& meet dozens of singles today!

User blogs

John Ruffolo isn’t as famous as some investors but he’s very well-known in Canadian business circles. The longtime head of Arthur Andersen’s tech, media, and telecommunications practice, he joined OMERS roughly a decade ago when a former colleague became CEO and brought him aboard the pension giant to create a venture fund.

The idea was to back the most promising Canadian companies, and Ruffolo steered the unit into investments like the social media management Hootsuite, the recently acquired storytelling platform Wattpad, and the e-commerce platform Shopify, among other deals. The last was particularly meaningful, given that OMERS owned around 6% of the company sailing into a 2015 IPO that valued it at roughly $1.3 billion at the time. Alas, owing to the pension fund’s rules, it also began steadily selling that entire stake, even as the company’s valued ticked upward. (Shopify’s market cap is currently $130 billion.)

Indeed, after helping OMERS subsequently get a growth equity unit off the ground, an antsy Ruffolo left to launch his own fund. Then came COVID, and as if the pandemic weren’t bad enough, Ruffolo further underwent a harrowing ordeal last summer. An avid cyclist, he last September set out to ride 60 miles one sunny morning on a country road, was knocked far off his bike by a Mack truck in an accident that shattered most of his bones and left him paralyzed from the waist down.

That kind of one-two punch might drive someone to the brink. Instead, six months and multiple surgeries later, Ruffolo, is undergoing training and therapy and intends to bike someday again. He is also very much back to work and just taking the wraps off his new Toronto-based firm, Maverix Private Equity, which has $500 million to invest in “traditional businesses” that already produce at least $100 million revenue and are using tech to grow but could use an outside investor for the first time to really hit the gas.

We talked with Ruffolo about the accident and his new fund this morning. You can hear that conversation here (it starts nearly seven minutes into things and it’s worth a listen). In the meantime, below are excerpts from that conversation.

TC: You’re surely tired of answering the question, but how are you doing?

JR: Well, when somebody says it’s great to be alive, it is. I actually never knew how close I was to death, to be honest, until about eight days after the accident. When I asked for my phone, just to kind of see what’s going on in the world, there was thousands of messages coming through. And I’m like, ‘What the hell?’

People were copying various articles. I picked off the first one, and it said, ‘John suffered a life threatening injury.’ And I’m kind of thinking, ‘Life threatening? Why are they saying that? And the doctors came in and said, ‘Because it was. We thought that you were going to die in the first 48 hours.’ I subsequently spoke to some of the top physicians [in Canada], and they don’t understand why I didn’t die on impact. That kind of scared me a little bit, but I’m so glad to be alive. And my recovery is far ahead of schedule. It was only within a couple of weeks where I started feeling my legs again.

TC: You were basically pulverized, yet a recent piece about your recovery in The Globe & Mail notes that within a month or so, you were back to thinking about your new fund. Do you think you might be . . . a workaholic?

JR: Some people call it stupid. [Laughs.] But for the two months, my first memory was worrying about my family and stuff [but] I have group of cycling friends — we’re called Les Domestiques — who have committed to cycling, and it’s a lot of folks who are investors, CEOs of big banks in Canada, we’re all close friends, [and] they all came to cocoon the family to make sure that nothing went wrong. So very quickly, all of these folks take over every element of the family, and the kids were fine, everybody was fine. I then had a lot of this time in hospital, and I do get antsy, and I started placing the calls to the investors who were committing to this fund pre COVID . . . I just really wanted to tell them, ‘Hey, I’m not dead. All my faculties are there. Are you still gonna be there when I get out of hospital?’

TC: Because they’re really investing in you and your track record.

