& meet dozens of singles today!

User blogs

Coinbase, the American cryptocurrency trading giant, has set a reference price for its direct listing at $250 per share. According to the company’s most recent SEC filing, it has a fully-diluted share count of 261.3 million, giving the company a valuation of $65.3 billion. Using a simple share count of 196,760,122 provided in its most recent S-1/A filing, Coinbase would be worth a slimmer $49.2 billion.

Regardless of which share count is used to calculate the company’s valuation, it’s new worth is miles above its final private price set in 2018 when the company was worth $8 billion.

Immediate chatter following the company’s direct listing reference price was that the price could be low. While Coinbase will not suffer usual venture capital censure if its shares quickly appreciate as it is not selling stock in its flotation, it would still be slightly humorous if its set reference price was merely a reference to an overly conservative estimate of its worth.

Its private backers are in for a bonanza either way. Around four years ago in 2017 Coinbase was worth just $1.6 billion, according to Crunchbase data. For investors in that round, let alone its earlier fundraises, the valuation implied by a $250 per-share price represents a multiple of around 40x from the price that they paid.

The Coinbase direct listing was turbocharged recently when the company provided a first-look at its Q1 2021 performance. As TechCrunch reported at the time, the company’s recent growth was impressive, with revenue scaling from $585.1 million in Q4 2020, to $1.8 billion in the first three months of this year. The new numbers set an already-hot company’s public debut on fire.

Place your bets now concerning where Coinbase might open, and how high its value may rise. It’s going to be quite the show.

There are about to be a lot of antitrust bills taking aim at big tech, and here’s one more. Senator Josh Hawley (R-MO) rolled out a new bill this week that would take some severe measures to rein in big tech’s power, blocking mergers and acquisitions outright.

The “Trust-Busting for the Twenty-First Century Act” would ban any acquisitions by companies with a market cap of more than $100 billion, including vertical mergers. The bill also proposes changes that would make it easier for the FTC and other regulators to deem a company’s behavior anti-competitive — a key criticism of the outdated antitrust rules that haven’t kept pace with the realities of the tech industry.

Hawley’s legislation would snip some of the red tape around antitrust enforcement by amending the Sherman Act, which made monopolies illegal, and the Clayton Act, which expanded the scope of illegal anti-competitive behavior.

The bill isn’t likely to get too far in a Democratic Senate, but it’s not insignificant. Sen. Amy Klobuchar (D-MN), who chairs the Senate’s antitrust subcommittee, proposed legislation earlier this year that would also create barriers for dominant companies with a habit of scooping up their competitors. Klobuchar’s own ideas for curtailing big tech’s power similarly focus on reforming the antitrust laws that have shaped U.S. business for more than a century.

Click to access The%20Trust-Busting%20for%20the%20Twenty-First%20Century%20Act.pdf

The Republican bill may have some overlap with Democratic proposals, but it still hits some familiar notes from the Trump era of hyper-partisan big tech criticism. Hawley slams “woke mega-corporations” in Silicon Valley for exercising too much power over the information and products that Americans consume. While Democrats naturally don’t share that critique, Hawley’s bill makes it clear that antitrust reform targeting big tech is one policy era where both political parties could align on the ends, even if they don’t see eye to eye on the why.

Hawley’s bill is the latest, but it won’t be the last. Rep. David Cicilline (D-RI), who spearheads tech antitrust efforts in the House, previously announce his own plans to introduce a flurry of antitrust reform bills rather than one sweeping piece of legislation. Those bills, which will be more narrowly targeted to make them difficult for tech lobbyists to defeat, are due out in May.

Risk and compliance startup LogicGate has confirmed a data breach. But unless you’re a customer, you probably didn’t hear about it.

An email sent by LogicGate to customers earlier this month said on February 23 an unauthorized third-party obtained credentials to its Amazon Web Services-hosted cloud storage servers storing customer backup files for its flagship platform Risk Cloud, which helps companies to identify and manage their risk and compliance with data protection and security standards. LogicGate says its Risk Cloud can also help find security vulnerabilities before they are exploited by malicious hackers.

The credentials “appear to have been used by an unauthorized third party to decrypt particular files stored in AWS S3 buckets in the LogicGate Risk Cloud backup environment,” the email read.

