& meet dozens of singles today!

User blogs

Meniga, the London fintech that provides digital banking technology to leading banks, has closed €10 million in additional funding.

The round is led by Velocity Capital and Frumtak Ventures. Also participating are Industrifonden, the U.K. Government’s Future Fund and existing customers UniCredit, Swedbank, Groupe BPCE and Íslandsbanki.

Meniga says the funding will be used for continued investment in R&D, and in particular further development of green banking products — building on its carbon spending insights product. In addition, the fintech will bolster its sales and service teams.

Headquartered in London but with additional offices in Reykjavik, Stockholm, Warsaw, Singapore and Barcelona, Meniga’s digital banking solutions help banks (and other fintechs) use personal finance data to innovate in their online and mobile offerings.

Its various products include a software layer that bridges the gap between a bank’s legacy tech infrastructure and a modern API, making it easier to build consumer-friendly digital banking experiences. The product suite spans data aggregation technologies, personal and business finance management solutions, cash-back rewards and transaction-based carbon insights.

Meniga tells TechCrunch it has experienced a significant increase in the demand for its digital banking products and services over the past year. This has seen the fintech launch a total of 18 digital banking solutions across 17 countries.

Image Credits: Meniga

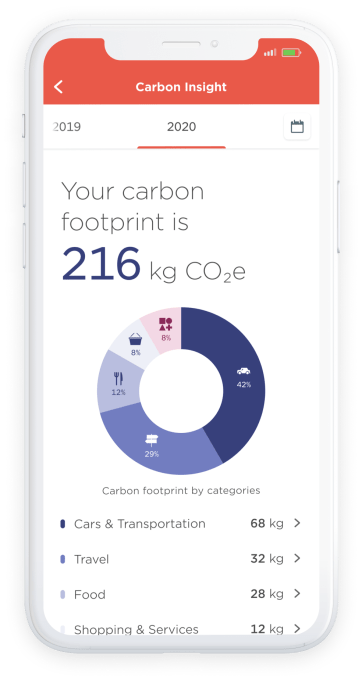

Helping fuel that demand is the need for banks to attract and retain a generation of customers that increasingly care about sustainability and the need to tackle climate change. Enter Meniga’s green banking solution: Dubbed “Carbon Insight,” it leverages personal finance data so that mobile banking customers can track and, in theory, reduce their carbon footprint.

Specifically, it lets users track their estimated carbon footprint for a given time period (which can be broken down into specific spending categories); track the estimated carbon footprint of individual transactions; and compare their overall carbon footprint and the carbon footprint of spending categories with that of other users.

Last month, Íslandsbanki became the first Nordic bank to implement Meniga’s Carbon Insight solution into its own digital banking offering.

Outlets that follow the crypto industry have been observing a trend, which is that according to Google search data, the rise in interest in non-fungible tokens, or NFTs, now almost matches the level of interest in 2017 in initial coin offerings, or ICOs.

Of course, ICOs largely disappeared from the scene after the SEC started poking around and determining, in some cases, that they were being used to launder money. Now experts in blockchain transactions see the potential for abuse again with NFTs, despite the traceable nature of the tokens — and perhaps even because of it.

As most readers may know at this point (because they’re increasingly hard to avoid), an NFT is a kind of digital collectible that can come in almost any form, a PDF, a tweet — even a digitized New York Times column.

Each of these items — and there can be many copies of the same item — is stamped with a long string of alphanumerics that makes it immutable. As early crypto investor David Pakman of Venrock explains it, that code is also recorded on the blockchain, so that there’s a permanent record of who own what. Someone else can screenshot that PDF or tweet or Times column, but they won’t be able to do anything with that screenshot, whereas the NFT owner can, theoretically at least, sell that collectible at some point to a higher bidder.

The biggest NFT sale to date, about 15 days ago, was the sale of digital artist Mike Winkelmann’s “Everydays: The First 5000 Days,” which sold for a stunning $69 million — the third-highest auction price achieved for a living artist, after Jeff Koons and David Hockney. Winkelmann, who uses the name Beeple, broke his own record with the sale, having sold another crypto art piece for $6.6 million in February. (Earlier this week, he sold yet another for $6 million.) There is such a frenzy that Beeple has told numerous outlets that he believes there’s a crypto art “bubble” and that many NFTs will “absolutely go to zero.”

There is so much money involved that experts believe that NFTs have become a rife opportunity for bad actors, even if action hasn’t been brought against one yet.

