& meet dozens of singles today!

User blogs

Encrypted chat app Signal is adding payments to the services it provides, a long-expected move and one the company is taking its time on. A U.K.-only beta program will allow users to trade the cryptocurrency MobileCoin quickly, easily, and most importantly, privately.

If you’re in the U.K., or have some way to appear to be, you’ll notice a new Signal Payments feature in the app when you update. All you need to do to use it is link a MobileCoin wallet after you buy some on the cryptocurrency exchange FTX, the only one that lists it right now.

Once you link up, you’ll be able to instantly send MOB to anyone else with a linked wallet, pretty much as easily as you’d send a chat. (No word on when the beta will expand to other countries or currencies.)

Just as Signal doesn’t have any kind of access to the messages you send or calls you make, your payments are totally private. MobileCoin, which Signal has been working with for a couple years now, was built from the ground up for speed and privacy, using a zero-knowledge proof system and other innovations to make it as easy as Venmo but as secure as… well, Signal. You can read more about their approach in this paper (PDF).

MobileCoin just snagged a little over $11M in funding last month as rumors swirled that this integration was nearing readiness. Further whispers propelled the value of MOB into the stratosphere as well, nice for those holding it but not for people who want to use it to pay someone back for a meal. All of a sudden you’ve given your friend a Benjamin (or perhaps now, in the UK, a Turing) for no good reason, or that the sandwich has depreciated precipitously since lunchtime.

There’s no reason you have to hold the currency, of course, but swapping it for stable or fiat currencies every time seems a chore. Speaking to Wired, Signal co-founder Moxie Marlinspike envisioned an automatic trade-out system, though he is rarely so free with information like that if it is something under active development.

While there is some risk that getting involved with cryptocurrency, with the field’s mixed reputation, may dilute or pollute the goodwill Signal has developed as a secure and disinterested service provider, the team there seems to think it’s inevitable. After all, if popular payment services are being monitored the same way your email and social media are, perhaps we ought to nip this one in the bud and go end-to-end encrypted as quickly as possible.

TechCrunch is embarking on a major new project to survey European founders and investors in cities outside the larger European capitals.

Over the next few weeks, we will ask entrepreneurs in these cities to talk about their ecosystems, in their own words.

This is your chance to put Belfast on the Techcrunch Map!

If you are a tech startup founder or investor in the city please fill out the survey form here.

This is the follow-up to the huge survey of investors (see also below) we’ve done over the last six or more months, largely in capital cities.

These formed part of a broader series of surveys we’re doing regularly for ExtraCrunch, our subscription service that unpacks key issues for startups and investors.

In the first wave of surveys, the cities we wrote about were largely capitals. You can see them listed here.

This time, we will be surveying founders and investors in Europe’s other cities to capture how European hubs are growing, from the perspective of the people on the ground.

We’d like to know how your city’s startup scene is evolving, how the tech sector is being impacted by COVID-19, and generally how your city will evolve.

We leave submissions mostly unedited and are generally looking for at least one or two paragraphs in answers to the questions.

So if you are a tech startup founder or investor in one of these cities please fill out our survey form here.

Thank you for participating. If you have questions you can email mike@techcrunch.com and/or reply on Twitter to @mikebutcher.

Wisk Aero, the air mobility company borne out of a joint venture between Kitty Hawk and Boeing, filed a lawsuit Tuesday against Archer Aviation alleging patent infringement and trade secret misappropriation.

Wisk claims in the lawsuit that Archer perpetrated a “brazen theft” of confidential information and intellectual property. The lawsuit points to the design of Archer’s first electric aircraft that was released in February, which Wisk says is a copy of one of its potential designs. That design was submitted to the U.S. Patent and Trademark Office in January 2020, and Wisk alleges the similarities are too numerous to have been a coincidence.

Wisk further claims that during a forensic investigation it opened after Archer hired 10 former Wisk engineers, one of those hires secretly downloaded thousands of files before his departure. Another engineer also downloaded files, the suit alleges.

The information contained in the stolen files includes systems designs, test data, and aircraft designs, Wisk said in a blog posted Tuesday.

“As our Complaint explains, the design Archer disclosed above reflects its insider knowledge of Wisk’s extensive aerodynamic test and evaluation data based on years of experimentation and modeling,” the company said in the blog post. “The similarity in overall aircraft design further indicates Archer’s use of more detailed design features, including features related to aircraft propulsion, power management, avionics, flight control, and manufacturing methodology.”

Archer has snagged some major wins in 2021, including an announcement in February that it would merge with special purpose acquisition company Atlas Crest Investment Corp. for an equity valuation of $3.8 billion. Also in February, the Palo Alto, California-based startup landed a $1 billion order with United Airlines as a customer and investor.

“It’s regrettable that Wisk would engage in litigation in an attempt to deflect from the business issues that have caused several of its employees to depart,” an Archer spokesperson said in an email to TechCrunch. The plaintiff raised these matters over a year ago, and after looking into them thoroughly, we have no reason to believe any proprietary Wisk technology ever made its way to Archer. We intend to defend ourselves vigorously.”

