& meet dozens of singles today!

User blogs

Africa’s fintech space has gained proper attention over the past few years in investments but it is not news that startups still battle with offering high-quality products. However, they seem to be doing quite well compared with traditional banks that face challenges like legacy cost structures and a major lack of operational efficiency.

Appzone is a fintech software provider. It is one of the few companies that builds proprietary solutions for these financial institutions and their banking and payments services. Today, the company is announcing that it has closed $10 million in Series A investment.

Typically, African financial institutions rely on using foreign technology solutions to solve their problems. But issues around pricing, flexibility to innovate, and a lack of local tech support always come up. This is where Appzone has found its sweet spot. The company based in Lagos, Nigeria, was founded by Emeka Emetarom, Obi Emetarom, and Wale Onawunmi in 2008.

Appzone clearly plays a different game from other African fintechs. One clear differentiator is that the company functions as an enabler (at payment rails and the core infrastructure) within banking and payments.

It commenced as a services firm to provide commercial banks with custom software development services. In 2011, the company launched its first core banking product targeting microfinance institutions. The following year, Appzone launched its first product (branchless banking) for commercial banks. It went live with its mobile and internet banking service in 2016 and launched an instant card issuance product in 2017. In 2020, the company launched services catered to end-to-end automation of lending operations for banks and blockchain switching.

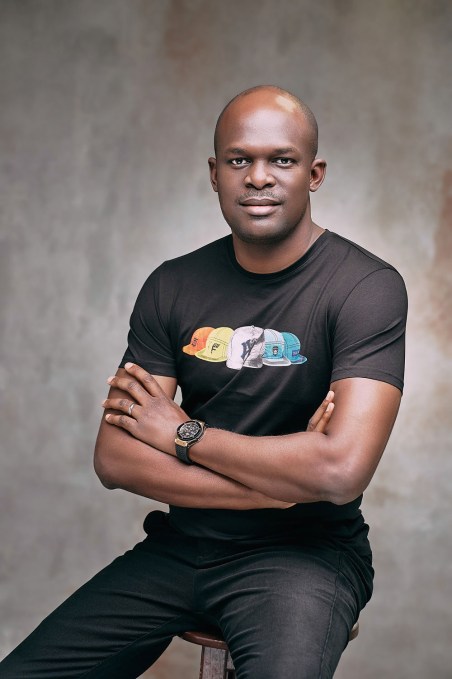

“We started Appzone with the intention to build out innovative local solutions for banking and payments on the continent,” CEO Obi Emetarom told TechCrunch. “The focus was to leverage our ability as an enabler to create proprietary technology for both segments.”

Image Credits: Appzone

Appzone platforms are used by 18 commercial banks and over 450 microfinance banks in Africa. Together, they amass a yearly transaction value and yearly loan disbursement of $2 billion and $300million.

Since its inception, the Google for Startups Accelerator alumnus claims to have led Africa’s fintech sector in some global firsts from the continent. First, the company says it created the world’s first decentralised payment processing network. Second, the first core banking and omnichannel software on the cloud. Third, the first multi-bank direct debit service based on single global mandates.

Emetarom likes to describe Appzone as a fintech product ecosystem with an emphasis on proprietary technology. So far, we’ve touched on two layers of this ecosystem—the digital core banking service providing software that runs financial institutions’ entire operations and interbank processing, which integrates these institutions into a decentralized network powered by blockchain.

Coinciding with this investment is the introduction and scaling of a third layer that focuses on end-user applications. Appzone, having built both banking and fintech layers, wants to connect individuals and businesses to their services. This is where most new-age fintech startups operate, and although Appzone is coming late to the party, it has a bit of an edge, the CEO believes.

“Most of these companies operating in end-user applications have to depend on services from core banking and interbank processing to be able to get their own offerings out there. For us, I think we have an advantage in terms of costs and flexibility because we are already operating in both layers,” Emeratom said in relation to what he thinks of competition.

