& meet dozens of singles today!

User blogs

Chih-Han Yu, chief executive officer and co-founder of Appier Group Inc., right, holds a hammer next to a bell during an event marking the listing of the company on the Tokyo Stock Exchange, at the company’s office in Taipei, Taiwan on Tuesday, March 30, 2021. Photographer: Billy H.C. Kwok/Bloomberg via Getty Images

Appier’s initial public offering on the Tokyo Stock Exchange yesterday was a milestone not only for the company, but also Sequoia Capital India, one of its earliest investors. Founded in Taiwan, Appier was the fund’s first investment outside of India, and is now also the first company in its portfolio outside of India to go public. In an interview with TechCrunch, Sequoia Capital managing director Abheek Anand talked about what drew the firm to Appier, which develops AI-based marketing software.

Before shifting its focus to marketing, Appier’s founders—chief executive officer Chih-Han Yu, chief operating officer Winnie Lee and chief technology officer Joe Su—worked on a startup called Plaxie to develop AI-powered gaming engines. Yu and Su came up with the idea when they were both graduate students at Harvard, but found there was little demand at the time. Anand met them in 2013, soon after their pivot to big data and marketing, and Sequoia Capital India invested in Appier’s Series A a few months later.

“It’s easy to say in retrospect what worked and what didn’t work. What really stands out without trying to write revisionist history is that this was just an incredibly smart team,” said Anand. “They had probably the most technical core DNA of any Series A company that we’ve met in years, I would argue.” Yu holds a PhD in computer science from Harvard, Wu earned a PhD in immunology at Washington University in St. Louis and Su has a M.S. in computer science from Harvard. The company also filled its team with AI and machine learning researchers from top universities in Taiwan and the United States.

At the time, Sequoia Capital “had a broad thesis that there would be adoption of AI in enterprises,” Anand said. “What we believed was there were a bunch of people going after that problem, but they were trying to solve business problems without necessarily having the technical depth to do it.” Appier stood out because they “were swinging at it from the other end, where they had an enormous amount of technical expertise.”

Since Appier’s launch in 2012, more companies have emerged that use machine learning and big data to help companies automate marketing decisions and create online campaigns. Anand said one of the reasons Appier, which now operates in 14 markets across the Asia-Pacific region, remains competitive is its strategy of cross-selling new products and focusing on specific use cases instead of building a general purpose platform.

Appier’s core product is a cross-platform advertising engine called CrossX that focuses on user acquisition. Then it has products that address other parts of their customers’ value chain: AiDeal to help companies send coupons to the customers who are most likely to use them; user engagement platform AIQUA; and AIXON, a data science platform that uses AI models to predict customer actions, including the likelihood of repeat purchases.

“I think the number one thing that the company has spent a lot of time on is focusing on efficiency,” said Anand. “Customers have tons of data, both external and first-party, that they’re processing to drive business outcomes. It’s a very hard technical problem. Appier starts with a solution that is relatively easy to break into a customer, and then builds deeper and deeper solutions for those customers.”

Appier’s listing is also noteworthy because it marks the first time a company from Taiwan has listed in Japan since Trend Micro’s IPO in 1998. Japan is one of Appier’s biggest markets (customers there include Rakuten, Toyota and Shiseido), making the Tokyo Stock Exchange a natural fit, Anand said, even though most of Sequoia Capital India’s portfolio companies list in India or the United States.

The Tokyo Stock Exchange also stood out because of its retail investor participation, liquidity and total volume. Some of Appier’s other core investors, including JAFCO Asia and SoftBank Group Corp., are also based in Japan. But though it has almost $30 billion in average trading volume, the vast majority of listings are domestic companies. In a recent report, Nikkei Asia cited a higher corporate tax rate and lack of potential underwriters, especially for smaller listings, as a potential obstacles for foreign companies.

But Appier’s debut may lead the way for other Asian startups to chose the Tokyo Stock Exchange, said Anand. “Getting ready for the Japanese exchange meant having the right accounting practices, the right reporting, a whole bunch of compliance stuff. It was a long process. In some ways we were leading the charge for external companies to get there, and I’m sure over time it will keep getting easier and easier.”