One of the most practical dangers centers on trade-based money laundering, or the process of disguising illegal proceeds by moving them through trade transactions in an effort to legitimize them. It’s already a huge issue in the art world, and NFTs are comparable to art, with even more erratic pricing right now.

Jesse Spiro, the chief of government affairs at the blockchain analysis firm Chainalysis explains it this way: “One of the ways to identify trade-based money laundering with [traditional] art is that [an appraiser] comes up with a fair market value for something, and you’re able to measure that fair market value against the pricing that’s involved [and flag] over invoicing or under invoicing, which is either selling that asset for less than it’s worth, or for more than it’s worth.”

The good news is that in some instances where hundreds or even thousands of NFTs are being sold, even at very different prices, as has been happening with NBA highlight clips, there’s an average value that can be measured, Spiro notes, and that makes unusual activity easier to spot.

In cases where it’s impossible to establish a sales history, however, its ultimate price “could be whatever the buyer is willing to pay for something, so you can’t really make that determination” that something nefarious is afoot. According to Spiro, “All that’s needed is two parties that are involved to effectively execute that [transaction] successfully.”

There are many other flavors of crime when it comes to digital assets and, potentially, with regard to NFTs. Asaf Meir, the cofounder and CEO of the crypto market surveillance company Solidus Labs, points as examples to wash trades, where an individual or outfit simultaneously sells and buys the same financial instruments; as well as cross trades, which involve a trade between two accounts within the same organization, all to create a false record around the price of an asset that doesn’t reflect the true market price.

Both are illegal under money laundering laws and also very hard to spot, especially for legacy systems. The “tricky thing about the crypto markets is they are retail-oriented first, so there could be multiple different accounts with multiple addresses doing multiple things in collusion — sometimes mixed or not mixed with institutional accounts for different beneficial owners,” says Meir, who met his cofounders at Goldman Sachs, where they worked on the electronic trading desk for equities and quickly observed that surveillance for digital assets was very much an unsolved issue.

It’s worth noting that not everyone thinks it likely that NFTs are being used to transfer money illegally. Says Pakman, an investor in the NFT marketplace Dapper Labs, “Crytpo purists are upset this happened, but national governments can go to marketplaces and exchanges and they can say, ‘In order for you to do business, you need to follow [know-your-customer] and [anti-money-laundering] laws that force [these entities] to get a verified identify of everyone of their customers. Then any suspicious transactions over a certain amount, they have to file paperwork.”

The two tools make it easier for authorities to subpoena the marketplaces and exchanges when a suspicious transaction is flagged and force the outfits to verify their user’s identity.

Still, one question is how effective such a process is if enough time elapses between the suspicious transaction and it being flagged. Pakman answers that “everything is retroactively researchable. If you get away with it today, there’s nothing to stop the FBI from tracking it a year later.”

Another question is why money launderers would bother with NFTs when there are easier ways to transfer large sums of money in the crypto world. Max Galka, cofounder and CEO of the blockchain analytics platform Elementus, says that “one piece that kind of makes me think NFTs might not be the best vehicle for money laundering is just that secondary markets are not as liquid,” meaning it isn’t so easy for bad actors to create distance between themselves and a transaction.

Galka also wonders whether a criminal wouldn’t instead simply go to a decentralized exchange and buy up liquid tokens that are truly fungible (meaning no unique information can be written into the token) so that the location of those funds is harder to trace than with a nonfungible token.

“I certainly see the potential for money laundering here, but given that there are lots of assets out there on the blockchain that people can use for that, [NFTs] may not be best-suited” compared with their other options, says Galka.

Theoretically, Spiro of Chainalysis agrees on all fronts, but he suggests that the minting and sale of NFTs have ballooned so fast that a lot of processes that should be in place are not.

“Most NFTs operate on the Ethereum blockchain, so it’s technically true that these are traceable,” he says. It’s also true that “the entities running these NFTs should have compliance and work with blockchain forensics and analytics to ensure that someone is able to follow the flow of funds.”

Indeed, he says, in an “ideal world, you’d be able to follow transactions, and then at the choke points where individuals were trying to convert whatever token they’re using into maybe fiat currency, they’d have to provide their [personal identifiable information]” and law enforcement or regulators could then see if the transaction was connected to illicit activity.

We’re not there yet, though, which means bad things could very definitely be happening.

“Right now,” says Spiro, “compliance in relation to these NFTs is a gray area.”

Hong Kong-based viAct helps construction sites perform around-the-clock monitoring with an AI-based cloud platform that combines computer vision, edge devices and a mobile app. The startup announced today it has raised a $2 million seed round, co-led by SOSV and Vectr Ventures. The funding included participation from Alibaba Hong Kong Entrepreneurs Fund, Artesian Ventures and ParticleX.

Founded in 2016, viAct currently serves more than 30 construction industry clients in Asia and Europe. Its new funding will be used on research and development, product development and expanding into Southeast Asian countries.

The platform uses computer vision to detect potential safety hazards, construction progress and the location of machinery and materials. Real-time alerts are sent to a mobile app with a simple interface, designed for engineers who are often “working in a noisy and dynamic environment that makes it hard to look at detailed dashboards,” co-founder and chief operating officer Hugo Cheuk told TechCrunch.

As companies signed up for viAct to monitor sites while complying with COVID-19 social distancing measures, the company provided training over Zoom to help teams onboard more quickly.

Cheuk said the company’s initial markets in Southeast Asia will include Indonesia and Vietnam because government planning for smart cities and new infrastructure means new construction projects there will increase over the next five to 10 years. It will also enter Singapore because developers are willing to adopt AI-based technology.

In a press statement, SOSV partner and Chinaccelerator managing director Oscar Ramos said, “COVID has accelerated digital transformation and traditional industries like construction are going through an even faster process of transformation that is critical for survival. The viAct team has not only created a product that drives value for the industry but has also been able to earn the trust of their customers and accelerate adoption.”

While the governments of the United States and China are pushing policies for technological decoupling, private tech firms continue to tap resources from both sides. In the field of autonomous vehicles, it’s common to see Chinese startups — or startups with a strong Chinese link — keep operations and seek investments in both countries.

But as these companies mature and expand globally, their ties to China also come under increasing scrutiny.

When TuSimple, a self-driving truck company headquartered in San Diego, filed for an initial public offering on Nasdaq this week, its prospectus flagged a regulatory risk due to its Chinese funding source.

On March 1, the Committee on Foreign Investment in the United States (CFIUS) requested a written notice from TuSimple regarding an investment by Sun Dream, an affiliate of Sina Corporation, which runs China’s biggest microblogging platform Sina Weibo. Sun Dream is TuSimple’s largest shareholder with 20% Class A shares. Charles Chao and Bonnie Yi Zhang, respectively the CEO and CFO of Weibo, are both members of TuSimple’s board.

If the U.S. government concludes that Sun Dream’s investment poses a threat to the national security of the country, the investor may be told to divest from TuSimple, the filing notes.

Several China-based autonomous driving upstarts, including WeRide.ai, Pony.ai and AutoX, keep research labs in California and have secured regulatory permits to test in the U.S., but most don’t seem to have apparent commercial plans in the country.

TuSimple, on the other hand, is focused on the U.S. for now, with 50 of its Level 4 semi-trucks hauling in the U.S. and 20 operating in China.

“Their strong Chinese background could hobble their U.S.-focused strategy,” an executive from a Chinese autonomous vehicle startup told TechCrunch, asking not to be named.

TuSimple cannot comment because it’s in the pre-IPO quiet period.

This kind of roadblock is hardly new to China-related tech firms coveting the U.S. market (or its allies). In a more famous instance, CFIUS opened a national security probe into ByteDance’s $1 billion acquisition of Musical.ly, which was folded into TikTok. As of last December, the agency was “engaging with ByteDance” to complete a divestment, Reuters reported.

While self-driving ventures can divest to shed their Chinese association, it may be more complicated to achieve short-term supply chain independence in an industry with tight global ties, as an executive from Momenta pointed out.

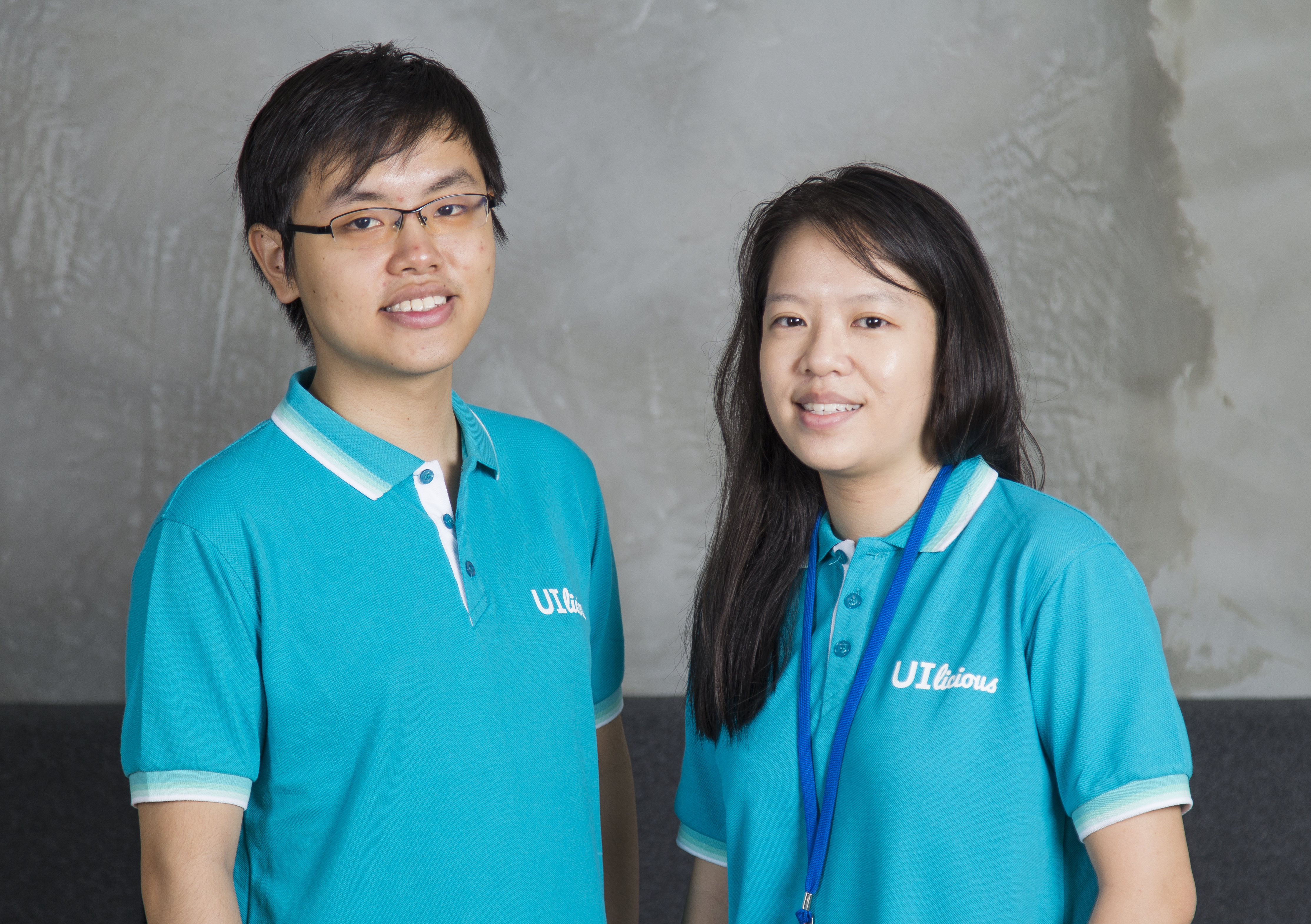

UI-licious’ co-founders, chief technology officer Eugene Cheah (left) and chief executive officer Shi Ling Tai (right)

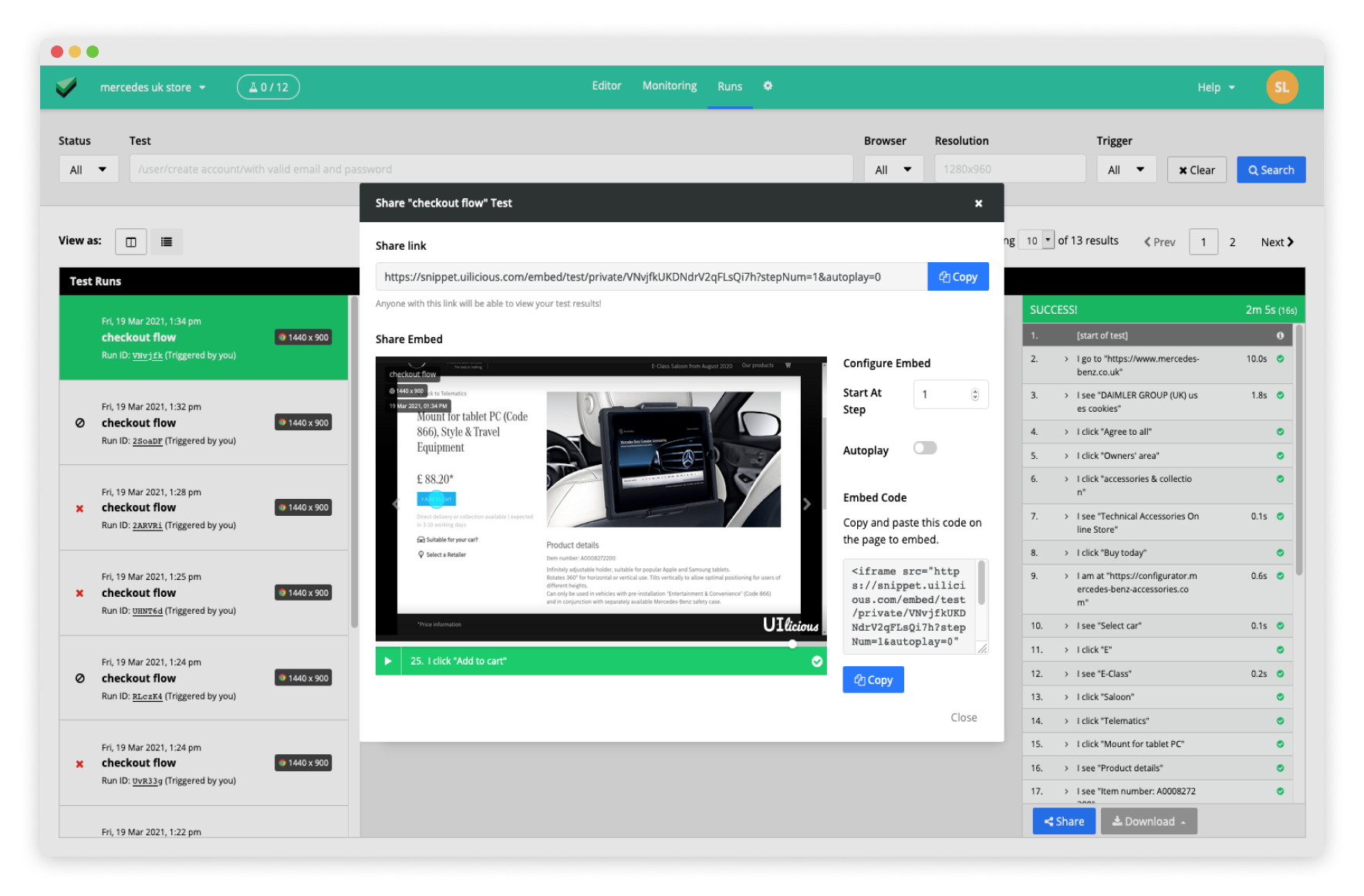

UI-licious, a Singapore-based startup that simplifies automated user interface testing for web applications, announced today it has raised $1.5 million in pre-Series A funding. The round was led by Monk’s Hill Ventures and will be used to grow UI-licious’ product development and marketing teams.

Founded in 2016 by Shi Ling Tai and Eugene Cheah, UI-licious serves companies of all sizes, and its current clients include Daimler, Jones Lang LaSalle and tech recruitment platform Glints.

Tai, UI-licious’ chief executive officer, said that about 90% of software teams around the world rely on manual testing, which is both time-consuming and expensive. UI-licious enables users to write test scripts in pseudocode, or a language that is similar to plain English and therefore accessible to people with little programming experience.

Software teams can then schedule how often the tests run. UI-licious’ proprietary smart targeting test engine supports all browsers and allows the same scripts to be run even if there are changes in a web application’s user interface or underlying code. It also produces detailed error reports to reduce the time needed to find and fix a bug.

When asked how UI-licious compares to other automated user interface testing solutions, Tai told TechCrunch, “Coded solutions require a trained engineer to inspect the website’s code to write the test scripts. The problem is that most software testers are not trained programmers, sometimes they may be the marketing or sales team that owns the project. And while there are other no-code solutions that allow non-programmers to record their actions and replay it, such tests tend to become obsolete quickly as the UI changes.”

UI-licious’ selling point is that “it is designed to make it accessible for anyone to automate UI testing and set up error alerts without needing to know how to code,” she added. “UI-licious also reduces the effort to maintain the tests as the UI code changes with its smart targeting test engine.”

In press statement, Monk’s Hill Ventures partner Justin Nguyen said, “Co-founders Shi Ling and Eugene have developed a product to address the quality assurance issues that have plagued the software automation industry for decades,” adding that “the team’s experience as software engineers has equipped them with the technical knowledge and insights to build a simple and robust tool that empowers manual testers to automate testing and detect bugs before users do.”