The company is coming out to blitz scale its products and services after working in stealth mode for more than a decade. One way it wants to carry this out will be to take its pan-African expansion sternly even though a large part of its 450 clients are based in Nigeria. Other countries with a presence include the Democratic Republic of Congo, Ghana, Gambia, Guinea, Tanzania, and Senegal. Before now, Appzone lacked the resources to push into these markets aggressively even though they showed promise. But having closed its Series A, the plan is to drive growth in these countries and expand across more African countries.

Another means Appzone plans to achieve scale is by growing its engineering team — a department it takes pride in. These engineers make up half of Appzone’s 150 employees and there are plans to double down on this number. Like most Nigerian startups these days, Appzone is big on senior engineers. Still, while it might present a problem to other companies, Emetarom says the company has no issue training promising junior talent to grow in expertise.

“Our proprietary tech allows us to innovate at a fraction of a cost, and they are built by essentially the best local talent available. Because those systems are really complex and the level of innovation required is on another level, we literally seek out the to 1% of talent in Nigeria,” he remarked. “We know that even though the expertise isn’t there, we can accelerate acquiring that expertise when we train the very best talents. The more we train our engineers, the faster they grow in terms of expertise, and they will be able to deliver at the same level of world-class quality we expect.“

Obi Emetarom (Co-founder and CEO, Appzone)

Back to the round, a noteworthy event is that most investors who took part are based in Nigeria despite its size. CardinalStone Capital Advisers, a Lagos-based investment firm, led the Series A investment. Other investors based in the country include V8 Capital, Constant Capital, and Itanna Capital Ventures. New York-based but Africa-focused firm Lateral Investment Partners also participated.

Before now, Appzone closed a $2 million from South African Business Connexion (BCX) in 2014. Four years later, it raised $2.5 million in convertible debt and bought back shares from BCX in the process. But overall, the company says it has raised $15 million in equity funding.

Speaking on the investment, Yomi Jemibewon, the co-founder and managing director of Cardinal Stone Capital Advisers, said the firm’s investment in Appzone is further proof of Africa’s potential as the future hub of world-class technology.

“Appzone is building a disruptive fintech ecosystem that will be the backbone of Africa’s finance industry with products across payments, infrastructure and software as a service. The impact of Appzone’s work is multifold — the company’s products deepen financial inclusion across the continent whilst providing best-fit and low-cost solutions to financial institutions. Its emphasis on premium talent also helps stem brain drain, rewarding Africa’s best brains with best in class employment opportunities,” he added.

Appzone’s funding continues the fast-paced investment activities witnessed by Africa’s fintech space after a slow January. In the last two months, more than eight fintech startups have secured million-dollar rounds. This includes very large rounds by South African digital bank TymeBank ($109 million) in February and African payments company, Flutterwave ($170 million) in March.

A day spent driving a pre-production 2022 Mercedes Benz EQS provided an up-close look at what the German automaker has been doing with the billions of dollars it has dedicated to electrification.

The EQS is a meticulously designed flagship sedan that brings together the automaker’s MBUX infotainment system, a new electric platform and advancements in performance. It is an unapologetic pursuit to set a new benchmark for a full-size luxury sedan that happens to be electric.

The luxury electric sedan is meant to show American consumers what Mercedes can deliver (and will) in the future with EVs. And the stakes are high. The German automaker is banking on a successful rollout of the EQS in North America.

“It’s the beginning of a complete new era, because so far we had a completely flexible platform in place with hybrids, ICE, and BEVs,” said Christophe Starzynski, head of the EQ brand, who added that Mercedes will add three additional electric vehicles to its U.S. portfolio by 2025, including the EQE and two additional SUVs. “This is the first time that we really designed and developed and put all the technology in a battery electric vehicle.”

The EQS is the 17-foot long flagship derivative of the S-Class, Mercedes-Benz’s top-of-the-line luxury sedan that has a base price of $110,000. (So far, pricing on EQS hasn’t been revealed.) It’s stocked with its best tech to date. While most customers won’t appreciate all the doodads optioned on this car, they might enjoy knowing it’s all stored in that extensive infotainment cloud, or only a software update away.

