& meet dozens of singles today!

User blogs

Charles, a Berlin-based startup that offers a “conversational-commerce” SaaS for businesses that want to sell on WhatsApp and other chat apps, has raised €6.4 million in funding.

Led by Accel and HV Capital, the seed funding will be used by the company to scale and meet existing demand for its conversational commerce platform.

Launched in 2020 by Artjem Weissbeck and Andreas Tussing after the pair had run a year-long experiment running a store in WhatsApp, Charles enables businesses to sell products and services via WhatsApp and other chat apps in order to “increase conversion rate, customer loyalty and ultimately revenue”.

The SaaS connects chat app APIs, such as WhatsApp and Messenger, with shop and CRM systems, like Shopify, SAP and HubSpot, all delivered through a user-friendly interface. The idea is to make it easier for businesses to meet their customers on the channels they already use and to bridge the gap between sales enquiries and support, and actual conversions.

” ‘Traffic’ and with it ‘conversion’ will exponentially move from the streets (retail) and the browser/native apps into chat apps,” says Weissbeck. “Thereby, conversational commerce will be the third big pillar of commerce, gluing together all channels and unlocking the full potential of personalization via the unique identification of customers via their phone number”.

This transition, argues the Charles founder, creates “tremendous challenges and opportunities” for companies in terms of customer journey design and the tech stack, which to date — Asia, aside — has been predominantly tailored around webshops and e-mail.

“Ultimately our technology provides the operating system for companies to master this challenge,” adds Tussing. “The core of our software integrates chat apps with shop/CRM backends in an intuitive interface that puts the human chat sales agent in the center, supported by chatbots and AI”.

Luca Bocchio, partner at Accel, says that conversational commerce is emerging as a “critical channel for brands,” and is a trend that will reshape the way brands interact with customers. [This is] paving the way for potential new category-defining tools to emerge,” he says, noting that Charles has the potential to be one of those tools.

“When we talk to potential clients it’s mostly existing customer service tools like Zendesk who are starting to add chat apps as an additional channel,” says Weissbeck, when asked to cite direct competitors. “These tools are usually built upon a ‘ticketing’ logic, optimized to solve customer inquiries as quickly as possible and with a clear focus on service cases, not sales”.

In contrast, Weissbeck says Charles is built upon a “feed” logic, showing customer interaction as an ongoing conversation and end-to-end relationship — in the same way as the customer sees it.

“Further we deeply integrate into shop/CRM-backends to make it easy for agents to sell product and create carts or contracts — all in a very design-driven and intuitive interface, that is fun to use for the agent and puts her/him in the center,” says Tussing. “Supported by chatbots, not replaced”.

Meanwhile, the revenue model is simple enough: Businesses pay a monthly base fee to cover Charles’ fixed costs and on top of this the startup earns money on conversions. “We take a small share of the net sales, ensuring we are co-incentivised,” explains Weissbeck.

Egyptian-based VC firm Sawari Ventures has closed its $71 million fund for North Africa’s rapidly growing startup ecosystem.

The firm first announced its fund in 2018, when it closed an initial $35 million (which subsequently increased to $41 million) in hopes to close at $70 million, per Menabytes. The investors in the first tranche included CDC (which forked over $12 million), European Investment Bank, Proparco and the Dutch Good Growth Fund.

Having closed an additional $30 million, Sawari Ventures’ total raise is $1 million more than its original target. And it has added a range of new backers that includes Banque Misr, Banque du Caire, Ekuity, Misr Insurance Group, National Bank of Egypt and Suez Canal Bank.

Ahmed El Alfi, Hany Al-Sonbaty and Wael Amin launched Sawari Ventures in 2010. Before venturing into the world of venture capital, El Alfi and Al-Sonbaty were investment professionals in the Egyptian tech space for more than two decades. Amin, meanwhile, was a founder of a tech company called ITWorx that made notable acquisitions in the Egyptian tech ecosystem.

In addition to Egypt, Sawari Ventures focuses on Morocco and Tunisia. For the firm, these three countries represent one of the best investment opportunities around given the mismatch between the capital available (amounts and variation at every stage) and the market opportunity. They also share common traits such as language, culture, business, governance norms and market dynamics, making it easier for cross-border cooperation.

Since launching the firm over 10 years ago, Sawari claims to have invested in more than 30 companies, mostly in Egypt. Some of these companies include ride-hailing service SWVL, software startup Instabug, and AI chat-based personal assistant Elves, but its sweet spots are the hardware, education, healthcare, cleantech and fintech sectors.

“We try to cast a wide net given that, in essence, this is a transformative moment in emerging markets tech with the rapid digitization of the underlying economy,” a company spokesperson told TechCrunch. “So as expected, we’re seeing a great deal flow in the digitization of financial services, health care and education technologies. Also, given the engineering talent, there are unique opportunities in SaaS products, semiconductors and IoT.”