The Archer spokesperson added that the company has “placed an employee on paid administrative leave in connection with a government investigation and a search warrant issued to the employee, which we believe are focused on conduct prior to the employee joining the company. Archer and three other Archer employees with whom the individual worked also have received subpoenas relating to this investigation, and all are fully cooperating with the authorities.”

The suit was filed with the California Northern District Court under case no. 5:21-cv-02450.

GM is adding an electric Chevrolet Silverado pickup truck to its lineup, as the automaker pushes to deliver more than 1 million electric vehicles globally by 2025.

GM President Mark Reuss said Tuesday that the Chevrolet Silverado electric full-size pickup will be based on the automaker’s Ultium battery platform and will have an estimated range of more than 400 miles on a full charge. It should be noted this is GM’s forecast not an official EPA figure.

GM is positioning the full-sized pickup for both consumer and commercial markets. Reuss said that retail and fleet versions of the Silverado electric pickup will be offered with a variety of options and configurations.

“I’m particularly excited about its potential in the fleet and commercial space, a crucial part of the EV market, especially initially,” Reuss said during a presentation at the company’s Factory ZERO assembly plant in Detroit and Hamtramck.

The electric Silverado will go head to head with Ford’s upcoming electric F-150. And while new EV entrant Rivian is not going after the commercial market, its electric RT1 pickup will also provide competition in the space. Rivian, which is expected to begin deliveries of its electric pickup this summer.

The news also follows a string of announcements over the past 18 months, including the GM’s Ultium battery platform and the launch of BrightDrop, an a new business unit to offer commercial customers — starting with FedEx — an ecosystem of electric and connected products. BrightDrop will begin with two main products: an electric van called the EV600 with an estimate range of 250 miles and a pod-like electric pallet dubbed EP1.

Last year, GM committed more than $27 billion to EV and AV product development, including $7 billion in 2021 and plans to launch 30 EVs globally by the end of 2025, with more than two-thirds available in North America.

Reuss said that the company will build the Silverado electric pickup truck at the company’s Factory ZERO assembly plant in Detroit and Hamtramck, Michigan. He confirmed that the GMC Hummer EV SUV, which was unveiled over the weekend, will also be built at the factory. GM renamed its Detroit-Hamtramck assembly plant “Factory ZERO” in October 2020 and later said it would invest $2.2 billion in the factory to produce a variety of all-electric trucks and SUVs.

The facility, which is is undergoing a complete renovation and retooling and has expanded to more than 4.5 million square feet, will also produce the GMC Hummer EV pickup and the Cruise Origin, a purpose-built, all-electric and shared self-driving vehicle. Production of the GMC Hummer EV pickup will begin later this year.

Twitter is abuzz with the news that Topps, a company perhaps best known for making collectible trading cards, is going public via a SPAC.

The reverse merger with its chosen blank-check company values the combination on an equity basis at $1.163 billion. That makes Topps some sort of unicorn. And because it has both e-commerce and digital angles, Topps is technically a fruit tech company.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Why do we care? We care because Topps and its products are popular with the same set of folks who are very excited about creating rare digital items on particular blockchains. Yes, the baseball card company is going public in a debut that could easily be read as a way to put money into the NFT craze without actually having to buy cryptocurrencies and go speculating itself.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

And Topps apparently owns a number of assets in the candy space, which I find whimsical.

So let’s have a small giggle as we go through the Topps deck and then ask if the company is being valued on its actual, and modestly attractive, present-day business or on possible revenues from future NFT-related activities.

So, trading cards

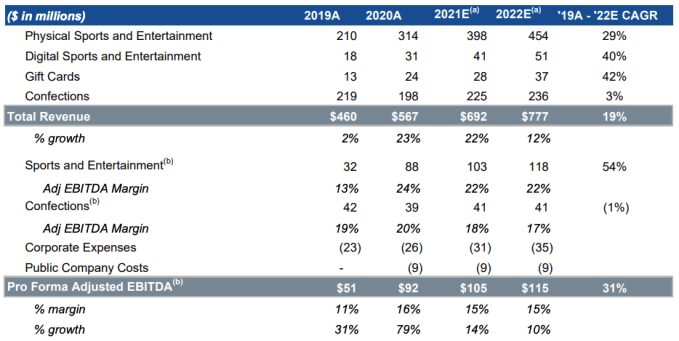

What is Topps? A mix of business units that it breaks down into four categories: Physical Sports and Entertainment (trading cards), Digital Sports and Entertainment (digital collectibles, apps and games), Gift Cards (gift cards for external brands), and Confections (candy).

In terms of scale, the company’s physical goods and confection businesses are by far its leading revenue drivers. Here’s the data:

Image Credits: Topps investor presentation

First, observe that the company’s pro forma adjusted EBITDA nearly doubled from 2019 to 2020. That’s an aggressive expansion in hyper-adjusted profitability. And note how much the company’s physical sports business grew from 2019 to 2020; a nearly 50% gain helped the company grow nicely last year.