JR: That’s exactly right. And I gotta tell you, it’s an interesting comparison. I’ve had American investors, and Canadian investors. American investors are very transactional. They’re very fast to come in if they see a great value proposition. Canada is not the same thing. In Canada, I’m extremely well-known as an investor and there, it’s actually relationship-driven, which is both good and bad. It’s tough in Canada because they’re more conservative, however, they stick with you in bad times. In my case, every single investor, everyone that had committed on pre- COVID, came in. Then one in particular doubled the size of the investment. They just felt bad for me, and I was like, ‘Hey, dude, I will take that sympathy card. Anytime.’

TC: You also see a real market for a Canadian-led firm to invest in Canadian companies versus taking money from American counterparts.

JR: So now this is going a little bit to the thesis, which is not a new thesis from a US perspective but is new from a Canadian perspective: the great firms in the U.S., like an Insight [Partners], like a Madison Dearborn, Bain Capital, General Atlantic, Summit — we don’t have any of those in Canada. We have great venture capital firms, and we have great buyout private equity firms. But what was really happening here is the entrepreneurs who are building great businesses are not really tech entrepreneurs; they’re just traditional industry entrepreneurs. And really, all I’m doing is planting a Canadian flag and saying, Hey, we have a Canadian firm that will lead or highly participate in these deals [to help you scale that business].

TC: You’re drawing a distinction between old-line industries and growth-stage tech companies, in other words, and you’re going after the former?

JR: [To me] a true technology company is one that actually builds the tool sets that are used by other businesses to make them bigger, faster, and stronger and I’ve been investing in those companies for 10 years with great success, but there’s a massive oversupply of capital in those spaces, particularly in the SaaS software space. It’s just not making mathematical sense on when it comes to a lot of these valuations. Meanwhile, when it comes to financial services, health care, travel, whatever, these are not tech entrepreneurs but they’re enlightened. We’re not introducing technology into the business, they already have it. But in one case, with a travel company we’re looking at closely, they want somebody who understands the travel space and also who understands technology and the impact as you scale globally.

The profile of the companies that I’m talking about have, on average, $100 million dollars of top line [growth], with flattish EBITDA, and that haven’t done any external financing with institutions. They’re growing at 20% to 50% a year, but they really want to become the next billion-dollar company.

TC: How much of these companies do you think you can own and for what size checks?

JR: We’re looking at 20% to 40% stakes in the business, so I’d say a significant minority, and we’re cutting checks of $50 to $75 million (U.S.)

TC: There aren’t a lot of massive companies in Canada, Shopify notwithstanding. How do you get the companies you plan to work with thinking on a different scale?

JR: Canadians might be a little bit more conservative, but the irony is, take a survey and [you’ll see] how many Canadians are running huge firms in the United States or in the Valley. It’s not inherent in Canadians [that they are risk averse].

Part of why I got into venture capital was I was so frustrated in the number of companies that were building products but couldn’t even generate revenues. Since then, I think we solved in Canada the zero to $10 million problem, then the $10 million to $100 million [challenge]. But starting around 2016 or so, I started to see companies that had $50 million, $60 million, $70 million in revenue starting to plateau, and the issue was global scalability.

In the U.S., so many companies can be a domestic company and be a billion-dollar company. In Canada, our market is too small; you’re forced to sell on a global scale, and many Canadian companies struggle with that. So my focus now is that last part of the piece. How do we get these companies from $100 million businesses into $1 billion-plus?

Since the pandemic began, I have been pushing the limits of my imagination to try to picture what cities will look and feel like in the coming years.

If your town looks like San Francisco, where I live, it’s a pressing question: Our once-bustling financial district is a ghost town, but even in outer neighborhoods, the number of vacant storefronts is unsettling. People are starting to emerge after sheltering in place for a year, but we are a long way from fully restoring our shared spaces.

What’s going to happen to those semi-vacant office towers, some of which are still under construction? There’s been renewed talk of converting some skyscrapers into residential housing, but there are real economic/logistic hurdles to clear before that can be broadly applied. Scores of restaurants have closed in recent months; who will take over those spaces? I spend a lot of time walking around, and it’s been a long time since I’ve noticed a “Grand Opening” sign.