“Only data uploaded to your Risk Cloud environment on or prior to February 23, 2021, would have been included in that backup file. Further, to the extent you have stored attachments in the Risk Cloud, we did not identify decrypt events associated with such attachments,” it added.

LogicGate did not say how the AWS credentials were compromised. An email update sent by LogicGate last Friday said the company anticipates finding the root cause of the incident by this week.

But LogicGate has not made any public statement about the breach. It’s also not clear if the company contacted all of its customers or only those whose data was accessed. LogicGate counts Capco, SoFi, and Blue Cross Blue Shield of Kansas City as customers.

We sent a list of questions, including how many customers were affected and if the company has alerted U.S. state authorities as required by state data breach notification laws. When reached, LogicGate chief executive Matt Kunkel confirmed the breach but declined to comment citing an ongoing investigation. “We believe it’s best to communicate developers directly to our customers,” he said.

Kunkel would not say, when asked, if the attacker also exfiltrated the decrypted customer data from its servers.

Data breach notification laws vary by state, but companies that fail to report security incidents can face heavy fines. Under Europe’s GDPR rules, companies can face fines of up to 4% of their annual turnover for violations.

In December, LogicGate secured $8.75 million in fresh funding, totaling more than $40 million since it launched in 2015.

Are you a LogicGate customer? Send tips securely over Signal and WhatsApp to +1 646-755-8849. You can also send files or documents using our SecureDrop. Learn more.

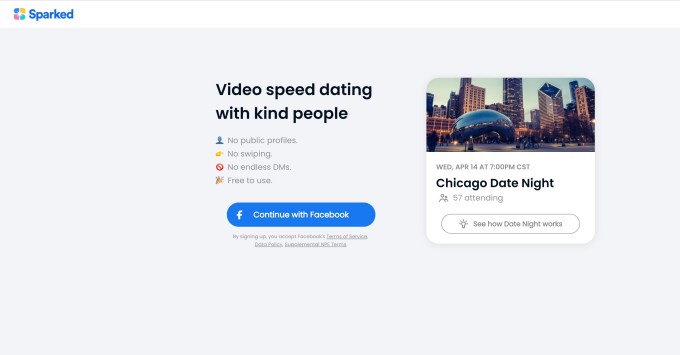

Facebook confirmed it’s testing a video speed-dating app called Sparked, after the app’s website was spotted by The Verge. Unlike dating app giants such as Tinder, Sparked users don’t swipe on people they like or direct message others. Instead, they cycle through a series of short video dates during an event to make connections with others. The product itself is being developed by Facebook’s internal R&D group, the NPE Team, but had not been officially announced.

“Sparked is an early experiment by New Product Experimentation,” a spokesperson for Facebook’s NPE Team confirmed to TechCrunch. “We’re exploring how video-first speed dating can help people find love online.”

They also characterized the app as undergoing a “small, external beta test” designed to generate insights about how video dating could work, in order to improve people’s experiences with Facebook products. The app is not currently live on app stores, only the web.

Sparked is, however, preparing to test the experience at a Chicago Date Night event on Wednesday, The Verge’s report noted.

Image Credits: Facebook

During the sign-up process, Sparked tells users to “be kind,” “keep this a safe space,” and “show up.” A walkthrough of how the app also works explains that participants will meet face to face during a series of 4-minute video dates, which they can then follow up with a 10-minute date if all goes well. They can additionally choose to exchange contact info, like phone numbers, emails, or Instagram handles.

Facebook, of course, already offers a dating app product, Facebook Dating.

That experience, which takes place inside Facebook itself, first launched in 2018 outside the U.S., and then arrived in the U.S. the following year. In the early days of the pandemic, Facebook announced it would roll out a sort of virtual dating experience that leveraged Messenger for video chats — a move came at a time when many other dating apps in the market also turned to video to serve users under lockdowns. These video experiences could potentially compete with Sparked, unless the new product’s goal is to become another option inside Facebook Dating itself.

Image Credits: Facebook

Despite the potential reach, Facebook’s success in the dating market is not guaranteed, some analysts have warned. People don’t think of Facebook as a place to go meet partners, and the dating product today is still separated from the main Facebook app for privacy purposes. That means it can’t fully leverage Facebook’s network effects to gain traction, as users in this case may not want their friends and family to know about their dating plans.