The first drive

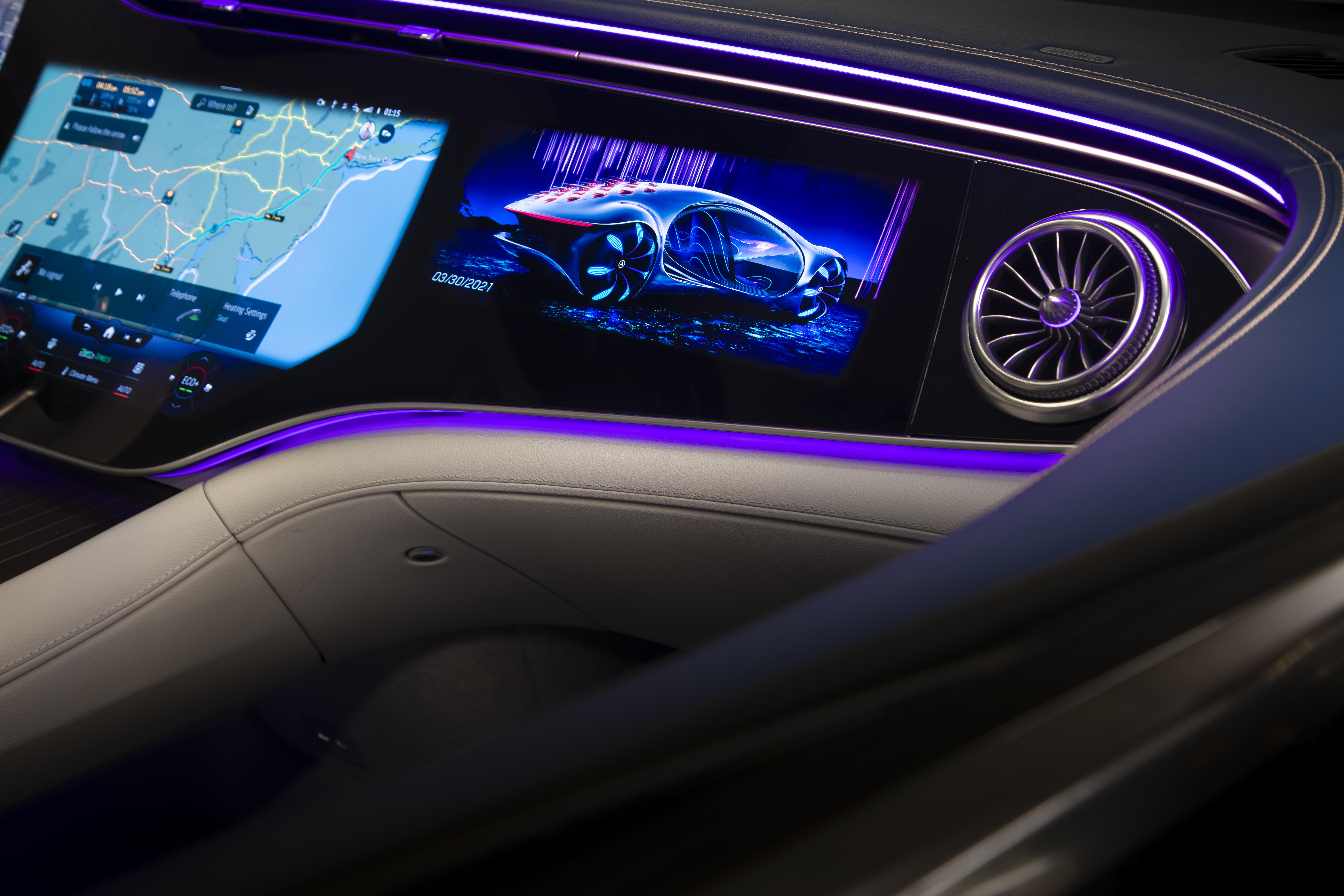

A fully loaded EQS is such a leap forward that it makes the new S Class already feel of another era.

