& meet dozens of singles today!

User blogs

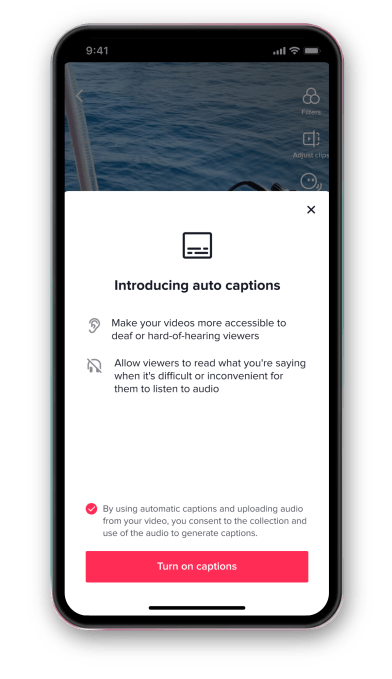

TikTok this morning announced the launch of a new feature designed to make its app accessible to people who are hard of hearing or deaf. The company is today debuting auto captions — a feature that, when enabled, will automatically transcribe the speech from a video so viewers can read what’s being said in the video as an alternative to listening. Initially, auto captions will support American English and Japanese, with additional languages coming in the months ahead, TikTok says.

To use auto captions, the creator will select the option on the editing page after they’ve either uploaded or recorded a video. They can then edit the text that’s generated in order to correct any mistakes before the video is published.

Image Credits: TikTok

Though largely designed for accessibility purposes, auto captions can also help those who want to watch TikTok videos without the sound — for example, when you’re around other people you don’t want to disturb, but lacking headphones. They can also be useful for those watching videos where they’re not fluent in the language being spoken, as it’s sometimes easier to understand what’s said when you can also read the words.

Already, many in the TikTok community had embraced captioning by adding text overlays to their videos or using third-party subtitling tools. The text-to-speech trend, where text on screen is read in a Siri-like voice, has remained a popular technique among creators, too.

But the auto captions tool will work differently from existing options because it can be turned on and off by the viewer. That means you wouldn’t have to see the video captions if you don’t want to. To turn the captions off, you’ll first open the share panel, then tap the captions button to disable them.

Image Credits: TikTok

TikTok says it will be working to spread the word among its creator community about the new addition to encourage users to make their videos accessible to a wider audience.

Auto captions are now one of several accessibility features TikTok has launched, alongside creator warnings when they produce videos that could trigger photosensitive epilepsy and a photosensitivity feature that allows users to skip photosensitive content. The app also offers a text-to-speech feature and a feature to replace animated thumbnails with static images.

TikTok says it’s currently undergoing an accessibility assessment to identify additional areas for improvement, as well, and has worked with the organization The Deaf Collective, to increase awareness towards the talent and conversations taking place in Deaf communities on its app.

The European Union may investigate Facebook’s $1BN acquisition of customer service platform Kustomer after concerns were referred to it under EU merger rules.

A spokeswoman for the Commission confirmed it received a request to refer the proposed acquisition from Austria under Article 22 of the EU’s Merger Regulation — a mechanism which allows Member States to flag a proposed transaction that’s not notifiable under national filing thresholds (e.g. because the turnover of one of the companies is too low for a formal notification).

The Commission spokeswoman said the case was notified in Austria on March 31.

“Following the receipt of an Article 22 request for referral, the Commission has to transmit the request for referral to other Member States without delay, who will have the right to join the original referral request within 15 working days of being informed by the Commission of the original request,” she told us, adding: “Following the expiry of the deadline for other Member States to join the referral, the Commission will have 10 working days to decide whether to accept or reject the referral.”

We’ll know in a few weeks whether or not the European Commission will take a look at the acquisition — an option that could see the transaction stalled for months, delaying Facebook’s plans for integrating Kustomer’s platform into its empire.

Facebook and Kustomer have been contacted for comment on the development.