Seeking answers, Managing Editor Eric Eldon interviewed 10 VCs who are active in proptech and found that most were generally “optimistic.”

Several expressed genuine uncertainty about the future of offices, but most were bullish about prospects for remote work, the rebirth of physical retail and the emergence of “third spaces” that will fill the gap between work and home.

In a companion article on TechCrunch, Eric explores these broader shifts, concluding, “you can start to see a world emerging that sounds a lot more like the fantasies of a New Urbanist than the world before the pandemic.”

Here’s who he interviewed:

- Clelia Warburg Peters, venture partner, Bain Capital Ventures

- Christopher Yip, partner and managing director, RET Ventures

- Zach Aarons, co-founder and general partner, MetaProp

- Casey Berman, general partner, Camber Creek

- Vik Chawla, partner, Fifth Wall

- Adam Demuyakor, co-founder and managing partner, Wilshire Lane Partners

- Robin Godenrath and Julian Roeoes, partners, Picus Capital

- Stonly Baptiste, founding partner, and Shaun Abrahamson, managing partner, Urban Us

- Andrew Ackerman, managing director, Dreamit

Thanks very much for reading Extra Crunch this week. Have a great weekend!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

It’s time to abandon business intelligence tools

Image Credits: Jon Feingersh Photography Inc / Getty Images

Ideally, BI transforms raw data into actionable information, but according to Charles Caldwell, VP of product management at Logi Analytics, “a gap exists between the functionalities provided by current BI and data discovery tools and what users want and need.”

Few BI tools actually integrate with existing workflows and most offer clunky user experiences, “leaving many individuals feeling like they need an advanced computer science degree to actually be able to pull insights out.”

Instead of requiring workers to abandon workflow applications to access data, embedded analytics are more efficient and easier to use, says Caldwell.

In short, “it’s time to abandon BI — at least as we currently know it.”

Pre-seed round funding is under scrutiny: Is VC pandemic posturing here to stay?

Image Credits: nadia_bormotova / Getty Images

Amid the pandemic, investors became laser-focused on sections of the pitch deck that address monetization and business viability — signs that founders need to come to the table with better-defined businesses in order to succeed.

Investors’ heightened expectations for monetization potential and a company’s positioning within its competitive landscape are unlikely to lessen in the years to come, even in a post-COVID economy.

Clubhouse UX teardown: A closer look at homepage curation, follow hooks and other features

Image Credits: Rafael Henrique/SOPA Images/LightRocket via Getty Images

Clubhouse’s hockey-stick growth is something most startups would kill for.

However, it also means that UX problems can only be addressed while in “full flight” — and that changes to the user experience will be felt at scale rather under the cover of a small, loyal and (usually) forgiving user base.

Our favorite companies from Y Combinator’s W21 Demo Day

We’re not investors, so we’re not pretending to sort the unicorns from the goats.

But TechCrunch reporters spend a lot of time talking with startups, hearing pitches and telling their stories; if you’re curious about which companies stood out from Y Combinator’s W21 Demo Day, read on.

A look at 4 IPO updates and 2 late-stage funding rounds

Image Credits: Nigel Sussman (opens in a new window)

There’s a lot going on: The venture capital market is redlining its engines while public markets remain sympathetic to growing, unprofitable companies.

Let’s round up IPO news from DigitalOcean, Kaltura, Robinhood and Zymergen, and big rounds for Lattice and goPuff.

Dear Sophie: When can I finally come to Silicon Valley?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I’m a startup founder looking to expand in the U.S. I was originally looking at opening an office in Silicon Valley to be close to software engineers and investors, but then … COVID-19 :)

A lot has changed over the last year — can I still come?

— Hopeful in Hungary

Staying ahead of the curve on Google’s Core Web Vitals

Image Credits: Aleksei Naumov / Getty Images

Aside from improved SEO, small business websites optimizing for Google’s new Core Web Vitals will reap the rewards of an improved user experience for their site visitors.