Sawari Ventures invests in growth-stage companies, in particular. But it also operates Flat6Labs, a seed VC firm akin to an accelerator that has been used to perform its seed investments since establishing both Cairo and Tunis offices in 2011 and 2016.

Image Credits: Sawari Ventures

Sawari says 10% of the now-closed investments will be earmarked for seed-stage companies as investments through Flat6Labs Cairo and Tunis. Flat6Labs Cairo will seed between 80 to 100 companies and offer follow-on investments to between 30 and 40. Flat6Labs Tunisia will seed 60 to 70 companies and offer follow-on investments for 30 to 40. The remaining 90% will be used to invest in 20 to 25 growth-stage companies across Egypt, Tunisia and Morocco, with a median investment range of $2 million to $3 million.

The investment range is a continuation of how Sawari typically cut checks for portfolio startups since closing the first tranche three years ago. The firm said it has invested between $1 million and $4 million in Elves, Brantu, and ExpandCart, Almentor, SWVL and MoneyFellows, among others.

“The Egypt-based fund is a privately held fund regulated by the Financial Regulatory Authority of Egypt (FRA), which allowed us to attract capital from top-tier local financial institutions to co-invest with foreign capital from international development financial institutions, doubling our allocation to invest in Egyptian high-growth companies to $68 million,” El Alfi said in a statement.

“Our aim is to create exceptional returns through investing in knowledge-driven companies, which have the potential of bringing transformational changes to the Egyptian economy. The fund will support local companies with dedicated capital, in addition to quality expertise from our seasoned and specialized team, and the value-add of our investors.”

Glints, the Singapore-based career platform, announced today it has raised $22.5 million in Series C funding led by Japanese human resources management firm PERSOL Holdings. The new capital will be used on Glints’ expansion in Singapore, Indonesia, Vietnam and Taiwan and hiring for its product and engineering teams.

Glints co-founder and chief executive officer Oswald Yeo said this is the largest funding round to date for a talent platform in Southeast Asia, and brings the startup’s total raised to $33 million. Other participants included returning investors Monk’s Hill Ventures, Fresco Capital, Mindworks Ventures, Wavemaker Partners, Flipkart co-founder Binny Bansal and former Goldman Sachs TMT China head and partner Xiaoyin Zhang.

Founded in 2013, Glints says it has been used by more than 1.5 million professionals and 30,000 organizations, including Gojek, Tokopedia, Starbucks and Mediacorp. Most of its current users are from the tech and financial services sectors, but Glints has a “broad horizontal focus on young to mid-level professionals,” and its long-term goal is to be sector agnostic, Yeo told TechCrunch.

One of the ways Glints differentiates from other job platforms active in its markets, like LinkedIn, JobStreet and CakeResume, is by building a “full-stack” of services for people who want to advance their careers. In addition to its job marketplace, which the company says has more than 7,000 active listings and 4 million visitors each month, Glints also offers community features and skills education, like online classes.

One of Glints’ value propositions is helping companies, especially in tech, cope with the regional talent shortage, a topic it recently covered in a comprehensive report with Monk’s Hill Ventures.

One of the solutions the report highlighted is hiring teams based in different Southeast Asian countries to address talent crunches in specific markets, like Singapore. Glints says its cross-border remote work hub, TalentHub, doubled its business in 2020 as the pandemic also made employers more open to hiring remotely.

Hipmunk’s founders are building a successor to their now-defunct flight search service.

The startup was acquired by SAP-owned travel and expense platform Concur in 2016, and its CEO Adam Goldstein departed in 2018. But Goldstein told me he and his co-founder Steve Huffman (also co-founder and CEO of Reddit) were still disappointed when Concur shut the service down at the beginning of last year.

“Over the years, there were millions and millions of people who used it and loved it,” Goldstein said. (I was one of those people — even before I knew what he was working on, I started out our call by telling Goldstein how much I miss Hipmunk.)

So the pair seed funded a project called Flight Penguin, with Goldstein serving as the new company’s chairman. And he said the actual product was built by former Hipmunk developer Sheri Zada.

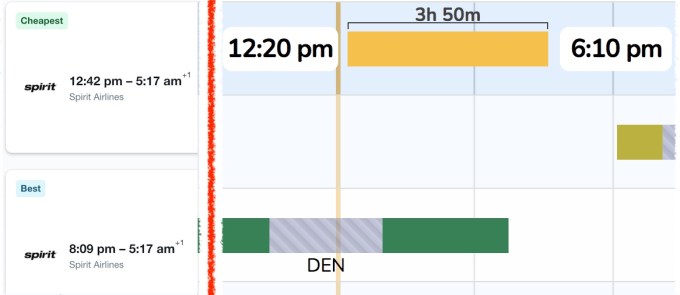

The Flight Penguin interface will be very familiar to old Hipmunk users, with a visual layout that makes it easy to see the timing of flights and length of layovers. And just as Hipmunk allowed users to organize results by “agony” (so that the top results aren’t just cheap flights with inconvenient timing or ridiculous layovers), Flight Penguin allows them to sort their flights by “pain.”