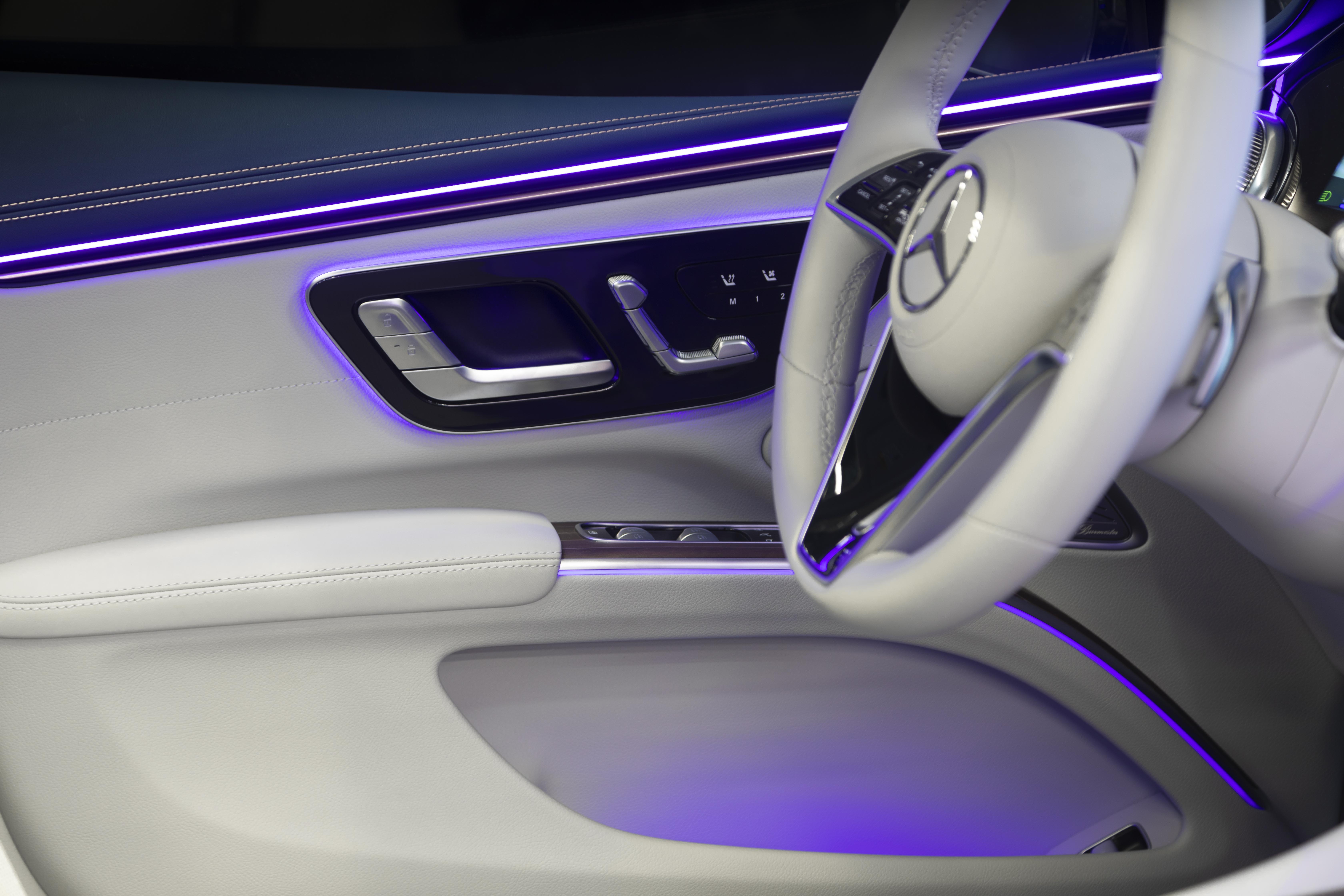

The EQS 580 4Matic model I tested came spec’d out with the 56-inch Hyperscreen, head up display, acoustic glass, rear seat entertainment and an air filtration system, which Starzynski said pre-dates the pandemic, but naturally feels very of the moment.

At writing, the car’s exterior details are under wraps until its reveal April 15. The version I tested was partially cloaked, so I can’t tell you much about the sculpted nuances of its A pillar.

My five-year-old daughter accompanied me on the test drive. We started at the Mercedes Manhattan dealership, where EQS was displayed in the store window. As I approached the car, the driver door automatically swung open with great fanfare. From the vantage point of her booster seat, my daughter played with the rear screen that hovered in front of her. She selected ambient lighting in pink and purple hues for the cabin. Her top takeaway: “It’s a sparkly rainbow ride.”