While many are looking at the Core Web Vitals as a big hoop to jump through to please the search powers that be, others are seeing — and seizing — the opportunities that come along with this change.

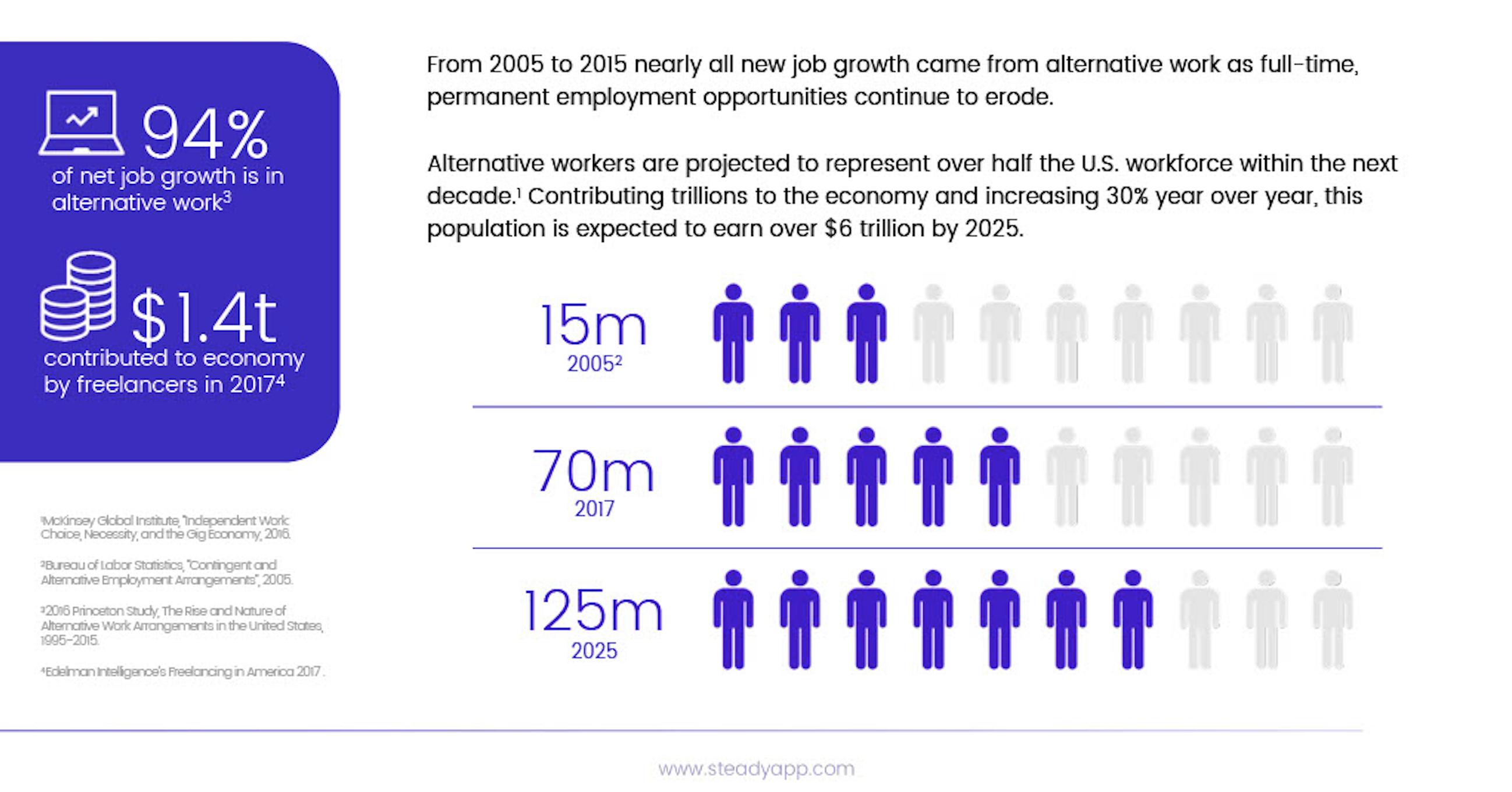

Steady’s Adam Roseman and investor Emmalyn Shaw outline what worked (and what was missing) in the Series A deck

Image Credits: Steady

When it comes to Steady — the platform that helps hourly workers manage and maximize their income and access deals on things like benefits and financial services — the strengths of the business are clear.