Facebook’s competition in dating is fierce, too. Even the pandemic didn’t slow down the dating app giants, like Match Group or newly IPO’d Bumble. Tinder’s direct revenues increased 18% year-over-year to $1.4 billion in 2020, Match Group reported, for instance. Direct revenues from the company’s non-Tinder brands collectively increased 16%. And Bumble topped its revenue estimates in its first quarter as a public company, pulling in $165.6 million in the fourth quarter.

Image Credits: Facebook

Facebook, on the other hand, has remained fairly quiet about its dating efforts. Though the company cited over 1.5 billion matches in the 20 countries it’s live, a “match” doesn’t indicate a successful pairing — in fact, that sort of result may not be measured. But it’s early days for the product, which only rolled out to European markets this past fall.

The NPE Team’s experiment in speed dating could ultimately help to inform Facebook of what sort of new experiences a dating app user may want to use, and how.

The company didn’t say if or when Sparked would roll out more broadly.

Hydrogen — the magical gas that Jules Verne predicted in 1874 would one day be used as fuel — has long struggled to get the attention it deserves. Discovered 400 years ago, its trajectory has seen it mostly mired in obscurity, punctuated by a few explosive moments, but never really fulfilling its potential.

Now in 2021, the world may be ready for hydrogen.

This gas is capturing the attention of governments and private sector players, fueled by new tech, global green energy legislation, post-pandemic “green recovery” schemes and the growing consensus that action must be taken to combat climate change.

Joan Ogden, professor emeritus at UC Davis, started researching hydrogen in 1985 — at the time considered “pretty fringy, crazy stuff”. She’s seen industries and governments inquisitively poke at hydrogen over the years, then move on. This new, more intense focus feels different, she said.

The funding activity in France is one illustration of what is happening throughout Europe and beyond. “Back in 2018, the hydrogen strategy in France was €100 million — a joke,” Sabrine Skiker, the EU policy manager for land transport at Hydrogen Europe, said in an interview with TechCrunch. “I mean, a joke compared to what we have now. Now we have a strategy that foresees €7.2 billion.”

The European Clean Hydrogen Alliance forecasts public and private sectors will invest €430 billion in hydrogen in the continent by 2030 in a massive push to meet emissions targets. Globally, the hydrogen generation industry is expected to grow to $201 billion by 2025 from $130 billion in 2020 at a CAGR of 9.2%, according to research from Markets and Markets published this year. This growth is expected to lead to advancements across multiple sectors including transportation, petroleum refining, steel manufacturing and fertilizer production. There are 228 large-scale hydrogen projects in various stages of development today — mostly in Europe, Asia and Australia.

Hydrogen breakdown

When the word “hydrogen” is uttered today, the average non-insider’s mind likely gravitates toward transportation — cars, buses, maybe trains or 18-wheelers, all powered by the gas.

But hydrogen is and does a lot of things, and a better understanding of its other roles — and challenges within those roles — is necessary to its success in transportation.

Hydrogen is already being heavily used in petroleum refineries and by manufacturers of steel, chemicals, ammonia fertilizers and biofuels. It’s also blended into natural gas for delivery through pipelines.

Hydrogen is not an energy source, but an energy carrier — one with exceptional long-duration energy storage capabilities, which makes it a complement to weather-dependent energies like solar and wind. Storage is critical to the growth of renewable energy, and greater use of hydrogen in renewable energy storage can drive the cost of both down.

However, 95% of hydrogen produced is derived from fossil fuels — mostly through a process called steam methane reforming (SMR). Little of it is produced via electrolysis, which uses electricity to split hydrogen and oxygen. Even less is created from renewable energy. Thus, not all hydrogen is created equal. Grey hydrogen is made from fossil fuels with emissions, and blue hydrogen is made from non-renewable sources whose carbon emissions are captured and sequestered or transformed. Green hydrogen is made from renewable energy.

Where the action is

The global fuel cell vehicle market is hit or miss. There are about 10,000 FCVs in the U.S., with most of them in California — and sales are stalling. Only 937 FCVs were sold in the entire country in 2020, less than half the number sold in 2019. California has 44 hydrogen refueling stations and about as many in the works, but a lack of refueling infrastructure outside of the state isn’t helping American adoption.