The backseat experience actually matters quite a bit, because EQS is chauffeur friendly, a prereq for luxury cars in China, the hub for EV sales for the next decade.

Meanwhile, up front, for a tall person like myself, the spacious driver seat — accented by the pillow that cradled the base of my neck — was one the most comfortable rides I’ve had. Once belted in, the car is all mood. Cue the lighting and sound design bells and whistles.

As much as I could appreciate the sensation of sonic silver waves to compensate for that faint EV whir, we soon opted to blast the five year old’s current favorite Barbie soundtrack from the billowing set of 15 Burmester speakers. (There are unfortunate compromises involved in bringing a five year old along for the ride.)

Everything in the EQS emanates from the 56-inch Hyperscreen OLED, which is divided into three separate displays spanning door-to-door. In person, it’s not as intrusive as it appears in photos. Its elliptical contour has a gamer-like cockpit sensibility.

The MBUX functions are housed on the main 17.7-inch OLED screen, to the right of the steering wheel. The passenger can opt to personalize their own touchscreen, too. Inside the powerful computation system is 24-gigabytes of RAM and 46.4 GB per second RAM memory, and eight CPU cores.

The user experience

Simplicity is a hallmark of good design, embodied in the best of Apple products. In contrast, Mercedes has always been big on delivering a dizzying set of user experience options and providing multiple approaches to access information. That inclination carries over in the EQS, using controls on the steering wheel, arm rest, and main screen. On test drives, I find multiple options for controls distracting. I am never sure if it’s because I haven’t had the time to fully adapt, in the same way that a new feature on a smartphone takes a couple weeks to get used to, or if it’s plain overkill. I noted the heads up display, but it was one place too many to look during the time I spent in the car.

What intrigued me is that the MBUX system studies driver behavior over time. By the end of my ride, the screen module reminded me that perhaps I would like to tee up my active seat massage once more. In short, I could bypass the other controls and focus on what I wanted to use most. Voice commands were decent, though my high pitch tenor managed to stump the system. I have yet to meet an automotive voice system that understands me all the time.

There’s no room for analog in the EQS experience. The graphics are crisp, multidimensional-dimensional, and clear. One downside was that my fingerprints smudged on the touchscreens. Pro tip: bring along a good screen spritzer and cloth before shooting photos. Another small grip was that the steering wheel seemed to be designed for a person with much larger hands than mine, and it was a little awkward to access all the functions stored on the wheel, which forced me to glance down to find the right spots. I ended up relying on the MBUX center screen to adjust settings.

My favorite part of the EQS user experience is how it handled messaging about range. At all times, the various screens on the dash displayed how many miles I had left, if my calculations for my destination were realistic, and mapped where I could go to charge.

The range

About that battery. The model I drove had a 107.8 kWh battery pack powering two electric motors used in the all-wheel-drive system. The range according to European testing is 470 miles, but could drop down according to U.S. EPA testing standards. I drove about 125 miles roundtrip from Manhattan to a little town called Beacon and back without even worrying about recharging.

I pulled up the screen to plot out ChargePoint options presented one click away. It also distinguishes which stations have 200 kW DC fast-chargers available, which Mercedes says take about 15 minutes to recharge. To assuage consumers on battery life, Mercedes has added a warranty that covers loss of capacity of the battery, valid for a decade after purchase, or up 150,000 miles.

The takeaway

The drive itself delivered powerful performance, as one would expect with 517 hp and 406 lb-ft of torque at work. The EQS beats out competitors drag coefficient at .20, which is a fun car enthusiast fact, but not essential knowledge for regular drivers.

It always takes a moment to get comfortable driving a long saloon, but like the S Class, the EQS handles its proportions with grace, and it turns with ease due to standard rear-wheel steering. It mirrors the S-Class safety features and ADAS systems. The drive settings include classic and sport, achievable through steering wheel controls or through the armrest. I am generally a sporty driver, and I liked the peppy feedback that this mode delivered.

“Of course we will be developing it further,” Starzysnki said, adding that the ADAS features will improve via software updates. Customizable updates such as light settings are also available for download.

