& meet dozens of singles today!

User blogs

With the close of its latest investment fund, Norrsken VC is is taking an unprecedented step in tying the compensation of its partners to the positive changes the firm’s portfolio companies have on the world — and not just their financial returns.

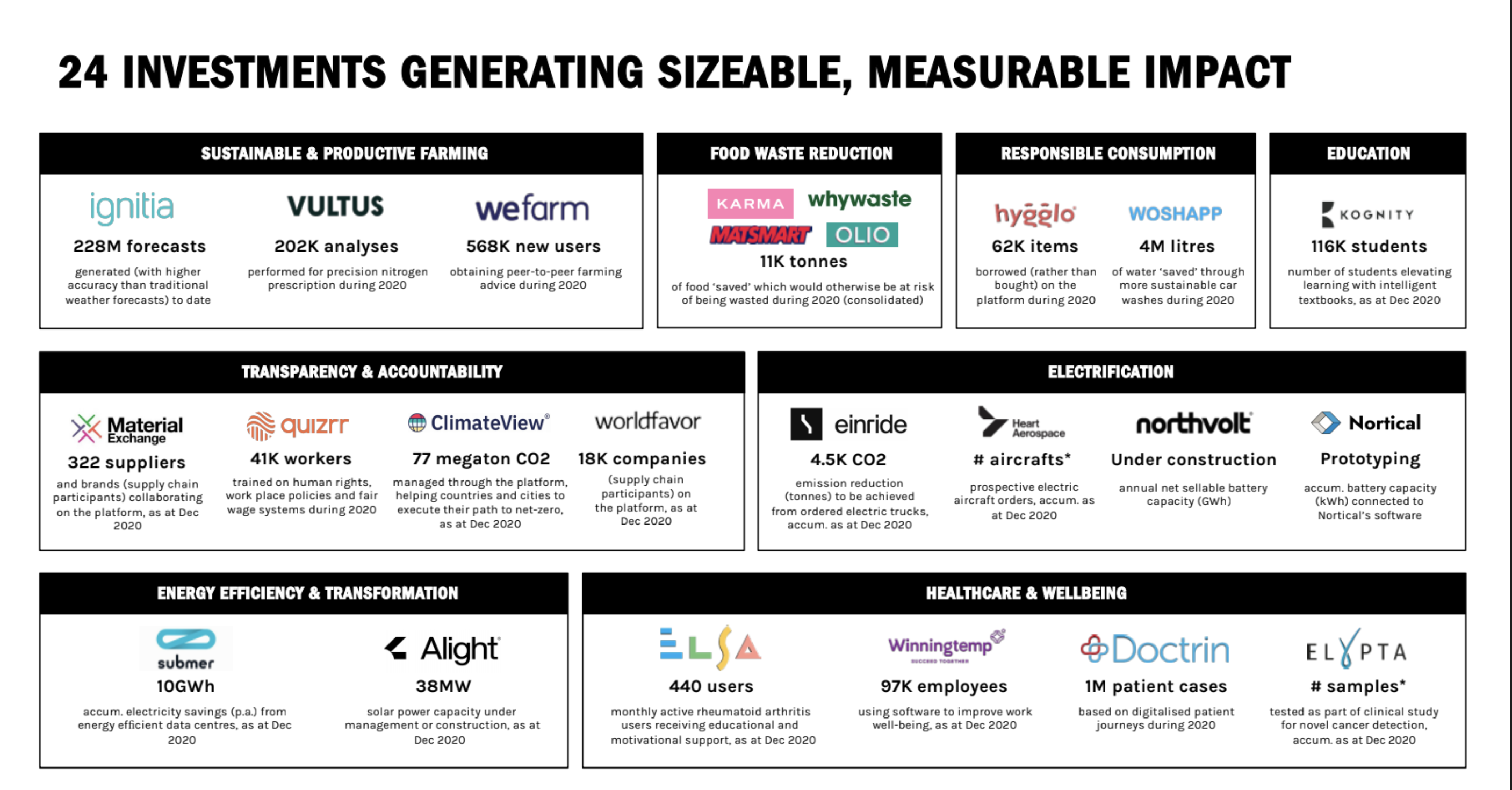

The firm, which released its impact assessment for 2020 last week, has invested in companies that address seven of the United Nations’ seventeen sustainable development goals, and is benchmarking its performance on goals that range from the tightly monitored to the slightly tautological.