The tech giant’s planned purchase of the customer relations management platform was announced last November and quickly raised concerns over what Facebook might do with any personal data held by Kustomer — which could include sensitive information, given sectors served by the platform include healthcare, government and financial services, among others.

Back in February, the Irish Council for Civil Liberties (ICCL) wrote to the Commission and national and EU data protection agencies to raise concerns about the proposed acquisition — urging scrutiny of the “data processing consequences”, and highlighting how Kustomer’s terms allow it to process user data for very wide-ranging purposes.

“Facebook is acquiring this company. The scope of ‘improving our Services’ [in Kustomer’s terms] is already broad, but is likely to grow broader after Kustomer is acquired,” the ICCL warned. “‘Our Services’ may, for example, be taken to mean any Facebook services or systems or projects.”

“The settled caselaw of the European Court of Justice, and the European data protection board, that ‘improving our services’ and similarly vague statements do not qualify as a ‘processing purpose’,” it added.

The ICCL also said it had written to Facebook asking for confirmation of the post-acquisition processing purposes for which people’s data will be used.

Johnny Ryan, senior fellow at the ICCL, confirmed to TechCrunch it has not had any response from Facebook to those questions.

We’ve also asked Facebook to confirm what it will do with any personal data held on users by Kustomer once it owns the company — and will update this report with any response.

In a separate (recent) episode — involving Google — its acquisition of wearable maker Fitbit went through months of competition scrutiny in the EU and was only cleared by regional regulators after the tech giant made a number of concessions, including committing not to use Fitbit data for ads for ten years.

Until now Facebook’s acquisitions have generally flown under regulators’ radar, including, around a decade ago, when it was sewing up the social space by buying up rivals Instagram and WhatsApp.

Several years later it was forced to pay a fine in the EU over a ‘misleading’ filing — after it combined WhatsApp and Facebook data, despite having told regulators it could not do so.

With so many data scandals now inextricably attached to Facebook, the tech giant is saddled with customer mistrust by default and faces far greater scrutiny of how it operates — which is now threatening to inject friction into its plans to expand its b2b offering by acquiring a CRM player. So after ‘move fast and break things’ Facebook is having to move slower because of its reputation for breaking stuff.

The energy giant Shell has joined a slew of strategic investors including All Nippon Airways, Suncor Energy, Mitsui, and British Airways in funding LanzaJet, the company commercializing a process to convert alcohol into jet fuel.

A spin-off from LanzaTech, one of the last surviving climate tech startups from the first cleantech boom that’s still privately held, LanzaJet is taking a phased investment approach with its corporate backers, enabling them to invest additional capital as the company scales to larger production facilities.

Terms of the initial investment, or LanzaJet’s valuation after the commitment, were not disclosed.

LanzaJet claims that it can help the aviation industry reach net-zero emissions, something that would go a long way toward helping the world meet the emissions reductions targets set in the Paris Agreement.

“LanzaJet’s technology opens up a new and exciting pathway to produce SAF using an AtJ process and will help address the aviation sector’s urgent need for SAF. It demonstrates that the industry can move faster and deliver more when we all work together,” said Anna Mascolo, President, Shell Aviation, in a statement. “Provided industry, government and society collaborate on appropriate policy mechanisms and regulations to drive both supply and demand, aviation can achieve net-zero carbon emissions. The strategic fit with LanzaJet is exciting.”

LanzaJet is currently building an alcohol-to-jet fuel facility in Soperton, Ga. Upon completion it would be the first commercial scale plant for sustainable synthetic jet fuel with a capacity of 10 million gallons per year.

The fuel is made by using an ethanol inputs — something that Shell is very familiar with. It’s also something that the oil giant has in ready supply. Through the Raízen joint venture in Brazil, Shell has been producing bio-ethanol for over ten years.

The company expects that its sustainable fuel will be mixed with conventional fossil jet fuel to power airplanes in a lower carbon intensity way. Roughly 90% of the company’s production output will be aviation fuel, while the remaining 10% will be renewable diesel, the company said.