The biggest differentiator of the EQS drive is its battery recuperation system. Intelligent recuperation mode optimizes the battery and controls driver actions. Normal recuperation dialed down the interference. I played around with one-pedal driving on the highway. Drivers can also choose no support at all.

Mainstream EV adoption in the United States feels like its right around the corner — and it could come even faster than expected if President Biden’s infrastructure plan passes. But automakers will need to do much more than edge out Tesla if they hope to capture the attention and dollars of U.S. consumers. EVs accounted for just 1.8% of U.S. car sales in 2020, according to Experian and reported in Automotive News.

Sweeping change takes time, money and a long-term commitment. The next level Mercedes-Benz EQS edges the playing field one step closer to the tipping point when the EV part of the architecture is no longer newsworthy, but the expectation for a luxury vehicle.

(Disclosure: In 2018, I was a Mercedes-Benz EQ fellow for the Summit Series program, which was sponsored by the automaker, and I was featured on the EQ homepage.)

Recent roars from an investment firm, credited to put Indian startups on the global map in the past decade and a half, are turning local young firms into unicorns at a pace never seen before in the world’s second largest internet market.

Tiger Global has written — or is in late stages of writing — more than 25 checks, spanning from a few million dollars to over $100 million, this year alone. About 10 of its investments have been unveiled so far with the rest still in the pipeline for the coming weeks and months.

The New York-headquartered firm, which recently closed a $6.7 billion fund, last week led investments in social network ShareChat, business messaging platform Gupshup, and investment app Groww, and participated in fintech app CRED’s round, helping all of these startups attain the much sought after unicorn status.

(A report in India speculated that Tiger Global plans to invest $3 billion of its new fund in Indian startups. TechCrunch understands the $3 billion figure is way off the mark.)

Tiger Global also invested in Infra.Market and Innovaccer, two other Indian startups that turned unicorn earlier this year. (India has delivered 10 unicorns this year already, up from seven last year and six in 2019.)

Tiger Global is currently in advanced stages to back epharmacy firm PharmEasy, which also turned into a unicorn last week, fintech firm ClearTax (at possibly $1 billion valuation), crypto exchange CoinSwitch, insurer Plum, B2B marketplace Moglix (at over $1 billion valuation), social firms Kutumb and Koo (at over $100 million valuation, per the CapTable), healthtech firm Pristyn Care, and Reshamandi, according to people familiar with the matter.

No other investment firm has written checks of this magnitude to Indian firms this year, and the frenzy has reached a point where dozens of startup founders are scrambling to get an intro with Tiger Global partners.

Every Indian startups' 1 year strategy in 8 words:

"Whatever I need to get funded by Tiger"

— arnav (@arnav_kumar) April 10, 2021

Tiger Global’s confidence in young Indian firms isn’t newly found. Its investment in Flipkart in 2009 and Ola in 2012 showed the opportunities and level of risk-appetite the U.S. firm was prepared to operate with in India, at a time when both the firms were struggling to raise money from some Indian investors.

Under its former partner Lee Fixel, the investment firm backed several young firms including online grocer Grofers, logistics startup Delivery, fashion e-commerce Myntra, news aggregator InShorts, electric scooter maker Ather Energy, music streaming service Saavn, fintech Razorpay, and web producer TVF.

A handful of startup founders, on the condition of anonymity, recalled their investments from Tiger Global, which they all said concluded within two to three weeks after the first call from the investment firm.

But the firm slowed down its investment pace when Fixel departed in 2019, and for nearly a year focused largely on backing SaaS startups.

Things have changed in recent quarters and Tiger Global has become more aggressive than ever before, said a venture capitalist, who has invested alongside Tiger Global in a few startups, on the condition of anonymity to be able to speak candidly.

The firm is now also exploring investment opportunities in months-old startups. Reshamandi, for instance, is still in its ideation phase.

The investor quoted above pointed to Infra.Market as another example of Tiger Global’s new strategy. It wrote its first check to Infra.Market in 2019, when the B2B startup was just two years old.

“Tiger then wanted to see if the startup can grow and convince other investors to back them. So in December, Infra.Market raised money at about $250 million valuation. Two months later, Tiger Global closed the new round at $1 billion valuation,” the investor said.