Image Credits: Flight Penguin

But this isn’t just the old experience with a fresh coat of paint — it’s also meant to improve on Hipmunk in a few key ways. For one thing, it allows users to search by Chase Ultimate Rewards Points (as well as U.S. dollars, with the goal of adding more currencies and rewards programs in the future).

And the product itself is a Google Chrome extension, rather than a traditional flight search website. The extension actually presents a full, standalone web experience (rather than an overlay on another website), but Goldstein said this approach is still important, because it allows Flight Penguin to pull its data “through the frontend instead of the backend,” giving it the most up-to-date data. This helps to avoid situations where a flight or price shows up in search results but isn’t available on the airline’s or other seller’s website.

In addition, Goldstein said Flight Penguin will show “all the flights.” In other words, it won’t be making any deals with the airlines to hide certain flights or prices, and it will also show airlines that don’t normally make their flights available on other search platforms.

“There are actually many, many flights available but consumers don’t see them because travel search sites work out these deals,” he said. “We’re choosing not to play that game.”

That has the obvious benefit of offering more comprehensive results, but also the disadvantage that Flight Penguin will not be able to collect affiliate fees for flight purchases. Instead, after a 30-day trial period, it will charge users $10 per month. (This is an introductory fee and will likely change in the future.)

Goldstein acknowledged that this is probably “not going to be a mainstream product that 50 million Americans use,” but he’s hoping that it can attract a significant subscriber base of frequent travelers who “value their time and care about the flight booking experience.”

“What we learned from Hipmunk was […] the way business has traditionally been done in online travel worked for consumer in an era lots of competition between airlines and travel agencies,” he added. “In a world where there’s much less competition, you’re basically becoming an agent for the people you’re working with, and i’s hard to build a business model around providing a great user experience. That’s why we’re saying that we’re going to opt out of this game and play by our own rules.”

Flight Penguin is currently accepting signups for its waitlist, but Goldstein said the company is simply using this to bring users on in a controlled fashion, and that it plans to move people off the wait list pretty quickly.

Clubhouse, a one-year-old social audio app reportedly valued at $1 billion, will now allow users to send money to their favorite creators — or speakers — on the platform. In a blog post, the startup announced the new monetization feature, Clubhouse Payments, as the “the first of many features that allow creators to get paid directly on Clubhouse.”

Clubhouse’s press team did not immediately respond to comment. Paul Davison, the co-founder of Clubhouse, mentioned in the company’s latest town hall that the startup wants to focus on direct monetization on creators, instead of advertisements.

Here’s how it will work: A user can send a payment in Clubhouse by going to the profile of the creator to whom they want to give money. If the creator has the feature enabled, the user will be able to tap “Send Money” and enter an amount. It’s like a virtual tip jar, or a Clubhouse-branded version of Venmo (although the payments feature doesn’t currently let the user send a personalized message along with the money).

.@joinClubhouse

@stripe pic.twitter.com/u7kXXdPXU7

— edwin (@edwinwee) April 5, 2021

“100% of the payment will go to the creator. The person sending the money will also be charged a small card processing fee, which will go directly to our payment processing partner, Stripe,” the post reads. “Clubhouse will take nothing.”

Stripe CEO Patrick Collison tweeted shortly after the blog post went up that “It’s cool to see a new social platform focus first on participant income rather than internalized monetization / advertising.”

It's cool to see a new social platform focus first on *participant* income rather than internalized monetization / advertising. Excited for the burgeoning creator economy and next era of internet business models.

— Patrick Collison (@patrickc) April 5, 2021

When the startup raised a Series B led by Andreessen Horowitz in January, part of the reported $100 million funding was said to go to a creator grant program. The program would be used to “support emerging Clubhouse creators,” according to a blog post. It’s unclear how they define emerging, but cultivating influencers (and rewarding them with money) is one way the startup is promoting high-quality content on its platform.

The synergies here are obvious. A Clubhouse creator can now get tips for a great show, or raise money for a great cause, while also being rewarded by the platform itself for being a recurring host.

The fact that Clubhouse’s first attempt at monetization includes no percentage cut of its own is certainly noteworthy. Monetization, or Clubhouse’s lack thereof, has been a topic of discussion about the buzzy startup since it took off in the early pandemic months. While it currently relies on venture capital to keep the wheels churning, it will need to make money eventually in order to be a self-sustaining business.

Creator monetization, with a cut for the platform, has led to the growth of large businesses. Cameo, a startup that sends personalized messages from creators and celebrities, takes about a 25% cut of each video sold on its platform. The startup reached unicorn status last week with a $100 million raise. OnlyFans, another platform that helps creators directly raise money from fans in exchange for paywalled contact, is projecting $1 billion in revenue for 2021.

Clubhouse’s payments feature will first be tested by a “small test group” starting today, but it is unclear who is in this group. Eventually, the payments feature will be rolled out to other users in waves.