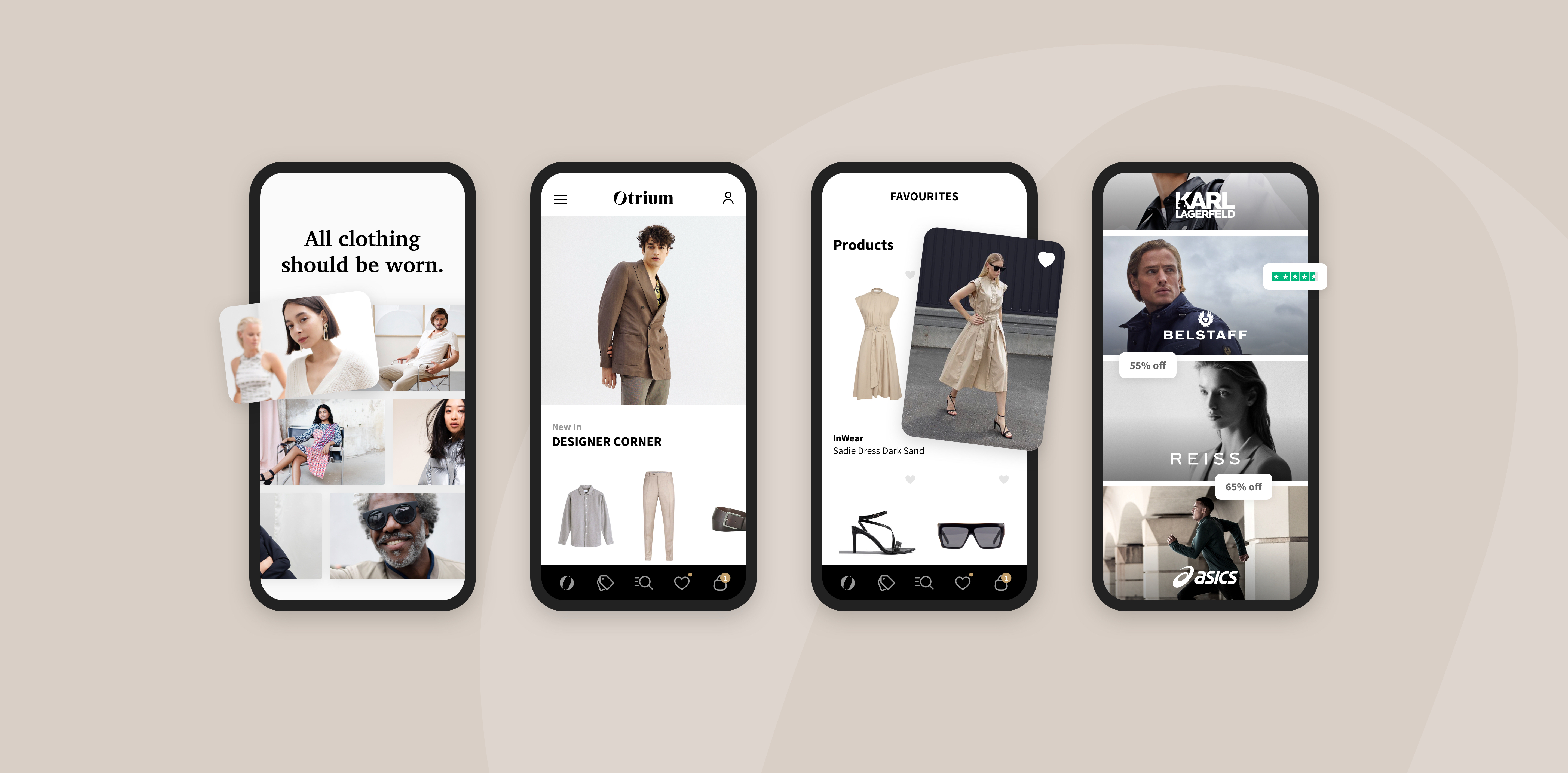

Otrium has raised a $120 million round just a year after raising its $26 million Series B round. BOND and returning investor Index Ventures are leading the round. Existing investor Eight Roads Ventures is also participating.

The concept behind Otrium is quite simple. When items reach the end-of-season status, brands can list those items on Otrium and keep selling them. Otrium is currently available in Europe. Right now, many brands have their own end-of-season sales. But there are some limits to this model.

Those companies often can’t sell their entire back inventory this way. Moreover, the most luxurious fashion brands don’t necessarily want to put a cheaper price tag on their items in their own stores. That’s why a lot of clothing produced stays unsold — and by unsold, it means that those items often get destroyed.

With Otrium, brands can add another sales channel for those specific items. And selling those items online makes a ton of sense as you don’t want to manage small end-of-season inventories across multiple stores. One big online inventory is all you need.

And because some brands are reluctant about selling outdated items, Otrium tries to be as friendly as possible with fashion companies. They retain control over pricing, merchandising and visibility of their excess inventory.

The startup also recently launched advanced analytics. The idea here is that Otrium can help brands identify evergreen products that should remain available year after year.

“We believe that the fashion world will see a rebalancing in the next few years, with more sales being driven by iconic items that brands sell year after year, and will be less reliant on new seasonal launches,” co-founder and CEO Milan Daniels said in a statement.

And it would be a win-win for everyone involved. Otrium would end up selling items that remain relevant for a longer time. And fashion brands could slowly build an evergreen collection of items that would nicely complement their fast fashion collections.