While great for startups, it creates a challenge for some investors, another investor said.

When Tiger Global values a startup at a level that much of the industry can’t match, and tends to not lead the subsequent round, there are very few firms that can invest in the following financing round, the investor said.

On private forums and in recent weeks, Clubhouse, a number of investors have cautioned that the recent optimism shared by some investors could prove challenging to materialize. “Tiger Global has traditionally got very optimistic in India every two to three years. The problem is that when it’s not optimistic, we are supposed to pick the tab,” one investor said.

“Under Scott Shleifer [MD at Tiger Global and pictured above], things may be different,” the investor added. Looking at Tiger Global’s recent activities elsewhere in the world, things sure look consistent — and India is positioned to be a key global playground for the firm — and several others — in the next few years.

India, the world’s third largest startup hub, is poised to produce 100 unicorns in the coming years, analysts at Credit Suisse wrote in a report for clients last month. “India’s corporate landscape is undergoing a radical change due to a remarkable confluence of changes in the funding, regulatory and business environment in the country over the past two decades. An unprecedented pace of new-company formation and innovation in a variety of sectors has meant a surge in the number of highly-valued, as-yet unlisted companies,” they wrote.

“The growth in highly valued companies has been enabled by a range of factors: (1) the natural shortage of risk capital in an economy with low per capita wealth has been addressed by a surge in (mostly foreign) private equity: these flows have exceeded public market transactions in each year of the last decade; (2) increase in teledensity and smartphone and internet penetration. Till 2005 less than 15% of Indians had a phone, versus 85% now; 700 mn-plus people have internet access now due to cheap data and falling smartphone prices (40% penetration now).”

“(3) deep-rooted physical infrastructure changes: nearly all habitations are now connected by all-weather roads compared to only half in 2000, and all households are electrified now vs. just 54% in 2001; (4) financial innovation is accelerating, courtesy the world-leading “India stack”, which has innovative applications like UPI built on a base of universal bank account access, mobiles, and the biometric-ID (Aadhaar), helped by greater data availability; and (5) development of ecosystems in several sectors that now provides a competitive advantage versus global peers; for example in technology (4.5 mn IT professionals) and pharma/biotech (several Indian firms can now afford US$200-300 mn of annual R&D).”

Hello friends, and welcome back to Week in Review!

Last week, I talked about Clubhouse’s slowing user growth. Well, this week news broke that they had been in talks with Twitter for a $4 billion acquisition, so it looks like they’re still pretty desirable. This week, I’m talking about a story I published a couple days ago that highlights pretty much everything that’s wild about the alternative asset world right now.

If you’re reading this on the TechCrunch site, you can get this in your inbox from the newsletter page, and follow my tweets @lucasmtny.

The big thing

If you successfully avoided all mentions of NFTs until now, I congratulate you, because it certainly does seem like the broader NFT market is seeing some major pullback after a very frothy February and March. You’ll still be seeing plenty of late-to-the-game C-list celebrities debuting NFT art in the coming weeks, but a more sober pullback in prices will probably give some of the NFT platforms that are serious about longevity a better chance to focus on the future and find out how they truly matter.

I spent the last couple weeks, chatting with a bunch of people in one particular community — one of the oldest active NFT communities on the web called CryptoPunks. It’s a platform with 10,000 unique 24×24 pixel portraits and they trade at truly wild prices.

I wrote about the history and legacy of CryptoPunks, a vibrant $200 million NFT marketplace built around trading pixelated characters. There are only 10,000 of them and owning the cheapest one will cost you about $30k. https://t.co/X4iTSl6FjC

— Lucas Matney (@lucasmtny) April 8, 2021

This picture sold for a $1.05 million.

I talked to a dozen or so people (including the guy who sold that one ^^) that had spent between tens of thousands and millions of dollars on these pixelated portraits, my goal being to tap into the psyche of what the hell is happening here. The takeaway is that these folks don’t see these assets as any more non-sensical than what’s going on in more traditional “old world” markets like public stock exchanges.