But it took time for founder and CEO Adam Roseman to clearly define and communicate each of them in his quest for fundraising.

Discord’s reported $10B exit; Compass and Intermedia Cloud Communications set IPO price ranges

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm dug into Discord’s possible $10 billion exit to Microsoft and explored IPO price ranges for real estate tech company Compass and Intermedia Cloud Communications, a unified-communications-as-a-service company.

“It’s a lot,” he noted, “but if we don’t get through it all now, we’ll fall behind and feel silly later.”

Will fading YOLO sentiment impact Robinhood, Coinbase and other trading platforms?

Image Credits: Nigel Sussman (opens in a new window)

The consumer trading frenzy could be slowing.

What would happen to Robinhood and its cohorts if the apparent cooling in consumer trading demand continues?

How VC and private equity funds can launch portfolio-acceleration platforms

Image Credits: Miguel Navarro (opens in a new window) / Getty Images (Image has been modified)

Almost every private equity and venture capital investor now advertises that they have a platform to support their portfolio companies, “however, most of us don’t have the budget of an Andreessen Horowitz to support almost every major need” for each startup they’ve bet on, says Versatile VC founder David Teten.

If you’re prioritizing a platform buildout for your firm, consider using the framework he’s outlined.

Automakers, suppliers and startups see growing market for in-vehicle AR/VR applications

Image Credits: Bryce Durbin

Despite all of the pomp and promises about the potential for AR and VR, there isn’t a clear understanding of market demand for bringing the technology to cars, trucks and passenger vans.

Estimates of the global market range from $14 billion by 2027 to as much as $673 billion by 2025, showing just how nascent the market currently is and how much opportunity is present.

Amid pandemic, Middle East adtech startups play essential role in business growth

Image Credits: phototechno / Getty Images

The Middle East is a promising region with growing digital advertising solutions despite locals’ attachment to traditional means of advertising.

In recent years, there has been a shift to the active use of social media and online shopping, meaning the Middle East embodies great potential for adtech startups.

Social+ payments: Why fintechs need social features

Image Credits: Getty Images

Social+ products are seeing mass adoption because they marry community with functionality.

This applies even to fintech companies as taboos around money fall away.

The lightning-fast Series A that was 3 years in the making

Image Credits: Mironov Konstantin / Getty Images

It took Christine Tao, founder of Sounding Board, just over three years to recognize the value of executive coaching and get her company to a Series A.

Here’s how she did it.

NFTs could bridge video games and the fashion industry

Image Credits: Amber J. Dickinson (opens in a new window)

Music companies, celebrities and fashion brands are some of the latest entities to dip a toe into the burgeoning NFT market.

In part two of a three-part series, we take a look at why NFTs are “the next chapter of digital art history.”

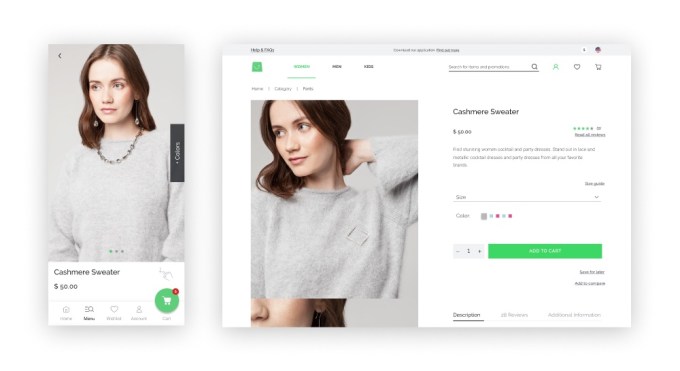

Where is the e-commerce app ecosystem headed in 2021?