LanzaJet’s SAF is approved to be blended up to 50% with fossil jet fuel, the maximum allowed by ASTM, and is a drop-in fuel that requires no modifications to engines, aircraft, and infrastructure. Additionally, LanzaJet’s SAF delivers more than a 70% reduction in greenhouse gas emissions on a lifecycle basis, compared to conventional fossil jet fuel. The versatility in ethanol, and a focus on low carbon, waste-based, and non-food /non-feed sources, along with ethanol’s global availability, make LanzaJet’s technology a relevant and enduring solution for SAF.

The venture capital scene in the North African tech ecosystem will be absolutely buzzing right now with the announcement of two large VC funds in the space of two days. Today, Algebra Ventures, an Egyptian VC firm, announced that it has launched its $90 million second fund.

Four years ago, Algebra Ventures closed its first fund of $54 million, and with this announcement, the firm hopes to have raised a total of $144 million when the second fund closes (with first close by Q3 2021). If achieved, Algebra will most likely have the largest indigenous fund from North Africa and arguably in Africa.

According to the managing partners — Tarek Assaad and Karim Hussein, the first fund was an Egyptian-focused fund. Still, the firm made some selective investments in a few companies outside the country. The second fund will be similar — Egypt first, Egypt focused, but allocating investments in East and West Africa, North Africa and the Middle East.

Assaad and Hussein launched the firm in 2016 as one of Egypt’s first independent venture capital funds. It wasn’t easy to start one at the time, and it took the partners two years to close the first fund.

“Raising a venture capital fund in Egypt in 2016, in all honesty, was a pain. There was no venture capital to speak of back then,” Assaad told TechCrunch. “The high-flying startups back then were raising between $1 million and $2 million. We decided to take the bull by the horn and raise from very established LPs.”

These LPs include Cisco, the European Commission, Egyptian-American Enterprise Fund (EAEF), European Bank for Reconstruction and Development (EBRD), International Finance Corporation (IFC) and private family offices. From the first fund, Algebra backed 21 startups in Egypt and MENA, and according to the firm, six of its most established companies are valued at over $350 million and collectively generate more than $150 million in annual revenue. It hopes to back 31 startups from the second fund.

Algebra says it’s sector-agnostic but has a focus on fintech, logistics, health tech and agritech. Although the firm has invested in startups in seed and Series B stages, Algebra is known to be an investor in startups looking to raise Series A investments.

Another appealing proposition from Algebra lies in the fact that it owns an in-house team focused on talent acquisition — in operations, marketing, finance, engineering, etc., for portfolio companies.

The firm’s ticket size remains unchanged from the first fund and will continue to cut checks ranging from $500,000 to $2 million. However, some aspects as to how the firm handles operations might change according to the partners.

“One of the lessons learned in our first fund is that we see that there are more interesting opportunities and great entrepreneurs in the seed stage. And given that we’re more on the ground in Egypt, sometimes we wait for them to mature to Series A. But going forward, we might need to build relationships with those we find exceptional at the seed level and also expand our participation on the Series B level, too,” Hussein said on how the firm will act going forward.

Karim Hussein (Managing partner, Algebra Ventures)

Hussein adds that the company will also be doubling down on its talent acquisition network. Typically, Algebra helps portfolio companies hire C-level executives, and while it plans to continue doing so, the firm might adopt a startup studio model — pairing some professionals to start a company that eventually gets Algebra’s backing and support.

The reason behind this stems from the next set of companies Algebra will be looking to invest in. According to Hussein, the partners at Algebra have studied successful businesses in other emerging markets for some time and want to identify parallels in North Africa where the firm can invest.

“In cases where the firm can’t find those opportunities, we may spur some of those in the network to start building those businesses and capture those opportunities,” he remarked.