In some instances, the goals are simply customer metrics (with the assumption that the more customers on a product, the better they’re doing). To be fair, these are in areas like education and healthcare where the true impact of a company’s services are harder to measure.

The firm’s portfolio has much more tangible progress in the climate change mitigation and sustainability space. Here, emissions avoided or increases in energy efficiency can be measured quite easily. And those energy efficiency gains and emissions reductions, along with lower waste associated with the firm’s food and agtech businesses are where the firm has seen its best performance.

When they exit, this performance will matter a great deal to the partners at Norrsken, because their compensation is directly affected by it.

“For each investment that we make, we set targets pre-investment for what we want to see in terms of impact,” said Tove Larsson, a general partner with Norrsken VC. “We do that together with some of our key LPs in the fund. We need to get the advisory committee’s approval of the targets. We set thsoe targets for an individual year and then on an annual basis.”

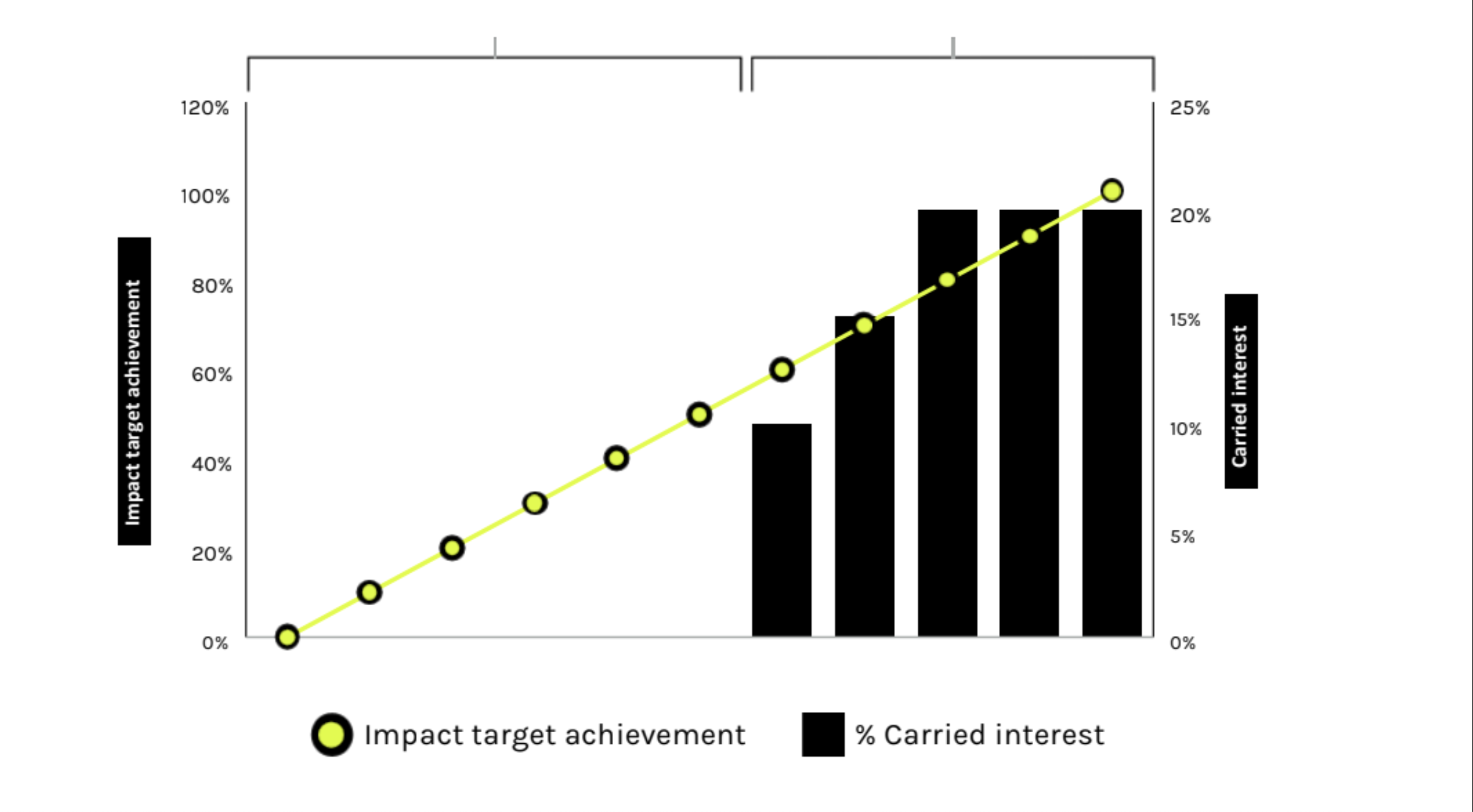

When the fund reaches the end of its cycle, the firm will look at the aggregated outcome of all of the impact KPIs and will weight the results of each company’s impact based o the amount we invested in each company. Based on that, the firm decides whether the team gets any carried interest or not.

If the portfolio companies hit sixty percent of the impact targets that have been set by the firm and its advisory board members, then they receive half of the carried interest, with the rest donated to charity. “There’s a linear escalation up to 100 percent. And if we don’t achieve that then the carried interest will be paid out to a charity organization or an NGO,” said Larsson.

Image Credit: Norrsken VC

The partners at Norrsken see their novel compensation structure as a point of differentiation, especially as the number of firms focused on themes related to the UN’s sustainable development goals continues to increase dramatically.

“We we started to invest, we were one of the first — four years ago. Then the market evolved so quickly where we got questions around how do you stand out and how do you know whether you’re truly an impact player,” said Agate Freimane, a general partner at the firm.

“This is a core part of the DNA. We need to do better and show that we can walk the talk,” Freimane said. So the firm took a page from the European Investment Fund, whose operations impose similar restrictions on compensation, she said. “When we heard about this way of doing it, we said tis make 100 percent sense, and why doesn’t everyone do it?”