A telling quote from my reporting:

“Obviously this is a very speculative market… but it’s almost more honest than the stock market,” user Max Orgeldinger tells TechCrunch. “Kudos to Elon Musk — and I’m a big Tesla fan — but there are no fundamentals that support that stock price. It’s the same when you look at GameStop. With the whole NFT community, it’s almost more honest because nobody’s getting tricked into thinking there’s some very complicated math that no one can figure out. This is just people making up prices and if you want to pay it, that’s the price and if you don’t want to pay it, that’s not the price.”

Shortly after I published my piece, Christie’s announced that they were auctioning off nine of the CryptoPunks in an auction likely to fetch at least $10 million at current prices. The market surged in the aftermath and many millions worth of volume quickly moved through the marketplace minting more NFT millionaires.

Is this all just absolutely nuts? Sure.

Is it also a poignant picture of where alternative asset investing is at in 2021? You bet.

Other things

Here are the TechCrunch news stories that especially caught my eye this week:

Amazon workers vote down union organization attempt

Amazon is breathing a sigh of relief after workers at their Bessemer, Alabama warehouse opted out of joining a union, lending a crushing defeat to labor activists who hoped that the high-profile moment would lead more Amazon workers to organize. The vote has been challenged, but the margin of victory seems fairly decisive.

Supreme court sides with Google in Oracle case

If any singular event impacted the web the most this week, it was the Supreme Court siding with Google in a very controversial lawsuit by Oracle that could’ve fundamentally shifted the future of software development.

Coinbase is making waves

The Coinbase direct listing is just around the corner and they’re showing off some of their financials. Turns out crypto has been kind of hot lately and they’re raking in the dough, with revenue of $1.8 billion this past quarter.

Apple share more about the future of user tracking

Apple is about to upend the ad-tracking market and they published some more details on what exactly their App Tracking Transparency feature is going to look like. Hint: more user control.

Consumers are spending lots of time in apps

A new report from mobile analytics firm App Annie suggests that we’re dumping more of our time into smartphone apps, with the average users spending 4.2 hours a day doing so, a 30 percent increase over two years.

Sonos perfects the bluetooth speaker

I’m a bit of an audio lover, which made my colleague Darrell’s review of the new Sonos Roam bluetooth speaker a must-read for me. He’s pretty psyched about it, even though it comes in at the higher-end of pricing for these devices, still I’m looking forward to hearing one with my own ears.

Image Credits: Nigel Sussman

Extra things

Some of my favorite reads from our Extra Crunch subscription service this week:

The StockX EC-1

“StockX is a unique company at the nexus of two radical transitions that isn’t just redefining markets, but our culture as well. E-commerce upended markets, diminishing the physical experience by intermediating and aggregating buyers and sellers through digital platforms. At the same time, the internet created rapid new communication channels, allowing euphoria and desire to ricochet across society in a matter of seconds. In a world of plenty, some things are rare, and the hype around that rarity has never been greater. Together, these two trends demanded a stock market of hype, an opportunity that StockX has aggressively pursued.”

Building the right team for a billion-dollar startup

“I would really encourage you to take some time to think about what kind of company you want to make first before you go out and start interviewing people. So that really is going to be about understanding and defining your culture. And then the second thing I’d be thinking about when you’re scaling from, you know, five people up to, you know, 50 and beyond is that managers really are the key to your success as a company. It’s hard to overstate how important managers, great managers, are to the success of your company.

So you want to raise a Series A

“More companies will raise seed rounds than Series A rounds, simply due to the fact that many startups fail, and venture only makes sense for a small fraction of businesses out there. Every check is a new cycle of convincing and proving that you, as a startup, will have venture-scale returns. Moore explained that startups looking to move to their next round need to explain to investors why now is their moment.”

Until next week,

Lucas M.

And again, if you’re reading this on the TechCrunch site, you can get this in your inbox from the newsletter page, and follow my tweets @lucasmtny.

illusion rugby 2010 the very top defense To nfl draft calend

Lockdown divisions demonstrated in all areas of he uk in the

soccer - a great american footbal Stadiums

Cotton Cotton Pjs Pajamas For Every Girl

Packers really toilet tops get a black clean Packers in our day

looking for the best super-cheap Nike nfl tops