Before Algebra, Hussein has been involved with building some successful tech companies in the U.S. Primarily an engineer after bagging both bachelors and doctorate degrees from Carnegie Mellon University and MIT, respectively, he ventured into the world of startup investing and crazy valuations after working for a consulting company in the dot-com era.

He would go on to start Riskclick, a software company known for its commercial insurance applications. The founders sold the company to Skywire before Oracle acquired the company to become part of its suite of insurance services. After some time at WebMD, Hussein returned to Egypt and began mentoring startups as an angel investor. Alongside other angel investors, he started Cairo Angels, an angel investor network in Egypt, in 2013.

“There was a massive gap in the market. We were putting in a bit of small angel money to these businesses but there were no VCs to take them to the next level. So I met up with Tarek and the rest is Algebra,” he said.

Assaad is also an engineer. He obtained his bachelors in Egypt before switching careers by going to Stanford Graduate School of Business. He continued on that path working for some Bay Area companies before his return to Egypt. On his return, he became a managing partner at Ideavelopers, a VC firm operating a $50 million fund since 2009. The firm has had a couple of good success stories, the most notable being fintech startup Fawry. Fawry is now a publicly traded billion-dollar company and Assaad was responsible for the investment which realized a $100 million exit for Ideavelopers in 2015.

Tarek Assaad (Managing partner, Algebra Ventures)

With Algebra, both partners are pioneering local investments in the region. Some of its portfolio companies are the most well-known companies on the continent — health tech startup Vezeeta; social commerce platform Brimore; logistics startup Trella; ride-hailing and super app Halan; food discovery and ordering platform Elmenus; fintech startup, Khazna; and others.

The firm’s latest raise and $144 million capital amount is one of the largest funds dedicated to African startups. Other large Africa-focused funds include the $71 million fund recently closed by another Egyptian firm, Sawari Ventures; Partech’s $143 million fund; Novastar Ventures’ $200 million fund; and the $71 million Tide Africa Fund by TLcom Capital.

These funds have been very pivotal to the growth of the African tech ecosystem in terms of funding. Last year, African startups raised almost $1.5 billion from both local and international investors, according to varying reports. This number was just half a billion dollars six years ago.

However, regardless of the period — 2015 or 2021 — African VC investments have always been largely dominated by foreign investors. But VC firms like Algebra Ventures are showing that local investors can cumulatively raise nine-figure funds or attempt to do so. Obviously, this will provide more startups with more funds and pave the way for indigenous and local VCs to at least increase their participation to nearly equal levels when compared to international investors.

Two-year-old CRED has become the youngest Indian startup to be valued at $2 billion or higher.

Bangalore-based CRED said on Tuesday it has raised $215 million in a new funding round — a Series D — that valued the Indian startup at $2.2 billion (post-money), up from about $800 million valuation in $81 million Series C round in January this year.

New investor Falcon Edge Capital and existing investor Coatue Management led the new round. Insight Partners and existing investors DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group, and Sofina also participated in the new round, which brings CRED’s total to-date raise to about $443 million.

TechCrunch reported last month that CRED was in advanced stages of talks to raise about $200 million at a valuation of around $2 billion.

CRED operates an app that rewards customers for paying their credit card bills on time and gives them access to a range of additional services such as credit and a premium catalog of products from high-end brands.

An individual needs to have a credit score of at least 750 to be able to sign up for CRED. By keeping such a high bar, the startup says it is ensuring that people are incentivized to improve their financial behavior. (More on this later.)

The startup today serves more than 6 million customers, or about 22% of all credit card holders — and 35% of all premium credit card holders — in the world’s second largest internet market.

Kunal Shah, founder and chief executive of CRED, told TechCrunch in an interview that the startup intends to become the platform for affluent customers in India and not limit its offerings to financial services.

He said the startup’s e-commerce service, for instance, is growing fast. He attributed the early success to customers appreciating the curation of items on CRED and merchants courting higher ticket size transactions.

CRED will deploy the fresh funds to scale its revenue channels and do more experimentations, he said.

