform it’s important to make sure our technical infrastructure continues to be enterprise-ready. Plaid’s engineering expertise and knowledge will prove useful to our team to help us plan and execute around our next level of service support architecture,” Spruill told TechCrunch.

- Guidefi is a marketplace focused on connecting communities of color to culturally-savvy financial advisors. Led by Charlene Fadirepo, the financial wellness startup doesn’t charge for matches to advisors, but only begins pricing once services begini.

- OfColor wants to be the go-to enterprise wellness platform for employees of color. Founder Yemi Rose tells TechCrunch that “a lot of companies we encounter generally pride themselves on being colorblind in their HR benefit practices, in spite of outcomes that show a different approach is needed…our biggest hurdle is education.” The startup focuses on features like a personalized financial manager as well as loans that allow employees to maximize their 401(k) contribution.

- Walnut is a point-of-sale lending platform that wants to make healthcare more affordable for patients. Roshan Patel, founder and CEO of the startup, says that its biggest competitor is PrimaHealth Credit, which focuses on elective care. “Walnut is care-agnostic: no matter where you are in the healthcare system, you can use Walnut to break up your bill into an installment plan that works for you. That can be at the dentist or cosmetic surgery practice, but it can also be in the emergency room or at your primary care physician,” he said.

- Zeta wants to build a better joint-bank experience for the modern couple. First covered by TechCrunch in February, Zeta has already raised $1.5 million in venture funding to create a platform that makes it easier to join accounts and split purchases. “In some ways, we see ourselves as part of a replacement for Venmo,” CEO and co-founder Aditi Shekar said. “We saw couples Venmoing back and forth to each other sometimes six times a day…we want to take over your money chores.” While Zeta is entering the market as a tool for couples, Shekar sees the startup’s moonshot as being the go-to operational account for any modern household.