With today’s funding round, Otrium plans to expand to the U.S. The company currently works with several well-known fashion houses, such as Karl Lagerfeld, Joseph, Anine Bing, Belstaff, Reiss and ASICS.

Image Credits: Otrium

Amazon will soon be a big part of the space economy in the form of its Kuiper satellite internet constellation, but here on Earth its ambitions are more commonplace: get an accelerator going. They’ve partnered with space-focused VC outfit Seraphim Capital to create a 4-week program with (among other things) a $100,000 AWS credit for a carrot.

Applications are open now for the AWS Space Accelerator, with the only requirement that you’re aiming for the space sector and plan to use AWS at some point. 10 will be accepted; you have until April 21 to apply.

The program sounds fairly straightforward: a “technical, business, and mentorship” deal where you’ll likely learn how to use AWS properly, get some good tips from the AWS Partner Network and other space-focused experts on tech, regulations, and security, then rub shoulders with some VCs to talk about that round you’re putting together. (No doubt Seraphim’s team gets first dibs, but there doesn’t appear to be any strict equity agreement.)

“Selected startups may receive up to $100,000 in AWS Activate credit,” the announcement says, which does hedge somewhat, but probably legal made them put that in.

There are a good amount of space-focused programs out there, but not nearly enough to cover demand — there are a lot of space startups! And they often face a special challenge of being highly technical, have customers in the public sector, and need rather a lot of cash to get going compared with your average enterprise SaaS.

We’ll understand more about the program once the first cohort is announced, likely not for at least a month or two.

Google tries out new ad targeting technology, PayPal adds cryptocurrency support and Substack raises additional funding. This is your Daily Crunch for March 30, 2021.

The big story: Google starts testing its cookie alternative

Google announced today that it has begun rolling out a new technology called Federated Learning of Cohorts (FLoC) in a developer trial. FLoC is meant to serve as an alternative to personally identifiable cookies (which are being phased out by Google and other platforms), with Google analyzing your web browsing behavior and grouping you with other people who have similar interests, for ad-targeting purposes.

The trial is starting out in a number of geographies, including the United States — but not in Europe, where there are concerns about compliance with Europe’s GDPR privacy regulations.

The tech giants

YouTube tests hiding dislike counts on videos — The company says it will run a “small experiment” with different designs that hide dislike counts, but not the “dislike” button itself.

Ballot counting for Amazon’s historic union vote starts today — Amazon’s warehouse in Bessemer, Alabama has become ground zero for one of the most import labor efforts in modern American history.

PayPal’s new feature allows US consumers to check out using cryptocurrency — The feature expands on PayPal’s current investments in the cryptocurrency market.

Startups, funding and venture capital

Celebrity video request site Cameo reaches unicorn status with $100M raise — Cameo has been building a good deal of steam in recent years, but it also got a major boost amidst the pandemic.

Substack confirms $65M raise, promises to ‘rapidly’ expand its financial backing of newly independent writers — Substack did not provide material new growth metrics, instead saying that it has “more than half a million people” paying for writers on its network.

NFT art marketplace SuperRare closes $9M Series A — SuperRare launched its art platform in 2018, since then it has differentiated by maintaining a closed early access platform, closely curating the art that’s sold.

Advice and analysis from Extra Crunch

The Tonal EC-1 — Remember our deep dives into the history, businesses and growth of Patreon, Niantic, Roblox, Kobalt and Unity? We’re bringing the format back with an in-depth, multi-part look at fitness startup Tonal.

Is Substack really worth $650M? — More thoughts on Substack’s finances.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

A trove of imported console games vanish from Chinese online stores — A handful of grey market videogame console vendors on Taobao stopped selling and shipping this week.

Applications for Startup Battlefield at TC Disrupt 2021 are now open — TechCrunch is on the hunt for game-changing and ground-breaking startups from around the globe to feature in Startup Battlefield during TechCrunch Disrupt 2021 this fall.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Apple has updated its native Maps app with more helpful information designed to assist with travel while mitigating the spread of COVID-19. Apple Maps on iPhone, iPad and Mac will now show COVID-19 health measure information for airports when searched via the app, either through a link to the airport’s own COVID-19 advisory page, or directly on the in-app location card itself.

The new information is made available through a partnership with the Airports Council International and provides details on COVID-19 safety guidelines in effect at over 300 airports worldwide. The type of information provided includes requirements around COVID-19 testing, mask usage, screening procedures and any quarantine measures in effect, and generally hopes to help make the process of traveling while the global pandemic continues easier, and as vaccination programs and other counterefforts are set to prompt a global travel recovery.

Earlier this month, Apple also added COVID-19 vaccination locations within the U.S. to Apple Maps, which can be found when searching either via text, with Siri, or using the “Find nearby” location-based feature. Last year, the company added testing sites in various locations around the world and added COVID-19 information modules to cards for other types of businesses.