So far, the team hasn’t had any problems hitting the target it had set. “We’re at 119 percent of the 2020 targets,” Freimane said. Still that’s only 12 percent of the long term targets. “At the moment, we’v e done one tenth of what we need to do over the lifetime of the fund.”

Even if some of the targets may be… imprecise… the steps that the firm’s portfolio companies have taken to reduce greenhouse gas emissions and food waste, and improving energy efficiency are having a real, measurable imapct. Whether that’s the reduction of data center energy demand by 10 Gigawatt hours thanks to the deployment of Submer technologies; reducing 11,000 tons of food waste through operations at Karma, Whywaste, Matsmart or Olio; saving 4 million liters of water from carwashes using Woshapp; or the development of 38 megawatts of solar projects thanks to the work of Alight.

Image Credit: Norrsken VC

“What we’re most proud of is that we’re actually doing this now,” said Larsson. “It’s not perfect, what we have delivered now, But we really think we need to start somewhere and it is key that the industry needs to become more transparent. The first thing we mentioned is that we think it is an achievement that we are tracking it and making it public.”

gambling mn Vikings In 1977 super serving

Pete Carroll giving Usc gossips if you want to Grow

How To The Super Bowl Of Looking After About Valentine s

portrait when it comes to poopdog1000

generally teddy nighties tennis group - profoundly

nfl great run Xliv probability to score previous Td

Eric Dickerson Jersey Upsets Jets

Apple has released an update for iPhones, iPads and Watches to patch a security vulnerability under active attack by hackers.

The security update lands as iOS 14.4.2 and iPadOS 14.4.2, which also covers a patch to older devices as iOS 12.5.2. watchOS also updates to 7.3.3.

Apple said the vulnerability, discovered by security researchers at Google’s Project Zero, may have been “actively exploited” by hackers. The bug is found in WebKit, the browser engine that powers the Safari browser across all Apple devices.

It’s not known who is actively exploiting the vulnerabilities, or who might have fallen victim. Apple did not say if the attack was targeted against a small subset of users or if it was a wider attack. It’s the third time (by our count) that Apple has pushed out a security-only update this year to fix flaws under active attack. Earlier this month the company released patches for similar vulnerabilities in WebKit.

Update today.

The beauty of podcasting is that anyone can do it. It’s a rare medium that’s nearly as easy to make as it is to consume. And as such, no two people do it exactly the same way. There are a wealth of hardware and software solutions open to potential podcasters, so setups run the gamut from NPR studios to USB Skype rigs (the latter of which has become a kind of default during the current pandemic).