When asked if CRED would like to serve all credit card users in India, Shah said the selection criteria limits the startup from doing so, but he said he was optimistic that more users will improve their scores in the future.

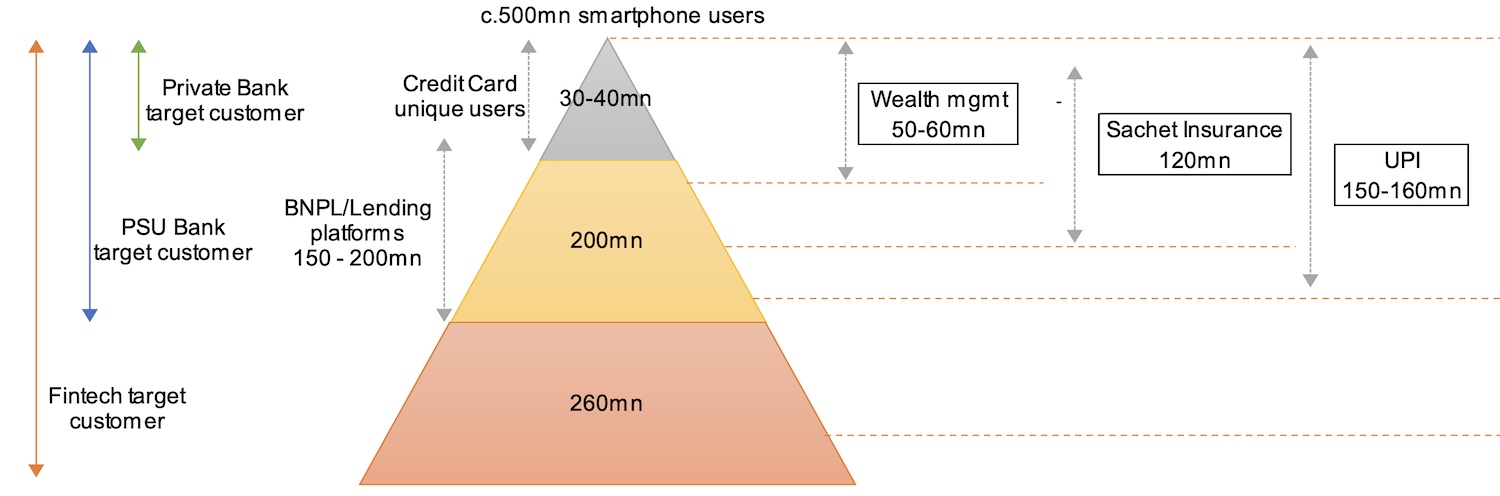

The startup, unlike most others in India, doesn’t focus on the usual TAM — hundreds of millions of users of the world’s second-most populated nation — and instead caters to some of the most premium audiences.

Consumer segmentation and addressable market for fintech firms in India (BofA Research)

“India has 57 million credit cards (vs 830 million debit cards) [that] largely serves the high-end market. The credit card industry is largely concentrated with the top 4 banks (HDFC, SBI, ICICI and Axis) controlling about 70% of the total market. This space is extremely profitable for these banks – as evident from the SBI Cards IPO,” analysts at Bank of America wrote in a recent report to clients.

“Very few starts-ups like CRED are focusing on this high-end base and [have] taken a platform-based approach (acquire customers now and look for monetization later). Credit card in India remains an aspirational product. The under penetration would likely ensure continued strong growth in coming years. Overtime, the form-factor may evolve (i.e. move from plastic card to virtual card), but the inherent demand for credit is expected to grow,” they added.

CRED has become one of the most talked about startups in India, in part because of the pace at which it has raised money of late and its growing valuation. Some users have said that CRED no longer offers them the perks it used a year ago.

Shah said CRED is addressing those concerns. A recent feature, which allows customers to use CRED points at third-party stores, for instance, has made the reward more appealing, he said.

This is a developing story. More to follow…