Image Credits: Charday Penn (opens in a new window) / Getty Images

The pandemic-induced growth of e-commerce is, by now, well documented.

What is happening in the app ecosystem that supports e-commerce? Is it growing, or are we more likely to see consolidations and IPOs?

Let’s explore.

ironSource is going public via a SPAC and its numbers are pretty good

Image Credits: Nigel Sussman (opens in a new window)

You’ll want to pay attention to this one: Israel’s ironSource, an app-monetization startup, is going public via a SPAC.

It’s the second SPAC-led debut from an Israeli company in recent weeks worth more than $10 billion, and ironSource is actually a pretty darn interesting company from a financial perspective.

Coursera set to roughly double its private valuation in impending IPO

Image Credits: Bryce Durbin / TechCrunch

The market views Coursera’s edtech business warmly ahead of its impending public offering.

Coursera is being valued as a software company, likely a breathe-easy moment for still-private edtech companies, since the debut could be an industry bellwether.

There’s certainly no shortage of SaaS performance metrics leaders focus on. While all SaaS companies do, and must, home in on acquisition metrics, there’s also massive revenue potential within your current customer base.

I think NRR (net revenue retention) is without question the most underrated metric out there. NRR is simply total revenue minus any revenue churn plus any revenue expansion from upgrades, cross-sells or upsells. The greater the NRR, the quicker companies can scale. Simply put: the power of compound math!

One of the biggest and most impactful changes we made was to move new business, retention and account management all under our chief revenue officer.

Over the course of two quarters, Terminus grew its NRR by more than 30 points, opening up incredible new levels of growth opportunities.

To boost our NRR for the better, I focused on three core pillars within our organization.

People

We took a holistic look at the organization and our org structure. One of the biggest and most impactful changes we made was to move new business, retention and account management all under our chief revenue officer. At the end of the day, it just makes a ton of sense to have acquisition and retention living under the same roof — why bother acquiring new customers if you can’t retain them?

We also rolled out a surround-sound team (around three or four people per customer) who onboard and help customers with their account from day one. In total, we have about a quarter of our company dedicated to this 24/7 support and hands-on guidance to ensure we’re enabling customers immediately.

Process

“Headless commerce” is a phrase that gets thrown around lot (I’ve typed it several times today already), but Vue Storefront CEO Patrick Friday has an especially vivid way of using the concept to illustrate his startup’s place in the broader ecosystem.

“Vue Storefront is the bodiless front-end,” Friday said. “We are the walking head.”

In other words, while most headless commerce companies are focused on creating back-end infrastructure, Vue powers the front-end, namely the progressive web applications with which consumers actually interact. The company describes itself as “the lightning-fast frontend platform for headless commerce.”

Friday said that he and CTO Filip Rakowski created the Vue Storefront technology as an open-source project while working at e-commerce agency Divante, before eventually spinning it out into a separate startup last year. The company was also part of the most recent class at accelerator Y Combinator, and it recently raised $1.5 million in seed funding led by SMOK Ventures and Movens VC.

“We had to set up a new entity in the middle of COVID, we had to raise in the middle of COVID and we had to convince the agency get rid of the product in the middle of COVID,” Friday said. He even recalled signing papers with an investor one morning in early December and doing an interview with Y Combinator that evening.

Image Credits: Vue Storefront

As they’ve built a business around the core open-source technology, Friday and his team have realized that Vue has more to offer than just building web apps, because it connects e-commerce platforms like Magento and Shopify with headless content management systems like Contentstack and Contentful, payments systems like PayPal and Stripe and other third-party services.