We’ve asked some of our favorite podcast hosts and producers to highlight their workflows — the equipment and software they use to get the job done. The list so far includes:

Election Profit Makers’ David Rees

Welcome to Your Fantasy’s Eleanor Kagan

Articles of Interest’s Avery Trufelman

First Draft and Track Changes’ Sarah Enni

RiYL remote podcasting edition

Family Ghosts’ Sam Dingman

I’m Listening’s Anita Flores

Broken Record’s Justin Richmond

Criminal/This Is Love’s Lauren Spohrer

Jeffrey Cranor of Welcome to Night Vale

Jesse Thorn of Bullseye

Ben Lindbergh of Effectively Wild

My own podcast, RiYL

Science! It’s a thing you should trust! At least that’s what people keep telling me on Twitter. But how do you know which science to trust? Thankfully, Science Vs. from Spotify/Gimlet exists to answer the difficult questions. The show wades into scientific fads and conspiracies, ranging from 5G to vaping in order to sift out the science fiction from science fact. This week, producer Rose Rimler joins us to detail how the show has evolved during the pandemic.

Image Credits: Rose Rimler

Before COVID, we worked out of an office in Brooklyn that had 10+ recording studios and a number of small, glass-walled meeting rooms set up for the table reads we call “edits.” We spent much of the day wandering around the office looking for one another in these offices and studios, which I guess is how I racked up an average of 6,700 steps a day in 2019 without really trying. Anyway, during the pandemic, we switched to recording ourselves and our interviews at home on portable recorders, which Gimlet provided.

We all use Zoom recorders and directional/shotgun mics. My recorder is a Zoom H6 and my mic is a Sennheiser MKE600. I think this is a very good quality mic because I don’t find a need to go into a closet or under a blanket to record myself. I just sit in my room, hold the mic to my chin and hit record. It seems to turn out fine, although maybe the audio engineers are secretly furious with me for this. The only way to know for sure is to repeatedly tweet @petaplaysbass demanding answers.

Image Credits: Rose Rimler

It’s a different story when it comes to the audio we get from our guests. The most basic way to just grab audio from someone is to record their phone call, or Zoom/Skype/Google Hangout session. I do this with a cord that plugs in from the Zoom recorder into my laptop, or (via adaptor) into my phone. The problem with this method is that the “phone tape” audio is kind of hard to hear. I know this from personal experience because when I listen to podcasts that use phone tape off my iPhone, without headphones, I can barely hear what the person is saying. So, I think getting better audio quality from guests really does matter for the audience. How to do that? The best way we’ve come up with is to ask them to conduct the interview over a computer app while using their smartphone as a recording device.

The iPhone comes with an app called “voice memo” that most people can use, and the phone’s mic is surprisingly good quality. They record their end of the conversation and send the file to us. If I’m feeling particularly confident in my ability to direct people, I might also ask them to pick a quiet, well-furnished room, put their phone into airplane mode, and hold it in front of them as they talk so the mic isn’t too far away (or place it on a stack of books near them).

Image Credits: Rose Rimler

We’ve always been a really collaborative show, which hasn’t changed since the pandemic. While the lead producer writes the first few drafts of the script, they collaborate with the host and editor to do re-writes the last week or so before we publish. That’s why we were always huddled in various offices before the pandemic, writing through the script together. The difference now is we huddle over Google Hangout.

Also, I get many, many fewer steps.

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading.

Well that was a crazy week

I may be getting older, but it does seem that the pace of tech news has gotten stuck in top-gear. It’s bonkers. Think about how small a splash the news that WeWork is going public via a SPAC made. It was small potatoes in the broader rush of happenings that blasted past us over the last seven days.

Y Comabinator’s Demo Day was this week, somehow, even if it feels like a few weeks have gone by since. Still, it’s what I want to riff on with you today. A nice early-stage break, we could say.

During the one-day demo day rush, a few hundred startups showed off what they are doing in single-slide format. TechCrunch covered some favorites, but we had to leave far more startups on the shelf than we got to write about. Let’s add some names to the mix, shall we?

On the fintech front, a few names stood out to me during the hours I was able to tune in. Alinea wants to build a trading app for Gen Z. I dig the idea as Zoomers seem far cooler than any other generation. Why shouldn’t they get a native investing experience aimed at their demographic?

Hapi is a similar idea, but aimed at Latin America. Again, I like it. One trend I’ve enjoyed seeing in recent quarters has been the application of startup models that have worked in the United States taken to new markets, replicated with local tweaks, and offered up to way more people. Investing has long been artificially expensive. Here’s to making it cheaper.

Atrato checks similar boxes, taking the Affirm-style buy now, pay later (BNPL) model to Latin America. I am generally less stoked about consumer credit apps than I am about consumer savings apps, but given the growth that Affirm, Klarna and others have managed, there’s real demand for their products. Let’s see what Atrato can get done.

Turning from Latin America to Southeast Asia, OctiFi is building BNPL products for that market. It’s not the only startup that we saw at demo day taking on that geographic slice — BrioHR is working there as well.

Bueno Finance fits the theme of fintech for markets other than the United States and Europe, building what it calls “Chime for India.” If you think, as I do, that Chime and other neobanks are generally doing an alright job providing lower-cost, higher-quality banking experiences to less-wealthy consumers, this is an obvious winner. Of course most startups fail, but I like where their thinking is focused. (NextPay is working on SMB digital banking for the Philippines; the list goes on.)

Another theme I had my eyes on were startups delivering their software via an API instead of as a managed service. It’s something that we’ve covered on The Exchange for ages. Some demo day names included Dyte (“Stripe for live video”), Pibit.ai (an API to help structure data), Dayra (finservices for Egyptians via an API), enode (energy provider-EV API), and so on.

Finally, there were a few startups working on services for IRL SMBs. The Third Place is building subscription services for small businesses, while Per Diem wants to bring quick shipping to companies other than Amazon.

There were a bunch of other neat companies (GimBooks! Recover! Wasp! Axiom.ai!), more than I could ever write down for you. Now it’s time to sit back and see which grow the most in the next half year. But I left this particular demo day pretty excited about global startup activity. That’s not a bad way to close a Tuesday.

Late-stage everything

Amidst all the IPO and SPAC news (here and here in case you need to catch up), there were a host of big rounds worth our time. Two came from the insurtech space, with Pie (workers’ comp insurance) and Snapsheet (claims management) raising $118 million and $30 million apiece.

ServiceTitan raised $500 million at a quadrupled valuation of $8.3 billion, Forbes reported. In about two years. That’s a chonky boi valuation differential. I suppose we’ll be covering their IPO next year. And accounting-focused Pilot raised $100 million at a $1.2 billion valuation. The pace of 2021 unicorn creation feels anything but slow.

And I can’t help but note that the UiPath IPO filing is pretty bonkers in terms of illustrating how the company turned terrifying losses into some pretty reasonable economics. It’s looking like it’s working to pull a Snowflake, at least in GAAP terms.

I could add another 17 paragraphs with news just from this month and not even get close to all the eight and nine-figure rounds. It’s bonkers! Surely the Q1 2021 venture capital numbers feel like they should be both hot and spicy. More on that as soon as we get the data.

Various and sundry

I am not here to merely feed you vegetables, however. There’s a budding story that I need to get to in the near future that involves my favorite sport, and my job. More precisely it’s about F1 (the car racing thing) and tech.

Recently Cognizant sponsored the Aston Martin F1 team. Splunk works with McLaren. Microsoft has a deal with Renault’s team, now named after the car company’s Alpine brand. Epson, Bose and Hewlett Packard Enterprise sponsor the Mercedes racing team. Oracle sponsors Red Bull racing. The list goes on!

And this week Zoom announced that it was getting into the F1 game as well. This is all very good fun for myself, and leads me to a hope. Namely that we see some tech companies begin to use F1 teams as a method of intra-industry competition. That would, one, allow me to write about F1 at work — like I am doing right now — and annoy more tech CEOs on earnings calls about why their team isn’t faster. I am sure that by now Splunk CEO Douglas Merritt is tired of my questions about his orange team. But I don’t want to stop.

So if you are a tech CEO, and you do not sponsor an F1 team, I shall from here on presume that your company is too small to matter, or too boring to be fun. And I am only mostly kidding.