In fact, Friday said customers have been telling them, “You are like the glue. Headless was so complex to me, and then I got this Vue Storefront thing to come in on top everything else and be the glue connecting things.”

The platform has been used to create more than 300 stores worldwide. Friday said adoption has accelerated as the pandemic and resulting growth in e-commerce have driven businesses to realize they’re using “this legacy platform, using outdated frameworks and technologies from a good four or five years ago.”

Rakowski added, “We also see that many customers actually come to us deciding that Vue Storefront can be the first step of migration to another platform. We can quickly migrate the front-end and write back-end agnostic code.”

Because it had just raised funding, the Vue Storefront team did not participant in the recent YC Demo Day, and will be presenting at the next Demo Day instead. In the meantime, it will be holding its own virtual Vue Storefront Summit on April 20.

This year is all about the roll-ups. No, not those fruity snacks you used to find in your lunchbox; roll-ups are the aggregation of smaller companies into larger firms, creating a potentially compelling path for equity value.

Right now, all eyes are on Thrasio, the fastest company to reach unicorn status, and its cadre of competitors, such as Heyday, Branded and Perch, all vying to become the modern model of consumer packaged goods (CPG) companies.

Making things even more interesting, famed investor and operator Keith Rabois recently announced that he too is working on a roll-up concept called OpenStore with Atomic co-founder Jack Abraham.

Like any investment firm, to be successful, a roll-up should have a thesis or two providing it with a cohesive strategy across its portfolio.

Thrasio has been reaping the benefits of the e-commerce market’s Cambrian explosion in 2020, in which over $1 billion of capital was invested in firms on a mission to acquire independent Amazon sellers and brands.

This catalyst can be attributed to a few key factors, the first and most notable being the pandemic accelerating spending on Amazon and e-commerce more broadly. Next is the low cost of capital, a reflection of interest rates making markets flush with cash; this has made it easier to raise both equity and debt capital.

The third is the emerging and quantifiable proofs of concept: Thrasio is one of several raising hundreds of millions of dollars, and Anker, a primarily Amazon-native brand, went public. Both stories have provided further validation that a meaningful brand can be built on top of Amazon’s marketplace.

Still, the interest in creating value through e-commerce brands is particularly striking. Just a year ago, digitally native brands had fallen out of favor with venture capitalists after so many failed to create venture-scale returns. So what’s the roll-up hype about?

Roll-ups are another flavor of investing

Roll-ups aren’t a new concept; they’ve existed for a while. In the offline world, roll-ups often achieve much greater exit multiples, known as “multiple arbitrage,” so it’s no surprise that the trend is making its way online.

Historically, though, roll-ups haven’t been all that successful; HBR notes that more than two-thirds of roll-ups fail to create value for investors. While roll-ups are often effective at building larger companies, they don’t always increase profits or operating cash flows.

Acquirers, i.e., those rolling up smaller companies, need to uncover new operating approaches for their acquired companies to increase equity value, and the only way to increase equity value is to increase operating cash flow. There are four ways to do this: reducing overhead costs, reducing operating costs without sacrificing price or volume, increasing pricing without sacrificing volume or increasing volume without increasing unit costs.

E-commerce could present a new and different opportunity, or at least that’s what investors and smart money are betting on. Let’s explore how this new wave of roll-ups is approaching both growth and value creation.

Channel your enthusiasm: Why every roll-up needs a thesis

Like any investment firm, to be successful, a roll-up should have a thesis or two providing it with a cohesive strategy across its portfolio. There are a few that are trending in this particular wave.

The first is the primary distribution channel upon which a company grows. Evaluating companies with a common distribution channel can be helpful for creating economies of scale, focusing marketing and growth resources in a specific channel versus diluting resources across several.

On the downside, these companies become reliant on this distribution strategy and any changes could create vulnerabilities for their portfolio companies. As a study, let’s take a look at how two companies take different approaches: